by Calculated Risk on 10/04/2009 11:30:00 PM

Sunday, October 04, 2009

Roubini: Investors Too Optimistic

From Bloomberg: Roubini Says Stocks Have Risen ‘Too Much, Too Soon, Too Fast’

“I see the risk of a correction, especially when the markets now realize that the recovery is not rapid and V-shaped, but more like U- shaped. That might be in the fourth quarter or the first quarter of next year.” [Roubini said in an interview in Istanbul on Oct. 3.]As I've noted several times, a V-shaped or "Immaculate" recovery seems very unlikely.

...

“The real economy is barely recovering while markets are going this way,” Roubini said. If growth doesn’t rebound rapidly, “eventually markets are going to flatten out and correct to valuations that are justified. I see a growing gap between what markets are doing and the weaker real economic activities.”

Futures are up slightly ...

Futures from barchart.com

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

And the Asian markets are mixed.

Best to all.

MERS v. Kansas

by Calculated Risk on 10/04/2009 06:56:00 PM

CR Note: This is a guest post from albrt.

MERS v. Kansas

Although the internet discussion has died down considerably, I thought it might be helpful to offer some background and some explanation of what happened in the recent Kansas MERS case. I am not involved in the case, but I used to read Tanta’s posts about this sort of thing and I did some research, so I guess I am well-qualified to opine.

What is MERS?

MERS is part of an attempt by bankers to homogenize mortgages so they can be traded among banks more easily. In many cases the ultimate goal is to bundle the mortgages into bonds. From the MERS website:

About MERSGot it? I didn’t think so. MERS’ claim that its loans are “inoculated against future assignments” is an unmixed, but also unenlightening metaphor. Inoculation most commonly means exposing someone to a pathogenic organism or other immunologically active material in order to promote the development of antibodies. I can’t think of anything in the MERS process that can be profitably compared to either a pathogen or an antibody.

MERS was created by the mortgage banking industry to streamline the mortgage process by using electronic commerce to eliminate paper. Our mission is to register every mortgage loan in the United States on the MERS® System.

* * *

MERS acts as nominee in the county land records for the lender and servicer. Any loan registered on the MERS® System is inoculated against future assignments because MERS remains the nominal mortgagee no matter how many times servicing is traded. MERS as original mortgagee (MOM) is approved by Fannie Mae, Freddie Mac, Ginnie Mae, FHA and VA, California and Utah Housing Finance Agencies, as well as all of the major Wall Street rating agencies.

What actually happens is that a MERS mortgage is recorded once, usually with MERS shown as the “nominee” of the lender. MERS then tracks loan assignments, including both repayment rights and servicing rights. The output of the tracking system is approximately as good as the input from the lenders. When something happens, MERS is supposed to notify the interested parties.

In some cases MERS will act for the interested parties in lawsuits. If a MERS lender wants MERS to file a foreclosure suit, the lender is supposed to find the original note, endorse it in blank, and give it to a certifying MERS officer before the foreclosure is filed. That makes MERS a “holder” of the note, even if MERS is not actually the owner of the note. Being a holder is generally sufficient to allow MERS to foreclose.

Tanta explained how endorsement works here. MERS apparently has more computers involved, but when it comes time to produce the note in litigation it still amounts to pretty much the same thing. Pathogens and antibodies aside, MERS can’t really provide protection from all the potential errors and problems that came up when loans were being traded and securitized at warp speed all over the country. Many of the cases where MERS has gotten in trouble involved a misplaced note, but it is generally not clear that the problem was MERS’ fault, and it is not all that much different from what happens when a non-MERS lender files a foreclosure suit without having the original note handy.

This should be enough background to understand what happened (and did not happen) in the recent Kansas Supreme Court case.

The Kansas Supreme Court case

In Landmark National Bank v. Kesler , Landmark held a first mortgage and foreclosed on Mr. Kesler’s property. Landmark obtained a default judgment and was able to sell the property for more than the balance due on the first mortgage.

There was also a second mortgage on the property. The document for the second mortgage showed an outfit called “Millennia” as the lender, and showed MERS as the lender’s nominee. The document said notice should be sent to the lender, and did not say much about the nominee. Landmark sent notice of the foreclosure suit to Millennia, but not to MERS.

As it turned out, the second mortgage had been sold to an outfit called “Sovereign,” so Millennia no longer had an interest in the case. After the foreclosure judgment and sale, but before the distribution of the proceeds from the sale, Sovereign entered the case and tried to set aside the foreclosure judgment. Sovereign’s problem was that it never recorded anything to show that it held an interest in the property, so it really didn’t have much of an argument that it was entitled to notice of the foreclosure.

In order to address this problem, MERS joined in the case a couple of months later. MERS was essentially on Sovereign’s side, arguing that even if Sovereign wasn’t entitled to notice, MERS was on the original mortgage and was entitled to notice, and MERS would have notified Sovereign if MERS had received notice.

Not surprisingly, the judge held Sovereign was not entitled to notice because it didn’t register the assignment of the loan in the public records. The judge also held MERS was an agent of the lender at most, and did not have a sufficient interest to be able to show up late and overturn the judgment.

The Kansas Supreme Court upheld the judge’s decision, based in part on the conclusion that MERS didn’t own an interest in the note or the mortgage. This is what got a lot of attention on the internets, but most commentators seem to have missed the point. The court did not say the mortgage was invalidated because MERS separated the mortgage from the note. The court said MERS did not appear to own either the mortgage or the note. Part of the reason for the court’s conclusion was that you can’t separate a mortgage from the note it secures.

The key to the Kansas decision, like most judicial decisions, is in the details. The actual mortgage document required notice to the lender, not to MERS. The mortgage document listed MERS as a “nominee,” but never really defined what a nominee was or provided any basis for arguing that a nominee is entitled to notice above and beyond the notice given to the lender.

The only broad effect of this decision is that the court refused to make a special exception for MERS mortgages and require precautionary notice to MERS regardless of what the document said. Most MERS mortgages do say that MERS should get notice. If the mortgage document says that, most courts will enforce it.

There are other cases discussing MERS, some of which provide more general information than the Kansas case. One I would recommend is a decision by bankruptcy judge Linda Riegle on a group of bankruptcy cases in Nevada. The essence of Judge Riegle’s decision is that MERS isn’t entitled to any special status, and needs to have the note in order to take any action on it. The decision is available on Westlaw under the name Hawkins at 2009 WL 901766. Substantially the same decision is publicly available under the case name Mitchell, No. BK-S-07-16226-LBR .

What is the problem?

Mortgages are complicated. Most mortgage primers start with the distinction between states maintaining a “title” theory of mortgages and states maintaining a “lien” theory. This is mostly nonsense, as summed up by an eminent commentator nearly a hundred years ago: “There is no complete adoption of a logical theory in any of the American jurisdictions.” Manley O. Hudson, Law of Mortgages Real & Chattel, in 8 Modern American Law, at 297 (E. A. Gilmore & W. C. Wermuth eds. 1917).

So there are really two basic problems reflected in the MERS cases: (1) mortgages are complicated, and (2) the creation of MERS did not really reduce the complications, it just papered over them.

1. Mortgages are complicated

Mortgages are not homogenous. Not at any level. The borrowers are different, the mortgaged real estate is different, the practices of the banks are different, state laws are different, and federal government involvement is different for different types of lenders and borrowers. An important corollary of principle number one is that whatever a lender does, and whatever MERS does on behalf of lenders, will have different effects in different cases.

As Tanta wisely noted a few years ago, it is very difficult to see how an increasingly centralized industry can deal with all these details, and do it cheaply enough to make a profit when interest rates are at five percent and spreads are thin. In order to do it cheaply enough, the industry got rid of most of its Tanta-caliber people and replaced them with inexperienced temps, or perhaps with MERS. The main reason it worked for a few years was because problem mortgages could be refinanced so easily, and fees could be charged for each refinancing.

2. The creation of MERS did not really reduce the complications.

MERS undoubtedly provides some useful services to banks, but it does not “inoculate” them from dealing with necessary administrative costs. The administrative costs, especially in a lousy market, will probably make high-velocity mortgage loan trading and securitizing an unprofitable venture. As Tanta said, “the true cost of doing business is belatedly showing up.”

The goal of the people who created MERS was to design a system that has traction in local recording systems, and is flexible enough that it could be made to work under the law of every state. The MERS system probably meets this goal when it is done right. In theory, using the term “nominee” gives MERS flexibility in defining the duties and obligations of the relationship. It may also give MERS some flexibility in explaining how the court should treat a nominee after something has gone wrong, as the law of the jurisdiction or the facts of a particular case seem to require. Unfortunately for MERS, experienced judges are wise to this trick and will most likely to continue placing reasonable limits on the ability of MERS to claim it is all things to all lenders.

But setting all the cleverness of the MERS system aside, the system still requires the last lender in the chain to endorse the note over to MERS before the foreclosure can begin. If the lenders have been ignoring their paperwork because they think they are “inoculated against future assignments,” it is possible the lenders are worse off than they would have been without MERS. From what I can see, that is not the case. The way lenders were acting in 2005, if left to their own devices they would probably have lost about 90% of everything. With MERS, they probably did better than that.

So is this a nothingburger?

Sort of. MERS isn’t obscuring land titles in a way that will interfere with future transactions. If a mortgage is paid off, it should be released in the local public records. The odds that somebody screwed something up may go up a little or down a little, but a title company should be able to insure any subsequent sale.

We can also be reasonably certain the MERS cases are not going to invalidate millions of mortgages at one swipe. Because mortgages are complicated, whatever a lender does and whatever MERS does on behalf of lenders will have different effects in different cases. Most of the problems can be attributed to non-standard mortgage documents, poorly drafted foreclosure complaints, or foreclosure complaints filed prematurely without verifying the status of the mortgage and who is holding the note. These problems affect non-MERS lenders in more or less the same way they affect MERS lenders. Having MERS involved might help get things straightened out in some cases, or it might make the problem worse in some cases.

I think the important question is whether, on balance and in the aggregate, the MERS system works well enough to allow lenders to re-start the private label securitization money machine in a few years. I think the answer is probably no.

Of course, since the residential lending industry has effectively been nationalized, it would not be particularly surprising to see fundamental change on a national level that would allow the resumption of securitization. But that would probably bring us back to something like the plain vanilla Fannie and Freddie system that existed before 2000, not the insanely profitable liar loan system that Wall Street had created by 2005.

This post is intended as a tribute to Tanta, who already wrote pretty much everything you need to know to understand these issues, and did it much more cleverly than I can. I have not been able to read all the comments recently, so I apologize if I have inadvertently stolen anyone’s ideas besides Tanta’s.

CR Note: This is a guest post from albrt.

Failed Banks and the Deposit Insurance Fund

by Calculated Risk on 10/04/2009 02:59:00 PM

As a companion to the Oct 2nd Problem Bank List (unofficial), below is a list of failed banks since Jan 2007.

From the FDIC FAQs: (ht JB)

11. When is the DIF expected to go negative?However the DIF reserves against future losses, and the DIF still has cash to pay for bank closures - but I show the DIF balance as zero on the following graph:

FDIC estimates that the DIF balance as of September 30, 2009 will be negative.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.

The cumulative estimated losses for the DIF, since early 2007, is now over $44.5 billion.

Regulators closed three more banks on Friday, and that brings the total FDIC insured bank failures to 98 in 2009. Although regulators have slowed down in recent weeks, they are still on pace to close over 130 banks this year - the most since 1992.

Failed Bank List

Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets. Note that losses for the Irwin banks were combined by the FDIC, so one of the banks shows up as zero percent in the table.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

Click here for a full screen version.

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Weekly Summary

by Calculated Risk on 10/04/2009 07:41:00 AM

Consumer spending was up in August because of Cash-for-Clunkers, but auto sales were down sharply in September.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for September (red, light vehicle sales of 9.22 million SAAR from AutoData Corp).

This is the third lowest vehicle sales this year.

Industrial indicators stalled:

Housing: House Prices increased, meanwhile delinquencies and foreclosure are rising.

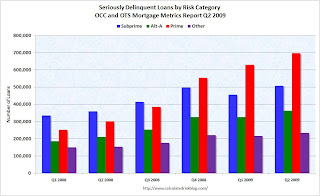

This data is from the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for Second Quarter 2009

This data is from the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for Second Quarter 2009 Seriously delinquent loans continue to rise rapidly, especially for prime loans.

About 25% to 30% of modifications fail in the first three months. For Q1 and Q2 2008, about 55% of borrowers have re-defaulted. Q3 2008 will probably be worse, and Q4 2008 and Q1 2009 about the same.

The Labor Market was very weak.

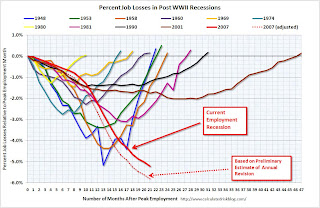

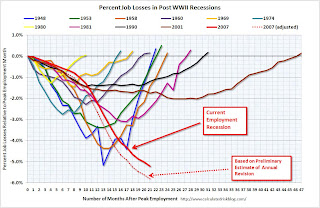

The graph compares the job losses from the start of the employment recession in percentage terms (as opposed to the number of jobs lost).

The graph compares the job losses from the start of the employment recession in percentage terms (as opposed to the number of jobs lost).The dashed line is an estimate of the impact of the large benchmark revision (824 thousand more jobs lost).

Instead of 7.2 million net jobs lost since December 2007, the preliminary benchmark estimate suggests the U.S. has lost over 8.0 million net jobs during that period.

Saturday, October 03, 2009

On Extending the Safety Net

by Calculated Risk on 10/03/2009 08:00:00 PM

Proposals:

If this is just a safety net extension, then the "first-time" homebuyer tax credit doesn't qualify. And if this is the "Next Stimulus Package", providing more aid to the unemployed (13 weeks won't last long), or aid to the states, would be a far more effective use of money than the homebuyer tax credit ...

A couple of stories, first from the WSJ: Democrats Weigh Extending Key Parts of Stimulus

Obama administration economists said they would like the enhanced unemployment-insurance program to extend beyond its Dec. 31 expiration date. They also want to maintain a program that offers tax credits to pay 65% of the cost of health insurance policies under the COBRA program, which allows laid-off workers to purchase the health plans they had through their previous employer.From the NY Times: After More Job Losses, Democrats Move to Extend Benefits

White House officials said they also are examining whether to extend a soon-to-expire tax credit for first-time homebuyers, but that provision faces a stiffer headwind.

The House on Friday approved legislation that would provide 13 more weeks of benefits to states with unemployment rates of 8.5 percent or higher. Democratic leaders in the Senate are pushing a measure that would also provide aid to states that do not meet the threshold.

Senator Harry Reid of Nevada, the majority leader, is promoting legislation that would provide four more weeks of unemployment coverage to all states, while states over the 8.5 percent threshold would get 12 more weeks.

Lawrence H. Summers, director of the National Economic Council, said in an interview with The Atlantic online that the administration should “continue to support people who are in need, whether it’s unemployment insurance, or the Cobra program,” which provides health insurance for the unemployed.

The Impact of the Declining Homeownership Rate

by Calculated Risk on 10/03/2009 05:00:00 PM

This is an update to a 2007 post: Home Builders and Homeownership Rates1

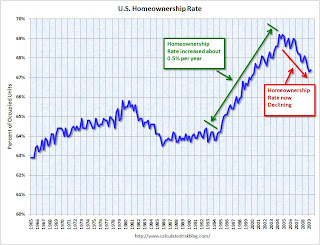

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The reasons for the change in homeownership rate are discussed in the 2007 post ( a combination of demographics and changes in mortgage "innovation"), but here are two key points: 1) During the boom, the change in the homeownership rate added about half a million new homeowners per year, as compared to a steady homeownership rate, 2) the homeownership rate (red arrow is trend) is now declining.

The U.S. population has been growing at close to 3 million people per year on average, and there are about 2.4 people per household. Assuming no change in these rates, there would be close to 1.25 million new households formed per year in the U.S. (The are just estimates, and fewer households are formed during a recession - a key problem right now).

Since about 2/3s of all households are owner occupied, an increase of 1.25 million households per year would imply an increase in homes owned of about 800K+ per year. If an additional 500K per year moved to homeownership - as indicated by the increase in the homeownership rate from 1995 to 2005 - then the U.S. would have needed 1.3 million additional owner occupied homes per year.

Important note: these number can't be compared directly to the Census Bureau housing starts and new home sales. There are many other factors that must be accounted for to compare the numbers.

During that same period, since about 1/3 of all households rent, the U.S. would have needed about 400K+ new rental units per year, minus the 500K per year of renters moving to homeownership. So the U.S. needed fewer rental units per year from 1995 to 2005. The second graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The second graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Even though the total number of rental units was declining, this didn't completely offset the number of renters moving to homeownership, so the rental vacancy rate started moving up - from about 8% in 1995 to over 10% in 2004.

Since 2004 there has been a surge in rental units. Most of this increase is not new apartment buildings, rather a combination of investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes or 2nd homes instead of selling. This increase in rental units is more than offsetting the decline in the homeowership rate, and the rental vacancy rate was at a record 10.6% in Q2. (and will probably be over 11% soon because of the "first-time" homebuyer tax credit).

This increase in the homeownership rate, from 1995 through 2005, meant the homebuilders had the wind to their backs. Instead of 800K of new owner demand per year (plus replacement of demolished units, and second home buying), the homebuilders saw an additional 500K of new owner demand during the period 1995 to 2005. This doesn't include the extra demand from speculative buying. Some of this demand was satisfied by condo conversions and owner built units, but the builders definitely benefited from the increase in homeownership rate.

Looking ahead, if the homeownership rate stays steady, the demand for net additional homeowner occupied units would fall back to 800K or so per year (assuming steady population growth and persons per household). However the homeownership rate is declining, and this is now a headwind for the builders.

It appears the rate is declining at about 0.5% per year. This means the net demand for owner occupied units would be 833K minus about 500K per year or about 333K per year - about 25% of the net demand for owner occupied units for the period 1995 to 2005. (Not including replacing demolished units and 2nd home buying).

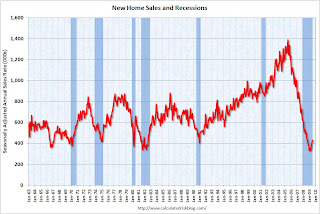

Although we can't compare this number directly to new home sales (because of 2nd home buying, replacement of demolished units, and other factors) this does suggest new home sales will probably remain at a low level until the homeownership rate stops declining. The third graph shows New Home Sales for the last 45 years. the Census Bureau reported: "Sales of new one-family houses in August 2009 were at a seasonally adjusted annual rate of 429,000."

The third graph shows New Home Sales for the last 45 years. the Census Bureau reported: "Sales of new one-family houses in August 2009 were at a seasonally adjusted annual rate of 429,000."

Once the homeownership rate stops declining - probably at about the same time the excess existing home units are mostly absorbed - new home sales will probably increase to a steady state rate based on population growth. However this level will be substantially below the average for the period from 1995 to 2005 when the homebuilders benefited from the increasing homeownership rate.

The "first-time" homebuyer tax credit (and new homebuyer tax credit in California) probably boosted new home sales a little this year, so the homeownership rate might increase in the 2nd half of 2009. However that increase will probably be temporary, and the homeownership rate will probably start declining again.

Key points:

1 A special thanks to Jan Hatzius. Several of the ideas for this post are from his piece: "Housing (Still) Holds the Key to Fed Policy", Nov 27, 2007

NY Times: Retailers Expect No Growth in Holiday Spending

by Calculated Risk on 10/03/2009 01:43:00 PM

From the NY Times: Retailers Expect Flat Christmas Sales This Year

[A] lot of people are thinking about it, and taking surveys to test the mood of the American consumer, and deciding that this Christmas will be as bad as last — which is to say, one of the worst on record.And that suggests that seasonal retail hiring will be weak too. Here is a repeat of a graph from a post a couple weeks ago: Seasonal Retail Hiring

Retailers are relieved to hear that prediction. Flat sales this holiday season would at least mean that things had stopped getting worse ... several reports published in the last few days, including surveys by Nielsen and Deloitte, forecast no change in holiday sales from last year to this year.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. This graph shows the historical net retail jobs added for October, November and December by year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This really shows the collapse in retail hiring in 2008. This also shows how the season has changed over time - back in the '80s, retailers hired mostly in December. Now the peak month is November, and many retailers start hiring seasonal workers in October.

Given the expectation of no growth in holiday spending, retailers will probably be very cautious hiring again this year.

Comparing Employment Recessions including Revision

by Calculated Risk on 10/03/2009 08:56:00 AM

Here is a graph with an estimate of the impact of the preliminary estimate of the annual benchmark revision. (ht John) Click on graph for larger image.

Click on graph for larger image.

The dashed line is an estimate of the impact of the large benchmark revision (824 thousand more jobs lost).

The graph compares the job losses from the start of the employment recession in percentage terms (as opposed to the number of jobs lost).

Instead of 7.2 million net jobs lost since December 2007, the preliminary benchmark estimate suggests the U.S. has lost over 8.0 million net jobs during that period.

Even before the annual revision, the current employment recession was already the worst recession since WWII in terms of percent of job losses. The benchmark revision shows this recession was even deeper. The revision will be reported in February ... just something to remember over the next few months.

Friday, October 02, 2009

Problem Bank List (Unofficial) Oct 2, 2009

by Calculated Risk on 10/02/2009 09:15:00 PM

This is an unofficial list of Problem Banks. All three banks failures today were on this list (Warren Bank, Warren, Michigan; Jennings State Bank, Spring Grove, Minnesota; Southern Colorado National Bank, Pueblo, Colorado)

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by a net four institutions during the week to 463. Aggregate assets increased by $1.5 billion to $298.6 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Additions include three Illinois-based institutions -- Valley Bank, Moline ($691m); Highland Community Bank, Chicago ($120m); and Freedom Bank, Sterling ($86m) - and First Utah Bank, Salt Lake City ($358m) and Coastal Community Bank, Everett, WA ($262m).

The state banking department of Illinois may be the only state department that publicly releases its enforcement actions. We wish other state banking departments would follow Illinois’ lead by providing transparency around their actions.

There is one deletion from last week’s list -- Waterford Village Bank, Williamsville, NY, which we inadvertently missed removing from the list when it failed on July 24th. We greatly appreciate all feedback received in making this list as accurate as possible.

The only other notable change to the list is the addition of a Prompt Corrective Action order against Partners Bank, Naples, FL issued on September 18th. The OTS had previously placed Partners Bank under a Cease & Desist Order on August 21st.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #98: Southern Colorado National Bank, Pueblo, Colorado

by Calculated Risk on 10/02/2009 08:20:00 PM

Rarified Air, Rarer cash.

Where did it all go?

by Soylent Green is People

Form the FDIC: Legacy Bank, Wiley, Colorado, Assumes All of the Deposits of Southern Colorado National Bank, Pueblo, Colorado

Southern Colorado National Bank, Pueblo, Colorado, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Three down. Closing in on 100.

As of September 4, 2009, Southern Colorado National Bank had total assets of $39.5 million and total deposits of approximately $31.9 million. ....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.6 million.... Southern Colorado National Bank is the 98th FDIC-insured institution to fail in the nation this year, and the third in Colorado. The last FDIC-insured institution closed in the state was New Frontier Bank, Greeley, on April 10, 2009.

Bank Failure #97: Jennings State Bank, Spring Grove, Minnesota

by Calculated Risk on 10/02/2009 07:08:00 PM

Recovery is forestalled

More bankers jobless

by Soylent Green is People

From the FDIC: Central Bank, Stillwater, Minnesota, Assumes All of the Deposits of Jennings State Bank, Spring Grove, Minnesota

Jennings State Bank, Spring Grove, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Hey, less than $12 million! Still counts ...

As of July 31, 2009, Jennings State Bank had total assets of $56.3 million and total deposits of approximately $52.4 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.7 million. ... Jennings State Bank is the 97th FDIC-insured institution to fail in the nation this year, and the fourth in Minnesota. The last FDIC-insured institution closed in the state was Brickwell Community Bank, Woodbury, on September 11, 2009.

Bank Failure #96: Warren Bank, Warren, Michigan

by Calculated Risk on 10/02/2009 06:11:00 PM

Bank: GL GBTW

Bair: BCNU

by Soylent Green is People

From the FDIC: The Huntington National Bank, Columbus, Ohio, Assumes All of the Deposits of Warren Bank, Warren, Michigan

Warren Bank, Warren, Michigan, was closed today by the Michigan Office of Financial and Insurance Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday!

As of July 31, 2009, Warren Bank had total assets of $538 million and total deposits of approximately $501 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $275 million. ... Warren Bank is the 96th FDIC-insured institution to fail in the nation this year, and the second in Michigan. The last FDIC-insured institution closed in the state was Michigan Heritage Bank, Farmington Hills, on April 24, 2009.

Report: Starwood "Winner" of Corus "Assets", and more Walking Away from Hotels

by Calculated Risk on 10/02/2009 03:56:00 PM

Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From the WSJ: Starwood-Led Group Likely Winner of Corus Assets

... a group of investors led by ... Starwood Capital Group is emerging as the likely winner ... of the failed Corus Bank's condominium loans and other property ...And more hotels going down ... from a Lodgian press release: (ht Zach)

The assets have a face value of about $5 billion but the winning bid is expected to be far less than that ... To minimize the losses to taxpayers from the failure of Corus, the FDIC will take a 60% equity stake in the partnership that ends up owning the Corus assets ...The FDIC also will provide financing to the partnership.

The Merrill Lynch Fixed Rate Pool 3, secured by six hotels, is in default. The loan matured on October 1, 2009. The company has engaged in negotiations with the lender regarding extension and modification of the loan, with no resolution to date. Unless some agreement is reached in the near-term, the company intends to return the hotels to the lender in full satisfaction of the debt; The company has stopped servicing the debt secured by the Crowne Plaza in Worcester, Mass., and intends to return the hotel to the lender in full satisfaction of the debt;

Bloomberg: Banks With 20% Unpaid Loans

by Calculated Risk on 10/02/2009 03:09:00 PM

Since it is Friday ...

From Bloomberg: Banks With 20% Unpaid Loans at 18-Year High Amid Recovery Doubt

The number of U.S. lenders that can’t collect on at least 20 percent of their loans hit an 18-year high, signaling that more bank failures and losses could slow an economic recovery.And here is a classic quote:

[There are] 26 firms with more than one-fifth of their loans 90 days overdue or not accruing interest as of June 30 -- a level of distress almost five times the national average ...

For banks with 20 percent of loans overdue, “either they’ve got a massive amount of capital, or the FDIC just hasn’t gotten around to them,” said Jeff Davis, an analyst with FTN Equity Capital Markets in Nashville.

“Everything was so positive for so long in this area, it came as a surprise when it stopped,” said John Medernach, Benchmark’s CEO ...Hey, Hoocoodanode? (Who could have known?)

“I stop and think of all the rich farmland that has been developed into subdivisions during the boom years,” Medernach said. “It makes you wonder what we’ve been doing.”

The article includes a table with all 62 banks. Here are the "leaders" according to Bloomberg:

| Company | Location | Nonaccrual Loans as % of Total |

|---|---|---|

| Community Bank of Lemont | Lemont, IL | 49.45 |

| Eastern Savings Bank FSB | Hunt Valley, MD | 48.01 |

| City Bank | Lynnwood, WA | 43.95 |

ABI: Personal Bankruptcy Filings up 41 Percent Compared to Sept 2008

by Calculated Risk on 10/02/2009 12:41:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Surge Past One Million During First Nine Months of 2009

Consumer bankruptcies totaled 1,046,449 filings through the first nine months of 2009 (Jan. 1-Sept. 30), the first time since the 2005 bankruptcy overhaul that filings have surged past the 1 million mark during the first three calendar quarters of a year, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The filings for the first three-quarters of 2009 were the highest total since the 1,350,360 consumer filings through the first nine months of 2005.

"Bankruptcy filings continue to climb as consumers look to shelter themselves from the effects of rising unemployment rates and housing debt," said ABI Executive Director Samuel J. Gerdano. "The consumer filing total through the first nine months is consistent with our expectation that consumer bankruptcies will top 1.4 million in 2009."

The September 2009 consumer filing total reached 124,790, a 41 percent increase from the 88,663 consumer filings in September 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.05 million personal bankruptcy filings through Sept 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!

Employment-Population Ratio, 10% Unemployment, Part Time Workers

by Calculated Risk on 10/02/2009 11:26:00 AM

A few more graphs based on the (un)employment report ...

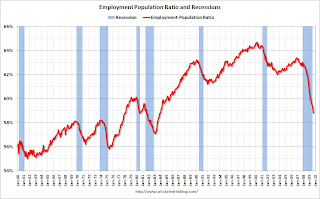

Employment-Population Ratio Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

This measure fell in September to 58.8%, the lowest level since the early '80s.

The Labor Force Participation Rate fell to 65.2% (the percentage of the working age population in the labor force). This is also the lowest since the mid-80s.

When the job market starts to recover, many of these people will reenter the workforce and look for employment - and that will keep the unemployment rate elevated for some time.

This second graph shows the quarterly change in net jobs (on the x-axis) as a percentage of the civilian workforce, and the change in the unemployment rate on the y-axis. Although this data is from two different surveys, there is a clear relationship between the data. For a discussion of the two surveys, see Jobs and the Unemployment Rate.

The following data is for the last 40 years: 1969 through Q3 2009. The Red squares are for 2008, and for the first three quarters of 2009 (the current employment recession).

The Red squares are for 2008, and for the first three quarters of 2009 (the current employment recession).

The U-3 headline unemployment rate for September was reported at 9.8% (this was actually rounded down from 9.83%).

Notice the relationship is not linear. As the job market starts to recover, more people will participate in the labor force - and the Labor Force Participation Rate and the employment-population ratio will increase.

10% Unemployment

It is possible that the unemployment rate will hit 10% in October (the current unemployment rate is 9.83%, an increase of 0.17% from August).

With similar job losses in October as in September, or just more people participating in the work force - perhaps looking for one of the scarce holiday retail jobs - the unemployment rate could easily hit 10% this month. If not in October, then probably in November.

Part Time for Economic Reasons

From the BLS report:

In September, the number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 9.2 million. The number of such workers rose sharply throughout most of the fall and winter but has been little changed since March.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at a record 9.179 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at a record 9.179 million. Note: the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this is not quite a record.

Earlier employment posts today:

Unemployment: Stress Tests, Unemployed over 26 Weeks, Diffusion Index

by Calculated Risk on 10/02/2009 09:30:00 AM

Note: earlier Employment post: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate. The earlier post includes a graph of percent job losses in a recession - the current recession is the worst post-WWII.

Stress Test Scenarios

The economy is performing better that the stress test baseline scenario for GDP and house prices, but worse than the "more adverse" stress test scenario for unemployment.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: the Unemployment Rate for Q3 is 9.63% (rounded to 9.6%), and will move higher in Q4. Once again, the unemployment rate is already higher than the "more adverse" scenario.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

Unemployed over 26 Weeks

The DOL report yesterday showed seasonally adjusted insured unemployment at 6.1 million, down from a peak of about 6.9 million. This raises the question of how many unemployed workers have exhausted their regular unemployment benefits (Note: most are still receiving extended benefits, although many workers are starting to exhaust their extended benefits too).

The monthly BLS report provides data on workers unemployed for 27 or more weeks, and here is a graph ... The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are a record 5.4 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 3.5% of the civilian workforce. (note: records started in 1948)

Diffusion Index The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Both the "all industries" and "manufacturing" employment diffusion indices had been trending up - meaning job losses were becoming less widespread. However both turned down in September. This series is noisy month-to-month, but it still appears job losses are widespread across industries.

Ugly. Ugly. Ugly.

Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

by Calculated Risk on 10/02/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to decline in September (-263,000), and the unemployment rate (9.8 percent) continued to trend up, the U.S. Bureau of Labor Statistics reported today. The largest job losses were in construction, manufacturing, retail trade, and government.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 263,000 in September. The economy has lost almost 5.8 million jobs over the last year, and 7.2 million jobs during the 21 consecutive months of job losses.

The unemployment rate increased to 9.8 percent. This is the highest unemployment rate in 26 years.

Year over year employment is strongly negative.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up earlier this year, and the current recession is now the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession was worse).

The economy is still losing jobs at about a 3.2 million annual rate, and the unemployment rate will probably be above 10% soon. This is a very weak employment report - just not as bad as earlier this year. Much more to come ...

Note: The the preliminary benchmark payroll revision is minus 824,000 jobs. (This is the preliminary estimate of the annual revision - this is very large).

Thursday, October 01, 2009

"After the Storm": No Immaculate Recovery

by Calculated Risk on 10/01/2009 10:44:00 PM

A couple late night articles:

The Ylan Mui at the WaPo reviews the recent economic data: New Economic Reports Show We're Still Hurting (ht Ann)

The fragile economic recovery has relied heavily on government stimulus spending, but new data show that as the money runs out, a sustained rebound may be elusive.A similar theme from The Economist: After the storm

Despite a welcome return to growth, the world economy is far from returning to “normal” activity. Unemployment is still rising and much manufacturing capacity remains idle. Many of the sources of today’s growth are temporary and precarious. The rebuilding of inventories will not boost firms’ output for long. Across the globe spending is being driven by government largesse, not animal spirits. Massive fiscal and monetary stimulus is cushioning the damage to households’ and banks’ balance-sheets, but the underlying problems remain. In America and other former bubble economies, household debts are worryingly high, and banks need to bolster their capital. That suggests consumer spending will be lower and the cost of capital higher than before the crunch. The world economy may see a few quarters of respectable growth, but it will not bounce back to where it would have been had the crisis never happened.Recoveries are usually led by a pickup in consumer spending and residential investment. Although consumer spending was strong in August, the numbers were distorted by the cash-for-clunkers program, and I expect weak growth for consumer spending through most of next year as households save more and rebuild their balance sheets.

And for residential investment, there is still too much excess existing home inventory, and possibly a large shadow inventory. I will write more on the outlook for consumer spending and residential investment soon.

As The Economists notes, rebuilding inventories will be a transitory boost for the economy, and that leaves government spending and exports. That doesn't sound like an Immaculate Recovery.

Summary and Misc Articles

by Calculated Risk on 10/01/2009 06:40:00 PM

The BLS jobs report will be released tomorrow morning. The consensus is for 170 thousand net jobs lost and the unemployment rate rising to 9.8%. That seems a little optimistic given the recent data flow.

Lots of data today:

And a few other interesting articles:

So-called strategic defaults, in which homeowners stop paying their mortgages while remaining current on other debts, rose 128 percent to 588,000 last year, according to Experian PLC ...The classic definition of a "strategic default" is a borrower who can afford their mortgage, but stops paying it because they owe far more than their home is worth. This measurement from Experian is very different and includes many people who can no longer afford their mortgage. Long ago borrowers paid their mortgages first - to keep their homes - but that was when people actually had money invested in their homes. (sorry for the snark).

There was a stunning omission from the government’s latest list of “problem” banks, which ran to 416 lenders, a 15-year high, as of June 30. One outfit not on the list was Georgian Bank, the second-largest Atlanta-based bank, which supposedly had plenty of capital.I believe it would be helpful if the FDIC released the Cease & Desist orders on a more timely basis.

...

The cost of Georgian’s failure confirms that the bank’s asset values were too optimistic.

...

Georgian also reported a 12-fold jump in nonperforming loans to $306.4 million from $24.7 million three months earlier, mostly construction loans. Georgian’s numbers made it seem as if the surge arose from nowhere.

...

What wasn’t made public until Sept. 25, the day it closed, was that Georgian Bank had agreed to a cease-and-desist order with the FDIC on Aug. 31 after flunking an agency examination.

Delinquencies in the Phoenix area on loans backed by office, industrial, retail and apartment properties have risen more than five-fold since March, according to data compiled by Bloomberg.Live by real estate. Die by real estate.

...

“The problems in commercial real estate are just getting started and they will dampen what is already going to be a weak economic recovery,” said Jim Rounds, senior vice president and senior economist at Elliott D. Pollack. “In Arizona, the recession is probably going to last to the middle of the next calendar year.”