by Calculated Risk on 10/22/2009 04:00:00 PM

Thursday, October 22, 2009

Fed Treasury Purchases: Just $2 Billion More

Just an update on the status of the Fed's Treasury and MBS purchase programs.

From the Atlanta Fed weekly Financial Highlights:  From the Atlanta Fed:

From the Atlanta Fed:

The NY Fed purchased $1.05 billion more yesterday, so there is just $2 billion more to come over the next week.The Fed has purchased a total of $297 billion of Treasury securities through October 21, bringing it about 99% toward its goal. Of these purchases, $4.5 billion have been TIPS. Last week, the Fed made a purchase on October 13 for $2.95 billion in the seven-to-10-year sector.

And from the Atlanta Fed:

And from the Atlanta Fed: The Fed purchased an additional $18.1 billion net in MBS over the last week, bringing the total to $963 billion.The Fed purchased a net total of $16.1 billion of agency-backed MBS between October 8 and 14, bringing its total purchases up to about $945 billion, and by year-end [CR Note: by the end of Q1] the Fed will purchase up to $1.25 trillion.

The Treasury purchases will end next week - and will probably make the news. The MBS purchases are ongoing.

The third graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Christina Romer on Impact of Stimulus on GDP

by Calculated Risk on 10/22/2009 02:52:00 PM

A key point on the impact of the stimulus on GDP ...

From Christina Romer, Chair, Council of Economic Advisers in Testimony before the Joint Economic Committee: From Recession to Recovery

In a report issued on September 10, the Council of Economic Advisers (CEA) provided estimates of the impact of the ARRA on GDP and employment. ...The impact on GDP will be smaller going forward, and according to Dr. Romer, the impact will be around zero by mid next year, and will be a drag later in 2010 (as stimulus is reduced).

These estimates suggest that the ARRA added two to three percentage points to real GDP growth in the second quarter and three to four percentage points to growth in the third quarter. This implies that much of the moderation of the decline in GDP growth in the second quarter and the anticipated rise in the third quarter is directly attributable to the ARRA.

Fiscal stimulus has its greatest impact on growth around the quarters when it is increasing most strongly. When spending and tax cuts reach their maximum and level off, the contribution to growth returns to roughly zero. This does not mean that stimulus is no longer having an effect. Rather, it means that the effect is to keep GDP above the level it would be at in the absence of stimulus, not to raise growth further. Most analysts predict that the fiscal stimulus will have its greatest impact on growth in the second and third quarters of 2009. By mid-2010, fiscal stimulus will likely be contributing little to growth.

emphasis added

Hotel RevPAR off 16 Percent

by Calculated Risk on 10/22/2009 12:14:00 PM

From HotelNewsNow.com: Houston leads losses in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 8.1 percent to end the week at 58.9 percent. ADR dropped 8.5 percent to finish the week at US$99.14. RevPAR for the week decreased 16.0 percent to finish at US$58.42.

Click on graph for larger image in new window.

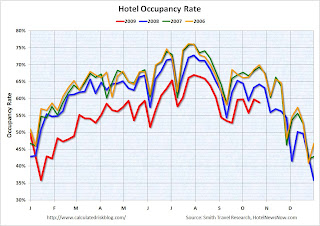

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

The above graph shows the distinct seasonal pattern for occupancy.

The occupancy rate is higher in the summer (because of leisure travel), and lower on certain holidays. This also shows that hotels are in two year occupancy slump. The year-over-year comparisons are easier now since business travel fell off a cliff last October. Comparing to the same week two years ago, occupancy rates are off 15%.

The HotelNewsNow press release has three graphs on daily occupancy, room rates, and RevPAR variance with 2008.

The HotelNewsNow press release has three graphs on daily occupancy, room rates, and RevPAR variance with 2008.This graph shows the RevPAR variance by day, and indicates that business travel (weekdays) is off more than leisure travel (weekends). This has been an ongoing story ...

So far there is little evidence of an increase in business travel this Fall.

CNN: 7,000 People per Day exhaust Extended Unemployment Benefits

by Calculated Risk on 10/22/2009 10:59:00 AM

From Tami Luhby at CNNMoney: 7,000 unemployed Americans lose their lifeline every day (ht Dirk)

Another day, another 7,000 people run out of unemployment benefits.This will probably hit 10,000 people per day soon. An extension of this safety net has widespread support ... and is still being held up in the Senate.

One month after the House passed a bill extending unemployment benefits, the issue is still being debated in the Senate.

...1.3 million people [are] set to lose their benefits before year's end if Congress doesn't act, according to the National Employment Law Project, an advocacy group. In October alone, more than 200,000 people will fall off the rolls.

Weekly Unemployment Claims Increase

by Calculated Risk on 10/22/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims increased to 531,000:

In the week ending Oct. 17, the advance figure for seasonally adjusted initial claims was 531,000, an increase of 11,000 from the previous week's revised figure of 520,000. The 4-week moving average was 532,250, a decrease of 750 from the previous week's revised average of 533,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 10 was 5,923,000, a decrease of 98,000 from the preceding week's revised level of 6,021,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 750 to 532,250, and is now 126,500 below the peak in April.

Initial weekly claims have peaked for this cycle. The key question is: Will claims continue to decline sharply, like following the recessions in the '70s and '80s, or will claims plateau for some time at an elevated level, as happened during the jobless recoveries in the early '90s and '00s?

The level is still very high suggesting continuing job losses ...

Apartment Rents "Plunge" in the West

by Calculated Risk on 10/22/2009 12:08:00 AM

From the Mercury News: Santa Clara County apartment rents plunge

Apartment rents plunged 10 percent in Santa Clara County in the third quarter compared with a year earlier, the biggest decline in any metro area in the Western United States ...From the Las Vegas Sun: LV apartment rental rates decline in third quarter

RealFacts ... said the average asking price for apartments in the Las Vegas area in the quarter was $837, down 2.1 percent from $855 in the second quarter and down 5.7 percent from $887 one year ago.From Bloomberg: Apartment Rents Decline in U.S. West as Unemployment Increases

Apartment rents declined throughout the U.S. West and South in the third quarter as rising unemployment made it harder for landlords to raise their rates.Falling rents is great for renters, but it means falling apartment values, more losses for lenders and CMBS investors, more pressure on home prices, and possibly a declining CPI (rent is the largest component).

The average asking rent fell to $965 from $1,002 a year earlier, said Novato, California-based RealFacts, which surveyed owners of more than 12,600 complexes. The occupancy rate dipped below 92 percent from almost 93 percent a year earlier.

...

In California’s Oxnard-Thousand Oaks-Ventura region, rents fell 7.4 percent to $1,429, and in the Seattle area they dropped 7.3 percent to $1,036.

Wednesday, October 21, 2009

Financial Times: Top China banker warns on asset bubbles

by Calculated Risk on 10/21/2009 08:22:00 PM

From the Financial Times: Top China banker warns on asset bubbles

The Financial Times quotes Qin Xiao, chairman of China Merchants Bank, arguing that "it is urgent" for China to shift to a neutral monetary policy because of asset price increases.

The stimulus package in China is huge:

... China’s stimulus measures could amount to 15-17 per cent of GDP this year if government-induced bank lending is taken into account – by far the largest among major economies.And from the WSJ: China Gains Confidence in Recovery

excerpted with permission

China's recovery is becoming broader and potentially more sustainable, a shift that could provide better support for a still-fragile global economy. ... Economic data for the third quarter ... are expected to show that gross domestic product grew by around 9% from a year earlier.This is a key point for China and the global economy. If China slows down too quickly, the global recovery could stall.

...

As the fastest-growing major economy, China has a key role to play in pulling the world out of the deep slump it fell into last year. But its rebound this year has been so quick, and driven by such a huge flood of money from the state-controlled banking system, that many investors have questioned whether the expansion can continue for much longer.

Macroblog: "The growing case for a jobless recovery"

by Calculated Risk on 10/21/2009 05:13:00 PM

Dave Altig writes at Macroblog: The growing case for a jobless recovery

Dr. Altig reviews several recent Macroblog posts, and adds:

The percentage of employee separations labeled permanent is at a recorded high.So far the current recovery is even worse than "jobless"; it is a "job-loss" recovery.

Underneath the usual total unemployment numbers are the reasons an individual is unemployed: You are on temporary layoff; you quit your job; you have reentered the labor market and have yet to find a job; or you are entering the job market for the first time and have yet to find a job. Or, finally, you have been permanently separated from your previous employer, who has no expectation of hiring you back.

The last category is the dominant reason for unemployment at this time. That might not seem surprising, but it actually is. Never, in the six recessions preceding the latest one, did permanent separations account for more than 45 percent of the unemployed. The current percentage stands at 56 percent as of September and appears to be still climbing:

Of course, none of this is proof positive that we are in for a "jobless recovery," but, to me, the odds appear to be increasing.

Fed's Beige Book: Stabilization

by Calculated Risk on 10/21/2009 03:02:00 PM

From the Fed: Beige Book

Reports from the 12 Federal Reserve Districts indicated either stabilization or modest improvements in many sectors since the last report, albeit often from depressed levels. Leading the more positive sector reports among Districts were residential real estate and manufacturing, both of which continued a pattern of improvement that emerged over the summer. Reports on consumer spending and nonfinancial services were mixed. Commercial real estate was reported to be one of the weakest sectors, although reports of weakness or moderate decline were frequently noted in other sectors.On real estate:

Most Districts reported that housing market conditions improved in recent weeks, primarily from a pickup in sales of low- to middle-priced houses. Contacts reported that sales were boosted by the government's tax credit for first-time homebuyers. Resale activity also edged up in parts of the New York District, although prices continued to be depressed due to a substantial volume of foreclosures and short sales. New and existing home sales remained flat in the Philadelphia District, and home sales continued to decline throughout the St. Louis District. Sales of higher-priced homes were very slow, according to Philadelphia, Cleveland, and Kansas City. Moreover, real estate agents in the Boston and Cleveland Districts were uncertain about the future of home sales once the tax credit expires. Availability of financing continued to be a concern for potential buyers in the Cleveland and Chicago Districts.

...

Commercial real estate continued to weaken across the 12 Districts, although even this sector had scattered bright spots. Each District indicated that demand for private commercial real estate was weak, with New York, Philadelphia, Cleveland, Atlanta, Chicago, St. Louis, Kansas City, and San Francisco all characterizing activity as declining further since the last report. An inability to obtain credit was often cited as a problem for businesses that wanted to purchase or build space. High vacancy rates were noted as a key concern especially for landlords who were not offering concessions. And, while industrial real estate in the Richmond District was generally weak, renewed interest by retailers to revisit postponed expansion plans was also noted. Finally, public nonresidential construction activity funded by federal stimulus projects was a source of strength in the Cleveland, Chicago, Minneapolis, and Dallas Districts, but gains were often offset by state and local government cutbacks.

Fed's Tarullo on "Too Big to Fail"

by Calculated Risk on 10/21/2009 01:30:00 PM

From Fed Governor Daniel Tarullo: Confronting Too Big to Fail

One approach suggested by a number of commentators is to reverse the 30-year trend that allowed progressively more financial activities within commercial banks and more affiliations with non-bank financial firms. The idea is presumably to insulate insured depository institutions from trading or other capital market activities that are thought riskier than traditional lending functions. There are, however, at least two reasons why this strategy seems unlikely to limit the too-big-to-fail problem to a significant degree. One is that, historically at least, some very large institutions got themselves into a good deal of trouble through risky lending alone. Moreover, as we have already seen in the experience with Bear Stearns and Lehman, firms without commercial banking operations can now also pose a too-big-to-fail threat.Tarullo suggests:

Another approach would be to attack the bigness problem head-on by limiting the size or interconnectedness of financial institutions. Some observers have even suggested that existing large firms should be split up into smaller, not-too-big-to-fail entities, in a manner a bit reminiscent of the break-up of AT&T in the early 1980s. Of course, the conceptual and practical challenges in breaking up the nation’s largest financial institutions would be considerably more daunting than those faced by Judge Greene in creating four regional operating companies and a long distance carrier out of the old AT&T. Indeed, to my knowledge, no one has offered anything like standards for undertaking this task, much less a blueprint for how it would be accomplished. This is, in other words, more a provocative idea than a proposal. Like many a provocative idea, though, even in an unelaborated form it can focus attention on the relative effectiveness of alternative policy proposals.

The fact that the largest financial firms will account for a significantly larger share of total industry assets after the crisis than they did before can only add to the uneasiness of those worried about the too-big-to-fail phenomenon. It is notable that current law provides very little in the way of structural means to limit systemic risk and the too-big-to-fail problem. The statutory prohibition on interstate acquisitions that would result in a commercial bank and its affiliates holding more than 10 percent of insured deposits nationwide is the closest thing to such an instrument. Policymakers and policy commentators alike might usefully attempt to develop similarly discrete mechanisms that could be beneficial in containing the too-big-to-fail problem. As must be apparent from my remarks today, my strong suspicion is that an effective response to the problem will likely require multiple, mutually reinforcing instruments.

emphasis added

A regulatory response for the too-big-to-fail problem would enhance the safety and soundness of large financial institutions and thereby reduce the likelihood of severe financial distress that could raise the prospect of systemic effects. Such a response consists of three elements.

First, the shortcomings of the regulations that failed to protect the stability of the firms and the financial system need to be rectified. Regulatory capital requirements can balance the incentive to excessive risk-taking that may arise when there is believed to be government support for a firm, or at least some of its liabilities. There is little doubt that capital levels prior to the crisis were insufficient to serve their functions as an adequate constraint on leverage and a buffer against loss. The Federal Reserve has worked with other U.S. and foreign supervisors to strengthen capital, liquidity, and risk-management requirements for banking organizations. In particular, higher capital requirements for trading activities and securitization exposures have already been agreed. Work continues on improving the quality of capital and counteracting the procyclical tendencies of important areas of financial regulation, such as capital and accounting standards.

These regulatory changes are surely a necessary part of a response to the too-big-to-fail problem, but there is good reason to doubt that they are sufficient. Generally applicable capital and other regulatory requirements do not take account of the specifically systemic consequences of the failure of a large institution. It is for this reason that many have proposed a second kind of regulatory response--a special charge, possibly a special capital requirement, based on the systemic importance of a firm. Ideally, this requirement would be calibrated so as to begin to bite gradually as a firm’s systemic importance increased, so as to avoid the need for identifying which firms are considered too-big-to-fail and, thereby, perhaps increasing moral hazard.

...

A third regulatory change is in some respects the most obvious and straightforward: Any firm whose failure could have serious systemic consequences ought to be subject to regulatory requirements such as those I have just described.

States Report Widespread Job Losses in September

by Calculated Risk on 10/21/2009 11:47:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Twenty-three states and the District of Columbia recorded over-the-month unemployment rate increases, 19 states registered rate decreases, and 8 states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in all 50 states and the District of Columbia.

...

In September, nonfarm payroll employment decreased in 43 states and the District of Columbia and increased in 7 states.

...

Michigan again recorded the highest unemployment rate among the states, 15.3 percent, in September. The states with the next highest rates were Nevada, 13.3 percent; Rhode Island, 13.0 percent; and California, 12.2 percent. The rates in Nevada and Rhode Island set new series highs. Florida, at 11.0 percent, also posted a series high.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Fourteen states and D.C. now have double digit unemployment rates.

New Jersey, Indiana, and Missouri are all close.

Three states are at record unemployment rates: Rhode Island, Nevada, and Florida. Several others - like California, Delaware, North Carolina and Georgia - are close.

AIA: Architectural Billings Index Shows Contraction

by Calculated Risk on 10/21/2009 09:11:00 AM

From Reuters: U.S. architecture billings up in September-AIA

... The Architecture Billings Index was up 1.4 points at 43.1, matching July's level, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008.

...

A measure of inquiries for new projects, however, rose to 59.1, its highest in two years -- "an encouraging sign," said AIA Chief Economist Kermit Baker.

"Some larger stimulus-funded building activity should be coming online over the next several months, partially offsetting the steep decline in private commercial construction," Baker said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment through most of 2010, if not longer.

MBA: Mortgage Applications Decrease, Rates Rise

by Calculated Risk on 10/21/2009 08:56:00 AM

The MBA reports: Mortgage Applications Decrease

The Market Composite Index, a measure of mortgage loan application volume, decreased 13.7 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index, also adjusted for the holiday, decreased 16.8 percent from the previous week and the seasonally adjusted Purchase Index decreased 7.6 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.07 percent from 5.02 percent, with points increasing to 1.13 from 1.11 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

The Purchase index declined to 268.8, and the 4-week moving average declined to 284.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Tuesday, October 20, 2009

Summary and Too Small To Fail?

by Calculated Risk on 10/20/2009 10:18:00 PM

A couple of interesting articles and a daily summary ...

The ABA and other bank lobby groups for small banks are seeking to have Treasury develop a program to provide TARP funds to small stressed banks -- those with less than $5 billion in assets -- on the cusp of a default that haven't received TARP funds.And I thought everyone agreed that the FDIC closing small failing banks - albeit slowly - was an example of how bank problems should be resolved. Now we have "Too small to fail"?

As the crisis unfolded and problems arose in different parts of the financial system, the Fed responded by trying to increase liquidity in several markets through special lending programs. These programs may have had some stabilizing effects on markets and may have lowered some spreads. Yet, without defining in advance a systematic and consistent approach to such lending, these programs also raised uncertainty — in this case, about who would or would not have access to the various facilities. This was illustrated when the Term Asset-Backed Securities Loan Facility (or TALF) was announced. Many market participants lobbied for expanding the categories of securities eligible for the program. Did these multiple lending programs keep lenders on the sidelines waiting to see which asset classes the Fed would support and which it would not? Did this delay the healing of the financial markets?

Note: I recently changed the page layout. It now has the last 5 posts, and then short excerpts and links to previous posts.

BofE Mervyn King: "Biggest moral hazard in history"

by Calculated Risk on 10/20/2009 07:16:00 PM

A quote from Bank of England Governor Mervyn King in the Telegraph: Mervyn King: bank bail-outs created 'biggest moral hazard in history' (ht Jonathan)

"It is in our collective interest to reduce the dependence of so many households and businesses on so few institutions that engage in so many risky activities. The case for a serious review of how the banking industry is structured and regulated is strong. ... The belief that appropriate regulation can ensure that speculative activities do not result in failures is a delusion. ... It is hard to see how the existence of institutions that are 'too important to fail' is consistent with their being in the private sector."More from The Times: Mervyn King calls for banks to split as public finances take record hit

“What does seem impractical, however, are the current arrangements. Anyone who proposed giving government guarantees to retail depositors and other creditors, and then suggested that such funding could be used to finance highly risky and speculative activities, would be thought rather unworldly. But that is where we now are.

“It is important that banks in receipt of public support are not encouraged to try to earn their way out of that support by resuming the very activities that got them into trouble in the first place.”

...

“To paraphrase a great wartime leader, never in the field of financial endeavour has so much money been owed by so few to so many. And, one might add, so far with little real reform.”

Home Buyer Tax Credit DOA?

by Calculated Risk on 10/20/2009 05:12:00 PM

From Reuters: White House skeptical on renewing home buyers credit

[Housing and Urban Development Secretary Shaun] Donovan told the Senate Banking Committee that while he was aware the program was popular with lawmakers, "At the same time, I am mindful that these proposals can be very expensive, especially at a time of significant budget deficits."And more from Reuters on the widespread fraud: IRS warned again of U.S. homebuyer credit fraud

...

Under questioning, Donovan said the administration would make a decision in the coming weeks after it sees more government data on the cost of the tax credit.

...

"I do not believe that a catastrophic decline would be the result of the end of the credit," Donovan said.

emphasis added

The internal watchdog for the U.S. Internal Revenue Service is expected to warn the agency for the fourth time about fraud in the multibillion dollar homebuyer tax credit program ... The inspector general found at least 70,000 tax credit claims, totaling $489 million, were granted to individuals who do not appear to qualify for it. ... The agency has opened 107,000 civil cases related to the credit and identified 167 criminal schemesFrom Diana Olick at CNBC: HUD Hints on Home Buyer Tax Credit . Olick reviews Donovan's testimony and writes:

[T]hat sounded more like a "No" to me than a "Yes."And Rex Nutting at MarketWatch reviews many of the arguments against the tax credit: Kill the wasteful home-buyer tax credit

There are other reasons to oppose the tax credit (other than it is expensive and poorly targeted). An extension of the tax credit will increase the apartment vacancy rate, push down rents, and lead to more defaults for CMBS (with falling rents), see Housing Wire: Rating Agencies See More Pain Ahead for Commercial MBS

[S]ervicers of commercial mortgage-backed securities (CMBS) are ... requiring more time to resolve delinquent loans, according to Fitch Ratings.And that means more losses for small and regional banks.

The delay for servicers, combined with continued market value declines, indicates loss severities are likely to increase “markedly” for US CMBS well into 2010, according to an annual study by the rating agency.

Multifamily loans in particular, which represent an average cumulative loss severity of 38.6% in 2008, will see a significant increase in loss severity as many markets suffer rising unemployment and oversupply.

And, for fun, from housing economist Tom Lawler (no link, a joke):

Michigan politicians, meanwhile, are arguing that Senator Isakson [sponsor of tax credit] is “almost right” in that housing needs a big boost, but so does the auto industry. As such, legislators from the Wolverine State are working behind the scenes to craft a “bipartisan” bill that would eliminate a home buyer tax credit, but instead would give all home buyers next year an American-made compact car valued up to $15,000 – at, of course, the MSRP, and paid for by the US government. Purportedly one staffer said, “hey, this proposal is no dumber than Isakson’s, and in fact it helps kill two birds with one stone, so to speak!”This was a joke, but it really is no dumber than the Isakson proposal.

HAMP Modification Documents

by Calculated Risk on 10/20/2009 04:12:00 PM

For those interested, here are some Wells Fargo (America's Servicing Corporation) HAMP documentation (pdf) (ht Dave).

A few notes:

DataQuick: California Mortgage Defaults Trend Down in Q3

by Calculated Risk on 10/20/2009 01:30:00 PM

There is a lot of interesting data in the DataQuick report. A few key points:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Notices of Default (NOD) by year through 20091 in California from DataQuick.

1 2009 estimated as total NODs to date, plus Q3 NODs (as estimate for Q4).

Clearly 2009 is on pace to break the record of 2008. I'd expect something close to 500 thousand NODs for the entire year.

From DataQuick: California Mortgage Defaults Trend Down Again

The number of mortgage default notices filed against California homeowners fell last quarter compared with the prior three-month period, the result of lenders' evolving foreclosure policies, an uncertain legislative environment and an uptick in the number of mortgages being renegotiated, a real estate information service reported.

A total of 111,689 default notices were sent out during the July-through-September period. That was down 10.3 percent from 124,562 for the prior quarter, and up 18.5 percent from 94,240 in third quarter 2008, according to San Diego-based MDA DataQuick.

The number of recorded default notices peaked in the first quarter of this year at 135,431, although that number was inflated by deferred activity from the prior four months.

"It may well be that lenders have intentionally slowed down the pace of formal foreclosure proceedings. If so, it's not out of the goodness of their hearts. It's because they've concluded that flooding the market with cheap foreclosures in this economic environment may not be in their best financial interest. Trying to keep motivated, employed homeowners in their homes might be the most cost-efficient way to stem losses," said John Walsh, DataQuick president.

...

While most foreclosure activity was still concentrated in affordable inland communities, the foreclosure problem continued to slowly migrate into more expensive areas. The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for 52.2 percent of all default activity a year ago. In third-quarter 2009 it fell to 42.9 percent.

...

Although 111,689 default notices were filed last quarter, they involved 108,372 homes because some borrowers were in default on multiple loans (e.g. a primary mortgage and a line of credit). Multiple default recordings on the same home are trending down, DataQuick reported.

...

Trustees Deeds recorded, or the actual loss of a home to foreclosure, totaled 50,013 during the third quarter. That was up 9.5 percent from 45,667 for the prior quarter, and down 37.1 percent from 79,511 for third-quarter 2008, which was the all-time peak.

In the last real estate cycle, Trustees Deeds peaked at 15,418 in third-quarter 1996. The state's all-time low was 637 in the second quarter of 2005, MDA DataQuick reported.

emphasis added

MBA's Chief Economist Brinkmann on State of Housing

by Calculated Risk on 10/20/2009 12:08:00 PM

Emile Brinkmann, MBA Chief Economist, testified today before the Senate Committee on Banking, Housing and Urban Affairs at a hearing titled, "The State of the Nation's Housing Market." Here are some excerpts:

"... Whenever I am asked when the housing market will recover, I explain that the economy and the housing market are inextricably linked. The number of people receiving paychecks will drive the demand for houses and apartments and the recovery will begin when unemployment stops rising. ...Edit: this is correct in terms of housing units, but it is important to note that housing investment leads the economy both into and out of a recession, and, in recent recessions, employment lags. I'd argue the recovery in housing investment has already started, but it will be a very sluggish recovery.

... Prior to the onset of this recession, the housing market was already weakened due in part to the heavy use of loans like pay option ARMs and stated income loans by borrowers for whom these loans were not designed. Together with rampant fraud by some borrowers buying multiple properties and speculating on continued price increases, this led to very high levels of construction to meet that increased demand, demand that turned out to be unsustainable. When that demand disappeared, a large number of houses were stranded without potential buyers. The resulting imbalance in supply and demand drove prices down, particularly in the most overbuilt markets like California, Florida, Arizona, and Nevada - markets that had previously seen some of the nation's largest price increases.Unfortunately the MBA didn't take the lead in trying to halt the spread of these products (Option ARMs and Stated Income loans).

emphasis added

Thus the nature of the problem has shifted. A year ago, subprime ARM loans accounted for 36 percent of foreclosures started, the largest share of any loan type despite being only 6 percent of the loans outstanding. Now prime fixed-rate loans represent the largest share of foreclosures initiated.We're all subprime now!

Unfortunately, the consensus is that unemployment will continue to get worse through the middle of next year before it slowly begins to improve. While we have seen certain good signs like a stabilization of home prices and millions of borrowers refinancing into lower rates, we still face major challenges.My estimate is an increase of 35 bps for mortgage rates (relative to the Ten Year Treasury yield).

The most immediate challenge is what will happen to interest rates when the Federal Reserve terminates its program for purchasing Fannie Mae and Freddie Mac mortgage-backed securities in March. The Federal Reserve has purchased the vast majority of MBS issued by these two companies this year and in September purchased more than 100% of the Fannie and Freddie MBS issued that month. The benefit has been that mortgage rates have been held lower than what they otherwise would have been without the purchase program, but there is growing concern over where rates may go once the Federal Reserve stops buying and what this will mean for borrowers. While the most benign estimates are for increases in the range of 20 to 30 basis points, some estimates of the potential increase in rates are several times those amounts.

The extension of the Fed's MBS purchase program to March gives the Obama administration time to announce its interim and, perhaps, long-term recommendations for Fannie and Freddie in February's budget release.One of the concerns is privatizing profits and socializing losses - exactly what happened with Fannie and Freddie. This proposal has some positive features - especially restricting insurance to "the safest types of mortgages". That would be prime fixed and ARM loans only, with no risk layering. Subprime would be excluded. Alt-A should disappear.

All of this, however, points to the need to begin replacing Fannie Mae and Freddie Mac with a long-term solution. MBA has been working on this problem for over a year now and recently released its plan for rebuilding the secondary market for mortgages.

MBA's plan envisions a system composed of private, non-government credit guarantor entities that would insure mortgage loans against default and securitize those mortgages for sale to investors. These entities would be well-capitalized and regulated, and would be restricted to insuring only a core set of the safest types of mortgages, and would only be allowed to hold de minimus portfolios. The resulting securities would, in turn, have a federal guarantee that would allow them to trade similar to the way Ginnie Mae securities trade today. The guarantee would not be free. The entities would pay a risk-based fee for the guarantee, with the fees building up an insurance fund that would operate similar to the bank deposit insurance fund. Any credit losses would be borne first by private equity in the entities and any risk-sharing arrangements put in place with lenders and private mortgage insurance companies. In the event one of these entities failed, the insurance fund would cover the losses. Only if the insurance fund were exhausted, would the government need to intervene.

It appears - although it isn't explicitly stated - that no other entities could securtize mortgages. That would be a key.

Housing and the Economy

by Calculated Risk on 10/20/2009 10:10:00 AM

Just a quick comment ...

Probably the best leading indicator for the economy is investment in housing1.

We can use new home sales, housing starts (usually single-family starts), or residential investment (from the BEA GDP report), as indicators of housing.

We can probably also use the NAHB builder confidence index.

Those expecting a "V-shaped" or immaculate recovery - with unemployment falling sharply in 2010 - are clearly expecting single family housing starts to rebound quickly to a rate significantly above 1 million units per year.

Not. Gonna. Happen.

There are just too many excess housing units for a rapid recovery in new home sales and single family housing starts. Yes, new home inventory has declined significantly, and existing home inventory has also decreased (although still very high). But there are also a record number of vacant rental units - with the vacancy rate approaching 11% - and the housing inventory includes these units too.

Notice what is not included as a leading indicator: existing home sales.

The sale of an existing home adds a little to the economy (some commissions and fees), and sometimes some added spending on improvements. Only the improvements add to the housing stock (not commissions). And right now marginal buyers have very little to spend on improvements (see this story).

Those looking at existing home sales for economic guidance are confusing activity with accomplishment.

1I've written about this extensively, but I'll put up another post on housing investment leading the economy soon.