by Calculated Risk on 11/13/2009 09:30:00 PM

Friday, November 13, 2009

Unofficial Problem Bank List increases to 507

Note: This was before the three FDIC bank seizures today.

This is an unofficial list of Problem Banks.

Changes and comments from surferdude808:

The Unofficial Problem Bank List changed by a net two institutions this week to 507.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Seven institutions with assets of $1.6 billion were added to the list. The largest addition is First Federal Bank of North Florida, Palatka, FL ($444 million). The OCC did not release its actions for October today so we will look for those additions next week.

Assets on the list fell substantially from $330 billion to $304 billion as $13.2 billion of the decline came from the three failures last week -- United Commercial Bank ($12.8 billion), Prosperan Bank ($197 million), and Home Federal Savings Bank ($14 million) – and 2 banks that underwent unassisted mergers during July -- Discovery Bank ($151 million), and Southern Bank of Commerce ($30 million).

The list has been updated to include asset figures for the third quarter of 2009, which accounted for $14.5 billion of the decline in assets from last week. The largest decline in assets during the quarter occurred at AmTrust Bank (down $1.7 billion) and Woodlands Commercial Bank (down $1 billion). The average decline in assets during the quarter was $29 million but the median decline was only $4.5 million.

Positively, 368 institutions reduced their asset size during the quarter.

The only other changes to the list are the issuance of Prompt Corrective Action orders against three institutions that are already under a formal enforcement action. These PCA order were issued against Evergreen Bank, New South Federal Savings Bank, and Orion Bank (CR Note: Orion failed today!).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #123 in 2009: Pacific Coast National Bank, San Clemente, CA

by Calculated Risk on 11/13/2009 08:08:00 PM

Sun sets on Pacific Coast

A bank, drowned by debt

by Soylent Green is People

From the FDIC: Sunwest Bank, Tustin, California, Assumes All of the Deposits of Pacific Coast National Bank, San Clemente, California

Pacific Coast National Bank, San Clemente, California, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes three today ...

As of August 31, 2009, Pacific Coast National Bank had total assets of $134.4 million and total deposits of approximately $130.9 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $27.4 million. ... Pacific Coast National Bank is the 123rd FDIC-insured institution to fail in the nation this year, and the fifteenth in California. The last FDIC-insured institution closed in the state was United Commercial Bank, San Francisco, on November 6, 2009.

Bank Failures #121 & 122: Two more in Florida

by Calculated Risk on 11/13/2009 06:08:00 PM

Waiting for critical mass

Century flames out

What is that white light?

Orion Supernovas

Hot money burns bright

by Soylent Green is People

From the FDIC: IBERIABANK, Lafayette, Louisiana, Assumes All of the Deposits of Century Bank, Federal Savings Bank, Sarasota, Florida

Century Bank, Federal Savings Bank, Sarasota, Florida, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: IBERIABANK, Lafayette, Louisiana, Assumes All of the Deposits of Orion Bank, Naples, Florida

As of October 31, 2009, Century Bank, FSB had total assets of $728 million and total deposits of approximately $631 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $344 million. ... Century Bank, FSB is the 121st FDIC-insured institution to fail in the nation this year, and the tenth in Florida. The last FDIC-insured institution closed in the state was Flagship National Bank, Bradenton, on November 6, 2009.

Orion Bank, Naples, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of October 31, 2009, Orion Bank had total assets of $2.7 billion and total deposits of approximately $2.1 billion. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $615 million. ... Orion Bank is the 122nd FDIC-insured institution to fail in the nation this year, and the eleventh in Florida. The last FDIC-insured institution closed in the state was Century Bank, Sarasota, FL, earlier today.

State Budget Quote of the Day, and more Bank Failure Preview

by Calculated Risk on 11/13/2009 05:07:00 PM

From the WSJ: State Finance Directors Warn of More Trouble Ahead

"I looked as hard as I could at how states could declare bankruptcy," said Michael Genest, director of the California Department of Finance who is stepping down at the end of the year. "I literally looked at the federal constitution to see if there was a way for states to return to territory status."And on banks:

From the Chicago Tribune: Amcore says regulators reject plan to raise capital (ht Doug)

Last month, Amcore ... disclosed it was "undercapitalized or significantly undercapitalized under some regulatory capital standards."Amcore has $4.9 billion in assets.

On Nov. 6, the Federal Reserve Bank of Chicago also notified Amcore that it found its capital plan unacceptable.

Amcore said it's continuing to work with its financial and professional advisors in seeking outside capital, and in complying with the regulators' orders, but "there can be no assurance that these actions will be successful."

It also conceded that it could get seized by regulators.

"Failure to submit an acceptable capital restoration plan or disposition plan or to restore capital levels may result in additional enforcement actions by the regulators, including the appointment of a receiver," it said.

And there is plenty of noise down in Florida tonight, from the Florida Business Journal BankUnited CEO: Big deal is coming

BankUnited CEO John Kanas told members of the Greater Miami Chamber of Commerce during a luncheon Tuesday that they should expect a big deal by his bank in the next week.And also: Texas billionaire Beal seeks failed Florida bank (ht Stephen)

Federal regulators have granted Texas billionaire and financial executive Andrew Beal approval to form a bank that could acquire a failed or failing Florida bank.

...

All of these players have plenty of problem banks from which to choose. On June 30, there were 15 undercapitalized banks in Florida, including Fort Pierce-based Riverside National Bank, Naples-based Orion Bank, Panama City-based Peoples First Community Bank, Immokalee-based Florida Community Bank and Sarasota-based Century Bank.

Bank Failure Preview

by Calculated Risk on 11/13/2009 03:32:00 PM

A couple of banks in trouble ...

From Reuters: US credit card issuer Advanta files for bankruptcy (ht jb)

The company also said its Advanta Bank's capital is below regulatory requirements and that the bank could turned over to a Federal Deposit Insurance Corp receivership.Advanta bank has just under $3 billion in assets.

Advanta said it decided not to fund the bank's capital shortfall to preserve value for other stakeholders.

emphasis added

And from SignonSanDiego: Imperial Capital hits deadline to raise capital

The regulator-imposed deadline has passed for La Jolla's Imperial Capital Bank to raise additional capital, putting into question the future of the long-struggling institution.Inperial has about $4.2 billion in assets, and has also received a Prompt Corrective Action from the FDIC:

...

Federal regulators first placed Imperial Capital under a cease-and-desist order in February. As part of that, the bank was required to submit a plan to raise additional capital.

The bank submitted its plan in August, but regulators rejected it and set yesterday as a deadline for the bank to sell stock to raise money or find a buyer.

On October 15, 2009, Imperial Capital Bank (the "Bank"), a wholly owned subsidiary of Imperial Capital Bancorp, Inc. (the "Company"), received a Supervisory Prompt Corrective Action Directive (the "Directive") from the Federal Deposit Insurance Corporation (the "FDIC").A Prompt Corrective Action Directive is basically a "Hail Mary pass" and frequently means failure is imminent (though not always).

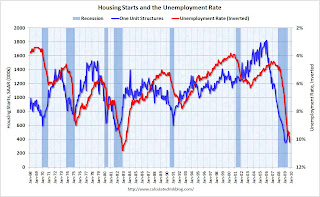

Housing Starts and the Unemployment Rate

by Calculated Risk on 11/13/2009 12:54:00 PM

This is an update to an earlier post. As I've noted for some time, housing leads the economy and is the best leading indicator for the economy - both into and out of recessions.

Update: Employment tends to be a coincident indicator into recessions, and used to be coincident coming out of recessions. Employment has lagged the economy after the previous two recessions (and appears to be lagging again).

Employment lags housing, and the following graph shows the relationship between starts and unemployment.

The graph is based on a talk by Jon Fisher, a professor at the University of San Francisco School of Business.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows housing starts (both total and single unit) and unemployment (inverted).

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Spring 2010.

Professor Fisher argued that unemployment will rise to about 10.4% and then fall rapidly. He is now projecting unemployment will decline to 8% by the end of 2010.

He is basing the rapid decline in unemployment on a "V shaped" housing recovery similar to previous recessions. I disagree with that point.

In most earlier recessions, the slumps were caused by the Fed raising interest rates to fight inflation. When the Fed cut rates, housing bounced back sharply (V shaped).

Although this recession was led by a housing bust - and that makes it look similar to some previous periods - this recession was not engineered by the Fed raising rates, rather it was the busting of the credit and housing bubbles, and all the related problems that led the economy into recession. Since there is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think Fisher's forecast for a rapid decline in unemployment is also unlikely.

Euro Zone GDP Grows in Q3

by Calculated Risk on 11/13/2009 11:19:00 AM

From the NY Times: Euro Zone Officially Out of Recession

... [T]he euro area emerged from recession during the third quarter, helped largely by export growth and improved industrial production in its largest economy, Germany.Note: the 0.4% is the quarterly rate (1.6% annualized when comparing to reporting in the U.S.).

The European Union’s statistics agency, Eurostat, reported Friday that gross domestic product for the 16 countries using the single currency expanded by 0.4 percent from the second quarter, following five quarters of contraction. Against a year earlier, G.D.P. was still 4.1 percent lower.

Analysts said the outlook remained patchy, particularly because unemployment is still climbing, wages are stagnant and consumption and lending are being propped up by government programs that will not be renewed indefinitely.

Here is the Eurostat report: Euro area GDP up by 0.4% and EU27 GDP up by 0.2% with a breakdown by country.

Trade Deficit Increases in September

by Calculated Risk on 11/13/2009 08:37:00 AM

The Census Bureau reports:

The ... total September exports of $132.0 billion and imports of $168.4 billion resulted in a goods and services deficit of $36.5 billion, up from $30.8 billion in August, revised. September exports were $3.7 billion more than August exports of $128.3 billion. September imports were $9.3 billion more than August imports of $159.1 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through September 2009.

Imports and exports increased in September. On a year-over-year basis, exports are off 13% and imports are off 21%.

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $68.17 in September - up more than 50% from the prices in February (at $39.22) - and the seventh monthly increase in a row. Import oil prices will probably rise further in October.

The major contributors to the increase in the trade deficit were the increase in oil prices, and more imports from China. Also - the deficit is higher than expected, suggesting a downward revision to Q3 GDP.

The Next Stimulus Package

by Calculated Risk on 11/13/2009 12:30:00 AM

Earlier this week I mentioned a possible "upside surprise" for GDP in 2010:

With unemployment above 10%, there will be significant political pressure for another stimulus package - especially if the economy starts to slow in the first half of 2010. This next package could be several hundred billion (maybe $500 billion) and could increase GDP growth in 2010 above my forecast.From The Hill: Senator Reid tees up 2010 jobs bill

Senate Democrats will take up a new job-creation bill in the wake of the 10.2 percent unemployment rate, Majority Leader Harry Reid told his colleagues Tuesday.And from the LA Times: Obama announces forum -- a brainstorming session on job creation

Next month, Obama said he would gather chief executives, small-business owners, economists, labor leaders and others to discuss ways to create jobs and grow the economy.It appears the idea of another stimulus package is gaining momentum ...

Thursday, November 12, 2009

TARP Inspector General: Taxpayers to suffer Losses

by Calculated Risk on 11/12/2009 08:17:00 PM

From Bloomberg: Barofsky Says TARP ‘Almost Certainly’ Will Bring Loss (ht jb)

Neil Barofsky ... said the [TARP] will “almost certainly” result in a loss to U.S. taxpayers.The TARP lost $2.33 billion on CIT and another $299

...

“Tens of billions of dollars are likely to be lost on the automotive bailout,” Barofsky said. In addition, some banks that received TARP money are failing, so the aid they received will be wiped out.

And there are a growing number of banks not paying their TARP dividends (33 banks as of August - not all will fail, but that is a bad sign).

And this is the quote of the day:

“When I first took office, I can’t tell you how many times I’d be having a sit-down and warning about potential fraud in the program and I would hear a response basically saying, ‘Oh, they’re bankers, and they wouldn’t put their reputations at risk by committing fraud,’” he said.

“I think we’ve done a good job of instilling a greater degree of skepticism that what comes from Wall Street isn’t necessarily the Holy Grail,” he said.

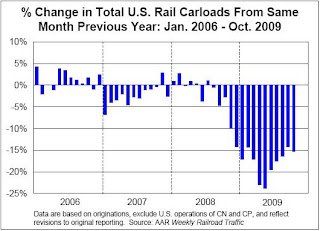

Rail Traffic Declines Slightly in October

by Calculated Risk on 11/12/2009 05:56:00 PM

Update: Title corrected to October.

From the Association of American Railroads: Rail Time Indicators

In October 2009, U.S. freight railroads originated 1,100,714 carloads, an average of 275,179 carloads per week. That’s down 15.3% from October 2008 (when the weekly average was 324,836 carloads) and down 0.3% from September 2009 (when the weekly average was 276,137 carloads). Average weekly carloads have now declined for two straight months.The following graph from the AAR shows average weekly carloads in the U.S.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Rail traffic fell off a cliff at the end of 2008, and it appears traffic has stabilized at a lower level.

Traffic will probably decline in November and December (the normal seasonal pattern).

The second graph shows the year-over-year change for rail traffic.

This is now a two year slump (like for the hotel occupancy rate), so the year-over-year decline will be significantly less in November and December.

This is now a two year slump (like for the hotel occupancy rate), so the year-over-year decline will be significantly less in November and December.The AAR report has a number of other graphs for various sectors like autos and housing. As an example they compare U.S. Housing Starts with U.S. and Canadian Rail Carloads

of Lumber, Wood & Forest Products.

For additional rail traffic, and a break down by carriers, see the Railfax report (ht Bob_in_MA)

FHA on DAPs: "Too many homeowners not equipped for home ownership"

by Calculated Risk on 11/12/2009 03:11:00 PM

The FHA commented on the damage caused by the Downpayment Assistance Programs (DAPs) today. These DAPs circumvented the FHA down payment requirements by having the seller funnel the "down payment" to the buyer through a "charity" (for a small fee of course). The FHA attempted to stop this practice, but thanks to Congress, the DAPs led to billions of losses:

FHA was also adversely selected from 2000 through 2008 because it was the only guarantor willing to accept loans using seller-funded downpayments. Such downpayments were channeled through nonprofit organizations in order to meet FHA requirements on direct sources of funds. Those facilities created too many homeowners in the FHA portfolio that were not equipped for the financial responsibilities of home ownership. Indeed, the FY 2009 MMI Fund actuarial study for single-family loans notes that, if FHA had not insured any loans with seller-funded downpayment assistance, the net capital ratio today would still be above the statutory required two percent. FHA’s estimated economic net worth would be $10.4 billion higher today were it not for those loans. ... Their claim rates have consistently been between 2.5 and three times those of other FHA-insured home purchase loans.This is still important today. The DAPs have been banned, but the first-time home buyer tax credit has probably created another group of "homeowners not equipped for the financial responsibilities of home ownership". Oh well ...

emphasis added

And some FHA stats ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the recent boom in FHA originations. The MBA estimates that there will be about $2 trillion in orginations this year, so the FHA insured loans were probably just under 20% of originations.

The second graph shows delinquencies by year.

Overall 17.71% of FHA insured loans are delinquent, and 8.52% seriously delinquent. Note: Seriously delinquent "Includes all loans 90-days past due plus all in-bankruptcy and in-foreclosure cases."

Overall 17.71% of FHA insured loans are delinquent, and 8.52% seriously delinquent. Note: Seriously delinquent "Includes all loans 90-days past due plus all in-bankruptcy and in-foreclosure cases."The 2009 vintage is just getting started, but the FHA has tightened standards (higher FICO scores), and DAPs were banned at the end of 2008 - and that will help. Also the stabilization in house prices is helping with fewer delinquencies.

However many of these recent homebuyers probably aren't ready to be homeowners, and the delinquency rate will probably rise sharply - especially if house prices start falling again.

Hotel RevPAR off 11.8 Percent

by Calculated Risk on 11/12/2009 01:20:00 PM

From HotelNewsNow.com: Boston leads RevPAR gains in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 3.6 percent to 54.8 percent, average daily rate dropped 8.5 percent US$97.19, and RevPAR decreased 11.8 percent to US$53.29.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

This is a two year slump for the hotel industry. Although occupancy is off 3.6% compared to 2008, occupancy is off about 17% compared to 2006 and 2007.

The occupancy rate really fell off a cliff in October 2008, and the good news is the occupancy rate for 2009 is tracking closer and closer to 2008.

Smith Travel Research is now predicting a slight uptick in occupancy rates in 2010 to 55.8% from an estimate of 55.2% in 2009. However average daily room rates (ADR), and revenue per available room (RevPAR) are expected to continue to decline slightly in 2010. The "good news" for the hotel industry is supply coming online is dropping sharply, and is expected to stay low for a few years. Of course that is bad news for construction workers ...

FHA Reserves Fall Sharply, Well Below Required Minimum

by Calculated Risk on 11/12/2009 11:08:00 AM

From David Streitfeld at the NY Times: Housing Agency Says Cash Reserves Are Down Sharply

The Federal Housing Administration said Thursday morning that its cash reserves had dwindled significantly in the last year after a record drop in home prices.From the FHA: Annual Actuarial Study Shows Capital Reserve Ratio Below Mandated Level; FHA Credit Policy Reforms Expected to Address Risk, Raise Reserve Levels

...

The results of the F.H.A.’s annual audit showed the agency’s capital reserves to be 0.53 percent, far under the 2 percent minimum mandated by Congress. A year ago, the capital reserves were 3 percent.

The independent study shows that FHA has sustained significant losses from loans made before 2009, and the capital reserve ratio has fallen below the congressionally mandated threshold, but concludes that under most economic scenarios considered FHA’s reserves would remain above zero.More links:

FHA’s capital reserve ratio, which is determined through findings from the independent actuarial study, measures reserves held in excess of those needed to cover projected losses over the next 30 years. The review projects the capital reserve ratio to be 0.53 percent of total insurance in force this year, below the two-percent statutory threshold. This capital ratio fell from 3 percent in the fall of 2008, reflecting difficult conditions in the housing market. The 0.53 percent capital ratio (which represents the funds held in the Capital Reserve Account) is in addition to the auditor’s base case estimate of the 30-year reserves needed to pay for losses on existing loans (which are held in the Financing Account). Combining those two accounts, FHA holds $31 billion in its total reserves today, or more than 4.5 percent of total insurance-in-force.

...

As part of its efforts to manage risk, FHA is modeling more extreme scenarios than those used by the actuary, including scenarios showing the reserves going below zero. FHA is committed not only to understanding its risks, but also to developing policy responses appropriate to addressing that risk.

emphasis added

Annual Report to Congress Regarding the Financial Status of the FHA Mutual Mortgage Insurance Fund

FHA Fiscal Year 2009 Actuarial Review Briefing

MBA: Purchase Applications Fall to Nine Year Low

by Calculated Risk on 11/12/2009 09:05:00 AM

The MBA reports: Mortgage Refinance Applications Increase, Purchase Applications at Nine Year Low

The Market Composite Index, a measure of mortgage loan application volume, increased 3.2 percent on a seasonally adjusted basis from one week earlier. ...It appears the post home buyer tax credit slump had started, although the tax credit will be extended and the eligibility expanded - so the slump might be delayed ... also existing home sales in October will probably be very strong - that is not good news for housing and the economy (since it was just demand from marginal buyers pulled forward at a very high cost).

The Refinance Index increased 11.3 percent from the previous week and the seasonally adjusted Purchase Index decreased 11.7 percent from one week earlier. The seasonally adjusted Purchase Index is at its lowest level since December 2000.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.90 percent from 4.97 percent, with points increasing to 1.03 from 1.01 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

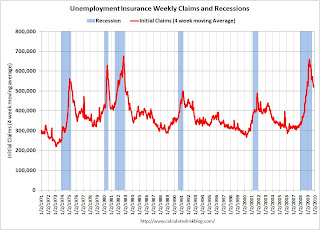

Weekly Initial Unemployment Claims: 502 Thousand

by Calculated Risk on 11/12/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims decreased to 502,000:

In the week ending Nov. 7, the advance figure for seasonally adjusted initial claims was 502,000, a decrease of 12,000 from the previous week's revised figure of 514,000. [revised from 512,000] The 4-week moving average was 519,750, a decrease of 4,500 from the previous week's revised average of 524,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 31 was 5,631,000, a decrease of 139,000 from the preceding week's revised level of 5,770,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,500 to 519,750, and is now 139,000 below the peak in April. The significant decline from the peak strongly suggests that initial weekly claims have peaked for this cycle.

The level is still very high suggesting continuing job losses.

Wednesday, November 11, 2009

Fannie, Freddie, Counterparty Risk and More

by Calculated Risk on 11/11/2009 10:08:00 PM

Yesterday I posted some excerpt from Freddie Mac's 10-Q:

We believe that several of our mortgage insurance counterparties are at risk of falling out of compliance with regulatory capital requirements, which may result in regulatory actions that could threaten our ability to receive future claims payments, and negatively impact our access to mortgage insurance for high LTV loans.The WSJ has more tonight, including the risks to Fannie Mae: Fannie, Freddie Warn on More Losses

Fannie Mae has about $109.5 billion of mortgage-insurance coverage in force ... Freddie Mac had $63.4 billion in mortgage insurance and $12.2 billion in bond insurance.And this a key sentence:

The reduction in private insurance coverage has contributed to the rise in the volume of loans backed by the Federal Housing Administration ...Instead of using private mortgage insurance for loans greater than 80% LTV, low down payment borrowers are now using FHA insurance.

That will probably end well ...

Also - the WSJ has more on the new FDIC "Prudent Commercial Real Estate Loan Workouts" guidance issued Oct 30th: Banks Hasten to Adopt New Loan Rules. Here is the new FDIC guidance that states performing loans "made to creditworthy borrowers" will not require write downs "solely because the value of the underlying collateral declined".

BofE's Mervyn King: Worst Over, "Long hard haul" Ahead

by Calculated Risk on 11/11/2009 07:25:00 PM

From The Times: The worst is over, says Bank of England Governor

Better-than-expected unemployment figures and a rosier growth forecast from the Bank of England raised hopes yesterday that Britain was beginning to claw its way towards economic recovery.The following graphs are from the BofE November 2009 Inflation Report. The first graph shows the projections for GDP.

...

Mervyn King, Governor of the Bank, said Britain had “only just started along the road to recovery” and that it would be “a long hard haul” back to regain the level of activity of two years ago before the financial crisis hit.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note that GDP isn't expect to return to pre-recession levels until sometime in 2011 (mean estimate).

Note from BofE: To the left of the first vertical dashed line, the distribution reflects the likelihood of revisions to the data over the past; to the right, it reflects uncertainty over the evolution of GDP growth in the future. The second dashed line is drawn at the two-year point of the projection.

The second graph shows the projections for inflation.

The BofE expects a short-term increase in inflation because of higher oil prices, but then below trend inflation through most of 2011.

The BofE expects a short-term increase in inflation because of higher oil prices, but then below trend inflation through most of 2011.Note that the line is drawn at the 2% target inflation rate (not zero).

From the BofE: Price stability is defined by the Government’s inflation target of 2%.

WSJ on Permanent Modifications

by Calculated Risk on 11/11/2009 04:30:00 PM

Ruth Simon at the WSJ has some details on permanent modifications: Mortgage Program Gathers Steam After Slow Start

The administration won't release figures on completed modifications until December, but so far it appears that very few trial modifications are becoming permanent, often because of a lack of documentation.Diani Olick at CNBC wrote yesterday:

...

J.P. Morgan Chase & Co. said last week that more than 92,000 of its customers have made at least three trial payments under the program, but just 26% of them had submitted all the required documents for a permanent fix.

...

At Morgan Stanley's Saxon Mortgage Services, about 26,000 of the 39,000 borrowers in the program have made more than three trial payments. Roughly 500 have received completed modifications.

emphasis added

Insiders however tell me that a lot of that paperwork has to do with those so-called "stated-income" loans ...In my list of possible upside surprises / downside risks for the economy, the percent of permanent modifications is related to the #1 downside risk. If few of these modifications are successful, there could be a flood of foreclosures on the market next year.

Unsolicited Principal Reduction Offer from BofA

by Calculated Risk on 11/11/2009 03:01:00 PM

Here is an unsolicited Principal Reduction Loan Modification (pdf) offer from BofA. (ht Dwight)

A few background details:

The offer from BofA:

If the homeowner accepts the offer, he would still owe more on the 1st than the house is worth (the 2nd mortgage would have to be resolved). The personal issue still exists, and reducing the monthly payments by a couple of hundred dollars probably will not help. My understanding is the homeowner is considering trying for a short sale, but it is interesting that BofA is sending out unsolicited principal reduction offers - probably to NegAm borrowers.

UPDATE: The number is answered by a recording that announces they are a "debt collector", and then says they are now closed (probably for Veterans Day)