by Calculated Risk on 10/25/2009 08:33:00 AM

Sunday, October 25, 2009

Seattle Times: "Reckless strategies doomed WaMu"

From Drew DeSilver at the Seattle Times: Reckless strategies doomed WaMu

This is the first of two parts. Here is a section on loose lending:

"The big saying was 'A skinny file is a good file,' " said Nancy Erken, a WaMu loan consultant in Seattle. She recalled helping credit-challenged borrowers collect canceled checks, explanatory letters and other documentation that they could afford their loans.And on risk management:

"I'd take the files over to the processing center in Bellevue and they'd tell me 'Nancy, why do you have all this stuff in here? We're just going to take this stuff and throw it out,' " she said.

In time, WaMu even began allowing low- or no-documentation option ARMs, piling risk on risk. The loose standards spread through the company like a flu virus.

In an internal newsletter dated Oct. 31, 2005, and obtained by The Seattle Times, risk managers were told they needed to "shift (their) ways of thinking" away from acting as a "regulatory burden" on the company's lending operations and toward being a "customer service" that supported WaMu's five-year growth plan.Ouch. There is much more in the article - on Option ARMs, switching to originate-to-sell and more ... WaMu was definitely "doomed".

Risk managers were to rely less on examining borrowers' documentation individually and more on automated processes, Melissa Martinez, WaMu's chief compliance and risk oversight officer, wrote in the memo.

...

"The whole tone it set was that 'Maybe the next file I review I should pull back, hold off on downgrading (a loan), not take a sharp pencil to what production was doing,' " [Dale George, a former senior credit-risk officer in Irvine, Calif.] said.

"They weren't going to have risk management get in the way of what they wanted to do, which was basically lend the customers more money."

Saturday, October 24, 2009

Hutton: "Mervyn King is right"

by Calculated Risk on 10/24/2009 11:55:00 PM

From Will Hutton at the Observer: Mervyn King is right – the time has come to break up the megabanks (ht Jonathan)

Will Hutton reviews the competing proposals to reform the banking system and suggests a combination of the two ...

The first proposal, championed by BofE Governor Mervyn King and former Fed Chairman Paul Volcker is to break up the banks and separate the commercial parts from the "casino banking":

If the status quo is untenable and unfair because it leaves us with banks so big they have to be bailed out in a crisis, and if the proposed increases in bank capital advanced by the government are unlikely to act as a restraint, then there is only one course of action left: we have to break up the megabanks. The speculative, risky parts of banks must be separated from the commercial parts which lend to business, consumers and home buyers.The second proposal, championed by Lord Turner in the U.K., and I believe favored by the Obama Administration in the U.S., is to have capital requirements based on the riskiness of the business:

This, after all, is what the Americans did after the 1929-33 crash. Under the famous Glass-Steagall Act, commercial banks were forbidden to offer any form of collateral, underwriting or loan that financed stocks and shares. The same could be done today. The banking the economy needs – so-called narrow banking – could be closely regulated and casino banking could be left to its separate, freewheeling devices.

The way forward, [Lord Turner] repeated, is more capital, especially more capital for the casino parts of any bank's business. On top, banks should make "living wills", setting out how they would wind themselves up without any cost to the taxpayer.Either way - I think the time has for action.

Silicon Valley Office Vacancy Rate over 19 Percent

by Calculated Risk on 10/24/2009 08:23:00 PM

From the Mercury News: Silicon Valley office vacancies near 20 percent

Nearly one-fifth of Silicon Valley office space stood empty last quarter, while landlords lowered rents to try to retain tenants and attract new ones, according to a [report from commercial real estate firm Grubb & Ellis] released Friday.Some of the increase in the vacancy rate was because of new office space coming online, but it sounds like Grubb & Ellis expects a significant amount of sublease space to come on the market too. That is usually a bad sign for rents - and also suggests companies don't expect much growth.

...

The rising vacancy rate is "re-emphasizing that this is the slowest commercial real estate market the valley has seen since the dot-com bust in 2001," the report stated.

Empty space for research and development, the one- to three-story buildings where so many smaller tech companies reside, is also beginning to pile up, said Dick Scott, Grubb & Ellis' managing director in Silicon Valley. ...

"There was a temporary period of time where we all were naively optimistic that R&D would hold up. But it's taking a hit now," he said.

...

Said the Grubb & Ellis report: "Expect asking rents to decrease as companies put unoccupied space onto the market."

Report: Capmark May File Bankruptcy this Weekend

by Calculated Risk on 10/24/2009 02:41:00 PM

This has been coming for some time ...

From the NY Times Dealbook: Capmark, Big Commercial Lender, May File for Bankruptcy

The Capmark Financial Group, the big commercial real estate finance company cobbled together from pieces of GMAC, may file for bankruptcy as soon as this weekend ... The company is only the latest to fall victim to continued trouble in the commercial real estate market ... Capmark has about $10 billion in assets, with another $10 billion in a Utah bank the company owns that would not be subject to a bankruptcy filing.Capmark bank in Utah is in trouble too, and is the fifth largest bank (in assets) on the unofficial problem bank list.

From a Capmark press release in September:

The FDIC has notified Capmark Bank that it intends to issue an administrative order, which will impose certain requirements and restrictions on Capmark Bank, including requiring submission of capital and liquidity plans, restrictions on affiliated party transactions and other activities.

Goldman: Government Policies Boosted House Prices 5%

by Calculated Risk on 10/24/2009 11:45:00 AM

From James Hagerty at the WSJ: Uncle Sam Adds 5% to Prices of Homes, Goldman Says

Uncle Sam’s interventions in the housing market have pushed home prices 5% higher on a national average than they would have been otherwise, Goldman Sachs estimates in a report released late Friday.In the research note, Phillips discussed how policies have reduced foreclosures, and stimulated demand with both the first-time home buyer tax credit and "abnormally low mortgage rates". Phillips wrote (no link):

...

But these artificial props won’t last forever and may have created a false bottom in the market. “The risk of renewed home-price declines remains significant,” Goldman economist Alec Phillips writes in the report, “and our working assumption is a further 5% to 10% decline by mid-2010.”

"In 2010, we expect some of these supports to fade. Fed and Treasury purchases of mortgage-backed securities will taper off, and the pause in foreclosures created by federal mortgage modification programs may end.Based on Goldman's estimates, the first-time home buyer tax credit probably cost around $80,000 per additional home sold. Ouch.

The federal tax credit for first-time homebuyers appears likely to be extended for at least a few months, but probably no longer than through the first half of 2010."

The report isn't all negative. Goldman believes "the brunt of the price decline is behind us" and the outlook is uncertain: "the cloudy policy outlook adds to our already considerable uncertainty of where house prices will ultimately bottom".

This is very close to my view, see: The Uncertain Housing Outlook

FDIC Bank Failure Update

by Calculated Risk on 10/24/2009 08:29:00 AM

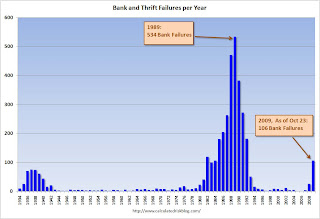

The FDIC closed seven more banks on Friday, and that brings the total FDIC bank failures to 106 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

After a busy summer, the FDIC slowed down in late September and early October with only five bank failures in four weeks. Perhaps the pace is about to pick up again. With 10 weeks to go, it seems 130 or so bank failures is likely this year.  The 2nd graph covers the entire FDIC period (annually since 1934).

The 2nd graph covers the entire FDIC period (annually since 1934).

This is the most failures per year since 1992 (181 failures).

As far as failures per week - there were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits. Also the cumulative estimated losses for the DIF, since early 2007, is now about $45 billion.

And a message from Sheila Bair:

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

Friday, October 23, 2009

Problem Bank List (Unofficial) Oct 23, 2009

by Calculated Risk on 10/23/2009 09:30:00 PM

Note: A late addition: R-G Premier Bank of Puerto Rico (SEC 8-K) to be added next week ($6.5 Billion in assets, Cert# 32185). The failures today will be removed next week.

This is an unofficial list of Problem Banks.

Changes and comments from surferdude808:

There is a net four institutions added to this week’s Unofficial Problem Bank List.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Overall, the institution count is 482 with aggregate assets of $321.9 billion, up from $316.6 billion last week. Additions include EuroBank, Hato Rey, PR ($2.7 billion); Cascade Bank, Everett, WA ($1.6 billion) (update: listed under "corrective action program"); Liberty Savings Bank, FSB, Wilmington, OH ($1.5 billion); Edgewater Bank, Saint Joseph, MI ($191 million); and Western Commercial Bank, Woodlands, CA ($122 million).

The sole deletion was San Joaquin Bank, Bakersfield, CA, which failed last Friday.

The only other change to the list is an FDIC issued Prompt Corrective Action order against Imperial Capital Bank, La Jolla, CA, which has been operating under a Cease & Desist Order since February 2009.

For next week’s list, we anticipate the FDIC will finally release its enforcement actions issued during September; thus, look for the list to grow by at least ten institutions.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure 106: First Dupage Bank, Westmont, Illinois

by Calculated Risk on 10/23/2009 08:14:00 PM

Not quite for 1st DuPage Bank

Cruel roll of the dice.

by Soylent Green is People

From the FDIC:

First Dupage Bank, Westmont, Illinois, was closed today by the Illinois Department of Financial & Professional Regulation – Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...When the levee breaks ... seven down today ...

As of July 31, 2009, First Dupage Bank had total assets of $279 million and total deposits of approximately $254 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $59 million. .... First Dupage Bank is the 106th FDIC-insured institution to fail in the Nation this year, and the seventeenth in Illinois. The last FDIC-insured institution closed in the state was Corus Bank, Chicago, on September 11, 2009.

Bank Failures 104 & 105 in Wisconsin and Minnesota

by Calculated Risk on 10/23/2009 07:11:00 PM

A flood is on horizon

The Ark is near full.

by Soylent Green is People

From the FDIC:

Bank of Elmwood, Racine, Wisconsin, was closed today by the Wisconsin Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC:

As of September 30, 2009, Bank of Elmwood had total assets of $327.4 million and total deposits of approximately $273.2 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $101.1 million. ... Bank of Elmwood is the 104th FDIC-insured institution to fail in the Nation this year, and the first in Wisconsin. The last FDIC-insured institution closed in the state was The First National Bank of Blanchardville, Blanchardville, on May 9, 2003

Riverview Community Bank, Otsego, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes six today ...

As of August 31, 2009, Riverview Community Bank had total assets of $108 million and total deposits of approximately $80 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20 million. ... Riverview Community Bank is the 105th FDIC-insured institution to fail in the Nation this year, and the fifth in Minnesota. The last FDIC-insured institution closed in the state was Jennings State Bank, Spring Grove, on October 2, 2009.

Bank Failures 102 & 103: Two More Florida Banks

by Calculated Risk on 10/23/2009 06:10:00 PM

Florida deals gone badly

Few survivors left

by Soylent Green is People

From the FDIC:

Hillcrest Bank Florida, Naples, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC:

As of October 1, 2009 , Hillcrest Bank Florida had total assets of $83 million and total deposits of approximately $84 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $45 million. ... Hillcrest Bank Florida is the 102nd FDIC-insured institution to fail in the Nation this year, and the eighth in Florida. The last FDIC-insured institution closed in the state was Partners Bank, Naples, earlier this evening.

Flagship National Bank, Bradenton, Florida, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of August 31, 2009, Flagship National Bank had total assets of $190 million and total deposits of approximately $175 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $59 million. ... Flagship National Bank is the 103rd FDIC-insured institution to fail in the Nation this year, and the ninth in Florida. The last FDIC-insured institution closed in the state was Hillcrest Bank Florida, Naples, which also closed today.

Bank Failure #101: American United Bank, Lawrenceville, Georgia

by Calculated Risk on 10/23/2009 05:35:00 PM

American United

We are all failed now.

by Soylent Green is People

From the FDIC:

American United Bank, Lawrenceville, Georgia, was closed today by the Georgia Department of Banking & Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...The banks are small, but the loss ratios are high! Two down already ...

As of August 11, 2009, American United Bank had total assets of $111 million and total deposits of approximately $101 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $44 million. ... American United Bank is the 101st FDIC-insured institution to fail in the Nation this year, and the twentieth in Georgia. The last FDIC-insured institution closed in the state was Georgian Bank, Atlanta, on September 25, 2009.

Bank Failure #100: Partners Bank, Naples, Florida

by Calculated Risk on 10/23/2009 05:07:00 PM

The pig still in the python

Working its way through.

by Soylent Green is People

FDIC Press Release:

Partners Bank, Naples, Florida, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Just a minnow, but it counts.

As of September 30, 2009, Partners Bank had total assets of $65.5 million and total deposits of approximately $64.9 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $28.6 million. ... Partners Bank is the 100th FDIC-insured institution to fail in the Nation this year, and the seventh in Florida. The last FDIC-insured institution closed in the state was Community National Bank of Sarasota County, Venice, on August 7, 2009.

Market, CRE Stories, and CIT Update

by Calculated Risk on 10/23/2009 04:00:00 PM

While we wait for the 100th bank failure of 2009 ... Click on graph for larger image in new window.

From Doug Short of dshort.com (financial planner).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The S&P was off 1.2% today. The index is up about 60% from the bottom (and off 31% from the peak).

Two different views on CIT:

From Bloomberg: CIT Sees Recovery as Low as 6 Cents in Bankruptcy

CIT said in a regulatory filing today that if its reorganization plan fails, it “will likely face bankruptcy” and that those claims would fetch recoveries between 6 cents and 37 cents a dollar.And from MarketWatch: Icahn urges bondholders not to accept CIT plan

Icahn said if assets on the comapny's balance sheet are "run off" in a controlled way, CIT bonds will be worth at least 80 cents to 85 cents on the dollar.A few CRE stories:

Yesterday from the NY Times: Court Deals Blow to Owners of Apartment Complex

And more Tishman troubles, from Bloomberg: Tishman Speyer Office Park in L.A. Faces Foreclosure (ht Brian)

A Tishman Speyer Properties LP office park in California ... is the subject of a foreclosure lawsuit saying the owners failed to repay $154 million in debt due in July.If that LA Business Journal story is correct, the lenders were trying to sell the $150 million note for $50 million. Ouch.

Tishman Speyer and Walton Street Capital LLC bought the Campus at Playa Vista at the top of the U.S. real estate boom in 2007. KeyBank National Association sued to foreclose against limited partnerships controlling the Los Angeles property ... The Los Angeles Business Journal reported Oct. 19 that a mortgage on the property was up for sale for $50 million.

And from Bloomberg: NYC Tower Buyers Wrestle Towering Vacancy Dilemma (ht Mike In Long Island, others!)

... Worldwide Plaza [is 40% vacant]. It’s one ... George Comfort & Sons Inc., was able to buy the ... in July for $590 million, two years after it sold for almost three times as much.

The purchase price may allow Duncan to undercut the rents competitors charge as he leases his 709,000 square feet. Manhattan has 59 million feet of available offices, according to brokerage Colliers ABR, the most since June 1996, and rents for the best space are down more than 30 percent from their peak last year.

Existing Home Sales: More Activity, Little Achievement

by Calculated Risk on 10/23/2009 01:48:00 PM

Coach John Wooden

Normally a decline in inventory and the months-of-supply would be considered a positive for the existing home market, however much of the apparent recent improvement is related to an artificial - and likely short lived - boost in activity.

The following graph is a turnover ratio for existing home sales. This is annual sales and year end inventory divided by the total number of owner occupied units. For 2009, sales are estimated at 5.0 million units, and inventory at the September level.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Although the turnover ratio has fallen from the bubble years, the level is still above the median for the last 40 years. This suggests activity in 2009 is slightly above a normal year for existing homes.

The reason turnover hasn't fallen further is because of all the distressed sales (foreclosures and short sales) primarily in the low priced areas, and because of the "first-time" home buyer tax credit.

The distressed sales activity is a necessary step towards a healthy market, but the burst in activity associated with the "first-time" home buyer tax credit is "mistaking activity for achievement".

NAR chief economist Lawrence Yun argued this morning: "[W]e need a steady supply of qualified buyers to meaningfully bring inventories down ..."

Mr. Yun is making two obvious mistakes. First he is narrowly defining "inventories" as just inventories of existing homes. The total housing inventory includes existing homes, new homes, and rental properties.

If we think of a balloon that contains existing home inventory and vacant apartment units, the tax credit is like pushing a finger on the balloon - the indent makes the balloon look smaller, but the volume of the balloon remains the same (the decline in existing home inventory is offset by an increase in vacant apartments).

Note: there is some reduction in overall inventory as new households are formed, but not from incentivizing renters to become owners.

The higher rental vacancy rate is leading to lower rents, so the buy-or-rent decision will favor renting once Congress removes their finger from the balloon.

Yun also appears to be suggesting that the first-time home buyer tax credit is providing a "supply of qualified buyers". This is bubble type thinking. Did all the exotic loans during the housing bubble provide a "supply of qualified buyers"? Those buyers qualified for the loans, but they were not really ready for homeownership.

The same is true for buyers today obtaining FHA insured loans and using the $8,000 tax credit as their downpayment. Imagine a $200,000 purchase with no money down (except the tax credit). What happens in three or four years when the homeowner wants to sell? The transaction costs will be around $15,000 (about 7.5%) if they sell for the same price.

So a homeowner, who has been unable to save a down payment so far, will be expected to make a $15,000 down payment in arrears? I don't think so.

Oh wait. Haven't prices fallen significantly? Shouldn't prices just go up from here? Yun says we are returning "to a period of normal, steady price growth". So the homeowner can use their appreciation to pay the transaction costs? That is more bubble type thinking. Prices may go up. Prices may fall further. Loans should not be predicated on asset prices increasing.

“The next mistake will be a new way to make a loan that will not be repaid.”

William Seidman, "Full Faith and Credit", 1993.

Allowing buyers to use the first-time home buyer tax credit as a downpayment is "the next mistake".

Earlier post: Existing Home Sales Increase in September

Freddie Mac: Delinquency Rate Rises to 3.33 Percent

by Calculated Risk on 10/23/2009 11:59:00 AM

NOTE: I'll have some more thoughts on existing home sales soon. Click on graph for large image.

Click on graph for large image.

This graph shows the Freddie Mac single family delinquency rate since January 2005.

Here is the Freddie Mac portfolio data.

From Reuters: Freddie Mac Sept portfolio up, delinquencies jump (ht Ron at WallStreetPit)

Delinquencies ... jumped to 3.33 percent of its book of business in September from 3.13 percent in August and 1.22 percent in September 2008.

The multifamily delinquency rate accelerated slightly in September to 0.11 percent from 0.10 percent in August. A year earlier it was 0.01 percent..

Philly Fed State Coincident Indicators Show Widespread Weakness in September

by Calculated Risk on 10/23/2009 11:00:00 AM

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty one states are showing declining three month activity. The index increased in 7 states, and was unchanged in 2.

Here is the Philadelphia Fed state coincident index release for September.

In the past month, the indexes increased in nine states (Idaho, Indiana, Louisiana, Montana, North Dakota, Ohio, South Dakota, Tennessee, and Vermont), decreased in 39, and remained unchanged in two (North Carolina and Nebraska) for a one-month diffusion index of -60. Over the past three months, the indexes increased in seven states (Indiana, Montana, North Dakota, Ohio, South Dakota, Tennessee, and Vermont), decreased in 41, and remained unchanged in two (Nebraska and South Carolina) for a three-month diffusion index of -68.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

A large percentage of states still showed declining activity in September.

Existing Home Sales Increase in September

by Calculated Risk on 10/23/2009 10:00:00 AM

The NAR reports: Big Rebound in Existing-Home Sales Shows First-Time Buyer Momentum

Existing-home sales – including single-family, townhomes, condominiums and co-ops – jumped 9.4 percent to a seasonally adjusted annual rate of 5.57 million units in September from a level of 5.10 million in August, and are 9.2 percent higher than the 5.10 million-unit pace in September 2008.

...

Total housing inventory at the end of September fell 7.5 percent to 3.63 million existing homes available for sale, which represents an 7.8-month supply2 at the current sales pace, down from an 9.3-month supply in August.

Click on graph for larger image in new window.

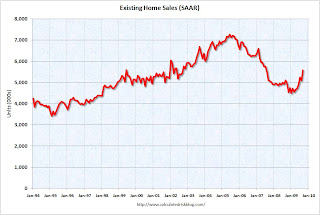

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Sept 2009 (5.57 million SAAR) were 9.4% higher than last month, and were 9.2% higher than Sept 2008 (5.1 million SAAR).

Here is another way to look at existing homes sales: Monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2009. For the fourth consecutive month, sales were higher in 2009 than in 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. For the fourth consecutive month, sales were higher in 2009 than in 2008. It's important to note that many of these transactions are either investors or first-time homebuyers. Also many of the sales are distressed sales (short sales or REOs).

Early information from a large annual consumer study to be released November 13, the 2009 National Association of Realtors® Profile of Home Buyers and Sellers, shows that first-time home buyers accounted for more than 45 percent of home sales during the past year. A separate practitioner survey shows that distressed homes accounted for 29 percent of transactions in September.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.63 million in September (August inventory was revised upwards significantly). The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.63 million in September (August inventory was revised upwards significantly). The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Typically inventory peaks in July or August, so some of this decline is seasonal.

The fourth graph shows the 'months of supply' metric for the last six years.

The fourth graph shows the 'months of supply' metric for the last six years.Months of supply was decline to 7.8 months.

Sales increased, and inventory decreased, so "months of supply" declined. A normal market has under 6 months of supply, so this is still high.

It is important to note that sales in September were distorted by the first time home buyer tax credit, and this activity will fade - whether or not the credit is extended.

U.K.: Recession Not Over

by Calculated Risk on 10/23/2009 08:30:00 AM

From Bloomberg: U.K. Economy Unexpectedly Shrinks in Longest Slump

GDP fell 0.4 percent from the previous three months, the Office for National Statistics said today in London. ... The economy has now shrunk over six quarters, the most since records began in 1955.

...

“The fact that the economy is still contracting despite the huge amount of policy stimulus supports our view that the recovery will be a long, slow process,” said Vicky Redwood, U.K. economist at Capital Economics Ltd in London and a former central bank official.

...

“This is desperately disappointing news, especially given that it was hoped that a modest recovery had begun,” said John Philpott, chief economist at the Chartered Institute of Personnel and Development. “The U.K. economy is continuing to shrink, with six quarters of contraction in output making this recession look more like a depression.”

This graph is from the Office for National Statistics: UK output decreases by 0.4 per cent

This graph is from the Office for National Statistics: UK output decreases by 0.4 per centThis is the sixth straight quarter of contraction.

Note that the U.K. reports GDP change per quarter, whereas the U.S. reports the annual rate of change. The 0.4% decline reported in the U.K. would be similar to a 1.6% decline reported in the U.S.

Thursday, October 22, 2009

Jim the Realtor: Not everything is Selling

by Calculated Risk on 10/22/2009 10:20:00 PM

Tomorrow: Existing Home Sales and bank failure #100 for 2009 (probably) ...

From Jim the Realtor: Nothing Price Won't Fix

CNBC's Olick: Could Home Valuation Code of Conduct Be History??

by Calculated Risk on 10/22/2009 07:02:00 PM

From Diana Olick at CNBC: Could HVCC Be History??

The House Financial Services Committee has just passed an amendment to the Consumer Financial Protection Agency Act to sunset the HVCC [Home Valuation Code of Conduct].I can understand fixing problems with the HVCC, but I can't understand going back to agents ordering appraisals. That was part of the systemic problem - some agents and appraisers abused the system.

...

Now before all you realtors and mortgage brokers get all excited, remember this is just a committee vote. ... The bill will be voted out of committee later today and then have to go to the House floor in some form and then of course there's the Senate, etc.

From David Streitfeld at the NY Times in August: In Appraisal Shift, Lenders Gain Power and Critics

Mike Kennedy, a real estate appraiser in Monroe, N.Y., was examining a suburban house a few years ago when he discovered five feet of water in the basement. The mortgage broker arranging the owner’s refinancing asked him to pretend it was not there.

Brokers, real estate agents and banks asked appraisers to do a lot of pretending during the housing boom, pumping up values while ignoring defects. While Mr. Kennedy says he never complied, many appraisers did, some of them thinking they had no choice if they wanted work. A profession that should have been a brake on the spiral in home prices instead became a big contributor.