by Calculated Risk on 11/11/2009 01:15:00 PM

Wednesday, November 11, 2009

Economic Outlook: Possible Upside Surprises, Downside Risks

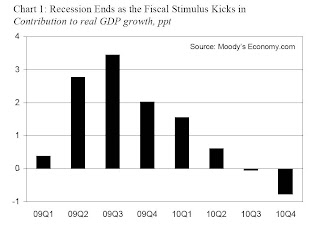

As I've noted several times, my general outlook is for GDP growth to be decent in Q4 (similar to Q3) and for sluggish and choppy GDP growth in 2010. I've been asked to list some possible upside surprises, and downside risks, to this forecast.

Possible Upside Surprises:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This suggests that all the growth in Q3 was due to the stimulus package, and the impact will now wane - only 2% in Q4, and 1.5% in Q1 2010 - and then the package will be a drag on the economy (impact on GDP growth will be negative) in the 2nd half of 2010.

With unemployment above 10%, there will be significant political pressure for another stimulus package - especially if the economy starts to slow in the first half of 2010. This next package could be several hundred billion (maybe $500 billion) and could increase GDP growth in 2010 above my forecast.

Possible Downside Risks:

I expect another wave of foreclosures in early 2010, and the impact of the housing tax credit to wane, and eventually lower house prices especially in higher priced bubble areas (although I think we've seen the bottom in many other areas). My expectation is prices will fall in real terms for several years. But if prices fall further than I expect that could have a serious impact on banks (more losses) and consumer confidence (less spending).

These are just some possible upside surprises and downside risks. I'm sure there are plenty more ...

FHA Temporarily Relaxes Condo Rules

by Calculated Risk on 11/11/2009 11:23:00 AM

Last week the FHA released a temporary guidance that relaxed some of the rules for condominiums. From the FHA: Temporary Guidance for Condominium Policy

The Miami Herald has the key points: FHA moves to boost condo market

• Increase from 30 percent to 50 percent the number of units in a project that can be financed with FHA loans. FHA, however, will make exceptions, even allowing up to 100 percent, when buildings meet an additional set of more stringent criteria.This temporary guidance is in effect from December 7, 2009 through December 31, 2010.

• Require at least 50 percent of units in a complex to be owner-occupied or sold to owners who plan to live in the units. Bank-owned units may be disqualified from the percentage calculation.

• Reduce a presale requirement in new construction to 30 percent, compared with 70 percent for loans from conventional lenders.

Orange County: Foreclosure Notices Hit Record High

by Calculated Risk on 11/11/2009 08:47:00 AM

Matt Padilla at the O.C. Register writes: Foreclosure notices hit record 8,800 Click on graph for larger image in new window.

Graph from O.C. Register.

ForeclosureRadar.com reports that outstanding foreclosure auction notices in Orange County rose to 8,895 at the end of September, the highest in this housing downturn and probably the highest ever.Padilla provides a second graph (see his article) of 90 day delinquencies, foreclosures and REOs. He writes:

September’s total was up 5% from August and 90% from a year ago.

[The second] chart shows that the ratio of borrowers having missed at least three monthly payments is at nearly 7% and has risen every month for more than three years.Loans in the trial modification period are still considered delinquent, so that might explain some of the increase in 90+ day delinquencies. But that doesn't explain the continuing surge in foreclosure notices.

It’s incredible that while so many mortgages are delinquent, banks are only holding 0.26% of first mortgages as REOs.

Tuesday, November 10, 2009

California Controller: Overview of the Commercial Property Markets

by Calculated Risk on 11/10/2009 10:23:00 PM

Buried in the California Controller's November analysis is a guest article: Overview of the Commercial Property and Capital Markets with Implications for the State of California by Dr. Randall Zisler. (ht picosec)

Here are some excerpts:

Whereas excessive and imprudent leverage fed the bubble, deleveraging not only popped the bubble, but, in the process, destroyed record amounts of equity and debt. Most deals financed with high leverage from 2005 to the present are under water. The equity is gone and the debt, if it trades at all, trades at a deep discount to face value. Most leveraged equity invested in real estate has evaporated since property prices, if marked to market, have fallen 30% to 50%.

Click on graph for larger image in new window.

Click on graph for larger image in new window. The chart [right] shows overall U.S. property total returns, quarterly (at annual rates) and lagging four quarters. This appraisal-based, lagging index shows sharp negative returns exceeding the deterioration of the RTC (Resolution Trust Corp.)The author points out that many local and regional banks will fail because of CRE loans.

period of the early 1990s. (See Chart 1.) Second quarter 2009 returns indicate the possibility that total returns, while still negative, may have hit a point of inflection. We expect that property values in many sectors, especially office, retail, and industrial, will likely deteriorate further in 2010 with improvement beginning sometime in 2011.

...

A crisis of unprecedented proportions is approaching. Of the $3 trillion of outstanding mortgage debt, $1.4 trillion is scheduled to mature in four years. We estimate another $500 billion to $750 billion of unscheduled maturities (i.e., defaults). Unfortunately, traditional lenders of consequence are practically out of the market and massive amounts of maturing debt will not easily find refinancing. Marking-to-market outstanding debt will render many banks, especially regional and community banks, insolvent, especially as much of the debt is likely worth about 50% of par, or less.

The inability of many banks and other capital sources to lend not just to real estate firms but to other businesses in the State as well presents a real challenge to the private sector and state and local governments.

FDIC Chairwoman Sheila Bair said today: "We do obviously have a lot more banks that will close this year and next," Bair said, adding the failures "will peak next year and then subside."

These bad loans are also limiting lending to small businesses. Atlanta Fed President Dennis Lockhart made the same argument this morning:

I am concerned about the potential impact of CRE on the broader economy ... there could be an impact resulting from small banks' impaired ability to support the small business sector—a sector I expect will be critically important to job creation.

...

Many small businesses rely on these smaller banks for credit. Small banks account for almost half of all small business loans (loans under $1 million). Moreover, small firms' reliance on banks with heavy CRE exposure is substantial. Banks with the highest CRE exposure (CRE loan books that are more than three times their tier 1 capital) account for almost 40 percent of all small business loans.

Fed's Fisher: Suboptimal Growth in 2010, "Perhaps" 2011

by Calculated Risk on 11/10/2009 07:39:00 PM

"[L]ooking into 2010 and perhaps to 2011, the most likely outcome is for growth to be suboptimal, unemployment to remain a vexing problem and inflation to remain subdued."And a little more Fed Speak ... (note: Fisher's speeches are always colorful).

Dallas Fed President Richard Fisher

From Dallas Fed President Richard Fisher: The Current State of the Economy and a Look to the Future

Now, I’ve often thought that economic forecasters seem to be cursed—or maybe blessed, I suppose, dependent upon your point-of-view—with a short-term memory: They tend to extrapolate only the most recent trends into the future. As if goosed by the more optimistic tone of the latest GDP release, many now believe that solid output growth will extend into the first half of next year. The latest Blue Chip survey, for example, shows that professional forecasters expect GDP growth averaging 2.8 percent in the first half of 2010.And Fisher is usually one of the more optimistic Fed presidents.

I am wary of the consensus view. For a good while now, I’ve suggested that we are more likely to see a more uneven recovery—not a “V”-shaped recovery but something more akin to a check mark, where the elongated arm of that check mark inclines at a slope that is less than desirable and might possibly be repressed by an occasional pause or several quarters of weak growth.

Why a check mark?

Several recent sources of strength are likely to wane as we head into next year. Cash-for-clunkers and the first-time-homebuyer tax credit have both shifted demand forward, increasing sales today at the expense of sales tomorrow. Neither of these programs can be repeated with any real hope of achieving anywhere near the same effect: The more demand you steal from the future, the less future demand there is for you to steal. The general tax cuts and government spending increases included in this year’s fiscal stimulus package won’t have their peak impact on the level of GDP until sometime in 2010, but their peak impact on the growth of GDP has come and gone; the fiscal stimulus continues to drive GDP upward, compared with what it would otherwise have been, but the increments to GDP are beginning to shrink. And, as we all know, the shot in the arm that our economy is receiving from inventory adjustments is, while welcome, inherently transitory.

What about growth in the longer term—the second half of 2010 and beyond? American households have finally come to realize that they’ve been playing the part of the grasshopper in Aesop’s fable: They see that our previous spending boom was financed by somewhat reckless disregard for tomorrow by over-eager creditors feeding their desire for unsustainable leveraging of their income and balance sheets and, for the nation as a whole, by increases in overseas borrowing. That reality has been largely absorbed, and consumer spending is growing again—albeit from a lower base and at a slower pace. I doubt it will recover its previous vigor for some time to come. I expect that the strong bounce-back in consumer demand that we’ve come to expect in recoveries past will be absent this time around as Americans recalibrate the proportion of their income and wealth that they need to save versus what they need to consume. We need not become a nation as parsimonious as William Miles, but we are going to have to be more ant- than grasshopper-like in our behavior.[4]

...

It may be some time before significant job growth occurs and even longer before we see meaningful declines in the unemployment rate.

emphasis added

Loan Modifications: Key Numbers not Released

by Calculated Risk on 11/10/2009 03:17:00 PM

From Reuters: Treasury says 650,000 in trial home loan workouts

[The Treasury Department] said there were 650,994 active trial modifications through October under President Barack Obama's plan to help the housing market. That was up from 487,081 ... participating through September.The key number - permanent modifications - was not released. As of Sept 1st, the Obama plan had produced only 1,711 permanent loan modifications.

The Treasury did not release figures for trial modifications that have been made permanent.

Why doesn't Treasury release the number of trial modifications started, the redefault rates for trial modifications (by month started) and the number of permanent modifications?

Diani Olick at CNBC has more: Shadow Inventory Dwarfs Loan Mods

[W]e have no idea how successful those mods are now five months after the program really got cooking.The size of the next wave of foreclosures depends on the success of the modification programs. And right now Treasury is leaving us in the dark ...

It's coming, that's what the folks at Treasury say.

They also say that a lot of borrowers got extensions on the trial period in order to get paperwork together to move on to permanent modifications. Insiders however tell me that a lot of that paperwork has to do with those so-called "stated-income" loans, where you just had to tell the lender what you make for a living, not actually prove it. In order to move to a permanent mod, you have to prove it, so now we get to find out how many of those "liar loans" were just that.

emphasis added

Counterparty Risk: The Mortgage Insurers

by Calculated Risk on 11/10/2009 01:35:00 PM

From the Ambac 10-Q:

While management believes that Ambac will have sufficient liquidity to satisfy its needs through the second quarter of 2011, no guarantee can be given that it will be able to pay all of its operating expenses and debt service obligations thereafter, including maturing principal in the amount of $143,000 in August 2011. In addition, it is possible its liquidity may run out prior to the second quarter of 2011. Ambac is developing strategies to address its liquidity needs; such strategies may include a negotiated restructuring of its debt through a prepackaged bankruptcy proceeding. No assurances can be given that Ambac will be successful in executing any or all of its strategies. If Ambac is unable to execute these strategies, it will consider seeking bankruptcy protection without agreement concerning a plan of reorganization with major creditor groups.Apparently the Wisconsin Commissioner of Insurance will rule on Ambac’s statutory capital by November 16th. (ht JA)

emphasis added

And from Freddie Mac's 10-Q:

We have institutional credit risk relating to the potential insolvency or non-performance of mortgage insurers that insure single-family mortgages we purchase or guarantee. As a guarantor, we remain responsible for the payment of principal and interest if a mortgage insurer fails to meet its obligations to reimburse us for claims. If any of our mortgage insurers that provides credit enhancement fails to fulfill its obligation, we could experience increased credit-related costs and a possible reduction in the fair values associated with our PCs or Structured Securities.More from MarketWatch: MBIA loses $728 million as slowdown hits bond insurer

...

Based upon currently available information, we expect that all of our mortgage insurance counterparties will continue to pay all claims as due in the normal course for the near term except for claims obligations of Triad that are partially deferred after June 1, 2009, under order of Triad’s state regulator. We believe that several of our mortgage insurance counterparties are at risk of falling out of compliance with regulatory capital requirements, which may result in regulatory actions that could threaten our ability to receive future claims payments, and negatively impact our access to mortgage insurance for high LTV loans. Further, one or more of these mortgage insurers, over the remainder of 2009 or in the first half of 2010, could lack sufficient capital to pay claims and face suspension under Freddie Mac’s eligibility requirements for mortgage insurers.

The zombie watch continues ...

Fed's Yellen on the Economic Outlook

by Calculated Risk on 11/10/2009 10:53:00 AM

Lately I’ve been leaning against the view of a “V shaped” recovery. I think that growth will be decent in the second half of 2009, but growth will be sluggish in 2010.

San Francisco Fed President Dr. Yellen has a similar view – from her speech this morning: The Outlook for the Economy and Real Estate

The big issue is how strong the upturn will be. With such enormous reservoirs of slack in the form of high unemployment and idle productive capacity, we need a strong rebound to put unemployed people back to work and get underutilized factories, offices, and stores humming again. Unfortunately, my own forecast envisions a less-than-robust recovery for several reasons. As the impetus from government programs and inventories diminishes in the quarters ahead, private final demand will have to fill the breach. The danger is that demand may grow at too anemic a pace to support vigorous expansion.

First, it may take quite a while for financial institutions to heal to the point that normal credit flows are restored. The credit crunch hasn’t entirely gone away. In the face of massive loan losses, banks have clamped down on underwriting and credit terms for both businesses and consumers. Smaller businesses without direct access to capital markets are particularly feeling the pinch. Lenders have had to run hard just to stay in place: Rising unemployment, business failures, and delinquencies in real estate markets have fed additional credit losses and made it more difficult for financial institutions to get their balance sheets in good order.

Second, households have been pummeled and prospects for consumer spending are cloudy. Consumers have surprised us in the past with their free-spending ways and it’s not out of the question that they will do so again. But I wouldn’t count on them leading a strong recovery. They face high and rising unemployment, stagnant wages, and heavy debt burdens. Their nest eggs have shrunk dramatically as house and stock prices have fallen, and their access to credit has been squeezed.

It may be that we are witnessing the start of a new era for consumers following the harsh financial blows they have endured. ...

Weakness in the labor market is another factor that may keep the recovery sluggish for quite some time. Payroll employment has been plummeting for more than a year and a half, and, even though the pace of the decline has slowed, unemployment now stands at its highest level since 1983. In addition, many workers have seen their hours cut or are experiencing involuntary furloughs. ... my business contacts say they will be reluctant to hire again until they see clear evidence of a sustained recovery. High unemployment, weak job growth, and paltry wage increases are a recipe for sluggish consumer spending growth and a tepid recovery.

... the outlook for housing has turned up in response to favorable mortgage rates, lower house prices, and a lower overhang of unsold houses. And growth in this sector should contribute to the overall economic recovery. These developments represent real gains, but it’s important not to get carried away. Some of the advance reflects temporary government support in the form of tax credits for first-time home buyers, and the impact of loan modification programs and foreclosure moratoriums that reduced the pace of distressed sales. Moreover, foreclosure notices surged earlier this year and distressed property sales may rise once again in the months ahead. If so, we could see renewed pressure on house prices. Of course, continuing high unemployment will also fuel additional foreclosures. And the supply of credit for nonconforming mortgages remains extremely tight. Financial institutions are reluctant to place them on their books when they are trying to reduce leverage and we have yet to see any revival of the market for private mortgage-backed securities.

When we turn to commercial real estate, the prospects are worrisome. ...

When the weakness of the commercial property market is combined with the muted outlook for housing and consumer spending, you can see why I believe that the overall economic recovery is likely to be gradual and remain vulnerable to shocks. It’s popular to pick a letter of the alphabet to describe the likely course of the economy. The letter I would choose doesn’t exist in our alphabet, but if I were to describe it, it would look something like an “L” with a gradual upward tilt of the base. With such a slow rebound, unemployment could well stay high for several years to come. In other words, our recovery is likely to feel like something well short of good times.

emphasis added

Fed's Lockhart on CRE and Small Business

by Calculated Risk on 11/10/2009 09:23:00 AM

From Atlanta Fed President Dennis Lockhart: Economic Recovery, Small Business, and the Challenge of Commercial Real Estate

[H]ow serious is the CRE problem for the financial system and the broad economy?As Lockhart noted earlier in the speech, small business employment has been especially hard hit during the current employment recession. (Note: this is probably one of the key reasons that the BLS birth/death model has overestimated new job creation).

First, let me provide some overview comments: While the CRE problem is serious for parts of the banking industry, I don't believe it poses a broad risk to the financial system. Compared with residential real estate, the size of the CRE debt market is smaller, and the exposure is more concentrated in smaller banks.

However, I am concerned about the potential impact of CRE on the broader economy. Unlike residential real estate, there is not the same direct linkage from CRE to household wealth—and therefore consumption—caused by erosion of home equity. However, there could be an impact resulting from small banks' impaired ability to support the small business sector—a sector I expect will be critically important to job creation.

To add some detail: At the end of June 2009 there was approximately $3.5 trillion of outstanding debt associated with CRE. This figure compares with about $11 trillion of residential debt outstanding.

About 40 percent of the CRE debt is held on commercial bank balance sheets in the form of whole loans. A lot of the CRE exposure is concentrated at smaller institutions (banks with total assets under $10 billion). These smaller banks account for only 20 percent of total commercial banking assets in the United States but carry almost half of total CRE loans (based on Bank Call Report data).

Many small businesses rely on these smaller banks for credit. Small banks account for almost half of all small business loans (loans under $1 million). Moreover, small firms' reliance on banks with heavy CRE exposure is substantial. Banks with the highest CRE exposure (CRE loan books that are more than three times their tier 1 capital) account for almost 40 percent of all small business loans.

To repeat my current assessment, while the CRE problem is very worrisome for parts of the banking industry, I don't see it posing a broad risk to the financial system. Nonetheless, CRE could be a factor that suppresses the pace of recovery. As the recovery develops, the CRE problem will be a headwind, but not a show stopper, in my view.

It's appropriate to be a bit tentative in the assessment of CRE risk to the financial system, however. In 2007, many underestimated the scale and contagion potential of the subprime residential mortgage-backed securities problem. With this experience in mind, my assessment should continue to be refined.

Many of the banks in trouble because of CRE lending are also key lenders to small businesses. Therefore this might limit small business financing, and further inhibit small business job creation.

Tough Times for the Travel Industry

by Calculated Risk on 11/10/2009 08:43:00 AM

According to an article in the LA Times, it appears the 2009 holiday season will be worse than 2008 for the travel industry: Airlines, hotels face bleak holidays

According to the Auto Club, 46% of those surveyed said they planned to spend the same amount on holiday travel as they did last year, while 36% planned to spend less. Only 18% planned to spend more.The article also mentions a forecast for air travel: ATA Expects 4 Percent Decline in Air Travel Over 12-Day Thanksgiving Holiday Period

The Air Transport Association of America (ATA), the industry trade association for the leading U.S. airlines, today said that it expects a 4 percent year-over-year decrease in the number of passengers traveling on U.S. airlines during the 2009 Thanksgiving holiday season, despite deep discounting over the past several months.And of course this will be a very difficult holiday season for hotels.

“It is increasingly apparent that the economic head winds facing the airlines and their customers are anything but behind us. ...” said ATA President and CEO James C. May.

... Carriers have cut back their schedules in response to economic pressures, with 2009 capacity reductions the deepest since 1942. In addition, recently released government data show that average domestic airfares in the second quarter of 2009 fell to their lowest level since 1998, dropping 13 percent from the second quarter of 2008 – the largest year-to-year decline on record.

emphasis added

Employment and the Seasonal Adjustment

by Calculated Risk on 11/10/2009 12:19:00 AM

Floyd Norris at the NY Times asks: Did Unemployment Really Rise?

The economic reactions over the weekend to Friday’s employment report all started from the assumption that things grew much worse in October. The unemployment rate leaped to 10.2 percent from 9.8 percent. Another 190,000 jobs vanished.I'm not sure where the 80,000 number came from - the not seasonally adjusted (NSA) payroll employment increased by 641,000 in October - but the BLS did report a 9.5% NSA unemployment rate.

Actually, none of that happened.

In reality, the government report says unemployment rates remained steady at 9.5 percent. And the number of jobs actually rose, by 80,000. ...

The adjustments are for seasonality. ... All this may be very reasonable, and there is no way I can think of to test whether the seasonal adjustments are reliable. But I suspect seasonal factors are less important this year, when the economy may be changing directions, than they normally are.

However there is a strong and consistent seasonal pattern for employment, and I think the seasonal adjusted numbers are the ones to use. I wrote about this earlier this year (excerpt with an updated graph):

What if I wrote that U.S. payroll employment increased by 383 thousand jobs in May 2009 following an increase of 259 thousand jobs in April 2009?There may be problems with the BLS numbers - as an example the birth/death model has consistently overestimated new job creation during the current employment recession, possibly because small businesses have been impacted more than larger companies. But the model used by the BLS for seasonal adjustments is very good, and the SA number is still the one to use.

Some readers would suspect CR had been captured by aliens or had visited crazytown.

But, in fact, those numbers are exactly what the BLS reported as the actual change in payroll employment in April and May. The economy added 643 thousand jobs over those two months. However no one reports those numbers because there is a strong seasonal pattern to employment.

Even in the best of years, 2.5 to 3.0 million people lose their jobs in January. It happens every year for a number of reasons such as retail cutting back on holiday hires. And just about every July the economy loses over 1 million jobs for seasonal reasons too.

The following graph shows this seasonal pattern:Click on graph for larger image in new window.

The blue line is the seasonally adjusted (SA) change in net jobs as reported by the BLS, and the red columns are the actual not seasonally adjusted (NSA) data.

No one reports the NSA data because the swings are so wild and the pattern very consistent. Unless you follow the data closely, the NSA numbers are meaningless.

Monday, November 09, 2009

Mishkin: Not all bubbles the same

by Calculated Risk on 11/09/2009 09:24:00 PM

Former Fed Governor Frederic Mishkin writes in the Financial Times: Not all bubbles present a risk to the economy

There is increasing concern that we may be experiencing another round of asset-price bubbles that could pose great danger to the economy. Does this danger provide a case for the US Federal Reserve to exit from its zero-interest-rate policy sooner rather than later, as many commentators have suggested? The answer is no.Mishkin outlines two different types of bubbles, and argues a "credit boom bubble" poses a risk to the economy, but a "pure irrational exuberance bubble" does not.

excerpted with permission

For more excerpts, see EconomistView: "Not All Bubbles Present a Risk to the Economy"

NY Governor: "Unprecedented financial challenge"

by Calculated Risk on 11/09/2009 06:10:00 PM

From the NY Times: Paterson Paints Grim Picture of N.Y. Budget Crisis

"We stand on the brink of a financial challenge of unprecedented magnitude in the history of this state,” Mr. Paterson told lawmakers as he warned that New York was rapidly running out of cash ...The Rockefeller Institure recently released a report showing most states have seen a precipitous decline in revenues.

While the state faces a deficit of more than $3 billion for the remaining four and a half months of this fiscal year, the greater worry among state officials are the unprecedented deficits the state faces in 2011 and 2012, after federal stimulus financing and a temporary tax increase on the wealthy expire.

“We’re going to fall off a cliff unless we get our revenues and our expenditures in true sync,” said Lt. Gov. Richard Ravitch ...

Total state tax collections as well as collections from two major sources — sales tax and personal income — all declined for the third consecutive quarter. Overall state tax collections in the April-June quarter of 2009, as reported by the Census Bureau, declined by 16.6 percent from the same quarter of the previous year. We have compiled historical data from the Census Bureau Web site going back to 1962. Both nominal and inflation adjusted figures indicate that the second quarter of 2009 marked the largest decline in state tax collections at least since 1963. The same is true for combined state and local tax collections, which declined by 12.2 percent in nominal terms.

emphasis added

Distressed Sales: Sacramento as Example

by Calculated Risk on 11/09/2009 03:19:00 PM

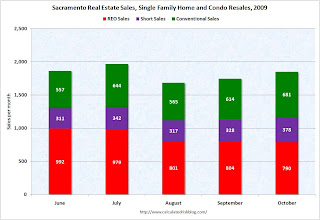

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

UPDATE: percentages corrected.

Here is the October data.

They started breaking out REO sales last year, but this is only the fifth monthly report with short sales. About 63.2 percent of all resales (single family homes and condos) were distressed sales in October. The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

Total sales in October were off 17.5% compared to October 2008; the fifth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.6%) or FHA loans (28.9%), suggesting most of the activity in distressed former bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credit), and investors paying cash.

This is a local market still in distress.

Fed: Lending Standards Tighten, Loan Demand Weakens

by Calculated Risk on 11/09/2009 02:00:00 PM

From the Fed: The October 2009 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the October survey, domestic banks indicated that they continued to tighten standards and terms over the past three months on all major types of loans to businesses and households. However, the net percentages of banks that tightened standards and terms for most loan categories continued to decline from the peaks reached late last year. The exceptions were prime residential mortgages and revolving home equity lines of credit, for which there were only small changes in the net fractions of banks that had tightened standards. A small net fraction of branches and agencies of foreign banks eased standards on C&I loans, whereas a significant net fraction continued to tighten standards on CRE loans. Demand for most major categories of loans at domestic banks reportedly continued to weaken, on balance, over the past three months.The banks are still tightening lending standards and demand continues to weaken.

emphasis added

And a special question on maturing CRE loans:

The October survey included a special question on the status of CRE loans on banks' books that, at the beginning of 2009, were scheduled to mature by September of this year. Among the domestic respondents that reported having such loans, about 75 percent indicated that they had extended more than one-fourth of maturing construction and land development loans, and 70 percent reported extending more than one-fourth of maturing loans secured by nonfarm nonresidential real estate. In contrast, only 15 to 20 percent of domestic banks reported that they had refinanced more than one-fourth of each of the two types of maturing CRE loans.Extend and ... hope.

The 2009 Jobless Recovery

by Calculated Risk on 11/09/2009 11:11:00 AM

The following graph shows the maximum number of net jobs lost after the end of several official recessions (both in numbers and as a percent of peak employment prior to the start of the recession).

Note: The last two columns assume the 2007 recession officially ended in June 2009 or in July 2009. Recessions are labled by starting year. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Even if the economy started adding jobs in November (very unlikely), the 2009 recovery would already be one of weakest for job creation.

The recovery following the 2001 recession was the worst for job creation, with the bottom for employment happening in August 2003, twenty one months after the official end of the recession. This graph shows the job losses from the start of the employment recession, in percentage terms.

This graph shows the job losses from the start of the employment recession, in percentage terms.

Look at the brown line for the 2001 recession. According to NBER, the 2001 recession lasted 8 months, but the job losses continued for another 21 months (the brown line bottoms in month 29) - and employment didn't reach the pre-recession level for 46 months.

In terms of jobs lost, the 2009 "recovery" might be even worse than the 2001 recovery.

Maybe we should call this a "job loss" recovery?

Fed's Bullard: Inflation Outlook Uncertain

by Calculated Risk on 11/09/2009 08:39:00 AM

St. Louis Fed President James Bullard told the Financial Times that uncertainty about the inflation outlook is the most since 1980.

From the Financial Times: Uncertainty ‘high’ over inflation outlook

“For 2009, in particular, and maybe a little bit into 2010, you have to worry about getting out of the recession, establishing your recovery, making sure the recovery has really taken hold. And then, at the appropriate time, when things are all going forward, you have to switch gears and watch whether the inflation rate is coming up.” [Bullard said]Bullard noted that the first step would not be raising the Fed Funds rate, and unwinding some of the unconventional policy. Bullard also added the Fed is concerned about asset bubbles this time:

excerpted with permission

What is different this time is that the argument about staying too low for too long is going to weigh pretty heavily on the committee. It is more than just: ‘What does the output gap look like; what does inflation look like?’ ”My comment: historically the Fed does not raise rates until well after the unemployment rate peaks. And the Fed plans on buying MBS through the first quarter of 2010 - so Bullard's comment about starting to switch gears "a little bit into 2010" is probably way too early.

He said it was also the issue of whether “you are generating the conditions that might foster a bubble that really might come back to hurt you later? I think this will be a big issue for the committee.”

Sunday, November 08, 2009

WalMart: Quote of the Night

by Calculated Risk on 11/08/2009 11:58:00 PM

A quote from a conference this weekend, from the NY Times:

"There are families not eating at the end of the month,” said Stephen Quinn, executive vice president and chief marketing officer at Wal-Mart Stores, and “literally lining up at midnight” at Wal-Mart stores waiting to buy food when paychecks or government checks land in their accounts.

Default Notices: Movin' on Up!

by Calculated Risk on 11/08/2009 08:28:00 PM

Here is some more on a theme we've been discussing ...

From Carolyn Said at the San Francisco Chronicle: Default notices rising in upper echelon ZIPs (ht Hymn)

In upscale communities such as Los Altos, Greenbrae and Alamo, where median prices top $1 million, about twice as many households received default notices from January to September as in the same period in 2008, according to recorders' office data compiled by MDA DataQuick, a San Diego real estate research firm.There is much more in the article. The mid-to-high end will never see the levels of foreclosure activity as some of the low end areas - and the process will take longer because many of these homeowners have other financial resources. But I do expect further price declines in many mid-to-high end areas as distress sales increase.

The same is true for mid-scale areas with median prices around $500,000, such as Walnut Creek, Los Gatos and Campbell.

"The question is, could this be the beginning of something that gets a whole lot worse?" said Andrew LePage, an analyst with DataQuick. "The distress in the high end right now is important to watch; it helps explain why we have more sales (of high-end homes). More distress means more-motivated and more-realistic sellers. We're just starting to find out whether the riskier loans that were not subprime will come back to haunt us."

Summary and a Look Ahead

by Calculated Risk on 11/08/2009 03:58:00 PM

On Monday, the Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices for October will probably be released. This survey was available for the FOMC meeting last week, and tight lending standards and weak loan demand is probably one of the reasons the FOMC expects economic activity "to remain weak for a time".

This will also be a busy week for Fed Speak. We might get somewhat different economic outlooks on Tuesday from San Francisco Fed President Dr. Janet Yellen in the morning and Dallas Fed President Richard Fisher in the evening.

Dr. Yellen will be the keynote speaker at the Lambda Alpha International Fall Real Estate Seminar in Phoenix. She is expected to discuss the economic outlook with an emphasis on real estate. In the evening, Richard Fisher will speak at the Headliners Club of Austin, Texas.

Last week on the economy:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 10.46 million SAAR from AutoData Corp). This was the first month over a 10 million sales rate (SAAR) - excluding the cash-for-clunkers months of July and August - since December 2008.

This graph shows the non-business bankruptcy filings by quarter.

This graph shows the non-business bankruptcy filings by quarter.The quarterly rate is at about the same level as prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

And on the employment report:

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).The current employment recession has seen the worst job losses since WWII, and is the 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Here is a graph of seasonal retail hiring.

Here is a graph of seasonal retail hiring.Retailers only hired 63.5 thousand workers (NSA) net in October.

This is essentially the same as in 2008 (59.1 thousand NSA), and suggests retailers are being very cautious with their seasonal hiring.

And there were five more bank failures on Friday taking the total to 120 in 2009:

And a couple other stories of interest:

Best wishes to all.