by Calculated Risk on 10/07/2009 04:02:00 PM

Wednesday, October 07, 2009

The Housing Tax Credit: NAHB Projections and more

From the NAHB:

Extending the credit through Nov. 30, 2010 and making it available to all purchasers of a principal residence would result in an additional 383,000 home sales ...The NAHB has also been arguing to expand the tax credit from $8,000 to $15,000. But using $8,000 per home buyer - and estimating 5 million home sales over the next year - the total cost of the tax credit would be $40 billion.

According to the NAHB this would result in 383,000 additional home sales. Dividing $40 billion by 383 thousand gives $104,400 per additional home sold!

That is higher than my original estimate that an extension of the tax credit would cost about $100 thousand per additional home sold.

Note: If the NAHB meant $15,000 per home buyer, the cost would be $75 billion - or $157 thousand per additional home sold.

And this doesn't included the costs of the unintended consequences.

[Fed economist] Mr. Conway's presentation painted a bleak picture of the sliding real-estate values and enormous debt that will need to be refinanced in the next few years. Vacancy rates in the apartment, retail and warehouse sectors already have exceeded those seen during the real-estate collapse of the early 1990s, Mr. Conway noted. His report also predicted that commercial real-estate losses would reach roughly 45% next year. Valuing real estate has always been tricky for banks, and the problem is particularly acute now because sales activity is practically nonexistent.

...

More than half of the $3.4 trillion in outstanding commercial real-estate debt is held by banks.

Anyone analyzing the tax credit should call the economists at the BLS and ask about how falling rents will impact owners' equivalent rent and CPI. Then call the economists at the Federal Reserve and ask how CPI deflation will impact consumer behavior and monetary policy. Welcome to the Fed's nightmare.

Consumer Credit Declines Sharply in August

by Calculated Risk on 10/07/2009 03:00:00 PM

From MarketWatch: U.S. consumer credit falls for 7th straight month

U.S. consumers reduced their debt for the seventh straight month in August, the Federal Reserve reported Wednesday. Total seasonally adjusted consumer debt fell $11.98 billion, or at a 5.8% annual rate ... In the subcategories, credit-card debt fell $9.91 billion, or 13.1%, to $899.41 billion. This is the record 11th straight monthly drop in credit card debt. Non-revolving credit, such as auto loans, personal loans and student loans fell $2.10 billion or 1.6% to $1.56 trillion.Cash-for-clunkers probably kept non-revolving credit from falling further - just wait for the September numbers!

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 4.4% over the last 12 months. The previous record YoY decline was 1.9% in 1991.

Here is the Fed report: Consumer Credit

Consumer credit decreased at an annual rate of 5-3/4 percent in August 2009. Revolving credit decreased at an annual rate of 13 percent, and nonrevolving credit decreased at an annual rate of 1-1/2 percent.Note: The Fed reports a simple annual rate (multiplies change in month by 12) as opposed to a compounded annual rate. Consumer credit does not include real estate debt.

Hotel Defaults and Foreclosures Increase Sharply in California

by Calculated Risk on 10/07/2009 11:52:00 AM

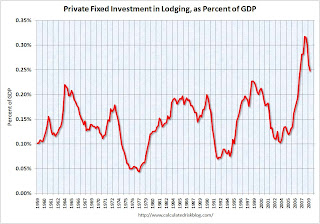

Hotel investment has always been boom and bust, but the most recent boom was off the charts ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows lodging investment as a percent of GDP since 1959 through Q2 2009.

Lodging investment peaked in mid-2008, but because of the length of time for hotel construction, there are many new hotels still coming online - at just the wrong time.

From the LA Times: Hotel defaults, foreclosures rise in California (ht Ann)

... Statewide, more than 300 hotels were in foreclosure or default on their loans as of Sept. 30 -- a nearly fivefold increase since the start of the year, according to an industry report released Tuesday.Not only is the recession impacting business and leisure travel, but there are just too many hotel rooms, and many more on the way.

...

Most struggling hotels remain open, but industry experts believe many properties are likely to be closed down in the months ahead, even if they are not in foreclosure, because they are losing so much money. ...

"I have never seen so many lenders contemplating mothballing properties," said Jim Butler, a hotel lawyer and chairman of the global hospitality group for Jeffer, Mangels, Butler & Marmaro. "It can and it will get worse for the hotel industry."

...

Statewide, 260 hotels were in default on their loans and 47 had been taken over by their lenders in foreclosure, the Atlas report said.

... a leading hotel consulting firm, Smith Travel Research, recently issued a report that predicted no significant improvement for the hotel industry until 2011 at the earliest.

"It's going to be a lot worse than it is now," said Bobby Bowers, senior vice president of Smith Travel Research.

... an increasing number of hotels have so little revenue that they can't even afford to pay their operating bills and payroll, not to mention servicing debt.

Owners of such hotels are increasingly handing the keys back to the lenders, and the problem is likely to get worse: As many as 1 in 5 U.S. hotel loans may default through 2010, UC Berkeley economist Kenneth Rosen said.

In some cases the lenders are simply locking up the properties...

emphasis added

Office Vacancy Rate and Unemployment

by Calculated Risk on 10/07/2009 10:31:00 AM

Last night Reis reported that the U.S. office vacancy rate hits 16.5 percent in Q3. (See Reis: U.S. Office Vacancy Rate Hits 16.5% in Q3 for a graph). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

The unemployment rate and the office vacancy rate tend to move in the same direction - and the peaks and troughs mostly line up.

As the unemployment rate continues to rise over the next year or more, the office vacancy rate will probably rise too. Reis' forecast is for the office vacancy rate to peak at 18.2 percent in 2010, and for rents to continue to decline through 2011.

One of the questions is why - with a 9.8% unemployment rate in September - the office vacancy rate isn't even higher? This is probably because of less overbuilding, as compared to the S&L related overbuilding in the '80s, and the tech bubble overbuilding a few years ago. Also a number of non-office workers (construction and retail workers) have lost their jobs in the current employment recession. The second graph shows office investment as a percent of GDP since 1959 through Q2 2009.

The second graph shows office investment as a percent of GDP since 1959 through Q2 2009.

Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

Of course many existing office buildings were purchased in recent years at very low cap rates, with excessive leverage, and optimistic income projections. Now that prices have fallen sharply, many of these building owners are far underwater - and that will lead to more losses for lenders. See the WSJ: Fed Frets About Commercial Real Estate

NY Times: Employment Tax Credit Gains Support

by Calculated Risk on 10/07/2009 09:21:00 AM

From Catherine Rampell at the NY Times: Support Builds for Tax Credit to Help Hiring

... a tax credit for companies that create new jobs ... is gaining support among economists and Washington officials ...The timing is probably better than in 1977 when employment was already recovering. If the 1970s estimate is accurate (about 2/3 of the jobs would have been created anyway), this proposal is already much better targeted than the housing tax credit, and better for the economy and the housing market too.

Timothy J. Bartik, a senior economist at the Upjohn Institute for Employment Research who is working on the draft with John H. Bishop of Cornell, estimates that it would cost about $20,000 for each job created.

...

Under the proposal from Mr. Bartik and Mr. Bishop, the credit in the first year would equal 15.3 percent of the cost of adding an employee. In the second year, it would fall to about 10.2 percent.

...

The authors estimate their proposal could create more than two million jobs in the first year.

...

Of course, even in recessionary times, some companies are hiring without tax breaks. So a subsidy could merely benefit those businesses that already would have added new workers.

An American Economic Review study has suggested that the 1970s policy was responsible for adding about 700,000 of the 2.1 million jobs that were awarded the credit.

...

Advocates argue that such incentives would be more effective this time around not only because of design, but also because of timing. In 1977, hiring was already on the upswing, whereas economists expect today’s job market to decline a bit more and then stagnate for months.

A key problem for housing and the economy is that there are too many housing units compared to the number of households. This proposal will indirectly stimulate more household formation - more jobs will create more households - and more households is the key to the housing market and the economy.

Reis: U.S. Office Vacancy Rate Hits 16.5% in Q3

by Calculated Risk on 10/07/2009 01:11:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate starting 1991.

Reis is reporting the vacancy rate rose to 16.5% in Q3 from 15.9% in Q2. The peak following the previous recession was 17%.

From Bloomberg: U.S. Office Vacancies Reach Five-Year High of 16.5%, Reis Says

U.S. office vacancies ... climbed to 16.5 percent ... New York-based Reis said in a report. Effective rents ... fell 8.5 percent, the biggest year-over-year drop since 1995.Earlier this year Reis forecast that the U.S. office vacancy rate will top out at 18.2 percent in 2010, and that rents will continue to decline through 2011.

“The decline in effective rents really accelerated after the fall of Lehman Brothers,” Victor Calanog, director of research at Reis, said in a statement. “Tenants will continue shedding occupied space as jobs are lost.”

...

“Weakness in rents is not concentrated in just a few” cities, Calanog said.

No wonder the Fed is so worried (previous post).

Tuesday, October 06, 2009

Fed Worries about CRE Grow

by Calculated Risk on 10/06/2009 10:07:00 PM

From the WSJ: Fed Frets About Commercial Real Estate

Banks in the U.S. "are slow" to take losses on their commercial real-estate loans being battered by slumping property values and rental payments, according to a Federal Reserve presentation to banking regulators last month.There is much more in the article, including a discussion on interest reserves masking bad loans (something we've been discussing for a few years) and "extend and pretend". Hey, hoocoodanode!

.... "Banks will be slow to recognize the severity of the loss -- just as they were in residential," according to the Fed presentation, which was reviewed by The Wall Street Journal.

A Fed official confirmed the authenticity of the document, prepared by an Atlanta Fed real-estate expert who is part of the central bank's Rapid Response program to spread information about emerging problem areas to federal and state banking examiners throughout the U.S.

While the Sept. 29 presentation by K.C. Conway doesn't represent the central bank's formal opinion, worries about the banking industry's commercial real-estate exposure have been building inside the Fed for months. ...

Mr. Conway's presentation painted a bleak picture of the sliding real-estate values and enormous debt that will need to be refinanced in the next few years. Vacancy rates in the apartment, retail and warehouse sectors already have exceeded those seen during the real-estate collapse of the early 1990s, Mr. Conway noted. His report also predicted that commercial real-estate losses would reach roughly 45% next year. Valuing real estate has always been tricky for banks, and the problem is particularly acute now because sales activity is practically nonexistent.

...

More than half of the $3.4 trillion in outstanding commercial real-estate debt is held by banks.

Note: REIS reported today that the apartment vacancy rate in cities hit a 23 year high: From Reuters: US apartment vacancy rate hits 23-year high-report and other CRE categories are also seeing rapidly rising vacancies and falling rents.

Small Business and Employment

by Calculated Risk on 10/06/2009 07:00:00 PM

Atlanta Fed research economist Melinda Pitts writes at Macroblog: Prospects for a small business-fueled employment recovery

In a speech yesterday, William Dudley, the president of the Federal Reserve Bank of New York, identified financial constraints for small businesses as a restraint on the pace of economic recovery.Dr. Pitts excerpt from William Dudley's speech, and then notes:

President Dudley's comments are even more relevant in the current recession if one considers the disproportionate effect the recession has had on very small businesses.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Graph Credit: Melinda Pitts, Atlanta Fed research economist and associate policy adviser

This graph breaks down net job gains and losses by firm size since 1992. During the current employment recession, small firms have accounted for about 45% of the job losses - much higher than during the 2001 recession.

Dr. Pitts cautions:

Looking ahead, it's not clear whether small businesses will continue to play their traditional role in hiring staff and helping to fuel an employment recovery. However, if the above-mentioned financial constraints are a major contributor to the disproportionately large employment contractions for very small firms, then the post-recession employment boost these firms typically provide may be less robust than in previous recoveries.

Starwood to Buy Corus Assets

by Calculated Risk on 10/06/2009 04:00:00 PM

From Zachery Kouwe and Eric Dash at the NY Times DealBook: Sternlicht, Ross Strike Deal for Corus Assets

The Federal Deposit Insurance Corporation plans to announce on Tuesday that it will sell about $4.5 billion of troubled real estate loans that it recently seized from Corus Bancshares to a group of private investment firms led by the Starwood Capital Group ...The details are not available yet.

Under the terms of the complex deal, Starwood and its business partners agreed to pay $554 million for a 40 percent equity stake in the loan pool while the F.D.I.C. keeps a 60 percent stake ... By providing guaranteed financing to the buyers, the government hopes that they will be able finish developing the condo projects or turn them into apartments or hotels.

...

The sale reflects an estimated price of about 50 cents on the dollar for the batch of troubled loans ...

Inland Empire Retail Vacancy Rate Increases

by Calculated Risk on 10/06/2009 02:45:00 PM

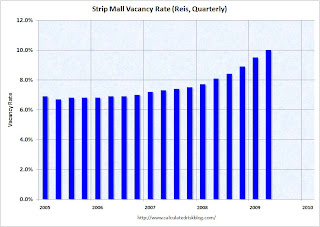

Just to complete the CRE circle: rising vacancy rates for apartments, offices, and retail ...

From the Press Enterprise: Vacancy rates among Inland retailers mounts

... Inland retail vacancy rates in the third quarter [were] 11.2 percent ...The REIS national Q3 retail vacancy rates will be released soon, but here is a preview based on the Q2 numbers:

That marked a rise from 10.6 percent in the prior quarter, and was well up from 7.6 percent in the third quarter of 2008, according to new data from commercial real estate broker CB Richard Ellis.

...

"I think we're going to be seeing these trends for the rest of this year and for much of 2010," said Matt Burnett, senior associate in the Ontario office of CB Richard Ellis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.In Q2, the U.S. strip mall vacancy rate hit 10%, the highest level since 1992.

"Until we see stabilization and recovery take root in both consumer spending and business spending and hiring, we do not foresee a recovery in the retail sector until late 2012 at the earliest."

Victor Calanog, director of research for Reis Inc, July 2009

Report: Manhattan Office Vacancy Rate Increases, Rents Decline

by Calculated Risk on 10/06/2009 11:43:00 AM

From Bloomberg: Manhattan Office Vacancies Reach Five Year High, Cushman Says

Manhattan’s third-quarter office vacancy rate hit a five-year high ... The rate rose to 11.1 percent, the highest since the third quarter of 2004, New York-based broker Cushman & Wakefield said in a statement today. Rents fell 5.2 percent from the second quarter to $57.08 a square foot and were down 22 percent from a year earlier.Yesterday, NY Fed President commented about falling commercial real estate prices:

emphasis added

First, the capitalization rate—the ratio of income to valuation—has climbed sharply. At the peak, capitalization rates for prime properties were in the range of 5 percent. That means that investors were willing to pay $20 for a $1 of income. Today, the capitalization rate appears to have risen to about 8 percent. That means that the same dollar of income is now capitalized as worth only $12.50. In other words, if income were stable, the value of the properties would have fallen by 37.5 percent. Second, the income generated by commercial real estate has generally been falling.According to Cushman, rents are off 22% over the last year (probably more since the peak), and combined with the higher cap rate, Dudley's estimate suggests office building prices have fallen by half or more in New York.

There was a little good news in the Cushman report:

Sublease space declined to 11.1 million square feet from 11.4 million at mid-year, the first drop since the end of 2007, Cushman said.However the vacancy rate is still expect to rise further, perhaps to 14% in New York according to Cushman.

“A decline in sublease space is indicative of the market beginning to move towards stabilization,” said Joseph Harbert, chief operating officer for Cushman’s New York metropolitan region.

The national office vacancy data from REIS will be released soon.

NRF Forecasts One Percent Decline in Holiday Retail Sales

by Calculated Risk on 10/06/2009 08:50:00 AM

From the National Retail Federation: NRF Forecasts One Percent Decline in Holiday Sales

The National Retail Federation today released its 2009 holiday forecast, projecting holiday retail industry sales to decline one percent this year to $437.6 billion.* While this number falls significantly below the ten-year average of 3.39 percent holiday season growth, the decline is not expected to be as dramatic as last year’s 3.4 percent drop in holiday retail sales ...Notice the focus on cost controls, and that suggests retail hiring for the holiday season will be weak.

“The expectation of another challenging holiday season does not come as news to retailers, who have been experiencing a pullback in consumer spending for over a year,” said NRF President and CEO Tracy Mullin. “To compensate, retailers’ focus on the holiday season has been razor-sharp with companies cutting back as much as possible on operating costs in order to pass along aggressive savings and promotions to customers.”

* NRF defines “holiday sales” as retail industry sales in the months of November and December. Retail industry sales include most traditional retail categories including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

Here is a repeat of a graph from a post a couple weeks ago: Retail Hiring Outlook "Jobs Scarce"

Click on graph for larger image in new window.

Click on graph for larger image in new window.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. This graph shows the historical net retail jobs added for October, November and December by year.

Based on the NRF forecast, seasonal retail hiring might be around 400 thousand again in 2009.

More from Ylan Mui at the WaPo: Retailers Hope for Holiday Cheer

The retail federation's forecast "is a good number in that it shows stabilizing in sales," NRF spokesman Scott Krugman said. "However, it also acknowledges that the recovery is not going to be consumer-led."Typically recoveries are consumer led, and then the increase in end demand eventually leads to more business investment. Not this time. Just another reminder that the typical engines of recovery are still misfiring.

Apartment Vacancy Rate at 23 Year High

by Calculated Risk on 10/06/2009 12:20:00 AM

From Reuters: US apartment vacancy rate hits 23-year high-report

The U.S. apartment vacancy rate rose to 7.8 percent in the third quarter, its highest since 1986, ... according to Reis.Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at a record 10.6% in Q2 2009. This also fits with the NMHC apartment market survey.

...

"It makes me wonder whether the avalanche is on its way for office and retail (real estate) unless things change really quickly and really drastically," Victor Calanog, Reis director of research, said.

Reis still expects the U.S. apartment vacancy rate to pass the 8 percent mark by perhaps next quarter but certainly by next year, Calanog said. That would make it the highest vacancy rate since Reis began tracking the market in 1980.

In the third quarter, the U.S. apartment asking rental rate fell 0.5 percent to $1,035 per month, the fourth consecutive declining quarter. ...

Rising vacancies. Falling Rents. Here comes the Fed's nightmare.

Monday, October 05, 2009

Sorkin Book Excerpt: "Too Big to Fail"

by Calculated Risk on 10/05/2009 10:48:00 PM

From Vanity Fair: Wall Street’s Near-Death Experience (ht jb)

The Vanity Fair piece is an excerpt from Andrew Ross Sorkin's "Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System---and Themselves" to be released on October 20th.

Sunday, September 21, 2008: The Last StandThe Vanity Fair excerpt is a page-turner.

...

Upstairs, [Morgan Stanley CEO John] Mack was on the phone with Mitsubishi’s chief executive, Nobuo Kuroyanagi, and a translator trying to nail down the letter of intent. His assistant interrupted him, whispering, “Tim Geithner is on the phone—he has to talk to you.”

Cupping the receiver, Mack said, “Tell him I can’t speak now. I’ll call him back.”

Five minutes later, Paulson called. “I can’t. I’m on with the Japanese. I’ll call him when I’m off,” he told his assistant.

Two minutes later, Geithner was back on the line. “He says he has to talk to you and it’s important,” Mack’s assistant reported helplessly.

Mack was minutes away from reaching an agreement. He looked at Ji-Yeun Lee, who was standing in his office helping with the deal, and told her, “Cover your ears.”

“Tell him to get fucked,” Mack said of Geithner. “I’m trying to save my firm.”

NY Fed's Dudley: Downside Risks to Inflation for "next year or two"

by Calculated Risk on 10/05/2009 08:00:00 PM

From NY Fed President William Dudley: A Bit Better, But Very Far From Best

... My assessment of where things stand today is mixed. On the positive side, the financial markets are performing better and the economy is now recovering. ...There is much more in the speech about resource slack and the Fed's tools "to exit smoothly from the very low federal funds rate".

On the negative side, the unemployment rate is much too high and it seems likely that the recovery will be less robust than desired. This means that the economy has significant excess slack and implies that we face meaningful downside risks to inflation over the next year or two. ...

... I also suspect that the recovery will turn out to be moderate by historical standards. This is a disappointing outcome in that growth will likely not be strong enough to bring the unemployment rate—currently 9.8 percent —down quickly.

I see three major forces restraining the pace of this recovery. First, households are unlikely to have fully adjusted to the net wealth shock that has been generated by the housing price decline and the weakness in share prices. ...

The shock to household net worth seems likely to have several important implications for household behavior. The shock creates a risk that the household saving rate could increase further. For example, during the period from 1990 to 1992, the household saving rate averaged about 7 percent of disposable personal income, considerably higher than the 4.3 percent average rate during the first half of this year. If the household saving rate were to rise, then consumption would rise more slowly than income, making it more difficult for the economy to develop strong forward momentum. ...

The second force that could restrain the recovery is the fiscal outlook. The fiscal stimulus that is currently providing support to economic activity is temporary rather than permanent. This has to be the case if we are to ensure that fiscal policy is on a sustainable path over the long-run. This means that the positive impulse from fiscal stimulus will abate over the next year.

The third, and perhaps most important factor, is that the banking system has still not fully recovered. Bank credit losses lag the business cycle and are still climbing. ...

The commercial real estate sector is under particular pressure because the fundamentals of the sector have deteriorated sharply and because the sector is highly dependent upon bank lending. In terms of the fundamentals, there are two problems. First, the capitalization rate—the ratio of income to valuation—has climbed sharply. At the peak, capitalization rates for prime properties were in the range of 5 percent. ... Today, the capitalization rate appears to have risen to about 8 percent. ... Second, the income generated by commercial real estate has generally been falling. ...

The decline in commercial real estate valuations has created a significant amount of “rollover risk” when commercial real estate loans and mortgages mature and need to be refinanced. ... This means that more pain likely lies ahead for this sector and for those banks with heavy commercial real estate exposures.

For small business borrowers, there are three problems. First, the fundamentals of their businesses have often deteriorated because of the length and severity of the recession—making many less creditworthy. Second, some sources of funding for small businesses—credit card borrowing and home equity loans—have dried up as banks have responded to rising credit losses in these areas by tightening credit standards. Third, small businesses have few alternative sources of funds. ...

All of these factors will tend to inhibit the pace of the economic recovery. Given that the recovery is starting with an abnormally large amount of slack, and the pace of recovery is not likely to be robust, this means the economy is likely to have significant excess resources for some time to come. As a result, the balance of risks to inflation lies on the downside, not the upside, at least for the next year or two.

...

In summary, I believe the current balance of risks around the inflation outlook lie to the downside due to the very low level of resource utilization and the fact that long-run inflation expectations remain stable. This balance of risks is problematic because the current level of inflation is already so low—the core PCE (personal consumption expenditures) deflator has increased only 1.3 percent over the past 12 months. Thus, we would not need much of a decline in inflation to run the risk of an outright deflation. Outright deflation, in turn, would be a dangerous development because it would drive up real debt burdens and make it much more difficult for households and businesses to deleverage.

emphasis added

CityCenter Las Vegas Cuts Condo Prices 30% for Existing Buyers

by Calculated Risk on 10/05/2009 05:59:00 PM

Press Release: CityCenter Announces Residential Price Reductions (ht Charlie)

CityCenter ... on the Las Vegas Strip, has announced that a 30 percent price reduction will be offered at closing to the existing buyers of CityCenter's three luxury residential offerings: The Residences at Mandarin Oriental, Las Vegas, Veer Towers and Vdara Condo Hotel.This is a price concession to existing buyers; those buyers who originally signed contracts starting in January 2007. This is an attempt to get those buyers to close escrow and not walk away from their deposits.

"We believe that in this economic climate this price reduction is an appropriate step to take on behalf of our buyers so as to provide them greater flexibility in closing on their residences," said Bobby Baldwin, president and CEO of CityCenter.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Case-Shiller house price index for Las Vegas.

The CityCenter condos were first offered for sale in January 2007 (almost at the price peak), and prices in Las Vegas have fallen 55% since then according to Case-Shiller.

The Case-Shiller index suggests these buyers will still be far underwater.

New York Income Tax Revenue Falls 36%

by Calculated Risk on 10/05/2009 02:05:00 PM

From Bloomberg: New York Income Tax Revenue Falls 36% in Year, Paterson Says (ht Mike In Long Island)

New York State’s income tax revenue has dropped 36 percent from the same period in 2008 ...And in Massachusetts from Reuters: Massachusetts government to announce emergency budget cuts

“We added personal income tax, which we thought would make the falloff 10 percent to 15 percent,” Paterson ... referring to $5.2 billion in new or increased taxes. “This is what is so frustrating. It’s still 36 percent, meaning our revenues fell more in 2009 than they did in 2008.”

...

Besides boosting taxes for the fiscal year that began April 1, lawmakers made $5.1 billion in spending cuts. The plan also includes $6.2 billion in federal stimulus money and $1.1 billion in one-time revenue ...

Massachusetts officials have begun identifying emergency cuts to make to the fiscal year 2010 budget after the state's September tax revenue collections missed their target, Governor Deval Patrick said on Friday.And this will lead to cuts in state and local employment (tend to lag private sector cuts).

"Our cabinet has effectively managed through a $7 billion gap already" with spending cuts, layoffs and other measures, Patrick said. "But today's news means we have more to do."

September's monthly tax collection totaled $1.766 billion, an estimated $243 million below its target, highlighting the state's struggling finances in the midst of the recession.

A comment on Senators Cornyn and Schumer and the Housing Market

by Calculated Risk on 10/05/2009 11:38:00 AM

Senators John Cornyn and Charles Schumer appeared on ABC's 'This Week' with George Stephanopoulos and commented on the housing market: (CQ Transcript)

Sen. John Cornyn , R-Texas: [Senator] Johnny Isakson of Georgia has been championing the -- the tax credit for home purchases. Now it’s getting ready to expire, and it’s limited to $8,000 for first-time purchasers. His argument is, and I think he’s right, is that the housing inventories, or excess housing inventories are what are dampening the recovery. And I think he’s right.A key problem for housing and the economy is that there are too many housing units compared to the number of households. However it is important to note that the two key categories of housing inventory are owner occupied units and rental units.

The so-called "first-time" homebuyer tax credit just moves people from renting to owning, and doesn't reduce the overall number of excess housing units. As I've noted before, the tax credit policy will push the rental vacancy rate above 11% soon.

And how will that impact all the "accidental landlords"? From Shahien Nasiripour at the HuffPost: Unable To Sell Their Houses, Millions Of Homeowners Are Turning Into Landlords:

[A] growing number of homeowners ... have become landlords, often reluctantly, as they struggle to sell during one of the worst housing markets in recent memory. The most prominent example may be U.S. Treasury Secretary Timothy Geithner, who after failing to sell his $1.6 million home in a New York City suburb found tenants instead.By just shuffling housholds from renting to owning, the tax credit will force some of these accidental landlords into foreclosure.

And although a higher vacancy rate and lower rents is good news for renters, this will also lead to more apartment defaults, higher default rates for apartment CMBS, and more losses for small and regional banks.

Since the tax credit is poorly targeted and inefficient, it might be hurting the economy more than helping. And it does nothing to reduce the excess inventory problem.

And from Senator Schumer:

Sen. Charles E. Schumer , D-N.Y. : ... I’d be for extending the housing tax credit, which has helped get the housing market out of the severe depression it was in.The new home market is definitely in a depression, and will not recover until the excess housing inventory is reduced. However most of the tax credit was aimed at the existing home market - and existing home sales are at about a normal level (not depressed), although the mix is skewed toward the lower end and distressed sales (not a healthy market).

Note: no one should expect the new home market to recover to the level of the boom years (I wrote about the new home housing market his weekend: The Impact of the Declining Homeownership Rate)

And finally from the host:

George Stephanopoulos: So we have agreement: extend unemployment benefits, extend health care benefits for people who are unemployed, and extend the housing tax credit.I don't think there is agreement. The Obama administration is talking about "extending the safety net", and no one can argue the tax credit is part of the safety net.

If Senators Cornyn and Isakson want additional stimulus, then providing more aid to the unemployed (13 weeks won't last long), or aid to the states, would be far more effective use of money than the homebuyer tax credit. More jobs will create more households - and more households is the key to the housing market.

ISM Non-Manufacturing Shows Expansion in September

by Calculated Risk on 10/05/2009 09:58:00 AM

From the Institute for Supply Management: September 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector expanded in September, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Hotels Corporation. "The NMI (Non-Manufacturing Index) registered 50.9 percent in September, 2.5 percentage points higher than the 48.4 percent registered in August, indicating growth in the non-manufacturing sector after 11 consecutive months of contraction. The Non-Manufacturing Business Activity Index increased 3.8 percentage points to 55.1 percent. This is the second consecutive month this index has reflected growth since September 2008. The New Orders Index increased 4.3 percentage points to 54.2 percent, and the Employment Index increased 0.8 percentage point to 44.3 percent. The Prices Index decreased 14.3 percentage points to 48.8 percent in September, indicating a significant reversal and decrease in prices paid from August. According to the NMI, five non-manufacturing industries reported growth in September. Even with the overall month-over-month growth reflected in the report this month, respondents' comments vary by industry and remain mixed about business conditions and the overall economy.

emphasis added

U.K.: FSA Introduces Tighter Liquidity Requirements

by Calculated Risk on 10/05/2009 08:56:00 AM

Something similar to these requirements will probably be enacted internationally ...

From the Financial Times: FSA sets out tough new liquidity rules

UK banks and investment firms would have to increase their holdings of cash and government bonds by £110bn and cut their reliance on short-term funding by 20 per cent in the first year of tough liquidity standards put forward by the Financial Services Authority on Monday.In future years, banks would have to reduce their reliance on short-term funding by 80 per cent from current levels and hold additonal liquid assets.

Excerpted with permission.

From the FSA:

Paul Sharma, FSA director of prudential policy, said:

"The FSA is the first major regulator to introduce tighter liquidity requirements for firms. We must learn the lessons of the financial crisis and we believe that implementing tougher liquidity rules is essential to ensure we are in a better position to face future crises.

...

The FSA will not tighten quantitative standards before economic recovery is assured. It plans to phase in the quantitative aspects of the regime in several stages, over an adjustment period of several years. This is to take into account the fact that all firms at present are experiencing a market-wide stress.

...

The qualitative aspects of the regime will be put into place by December 2009.

The FSA strongly supports the liquidity workstreams that are underway internationally although recognises that it may be some time before there is international agreement on specific proposals, Therefore, the structure of the new regime is sufficiently flexible to allow the FSA to amend it through time to reflect any new international standards.