by Calculated Risk on 10/01/2009 03:38:00 PM

Thursday, October 01, 2009

Light Vehicle Sales 9.2 Million (SAAR) in September

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for September (red, light vehicle sales of 9.22 million SAAR from AutoData Corp).

This is the third lowest vehicle sales this year. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July. Although this wasn't as bad as some of the lower forecasts, it was still below most estimates.

Note: the answer to the earlier poll was 746 thousand (not seasonally adjusted sales).

Hotel RevPAR off 16.6 Percent

by Calculated Risk on 10/01/2009 02:44:00 PM

We are now in the Fall business travel season ...

From HotelNewsNow.com: Norfolk-Virginia Beach posts RevPAR growth in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 7.2 percent to end the week at 59.8 percent. Average daily rate dropped 10.1 percent to finish the week at US$100.30. RevPAR for the week decreased 16.6 percent to finish at US$59.94.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 10.2% from the same period in 2008.

The average daily rate is down 10.1%, and RevPAR is off 16.6% from the same week last year.

The goods news is the comparisons will become easier soon since business travel fell off a cliff last October. However occupancy rates below 60% are crushing. For comparison, occupancy rates for October in 2006 and 2007 were close to 68%.

Ford reports U.S. Sept. sales fall 5.1%

by Calculated Risk on 10/01/2009 12:05:00 PM

Note: graphs will be posted around 4 PM ET.

Update: Percentage comparisons are to Sept 2008.

From MarketWatch: Ford total U.S. Sept. sales decline 5.1%

Ford Motor Co. said Thursday that U.S. auto sales for September dropped 5.1% to 114,655 vehicles from 116,734 a year ago.UPDATES: GM U.S. Sept. sales drop 45% (compared to Sept 2008)

Chrysler sales off 42%.

Toyota U.S. Sept. sales off 12.7%

Once all the reports are released, I'll post a graph of the estimated total September sales (SAAR: seasonally adjusted annual rate). The range of estimates for September have been very wide ...

For fun, here are the results of a poll in the comments (Monthly, not SAAR):

620,000 end of the world 6% (3 votes)

650,000 black hole 40% (20 votes)

700,000 detectable pulse 42% (21 votes)

740,000 trend sans C4C 6% (3 votes)

800,000 post Viagra pause 2% (1 vote)

960,000 all clear same as Sept 2008 2% (1 vote)

1,000,000 (puts pinky to corner of mouth) 2% (1 vote)

Total votes: 50

Construction Spending increases in August

by Calculated Risk on 10/01/2009 10:26:00 AM

We started the year looking for two key construction spending stories: a likely bottom for residential construction spending, and the collapse in private non-residential construction. This report shows further evidence of both stories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending increased in August, and nonresidential spending continued to decline.

Private residential construction spending is now 63.1% below the peak of early 2006. Although it appears residential construction spending may have bottomed, any growth in spending will probably be sluggish until the large overhang of existing inventory is reduced.

Private non-residential construction spending is still only 12.6% below the peak of last September. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is off 10.5% on a year-over-year basis, and will turn strongly negative as projects are completed. Residential construction spending is still declining YoY, although the negative YoY change will get smaller going forward.

From the Census Bureau: August 2009 Construction at $941.9 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2009 was estimated at a seasonally adjusted annual rate of $941.9 billion, 0.8 percent (±1.8%) above the revised July estimate of $934.6 billion. The August figure is 11.6 percent (±1.8%) below the August 2008 estimate of $1,066.1 billion.

ISM Manufacturing shows expansion in September

by Calculated Risk on 10/01/2009 10:00:00 AM

PMI at 52.6% in September down from 52.9% in August.

From the Institute for Supply Management: September 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in September for the second consecutive month, and the overall economy grew for the fifth consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading above 50 shows expansion.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew for the second consecutive month in September. While the rate of growth moderated slightly when compared to August, the recovery broadened as the number of industries reporting growth increased from 11 to 13. Both new orders and production are growing, but at a slower rate when compared to August. It appears the fundamentals for continuing recovery are still at work as inventories and sales are gaining balance."

...

ISM's New Orders Index registered 60.8 percent in September, 4.1 percentage points lower than the 64.9 percent registered in August. This is the third consecutive month of growth in the New Orders Index. A New Orders Index above 48.8 percent, over time, is generally consistent with an increase in the Census Bureau's series on manufacturing orders (in constant 2000 dollars).

emphasis added

Also, from the NAR: Record Streak Continues for Pending Home Sales

The Pending Home Sales Index,* a forward-looking indicator based on contracts signed in August, rose 6.4 percent to 103.8 from a reading of 97.6 in July, and is 12.4 percent above August 2008 when it was 92.4. The index is at the highest level since March 2007 when it was 104.5.

August PCE and Saving Rate

by Calculated Risk on 10/01/2009 08:53:00 AM

Note: A large portion of the increase in durable goods consumption in August was due to cash-for-clunkers, however there was also a significant increase in non-durable goods.

From the BEA: Personal Income and Outlays, August 2009

Personal income increased $19.3 billion, or 0.2 percent, and disposable personal income (DPI) increased $15.5 billion, or 0.1 percent, in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $129.6 billion, or 1.3 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.9 percent in August, compared with an increase of 0.2 percent in July. Purchases of durable goods increased 5.8 percent, compared with an increase of 1.8 percent. Reflecting the impact of the federal CARS program (popularly called "cash for clunkers"), purchases of motor vehicles and parts accounted for most of the August increase in purchases of durable goods and more than accounted for the July increase.

...

Personal saving -- DPI less personal outlays -- was $324.1 billion in August, compared with $436.0 billion in July. Personal saving as a percentage of disposable personal income was 3.0 percent in August, compared with 4.0 percent in July.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the August Personal Income report. The saving rate was 3.0% in August.

This decline in the saving rate was probably temporary, and I expect the saving rate to continue to rise.

The following graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The July and August numbers suggest PCE will grow at over 3% (annualized rate) in Q3, however I expect September to be much lower. So I expect a 2% increase in Q3 PCE.

Note that PCE declined sharply in Q3 and Q4 2008 - the cliff diving - and was been relatively flat in Q1 and Q2 2009. Auto sales gave a boost to PCE in Q3, but in general PCE will probably remain weak into 2010 as households continue to repair their balance sheets.

Weekly Unemployment Claims: 551,000

by Calculated Risk on 10/01/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims increased to 551,000:

In the week ending Sept. 26, the advance figure for seasonally adjusted initial claims was 551,000, an increase of 17,000 from the previous week's revised figure of 534,000. The 4-week moving average was 548,000, a decrease of 6,250 from the previous week's revised average of 554,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Sept. 19 was 6,090,000, a decrease of 70,000 from the preceding week's revised level of 6,160,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 6,250 to 548,000, and is now 110,750 below the peak in April.

Initial weekly claims have peaked for this cycle, however the continuing high level of weekly claims indicates significant weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before total employment stops falling.

And in other employment news ... from Reuters: Challenger, Gray reports planned layoffs declined in Sept.

Planned job cuts announced by U.S. employers fell to 66,404 last month, down 13 percent from 76,456 in August, according to a report released Thursday by global outplacement consultancy Challenger, Gray & Christmas.But a big part of the problem is lack of hiring, not firings. From Monster.com:

September's layoff tally was 30 percent lower than the 95,094 job cuts during the same time last year. This brought the figure for the July-September quarter to 240,233, the lowest since the first quarter of 2008 and marking the fourth consecutive quarter in which job cuts declined from the year prior level.

The Monster Employment Index edged downward in September after a significant rise in late summer recruitment activity during August. Over the year, the Index fell 25 percent largely unchanged from last month’s pace.The BLS report will be released tomorrow.

Wednesday, September 30, 2009

Summary: Today and Tomorrow

by Calculated Risk on 9/30/2009 09:40:00 PM

A quick summary and a look ahead ...

CIT Group Inc. upped the ante with its creditors by drawing up a prepackaged bankruptcy plan, two people familiar with the matter said Wednesday. ... Another person familiar with the matter said CIT likely wouldn't roll out the debt-exchange offer and prepackaged bankruptcy solicitation until late Thursday night.CIT would be the fifth largest bankruptcy in U.S. history behind Lehman Brothers, Washington Mutual, WorldCom and General Motors.

Tomorrow

And Bernanke testifies on financial reform.

So I apologize in advance for all the posts.

BofA CEO Ken Lewis to Retire

by Calculated Risk on 9/30/2009 05:48:00 PM

From Bloomberg: Bank of America’s Chief Executive Ken Lewis to Retire Dec. 31

No successor named.

Not sure what to make of this.

BofA Press Release: Ken Lewis Announces His Retirement

"Bank of America is well positioned to meet the continuing challenges of the economy and markets," said Lewis. "I am particularly heartened by the results that are emerging from the decisions and initiatives of the difficult past year-and-a-half."

"The Merrill Lynch and Countrywide integrations are on track and returning value already," Lewis noted. "Our board of directors and our senior management include more talent, and more diversity of talent, than at any time in this company's history. We are in position to begin to repay the federal government's TARP investments. For these reasons, I decided now is the time to begin to transition to the next generation of leadership at Bank of America."

OCC and OTS: Modification Re-Default Rates

by Calculated Risk on 9/30/2009 04:02:00 PM

Here is some more data from the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for Second Quarter 2009

Modified Loan Performance ... [T]he percentage of loans that were 60 or more days delinquent or in the process of foreclosure rose steadily in the months subsequent to modification for all vintages for which data were available. Modifications made in third quarter 2008 showed the highest percentage of modifications that were 60 or more days past due following the modification. Modifications made during fourth quarter 2008 and first quarter 2009 performed better in the first three to six months after the modification than those made in the third quarter 2008.Note: This doesn't include HAMP yet because all of those modifications are still in the "trial period". That raises a question: If a borrower re-defaults during the trial, will they still be considered a "re-default"? Something to watch for if the re-default rate drops sharply next quarter - they might be excluding the trial period re-defaulters.

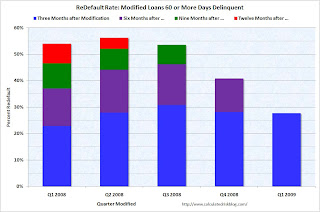

Click on graph for larger image.

Click on graph for larger image.This graph shows the cumulative re-default rate by quarter of modifications. About 25% to 30% of modifications fail in the first three months.

For Q1 and Q2 2008, about 55% of borrowers have re-defaulted. Q3 2008 will probably be worse, and Q4 2008 and Q1 2009 about the same.

Over time, I expect a very high re-default rate since many of these modifications are just "extend and pretend" (the missed payments and fees are added to the principal, and the rate is reduced for a few years), although about 10% of borrowers received a principal reduction in Q2 (more than double as in Q1).

Restaurants: 24th Consecutive Month of Contraction

by Calculated Risk on 9/30/2009 02:11:00 PM

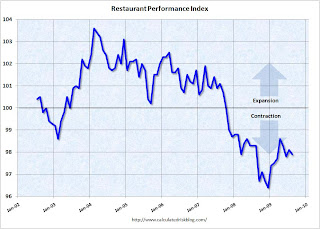

Note: Any reading below 100 shows contraction for this index.

From the National Restaurant Association (NRA): Restaurant Performance Index Declined in August as Same-Store Sales and Customer Traffic Slipped

Restaurant industry performance softened in August, as the National Restaurant Association’s comprehensive index of restaurant activity posted a modest decline. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.9 in August, down 0.2 percent from July and its third decline in the last four months.

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 96.0 in August – down 0.9 percent from July and its sharpest decline in nearly a year. In addition, August represented the 24th consecutive month below 100, which signifies contraction in the current situation indicators.

The sharp decline in Current Situation Index was the result of deteriorating sales and traffic levels in August.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The restaurant business is still contracting ...

No Green Shoots for you!

OCC and OTS: Foreclosures, Delinquencies increase in Q2

by Calculated Risk on 9/30/2009 11:32:00 AM

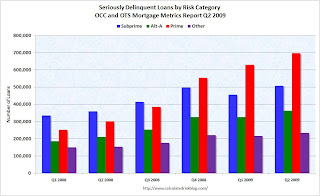

From the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for Second Quarter 2009

This OCC and OTS Mortgage Metrics Report for the second quarter of 2009 provides performance data on first lien residential mortgages serviced by national banks and federally regulated thrifts. The report covers all types of first lien mortgages serviced by most of the industry’s largest mortgage servicers, whose loans make up approximately 64 percent of all mortgages outstanding in the United States. The report covers nearly 34 million loans totaling almost $6 trillion in principal balances and provides information on their performance through the end of the second quarter of 2009 (June 30, 2009).Much of the report focuses on modifications and recidivism, but this report also shows far more seriously delinquent prime loans than subprime loans (by number, not percentage).

The mortgage data reported for the second quarter of 2009 continued to reflect negative trends influenced by weakness in economic conditions including high unemployment and declining home prices in weak housing markets. As a result, the number of seriously delinquent mortgages and foreclosures in process continued to increase. However, a lull in newly initiated foreclosures occurred as servicers worked to implement the “Making Home Affordable” program during the second quarter.

...

The percentage of current and performing mortgages in the portfolio decreased by 1.4 percent from the previous quarter to 88.6 percent of all mortgages in the portfolio. All categories of delinquencies increased from the previous quarter, with serious delinquencies—loans 60 or more days past due and loans to delinquent bankrupt borrowers—reaching 5.3 percent of all mortgages in the portfolio, an increase of 11.5 percent from the previous quarter. Foreclosures in process reached 2.9 percent of all mortgages, a 16.2 percent increase.

...

In the second quarter, 15.2 percent of Payment Option ARMs were seriously delinquent, compared with 5.3 percent of all mortgages, and 10 percent were in the process of foreclosure, more than triple the 2.9 percent rate for all mortgages.

...

Mortgages guaranteed by the U.S. government, primarily through the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), also showed higher delinquencies than the overall servicing portfolio. Serious delinquencies increased to 7.5 percent of all government guaranteed mortgages, up from 6.8 percent in the previous quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.We're all subprime now!

Note: "Approximately 13 percent of loans in the data were not accompanied by credit scores and are classified as “other.” This group includes a mix of prime, Alt-A, and subprime. In large part, the loans were result of acquisitions of loan portfolios from third parties where borrower credit scores at the origination of the loans were not available."

This report covers about two-thirds of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now significantly more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

The second graph shows foreclosure activity.

Notice that foreclosure in process are increasing sharply, but completed foreclosures were only up slightly.

The only reason initiated foreclosures declined slightly was because Q1 was revised up significantly. Short sales remain mostly irrelevant.

The next wave of completed foreclosures is about to break, but the size of the wave depends on the modification programs.

Chicago Purchasing Managers Index Declines in September

by Calculated Risk on 9/30/2009 09:54:00 AM

From MarketWatch: Business activity declines in Chicago area

The Chicago purchasing managers index fell to 46.1% in September from 50.0% in August ... The new orders index backtracked to 46.3% from 52.5% in August. The employment index was essentially unchanged at 38.8% ...Readings below 50% indicate contraction.

This index is for both manufacturing and service activity in the Chicago region. In general the Chicago area is considered representative of the mix of manufacturing and non-manufacturing business activity in the nation, so a decline in the Chicago PMI is significant.

The national ISM manufacturing index will be released tomorrow, and the ISM non-manufacturing index on Monday.

MBA: 30 Year Mortgage Rate Falls to 4.94 Percent

by Calculated Risk on 9/30/2009 08:42:00 AM

The MBA reports: Mortgage Applications Decrease

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.8 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 0.8 percent from the previous week and the seasonally adjusted Purchase Index decreased 6.2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.94 percent from 4.97 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

The Purchase index declined to 270.4, and the 4-week moving average declined to 283.9.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Tuesday, September 29, 2009

Survey: Home Purchase Market by Homebuyer Category

by Calculated Risk on 9/29/2009 11:20:00 PM

Here is some national data on the types of homebuyers in August. This is from a survey by Campbell Communications (excerpted with permission).

Source: Tracking Real Estate Market Conditions, a whitepaper regarding the Campbell/Inside Mortgage Finance Monthly Survey on Real Estate Market Conditions. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Campbell survey breaks out sales by buyer type.

According to the Campbell survey about 64% of sales in August were to first-time buyers and investors.

Survey results show that first-time homebuyers, motivated by first-time homebuyer tax credit, made up the largest component of demand in August 2009. In the summer months, current homeowners also make up a significant component of demand. (Note: rounding on graph figures precludes totaling to 100%.)

For comparison, here is the same breakdown for Q2.

For comparison, here is the same breakdown for Q2.According to the Campbell survey over 70% of sales in Q2 were to first-time buyers and investors.

Whenever the tax credit expires (whether or not is extended), the percent of first time buyers will decline.

Report: CIT Preparing Plan to Hand Control to Bondholders

by Calculated Risk on 9/29/2009 07:46:00 PM

From the WSJ: CIT in Last-Ditch Rescue Bid

CIT is preparing a sweeping exchange offer that would eliminate 30% to 40% of its more than $30 billion in outstanding debt ... The plan would offer bondholders new debt secured by CIT assets, as well as nearly all of the equity in a restructured company. ... If not enough bondholders agreed to the plan, the company could seek to execute the restructuring in bankruptcy court, the person said. The result could potentially be one of the largest Chapter 11 bankruptcy-court filings in U.S. history.The writing was on the wall in July when CIT obtained a $3 billion emergency loan secured by all of their assets. As I noted in July, the emergency loan just kicked the can down the road.

Now it appears CIT is at the end of the road ...

Citi Still Using FDIC TLGP

by Calculated Risk on 9/29/2009 07:26:00 PM

From Dow Jones: Citi Prices $5B Four-Part FDIC-Backed Deal-Source

Citigroup Inc. priced a $5 billion government-backed bond Tuesday, its second benchmark-sized bond offering this month under the U.S. Federal Deposit Insurance Corp.'s Temporary Liquidity Guarantee Program ... Since November of last year, when the FDIC program was launched, Citi has issued $49.6 billion of these deals ...If the TLGP is extended, Citi might be the only user.

Also, the FDIC earlier today announced a plan to "require insured institutions to prepay their estimated quarterly risk-based assessments" for the next three years. This plan would raise approximately $45 billion.

Bloomberg has a story on the costs: Bank of America, 3 Other Banks’ FDIC Fees May Top $10 Billion

Bank of America, the biggest U.S. lender by deposits, may owe $3.5 billion under the FDIC proposal for banks to prepay three years of premiums, based on the lowest assessment rate multiplied by the bank’s $900 billion in second-quarter U.S. deposits.Ouch.

...

U.S. bank premiums range from 12 cents per $100 in deposits for the safest lenders to 45 cents for banks the U.S. considers risky, said Chris Cole, senior regulatory counsel for the Independent Community Bankers of America.

...

Based on the current assessment and each bank’s deposits, Wells Fargo & Co.’s fee may be $3.2 billion based on its $814 billion in deposits, JPMorgan Chase & Co. may pay $2.4 billion and Citigroup Inc. $1.2 billion.

Market Update

by Calculated Risk on 9/29/2009 04:12:00 PM

Note: Looking ahead, Thursday and Friday will be heavy economic news days with vehicle sales (how bad will the post-clunker slump be?), construction spending, personal income and outlays for August, the employment report on Friday and more.

A couple of market graphs ... the S&P 500 was first at this level in March 1998; about 11 1/2 years ago.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 57% from the bottom (384 points), and still off 32% from the peak (505 points below the max). The second graph is from Doug Short - Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

House Prices: Stress Test and Price-to-Rent

by Calculated Risk on 9/29/2009 12:56:00 PM

This following graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index (SA), July: 154.69

Stress Test Baseline Scenario, July: 147.23

Stress Test More Adverse Scenario, July: 138.14

Unlike with the unemployment rate (worse than both scenarios), house prices are performing better than the the stress test scenarios.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through July 2009 using the Case-Shiller Composite Indices (SA): Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices. For rents, the national Owners' Equivalent Rent from the BLS is used.

Back in 2004 or 2005, it was obvious that prices were out of line with fundamentals. This was clear in the price-to-income and price-to-rent ratios - and there was also widespread speculation (the definition of a bubble).

Now, looking at the price-to-rent ratio based on the Case-Shiller indices, the adjustment in the price-to-rent ratio is mostly behind us. Although the ratio is still a little high. Note: some would argue the ratio being a little too high is reasonable based on mortgage rates and "affordability".

With rents now falling almost everywhere, a further downward adjustment in house prices seems likely.

FDIC Seeks $45 Billion in Prepayments from Banks

by Calculated Risk on 9/29/2009 11:03:00 AM

The Board of Directors of the Federal Deposit Insurance Corporation today adopted a Notice of Proposed Rulemaking (NPR) that would require insured institutions to prepay their estimated quarterly risk-based assessments for the fourth quarter of 2009 and for all of 2010, 2011 and 2012. The FDIC estimates that the total prepaid assessments collected would be approximately $45 billion.MarketWatch has more details: Fund to protect deposits has shrunk to low levels

Absent the prepaid premiums, the FDIC said that the agency's Deposit Insurance Fund ... would face a liquidity crunch early next year, and that it will be operating in the red by the end of this month.

The FDIC said that the prepayments would raise $45 billion for the fund. The board said it estimates that total bank failure losses could reach $100 billion by 2013.

emphasis added