by Calculated Risk on 10/10/2009 10:35:00 PM

Saturday, October 10, 2009

The Pension Crisis

From David Cho at the WaPo: Steep Losses Pose Crisis for Pensions

The financial crisis has blown a hole in the rosy forecasts of pension funds that cover teachers, police officers and other government employees, casting into doubt as never before whether these public systems will be able to keep their promises to future generations of retirees.Infinity!

...

Within 15 years, public systems on average will have less half the money they need to pay pension benefits, according to an analysis by Pricewaterhouse Coopers. Other analysts say funding levels could hit that low within a decade.

After losing about $1 trillion in the markets, state and local governments are facing a devil's choice: Either slash retirement benefits or pursue high-return investments that come with high risk.

...

Some pension experts say the funding gap has become so great that no investment strategy can close it and that taxpayers will have to cover the massive bill.

The problem isn't limited to public pension funds; many corporate pension funds have lost so much ground that they are also pursuing riskier investments. And they, too, could end up a taxpayer burden if they cannot meet their obligations and are taken over by the federal Pension Benefit Guarantee Corp.

...

In Ohio, for instance, the teachers pension system reported that it would take 41 years for its investments to catch up with the costs of meeting its obligations to retirees. That was before the worst of the financial crisis.

During the last fiscal year, Ohio's fund lost 31 percent. Its most recent annual report detailed how long it would now take for its investments to put the fund back on track. Officials simply said: "Infinity."

Also check out the Time magazine cover story: Why It's Time to Retire the 401(k).

... at the end of 2007, the average 401(k) of a near retiree [55-to-64-year-old] held just $78,000 — and that was before the market meltdown.

The coming CRE losses for Local and Regional Banks

by Calculated Risk on 10/10/2009 05:45:00 PM

From Eric Dash at the NY Times: Small Banks Failure Rate Grows, Straining F.D.I.C.

A few numbers from the article:

... About $870 billion, or roughly half of the industry’s $1.8 trillion of commercial real estate loans, now sit on the balance sheets of small and medium-size banks like these, according to an analysis by Foresight Analytics, a research firm. ... And as a group, small banks have written off only a tiny percentage of the losses that analysts expect them to incur.This gives us a ballpark feel for the coming CRE losses. Local and regional banks are exposed to about $870 billion in CRE loans. Not all of the loans will go bad, and the loss severity will be far less than 100%. So the losses may be in the $100 to $200 billion range; small compared to the residential mortgage losses, but still very significant.

In fact, applying only the commercial real estate loss assumptions that federal regulators used during the stress tests for the big banks last spring, Foresight analysts estimated that as many as 581 small banks were at risk of collapse by 2011.

By contrast, commercial real estate losses put none of the nation’s 19 biggest banks, and only about 5 of the next 100 largest lenders, in jeopardy.

....

[Gerard Cassidy, a veteran banking analyst] projects that as many as 1,000 small banks will close over the next few years and that their losses will be more severe. “It’s a repeat [of savings and loan crisis] on steroids,” he said.

Banks Reducing Lending to Small Businesses

by Calculated Risk on 10/10/2009 12:56:00 PM

From Rex Nutting at MarketWatch: Banks cutting back on loans to businesses

U.S. banks are reducing their lending at the fastest rate on record ... According to weekly figures provided by the Federal Reserve, total loans at commercial banks have fallen at a 19% annual rate over the past three months, while loans to businesses have dropped at a 28% annualized pace.There is more on small businesses including excerpts from NY Fed President William Dudley's speech: A Bit Better, But Very Far From Best, and from Atlanta Fed research economist Melinda Pitts: Prospects for a small business-fueled employment recovery

...

The question is whether the decline in lending will be reversed soon.

... if the decline is mainly due to weak banks unable or unwilling to lend, then a turnaround in credit creation may have to wait until banks' balance sheets are repaired, a process that could be delayed by further expected defaults in consumer loans, mortgages and commercial real-estate loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Graph Credit: Melinda Pitts, Atlanta Fed research economist and associate policy adviser

This graph breaks down net job gains and losses by firm size since 1992. During the current employment recession, small firms have accounted for about 45% of the job losses - much higher than during the 2001 recession.

Dr. Pitts cautions:

Looking ahead, it's not clear whether small businesses will continue to play their traditional role in hiring staff and helping to fuel an employment recovery. However, if the above-mentioned financial constraints are a major contributor to the disproportionately large employment contractions for very small firms, then the post-recession employment boost these firms typically provide may be less robust than in previous recoveries.

Congressional Oversight Panel: Obama Foreclosure Plan will Fall Short

by Calculated Risk on 10/10/2009 08:48:00 AM

From Peter Goodman at the NY Times: Panel Says Obama Plan Won’t Slow Foreclosures

In a report mild in language but pointed in substance, the Congressional Oversight Panel — a watchdog created last year to keep tabs on taxpayer bailout funds — said the administration’s program would, “in the best case,” prevent “fewer than half of the predicted foreclosures.”The numbers that matter are the permanent loan modifications and the redefault rate. With the report next month we should know much more ...

...

When the Obama administration began its $75 billion Making Home Affordable program in March, it said the plan would spare as many as four million households from foreclosure. On Thursday, Treasury announced that 500,000 homeowners had since had their payments lowered on a trial basis, celebrating this as a milestone.

But the report from the oversight panel directly challenged the administration’s characterizations.

Most prominently, the panel had grave uncertainty about whether large numbers of the trial loan modifications — which typically run for three months — would successfully be converted to permanent terms.

As of the beginning of September, only 1.26 percent of trial modifications that had made it through the three-month trial period had become permanent, the report found. Of course, very few of those trial loans had reached their three-month expiration because the program only recently began processing large numbers of applications. As of Sept. 1, the Obama plan had produced 1,711 permanent loan modifications.

emphasis added

Friday, October 09, 2009

A CRE News Summary

by Calculated Risk on 10/09/2009 11:15:00 PM

Since this was a busy week for commercial real estate data. Here is a summary:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate starting in 1991.

Reis is reporting the vacancy rate rose to 16.5% in Q3 from 15.9% in Q2. The peak following the previous recession was 17%.

Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at a record 10.6% in Q2 2009.

Reis reports the strip mall vacancy rate hit 10.3% in Q3 2009; the highest vacancy rate since 1992.

Reis reports the strip mall vacancy rate hit 10.3% in Q3 2009; the highest vacancy rate since 1992.And rents are cliff diving ...

"[W]e do not foresee a recovery in the retail sector until late 2012 at the earliest."

Victor Calanog, Reis director of research

And a couple of articles:

Problem Bank List (Unofficial) Oct 9, 2009

by Calculated Risk on 10/09/2009 08:11:00 PM

This is an unofficial list of Problem Banks.

Changes and comments from surferdude808:

Since last week, the Unofficial Problem Bank List shrank by a net three institutions to 460. Aggregate assets decreased slightly to $297.8 billion from $298.6 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

New additions include two Cease & Desist orders issued by the OTS against Lincoln FSB of Nebraska, Lincoln ($371.3m) and Waterfield Bank, Germantown, MD ($217.3m). Also, the Federal Reserve issued a Prompt Corrective Action order against San Joaquin Bank, Bakersfield, CA ($832.8m) on October 5th, which was has been operating under a Cease & Desist order since April 9, 2009.

The removals include the failures last Friday – Warren Bank, Jennings State Bank, and Southern Colorado National Bank. The OCC terminated a Formal Agreement against Pacific National Bank, Miami, FL on September 29th.

The other deletion was Venture Bank which was misidentified with the bank of the same name based out of Washington that failed on September 11th. We were notified of the error by a reader and greatly appreciate the assistance in maintaining the accuracy of this list.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

California Controller: "Prepare for more difficult decisions ahead"

by Calculated Risk on 10/09/2009 05:23:00 PM

From California State Controller John Chiang: Controller Releases September 2009 Cash Report

State Controller John Chiang today released his monthly report covering California’s cash balance, receipts and disbursements in September. For the first three months of the fiscal year, total General Fund revenue was nearly $1.1 billion below the recently amended 2009-10 Budget Act estimates.Here are the September 2009 financial statement and summary analysis.

“Revenues more than $1 billion under estimates and recent adverse court rulings are dealing a major blow to a budget that is barely 10-weeks old,” said Controller Chiang. “While there are encouraging signs that California’s economy is preparing for a comeback, the recession continues to drag State revenues down. I urge lawmakers and the Governor to prepare for more difficult decisions ahead.”

emphasis added

Just add this to the pile of state budgets falling short ...

Thirty-three TARP Recipients Miss Scheduled Dividend Payments

by Calculated Risk on 10/09/2009 04:02:00 PM

While we wait for the FDIC, from Rolfe Winkler at Reuters: TARP deadbeats

Thirty-three TARP recipients missed a scheduled dividend payment to taxpayers last month, according to the Treasury Department, including 18 banks that missed a payment for the first time.

...

The 33 banks that missed dividend payments in August have received $4.5 billion of TARP money. The biggest is CIT. Previously it paid $44 million of dividends, but with a bankruptcy filing looking likely, Treasury’s $2.3 billion investment seems headed toward zero.

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

BLS: Job Openings at Series Low at End of August

by Calculated Risk on 10/09/2009 12:30:00 PM

From the BLS: Job Openings and Labor Turnover Summary

On the last business day of August, the number of job openings in the U.S. was little changed at a series low level of 2.4 million, the U.S. Bureau of Labor Statistics reported today. The hires rate was little changed and remained low at 3.1 percent in August. The total separations rate was little changed and remained low at 3.3 percent.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people. See Jobs and the Unemployment Rate for a comparison of the two surveys.

The following graph shows job openings (yellow line), hires (blue Line), Quits (green bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and green added together equals total separations.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (blue line) and separations (red and green together) are pretty close each month. When the blue line is above total separations, the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 4.029 million hires in August, and 4.265 million separations, or 236 thousand net jobs lost.

I'm not sure if openings is predictive of future hires (the data set is limited), but openings at a series low can't be a positive. Separations have declined sharply, with fewer quits and layoffs, but hiring has not picked up.

As David Leonhardt noted in the NY Times last month: Wages Grow for Those With Jobs, New Figures Show

Try thinking of it this way: All of the unemployed people in the country are gathered in a huge gymnasium that’s been turned into a job search center. The fact that this recession is the worst in a generation means that there are many, many people in the gym. The fact that the economy is churning so slowly means that there is not much traffic into and out of the gym.

If you’re inside, you will have a hard time getting out.

More on Problems at the FHA and Quote of the Day

by Calculated Risk on 10/09/2009 10:11:00 AM

“I don’t think it’s a bad thing that the bad loans occurred. It was an effort to keep prices from falling too fast. That’s a policy.”The quote is from David Streitfeld and Louise Story's article in the NY Times: U.S. Mortgage Backer May Need Bailout, Experts Say

Barney Frank, chairman of the House Financial Services Committee on recent FHA lending.

The article covers the problems at the FHA, and includes this anecdote:

Like many Americans, Ms. [Bernadine Shimon] has recently been through some rough times. She lost a house to foreclosure, declared bankruptcy, got divorced and is now a single mother, teaching high school English in a Denver suburb.Maybe Ms. Shimon will make it (I hope so). But according to the article she has no savings, and is spending half her take home income on just the mortgage payment. update

She wanted a house but no lender would touch her. The Federal Housing Administration was more obliging. With the F.H.A. insuring her mortgage, Ms. Shimon was able to buy a $134,000 fixer-upper in August.

...

Any more than [3.5% down] and Ms. Shimon, 45, would still be a renter. As it was, she cashed in her retirement savings account to come up with the necessary funds. She did not have enough to spare for closing costs, so her mortgage broker arranged a deal where the charges were wrapped into the loan at the cost of a higher interest rate. She cried when the deal was done.

The house was empty and trashed. Slowly, she is trying to bring it back to life. She spent the first few weeks picking up garbage in the backyard.

Is Ms. Shimon a good bet? Even she has no easy answer. Her mortgage payment, $1,100, is half of what she takes home every month. It is not easy to make ends meet. Teachers can get laid off like everyone else.

emphasis added

Maybe she can qualify for a loan modification! The HAMP guidelines are for loans not to exceed 31 percent of gross income. Update: It is not clear from the story the percentage of her gross income (the half is take home income). The FHA guidelines are that the payment-to-income ratio not exceed 31%, however, with all of the "compensating factors", it is possible that the FHA is insuring loans that the Obama Administration (through HAMP) has called "unaffordable". (ht TL)

And the NAR thinks Ms. Shimon will spend $10 of thousands of dollars fixing up her home over the next year? That is their argument for extending the "first-time" homebuyer tax credit (for anyone who hasn't owned for three years).

As Frank said, this is "a policy". But is it a good policy?

Trade Deficit Decreases Slightly in August

by Calculated Risk on 10/09/2009 08:37:00 AM

The Census Bureau reports:

The ... total August exports of $128.2 billion and imports of $158.9 billion resulted in a goods and services deficit of $30.7 billion, down from $31.9 billion in July, revised. August exports were $0.2 billion more than July exports of $128.0 billion. August imports were $0.9 billion less than July imports of $159.8 billion.

Click on graph for larger image.

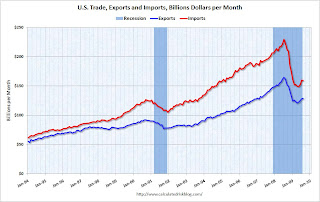

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through August 2009.

Imports were down in August, and exports increased slightly. On a year-over-year basis, exports are off 21% and imports are off 29%.

The second graph shows the U.S. trade deficit, with and without petroleum, through August.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $64.75 in August - up more than 50% from the prices in February (at $39.22) - and the sixth monthly increase in a row. Import oil prices will probably rise further in September.

It appears the cliff diving for U.S. trade is over. The weaker dollar is probably helping exports - and hurting imports.

Thursday, October 08, 2009

NY Times: Divergent Fed Views

by Calculated Risk on 10/08/2009 09:05:00 PM

From the Edmund Andrews at the NY Times: Rift Emerges in Fed Over When to Tighten Money

Fissures are developing among policy makers at the Federal Reserve as they debate how and when to start raising the benchmark interest rate from its current level just above zero.And on the other side:

...

One hint of the discord came Tuesday, in a speech by Thomas M. Hoenig, president of the Federal Reserve Bank of Kansas City.

Though he stopped short of calling for immediate rate increases, Mr. Hoenig made it clear that he was getting impatient.

“My experience tells me that we will need to remove our very accommodative policy sooner rather than later,” he told an audience of business executives. ...

And he is not alone.

Richard Fisher, president of the Federal Reserve Bank of Dallas, sent a similar message in a speech on Sept. 29. “That wind-down process needs to begin as soon as there are convincing signs that economic growth is gaining traction,” he told a business group.

Other Fed officials [have] similar views ...

“The turnaround is certainly welcome, but it shouldn’t be overstated,” Daniel K. Tarullo, a Fed governor ...As I noted last month, it is unlikely that the Fed will increase the Fed's Fund rate until sometime after the unemployment rate peaks.

“Some observers are concerned that this expansion will ultimately prove to be inflationary,” William C. Dudley, president of the New York Fed told an audience at the Fordham University’s Corporate Law Center. “This concern is not well founded.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

And from Chairman Bernanke tonight:

When the economic outlook has improved sufficiently, we will be prepared to tighten the stance of monetary policy and eventually return our balance sheet to a more normal configuration.Some people are taking that as tough talk, see: Dollar Rises After Bernanke Says Fed Ready to ‘Tighten’ Policy, but I disagree - I think "improved sufficiently" means Bernanke will wait for a meaningful decline in the unemployment rate.

Fed's Tarullo: "Considerable uncertainty" about "how robust growth will be in 2010"

by Calculated Risk on 10/08/2009 05:40:00 PM

From Fed Governor Daniel Tarullo: In the Wake of the Crisis

Turning first to the economic outlook, let me begin by stating the obvious: After a period in which there seemed to be only two plausible scenarios--very bad and even worse--financial and economic conditions have steadied. ... As we closed out the third quarter last week, it was apparent that economic growth was back in positive territory. ...

This turnaround is certainly welcome, but it should not be overstated. Although we can expect positive growth to continue beyond the third quarter, economic activity remains relatively weak. The upturns in industrial production and residential investment, for example, follow startling declines in the first half of the year. Improvement is gradual and beginning from very low levels.

The employment situation continues to be dismal. While the pace of job losses has slowed from the extraordinary levels of early 2009, the economy has recently still been losing on average about a quarter of a million jobs each month. Hopes for a steady reduction in the pace of job losses were once again confounded last Friday with release of the September employment report, which showed net job declines well above the consensus expectation of economic forecasters. The unemployment rate has risen to 9.8 percent. ...

Indicators apart from the unemployment rate underscore the weakness of labor markets. The percentage of working-age people with jobs has fallen to a point not seen in a quarter century. Average hours worked have not increased through the spring and summer from what were, by historic standards, unusually low levels.The number of part-time workers who want full-time jobs jumped nearly 50 percent last fall and winter and has remained elevated since. The a>verage duration of unemployment has risen almost 10 weeks since the recession began, to more than six months.

The labor market conditions I have just described reflect the low level of resource utilization in the economy as a whole. In this context, with inflation expected to remain subdued for some time, the Federal Open Market Committee indicated after our meeting two weeks ago that exceptionally low interest rates are likely to be warranted for an extended period. Indeed, with the effects of the February stimulus package diminishing next year, bank lending that is still declining, and continued dysfunction in some parts of capital markets, there is considerable uncertainty as to how robust growth will be in 2010. At the same time, the unconventional policies pursued by the Federal Reserve in order to halt the crisis have produced levels and types of reserves that will eventually require use of the unconventional exit tools discussed on numerous occasions by Chairman Bernanke and Vice Chairman Kohn.

The coincidence of a weak economy and an unusually large balance sheet at the Federal Reserve will require some judgments by the Federal Open Market Committee of a sort for which there are not many historical precedents. Still, just as with conventional monetary policy, decisions on the timing and pace for removing accommodation should and will depend on our ongoing analysis and forecasts of all relevant economic factors.

emphasis added

Hotel Occupancy: Two Year Slump

by Calculated Risk on 10/08/2009 03:47:00 PM

Note: Market graph at bottom.

From HotelNewsNow.com: NorfolkLuxury occupancy holds steady in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 5.8 percent to end the week at 55.8 percent. Average daily rate dropped 8.3 percent to finish the week at US$95.51. Revenue per available room for the week decreased 13.7 percent to finish at US$53.30.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 7.3% from the same period in 2008.

The average daily rate is down 8.3%, and RevPAR is off 13.7% from the same week last year.

As I noted last week, the comparisons are now easier soon since business travel fell off a cliff last October. Comparing to the same week two years ago, occupancy rates are off 16.4%.

Occupancy rates for October in 2006 and 2007 were close to 68%.

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Treasury: 500,000 mortgage modifications started

by Calculated Risk on 10/08/2009 02:20:00 PM

From MarketWatch: Obama plan claims 500,000 mortgage modifications started

U.S. loan servicers have begun modifying more than 487,081 loans for troubled homeowners on the verge of foreclosure as of the end Sept. 30, according to the report. The program met its 500,000 goal in early October. More than 757,955 modification offers have been extended by loan servicers as part of the program known as the Home Affordable Modification Program, or HAMP.And from Scott Reckard at LA Land (LA Times):

Stand by ... for answers to the big question: whether these modified loans will hold up or whether “underwater” homeowners will stumble back into default after hitting new bumps along their financial roads.As I noted back in July when this goal was announced:

...

The trial modifications “are simply offers,” [Mark Zandi of Moody's Economy.com notes]. “Many won't turn into actual mods, and those mods that occur will have a high redefault rate.”

Counting the number of mods might make for useful PR, but some mods are more effective than others. A capitalization of missed payments and fees, along with a rate reduction and/or extended term, are the most common modifications. But for homeowners with significant negative equity that is just "extend and pretend" and leads to a high redefault rate and just postpones foreclosure.The September industry data is not available yet on the HopeNow website.

FHA Bailout Seen

by Calculated Risk on 10/08/2009 11:34:00 AM

From Bloomberg: FHA Shortfall Seen at $54 Billion May Lead to Bailout (ht Mike in Long Island, Ron at WallStreetPit)

The Federal Housing Administration, which insures mortgages with low down payments, may require a U.S. bailout because of $54 billion more in losses than it can withstand, a former Fannie Mae executive said.Pinto makes several points, including:

“It appears destined for a taxpayer bailout in the next 24 to 36 months,” consultant Edward Pinto said in testimony prepared for a House committee hearing in Washington today. Pinto was the chief credit officer from 1987 to 1989 for Fannie Mae ...

There is more in his testimony.

Reis: Strip Mall Vacancy Rate Hits 10.3%, Highest Since 1992

by Calculated Risk on 10/08/2009 09:05:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Reis reports the strip mall vacancy rate hit 10.3% in Q3 2009; the highest vacancy rate since 1992. And rents are cliff diving ...

From Reuters: Shopping center vacancy rate hits 17-year high: report

"Our outlook for retail properties as a whole is bleak," Victor Calanog, Reis director of research, said. "Until we see stabilization and recovery take root in both consumer spending and business spending and hiring, we do not foresee a recovery in the retail sector until late 2012 at the earliest."A grim outlook: no recovery seen in the retail CRE sector "until late 2012 at the earliest".

...

The third-quarter vacancy rate at U.S. strip malls, which include local shopping and big-box centers, rose 0.3 percentage points from the second quarter to 10.3 percent, the highest since 1992, Reis said.

...

Factoring in months of free rent and other perks, effective rent fell 0.8 percent from the second quarter to $16.89 per square foot or down 3.8 percent from the third quarter 2008. Rents were the lowest since mid-2007

...

"Since asking and effective rent growth only turned negative about one year ago, it is daunting to observe this acceleration in decline in what has traditionally been regarded as a stable property type," Calanog said.

Malls. Offices. Apartments. The story is the same: rising vacancies and falling rents. Here are the earlier reports this week on offices and apartments:

U.S. Office Vacancy Rate Hits 16.5% in Q3

Apartment Vacancy Rate at 23 Year High

Weekly Unemployment Claims: Lowest Since January

by Calculated Risk on 10/08/2009 08:34:00 AM

The DOL reports weekly unemployment insurance claims decreased to 521,000:

In the week ending Oct. 3, the advance figure for seasonally adjusted initial claims was 521,000, a decrease of 33,000 from the previous week's revised figure of 554,000. The 4-week moving average was 539,750, a decrease of 9,000 from the previous week's revised average of 548,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Sept. 26 was 6,040,000, a decrease of 72,000 from the preceding week's revised level of 6,112,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 9,000 to 539,750, and is now 119,000 below the peak in April.

Initial weekly claims have peaked for this cycle, however the level of weekly claims indicates continuing weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before total employment stops falling.

Wednesday, October 07, 2009

Report: Pimco, Baupost Quit CIT Bondholder Committee

by Calculated Risk on 10/07/2009 09:50:00 PM

From Dow Jones: Pimco Has Quit CIT Bondholder Steering Committee

The future of CIT Group Inc. (CIT) grew murkier Wednesday after the disclosure that bond fund giant Pacific Investment Management Co. had quit a steering committee that's trying to prevent the commercial lender from collapse. ... Boston-based Baupost Group LLC [had quit earlier].Small firms have already been hit hard in this recession, accounting for about 45% of the job losses (see Melinda Pitts at Macroblog: Prospects for a small business-fueled employment recovery):

...

The company has an estimated $75 billion in assets, and provides critical short-term financing to about one million small companies.

...

Investors have until 11:59 p.m. Eastern time on Oct. 29 to tender their bonds under the restructuring plan.

In a speech [Monday], William Dudley, the president of the Federal Reserve Bank of New York, identified financial constraints for small businesses as a restraint on the pace of economic recovery.As the article mentioned, CIT provides financing for about one million small business. If CIT files bankruptcy, the company will continue to operate, but they may not write any new business. Their competitors will pick up the best of the business, but many small firms will struggle to find new financing.

...

Looking ahead, it's not clear whether small businesses will continue to play their traditional role in hiring staff and helping to fuel an employment recovery. However, if the above-mentioned financial constraints are a major contributor to the disproportionately large employment contractions for very small firms, then the post-recession employment boost these firms typically provide may be less robust than in previous recoveries.

The clock is ticking.

Jim the Realtor: "No shortage of buyers"

by Calculated Risk on 10/07/2009 05:50:00 PM

Jim says the "market is hot, real hot." This is worth watching to get a feel for what is happening at the lower end of the housing market (in San Diego at least).