by Calculated Risk on 10/14/2009 10:10:00 AM

Wednesday, October 14, 2009

JPMorgan Conference Call

Update: see bottom of post for Q&A.

"While we seeing some initial signs of consumer credit stability, we are not certain that this trend will continue."

JPMorgan CEO Jamie Dimon, Oct 14, 2009

A few excerpts (ht Brian):

JPM:

“We continue to see initial signs of stability in the consumer, early bucket delinquency trends, but we are not ready to declare that's a sustained trend but it is continuing to be what we actually observe. Another overall comment is that as far as the impact of foreclosures moratorium, the trial mods which have been very active in doing, and just the overall extension of processing of REO through the courts, those things are obviously having an affect on overall delinquency and stats but we are doing everything we can to stay on top of the income statement taking recognizing losses through charge offs and adding to reserves without regard for the impact that those factors would be causing in the overall delinquency.Brian notes that these comments about prime loans relate to the purchased WaMu portfolio, and that this charge is over and above the $30B write down they took at the time of the acquisition.

Looking ahead to what we see, we are not changing any of these numbers [loss estimatse by loan category] and obviously whether we advance to these levels is going to be a function of whether some of the early bucket delinquency trends that we described continue or not. But we measure impairment at sub portfolio levels for purposes of accounting impairments, and so as we look at the prime portfolio, not option arms just the prime mortgage portfolio, we see some weakness. We obviously measure that in terms of expected lifetime losses on that portfolio, and have added $1.1 billion, that is put on the books in the form of a loan loss reserve as opposed to an incremental mark.

This table on Card Services (Managed) is from the JPMorgan investor presentation.

This table on Card Services (Managed) is from the JPMorgan investor presentation.Click on table for larger image in new window.

The net charge-off rate rose to 9.41% in Q3, and JPM expects charge offs to hit 11% on the non-Wamu portfolio in Q1, Wamu losses could approach 24%!

Credit card losses tend to track unemployment, so the charge-off rate will probably stay elevated for some time.

Update from the Q&A:

Analyst: Loans were down about 5% linked quarter 16% year-over-year. Is that supply or demand, what are some of the ins and outs there?

JPM: Consumer portfolios, you have run off portfolios from Washington mutual and in retail, some tightening of underwriting standards in those businesses generally. So expect that at the origination levels, that for a period of time here, we are going to have downward pressure on those balances. We're in the business of making loans against our underwriting standards today. So it is active supply, meeting demand on that score. On the commercial side, you have seen it a little further down this quarter, and that is you know more, it is a little bit of everything but it is more demand clearly because we see extended credit lines utilized at the lowest levels of all time. You can see a swing in those numbers as soon as confidence returns in our commercial clients and they have some use for that money.

On the housing market:

Analyst: Would you comment on California housing market?

JPM: In the major MSAs you have seen a stabilization in fact an increase in the last couple of months, call it stabilization of home prices. That was more true for lower priced than higher priced but also happens in places where price is down dramatically, and obviously parts of Florida are still bad, parts of California we are seeing some improvement. We see that improvement in areas with a high percent of sales from forecloses and also in areas where foreclosure sales aren't as high of a percent. So I would agree with you there's a lot of distortion in that number but all things being equal it is a good fact not a bad fact.

Comment on delinquency trends and the denominator effect:

Analyst: I was hoping just to flush out some comments with respect to delinquency trends in home lending, can you talk to stabilization on Slide 17 on, in the slide deck, it looks like all of those lines are going up and it can be the discrepancy between percentage, delinquencies, come down maybe you can talk to that

JPM: Clearly on the overall 30 plus you get the distortion. I won't try to take that number down too much. You see those, in percentage terms on 17 you do see those affects rolling through. On a dollar basis it is stabilization that we are seeing across those portfolios and again it is portfolios [denominator] coming down.

On the economy

Analyst: As we look at the overall numbers they can be confusing as to the economic outlook but as you get the data kind of first-hand from people that are running the businesses that are dealing with small business, mid size and consumer, what does it tell you about the economic outlook?

JPM: You actually all see pretty much what we see, and there seems to be in the environment, in terms of consumer spending, confidence, in terms of delinquencies a little bit of improvement, and in home price. Those are actual data, and you know that can be forming the base of a recovery or not but we are not going to spend a lot of time guessing about that. The only thing anecdotally is that business, small business, middle market, large corporate, they kind of poised and waiting to see if the recovery is taking hold, they have growth plans, to me it would be a good sign if that's true because maybe, you know, people get a little more comfortable taking risks and making more investments in the future.”

On mortgage mods

Analyst: The mortgage mod, can you tell us has the process smoothed at this point? What the pipeline looks like and how long do you think its going be to get that pipeline fulfilled.

JPM: Growing pains in these processes. So we have been active. One thing it is just still early to see how effective people are in making their payments which is obviously one important thing but the other issue there is just people complying with all of the terms of what is required under the Governments guidelines in terms of amount, types of documentation before it can be declared [permanent]. So there's still I would call it growing pains in the process a little early to say it has stabilized and worked through. A lot of energy going into it adding a lot of people to it, ourselves and across the industry.

Analyst: Do you see this as something that's going to be permanent in the business, is this a pressure that will go away or is this something you guys have to live with to some degree or another permanently?

JPM (Dimon): The right way to look at it is it is so large the problem in housing today we certainly hope there’s nothing like this ever again. We have always had work out the department, the REO department, and it is just a prime delinquency that is ten times what you would have are expected, ten times expect in almost any environment. So it will come down to a much more normal thing eventually and you will have delinquency and charge offs and foreclosure that are just much smaller than they are today. It will never be this, probably never be this big again in our lifetime.

Retail Sales Decrease in September

by Calculated Risk on 10/14/2009 08:30:00 AM

On a monthly basis, retail sales decreased 1.5% from August to September (seasonally adjusted), and sales are off 5.7% from September 2008 (retail ex food services decreased 6.4%).

Excluding motor vehicles, retail sales were up 0.5%. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level. The second graph shows the year-over-year change in nominal and real retail sales since 1993.

The second graph shows the year-over-year change in nominal and real retail sales since 1993.

To calculate the real change, the core PCI price index from the BLS was used (August prices were estimated as the average increase over the previous 3 months).

Real retail sales (ex food services) declined by 7.9% on a YoY basis.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $344.7 billion, a decrease of 1.5 percent (±0.5%) from the previous month and 5.7 percent (±0.7%) below September 2008. Total sales for the July through September 2009 period were down 6.6 percent (±0.3%) from the same period a year ago. The July to August 2009 percent change was revised from +2.7 percent (±0.5%) to +2.2 percent (±0.2%).The large decrease in retail sales was because of the end of Cash-for-clunkers in August. Excluding autos, retail sales increased in September, but are still far below year ago levels.

Tuesday, October 13, 2009

Pearlstein: "Don't Reinflate the Old Bubbles"

by Calculated Risk on 10/13/2009 10:58:00 PM

From Steven Pearlstein at the WaPo: Don't Reinflate the Old Bubbles

What we're witnessing here is pretty simple: another bubble in financial assets. All that "liquidity" created by the Federal Reserve and other central banks has accomplished its task and prevented a global financial meltdown. ...It is tricky to balance monetary and fiscal policy. It appears the next stimulus package will include an extension to the inefficient first-time home buyer tax credit, and will not include some of the items Pearlstein suggests.

Many analysts now look at the economy and conclude that unemployment is still way too high and the threat of inflation still way too low for the Fed to even think about beginning to raise interest rates again. ...

The right policy response is for the Fed to begin withdrawing some of this extraordinary monetary stimulus even as the rest of the government steps up its effort to stimulate the real economy. That means more money for extended unemployment benefits; more aid to the states so that they can maintain the most vital public services; and more money to expand mass transit, state college and university systems, efficient energy production and basic scientific research. ...

What would surely not be good policy, by the way, is to extend and expand the current tax break for first-time home buyers that is set to expire at the end of the year, as many in Congress are now advocating.

MBA CEO: "Can't Modify Mortgage with No Income"

by Calculated Risk on 10/13/2009 07:54:00 PM

“You can’t modify someone if they don’t have income or a job. We have to be realistic going forward. If we are going to play a numbers game, we are going to see a smaller percentage of borrowers in default able to be modified. It’s an unfortunate and difficult fact we are going to have to face.”Quote from Denver Business Journal: MBA: Creative efforts needed to deal with foreclosures

John Courson, president and CEO of the MBA, Oct 13, 2009.

Maybe those NINJA loans weren't such a good idea either? (No income, no job and no assets)

The MBA also released their economic forecast for 2010: MBA Expects Economic Growth to Slow in First Half of 2010 Before Picking Up in Second Half, Originations Volume to Hit $1.5 Trillion

MBA expects economic growth to continue through the rest of 2009 before slowing in the first half of 2010. Unemployment is expected to climb to 10.2 percent by the middle of 2010 before beginning to moderate as economic growth resumes sustained growth in the second half of the year.Although I think this is optimistic, it does highlight a key point.

The key drivers of positive growth in the second half of 2009 are inventory restocking, growth in residential investment (some increase in single family starts from the very depressed levels earlier this year), exports, and the fiscal stimulus.

The impact of the fiscal stimulus will wane in early 2010 (the stimulus won't add to GDP because it is at the peak level right about now, and will act as a drag later in 2010 as the American Recovery and Reinvestment Act starts to wind down).

Inventory restocking is transitory, and without an increase in end demand, inventory investment will slow.

And any growth in residential investment will probably be sluggish, as Fed Vice Chairman Kohn noted today.

I guess that leaves exports ... but I suspect any growth in early 2010 will be very sluggish.

Fed's Kohn: Economic Outlook

by Calculated Risk on 10/13/2009 04:12:00 PM

Fed Vice Chairman Donald Kohn spoke at the National Association for Business Economics conference in St. Louis, Missouri today: The Economic Outlook

Kohn outlines why he expects a moderate recovery (not V-shaped), and why he believes the risks to inflation are on the downside ...

A few excerpts:

All told, I expect that the recovery in U.S. economic activity will proceed at a moderate pace in the second half of this year before strengthening some in 2010. As we move into and through next year, inventory investment is likely to play a smaller role in supporting the growth of output, and aggregate activity should increasingly be propelled by stronger gains in final demand ...

[W]hy do I expect a gradual strengthening of economic activity? The fiscal stimulus program enacted earlier this year is likely playing a role, and it will continue to do so for a while as the states spend their stimulus funds to pay for infrastructure projects, hire more teachers, and finance other types of spending. But what will support economic activity as fiscal stimulus wanes?

Most importantly, support for private demand should come from a continuation of the improvements we've seen lately in overall financial conditions. Low market interest rates should continue to induce savers to diversify into riskier assets, which would contribute to a further reversal in the flight to liquidity and safety that has characterized the past few years. As the economy improves and credit losses become easier to size, banks will be able to build capital from earnings and outside investors, making them more able and willing to extend credit--in effect, allowing the low market interest rates to show through to the cost of capital for more borrowers. A more stable economic environment and greater availability of credit should contribute to the restoration of business and household confidence, further spurring spending.

An encouraging aspect of the improvement in economic and financial conditions in recent months has been the firming in house prices that I mentioned earlier. House prices can affect economic activity through several channels. One channel is through the influence of house prices on the net worth of households and, thereby, on consumer spending. Another channel is through the effect of anticipated capital gains or losses from investing in residential real estate on the demand for housing. Finally, greater stability in house prices should help reduce the uncertainty about the value of mortgages and mortgage-related securities held on the balance sheets of banks and other financial institutions, which should have a positive effect on their willingness to lend. This circumstance should nourish a constructive feedback loop between the financial sector and the real activity.

Given this possibility, another reasonable question might be, Why do I expect the economic recovery to be so moderate? To be sure, many times in the past, a deep recession has been followed by a sharp recovery. But, for a number of reasons, I don't think a V-shaped recovery is the most likely outcome this time around. First, although financial conditions are improving and market interest rates are very low, credit remains tight for many borrowers. In particular, the supply of bank credit remains very tight, and many securitization markets that do not enjoy support from the Federal Reserve or other government agencies are still impaired. Consumers as well as small and medium-sized businesses are especially feeling the effects of constraints on credit availability. Banks are still rebuilding their capital positions, and their lending will be held back by the need to work through the embedded losses in their portfolios of consumer and commercial real estate loans. Over time, as I already have noted, bank balance sheets should improve, and the supply of bank credit should ease. But the financial headwinds are likely to abate slowly, restraining the economic recovery.

In addition, I do not anticipate that the recovery in homebuilding will exhibit its typical cyclical pattern. Even though the decline in residential construction began well in advance of the overall contraction in real activity, the sector continues to have an oversupply of vacant homes. To be sure, by August, the inventory of unsold, newly built single-family houses had fallen appreciably from its peak level in the summer of 2006. Nonetheless, when compared with still low levels of sales, the supply of new houses remains elevated. In addition, the overhang of vacant houses on the market for existing homesis sizable, and the pace of foreclosures is likely to remain very elevated for a while, which should further add to that overhang. Thus, even with affordability quite favorable and house price expectations brighter, I anticipate a relatively subdued pickup in housing starts over the coming year.

In the business sector, the extraordinary amount of excess capacity is likely to be another factor tempering the rate of recovery. In manufacturing, the utilization rate currently is below 67 percent--noticeably less than the low points reached in prior post-World War II recessions. I expect that the wide margin of unused capacity, combined with the tight credit conditions faced by firms that have to rely primarily on bank lending, will lead many businesses to be quite cautious about the pace at which they increase their capital spending.

In part, the gradual pace I expect in the recovery of the economy toward full employment reflects the process of shifting the composition of aggregate demand and the way it is financed in response to the events of the past few years. In particular, consumers probably will do more saving out of their income, reflecting the likelihood that household net worth will be lower relative to income than over the past decade or so and that credit, appropriately, will be somewhat less available than during the boom that preceded the crisis. In addition, housing is almost certainly going to be a smaller part of the economy than it was earlier in this decade, as financial institutions maintain tighter underwriting standards that also more adequately reflect underlying risks. Such an increase in private saving propensities and a reduced demand for residential capital should prompt movements in relative prices and other factors that will, in turn, make room for a larger role for business investment and net exports in overall economic activity.

The transition to full employment and the complete emergence of this new configuration will take time, in part because the rebalancing of the economy involves repairs to balance sheets, the movement of capital and labor across sectors of the economy, and shifts in the global pattern of production and consumption--adjustments that are likely to be gradual under any conditions. Current circumstances, however, may slow the re-equilibration process more than might otherwise be the case because of the essential role of changes in the relative cost of finance in the adjustment process. But with the nominal federal funds rate essentially constrained at zero, and spreads in markets already having narrowed, reductions in the effective cost of capital will mainly take place as conditions at financial institutions improve and lenders ease borrowing standards, which as I have already discussed I expect to happen gradually.

As noted earlier, I expect that inflation will likely be subdued, and that, for a while, the risk of further declines in underlying rates of inflation will be greater than the risk of increases. That outlook rests importantly on two judgments: First, that the economy will be producing well below its potential for some time, which will directly restrain production costs and profit margins; and second, that inflation expectations are more likely to fall than rise over time as the level of real activity remains persistently less than its potential and actual inflation remains low.

...

But it's not the current level of inflation or of output that figure into our policy decisions directly--rather, it is the expected level some quarters out, after the lags in the effects of policy actions have worked themselves out. In that regard, the projection of only a gradual strengthening of demand and subdued inflation imply that that these gaps--of inflation and output below our objectives--are likely to persist for quite some time. In these circumstances, at its last meeting, the FOMC was of the view that economic conditions were likely to warrant unusually low levels of interest rates for an extended period.

emphasis added

JPMorgan Proposes More 'Extend and Pretend' for Mortgage Modifications

by Calculated Risk on 10/13/2009 03:15:00 PM

From an article by Jody Shenn and Dawn Kopecki on Bloomberg: JPMorgan Pitches Interest-Only Mortgages to Boost Obama Plan

Banks will push the Obama administration to expand its mortgage-modification program to allow interest-only periods on reworked loans ... while recognizing concern that it may only postpone defaults, according to JPMorgan Chase & Co.This is simply more extend and pretend, and only postpones defaults.

“We’re working with our peers to develop a proposal to present,” Douglas Potolsky, a senior vice president at JPMorgan’s Chase home-loan unit, said yesterday at a Mortgage Bankers Association conference in San Diego.

The article also has some comments from Laurie Anne Maggiano, director of the Treasury’s policy office for homeownership preservation. Maggiano acknowleges that only "a couple thousand" modification are now permanent, and she notes that the trial period has been extended an extra two months (I guess a disappointing number of trial modifications are becoming permanent).

The key numbers to track going forward will be the number of permanent modificatons, and the redefault rate for permanent modifications. So far it is "a couple thousand" and too early to say.

The article also quotes Maggiano on the short sale initiative that should be announced next week. Housing Wire has more: Treasury to Announce New Program to Avoid Foreclosure

The Chief of the Homeowner Preservation Office at the Treasury, Laurie Maggiano, released information on the Home Affordable Foreclosure Alternatives (HAFA) while speaking at the MBA’s 96th Annual Convention going on in San Diego. The official launch is expected in the next week or so.

...

Maggiano adds that HAFA will offer financial incentives to both servicers and borrowers, and associated secondary investors, in order to facilitate a short sale or deed in lieu of the property.

DataQuick: SoCal home sales "inch up"

by Calculated Risk on 10/13/2009 01:23:00 PM

From DataQuick: Southern California home sales inch up; median price steady

Last month 21,539 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was up 0.2 percent from 21,502 in August and up 5.1 percent from 20,497 a year earlier, according to MDA DataQuick of San Diego.Although DataQuick doesn't track short sales, we can estimate from the Sacramento data that another 15% or so of sales in SoCal were short sales - so probably over half the sales are distressed.

September marked the 15th month in a row with a year-over-year sales gain, although last month’s was the smallest of those increases. ... The small uptick in September sales from August was atypical. On average, sales have fallen 9.5 percent between those two months.

...

“There were more than just normal, seasonal forces at work in these September sales numbers. More attempts at short sales, which typically take longer, and new appraisal rules no doubt delayed some deals this summer, causing them to close in September rather than August. September probably also got a boost from people opting to buy sooner rather than later to take advantage of the federal tax credit for first-time buyers, which is set to expire next month,” said John Walsh, MDA DataQuick president.

...

Foreclosure resales – houses and condos sold in September that had been foreclosed on at some point in the prior 12 months – made up 40.4 percent of all Southland homes resold last month. That was down slightly from a revised 41.7 percent foreclosure resales in August and down from a high of 56.7 percent in February this year.

...

A common form of financing used by first-time buyers in more affordable neighborhoods remained near record levels. Government-insured FHA mortgages made up 36.4 percent of all home purchase loans last month ...

Foreclosure activity remains high by historical standards.

emphasis added

This report suggests sales were strong in September - similar to other regional reports.

We will probably see a decrease in year-over-year sales soon, as the first-time homebuyer tax credit buying frenzy subsides later this year.

CRE in San Diego, Orange County and Las Vegas: Higher Vacancy Rates, Lower Rents

by Calculated Risk on 10/13/2009 11:18:00 AM

Voit released Q3 quarterly reports today for CRE in Las Vegas, San Diego and Orange County.

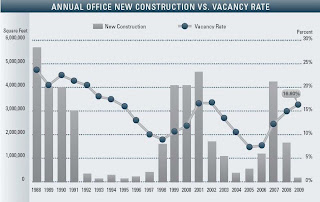

The reports show the vacancy rates are up and lease rates falling. It also shows new construction has slowed sharply. Here are a couple of graphs for Orange County and San Diego. We are seeing a similar pattern nationwide ...

Click on graph for larger image in new window.

This graph shows the annual Orange County office vacancy rate and new construction since 1988. See Voit report for more.

Note that in the previous slumps, office construction didn't pick up until the vacancy rate dropped below 10%.

From the Voit report:

Net absorption for the county posted a negative 438,803 square feet for the third quarter of 2009, giving the office market a total of 1.92 million square feet of negative absorption for the year.

...

The average asking Full Service Gross (FSG) lease rate per month per foot in Orange County is currently $2.24, which is a 16.73% decrease over last year’s rate of $2.69 and five cents lower than last quarter’s rate.

...

Total space under construction checked in at 166,455 square feet at the end of the third quarter, which is less than half the amount that was under construction this same time last year.

emphasis added

The second graph is for San Diego. The dynamics are similar, but absorption is slighly positive in San Diego. From Voit:

The second graph is for San Diego. The dynamics are similar, but absorption is slighly positive in San Diego. From Voit: Net absorption for the county posted a positive 346,030 square feet for the third quarter of 2009, giving the office market a total of 653,537 square feet of positive absorption for the year.Once again, investment in new office space will probably not increase until the vacancy rate is below 10%.

...

The average asking Full Service Gross (FSG) lease rate per month per foot in San Diego County is currently $2.39, which is a 12.8% decrease over last year’s rate of $2.74 and eight cents lower than last quarter’s rate. The record high rate of $2.76 was established in the first and second quarter of 2008.

Although Voit didn't provide a similar graph for Las Vegas, the situation is clearly worse:

The amount of occupied space valley-wide fell to 38.2 million, a level not witnessed since the second quarter of 2007. The average vacancy rate reached 22.7 percent, which represented a 0.7-point increase from the preceding quarter (Q2 2009). Compared to the prior year (Q3 2008), vacancies were up 5.7 points from 17.0 percent.New office construction has slowed significantly in these markets, and will not pick up until vacancy rates drop sharply.

...

On an annualized basis, new supply has dwindled and less than one million square feet of new supply is expected to enter the market during 2009, a figure not seen since 2003. We expect even less development in 2010 with a plug on the development pipe until the supply-demand imbalance corrects itself.

Report: CIT Nears Bankruptcy, CEO to Resign

by Calculated Risk on 10/13/2009 08:23:00 AM

From Reuters: CIT debt swap struggles, bankruptcy looms. Reuters is reporting that "sources familiar with the matter" say bondholders are showing little interest in the debt exchange offer and a bankruptcy is now more likely.

Also this morning CIT announced that CEO Jeffrey Peek is resigning effective Dec 31st.

The possible bankruptcy of CIT is a major concern because CIT provides financing for about one million small businesses. And small businesses are already having trouble obtaining credit.

From Peter Goodman in the NY Times: Credit Tightens for Small Businesses

Many small and midsize American businesses are still struggling to secure bank loans, impeding their expansion plans and constraining overall economic growth ...Also see: Small Business and Employment

Most banks expect their lending standards to remain tighter than the levels of the last decade until at least the middle of 2010, according to a survey of senior loan officers conducted by the Federal Reserve Board. ... Bankers worry about the extent of losses on credit card businesses ...[and] are also reckoning with anticipated failures in commercial real estate. Until the scope of these losses is known, many lenders are inclined to hang on to their dollars rather than risk them on loans to businesses in a weak economy ...

A CIT bankruptcy will probably lead to even tighter credit for many small businesses exacerbating the current credit situation.

Monday, October 12, 2009

Fed's Bullard: Falling Unemployment Rate "Prerequisite" for Rate Increase

by Calculated Risk on 10/12/2009 10:07:00 PM

Usually this would be a "duh", but with some of the Fed talk recently, this is worth noting ...

From Bloomberg: Bullard Says Lower Unemployment Condition to Tighten

...“You want some jobs growth and unemployment coming down. That is a prerequisite” for an increase in interest rates, Bullard said. “It doesn’t mean you need unemployment all the way down to more normal levels.”As Paul Krugman noted this weekend, we are a long way from when the Fed will raise rates.

...

Bullard, referring to a prior jobless rate of 10.8 percent, said “I don’t think we will quite hit the peak we hit in 1982, but things have surprised us before.”

...

“I’m the north pole of inflation hawks,” Bullard said. “But we are trying to describe optimal policy, some optimal outcomes in an environment where inflation is below target -- we have an implicit target of 1.5 to 2 percent -- and you have the specter of a Japanese-style outcome, which I have worried about and some other members of the FOMC have worried about.”

...

“It is a little disappointing that private-sector economists are thinking so much about when we are going to move our fed funds rate up,” he said. “We are at zero. We are going to be there awhile. The focus should be more on” the Fed’s asset purchase program.

CBRE: Retail Cap Rates Increase Sharply in Q3

by Calculated Risk on 10/12/2009 06:42:00 PM

From CB Richard Ellis: U.S. Retail Cap Rates

Ending at 8.71%, cap rates were up again. The 59 basis point gain is the largest quarterly increase we have ever measured, even trumping last quarter's previous record.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from CBRE shows the retail cap rate since 2003. Note that 2009 is an average of Q1 through Q3, and the cap rate in Q3 was at 8.71% - above the 2003 annual level.

Sharply higher vacancy rates, lower rents, reduced leverage and much higher cap rates - this is what Brian calls the "neutron bomb for RE equity"; destroys CRE investors (and lenders), but leaves the buildings still standing.

Cap Rate: the net operating income divided by the current value (or purchase price). Net operating income excludes depreciation and interest expenses. Say an investor paid $100 thousand in cash for a retail property, the investor would expect to clear $8,710 in cash per year after expenses with an 8.71% cap rate (the $8,710 is before paying income taxes that depend on financing and depreciation).

The History of the World wouldn't be complete without ...

by Calculated Risk on 10/12/2009 04:45:00 PM

From Larry Gonick's The Cartoon History of the Modern World, Part 2, on page 248 ... (ht TDM)

Click on cartoon for larger image in new window.

Posted with permission from Larry Gonick. Thanks!

For more on Tanta, see the menu bar above ...

Mortgage Modifications and BofA

by Calculated Risk on 10/12/2009 02:10:00 PM

Renae Merle at the WaPo writes about Bank of America's struggles to ramp-up their mortgage modification department: Racing the Clock to Avoid Foreclosures

The following section probably requires more explanation:

The company was also slow out of the box because it initially took a more conservative approach than some other banks, requiring that borrowers document their income and complete other paperwork before granting preliminary approval for a modification. In August, Bank of America softened the requirement and began authorizing some modifications without getting all the documents first.Read mort_fin notes:

"What the article doesn't make clear is that what was changed was the timing of the income documentation, not the level. It used to be the case that bofa required full documentation of income before they would even run the numbers to tell a borrower that they qualified. Now they will give an answer over the phone and start a trial mod, giving the borrower a month or 2 to provide the docs. No docs, no permanent mod. A borrower who can't document their claims gets a month or two of reduced payments before getting kicked out."This is why it will be important to watch the number of permanent modifications over the next few months. The Treasury announced last week that 500,000 modifications have been started, but the Obama plan had produced only 1,711 permanent loan modifications as of Sept. 1. That number should increase sharply soon.

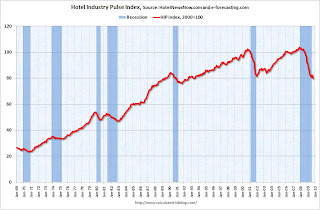

Hotel Industry Pulse Index Declines in September

by Calculated Risk on 10/12/2009 12:17:00 PM

From HotelNewsNow.com: Hotel Industry Pulse stalls

Economic research firm e-forecasting.com in conjunction with Smith Travel Research announced the HIP hit a snag in its recovery. After going up two months in a row, HIP declined 2.1 percent in September. HIP, the Hotel Industry's Pulse index, is a composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decline brought the index to a reading of 79.7. The index was set to equal 100 in 2000.

...

“The HIP had shown improvements over the previous two months, but we’ve tried to approach those gains with cautious optimism,” said Chad Church, industry research manager at STR. “Over the past months, we saw leisure demand continue to make strides in recovery while business travel maintained its downward trend. Now that the summer travel season has come to an end, we’re waiting to see any signs of life from the business segment.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This index is now at the lowest point since 1992.

Over the last couple of years the hotel industry has been crushed. RevPAR (Revenue per available room) is off about 14% compared to the same period in 2008. And at the current occupancy and room rate levels, many hotels are losing money.

HIP historical data provided by HotelNewsNow.com and e-forecasting.com.

More from Chad Church at STR: STR's October forecast holds steady

As we come to conference season again, our outlook for 2010 and 2011 will depend heavily on the performance data we see during the next two months. ... As of now, we stand at a RevPAR projection of -4.2 percent in 2010.Chad provides this graph comparing weekend (leisure) vs. business travel:

"[D]emand in the weekend segment (which we use as a gauge for leisure travel) has stabilized, while demand in the weekday segment has yet to hit a definitive bottom. If the unemployment rate remains close to 10 percent throughout 2010, sustained demand growth in the leisure segment will be difficult. The corporate travel segment will then be the barometer for recovery, and as of August, there have been no discernable trends in our monthly data to indicate a turning point."I'll have more on Thursday, but the hotel industry is still searching for a bottom for the occupancy rate, and at the current low occupancy rates, the Average Daily Rate and RevPAR will continue to decline in 2010.

Distressed Sales: Sacramento as Example

by Calculated Risk on 10/12/2009 10:12:00 AM

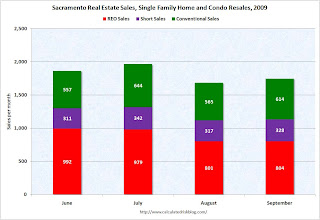

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series (as an example) to see changes in the mix.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the September data.

They started breaking out REO sales last year, but this is only the fourth monthly report with short sales. About 63 percent of all resales (single family homes and condos) were distressed sales in September. The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

Total sales in September were off 18% compared to September 2008; the fourth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (25.2%) or FHA loans (27.6%), suggesting most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.

Rosenberg on Economy: "String of lowercase Ws for the next five years"

by Calculated Risk on 10/12/2009 08:43:00 AM

We are starting to exhaust the keyboard for the shape of the recovery ... and reuse letters!

Two different views:

From Bloomberg: Rosenberg Sees Low-To-No-Growth as Kantor Vows Vigorous Economy (ht jb)

“Right now the economy is being held together by very strong tape and glue provided by the Fed, Treasury and Congress,” [said David Rosenberg, Gluskin Sheff + Associates Inc.] ... The current economy won’t resemble previous V-shaped recoveries, he says. “It’s going to look like this whole string of lowercase Ws for the next five years,” with periods of growth followed by periods of contraction.And from Larry Kantor, head of research at Barclays Capital Inc. and former Fed economist:

“We think the recovery will be sustained,” ... “People talk about double-dips, the economy’s on life support and once it’s withdrawn everything is going to fall apart again. Business cycles typically don’t work that way.” ... Kantor ... says the parallel is closer to 1992, when the economy expanded 3.4 percent coming out of recession, or 1983, when it grew 4.5 percent.Of course Rosenberg tends to be bearish, and I can't remember when Kantor wasn't bullish. He was worried about inflation in 2005 and bullish in June 2008.

But this does show the range of forecasts. My view is the recovery will be sluggish for some time.

Sunday, October 11, 2009

Foreclosures Movin' on Up or Euphoria Express?

by Calculated Risk on 10/11/2009 10:37:00 PM

Kind of a weird juxtaposition ...

From the WSJ: Foreclosures Grow in Housing Market's Top Tiers

About 30% of foreclosures in June involved homes in the top third of local housing values, up from 16% when the foreclosure crisis began three years ago, according to new data from real-estate Web site Zillow.com.Meanwhile Jim the Realtor rides the Euphoria Express (mostly at the high end):

More on When the Fed might Raise Rates

by Calculated Risk on 10/11/2009 04:45:00 PM

From Paul Krugman: When should the Fed raise rates? (even more wonkish)

Let me start with a rounded version of the Rudebusch version of the Taylor rule:This is all back-of-the-envelope stuff - and maybe NAIRU or core inflation will be a little higher (although I think core inflation might be lower next year because of declining owners' equivalent rent).

Fed funds target = 2 + 1.5 x inflation - 2 x excess unemployment

where inflation is measured by the change in the core PCE deflator over the past four quarters (currently 1.6), and excess unemployment is the different between the CBO estimate of the NAIRU (currently 4.8) and the actual unemployment rate (currently 9.8).

Right now, this rule says that the Fed funds rate should be -5.6%. So we’re hard up against the zero bound.

Suppose that core inflation stays at 1.6% (although in fact it’s almost sure to go lower.) Then we can back out the unemployment rate at which the target would cross zero, suggesting that tightening should begin: it’s an excess unemployment rate of 2.2, implying an actual rate of 7 percent. That’s a long way from here. ...

If we use Krugman's analysis, and the recent CBO projections for the average annual unemployment rate (10.2% in 2010, 9.1% in 2011, and 7.2% in 2012), the Fed would not raise rates until some time in 2012.

Last month I wrote:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)Maybe 2011. Or maybe 2012. But talk of a rate hike in early 2010 seems crazy ...

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

Ivy Zelman on Housing

by Calculated Risk on 10/11/2009 12:41:00 PM

Edward Robinson wrote a recent article for Bloomberg on the rise of independent research: ‘Sell’ for Research Renegades Becomes Business Off Wall Street (ht Eyal)

One of the analysts featured in the article is Ivy Zelman, formerly at Credit Suisse, and now at Zelman & Associates. Ms. Zelman became an internet favorite when she asked Toll Brothers CEO Bob Toll "Which Kool-aid are you drinking?" on the Q4 2006 Toll Brothers conference call.

On Zelman's current view:

Many of her clients are clamoring to know whether the market has hit bottom. In terms of prices, she says probably not: One out of three owners has a mortgage worth more than the value of the home, and mounting foreclosures and distressed properties are slated to account for 53 percent of home sales in 2010 compared with 40 percent in 2008, according to Moody’s.Although I think prices might have bottomed in some low end bubble areas at the end of 2008, or early 2009 - because of the flood of foreclosures at that time - some of these areas have seen prices increase 10% to 15% since then (according to local reports). This is because of a combination of a buying frenzy associated with the first time home buyer tax credit, and the lack of inventory because of foreclosure delays associated with the trial modifications. It is not unusual for homes in these areas to receive 20, 30 or 50 bids.

“When that inventory hits the market, it’s going to undermine prices,” she says.

Even if the first time home buyer tax credit is extended, I think the interest will wane. Meanwhile the banks are preparing to start foreclosing again. The WSJ recently quoted a Bank of America Corp. spokeswoman: "We are going to see a spike from now to the end of the year in foreclosures as we take people out of the running" [for a loan modification].

So I expect prices in the low end areas to decline again (even if the bottom is in). I also expect further price declines in the mid-to-high end bubble areas. Note: this isn't like in 2005 when I thought large price declines were inevitable. House prices are much closer to the bottom now, and the U.S. government is trying to support house prices, or at least slow the rate of price declines.

A Policy: Supporting House Prices

by Calculated Risk on 10/11/2009 09:45:00 AM

“I don’t think it’s a bad thing that the bad loans occurred. It was an effort to keep prices from falling too fast. That’s a policy.”

Barney Frank, chairman of the House Financial Services Committee on recent FHA lending, quoted Oct 9th, 2009 in the NY Times.

"I believe the intent of the FTHB [first time home buyer] credit (and any extensions) is to raise the floor on home prices to delay (and sometimes prevent) defaults, reducing the shock to the financial system."

reader picosec in email, Oct 2nd, 2009

And a couple more quotes from an article by Alan Heavens in Philadelphia Inquirer: Skeptics question housing recovery :

"Government intervention to date has been extremely helpful in preventing an even more dramatic decline in home prices."

John Burns, real estate industry consultant

The housing market "is showing improvement only because it is on government life support."

Mark Zandi, Economy.com

As Representative Frank notes, the policy of the U.S. appears to be to support asset prices at almost any cost. This includes:

We could probably include the Fed buying GSE MBS to lower mortgage rates, and other policies like increasing the "conforming loan" limit to $729,750 in high cost states.

Intentionally encouraging loans with high default rates (insured at taxpayer expense), and the FTHB tax credit (especially allowing buyers to use the credit as a down payment) have stimulated demand. And delaying foreclosures has restricted supply.

This has had the desired effect of pushing up asset prices, especially at the low end.

It is "a policy", but is it a good policy?