by Calculated Risk on 11/22/2009 04:10:00 PM

Sunday, November 22, 2009

Possible Changes to FHA Insured Mortgages

Kenneth Harney at the SF Chronicle lists a few possible changes: FHA looking for ways to pump up its reserves. Harney lists four possible changes:

Currently, FHA charges an "up-front" mortgage insurance premium of 1.75 percent of the loan amount. Most borrowers roll that into their loan and finance it. FHA also charges an annual premium, paid in monthly installments, of either 0.5 percent or 0.55 percent, depending on the down payment. To rebuild reserves, FHA could ... raise the up-front premium to 2 percent or as high as the current statutory maximum of 2.25 percent. It could also raise the annual fee...

FHA is by far the most lenient and flexible player when it comes to evaluating applicants' creditworthiness.I think the most likely changes are higher insurance premiums, lower seller concessions, and tougher standards.

Summary and a Look Ahead

by Calculated Risk on 11/22/2009 12:15:00 PM

This will be a busy week for housing news starting with October existing home sales on Monday, Case-Shiller house prices on Tuesday, and New Home sales on Wednesday.

Existing home sales will probably be very high - close to a 5.8 million SAAR - because of the rush of first-time home buyers to receive the tax credit (before it was extended). This high level of activity is not good economic news - although some people might be fooled. The more important housing number will be New Home sales on Wednesday.

In other economic news, the Q3 GDP revision will be released on Tuesday, and the October Personal Income and Spending report will be released Wednesday.

Also the Q3 FDIC Quarterly Banking Report will probably be released this week. This report will likely show close to 500 problem banks at the end of Q3 (the Unofficial Problem Bank list is up to 513 banks), and the report will also show that the Deposit Insurance Fund (DIF) was at zero or negative. Note: this doesn't mean the FDIC is "bankrupt" or even out of cash - the DIF balance includes reserves against future losses.

And a summary ...

The increase in October was mostly a rebound from the decline in September.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

The red line shows retail sales ex-gasoline and shows there has been little increase in final demand.

This graph shows Capacity Utilization. This series has increased for four straight months, and is up from the record low set in June (the series starts in 1967).

This graph shows Capacity Utilization. This series has increased for four straight months, and is up from the record low set in June (the series starts in 1967).From the Fed: Industrial production and Capacity Utilization

Note: y-axis doesn't start at zero to better show the change.

This is just one month, but the recovery in industrial production slowed in October.

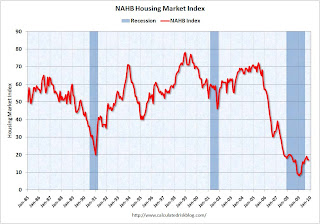

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 17 in November. October was revised down from 18 to 17. The record low was 8 set in January. This is very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

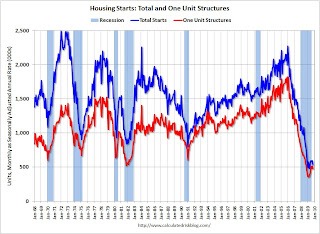

Total housing starts were at 529 thousand (SAAR) in October, down 10.6% from the revised September rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways (or down) for five months.

Total housing starts were at 529 thousand (SAAR) in October, down 10.6% from the revised September rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways (or down) for five months.Single-family starts were at 476 thousand (SAAR) in October, down 6.8% from the revised September rate, and 33 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for five months.

And some other economic stories

This graph shows the delinquency and 'in foreclosure' rates for all prime mortgage loans. Prime loan delinquencies are clearly a growing problem.

This graph shows the delinquency and 'in foreclosure' rates for all prime mortgage loans. Prime loan delinquencies are clearly a growing problem.MBA Chief Economist Jay Brinkmann said he expects the unemployment rate to peak in Q1 or Q2 2010, and delinquencies to peak sometime after the unemployment rate peaks. He now expects foreclosures to peak in early 2011 because a longer trailing effect than usual as the unemployment rate stays fairly high, and prime borrowers hang on before defaulting.

Bank Failures

The FDIC closed one bank on Friday, bringing the total for 2009 to 124.

Best wishes to all.

CRE Owners Seeking Property Tax Relief

by Calculated Risk on 11/22/2009 09:34:00 AM

From Carolyn Said at the San Francisco Chronicle: S.F. commercial properties seek tax relief

Landmark skyscrapers, signature hotels and upscale retailers glitter in the San Francisco skyline and enhance its cachet. But with commercial real estate slumping, they soon may subtract badly needed cash from the city's coffers.This is another impact of the CRE bust. I would think the city would have had a large budget surplus when property values - and property taxes - were soaring.

...

Collectively, those office towers, hotels, shopping centers and apartment buildings have an assessed value of $21.25 billion - but their owners say they're worth about half that amount. If those claims stand, that could wipe $115.78 million off the property taxes the city collects.

...

The potential property tax reductions come at the worst possible time for a city already grappling with budget cuts and deficits. San Francisco's controller warned last week that the city faces a potential half-billion-dollar deficit in its next fiscal year.

Saturday, November 21, 2009

More on Strategic Defaults

by Calculated Risk on 11/21/2009 09:22:00 PM

From Lew Sichelman at the LA Times: Owners' willingness to 'strategically default' on loans depends largely on how far underwater they are (ht Ann)

Most of the LA Times article is based on the paper by Guiso, Sapienza and Zingales that I covered in June: Moral and Social Constraints to Strategic Default on Mortgages (pdf)

Sichelman adds some comments from real estate agents on the ethics of strategic defaults:

Nellie Arrington of Long & Foster Real Estate in Columbia, Md., says it is "morally wrong, legally wrong and just plain wrong" for an owner to walk away from a mortgage he can afford simply because the balance exceeds the value of the underlying property.And on the other side:

Bob Hunt of Keller Williams O.C. Coastal Realty in San Clemente says the moral duty to protect your family outweighs the moral duty to repay the loan.

"Promise keeping is not the highest moral value," said Hunt, who before his real estate career taught ethics and logic at the University of Redlands. "If I promised to lend you my gun and you are now in a clearly dangerous psychotic stage, breaking my promise would be the right thing to do, not the wrong thing."

The Fed and Mortgage Rates

by Calculated Risk on 11/21/2009 03:20:00 PM

Meredith Whitney expressed concern about what will happen when the Fed stops buying GSE MBS by the end of the first quarter 2010. From Bloomberg: Meredith Whitney Says Bank Stocks Are ‘Grossly’ Overvalued

The Federal Reserve has begun slowing purchases in the $5 trillion market for so-called agency mortgage-backed securities after announcing in September that it would extend the timeline for its $1.25 trillion program to March 31 from year-end. Whitney said that banks are only originating home loans that they can sell to Fannie Mae and Freddie Mac.This raises an interesting question: What is the impact from Fed MBS buying on mortgage rates? I looked at this a couple of months ago: The Impact on Mortgage Rates of the Fed buying MBS and here is an update:

“If Fannie and Freddie can’t sell to an end buyer, i.e. the U.S. government steps back, the mortgage market at minimum contracts, rates go higher, and banks are poised with more writedowns,” said Whitney, founder of Meredith Whitney Advisory Group. “This is probably the issue that scares me most across the board.”

Earlier this year, Political Calculations introduced a tool to estimate mortgage rates based on the Ten Year Treasury yield (based on an earlier post of mine): Predicting Mortgage Rates and Treasury Yields. Using their tool, with the Ten Year yield at 3.356%, this suggests a 30 year mortgage rates of 5.33% based on the historical relationship between the Ten Year yield and mortgage rates.

Freddie Mac released their weekly survey Thursday:

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.83 percent with an average 0.7 point for the week ending November 19, 2009, down from last week when it averaged 4.91 percent. Last year at this time, the 30-year FRM averaged 6.04 percent.This suggests morgage rates are about 50 bps below the expect level ...

Here is an update to the previous graph. Sure enough mortgage rates have been below expectations for about seven months (recent months in yellow with blue outline at lower left).

Here is an update to the previous graph. Sure enough mortgage rates have been below expectations for about seven months (recent months in yellow with blue outline at lower left).Although this is a limited amount of data - and the yellow triangles are within the normal spread - this suggests the Fed's buying of MBS is reducing mortgage rates by about 35 to 50 bps relative to the Ten Year treasury.

It isn't that Fannie and Freddie "can’t sell to an end buyer", it is that the GSEs will be selling for a lower price (higher yield) when the Fed completes the MBS purchase program. At that time mortgage rates will probably rise by about 35 bps to 50 bps (relative to the Ten Year) in order to attract other buyers. Alone that isn't all that "scary".

But combined with the growing problems at the FHA, the distortions in the housing market caused by the first-time home buyer tax credit, rising delinquencies, the uncertainty of the modification programs, and likely further house price declines in many bubble states - there are serious problems ahead for the housing market.

FDIC Bank Failure Update

by Calculated Risk on 11/21/2009 11:01:00 AM

Note: The FDIC will probably release the Q3 Quarterly Banking Profile next week. The report will show the number of banks on the problem bank list, and the status of the Deposit Insurance Fund (DIF).

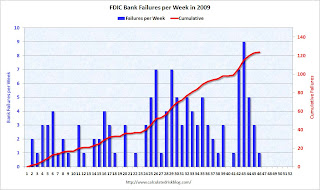

The FDIC closed another bank on Friday, and that brings the total FDIC bank failures to 124 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

The bank failures seem to come in bunches, and with 6 weeks to go it seems 140 to 150 or so bank failures is likely this year.

The 2nd graph covers the entire FDIC period (annually since 1934). This is the most failures per year since 1992 (181 failures).

This is the most failures per year since 1992 (181 failures).

As far as failures per week - there were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits. Also the cumulative estimated losses for the DIF, since early 2007, is now close to $50 billion.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

Fed Watch: "The Fed in a Corner"

by Calculated Risk on 11/21/2009 09:02:00 AM

From Tim Duy: The Fed in a Corner

Over the years, I have warned a seemingly countless number of undergraduates that Fed's hold on monetary independence was tenuous at best. Independence is not guaranteed by the Constitution. Congress made the Fed, and Congress can unmake the Fed. The Fed could only maintain the privilege of independence if policymakers pursued policy paths that fostered maximum, sustainable growth. Deviating from such paths would have consequences.There is much more in the piece.

The Fed is quickly learning the extent of those consequences, as Congress launches an assault on the Fed's independence.

...

The Fed earns accolades from academics for its handling of the crisis, in particular since the Lehman failure. Fair enough; I have few quibbles with policy since last fall. But what about the years before Lehman, when the crisis was building? Where was the Fed then? Did they abdicate regulatory responsibility? How did banks develop such incredible exposure to off-balance sheet SIV's? How could the Fed ignore increasingly predatory lending in the mortgage market? What exactly was Timothy Geithner, then president of the all important New York Fed, regulating and supervising? Clearly not Citibank.

Clearly the Fed (and other regulators) failed to properly supervise financial firms. We need to understand how and why this happened. (See The Failure of Regulatory Oversight)

Jim the Realtor: Trustee Sale

by Calculated Risk on 11/21/2009 12:30:00 AM

Jim is featuring a few trustee sale opportunities recently ... the total loan on this one is about $650,000 and the opening bid is $331,500 for a 2100 sq ft house on over 4 acres in a remote area of San Diego:

Friday, November 20, 2009

Unofficial Problem Bank List Increases to 513

by Calculated Risk on 11/20/2009 09:03:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by a net six institutions to 513 while aggregate assets declined to $302.3 billion from $304 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

There were 12 institutions added to the list with an average asset size of $194 million. The largest among the new faces include Modern Bank, National Association, New York, NY ($601 million); Eagle National Bank, Upper Darby, PA ($284 million), and The First National Bank of Wynne, Wynne, AR ($275 million). The OCC issued a Prompt Corrective Action order on September 30, 2009 to Marshall Bank, National Association, Hallock, MN ($60 million).

Six institutions were removed this week with half being failures last Friday including Orion Bank ($2.6 billion) and Century Bank, a Federal Savings Bank ($756 million). Three other banks were removed when their enforcement action was terminated including The First National Bank of Manchester and The Morris County National Bank of Naples. The only other change to the list this week is the OCC’s change in action against First National Bank in Pawhuska ($37 million) from a Formal Agreement to a Cease & Desist Order on October 22, 2009.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #124 in 2009: Commerce Bank of Southwest Florida, Fort Myers, Florida

by Calculated Risk on 11/20/2009 05:04:00 PM

Carved up by the Central Bank

MMMM Commerce Bank, Yum!

by Soylent Green is People

From the FDIC: Central Bank, Stillwater, Minnesota, Assumes All of the Deposits of Commerce Bank of Southwest Florida, Fort Myers, Florida

Commerce Bank of Southwest Florida, Fort Myers, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Off to a quick start ...

As of August 28, 2009, Commerce Bank of Southwest Florida had total assets of $79.7 million and total deposits of approximately $76.7 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $23.6 million. .... Commerce Bank of Southwest Florida is the 124th FDIC-insured institution to fail in the nation this year, and the twelfth in Florida. The last FDIC-insured institution closed in the state was Orion Bank, Naples, on November 13, 2009.

Moody's: CRE Prices Off 43% from Peak

by Calculated Risk on 11/20/2009 02:47:00 PM

From Globe St.: Values Off 43% From 2007 Peak

Prices nationwide have fallen 42.9% from their October 2007 peak, according to the latest Moody’s/REAL Commercial Property Price Index report issued Thursday, while Real Capital Analytics says total transaction volume for 2009 will be the lowest of the decade. The November Moody’s/REAL report ... covers transactions through Sept. 30 ... September’s index represented a 3.9% value decline compared to August.Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

...

"Further price declines are almost certain over the short term," says Nick Levidy, Moody’s managing director, in a statement. "However, it is notable that the pace of deterioration appears to be moderating."

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

National Survey: Data on Home Buying Financing

by Calculated Risk on 11/20/2009 01:43:00 PM

Here is some national data on home buyer financing in October. This is from a survey by Campbell Communications (excerpted with permission) released today.

Source: October Trends in Existing Home Sales, a presentation from Campbell/Inside Mortgage Finance Monthly Survey on Real Estate Market Conditions.

Thomas Popik, Campbell Surveys Research Director, highlighted several key trends from the survey in October:

Investor Purchases of REO Are Declining First-Time Homebuyers Largely Support the Market First-Time Homebuyers Dependent on FHA Financing If FHA Guidelines Get Tougher, Look for Large Impact Short Sale Inventory and Transactions Are Booming First-Time Homebuyer Traffic Is Starting to Ease

Click on graph for larger image in new window.

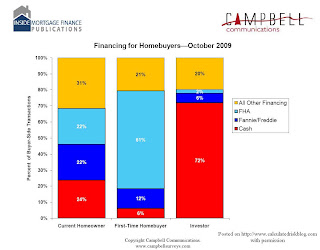

Click on graph for larger image in new window.The first chart shows the type of financing used in October.

The cash buyers were mostly investors (frequently buying damaged REOs), and the FHA buyers were mostly first time homebuyers.

The second graph shows the financing breakdown by buyer type.

According to the survey investors bought 15% of homes in October. About 72% of these purchases were cash.

According to the survey investors bought 15% of homes in October. About 72% of these purchases were cash.Current homeowners bought 38% of homes sold in October and used a mix of financing.

First-time homebuyers accounted for 47% of purchases and were mostly buying using FHA insured loans.

Krugman on AIG

by Calculated Risk on 11/20/2009 12:30:00 PM

From Paul Krugman writing in the NY Times: The Big Squander

During the bubble years, many financial companies created the illusion of financial soundness by buying credit-default swaps from A.I.G. — basically, insurance policies in which A.I.G. promised to make up the difference if borrowers defaulted on their debts. It was an illusion because the insurer didn’t have remotely enough money to make good on its promises if things went bad.Krugman argues that government officials have squandered the trust of the American people by treating the financial industry with kid gloves. He argues that this make it more difficult to pass another stimulus packaged focused on job creation.

... by the time A.I.G.’s hollowness became apparent, the world financial system was on the edge of collapse and officials judged — probably correctly — that letting A.I.G. go bankrupt would push the financial system over that edge. So A.I.G. was effectively nationalized; its promises became taxpayer liabilities.

... it seemed only fair for [the financial companies] to bear part of the cost of the bailout, which they could have done by accepting a “haircut” on the amounts A.I.G. owed them. Indeed, the government asked them to do just that. But they said no — and that was the end of the story. Taxpayers not only ended up honoring foolish promises made by other people, they ended up doing so at 100 cents on the dollar.

Unemployment Rate Increases in 29 States in October

by Calculated Risk on 11/20/2009 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Twenty-nine states and the District of Columbia recorded over-the-month unemployment rate increases, 13 states registered rate decreases, and 8 states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in all 50 states and the District of Columbia.

...

Michigan again recorded the highest unemployment rate among the states, 15.1 percent, in October. The states with the next highest rates were Nevada, 13.0 percent; Rhode Island, 12.9 percent; California, 12.5 percent; and South Carolina, 12.1 percent. The rate in California set a new series high, as did the rates in Delaware (8.7 percent) and Florida (11.2 percent). The District of Columbia also set a series high, 11.9 percent.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Fourteen states and D.C. now have double digit unemployment rates. New Jersey, Indiana, and Mississippi are all close.

Three states are at record unemployment rates: California, Delaware and Rhode Island. Several others are close.

A Few House Price Forecasts

by Calculated Risk on 11/20/2009 08:55:00 AM

From housing consultant Ivy Zelman commenting on the MBA Delinquency report in the NY Times U.S. Mortgage Delinquencies Reach a Record High

"I’ve been pretty bearish on this big ugly pig stuck in the python and this cements my view that home prices are going back down."From Bloomberg: Housing Recovery in U.S. Set Back to 2010 as Market Wanes

“I don’t think the housing crisis is over,” Mark Zandi, chief economist with Moody’s Economy.com, said in a telephone interview. “I think we’re going to see another leg down.”From Goldman Sachs chief economist Jan Hatzius in a note to clients: A Renewed Sag in the Housing Market (no link)

"Our current working assumption is a 5%-10% drop in home prices through the middle of 2010. ... house prices and credit quality ... to weigh on the US financial system, the availability of bank credit, and ultimately the pace of the economic recovery."My view is that house prices might have bottomed in some non-bubble areas, and also in some low end bubble areas with high foreclosure rates, however I expect further price decline in many mid-to-high end bubble areas.

Thursday, November 19, 2009

More on FHA Loans

by Calculated Risk on 11/19/2009 11:39:00 PM

David Streitfeld at the NY Times adds some color: Easy Loans in Expensive Areas

In January, Mike Rowland was so broke that he had to raid his retirement savings to move [to San Francisco] from Boston.Hopefully this will work out for Mr. Rowland and friends, but now for the chilling quote:

A week ago, he and a couple of buddies bought a two-unit apartment building for nearly a million dollars. They had only a little cash to bring to the table but, with the federal government insuring the transaction, a large down payment was not necessary.

“It was kind of crazy we could get this big a loan,” said Mr. Rowland, 27. “If a government official came out here, I would slap him a high-five.”

...

For decades, most F.H.A. loans were in low-cost states like Texas and Michigan. ... The Economic Stimulus Act of 2008 helped change that by temporarily doubling the maximum loan the F.H.A. insured, to $729,750. A two-unit property like the one bought by Mr. Rowland and his friends can be insured for up to $934,200.

Mr. Bedar, Mr. Rowland and the third partner in their property, Jordan Kurland, are all in the technology field, but their dreams of wealth do not feature stock options.This will end well ... (sorry for sarcasm)

“We’re banking on real estate,” said Mr. Kurland, 24. “Everyone expects prices to keep going up.”

Note: The MBA National Delinquency Survey showed 15.04% of FHA insured loans were delinquent as of the end of Q3, and another 3.32% were in the foreclosure process. The FHA Early Warning System shows that delinquencies are rising steadily on loans originated over the last two years. Not good.

On Negative T Bills

by Calculated Risk on 11/19/2009 09:30:00 PM

There was some buzz earlier today about short term T bill rates turning slightly negative. This happened last year too, but for different reasons ...

From the Financial Times: Short-term US interest rates turn negative

Short-term US interest rates turned negative on Thursday as banks frantically stockpiled government securities in order to polish their balance sheets for the end of the year.John Jansen at Across the Curve explains:

...

The scramble has been exacerbated by the fact that all leading US banks ... will this year close their books at the same time – at the end of December.

excerpted with permission

I do not speak to[o] often of the T bill market but yields in that market continue to collapse. In one recent conversation a market participant noted that bill yields are negative out to February. There are a couple of factors at work here. There is a massive wall of liquidity, a pile of cash which needs a home. That is driving yields lower.And more from John: More on Negative T Bills

Typically as the year end approaches clients tend to unwind profitable trades and reduce balance sheet. I think that some of that deleveraging process has created new piles of cash and that money needs a place to park.

Others are preparing to beautify their balance sheet by having some pristine government paper on the books over year end. Some of that trade has begun as investors purchase paper which will carry them into 2010.

In my closing post I noted that T bill rates are in negative territory and gave some reasons for that. Here is an excerpt from David Ader of CRT on that same topic;No worries ...

“We instead take our cue from activity in the financing markets, where year end is playing its hand – Jan bills are trading negative. The story here is not a new one as we saw bills negative at the end of the last quarter, but exacerbated by a more intense year end. We say that because 1) it’s clearly the talking point on funding desks, 2) EVERYONE has a Dec 31 year end as we have no investment banks any longer, and 3) as bank holding companies there’s a likelihood that former IBs, too, need to show cash in something other than a mattress.”

Another analyst whom I read suggested that an exacerbating factor was the maturity of some cash management bills which were not replaced.

Whatever the case, I am certain that the present circumstance is not an indicator of financial stress as plunging bill rates have been in the past.

States: Seriously Delinquent Mortgages vs. Unemployment Rate

by Calculated Risk on 11/19/2009 06:45:00 PM

Here is a scatter graph comparing the seriously delinquency rate for mortgage loans vs. unemployment rate for all states. The seriously delinquent rate include 90+ days delinquent loans, and loans in the foreclosure process for Q3 2009 (Source: MBA). Click on graph for larger image in new window.

Click on graph for larger image in new window.

There is a relationship between delinquency rates and the unemployment rate.

Florida really stands out because of state specific foreclosure laws. Arizona and Nevada also have higher than expected foreclosure rates - possibly because of high investor activity during the housing bubble.

As the unemployment rate continues to rise, the mortgage delinquency rate will increase too.

For more on the MBA National Delinquency Survey, see:

Mortgage Delinquencies and Foreclosures by Period Past Due

by Calculated Risk on 11/19/2009 03:49:00 PM

Click on graph for larger image in new window.

First, on the market ...

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Reader Yuri asked me if the number of 30 day delinquencies is decreasing. He was curious if the overall number of delinquencies is increasing because of the loan modifications and other actions that are limiting the outflow - but that that overall increase might be masking some improvement for the inflow of new delinquencies. This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

The percentage of 30 and 60 day delinquencies have decreased slightly. However the rates are still near record levels.

For the 30 day bucket, there were 3.57% percent delinquent - not much lower than the high in Q1 of 3.77%. For 60 days, the rate was 1.67% - also below the high in Q1.

Clearly most of the increase was in the 90 day and in foreclosure buckets. And that is why the modification programs are so important. The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

Since prime fixed rate mortgages account for about 2/3s of the mortgage market, a large portion of future foreclosures will probably be from these loans.