by Calculated Risk on 5/22/2012 10:00:00 AM

Tuesday, May 22, 2012

Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

The NAR reports: April Existing-Home Sales Up, Prices Rise Again

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 3.4 percent to a seasonally adjusted annual rate of 4.62 million in April from a downwardly revised 4.47 million in March, and are 10.0 percent higher than the 4.20 million-unit level in April 2011.

...

Total housing inventory at the end of April rose 9.5 percent to 2.54 million existing homes available for sale, a seasonal increase which represents a 6.6-month supply at the current sales pace, up from a 6.2-month supply in March. Listed inventory is 20.6 percent below a year ago when there was a 9.1-month supply; the record for unsold inventory was 4.04 million in July 2007.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April 2012 (4.62 million SAAR) were 3.4% higher than last month, and were 10.00% above the April 2011 rate.

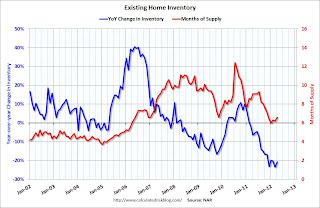

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.54 million in April from the downwardly revised 2.32 million in March (revised down from 2.40 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory increased to 2.54 million in April from the downwardly revised 2.32 million in March (revised down from 2.40 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.Months of supply was increased to 6.6 months in April.

This was slightly below expectations of sales of 4.66 million. I'll have more soon ...

New Push for Eurozone Bonds

by Calculated Risk on 5/22/2012 08:48:00 AM

From the Financial Times: OECD joins call for eurozone bonds

The Organization for Economic Co-operation and Development has joined French and EU officials in calling for a move towards jointly-guaranteed euro bonds ...Earlier from the Financial Times: France to push for eurozone bonds

Speaking to the Financial Times, Pier Carlo Padoan, the OECD deputy secretary general and chief economist, said fiscal consolidation alone without other elements of a “growth compact” could ruin chances of a longer-term economic union.

“We need to get on the path towards the issuance of euro bonds sooner rather than later,” he said.

excerpts with permission

France is determined to push the idea of jointly guaranteed bonds as a new form of borrowing for eurozone countries despite Germany’s opposition, Pierre Moscovici, finance minister, said in Berlin on Monday.Update: From the WSJ: IMF Chief, OECD Call For More Euro Debt Sharing

Speaking after a first intensive meeting with Wolfgang Schäuble, his German counterpart, Mr Moscovici confirmed that François Hollande, the newly elected French president, would include the concept as part of a package of growth measures to be debated by European leaders at an informal summit on Wednesday.

International Monetary Fund head Christine Lagarde Tuesday called on euro-zone governments to accept more common liability for each other's debts, saying that the region urgently needs to take further steps to contain the crisis.

"We consider that more needs to be done, particularly by way of fiscal liability-sharing, and there are multiple ways to do that," Ms. Lagarde told a press conference in London to mark the completion of a regular review of U.K. finances.

Monday, May 21, 2012

Look Ahead: Existing Home Sales

by Calculated Risk on 5/21/2012 09:31:00 PM

• Existing home sales for April will be released by the National Association of Realtors (NAR) at 10 AM ET. Existing home sales were at a 4.48 million seasonally adjusted annual rate in March, and the consensus is that sales increased to 4.66 million in April. Housing economist Tom Lawler is forecasting the NAR will report sales of 4.53 million.

Inventory will be closely watched. The NAR reported inventory at 2.37 million in March, and usually inventory increases sharply in April. The median increase from March to April over the last 10 years was 8%. Other sources suggest a smaller than normal seasonal increase, but as Tom Lawler noted last week: "for some reason the NAR’s inventory number in April has for many years shown a much larger monthly gain than listings data might suggest ...", and Lawler is projecting the NAR will report a 6.8% increase for April.

• Also at 10:00 AM, the Richmond Fed will release the regional Survey of Manufacturing Activity for May. The consensus is for a decrease to 11 for this survey from 14 in April (above zero is expansion).

For the monthly economic question contest:

LPS: Mortgage delinquencies increased slightly in April

by Calculated Risk on 5/21/2012 04:45:00 PM

LPS released their First Look report for April today. LPS reported that the percent of loans delinquent increased slightly in April from March, and declined year-over-year. The percent of loans in the foreclosure process was unchanged and remained at a very high level.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.12% from 7.09% in March. The percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.97%, so delinquencies have fallen over half way back to normal. Note: There is a seasonal pattern for delinquencies, and it is not unusual to see an increase in April after a sharp decline in March.

The following table shows the LPS numbers for April 2012, and also for last month (March 2012) and one year ago (April 2011).

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Apr-12 | Mar-12 | Apr-11 | |

| Delinquent | 7.12% | 7.09% | 7.97% |

| In Foreclosure | 4.14% | 4.14% | 4.14% |

| Number of loans: | |||

| Loans Less than 90 days | 1,927,000 | 1,888,000 | 2,243,000 |

| Loans More than 90 days | 1,595,000 | 1,643,000 | 1,961,000 |

| Loans In foreclosure | 2,048,000 | 2,060,000 | 2,184,000 |

| Total | 5,570,000 | 5,591,000 | 6,388,000 |

The number of delinquent loans is down about 16% year-over-year (682,000 fewer mortgages delinquent), and the number of loans in the foreclosure process is down 136,000 year-over-year (the percent in foreclosure is unchanged, but the number of total loans has declined).

The percent of loans less than 90 days delinquent is about normal, but the percent (and number) of loans 90+ days delinquent and in the foreclosure process are still very high.

DOT: Vehicle Miles Driven increased 0.9% in March

by Calculated Risk on 5/21/2012 02:34:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by +0.9% (2.3 billion vehicle miles) for March 2012 as compared with March 2011. Travel for the month is estimated to be 251.4 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Even with the year-over-year increase in March, the rolling 12 month total is mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 52 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

This is the fourth consecutive month with a year-over-year increase in miles driven.

This is the fourth consecutive month with a year-over-year increase in miles driven.Even though gasoline prices were up sharply earlier this year, prices also increased quickly last year in March and April - so we might not see a year-over-year decline in miles driven in the coming months.

The lack of growth in miles driven over the last 4+ years is probably due to a combination of factors: the great recession and the lingering effects, the high price of gasoline - and the aging of the overall population.

As I noted last month, HS Dent has a graph of gasoline demand by age (see page 13 of Age of Consumer demand curves based on Census Bureau data) - and this data shows that gasoline demand peaks around age 50 and then starts to decline. So the flattening of miles driven is probably, at least partially, another impact from the aging of the baby boomers (ht Brian).

FNC: Residential Property Values increase 0.5% in March

by Calculated Risk on 5/21/2012 11:18:00 AM

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and RadarLogic indexes.

FNC released their March index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.5% in March (Composite 100 index). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased about 0.8% in March. These indices are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year trends continued to show improvement in March, with the Composite 100 index down only 2.4% compared to March 2011. This is the smallest year-over-year decline in the FNC index since 2007.

The year-to-year declines in the largest housing markets, as indicated by the 10- and 30-MSA composites, are now below 3.0%, the slowest year-over-year decline since 2007.

Click on graph for larger image.

Click on graph for larger image.

This graph is based on the FNC index (four composites) through March 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The indexes are showing less of a year-over-year decline in March. If house prices have bottomed, the year-over-year decline should turn positive later this year or early in 2013.

The March Case-Shiller index will be released next Tuesday.

Chicago Fed: Economic growth near historical trend in April

by Calculated Risk on 5/21/2012 08:44:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic activity increased in April

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.11 in April from –0.44 in March. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, ticked down to –0.06 in April from +0.02 in March, falling below zero for the first time since November 2011. April’s CFNAI-MA3 suggests that growth in national economic activity was near its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests growth was near trend in April.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, May 20, 2012

Sunday Night Futures

by Calculated Risk on 5/20/2012 10:49:00 PM

There are no major economic releases scheduled for Monday. Atlanta Fed President Dennis Lockhart speaks in Tokyo on monetary policy at 5:15 AM ET, and at 8:30 AM, the Chicago Fed National Activity Index for April is scheduled to be released.

The Asian markets are mixed tonight. The Nikkei is up about 0.3%, and the Shanghai Composite is down 0.4%. On China, here is a worrisome article from the Financial Times: China buyers defer raw material cargos

Chinese consumers of thermal coal and iron ore are asking traders to defer cargos and – in some cases – defaulting on their contracts, in the clearest sign yet of the impact of the country’s economic slowdown on the global raw materials markets.From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up about 5, and Dow futures are up 40.

The deferrals and defaults have only emerged in the last few days ...

Excerpt with permission

Oil: WTI futures are down to $91.49 (this is down from $109.77 in February) and Brent is at $107.24 per barrel.

Yesterday:

• Summary for Week Ending May 18th

• Schedule for Week of May 20th

For the monthly economic question contest (for data to be released Tuesday, Wednesday and Friday):

Comment: We need more and better data, not less

by Calculated Risk on 5/20/2012 02:32:00 PM

The Depression led to an effort to enhance and expand data collection on employment, and I was hoping the housing bubble and bust would lead to a similar effort to collect better housing related data. From the BLS history:

[T]he growing crisis [the Depression], spurred action on improving employment statistics. In July [1930], Congress enacted a bill sponsored by Senator Wagner directing the Bureau to "collect, collate, report, and publish at least once each month full and complete statistics of the volume of and changes in employment." Additional appropriations were provided.In the early stages of the Depression, policymakers were flying blind. But at least they recognized the need for better data, and took action. All business people know that when there is a problem, a key first step is to measure the problem. That is why I've been a strong supporter of trying to improve data collection on the number of households, vacant housing units, foreclosures and more.

But unfortunately some people want to eliminate a key source of data ...

From Matthew Philips at Businessweek: Killing the American Community Survey Blinds Business

On May 9 the House voted to kill the American Community Survey, which collects data on some 3 million households each year and is the largest survey next to the decennial census. The ACS—which has a long bipartisan history, including its funding in the mid-1990s and full implementation in 2005—provides data that help determine how more than $400 billion in federal and state funds are spent annually. Businesses also rely heavily on it to do such things as decide where to build new stores, hire new employees, and get valuable insights on consumer spending habits. Check out this video of Target (TGT) executives talking about how much they use ACS data.From Catherine Rampell at the NY Times: The Beginning of the End of the Census?

“This is a program that intrudes on people’s lives, just like the Environmental Protection Agency or the bank regulators,” said Daniel Webster, a first-term Republican congressman from Florida who sponsored the relevant legislation.The good news is this vote is being criticized across the political spectrum ...

“We’re spending $70 per person to fill this out. That’s just not cost effective,” he continued, “especially since in the end this is not a scientific survey. It’s a random survey.”

In fact, the randomness of the survey is precisely what makes the survey scientific, statistical experts say.

From the WSJ: Republicans try to kill data collection that helps economic growth

The House voted 232 to 190 to abolish the Census's American Community Survey, or ACS, which is the new version of the long-form questionnaire and is conducted annually. Republicans claim the long form—asking about everything from demographics to income to commuting times—is prying into private life and is unconstitutional.From the NY Times: Operating in the Dark

In fact, the ACS provides some of the most accurate, objective and granular data about the economy and the American people, in something approaching real time. Ideally, Congress would use the information to make good decisions. Or economists and social scientists draw on the resource to offer better suggestions. Businesses also depend on the ACS's county-by-county statistics to inform investment and hiring decisions. As the great Peter Drucker had it, you can't manage or change what you don't measure.

...

Since the political class is attempting to define the GOP as insane and redefine "moderation" as anything President Obama favors, Republicans do themselves no favors by targeting a useful government purpose.

The Web site of Representative Daniel Webster, Republican of Florida, instructs visitors to click on a link for “Census data for the 8th district” to learn about the area’s economy, businesses, income, employment, homeownership and other important features. And yet, on Wednesday, Mr. Webster declared that the Census Bureau’s American Community Survey — the source for much of that data — is an unconstitutional breach of privacy.From AEI's Norman Ornstein at Roll Call: Research Cuts Are Akin to Eating Seed Corn

significant was the House vote to eliminate the annual American Community Survey and the Economic Census to provide basic information on the state of businesses and industries in the country and data used for generating quarterly gross domestic product estimates.From the WaPo: The American Community Survey is a count worth keeping

If ever we need evidence of ideology run rampant, these actions become exhibit A. Learning about the population and about the economy are fundamental for a society to understand where it has been and where it is going ...

Every year, the Census Bureau asks 3 million American households to answer questions on age, race, housing and health to produce timely information about localities, states and the country at large. This arrangement began as a bipartisan improvement on the decennial census. Yet last week the Republican-led House voted to kill the ACS. This is among the most shortsighted measures we have seen in this Congress, which is saying a lot.And from Menzie Chinn at Econonbrowser: The War on Data Collection

Pretty sad. The only good news is this vote was condemned across the political spectrum.

The Real Estate Agent Bust

by Calculated Risk on 5/20/2012 10:48:00 AM

Way back in 2005, I posted a graph of "the Real Estate Agent Boom". I saw the following article, and decided to update the graph of the number of real estate licensees in California.

Eric Wolff at the NC Times writes: Real estate agents bailing out, except in Southwest Riverside County

Real estate agents are getting out of the profession in California ---- except in Southwest Riverside County, according to the California Department of Real Estate and the Southwest Riverside County Association of Realtors.

A housing crunch left real estate agents faced with selling houses for less than what homeowners owed in mortgages, working with lenders suddenly terrified to give out loans, and otherwise battling headwinds that dramatically reduced their sales.

For many agents, especially those attracted by a housing boom that made the profession seem like easy money, that meant it was time to leave. But in Southwest Riverside County, a few people decided a slow market was just the time to jump in.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the number of real estate licensees in California. The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 29% from the peak, and has fallen to 2004 levels. But brokers' licenses are only off 7% and has only fallen to early 2007 levels. Even if activity and prices have bottomed, the number of agents will probably continue to decline.

Yesterday:

• Summary for Week Ending May 18th

• Schedule for Week of May 20th

Saturday, May 19, 2012

Unofficial Problem Bank list increases to 928 Institutions

by Calculated Risk on 5/19/2012 09:53:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 18, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The OCC released its actions through mid-April 2012, which contributed to many changes in the Unofficial Problem Bank List. For the week, there were eight additions and four removals that leave the list with 928 institutions and assets of $361.9 billion. The list is up from 924 institutions last week, which represents the first weekly count increase since February 24th, a period of 11 weeks. A year ago, the list held 988 institutions with assets of $423.8 billion.Earlier:

Among the removals is the failed Alabama Trust Bank, National Association, Sylacauga, AL ($56 million). There were two action terminations -- National Bank of Commerce, Birmingham, AL ($426 million) and BankTennessee, Collierville, TN ($247 million). The Peoples National Bank, Easley, SC ($324 million Ticker: PBCE) was removed because of an unassisted merger.

The eight additions this week are Sterling Bank and Trust, FSB, Southfield, MI ($762 million); The First National Bank of Talladega, Talladega, AL ($421 million); First Federal Bank Texas, Tyler, TX ($212 million Ticker: FFBT); Bank of St. Augustine, Saint Augustine, FL ($186 million); The First National Bank of Wamego, Wamego, KS ($159 million); The First National Bank of Hartford, Hartford, IL ($146 million); The First National Bank of Paducah, Paducah, TX ($56 million); and Flint River National Bank, Camilla, GA ($27 million). Flint River was removed from the list on April 20th when the OCC terminated an Formal Agreement, but the removal was inadvertent as they subsequently put the bank under a Consent Order.

Next week, we anticipate the FDIC will release the 2012q1 Official Problem Bank List and its enforcement actions through April 2012.

• Summary for Week Ending May 18th

• Schedule for Week of May 20th

Quarterly Housing Starts by Intent compared to New Home Sales

by Calculated Risk on 5/19/2012 06:00:00 PM

We can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The Q1 2012 quarterly report was released this week and showed there were 77,000 single family starts, built for sale, in Q1 2012, and that was below the 83,000 new homes sold for the same quarter (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 17% compared to Q1 2011. Usually Q2 is the strongest quarter seasonally, and single family starts, built for sale, will probably be close to 100 thousand in Q2 - the highest level since 2008.

Owner built starts were up 30% year-over-year from a record low in Q1 2011. And condos built for sale are still near the record low.

The 'units built for rent' has increased significantly and is up about 41% year-over-year.

The second graph shows the difference (quarterly) between single family starts, built for sale and new home sales.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory they had built up in 2005 and 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory they had built up in 2005 and 2006.For the last 2+ years, the builders have sold a few more homes than they started, and inventory levels are now at record lows. In Q1, builders started 6 thousand fewer homes than they sold.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories.

Earlier:

• Summary for Week Ending May 18th

• Schedule for Week of May 20th

Schedule for Week of May 20th

by Calculated Risk on 5/19/2012 01:31:00 PM

Earlier:

• Summary for Week Ending May 18th

There are two key housing reports to be released this week: April existing home sales on Tuesday, and April new home sales on Wednesday.

Other key reports include durable goods on Thursday, and two regional manufacturing surveys.

Note: The FDIC might release the Q1 Quarterly Bank Profile this week.

5:15 AM ET: Atlanta Fed President Dennis Lockhart speaks in Tokyo on monetary policy.

8:30 AM: Chicago Fed National Activity Index (April). This is a composite index of other data.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 4.66 million on seasonally adjusted annual rate (SAAR) basis. Sales in March 2012 were 4.48 million SAAR.

Housing economist Tom Lawler is forecasting the NAR will report sales of 4.53 million in April.

A key will be inventory and months-of-supply.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May. The consensus is for a decrease to 11 for this survey from 14 in April (above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

10:00 AM ET: New Home Sales for April from the Census Bureau.

10:00 AM ET: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an increase in sales to 335 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 328 thousand in March. This might be a little low based on recent builder comments and reports, and the homebuilder confidence survey. Watch for upward revisions to prior reports.

10:00 AM: FHFA House Price Index for March 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to be essentially unchanged at 371 thousand compared to 370 thousand last week.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

10:30 AM: New York Fed President William C. Dudley will speak on the regional economy and participate in a Q&A session with media. The New York Fed might release the Q1 2012 Report on Household Debt and Credit

11:00 AM: Kansas City Fed regional Manufacturing Survey for May. The index was at 3 in April (above zero is expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for May). The consensus is for no change from the preliminary reading of 77.8.

SIFMA recommends US markets close at 2:00 PM ET in advance of the Memorial Day Holiday on May 28th.

Summary for Week of May 18th

by Calculated Risk on 5/19/2012 08:27:00 AM

The headlines last week were once again mostly about Europe and Greece, especially the possibility of Greece exiting the euro (aka "Grexit") after the next election on June 17th. The outcome of the election is uncertain, although most Greeks and European policymakers would like Greece to stay in the euro. One thing is certain, Greece will be in the headlines for at least another month.

Most of the US economic data was at or above expectations last week. An exception was the Philly Fed manufacturing survey, but that was partially offset by faster expansion in the Empire State survey.

Housing starts were solid as the slow housing recovery continues. Industrial production and capacity utilization increased, and the mortgage deliquencies are trending down.

The US economy remains sluggish. However, excluding Europe (and other international issues), the outlook would be improving. Two key questions are: what will happen in Greece and Europe? and how will that impact the US economy? I'll try to add some thoughts soon, but even with the problems in Europe, a recession in the US seems unlikely this year.

Here is a summary in graphs:

• Housing Starts increased to 717,000 in April

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 717 thousand (SAAR) in April, up 2.6% from the revised March rate of 699 thousand (SAAR). Note that March was revised up sharply from 654 thousand to 699 thousand..

Single-family starts increased 2.3% to 492 thousand in April. March was revised up to 481 thousand from 462 thousand.

Total starts are up 50% from the bottom, and single family starts are up 39% from the low.

This was above expectations of 690 thousand starts in April, and was especially strong given the upward revisions to prior months.

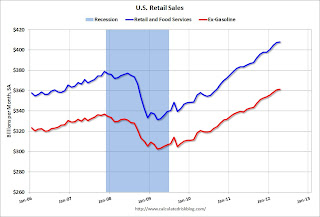

• Retail Sales increased 0.1% in April

On a monthly basis, retail sales were up 0.1% from March to April (seasonally adjusted), and sales were up 6.4% from April 2011. Ex-autos, retail sales also increased 0.1% in April.

On a monthly basis, retail sales were up 0.1% from March to April (seasonally adjusted), and sales were up 6.4% from April 2011. Ex-autos, retail sales also increased 0.1% in April.Sales for March was revised down to a 0.7% increase from 0.8%, and February was revised down to 1.0% from 1.1%.

This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 23.1% from the bottom, and now 7.7% above the pre-recession peak (not inflation adjusted)

This was at the consensus forecast for retail sales of a 0.1% increase in April, and below the consensus for a 0.2% increase ex-auto.

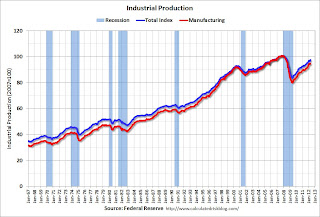

• Industrial Production up in April, Capacity Utilization increases

This graph shows Capacity Utilization. This series is up 12.4 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 12.4 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 79.2% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in April to 97.4. March was revised down (so the month-to-month increase was greater than expected), and February was revised up.

The consensus was for a 0.5% increase in Industrial Production in April, and for an increase to 79.0% (from 78.7%) for Capacity Utilization. This was above expectations.

• MBA: Mortgage Delinquencies decline in Q1

The MBA reported that 11.79 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2012 (delinquencies seasonally adjusted). This is down from 11.96 percent in Q4 2011 and is the lowest level since 2008.

The MBA reported that 11.79 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2012 (delinquencies seasonally adjusted). This is down from 11.96 percent in Q4 2011 and is the lowest level since 2008.This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (14.31% in foreclosure), New Jersey (8.37%), Illinois (7.46%), Nevada (the only non-judicial state in the top 10 at 6.47%), and New York (6.17%).

As Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education noted, the biggest problem is the number of loans in the foreclosure process. This is primarily a problem in states with a judicial foreclosure process. States like California and Arizona are now below the national average of percent of loans in the foreclosure process.

The second graph shows the percent of loans delinquent by days past due.

The second graph shows the percent of loans delinquent by days past due.Loans 30 days delinquent decreased to 3.13% from 3.22% in Q4. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.21% in Q1, from 1.25% in Q4. This is the lowest level since Q4 2007.

There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.06% from 3.11% in Q4 2011. This is the lowest level since 2008, but still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process increased slightly to 4.39% from 4.38%.

• Regional manufacturing activity mixed in May Surveys

From the Philly Fed: May 2012 Business Outlook Survey

Firms responding to the May Business Outlook Survey indicated that manufacturing growth fell back from the pace of recent months. The survey’s broad indicators for general activity fell into negative territory for the first time in eight months. Indicators for new orders and employment also suggested slight declines from April.

From the NY Fed: May Empire State Manufacturing Survey indicates manufacturing activity expanded at a moderate pace

From the NY Fed: May Empire State Manufacturing Survey indicates manufacturing activity expanded at a moderate paceThe May Empire State Manufacturing Survey indicates that manufacturing activity expanded in New York State at a moderate pace. The general business conditions index rose eleven points to 17.1.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The NY and Philly Fed surveys went in opposite directions this month. The NY Fed survey showed stronger expansion; the Philly Fed survey indicated contraction. The average of the Empire State and Philly Fed surveys declined in May, and is at the lowest level this year.

• Weekly Initial Unemployment Claims at 370,000

The DOL reports:

The DOL reports:In the week ending May 12, the advance figure for seasonally adjusted initial claims was 370,000, unchanged from the previous week's revised figure of 370,000. The 4-week moving average was 375,000, a decrease of 4,750 from the previous week's revised average of 379,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 375,000.

The 4-week average has declined for two consecutive weeks. The average has been between 363,000 and 384,000 all year.

This was above the consensus of 365,000.

• AIA: Architecture Billings Index indicates contraction in April

From AIA: Architecture Billings Index Reverts to Negative Territory

From AIA: Architecture Billings Index Reverts to Negative TerritoryAfter five months of positive readings, the Architecture Billings Index (ABI) has fallen into negative terrain. ... The American Institute of Architects (AIA) reported the April ABI score was 48.4, following a mark of 50.4 in March.This graph shows the Architecture Billings Index since 1996. The index was at 48.4 in April. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This is just one month - and as Baker noted, this might be payback for the mild weather earlier in the year - but this suggests CRE investment will stay weak all year (it will be some time before investment in offices and malls increases).

• Key Measures of Inflation in April

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in April. The 16% trimmed-mean Consumer Price Index increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.This graph shows the year-over-year change for core CPI, core PCE, median CPI and the trimmed-mean CPI. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.3%, and core CPI rose 2.3%. Core PCE is for March and increased 2.0% year-over-year.

...

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was flat at 0.0% (0.4% annualized rate) in April. The CPI less food and energy increased 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

These measures show inflation on a year-over-year basis is mostly still above the Fed's 2% target.

• Other Economic Stories ...

• NAHB Builder Confidence increases in May, Highest since May 2007

• Lawler: Early Read on Existing Home Sales in April

• Greece: Election is June 17th

• Hotels: RevPAR increases 4.5% compared to same week in 2011

• State Unemployment Rates decline in 37 states in April

Friday, May 18, 2012

Van Rompuy Statement: "Stay the course" in Europe, "Pro-growth agenda" in June

by Calculated Risk on 5/18/2012 09:13:00 PM

Remarks from Herman Van Rompuy, President of the European Council prior to the G8 summit:

This G8 summit comes at a time of significant challenges to the world economy, and for Europe in particular. As far as Europe is concerned, my message is straightforward: we are determined to stay the course. We will pursue our comprehensive strategy to decrease deficit and debts, and to return to growth and job creation, based on structural reforms, investments and trade. The European Council will discuss a pro-active growth agenda on the dinner on May 23 and we will finalize it on the European Council on 28-29 of June. In that respect it should not be forgotten that in aggregate terms growth in the Euro area is positive and picking up, while our external balances with the rest of the global economy are in equilibrium.The long awaited "growth agenda" will finalized in late June. Most likely too little, too late.

Recently, we have raised our firewalls and increased our contribution to the International Monetary Fund; we have also strengthened economic governance, recapitalised banks and provided ample bank liquidity through the European Central Bank. This week, finance ministers of the EU also made further significant progress in putting into European law the international Basel 3 agreements. We will do whatever is needed to guarantee the financial stability of the euro zone.

In parallel, most EU countries are engaged in very ambitious reforms to ensure debt sustainability, raise productivity and improve competitiveness. This is particularly the case in Spain - where the Government has embarked on a set of comprehensive reforms - and in Italy, as also positively recognized by the IMF after its consultation with Rome this week. I am confident they will succeed.

As regards Greece, I do not hide my concern about the current political uncertainty. Greece is a member of the EU and the Euro zone and this membership implies solidarity and responsibility. The Euro zone has shown considerable solidarity, supplying nearly € 150bn in loans to Greece so far. Alongside this support the EU is developing a huge effort to help reviving the Greek economic potential.

We do not question Greece's sense of responsibility and are hopeful that the next Greek government will act in accordance with the country's engagement and its European future. Continued reform is the best guarantee for the Greek economy and for a future of the Greek people in the euro area.

I'm not sure what Van Rompuy means by "aggregate growth in the Euro area is positive and picking up". According to Eurostat, "GDP remained stable in both the euro area1 (EA17) and the EU271 during the first quarter of 2012, compared with the previous quarter". Flat line isn't growth.

Although Van Rompuy expressed "concern" about Greece, he also said the EU will "do whatever is needed to guarantee the financial stability of the euro zone". It is important to remember that these guys are committed to the euro - and they will not give up easily.

Bank Failure #24 in 2012: Alabama Trust Bank

by Calculated Risk on 5/18/2012 06:26:00 PM

Torpedoed in sea of debt

Sunk by crimson tide

by Soylent Green is People

From the FDIC: Southern States Bank, Anniston, Alabama, Assumes All of the Deposits of Alabama Trust Bank, National Association, Sylacauga, Alabama

As of March 31, 2012, Alabama Trust Bank, National Association had approximately $51.6 million in total assets and $45.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.9 million. ... Alabama Trust Bank, National Association is the 24th FDIC-insured institution to fail in the nation this year, and the first in Alabama.It may be small, but it still counts. It's Friday, Friday ...

Grexit Update

by Calculated Risk on 5/18/2012 01:46:00 PM

The Greek election is still a month away ...

From the WSJ: EU Official: Greek Exit Plans Discussed

The European Commission and the European Central Bank are drawing up plans should Greece abandon the euro, Trade Commissioner Karel De Gucht said in an interview published Friday, the first time a senior European Union official has acknowledged such preparations.Here are some comments from analysts at Nomura:

The ECB and the commission are "working on emergency scenarios in case Greece doesn't make it," Mr. De Gucht said in an interview with the Flemish newspaper De Standaard.

...

European Economics Commissioner Olli Rehn quickly countered Mr. De Gucht's comments about the contingency plans, saying: "We are not working on the scenario of a Greek exit. We are working on the basis of a scenario of Greece staying in."

• We expect the ECB to cut the refi rate to 0.50% in July with risks skewed towards less and later; a policy error in our view.And some other commentary:

• We assume that the eurozone crisis will escalate and further increase pressure on the ECB: ultimately we expect QE.

• Based on current political trends, a Greek euro-area exit looks probable rather than possible following the 17 June election.

From Paul Krugman at the NY Times: Apocalypse Fairly Soon

Right now, Greece is experiencing what’s being called a “bank jog” — a somewhat slow-motion bank run, as more and more depositors pull out their cash in anticipation of a possible Greek exit from the euro. Europe’s central bank is, in effect, financing this bank run by lending Greece the necessary euros; if and (probably) when the central bank decides it can lend no more, Greece will be forced to abandon the euro and issue its own currency again.From Tim Duy at Fed Watch: Closer to Colliding

This demonstration that the euro is, in fact, reversible would lead, in turn, to runs on Spanish and Italian banks. Once again the European Central Bank would have to choose whether to provide open-ended financing; if it were to say no, the euro as a whole would blow up.

Yet financing isn’t enough.

Can the Troika cave to Greece while remaining credible with other troubled economies? I doubt it - which I think increases the risk that the core of Europe will believe it necessary to create a moral hazard example out of Greece.From Michael Pettis: Europe’s depressing prospects

Of course, this worked so well with Lehman Brothers. We will just foget about that little detail for the moment.

State Unemployment Rates decline in 37 states in April

by Calculated Risk on 5/18/2012 10:33:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in April. Thirty-seven states and the District of Columbia recorded unemployment rate decreases, five states posted rate increases, and eight states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-eight states and the District of Columbia registered unemployment rate decreases from a year earlier, while only one state experienced an increase and one had no change.

...

Nevada continued to record the highest unemployment rate among the states, 11.7 percent in April [down from 12.0 in March]. Rhode Island and California posted the next highest rates, 11.2 and 10.9 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent, followed by Nebraska, 3.9 percent, and South Dakota, 4.3 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

The states with the largest decrease in the unemployment rate are Michigan, Alabama, Tennessee, South Carolina, Ohio and Oregon. The states with the smallest improvement are New Jersey and New York.

Hotels: RevPAR increases 4.5% compared to same week in 2011

by Calculated Risk on 5/18/2012 08:49:00 AM

From HotelNewsNow.com: St. Louis posts top occupancy, RevPAR gains

Overall, the U.S. hotel industry’s occupancy ended the week virtually flat with a 0.1% increase to 62.7%, ADR increased 4.5% to $105.85 and RevPAR jumped 4.5% to $66.35.Hotel occupancy and RevPAR have improved from 2011, and occupancy is back close to normal. However ADR is still 3% to 4% below the precession levels, and the same for RevPAR.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Looking forward, leisure travel usually increases over the summer months, and occupancy rates will rise. So far it looks like 2012 will have higher occupancy than 2011, but still mostly below the pre-rececession median. Hotels have come a long way since 2008 when I was writing about The Coming Hotel Bust. But it will be sometime before investment increases again.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Thursday, May 17, 2012

Misc: Record Low Mortgage Rates, Spanish Banks downgraded, and more

by Calculated Risk on 5/17/2012 11:08:00 PM

The only economic release schedule for Friday is the State Employment and Unemployment report for April.

• From Freddie Mac: Fixed Mortgage Rates Hit Record Lows Again

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates again hitting new record lows. The 30-year fixed-rate mortgage at 3.79 percent continues to remain well below 4 percent and 15-year fixed-rate mortgages are also slightly down at 3.04 percent.• From the WSJ: Ten-Year Treasury Yield Near Record Low

30-year fixed-rate mortgage (FRM) averaged 3.79 percent with an average 0.7 point for the week ending May 17, 2012, down from last week when it averaged 3.83 percent. Last year at this time, the 30-year FRM averaged 4.61 percent.

The benchmark note gained 18/32 in price by late-afternoon trading to yield 1.702% after sinking as far as 1.692%. The record low of 1.672% was matched in September and originally set in February 1946. Based on a 3 p.m. EDT finish, 1.702% would be the lowest yield ever to round out a session.• From the Financial Times: Spain moves to calm bank fears

Moody’s downgraded 16 Spanish banks, with three-notch cuts for the “Big Three” lenders – Santander, BBVA and La Caixa – and three small institutions left in “junk” territory, though the agency made no mention of Bankia.Earlier in the day there were unfounded rumors of a bank run in Spain.

It said the downgrades were prompted primarily by the deteriorating Spanish economy and the reduced credit-worthiness of the government.

Excerpt with permission

• The Asian markets are all red tonight. From MarketWatch: Asia stocks tumble as Spain joins list of fears

Japan’s Nikkei Stock fell 2.1%, South Korea’s Kopsi dropped 2.7%, and Australia’s S&P/ASX 200 index skidded 2.1%.

Hong Kong’s Hang Seng Index fell 2%, and the Shanghai Composite index lost 0.7%.