by Calculated Risk on 5/17/2012 07:17:00 PM

Thursday, May 17, 2012

Greece: Election is June 17th

The election is a month away and Europe will support Greece financially through the next election, but no one knows what will happen at the end of June.

Until the election, the campaign rhetoric will be global front page news. Syriza leader Alexis Tsipras seems to think that Greece can stay in the euro and also break the bailout agreement. His opponents say a vote for Syriza is a vote to exit the euro.

From the AthensNews: Judge to lead Greece to critical eurozone vote

A senior judge was put in charge of an emergency government on Wednesday to lead Greece to new elections on June 17 and bankers sought to calm public fears after the president said political chaos risked causing panic and a run on deposits.The "run" on Greek deposits started in 2010, and deposits were already down about one-third before the recent run started. There won't be much left on June 17th.

European leaders who once denied vociferously that they were fretting over Greece leaving their currency union have given up pretence. Asked if he was concerned about a Greek exit, European Central Bank chief Mario Draghi said simply: "No comment".

Citizens have been withdrawing hundreds of millions of euros from Greek banks in recent days, as the prospect of the country being forced out of the European Union's common currency zone seems ever more real ...

Right now Syriza is leading in the polls, but the election outcome is uncertain. From the WSJ: Greek Leftist Leader Throws Down Gauntlet on Debt

The head of Greece's radical left party says there is little chance Europe will cut off funding to the country and if it does, Greece will repudiate its debts ...I think Tsipras is both right and wrong. He is correct about the need for growth policies, but he might be misjudging the European policymakers who seem more and more willing to stop financing Greece.

A financial collapse in Greece would drag down the rest of the euro zone, says Alexis Tsipras, the 37-year-old head of ... Syriza ... Instead, he says, Europe must consider a more growth-oriented policy to arrest Greece's spiraling recession and address what he calls a growing "humanitarian crisis" facing the country.

"Our first choice is to convince our European partners that, in their own interest, financing must not be stopped," Mr. Tsipras said in an interview with The Wall Street Journal. "If we can't convince them—because we don't have the intention to take unilateral action—but if they proceed with unilateral action on their side, in other words they cut off our funding, then we will be forced to stop paying our creditors, to go to a suspension in payments to our creditors."

Many people are asking: Will this be a Lehman moment? US policymakers had many months to prepare for the collapse of Lehman, and the Bush administration was still unprepared when it happened. Are the policymakers in Europe ready for Greece leaving the euro? They sure haven't inspired confidence so far ...

Lawler: Early Read on Existing Home Sales in April

by Calculated Risk on 5/17/2012 03:47:00 PM

From economist Tom Lawler:

Based on local realtor/MLS reports I’ve seen so far, I estimate that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.53 million in April, up 1.1% from March’s pace, and up 7.9% from last April’s pace. As was the case in March, the “subdued” nature of April sales relative to “anecdotal” reports of significantly improved conditions in many markets across the country in part reflected the sized YOY decline in REO sales, which in turn were the result of sharply lower REO inventories.

On the inventory front, my and other’s tracking would suggest a monthly increase in the number of existing homes listing for sale of a bit over 2% in April. However, for some reason the NAR’s inventory number in April has for many years shown a much larger monthly gain than listings data might suggest, for reasons that aren’t clear to me. YOY, I’d estimate that existing home inventories were down by about 21% YOY in April, and if the NAR’s inventory number showed a 21% YOY decline, that would imply a monthly increase of around 6.8% (assuming March’s inventory number is not revised, though I suspect it will be revised upward a bit.)

On the median sales price front, the story for April was the sharp increase in the number of markets reporting YOY increases in median sales prices – in some areas some substantial gains. In many (though not all markets) one reason was substantial YOY declines in the “distressed” sales share of total sales, and especially declines in the foreclosure share of sales. In other areas, however, anecdotal evidence suggests that many areas were seeing “real” price increases, though one can’t rightly tell for sure based on median sales prices. Net, I estimate that the NAR’s median SF sales price will show a YOY increase of about 5.1% in April, which would be the largest YOY increase since May 2006. Of course, a 5.1% YOY gain in the SF MSP for April would still leave last months median sales price almost 26% below the median sales price in April 2006!

CR Note: As Lawler notes, the median sales price is impacted by the mix, so I use other measures to track prices.

Other measures of inventory suggest a much smaller increase in inventory in April. However, if reported inventory increases 6.8% that would be 2.53 million, with month-of-supply at 6.7 months, up from 6.3 in March.

The NAR is scheduled to report April existing home sales on Tuesday, May 22nd.

RealtyTrac: Foreclosure activity declined in April

by Calculated Risk on 5/17/2012 12:33:00 PM

This was released earlier this morning by RealtyTrac: U.S. Foreclosure Activity Shifts Eastward in April

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for April 2012, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 188,780 U.S. properties in April, the lowest monthly total since July 2007.First, by "Eastward", RealtyTrac really means a "shift to judicial foreclosure states".

April foreclosure activity decreased 5 percent from the previous month and was down 14 percent from April 2011. ...

"Rising foreclosure activity in many state and local markets in April was masked at the national level by sizable decreases in hard-hit foreclosure states like California, Arizona and Nevada,” said Brandon Moore, CEO of RealtyTrac. “Those three states, and several other non-judicial foreclosure states like them, more efficiently processed foreclosures last year, resulting in fewer catch-up foreclosures this year."

“In addition, more distressed loans are being diverted into short sales rather than becoming completed foreclosures,” Moore continued. “Our preliminary first quarter sales data shows that pre-foreclosure sales — typically short sales — are on pace to outnumber sales of bank-owned properties during the quarter in California, Arizona and 10 other states.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a repeat of a graph from the MBA showing the percent of loans in the foreclosure process by state. See: Q1 MBA National Delinquency Survey Comments. According to RealtyTrac, foreclosure activity is picking up in the judicial states - and most of those are in the east.

Note: Graph posted with permission.

Last month, RealtyTrac was saying "The [foreclosure] dam may not burst in the next 30 to 45 days, but it will eventually burst, and everyone downstream should be prepared for that to happen". It is still early, but they seem to be backing off the "dam bursting" a little. As I noted earlier this year, Some thoughts on housing and foreclosures:

One of the "givens" for 2012 is that the number of foreclosures will increase following the mortgage servicer settlement agreement. But I've been wondering just how big that increase will be ... the increase might be less than many people expect.I reviewed some of the reasons that there might not be a huge flood. It is still early, but a combination of more short sales, more modifications, REO-to-rentals (including banks holding more REOs as rentals), underwater homeowners refinancing with HARP, and the slow process in judicial states will probably keep this from being a massive flood.

Philly Fed: Regional manufacturing activity contracted in May Survey

by Calculated Risk on 5/17/2012 10:11:00 AM

From the Philly Fed: May 2012 Business Outlook Survey

Firms responding to the May Business Outlook Survey indicated that manufacturing growth fell back from the pace of recent months. The survey’s broad indicators for general activity fell into negative territory for the first time in eight months. Indicators for new orders and employment also suggested slight declines from April.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, fell from a reading of 8.5 in April to -5.8 in May. The index for new orders fell four points, from 2.7 to -1.2, its first negative reading in eight months.

...

The current employment index, which had been positive for eight consecutive months, decreased 19 points, to -1.3. ... Firms also reported a slight decrease in average hours worked compared with April.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The NY and Philly Fed surveys went in opposite directions this month. The NY Fed survey showed stronger expansion; the Philly Fed survey indicated contraction. The average of the Empire State and Philly Fed surveys declined in May, and is at the lowest level this year.

Weekly Initial Unemployment Claims at 370,000

by Calculated Risk on 5/17/2012 08:38:00 AM

The DOL reports:

In the week ending May 12, the advance figure for seasonally adjusted initial claims was 370,000, unchanged from the previous week's revised figure of 370,000. The 4-week moving average was 375,000, a decrease of 4,750 from the previous week's revised average of 379,750.The previous week was revised up from 367,000 to 370,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 375,000.

The 4-week average has declined for two consecutive weeks. The average has been between 363,000 and 384,000 all year.

And here is a long term graph of weekly claims:

This was above the consensus of 365,000.

Wednesday, May 16, 2012

Look Ahead: Weekly Unemployment Claims, Philly Fed Manufacturing Survey

by Calculated Risk on 5/16/2012 09:55:00 PM

On Thursday:

• The initial weekly unemployment claims report will be released at 8:30 AM. The consensus is for claims to be essentially unchanged at 365 thousand compared to 367 thousand last week. Based on the consensus (and the usual upward revision to the previous week), the 4-week average will probably decline to below 375 thousand.

• At 10:00 AM, the Philly Fed Survey for May is scheduled for release. The consensus is for a reading of 10.0, up from 8.5 last month (above zero indicates expansion). This is the 2nd regional Fed survey for May; the NY Fed (Empire state) survey indicated faster expansion in May.

• Also at 10:00 AM, the Conference Board Leading Indicators for April will be released. The consensus is for a 0.1% increase in this index.

Earlier:

• Housing Starts increase to 717,000 in April

• Industrial Production up in April, Capacity Utilization increases

• MBA: Mortgage Delinquencies decline in Q1

• Q1 MBA National Delinquency Survey Comments

Some thoughts on Apartments and Rents

by Calculated Risk on 5/16/2012 07:37:00 PM

Just over two years ago we started discussing how the environment was becoming more favorable for apartment owners. This was based on several factors:

• Favorable demographics: a large cohort was moving into the low 20s to mid-30s age group. (see graph of age groups at "Rents soar")

• There were a record low number of multi-family housing units being started, meaning very few completions in 2010 and 2011.

• A large number of families were losing their homes in foreclosure, or through a short sales, and many of these families were becoming renters. (limited new supply)

• The price-to-rent ratio favored renting.

Sure enough, the vacancy rate for apartments declined sharply over the last two years, and rents have been rising.

Looking forward, the environment will be a little less favorable for apartments owners in a year or two. Demographics will still be favorable for several more years, but it appears completions might start catching up to absorption in a year or two (based on some comments and projections today from Reis director of research Victor Canalog on a webinar).

Below is an update to a graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction are also important for employment).

This graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing since mid-2010. The 12 month total for completions (red line) is now following starts up. This suggests that completions (new supply) will increase sharply in 2013 and 2014, although this will still be below the level for the pre-bust period.

Other factors that might make the environment less favorable for apartment owners are:

• More investor buying of single family homes as rentals.

• Fewer foreclosures in 2013 and beyond.

• Wages not keeping up with rent increases.

• House prices are now back to "normal" levels in many areas based on rents. Further rent increases will start pushing more renters to buy (those that can qualify).

These are just some preliminary thoughts - right now conditions remain very favorable for apartment owners as indicated by the recent NMHC apartment survey and Reis quarterly survey.

Earlier:

• Housing Starts increase to 717,000 in April

• Industrial Production up in April, Capacity Utilization increases

• MBA: Mortgage Delinquencies decline in Q1

• Q1 MBA National Delinquency Survey Comments

AIA: Architecture Billings Index indicates contraction in April

by Calculated Risk on 5/16/2012 05:37:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Reverts to Negative Territory

After five months of positive readings, the Architecture Billings Index (ABI) has fallen into negative terrain. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI score was 48.4, following a mark of 50.4 in March. This score reflects a decrease in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 54.4, down from mark of 56.6 the previous month.

“Considering the continued volatility in the overall economy, this decline in demand for design services isn’t terribly surprising,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Also, favorable conditions during the winter months may have accelerated design billings, producing a pause in projects that have moved ahead faster than expected.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.4 in April. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This is just one month - and as Baker noted, this might be payback for the mild weather earlier in the year - but this suggests CRE investment will stay weak all year (it will be some time before investment in offices and malls increases).

Report: Housing Inventory declines 18.9% year-over-year

by Calculated Risk on 5/16/2012 04:27:00 PM

From Realtor.com: April 2012 Real Estate Data

On the national level, inventory of for-sale single family homes, condominiums, townhouses and co-ops declined by -18.85% in April 2012 compared to a year ago, and declined in all but five of the 146 markets covered by Realtor.com.Realtor.com also reports that inventory was up 2.0% from the March level.

Inventory usually increases seasonally from March to April. Over the last 11 years, the average increase was close to 9% since many people typically list their homes in the spring, hoping to move during the summer months. If the NAR also reports a 2% increase, this would be the smallest increase in inventory from March to April since the year 2000.

The NAR is scheduled to report April existing home sales and inventory on Tuesday, May 22nd. Economist Tom Lawler told me he expects to have a preliminary estimate of April existing home sales tomorrow.

Earlier:

• Housing Starts increase to 717,000 in April

• Industrial Production up in April, Capacity Utilization increases

• MBA: Mortgage Delinquencies decline in Q1

• Q1 MBA National Delinquency Survey Comments

FOMC Minutes: "Several members indicated that additional monetary policy accommodation could be necessary" if economy slows

by Calculated Risk on 5/16/2012 02:00:00 PM

The Fed's program to "extend the average maturity of its holdings of securities" (aka Operation Twist) is schedule to end in June. Now analysts are looking for clues about the possibility of QE3.

Although there was no discussion of easing alternatives, several members indicated they'd support additional monetary policy accommodation if the economy slows. This was an increase from a "couple" members in the previous meeting.

From the Fed: Minutes of the Federal Open Market Committee, April 24-25, 2012 . Excerpt:

Several members indicated that additional monetary policy accommodation could be necessary if the economic recovery lost momentum or the downside risks to the forecast became great enough.Earlier:

• Housing Starts increase to 717,000 in April

• Industrial Production up in April, Capacity Utilization increases

• MBA: Mortgage Delinquencies decline in Q1

• Q1 MBA National Delinquency Survey Comments

Q1 MBA National Delinquency Survey Comments

by Calculated Risk on 5/16/2012 11:19:00 AM

A few comments from Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education, and Michael Fratantoni, MBA's Vice President, Vice President of Research and Economics, on the conference call.

• All delinquency categories were down in Q1, both seasonally adjusted (SA) and NSA.

• The 30 day delinquency rate is back to normal (at the long term average). (This means a normal amount of loans are going delinquent each month)

• This was the largest quarter-to-quarter drop in delinquencies in history (there is usually a large seasonal drop in Q1, but this was larger than normal).

• The biggest problem is the number of loans in the foreclosure process. This is primarily a problem in states with a judicial foreclosure process. States like California and Arizona are now below the national average of percent of loans in the foreclosure process.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (14.31% in foreclosure), New Jersey (8.37%), Illinois (7.46%), Nevada (the only non-judicial state in the top 10 at 6.47%), and New York (6.17%).

As Jay Brinkmann noted, California (3.29%) and Arizona (3.57%) are now below the national average and improving quickly.

The second graph shows the percent of loans delinquent by days past due.

The second graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.13% from 3.22% in Q4. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.21% in Q1, from 1.25% in Q4. This is the lowest level since Q4 2007.

There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.06% from 3.11% in Q4 2011. This is the lowest level since 2008, but still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process increased slightly to 4.39% from 4.38%.

A final comment: I asked about the impact of the mortgage settlement (signed on April 5th, after Q1 ended). Jay Brinkmann said that servicers might have been waiting for the settlement and that might have "built up" the in-foreclosure rate in Q1. The two key categories to watch for the impact of the settlement are the in-foreclosure and 90+ days delinquent buckets.

To reiterate: the key problem remains the very high level of seriously delinquent loans and loans in the foreclosure process.

Note: the MBA's National Delinquency Survey (NDS) covers about "42.8 million first-lien mortgages on one- to four-unit residential properties" and is "estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives about 5.7 million loans delinquent or in the foreclosure process.

MBA: Mortgage Delinquencies decline in Q1

by Calculated Risk on 5/16/2012 10:02:00 AM

The MBA reported that 11.79 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2012 (delinquencies seasonally adjusted). This is down from 11.96 percent in Q4 2011 and is the lowest level since 2008.

From the MBA: Delinquencies Decline in Latest MBA Mortgage Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 7.40 percent of all loans outstanding as of the end of the first quarter of 2012, a decrease of 18 basis points from the fourth quarter of 2011, and a decrease of 92 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased 121 basis points to 6.94 percent this quarter from 8.15 percent last quarter.Note: 7.40% (SA) and 4.39% equals 11.79%.

The percentage of loans on which foreclosure actions were started during the fourth quarter was 0.96 percent, down three basis points from last quarter and down 12 basis points from one year ago. The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 4.39 percent, up one basis point from the fourth quarter and 13 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.44 percent, a decrease of 29 basis points from last quarter, and a decrease of 66 basis points from the first quarter of last year.

...

“Mortgage delinquencies normally fall during the first quarter of the year, but the declines we saw were even greater than the normal seasonal adjustments would predict, so delinquencies are clearly continuing to improve. Newer delinquencies, loans one payment past due as of March 31, are down to the lowest level since the middle of 2007, indicating fewer new problems we will need to deal with in the future. The percentage of loans three payments or more past due, the loans that represent the backlog of problems that still need to be handled, is down to the lowest level since the end of 2008. Foreclosure starts are at their lowest level since the end of 2007,” said Michael Fratantoni, MBA's Vice President of Research and Economics.

...

"The problem continues to be the slow-moving judicial foreclosure systems in some of the largest states. While the rate of foreclosure starts is essentially the same in judicial and non-judicial foreclosure states, the percent of loans in the foreclosure process has reached another all-time high in the judicial states, 6.9 percent. In contrast, that rate has fallen to 2.8 percent in non-judicial states, the lowest since early 2009. As the foreclosure starts rate is essentially the same in both groups of states, that difference is due entirely to the systems some states have in place that effectively block timely resolution of non-performing loans and is not an indicator of the fundamental health of the housing market or the economy. In fact, hard-hit markets like Arizona that have moved through their foreclosure backlog quickly are seeing home price gains this spring."

I'll have more later after the conference call this morning.

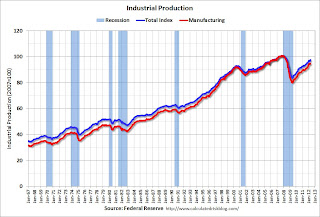

Industrial Production up in April, Capacity Utilization increases

by Calculated Risk on 5/16/2012 09:33:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.1 percent in April. Output is now reported to have fallen 0.6 percent in March and to have moved up 0.4 percent in February; previously, industrial production was estimated to have been unchanged in both months. Manufacturing output increased 0.6 percent in April after having decreased 0.5 percent in March. Excluding motor vehicles and parts, which increased nearly 4 percent, manufacturing output moved up 0.3 percent, and output for all but a few major industries increased. Production at mines rose 1.6 percent, and the output of utilities gained 4.5 percent after unseasonably warm weather in the first quarter held down demand for heating. At 97.4 percent of its 2007 average, total industrial production for April was 5.2 percent above its year-earlier level. The rate of capacity utilization for total industry moved up to 79.2 percent, a rate 3.1 percentage points above its level from a year earlier but 1.1 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.2% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in April to 97.4. March was revised down (so the month-to-month increase was greater than expected), and February was revised up.

The consensus was for a 0.5% increase in Industrial Production in April, and for an increase to 79.0% (from 78.7%) for Capacity Utilization. This was above expectations.

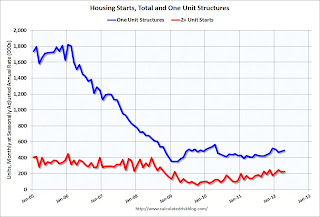

Housing Starts increase to 717,000 in April

by Calculated Risk on 5/16/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 717,000. This is 2.6 percent (±14.8%)* above the revised March estimate of 699,000 and is 29.9 percent (±15.2%) above the revised April 2011 rate of 552,000.

Single-family housing starts in April were at a rate of 492,000; this is 2.3 percent (±11.9%)* above the revised March figure of 481,000. The April rate for units in buildings with five units or more was 217,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 715,000. This is 7.0 percent (±1.0%) below the revised March rate of 769,000, but is 23.7 percent (±1.9%) above the revised April 2011 estimate of 578,000.

Single-family authorizations in April were at a rate of 475,000; this is 1.9 percent (±1.1%) above the revised March figure of 466,000. Authorizations of units in buildings with five units or more were at a rate of 217,000 in April.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 717 thousand (SAAR) in April, up 2.6% from the revised March rate of 699 thousand (SAAR). Note that March was revised up sharply from 654 thousand.

Single-family starts increased 2.3% to 492 thousand in April. March was revised up to 481 thousand from 462 thousand.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up 50% from the bottom, and single family starts are up 39% from the low.

This was above expectations of 690 thousand starts in April, and was especially strong given the upward revisions to prior months.

The housing recovery continues.

Tuesday, May 15, 2012

Look Ahead: Housing Starts, Industrial Production, Mortgage Delinquencies, FOMC Minutes

by Calculated Risk on 5/15/2012 09:16:00 PM

Wednesday will be another busy day:

• Housing starts for April will be released at 8:30 AM. Total housing starts were at 654,000 in March, on a seasonally adjusted annual rate basis (SAAR), and single-family starts were at 462,000. This was a decline from the February rate, but most of the decline was related to the volatile multi-family sector. Based on housing permits, starts probably rebounded in April. The consensus is for total housing starts to increase to 690,000 (SAAR) in April.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 0.5% increase in Industrial Production in April, and for Capacity Utilization to increase to 79.0% (from 78.6%).

• At 10:00 AM, the Mortgage Bankers Association (MBA) is scheduled to release the 1st Quarter 2012 National Delinquency Survey (NDS). This provides a breakdown of mortgage delinquencies by number of days delinquent, type of loan, and by state. Since the mortgage settlement was signed off on April 5th, there probably wasn't any impact on Q1 delinquencies. I'll be on the conference call at 10:30 AM and pass along any comments about the settlement, HARP, house prices, etc.

• At 2 PM, the FOMC Minutes for the meeting of April 24-25 will be released. From Goldman Sachs on things to look for:

We expect that the April FOMC minutes ... will include a discussion of possible easing options. ... The first set of options center around the Fed's balance sheet, and we think that the discussion might include the benefits of mortgage purchases, the potential for more “twisting,” and the pros and cons of sterilized asset purchases.• Also on Wednesday, the MBA will release the weekly mortgage applications survey, and the AIA will release the Architecture Billings Index for April (a leading indicator for commercial real estate).

For the monthly economic question contest:

Misc: NY Fed Manufacturing Survey, Remodeling Index

by Calculated Risk on 5/15/2012 05:49:00 PM

A couple of releases earlier this morning ...

• From the NY Fed: May Empire State Manufacturing Survey indicates manufacturing activity expanded at a moderate pace

The May Empire State Manufacturing Survey indicates that manufacturing activity expanded in New York State at a moderate pace. The general business conditions index rose eleven points to 17.1. The new orders index inched up to 8.3, and the shipments index shot up eighteen points to 24.1. ... Employment index readings remained relatively healthy, suggesting that employment levels and hours worked continued to expand. ... The index for number of employees was little changed at 20.5, and the average workweek index rose six points to 12.1.This was above the consensus forecast of 10.0, up from 6.6 in April (above zero is expansion).

• From BuildFax:

Residential remodels authorized by building permits in the United States in March were at a seasonally-adjusted annual rate of 2,781,000. This is 1 percent below the revised February rate of 2,811,000 and is 10 percent above the March 2011 estimate of 2,522,000.Even with the decline in March, the remodeling in is up 10% year-over-year.

"Overall, March 2012 had lower remodeling activity than February, which saw significantly greater-than-expected activity, likely due to the unseasonably warm winter weather," said Joe Emison, Vice President of Research and Development at BuildFax.

The BuildFax Remodeling Index (BFRI) is based on construction permits for residential remodeling projects filed with local building departments across the country. The index estimates the number of properties permitted. The national and regional indexes are based upon a subset of representative building departments in the U.S. and population estimates from the U.S. Census. The BFRI is seasonally-adjusted using the X12 procedure.

Lawler: Update Table of Short Sales and Foreclosures for Selected Cities

by Calculated Risk on 5/15/2012 03:12:00 PM

CR Note: Last week I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler sent me the updated table below for several other distressed areas. For all of these areas, the share of distressed sales is down from April 2011 - and for the areas that break out short sales, the share of short sales has increased and the share of foreclosure sales are down - and down significantly in some areas.

In five of the seven cities that break out short sales, there are now more short sales than foreclosure sales!

Economist Tom Lawler also wrote today: Plunge in Foreclosures Pushes Up REO Prices/Down REO Price Discounts

ForeclosureRadar released its April Foreclosure Report, which covers foreclosure activity in Arizona, California, Nevada, Oregon, and Washington. According to the report, foreclosure starts fell sharply in April in all five states, and completed foreclosure sales declined in all five states, with sizable drops from March in all states save for Washington. And in Arizona, California, and Nevada, record high percentages (44.6%, 41,1%, and 50.7%) of completed foreclosure sales were sold to third parties, rather than becoming bank REO. In its write-up, FR lamented that “we are seeing unprecedented government intervention into the foreclosure process leaving underwater homeowners in limbo, while stealing opportunity from investors and first time buyers." In discussing the “stolen opportunities,” FR noted that “In both Arizona and Nevada winning bids on the courthouse steps on average equal the current estimated value of those properties,” and that “(i)n California the discount between market value and winning bid have on average declined to 12.3 percent” – substantially lower than a year ago. According to FR, “(t)his leaves investors who intend to resell their purchases with record low profits after eviction, repairs, and closing costs.”

An increasing number of investors, of course, are buying REO with plans to rent the properties out, which has not only intensified demand but has reduced the supply of homes offered for sale.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Apr | 11-Apr | 12-Apr | 11-Apr | 12-Apr | 11-Apr | |

| Las Vegas | 29.9% | 23.8% | 36.9% | 46.3% | 66.8% | 70.1% |

| Reno | 32.0% | 31.0% | 26.0% | 38.0% | 58.0% | 69.0% |

| Phoenix | 25.2% | 19.7% | 18.8% | 44.5% | 44.0% | 64.2% |

| Sacramento | 30.4% | 22.2% | 30.3% | 44.6% | 60.7% | 66.8% |

| Minneapolis | 10.9% | 10.0% | 32.0% | 43.3% | 42.9% | 53.3% |

| Mid-Atlantic (MRIS) | 12.2% | 11.8% | 11.0% | 20.9% | 23.2% | 32.7% |

| Orlando | 29.4% | 25.4% | 25.5% | 40.2% | 54.9% | 65.6% |

| Northeast Florida | 38.1% | 50.3% | ||||

| Hampton Roads | 31.0% | 35.0% | ||||

Key Measures of Inflation in April

by Calculated Risk on 5/15/2012 11:52:00 AM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in April on a seasonally adjusted basis ... The gasoline index fell 2.6 percent in April and accounted for most of the decline in energy, though the indexes for natural gas and fuel oil decreased as well. ... The index for all items less food and energy rose 0.2 percent in April, the same increase as in March.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in April. The 16% trimmed-mean Consumer Price Index increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here.

...

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was flat at 0.0% (0.4% annualized rate) in April. The CPI less food and energy increased 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.3%, and core CPI rose 2.3%. Core PCE is for March and increased 2.0% year-over-year.

These measures show inflation on a year-over-year basis is mostly still above the Fed's 2% target.

NAHB Builder Confidence increases in May, Highest since May 2007

by Calculated Risk on 5/15/2012 10:05:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased 5 points in May to 29. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Five Points in May

Builder confidence in the market for newly built, single-family homes gained five points in May from a downwardly revised reading in the previous month to reach a level of 29 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This is the index’s strongest reading since May of 2007.

“Builders in many markets are reporting that buyer traffic and sales have picked back up after a pause this April,” said Barry Rutenberg, chairman of the National Association of Home Builders (NAHB) and a home builder from Gainesville, Fla. “It seems we have resumed the gradual upward trend in confidence that started at the beginning of this year, as stabilizing prices and excellent affordability encourage more people to pursue a new-home purchase.”

“While home building still has quite a way to go toward a fully healthy market, the fact that the HMI has returned to trend is an excellent sign that firming home values, improving employment and low mortgage rates are drawing consumers back,” said NAHB Chief Economist David Crowe.

...

Each of the index’s components rebounded from declines in the previous month. The component gauging current sales conditions and the component gauging traffic of prospective buyers each rose five points in May to 30 and 23, respectively, with the traffic component hitting its highest level since April of 2007. The component gauging sales expectations in the next six months rose three points to 34.

Three out of four regions registered improving builder sentiment in May. This included a six-point gain to 32 in the Northeast, and five-point gains to 27 and 28 in the Midwest and South, respectively. The West posted a two-point decline, to 29.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the May release for the HMI and the March data for starts (April housing starts will be released tomorrow).

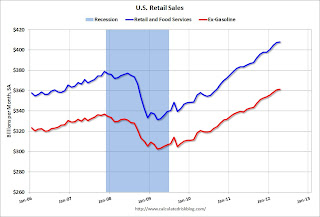

Retail Sales increased 0.1% in April

by Calculated Risk on 5/15/2012 08:47:00 AM

On a monthly basis, retail sales were up 0.1% from March to April (seasonally adjusted), and sales were up 6.4% from April 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $408.0 billion, an increase of 0.1 percent from the previous month and 6.4 percent above April 2011.Ex-autos, retail sales also increased 0.1% in April.

Click on graph for larger image.

Click on graph for larger image.Sales for March was revised down to a 0.7% increase from 0.8%, and February was revised down to 1.0% from 1.1%.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 23.1% from the bottom, and now 7.7% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.4% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.4% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.4% on a YoY basis (6.4% for all retail sales). Retail sales ex-gasoline increased 0.2% in April.

This was at the consensus forecast for retail sales of a 0.1% increase in April, and below the consensus for a 0.2% increase ex-auto.

This was at the consensus forecast for retail sales of a 0.1% increase in April, and below the consensus for a 0.2% increase ex-auto.