by Calculated Risk on 5/14/2012 09:37:00 PM

Monday, May 14, 2012

Look Ahead: Retail sales, CPI, Home Builder Confidence, NY Fed Manufacturing Survey

Tuesday will be a busy day with the release of several key economic indicators including retail sales, CPI, home builder confidence, and the NY Fed manufacturing survey:

• Retail sales for April will be released at 8:30 AM ET. Retail sales were very strong in February and March, increasing 1.1% and 0.8%, respectively. The consensus is for retail sales to increase 0.1% in April, and for retail sales ex-autos to increase 0.2%. This report could be weak. Note: The annual revision for retail sales was released on April 30th including new seasonal adjustments using the Census Bureau’s X-13ARIMA-SEATS (yes, a new model).

• Also at 8:30 AM, the Consumer Price Index for April will be released. The consensus is for no change in headline CPI (with the decline in energy prices) and for core CPI to increase 0.2%. From Merrill:

With gasoline prices peaking in early April, we expect headline CPI to soften, dropping 0.1% monthly, after a 0.3% rise in March. ... Overall, the annual headline CPI inflation rate is likely to decelerate in April to 2.2%, its slowest year-on-year rise since the rapid run-up in global oil prices in February 2011.• Also at 8:30 am, the NY Fed Empire Manufacturing Survey for May will be released. The consensus is for a reading of 10.0, up from 6.6 in April (above zero is expansion).

• At 10 AM, the May NAHB home builder confidence survey will be released. The consensus is for a reading of 26, up slightly from 25 in April. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

• The Manufacturing and Trade: Inventories and Sales report for March will be released at 10 AM, and Fed Governor Elizabeth Duke speaks at 9.30 AM: "Prescriptions for Housing Recovery".

For the monthly economic question contest:

Update on Gasoline Prices: West Coast Refinery Problems

by Calculated Risk on 5/14/2012 07:09:00 PM

Earlier I noted that gasoline prices will probably follow the price of Brent oil down, but that there were some refinery issues.

Here is a story from the Mercury News last Friday: Rising California gas prices expected to increase even more

Prices could rise an additional 20 cents in the next few days, as refinery problems continue to choke supplies for California's special blend of clean burning gas. On Thursday, many Bay Area stations saw jumps of several cents to a dime.Gasoline prices on the west coast are up about 20 cents this month, and about 10 cents over the last several days. Hopefully this is a short term problem.

"Prepare to get clobbered," said Patrick DeHaan, the senior petroleum analyst with GasBuddy.com.

West Coast gas inventories are at their lowest level in 20 years, he said, and the blame is with production on the West Coast.

"Refineries have been having a lousy spring with not just one massive facility outage," DeHaan said, "but smaller, more widespread issues."

Housing: The Return of Multiple Offers

by Calculated Risk on 5/14/2012 04:34:00 PM

I've mentioned this before, but here are a couple more excerpts from articles ...

From Susan Straight at the WaPo: How to buy a house in D.C.’s sellers’ market

If you’ve dipped a toe into the Washington-area real estate market these days, you know it’s returned to an era of multiple offers, escalation clauses and competitive bidding. According to RealEstate Business Intelligence, the active inventory of homes in March was down more than 25 percent from March 2011.From the Jon Lansner at the O.C. Register: O.C. homes draw multiple-offer ‘avalanche’ (an excerpt from Steve Thomas' report)

...

Sellers are in heaven; buyers are feeling the stress. These days you can go to any open house of a home in good condition in a desirable neighborhood, and you’ll find you’re one of a steady stream of potential buyers.

Below $500,000 range is NUTS. Homes priced at or near their market value are generating an avalanche of multiple offers. A home in this range is placed on the market and, within moments, cars filled with buyers are touring the home. ...The local economies in these two areas are probably better than most of the country, and anything priced right is selling pretty quickly. The key reason for the multiple offers is the sharp decline in inventory.

Upon writing an offer, buyers quickly find that they are one of many, sometimes over ten, offers on the home. Suddenly ... In the end, the seller factors the highest price with the largest down payment. I know, you are thinking, “What about the appraisal?” In many instances, shrewd sellers and Realtors are leveraging the competition to drop the appraisal contingency and require the buyer to make up the difference between the appraisal price and the purchase price, IF there is an appraisal problem. ...

Supply has dropped to levels not seen since June 2005. ... The expected market time for all of Orange County is 1.5 months, or six weeks.

Although this might remind some people of 2005, I think the dynamics are very different. This is only happening in a few parts of the country, the buyers are usually making substantial down payments, and I suspect any clear increase in prices would be met with more supply ("sellers waiting for a better market").

Oil and Gasoline Prices, and the Reversal of Seaway Pipeline

by Calculated Risk on 5/14/2012 12:15:00 PM

Oil prices have fallen sharply, and once again gasoline prices are lagging. But if oil prices stay at this level - or fall further - then gasoline prices should decline further too (there are always some refinery issues).

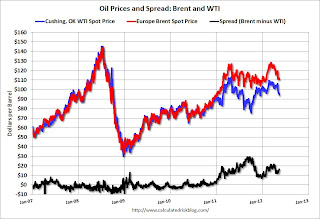

First, gasoline prices tend to track international oil prices, so we need to compare gasoline to Brent oil prices, and not WTI (West Texas Intermediate). A "glut" of oil at Cushing pushed down WTI prices relative to Brent over the last few years, but the spread has narrowed some now that a key pipeline is being reversed.

From Bloomberg: Sweet Crude From Seaway Pipeline Offered in the U.S. Gulf

Low-sulfur oil delivered from the soon-to-be reversed Seaway pipeline is being offered in the U.S. Gulf Coast for June delivery.This following graph shows the prices for Brent and WTI over the last few years.

Enterprise Product Partners LP (EPD) and Enbridge Inc. (ENB) are reversing the pipeline and on May 17 will begin shipping oil from the storage hub at Cushing, Oklahoma, to the Gulf. It is expected to narrow the discount of inland U.S. grades to imports and Gulf Coast production.

The first phase will carry 150,000 barrels a day on the 500-mile (800-kilometer) line, with subsequent phases expanding capacity to 850,000 barrels a day by mid-2014.

Click on graph for larger image.

Click on graph for larger image.The spread narrowed last year with the announcement of the partial reversal of the Seaway pipeline. The spread will probably narrow further as the capacity is expanded.

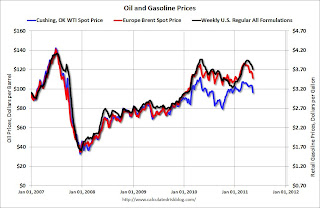

The second graphs shows that gasoline prices track Brent more than WTI.

Before the spread emerged, WTI and Brent tracked closely - and retail gasoline prices tracked pretty closely too.

Before the spread emerged, WTI and Brent tracked closely - and retail gasoline prices tracked pretty closely too.Once the "glut" emerged, gasoline prices tracked Brent oil prices. Brent was as high as $128 per barrel in March, and gasoline prices peaked at $3.94 (weekly basis) in early April.

We will probably see a similar lag this time, with gasoline prices falling to below $3.50 per gallon by early June (if oil prices stay at this level). It wouldn't be a surprise if most of the decline in gasoline prices happened after Memorial Day (May 28th).

And below is a graph of gasoline prices. Gasoline prices have been slowly moving down since peaking in early April. Note: The graph below shows oil prices for WTI; as noted above, gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Spanish and Italian Bond Yields Increase

by Calculated Risk on 5/14/2012 08:54:00 AM

From the WSJ: Global Stocks Hit by Greece Worries

Worries about what a Greek exit would mean for other euro-zone nations with hefty deficits pushed yields on 10-year Spanish government bonds above 6% to the highest levels seen since December.Here are the Spanish and Italian 10-year yields from Bloomberg.

The Spanish yields are at 6.3%, the highest level since last November. Compared to the German yield, Spanish borrowing costs at euro-era high:

Spreads on Spanish 10-year bonds over German Bunds hit a euro-era high of 486 basis points, surpassing the record hit last November. Yields on Spanish benchmark debt reached 6.30 per cent while German 10-year Bunds were at an all-time low of 1.44 per cent.The Italian yields are at 5.74%, the highest level since January.

excerpt with permission

The US 10-year yield is down to 1.78%, close to the record low of 1.7% last September.

Sunday, May 13, 2012

Look Ahead: Sunday Night Futures

by Calculated Risk on 5/13/2012 09:52:00 PM

This will be a busy week, but there are no economic indicators scheduled for release on Monday. The spotlight tomorrow will be on Greece and the Eurogroup meeting.

The Asian markets are mostly green tonight. The Nikkei is up about 0.6%, and the Shanghai Composite is up 0.3% after the People's Bank of China cut reserve requirements on Saturday.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down slightly, and Dow futures are down 5.

Oil: WTI futures are down to $95.47 (this is down from $109.77 in February) and Brent is down to $111.78 per barrel.

Yesterday:

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

For the monthly economic question contest (for data to be released on Tuesday and Wednesday):

Greek Exit: Looking more likely

by Calculated Risk on 5/13/2012 07:26:00 PM

The Financial Times has an overview of some things that might happen when Greece exits the euro: Eurozone: If Greece goes ...

In any exit scenario, the new drachma would depreciate rapidly. ... Goldman Sachs has estimated ... a devaluation of 30 per cent is needed compared with the rest of the eurozone, and more than 50 per cent with Germany.The price for imports would soar (like oil prices), and living standards would fall - and Greece would have to immediately bring their primary budget into balance. The hope would be that competitiveness would be restored, and the economy could start growing again.

...

Even if all interest payments were stopped [Greece defaults again], additional austerity would still be needed for a period because Greece’s tax revenues still fall short of its public spending – a primary deficit.

excerpt with permission

A key question is spillover to other countries.

Professor Krugman has some thoughts on timing: Eurodämmerung

Some of us have been talking it over, and here’s what we think the end game looks like:Yesterday:

1. Greek euro exit, very possibly next month.

2. Huge withdrawals from Spanish and Italian banks, as depositors try to move their money to Germany.

3a. Maybe, just possibly, de facto controls, with banks forbidden to transfer deposits out of country and limits on cash withdrawals.

3b. Alternatively, or maybe in tandem, huge draws on ECB credit to keep the banks from collapsing.

4a. Germany has a choice. Accept huge indirect public claims on Italy and Spain, plus a drastic revision of strategy — basically, to give Spain in particular any hope you need both guarantees on its debt to hold borrowing costs down and a higher eurozone inflation target to make relative price adjustment possible; or:

4b. End of the euro.

And we’re talking about months, not years, for this to play out.

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

Europe Update: Next Greek Election, Euro-area GDP expected to show recession

by Calculated Risk on 5/13/2012 11:44:00 AM

Greece: It is very unlikely that a coalition government will be formed. This means there will be another election on June 17th. The Europeans have said they will fund Greece through the next election, but it is not clear what will happen next. An exit from the euro is very possible.

From the Financial Times: Greek exit from eurozone ‘possible’

Greece’s exit from the eurozone “would be possible,” even if not in Europe’s interest, and countries should have a democratic right to quit, according to ... Luc Coene, the central bank governor of Belgium, in a Financial Times interview ...And it is appears data this week will confirm the European recession. From Nomura:

Mr Coene’s remarks – echoing similar comments by other eurozone central bankers – hinted at swirling debate within the ECB’s 23-strong council and suggested the ECB now realises such an outcome has become distinctly possible.

Excerpt with permission

An important state election in Germany and a Eurogroup meeting will take center stage amid heightened political uncertainty and GDP data likely to confirm the euro area is in recession. ... Euro-area Q1 GDP first release (Tuesday & Wednesday): The euro area seems to have entered into a technical recession in Q1, albeit with a shallower contraction than in Q4. We expect GDP growth to come in at -0.2% q-o-q in Q1 from -0.3% previously. By country, we think the core should hold up well, while the rest see a less sharp decline in economic output. In Germany and France, we forecast GDP growth of +0.1% q-o-q (vs Q4‟s -0.2%) and 0% q-o-q (vs Q4‟s +0.2%) respectively. ... In Italy, we think GDP growth is likely to print at -0.5% q-o-q in Q4 (vs -0.7% in Q4).Yesterday:

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

Unofficial Problem Bank list declines to 924 Institutions

by Calculated Risk on 5/13/2012 08:03:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 11, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Only one change to report this week to the Unofficial Problem Bank List.Yesterday:

A reader pointed out an action termination against First Missouri National Bank back in August 2011 that was not captured. First Missouri National Bank underwent a name change to First Missouri Bank and charter flip to state member in December 2011. While the name change and charter flip were properly identified, the action termination prior to the charter conversion was not as the OCC did not include the termination within a press release nor can it be found via the OCC's enforcement action search tool. Perhaps the reader has direct access into the OCC's database or a strong interest in this bank to discover such a needle in the haystack. We can only hope they find any other remaining needles.

With the removal, the Unofficial Problem Bank list stands at 924 institutions with assets of $361.1 billion. A year ago, the list held 983 institutions with assets of $425.4 billion. We thought there was an outside chance for the OCC to release its actions through mid-April, but they will keep us waiting until next week. Also, we will be on watch for the FDIC to release the Official Problem Bank List as of March 31, 2012.

Until then, do something kind this weekend for all of the mothers in your life.

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

Saturday, May 12, 2012

Gov. Brown: California Deficit increases to $16 Billion

by Calculated Risk on 5/12/2012 06:31:00 PM

From the LA Times: California deficit has soared to $16 billion, Gov. Jerry Brown says

Gov. Jerry Brown announced on Saturday that the state's deficit has ballooned to $16 billion, a huge increase over his $9.2-billion estimate in January.In addition to more budget cuts, Governor Brown is asking for a temporary 3% income tax hike for the highest income bracket, and an increase in the state sales tax (but still below a year ago).

The bigger deficit is a significant setback for California, which has struggled to turn the page on a devastating budget crisis. Brown, who announced the deficit on YouTube, is expected to outline his full budget proposal on Monday in Sacramento.

"This means we will have to go much further, and make cuts far greater, than I asked for at the beginning of the year," Brown said in the video.

In the aggregate, it appears state and local cuts might end mid-year, but some states - like California - will see further budget cuts.

Earlier:

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

Schedule for Week of May 13th

by Calculated Risk on 5/12/2012 01:00:00 PM

Earlier:

• Summary for Week Ending May 11th

This will be a busy week. There are two key housing reports to be released this week: May homebuilder confidence on Tuesday, and April housing starts on Wednesday.

Another key report is April retail sales. For manufacturing, the May NY Fed (Empire state) and Philly Fed surveys, and the April Industrial Production and Capacity Utilization report will be released this week.

Also, the Mortgage Bankers Association (MBA) 1st Quarter National Delinquency Survey, and the AIA's Architecture Billings Index for April will be released on Wednesday.

Europe will remain in the spotlight with a Eurogroup meeting on Monday, and euro area Q1 GDP being released in Tuesday.

No economic releases scheduled.

8:30 AM ET: Retail Sales for April.

8:30 AM ET: Retail Sales for April. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales were up 0.8% in March and 1.0% in February. There will probably be some payback in April for the strong retail reports over the previous two months.

The consensus is for retail sales to increase 0.1% in April, and for retail sales ex-autos to increase 0.2%.

8:30 AM: Consumer Price Index for April. The consensus is for no change in headline CPI (with the decline in energy prices). The consensus is for core CPI to increase 0.2%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for May. The consensus is for a reading of 10.0, up from 6.6 in April (above zero is expansion).

9:30 AM: Speech by Fed Governor Elizabeth Duke, "Prescriptions for Housing Recovery", At the National Association of Realtors Midyear Legislative Meetings and Trade Expo, Washington, D.C.

10:00 AM: Manufacturing and Trade: Inventories and Sales for March (Business inventories). The consensus is for 0.4% increase in inventories.

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 26, up slightly from 25 in April. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Housing Starts for April.

8:30 AM: Housing Starts for April. Total housing starts were at 654 thousand (SAAR) in March and single-family starts at 462 thousand in March. This was a decline from the February rate, but most of the decline was related to the volatile multi-family sector. Based on permits, starts probably rebounded in April.

The consensus is for total housing starts to increase to 690,000 (SAAR) in April from 654,000 in March.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for April. This shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production in April, and for Capacity Utilization to increase to 79.0% (from 78.6%).

10:00 AM: Mortgage Bankers Association (MBA) 1st Quarter 2012 National Delinquency Survey (NDS).

10:00 AM: Mortgage Bankers Association (MBA) 1st Quarter 2012 National Delinquency Survey (NDS). This graph shows the percent of loans delinquent by days past due through Q4 2011. Based on other data, the seasonally adjusted delinquency rate probably declined slightly in Q1.

The key problem remains the large number of seriously delinquent loans (90+ days and in the foreclosure process), especially in judicial foreclosure states like Florida, New Jersey, New York, and Illinois. With the mortgage servicer settlement signed off on April 5th, the delinquency rate will probably start falling faster by mid-2012 through a combination of more modifications and more foreclosures.

2:00 PM: FOMC Minutes, Meeting of April 24-25, 2012.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to be essentially unchanged at 365 thousand compared to 367 thousand last week.

10:00 AM: Philly Fed Survey for May. The consensus is for a reading of 10.0, up from 8.5 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for April. The consensus is for a 0.1% increase in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for April 2012

Summary for Week of May 11th

by Calculated Risk on 5/12/2012 08:01:00 AM

The key stories for the week were the elections in France and Greece, and JPMorgan’s $2 billion trading loss on a synthetic credit position. JPMorgan CEO Jamie Dimon said the losses were due to “egregious mistakes”, “sloppiness" and that the "portfolio still has risk”. This doesn’t appear to be a systemic risk, just poor risk management at JPMorgan.

The Greek political situation is unsettled, and the Europeans have said they support Greece through the next election on June 17th. After that … who knows? There is a strong possibility that Greece will leave the euro not long after the next election.

This was a light week for US economic data. The trade deficit was a little higher than expected, but most of the data improved slightly. The 4-week average of initial weekly unemployment claims declined, small business confidence improved, and consumer sentiment improved, and there were more job openings in March.

In an under reported story, both Fannie and Freddie reported improved performance due to “stabilization of house prices” in certain areas. The sharp decline in "for sale" inventory appears to be supporting house prices, and inventory and house prices continue to be key stories for 2012.

Here is a summary in graphs:

• Trade Deficit increased in March to $51.8 Billion

The trade deficit was above the consensus forecast of $49.5 billion.

The trade deficit was above the consensus forecast of $49.5 billion.

The first graph shows the monthly U.S. exports and imports in dollars through March 2012.

Exports increased in March, and are at record levels. Imports increased even more. Exports are 13% above the pre-recession peak and up 7% compared to March 2011; imports are 3% above the pre-recession peak, and up about 8% compared to March 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Oil averaged $107.95 per barrel in March, up from $103.63 in February. Import oil prices were probably a little higher in April too, but will probably decline in May. The increase in imports was a combination of more petroleum imports and more imports from China.

• BLS: Job Openings increased in March

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in March to 3.737 million, up from 3.565 million in February. The number of job openings (yellow) has generally been trending up, and openings are up about 17% year-over-year compared to March 2011. This is the highest level for job openings since July 2008.

Quits increased in March, and quits are now up about 8.5% year-over-year and quits are now at the highest level since 2008. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• REO Inventory for Fannie, Freddie and the FHA

This graph shows the combined REO inventory for Fannie, Freddie and the FHA (FHA through Feb 2012).

This graph shows the combined REO inventory for Fannie, Freddie and the FHA (FHA through Feb 2012).The combined REO inventory is down to 203 thousand in Q1 2012, down about 18% from Q1 2011.

The pace of REO acquisitions will probably increase following the mortgage servicer settlement (signed off on April 5th); and dispositions will probably increase too.

• CoreLogic: House Price Index increases in March, Down 0.6% Year-over-year

From CoreLogic: CoreLogic® March Home Price Index Shows Slight Year-Over-Year Decrease of Less Than One Percent

From CoreLogic: CoreLogic® March Home Price Index Shows Slight Year-Over-Year Decrease of Less Than One Percent[CoreLogic March Home Price Index (HPI®) report] shows that nationally home prices, including distressed sales, declined on a year-over-year basis by 0.6 percent in March 2012 compared to March 2011. On a month-over-month basis, home prices, including distressed sales, increased by 0.6 percent in March 2012 compared to February 2012, the first month-over-month increase since July 2011.This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.6% in March, and is down 0.6% over the last year.

The index is off 34% from the peak - and is just above the post-bubble low set last month.

• Weekly Initial Unemployment Claims at 367,000

Here is a long term graph of weekly claims:

Here is a long term graph of weekly claims:The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 379,000.

This decline in the 4-week moving average followed for four consecutive increases.

This was close to the consensus of 366,000. This is two consecutive weeks with initial unemployment claims in the 360s, after averaging close to 390,000 over the previous 3 weeks.

• NFIB: Small Business Optimism Index increases in April

This graph shows the small business optimism index since 1986. The index increased to 94.5 in April from 92.5 in March. This ties February 2011 as the highest level since December 2007.

This graph shows the small business optimism index since 1986. The index increased to 94.5 in April from 92.5 in March. This ties February 2011 as the highest level since December 2007.Another positive sign is that the "single most important problem" was not "poor sales" in April - for the first time in years. In the best of times, small business owners complain about taxes and regulations, and that is starting to happen again.

This index remains low, but as housing continues to recover, I expect this index to increase (there is a high concentration of real estate related companies in this index).

• Consumer Sentiment increases in May to 77.8

The preliminary Reuters / University of Michigan consumer sentiment index for May increased to 77.8, up from the April reading of 76.4.

The preliminary Reuters / University of Michigan consumer sentiment index for May increased to 77.8, up from the April reading of 76.4.This was above the consensus forecast of 76.2 and the highest level since January 2008. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and the sluggish economy.

• Other Economic Stories ...

• LPS: House Price Index increased 0.2% in February

• Lawler: Table of Short Sales and Foreclosures for Selected Cities

• Sacramento: Percentage of Distressed House Sales increases slightly in April

• Lawler: REO inventory of "the F's" and PLS

• Fannie Mae reports $2.7 billion in income, REO inventory declines in Q1 2012

• The economic impact of stabilizing house prices?

• The Declining Participation Rate

• Housing: Inventory declines 21% year-over-year in early May

Friday, May 11, 2012

Bookies stop taking bets on Greece leaving the euro

by Calculated Risk on 5/11/2012 07:38:00 PM

Something for a Friday evening ...

From the Athens News: No more bets for Greek euro exit

Want a flutter on Greece leaving the euro zone? It may already be too late. A surge in bets has forced Britain's biggest bookmakers William Hill Plc and Ladbrokes Plc to suspend betting on the odds of Greece dropping out.Maybe they could take bets on when Greece will leave the euro. The Europeans have said they support Greece through the next election (June 17th) ... after that ... who knows?

...

William Hill said the level of betting on Greece quitting first was such that it had become too risky to continue taking bets ...

"We've had Greece as hot favourites for some time but increasingly it was becoming the only one that people wanted to bet on," said a spokesman for William Hill, Britain's largest betting firm.

"It wasn't a healthy situation for bookmakers. We found it was virtually impossible to make a book."

Britain's second-biggest betting firm Ladbrokes said it had suspended betting on Greece dropping out of the euro zone by the end of the year, after repeatedly slashing the odds.

"It is safer for us to suspend betting than to keep cutting the odds," a spokesman for Ladbrokes said. "We have been slashing the odds repeatedly over the last few days."

Lawler: Fannie SF REO Inventory: Total vs. “Listed/Available for Sale”

by Calculated Risk on 5/11/2012 02:03:00 PM

From economist Tom Lawler:

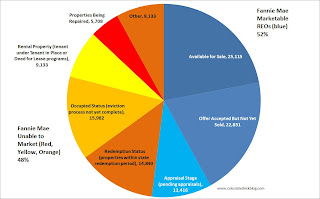

In its latest 10-Q filing Fannie Mae showed the distribution of the “status” of its SF REO inventory, including the % it was unable to “market” for various reasons. (Fannie’s SF REO inventory as of 3/31/2012 totaled 114,157 properties, down 25.5% from last March).

Of Fannie’s 114,157 SF REO properties, almost half – 54,795 – were characterized as being “unable to market” (meaning can’t be listed for sale). Another 11,416 were not yet “listed” or “available” for sale because the properties were still being appraised (so that a list price can be determined). That left just 47,946 properties that were available for sale (listed), of which 22,831 already had a purchase offer accepted but which had not yet closed escrow.

Every so often some “quack” writes a piece saying that “lots” of GSE REOs aren’t listed for sale, “proving” that the GSEs are “holding properties off the market.”

Hopefully disclosure such as these will make such quacks “duck” for cover.

Click on graph for larger image.

Click on graph for larger image.

CR Note: The Fannie table is below. Here is a pie chart showing the distribution of REO.

The "blue" categories are "marketable" (and many are in escrow).

The "orange, yellow, red" categories are not currently marketable. Some are within the state redemption period, some are rented, some are in the eviction process, some are being repaired ...

NOTE: Table below has a sub-total for "unable to market" that includes the categories below it:

| Fannie Mae SF REO Inventory by "Status," March 31, 2012 | ||

|---|---|---|

| Percent | Number (derived for categories) | |

| Available for Sale | 22% | 25,115 |

| Offer Accepted But Not Yet Sold | 20% | 22,831 |

| Appraisal Stage (pending appraisals) | 10% | 11,416 |

| Unable to Market: | 48% | 54,795 |

| Redemption Status (properties within state redemption period) | 13% | 14,840 |

| Occupied Status (eviction process not yet complete) | 14% | 15,982 |

| Rental Property (tenant under Tenant in Place or Deed for Lease programs) | 8% | 9,133 |

| Properties Being Repaired | 5% | 5,708 |

| Other | 8% | 9,133 |

| Total | 100% | 114,157 |

Las Vegas: Visitor Traffic at New High, Convention Attendance Lags

by Calculated Risk on 5/11/2012 01:01:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered.

From the Las Vegas Sun: Visitor volume continues steady climb, latest numbers show

Las Vegas visitor volume continued to climb in March despite a drop in convention attendance, the Las Vegas Convention and Visitors Authority reported Thursday.

The LVCVA said 3.5 million tourists visited the city in March, a 3.7 percent increase over March 2011. For the first quarter, visitor volume is up 3.6 percent over last year to 9.8 million, just under the pace needed to record an unprecedented 40 million visitors.

Convention attendance was down 3.9 percent to 513,010 ... Convention attendance was down despite a 34.6 percent increase in the number of conferences and meetings held (2,302).

Click on graph for larger image.

Click on graph for larger image. It looks like visitor traffic will set a record this year, but convention attendance is still way below the pre-recession levels. This is probably giving a boost to the hotel and gambling industry.

Consumer Sentiment increases in May to 77.8

by Calculated Risk on 5/11/2012 10:00:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for May increased to 77.8, up from the April reading of 76.4.

This was above the consensus forecast of 76.2 and the highest level since January 2008. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and the sluggish economy.

PPI declines 0.2% in April, Core PPI increased 0.2%

by Calculated Risk on 5/11/2012 08:42:00 AM

From the BLS: The Producer Price Index for finished goods falls 0.2% in April; finished core rises 0.2%

The decline in the headline number was mostly due to falling energy prices.

The index for crude energy materials fell 6.8 percent in April. From January to April, prices for crude energy materials dropped 15.1 percent subsequent to a 6.6-percent advance for the 3 months ended in January. Almost three-fourths of the April monthly decline can be traced to the index for crude petroleum, which decreased 7.9 percentHowever, excluding food and energy, core PPI increased 0.2%. We will probably see a slowdown in April CPI too due to declining oil and gasoline prices in April (to be released next week).

Thursday, May 10, 2012

Look Ahead: PPI, Consumer Sentiment

by Calculated Risk on 5/10/2012 09:55:00 PM

There are two minor economic indicators scheduled for release tomorrow.

• The Producer Price Index for April at 8:30 AM ET. The consensus is for no change in producer prices (0.2% increase in core).

• And at 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index is scheduled (preliminary for May). The consensus is for sentiment to decline to 76.2 from 76.4 in April.

Here are a couple of other sources for consumer confidence, with opposite readings. First from Gallup: U.S. Economic Confidence Steady at Relatively Improved Level

U.S. economic confidence for the week ending May 6 is at -18, up slightly from the previous week and slightly better than the -20 average for the month of April.And from IBD: U.S. Consumer Confidence Weakens in May

The IBD/TIPP Economic Optimism Index declined by 0.8 points, or 1.6%, in May posting 48.5 vs. 49.3 in April.• Of course the big stories tomorrow will be JPMorgan's $2 billion blunder, and the ongoing tragedy in Greece and Europe. It seems very likely that there will be another election in Greece on June 17th, from the Athens News:

Euro zone countries are prepared to keep financing Greece until the country forms a new government, whether one emerges from Sunday's election or if new elections have to be held next month, euro zone officials said on Thursday. "I expect an announcement of new elections in Greece by Sunday at the latest," one euro zone official said. "My understanding is that a second election in Greece could be by mid-June. We have the means to support Greece through the end of June," a second euro zone official said.

"We will provide enough funds for Greece to stay afloat for as long as the political decision is clarified," the first euro zone official said.

"There is no use letting them default in the middle of things. That is what yesterday was all about - giving them enough money to stay afloat and not induce new chaos if people are not paid, but not giving them more than the bare minimum to discourage parties which say that 'we can do whatever we want and they will still save us because it is in the EU's interest.'"

LPS: House Price Index increased 0.2% in February

by Calculated Risk on 5/10/2012 08:21:00 PM

Note: The timing of different house prices indexes can be a little confusing. LPS uses February closings only (not an average) and this tends to be closer to what other indexes report for March. The LPS index is seasonally adjusted.

From LPS: LPS Home Price Index Shows U.S. Home Price Increase of 0.2 Percent in February; Early Data Suggests Further Increase of 0.3 Percent is Likely During March

The updated LPS HPI national home price for transactions during February 2012 increased 0.2 percent to a level on par with those seen in June 2003 ...

"Our HPI shows an increase in seasonally adjusted prices this month for the first time since March 2010, and for only the third time in five years,” said Raj Dosaj, vice president of LPS Applied Analytics. “There have been signs of price declines slowing for a few months now, and our estimates for next month are flat to slightly positive. Without a pickup in sales volumes from their current anemic levels, it’s hard to be more optimistic that the market may be nearing the end of its fall.

“Reasons for caution are clear, as we’ve been here before. Non-seasonally adjusted prices increased for a few months in early 2009, 2010 and 2011 – trends that all ended by summer, after which all the gains – and then some – were lost. As is true this month, those temporary increases were on low sales volumes – about 30 percent lower than at any point since 1998. Furthermore, the inventory of distressed homes remains high, which will continue to put a drag on prices.”

Click on graph for larger image.

Click on graph for larger image. From LPS:

During the period of most rapid price declines, from April 2007 through April 2009, the LPS HPI national home price fell at an average annual rate of 9.3 percent. ... The slowest declining trend lasted from about April 2009 to April 2010, dates which are marked in Figure 1. ... The expiration of the first-time buyers’ tax incentive in April 2010 marks the start of a steadier decline in house prices. Figure 1 shows the trends for the three different post-bubble intervals.

JPM: $2 billion trading loss on synthetic credit position

by Calculated Risk on 5/10/2012 05:19:00 PM

At a special conference call, from the WSJ: J.P. Morgan To Host Surprise Conference Call. A few excerpts:

J.P. Morgan is now forecasting an $800 million loss in the corporate segment in the second quarter.

Dimon says the strategy was "Flawed complex poorly reviewed poorly executed and poorly monitored."

These were egregious mistakes, they were self-inflicted."- Dimon

Other headlines: "Obviously there was sloppiness" "Portofolio still has risk"