by Calculated Risk on 5/30/2012 12:26:00 PM

Wednesday, May 30, 2012

CoreLogic: 66,000 completed foreclosures in April

From CoreLogic: CoreLogic® Reports 66,000 Completed Foreclosures Nationally in April

CoreLogic ... today released its National Foreclosure Report for April, which provides monthly data on completed foreclosures and the overall foreclosure inventory. According to the report, there were 66,000 completed foreclosures in the U.S. in April 2012 compared to 78,000 in April 2011 and 66,000* in March 2012. Since the start of the financial crisis in September 2008, there have been approximately 3.6 million completed foreclosures across the country. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure.This is a new monthly report and might help track the number of completed foreclosures, and to see if the lenders are starting to clear the foreclosure inventory backlog following the mortgage settlement.

Approximately 1.4 million homes, or 3.4 percent of all homes with a mortgage, were in the national foreclosure inventory as of April 2012 compared to 1.5 million, or 3.5 percent, in April 2011 and 1.4 million, or 3.4 percent, in March 2012.

“There were more than 830,000 completed foreclosures over the past year or, in other words, one completed foreclosure for every 622 mortgaged homes,” said Mark Fleming, chief economist for CoreLogic. “Non-judicial foreclosure markets, like Nevada, Arizona and California, completed two and a half times as many foreclosures over the past year as judicial foreclosure states.”

...

“The inventory of homes in foreclosure in judicial foreclosure states is growing, but this increase is being more than offset by declining inventories in non-judicial states where the processing timelines to clear a foreclosure are shorter,” said Anand Nallathambi, chief executive officer of CoreLogic.

So far we haven't seen a surge in completed foreclosures - or a large increase in REO (lender Real Estate Owned) coming on the market. Note: The foreclosure inventory reported by CoreLogic is lower than either reported by LPS of 4.14% of mortgages or 2 million in foreclosure, and the Mortgage Bankers Association’s (MBA) Q1 report showing 4.39% of loans in the foreclosure process.

My guess is the "surge" in foreclosures will be less than many people expect (see from April: Some thoughts on housing and foreclosures).

NAR: Pending home sales index declined 5.5% in April

by Calculated Risk on 5/30/2012 10:00:00 AM

From the NAR: Pending Home Decline in April but Up Strongly From a Year Ago

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 5.5 percent to 95.5 from a downwardly revised 101.1 in March but is 14.4 percent above April 2011 when it was 83.5. The data reflects contracts but not closings.This was below the consensus of a 0.5% increase for this index.

...

The PHSI in the Northeast rose 0.9 percent to 78.9 in April and is 19.9 percent higher than April 2011. In the Midwest the index slipped 0.3 percent to 93.0 but is 23.0 percent above a year ago. Pending home sales in the South fell 6.8 percent to an index of 105.7 in April but are 13.3 percent higher than April 2011. In the West the index dropped 12.0 percent in April to 94.9 but is 5.1 percent above a year ago.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in May and June.

MBA: Mortgage Rates Drop to New Survey Lows

by Calculated Risk on 5/30/2012 07:00:00 AM

From the MBA: Mortgage Rates Drop to New Survey Lows

The Refinance Index decreased 1.5 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.6 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.91 percent, the lowest rate in the history of the survey, from 3.93 percent, with points increasing to 0.46 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The purchase index is still very weak. This index has mostly been moving sideways for the last two years, although the 4-week average has increased slightly over the last couple of months.

Mortgates rates fell to another record low last week.

Tuesday, May 29, 2012

Case-Shiller Seasonal Factors

by Calculated Risk on 5/29/2012 07:55:00 PM

Economist Tom Lawler wrote today:

I put “seasonally” in quotes, as there have substantial changes in the purported “seasonal” pattern of home prices since the housing market cratered. The reason, of course, is that there is a marked “seasonal” in the distressed-sales share of home sales, which peaks in the late winter months and hits a trough in the summer months. Not coincidentally, the “shift” in the “seasonal” pattern of home prices has been one where home prices are “seasonally” much weaker than they used to be in late winter, and “seasonally” much strong than they used to be in the summer.The following graph shows the change in the seasonal factor over time using the Case-Shiller National Index.

...

Everyone “knows” why, and since the “cause” of the apparent wider “seasonal” swings is known (and someday will go away), it’s not rightly correct to call such swings “seasonal.”

Click on graph for larger image.

Click on graph for larger image.Most of the wild "seasonal" swings are related to foreclosures. As Lawler noted, foreclosure sales are fairly steady throughout the year, and conventional sales have a seasonal pattern. So in the winter foreclosures are a higher percentage of sales, and that pushes down the NSA prices.

The second graph shows the year-over-year change in the seasonal factor. Clearly something started to happen around 2005.

It seems that the seasonal factors started changing in 2005 - when prices were still going up.

It seems that the seasonal factors started changing in 2005 - when prices were still going up.Also, it appears that the change in the seasonal factors has slowed, and will probably start to reverse soon.

Lawler also commented that he thinks there is a "better than even shot" the National HPI will show a year-over-year gain next quarter. That would be a 6% increase in the NSA index in Q2 (or about a 2% increase in the "seasonally adjusted" index). My guess is the index will turn positive on a year-over-year basis later this year.

Earlier on house prices:

• Case Shiller: House Prices fall to new post-bubble lows in March NSA

• Real House Prices and Price-to-Rent Ratio at late '90s Levels

House Prices: From "bold call" to consensus in four months

by Calculated Risk on 5/29/2012 03:53:00 PM

Less than four months ago, I wrote The Housing Bottom is Here and I pointed out that the house price data had a significant lag so we had to look at other data for clues. The post title refers to the many emails I received back in February: "bold call", "gutsy call", "you are insane" ... and many more.

I could still be wrong, but it sounds like Robert Shiller and Karl Case are coming around to a similar view. Here are couple of quotes from a CNBC interview this morning (video below):

Karl Case: “We lag of course – January, February and March moving average – and so we lag, and the indicators for the last three or four months on the quantity side have been real positive. We look like a bottom. You have to pick to find real negatives.”

CR: As I've noted before, this is just a possible bottom for nominal prices (not adjusted for inflation). We could see further real price declines, as Professor Shiller noted:

Robert Shiller on CNBC: "[The futures] go out to 2014. It is projecting something like 2% or 3% per year [increase], which by the way, is just the inflation rate. If you correct for the inflation rate, they [futures] are predicting no action."

Earlier on house prices:

• Case Shiller: House Prices fall to new post-bubble lows in March NSA

• Real House Prices and Price-to-Rent Ratio at late '90s Levels

Dallas Fed: Texas Manufacturing Expands but New Orders Remain Flat

by Calculated Risk on 5/29/2012 01:51:00 PM

From the Dallas Fed: Texas Manufacturing Expands but New Orders Remain Flat

Texas factory activity continued to increase in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, held steady at 5.5, suggesting growth continued at about the same pace as last month.This was below expectations of an increase in the general business activity index to +3.0.

...

The general business activity index remained negative for the second consecutive month and edged down from -3.4 to -5.1.

Labor market indicators reflected slightly slower labor demand growth and shorter workweeks. Employment grew again in May, but the pace continued to slow; the index receded from 11.8 to 8.5. Eighteen percent of firms reported hiring new workers, while 10 percent reported layoffs. The hours worked index remained negative but edged up from -4.6 to -2.2.

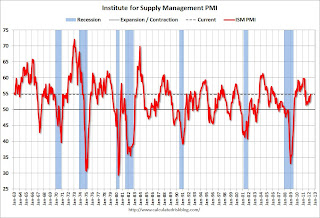

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

The ISM index for May will be released Friday, June 1st, and these surveys suggest some decrease from the 54.8 reading in April.

Real House Prices and Price-to-Rent Ratio at late '90s Levels

by Calculated Risk on 5/29/2012 11:03:00 AM

Another Update: Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1998 and early 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

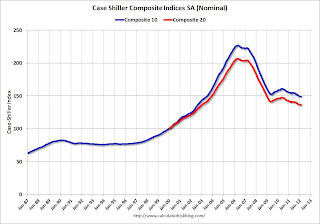

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to February 2003 levels, and the CoreLogic index (NSA) is also back to February 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to January 2000, and the CoreLogic index back to May 1999.

In real terms, all appreciation in the '00s is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000 levels, and the CoreLogic index is back to August 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

Case Shiller: House Prices fall to new post-bubble lows in March NSA

by Calculated Risk on 5/29/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March (a 3 month average of January, February and March).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the National index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Pace of Decline in Home Prices Moderates as the First Quarter of 2012 Ends, According to the S&P/Case-Shiller Home Price Indices

Data through March 2012, released today by S&P Indices for its S&P/CaseShiller Home Price Indices ... showed that all three headline composites ended the first quarter of 2012 at new post-crisis lows. The national composite fell by 2.0% in the first quarter of 2012 and was down 1.9% versus the first quarter of 2011. The 10- and 20-City Composites posted respective annual returns of -2.8% and -2.6% in March 2012. Month-over-month, their changes were minimal; average home prices in the 10-City Composite fell by 0.1% compared to February and the 20-City remained basically unchanged in March over February. However, with these latest data, all three composites still posted their lowest levels since the housing crisis began in mid-2006.

...

“While there has been improvement in some regions, housing prices have not turned,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “This month’s report saw all three composites and five cities hit new lows. However, with last month’s report nine cities hit new lows. Further, about half as many cities, seven, experienced falling prices this month compared to 16 last time."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.1% from the peak, and up 0.2% in March (SA). The Composite 10 is at a new post bubble low Not Seasonally Adjusted.

The Composite 20 index is off 33.8% from the peak, and up 0.2% (SA) from March. The Composite 20 is also at a new post-bubble low NSA.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 2.8% compared to March 2011.

The Composite 20 SA is down 2.6% compared to March 2011. This was a smaller year-over-year decline for both indexes than in February.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 15 of the 20 Case-Shiller cities in March seasonally adjusted (12 cities increased NSA). Prices in Las Vegas are off 61.5% from the peak, and prices in Dallas only off 6.7% from the peak.

Prices increased (SA) in 15 of the 20 Case-Shiller cities in March seasonally adjusted (12 cities increased NSA). Prices in Las Vegas are off 61.5% from the peak, and prices in Dallas only off 6.7% from the peak.The NSA indexes are at new post-bubble lows. I'll have more on prices later

Extended Unemployment Benefits ending for many long term unemployed

by Calculated Risk on 5/29/2012 08:40:00 AM

An important story that I haven't written about recently ... from Shaila Dewan at the NY Times: U.S. Winds Down Longer Benefits for the Unemployed

Hundreds of thousands of out-of-work Americans are receiving their final unemployment checks sooner than they expected, even though Congress renewed extended benefits until the end of the year. ... In February, when the program was set to expire, Congress renewed it, but also phased in a reduction of the number of weeks of extended aid and effectively made it more difficult for states to qualify for the maximum aid. Since then, the jobless in 23 states have lost up to five months’ worth of benefits.

Next month, an additional 70,000 people will lose benefits earlier than they presumed, bringing the number of people cut off prematurely this year to close to half a million, according to the National Employment Law Project. That estimate does not include people who simply exhausted the weeks of benefits they were entitled to.

...

Most states offer 26 weeks of unemployment benefits, plus the federal extensions that kicked in after the financial crash.

The number of extra weeks available by state is determined by several factors, including the state’s unemployment rate and whether it is higher than three years earlier. So states like California have had benefits cut even though the unemployment rate there is still almost 11 percent.

“Benefits have ended not because economic conditions have improved, but because they have not significantly deteriorated in the past three years,” Hannah Shaw, a researcher at the Center on Budget and Policy Priorities, wrote in a blog post. In May, an estimated 95,000 people lost benefits in California.

...

by the end of September, the extended benefits will end in the last three states providing 99 weeks of assistance — Nevada, New Jersey and Rhode Island.

Monday, May 28, 2012

Monday Night Futures

by Calculated Risk on 5/28/2012 09:52:00 PM

• The S&P/Case-Shiller House Price Index for March is scheduled to be released at 9:00 AM ET. The consensus is for a 2.7% decrease year-over-year in the Composite 20 index (NSA) in March.

The Zillow forecast is for the Composite 20 index to decline 2.6% year-over-year, and for prices to increase slightly month-over-month seasonally adjusted. I expect these indexes to be at new post-bubble lows, Not Seasonally Adjusted (NSA).

• At 10:00 AM, the Conference Board's consumer confidence index for May will be released. The consensus is for an increase to 69.7 from 69.2 last month.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for May. The consensus is for the general business activity index to increase to 3.0, up from -3.4 in April. This is the last of the regional Fed manufacturing surveys for May.

The Asian markets are mixed tonight. The Nikkei is down about 0.3%, and the Shanghai Composite is down slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up about 5, and Dow futures are up 40.

Oil: WTI futures are at $90.08 (this is down from $109.77 in February) and Brent is at $106.90 per barrel.

Saturday:

• Summary for Week Ending May 25th

• Schedule for Week of May 27th

For the monthly economic question contest (two more questions for May, and four questions for June):

Number of Cities with Increasing House Prices

by Calculated Risk on 5/28/2012 02:11:00 PM

The following graphs show the number of cities with increasing house prices on a year-over-year, six month, and month-over-month basis.

The first graph is based on the Case-Shiller Composite 20 cities using seasonally adjusted data starting in January 2007.

There were still a few cities with increasing prices in early 2007. The increases in 2009 and 2010 were related to the housing tax credit (all of those gains and more are gone).

Recently prices have started increasing in more and more cities again. Note: Case-Shiller data is through February, Zillow data is through April.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The second graph shows the same year-over-year, six month, and month-over-month price increases for the 166 cities tracked by Zillow.

The pattern is similar to the Case-Shiller Composite 20 cities.

I expect that the number of cities with a year-over-year price increase will continue to climb all year, and later this year the Case-Shiller Composite 20 index (and Zillow national index) will turn positive on a year-over-year basis.

In February, the Case-Shiller Composite 20 index was down 3.4% year-over-year, down 2.5% over the last six months, and up slightly in February. The March data will be released this coming Tuesday.

In February, the Case-Shiller Composite 20 index was down 3.4% year-over-year, down 2.5% over the last six months, and up slightly in February. The March data will be released this coming Tuesday.

The Zillow national index was down 1.4% year-over-year in April, only down 0.4% over the last six months, and up 0.7% month-over-month. This index will probably turn positive year-over-year in a few months.

Borrowing costs increase for Spain and Italy

by Calculated Risk on 5/28/2012 09:06:00 AM

From the Financial Times: Spain’s borrowing costs near crisis level

Yields on Spain’s 10-year government bonds on Monday moved above 6.50 per cent once again – moving closer to the 7 per cent level that prompted bailouts for Greece, Portugal and Ireland.From the WSJ: Bankia Bailout Hits Spanish Bonds

...

Spreads on Spanish 10-year bonds over German Bunds were also flirting with euro-era highs, climbing above 500 basis points.

excerpt with permission

Spanish sovereign bonds came under heavy pressure Monday, pushing yield spreads against German bunds and debt insurance costs to record highs, after the government announced a €19 billion ($23.78 billion) bailout of Bankia SA late Friday.From Reuters: Yields rise at Italy 2-yr debt sale

The effective nationalization of Bankia raised concern the government may be on the hook for further funds to prop up its fragile banking sector.

Italian two-year borrowing costs rose to their highest since December at a sale of zero-coupon paper on Monday as the prospect of a possible Greek euro exit and Spain's banking woes continued to weigh on the debt of weaker euro zone borrowers.Here are some links to various European bond yields. The Spanish 10 year yield is at 6.44%, and the Italian 10 year yield is at 5.7%.

Sunday, May 27, 2012

Unofficial Problem Bank list increases to 931 Institutions

by Calculated Risk on 5/27/2012 05:52:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 25, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, this week the FDIC released the Official Problem Bank List through March 2012 and it enforcement actions through April 2012. For the week, there were nine removals and 12 additions, which leaves the Unofficial Problem Bank List with 931 institutions and assets of $358.1 billion. A year ago, the list held 997 institutions with assets of $415.4 billion. From last week, the count on the UPBL increased by three while assets dropped by $3.9 billion. However, the decline in assets was solely due to shrinkage as updated assets figures through q1 declined by $5.1 billion. Moreover, the count increased in back-to-back weeks, which has not happened since a three consecutive weekly increase from June 24, 2011 through July 8, 2011. For the month, the UPBL increased from 930 to 931, but assets declined by $3.7 billion with the shrinkage also due to the updated assets figures. The FDIC reported the Official Problem Bank List at 772 institutions with assets of $292 billion.Yesterday:

The nine removals all were action terminations -- The Stillwater National Bank and Trust Company, Stillwater, OK ($2.0 billion Ticker: OKSB); Guaranty Bank and Trust Company, Denver, CO ($1.7 billion Ticker: GBNK); Transportation Alliance Bank, Inc., Ogden, UT ($852 million); First State Bank, New London, WI ($284 million); Front Range Bank, Lakewood, CO ($152 million); Bank of Alpena, Alpena, MI ($70 million); Security State Bank of Kenyon, Kenyon, MN ($53 million); VisionBank, Saint Louis Park, MN ($31 million); and Quality Bank, Fingal, ND ($25 million).

The 12 additions this weekly are the most since 16 institutions were added for the UPBL published on October 28, 2011. The additions this week were SpiritBank, Tulsa, OK ($1.3 billion); Crown Bank, Elizabeth, NJ ($575 million); Community Bank of Broward, Dania Beach, FL ($464 million); The Foster Bank, Chicago, IL ($441 million); Anderson Brothers Bank, Mullins, SC ($438 million); The Bank of Delmarva, Seaford, DE ($437 million Ticker: DBCP); Affinity Bank, Atlanta, GA ($285 million); Highlands Independent Bank, Sebring, FL ($270 million); The First National Bank of Ottawa, Ottawa, IL ($270 million Ticker: FOTB); First Trust and Savings Bank, Oneida, TN ($149 million); Hometown Community Bank, Braselton, GA ($137 million); and Legacy State Bank, Loganville, GA ($74 million).

Other changes include the FDIC issuing a Prompt Corrective Action Order against The Farmers Bank of Lynchburg, Lynchburg, TN ($164 million). Strangely, the PCA order was issued on November 21, 2011, but the FDIC waited until May 2012 to disclose.

It is anticipated next week's activity will be largely removals so the consecutive weekly increase should end. Until then, wishing all our readers a safe and happy Memorial Day weekend and we send out many thanks for all the past and current and their families for their service and sacrifice securing our freedom.

• Summary for Week Ending May 25th

• Schedule for Week of May 27th

A few Employment Report Forecasts

by Calculated Risk on 5/27/2012 02:02:00 PM

A few forecasts for the May employment report to be released on Friday. From Bloomberg: Job Growth in U.S. Probably Picked Up After April Slowing

Payrolls climbed by 150,000 workers after a 115,000 gain in April, according to the median forecast of 68 economists surveyed by Bloomberg News ahead of Labor Department figures due June 1.From Goldman Sachs:

...

Private payrolls, which exclude government jobs, climbed 160,000 in May after rising 130,000 last month, the weakest since August, economists forecast the Labor Department report will show.

...

The jobless rate, derived from a separate survey of households, held at a three-year low of 8.1 percent in May, economists in the Bloomberg survey predicted.

We forecast that nonfarm payroll employment increased by 125,000 in May, given continued weather “payback.” We expect the unemployment rate to remain unchangedAnd from Merrill Lynch:

We expect non-farm payrolls to increase 140,000 in May, leaving the three month moving average to slow to 128,000. This is a marked deceleration from the three month average gain of 252,000 from December through February. As we have been arguing for some time, we believe this swing can largely be explained by the abnormally warm weather in the winter.

[T]he household measure of employment is likely to look soft. In addition, the labor force participation rate could tick up modestly to reverse some of the recent sharp declines. This would push the unemployment rate up to 8.2% from 8.1% last month

| 2012 Monthly Payroll Jobs Added (000s) | ||||

|---|---|---|---|---|

| Total nonfarm | Private | Public | Unemployment Rate | |

| January | 275 | 277 | -2 | 8.3% |

| February | 259 | 254 | 5 | 8.3% |

| March | 154 | 166 | -12 | 8.2% |

| April | 115 | 130 | -15 | 8.1% |

| May | 1501 | 1601 | -101 | 8.1%1 |

| 1Consensus forecast for May from Bloomberg. | ||||

Yesterday:

• Summary for Week Ending May 25th

• Schedule for Week of May 27th

New home construction picks up in Las Vegas

by Calculated Risk on 5/27/2012 09:37:00 AM

This might surprise some people since Las Vegas is one of the hardest hit areas ... from Delen Goldberg at the Las Vegas Sun: Long time coming: Homebuilders are busy once again in Las Vegas. A few excerpts:

Las Vegas homebuilders can’t build houses fast enough these days to keep up with buyers’ demand.The land costs are much lower now, and the builders are typically building smaller homes than were built during the bubble - and that makes the new home prices competitive with existing homes.

Yes, you read that right.

The valley’s new home market is booming. Developers say they haven’t built, or sold, so many houses in years.

“I’m as much as 80 to 90 percent higher in volume than last year,” said Robert Beville, president of Harmony Homes. “I’ll probably more than double my deliveries this year.”

...

“The single largest impact has been houses under $200,000,” Beville said. “Homes in the $130,000 to $190,000 (range) are getting a lot of love. The ones in the $200,000 to $300,000 are getting a little bit less.

...

Most of the land being developed has changed hands since it was bought during the boom. The developers building on it now, in most cases, acquired it empty or half developed from others who paid a premium a few years ago.

...

Perhaps the biggest winners in the revived housing market are construction workers ...

Yesterday:

• Summary for Week Ending May 25th

• Schedule for Week of May 27th

Saturday, May 26, 2012

Conviction: Fraud for Housing

by Calculated Risk on 5/26/2012 04:55:00 PM

I'd like to start this post with something Tanta wrote in early 2007: Unwinding the Fraud for Bubbles

There is a tradition in the mortgage business of distinguishing between two major types of mortgage fraud, called “Fraud for Housing” and “Fraud for Profit.” The former is the borrower-initiated fraud—inflating income or assets, lying about employment, etc.—that is motivated by the borrower’s desire to get housing (not the same thing as “real estate”), by means of getting a loan he or she doesn’t actually qualify for. It may require some collusion by the loan originator or appraiser, but it may not. It is usually the least expensive kind of fraud to lenders and investors, since the goal is getting (and keeping) the property, so the borrower is at least usually motivated to make the payments. The problems come about, of course, because these borrowers failed to qualify honestly for a reason. Borrower-initiated fraud loans may be considered “self-underwritten,” and such loans do have a much higher failure rate than the “lender-underwritten” ones. Their only saving grace is that the lender tends to recover more in a foreclosure than in a fraud for profit case. Penalties to the borrower rarely ever come in the form of prosecution; losing the home and becoming a subprime borrower for the next four to seven years—with the credit costs that implies—are the borrower's punishment.As Tanta noted, usually "Fraud for housing" isn't prosecuted, but here is an example of that "whole new level of nastiness" from Julie Johnson at The Press Democrat: Former Petaluma man sent to prison for mortgage scheme (ht T. Stone)

Fraud for profit is simply someone trying to extract cash—not housing—out of the transaction somewhere. If it is borrower-initiated fraud, it’s not a borrower who wants a house; it’s a borrower who wants to flip a piece of real estate or launder money or in some other way grab the cash and leave the lender holding the bag. Most of it, however, is initiated by a seller, real estate broker, lender, or closing agent (or all of them in collusion). It generally requires additional collusion by bribable appraisers, although it can certainly be initiated by a corrupt appraiser looking for a kickback, or can merely take advantage of a trainee or gullible appraiser. This is the flip scam, straw borrower, equity skimming, misappropriation of payoff funds, identity theft kind of fraud. It may not be as common as fraud for housing, at least in some markets, but it’s much, much more expensive to the bagholder. At minimum, the fraud-for-housing borrower wants to take clear, merchantable title to the property and maintain it at an acceptable level. That’s either unnecessary expense or (in the case of title) a hurdle to be gotten over by the fraud-for-profit participant.

The problem with this traditional distinction is that, recently, we seem to have an epidemic of predator meeting predator and forming an alliance: a borrower willing to commit fraud for housing meets up with a seller or lender willing to commit fraud for profit, and the thing gets jacked up to a whole new level of nastiness.

A federal judge sentenced a former Petaluma man to 37 months in prison this week for securing a phony mortgage loan that let him buy a home on Muscat Circle in Petaluma, U.S. Attorney’s officials said.It sounds like Batemon's role was limited to, but still egregious, "fraud for housing". But this is an example of "predator meets predator", and Batemon is off to a 3+ year stay at the Big House.

Justin Batemon, 34, pleaded guilty Jan. 31 and was sentenced Wednesday ... Batemon was a client of San Francisco loan officer Jacob Moynihan who federal prosecutors said masterminded a scheme that involved $15 million in fraudulent mortgage loans.

Batemon said he was self-employed at a fake company and inflated his income on the documents, prepared by Moynihan, that helped him buy a single-family home at 801 Muscat Court near Maria Drive ...

Tanta finished her post writing: "Getting into a bubble is easy. Getting out?"

Five years later we are still trying to "get out".

Earlier:

• Summary for Week Ending May 25th

• Schedule for Week of May 27th

Schedule for Week of May 27th

by Calculated Risk on 5/26/2012 01:02:00 PM

Earlier:

• Summary for Week Ending May 25th

The key report this week is the May employment report to be released on Friday.

Other key reports include the March Case-Shiller house price index on Tuesday, the second estimate for Q1 GDP on Thursday, and the April Personal Income and Outlays report on Friday.

Auto sales for May will also be released on Friday.

All US markets will be closed in observance of the Memorial Day holiday.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through February 2012 (the Composite 20 was started in January 2000).

The consensus is for a 2.7% decrease year-over-year in Composite 20 prices (NSA) in March. The Zillow forecast is for the Composite 20 to decline 2.6% year-over-year, and for prices to increase slightly month-to-month seasonally adjusted. I expect these indexes to be at new post-bubble lows, Not Seasonally Adjusted (NSA). The CoreLogic index increased 0.6% in March (NSA).

10:00 AM: Conference Board's consumer confidence index for May. The consensus is for an increase to 69.7 from 69.2 last month.

10:30 AM: Dallas Fed Manufacturing Survey for May. The consensus is for 3.0 for the general business activity index, up from -3.4 in April. This is the last of the regional Fed manufacturing surveys for May.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

10:00 AM ET: Pending Home Sales Index for April. The consensus is for a 0.5% increase in the index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 154,000 payroll jobs added in May, up from the 119,000 reported last month.

8:30 AM: Q1 GDP (second estimate). This is the second estimate from the BEA. The consensus is that real GDP increased 1.9% annualized in Q1, slower than the advance estimate of 2.2%.

8:30 AM: Q1 GDP (second estimate). This is the second estimate from the BEA. The consensus is that real GDP increased 1.9% annualized in Q1, slower than the advance estimate of 2.2%.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column is the advance estimate for Q1 GDP.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 370 thousand.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a decrease to 56.1, down from 56.2 in April.

11:00 AM: New York Fed to Release Q1 2012 Report on Household Debt and Credit.

8:30 AM: Employment Report for May. The consensus is for an increase of 150,000 non-farm payroll jobs in May, up from the 115,000 jobs added in April.

8:30 AM: Employment Report for May. The consensus is for an increase of 150,000 non-farm payroll jobs in May, up from the 115,000 jobs added in April.The consensus is for the unemployment rate to remain unchanged at 8.1%.

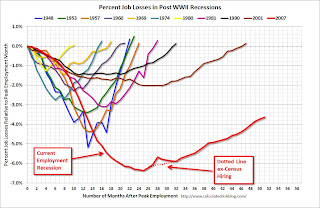

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through April.

The economy has added 3.75 million jobs since employment bottomed in February 2010 (4.25 million private sector jobs added, and 502 thousand public sector jobs lost).

The economy has added 3.75 million jobs since employment bottomed in February 2010 (4.25 million private sector jobs added, and 502 thousand public sector jobs lost).There are still 4.6 million fewer private sector jobs now than when the recession started in 2007. (5.0 million fewer total nonfarm jobs).

8:30 AM ET: Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income in April, and a 0.3% increase in personal spending, and for the Core PCE price index to increase 0.1%.

10:00 AM ET: ISM Manufacturing Index for May.

10:00 AM ET: ISM Manufacturing Index for May. Here is a long term graph of the ISM manufacturing index. The consensus is for a slight decrease to 54.0 from 54.8 in April. The regional Fed surveys were mixed this month. Also Markit has introduced a new "Flash PMI" for the US showing "the seasonally adjusted PMI falling from 56.0 in April to 53.9". This would suggest a larger decrease in the ISM index.

10:00 AM: Construction Spending for April. The consensus is for a 0.4% increase in construction spending.

All day: Light vehicle sales for May. Light vehicle sales are expected to increase to 14.5 million from 14.4 million in April (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate. TrueCar is forecasting:

The May 2012 forecast translates into a Seasonally Adjusted Annualized Rate (SAAR) of 14.5 million new car sales, up from 11.7 million in May 2011Edmund.com is forecasting:

Edmunds.com estimates that 1,391,163 new cars will be sold in May, for an estimated Seasonally Adjusted Annual Rate (SAAR) of 14.4 million. This would be a 17.5 percent increase from April 2012 and a 31.1 percent increase (unadjusted for number of selling days) from May 2011.

Summary for Week of May 25th

by Calculated Risk on 5/26/2012 08:01:00 AM

Housing remains weak, but improving. The Census Bureau reported that new home sales increased again in April, and that there were 117,000 new homes sold during the first four months of 2012. This compares to only 101,000 sold for the comparable period last year. This level of sales is historically very weak - and 2012 will probably be the 3rd worst year on record after 2011 and 2010 - but the increase in sales is important for both jobs and economic growth.

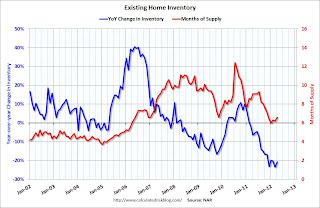

For existing home sales, the key number is inventory. The NAR reported that inventory increased seasonally in April, but that inventory is down 20.6% from last April. Less listed inventory means less downward pressure on prices, and some preliminary data suggests house prices may have stabilized. We will have more data on house prices next week.

Also consumer sentiment improved in May, probably because of the recent decline in gasoline prices.

There were some negatives too: Europe is a mess, durable goods orders were soft, the Richmond Fed manufacturing survey showed slower expansion, and the trucking index declined. But this was a week for housing data, and housing is slowly recovering. Here are some comments from home builder Toll Brothers CEO Doug Yearly, Jr this week:

"It appears that the housing market has moved into a new and stronger phase of recovery as we have experienced broad-based improvement across most of our regions over the past six months. The spring selling season has been the most robust and sustained since the downturn began. Even now, for the first three weeks of May, our non-binding reservation deposits, a leading indicator of future contracts, are running 39% ahead on a gross basis, and 23% ahead on a per-community basis, compared to last year's same May period."I always take home builder comments with a grain of salt, but that is a pretty strong statement.

Here is a summary in graphs:

• New Home Sales increase in April to 343,000 Annual Rate

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The Census Bureau reported New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 343 thousand.

This was up from a revised 332 thousand SAAR in March (revised up from 328 thousand).

The second graph shows New Home Months of Supply.

The second graph shows New Home Months of Supply.Months of supply decreased to 5.1 in April from 5.2 in March.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed.The inventory of completed homes for sale was at a record low 46,000 units in April. The combined total of completed and under construction is at the lowest level since this series started.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 340 thousand SAAR over the last 5 months, after averaging under 300 thousand for the previous 18 months. All of the recent revisions have been up too.

• Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in April 2012 (4.62 million SAAR) were 3.4% higher than last month, and were 10.00% above the April 2011 rate.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.Months of supply was increased to 6.6 months in April.

The NAR reported inventory increased to 2.54 million units in April, up 9.5% from the downwardly revised 2.32 million in March (revised down from 2.40 million).

• Q1 REO inventory of "the F's", PLS, and FDIC-insured institutions combined down about 20% from a year ago

From economist Tom Lawler: "FDIC released its Quarterly Banking Profile for the first quarter of 2012, and according to the report the carrying value of 1-4 family REO properties at FDIC-insured institutions at the end of March was $11.0819 billion, down from $11.6736 billion at the end of December and $13.2795 billion at the end of March. FDIC does not release institutions’ REO inventory by property count. If FDIC institutions’ average carrying value were 50% higher than the average for Fannie and Freddie, then the number of 1-4 family REO properties at the end of March at FDIC institutions would be about 89,398, down from 93,215 at the end of December and 100,530 at the end of last March.

From economist Tom Lawler: "FDIC released its Quarterly Banking Profile for the first quarter of 2012, and according to the report the carrying value of 1-4 family REO properties at FDIC-insured institutions at the end of March was $11.0819 billion, down from $11.6736 billion at the end of December and $13.2795 billion at the end of March. FDIC does not release institutions’ REO inventory by property count. If FDIC institutions’ average carrying value were 50% higher than the average for Fannie and Freddie, then the number of 1-4 family REO properties at the end of March at FDIC institutions would be about 89,398, down from 93,215 at the end of December and 100,530 at the end of last March.Using this assumption, here is a chart showing SF REO inventory for Fannie, Freddie, FHA, private-label ABS, and FDIC-insured institutions. The estimated total for this group in March was 450,194, down 19.9% from last March."

• Weekly Initial Unemployment Claims essentially unchanged at 370,000

This graph shows the 4-week moving average of weekly claims.

This graph shows the 4-week moving average of weekly claims.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 370,000.

The 4-week average has declined for three consecutive weeks. The average has been between 363,000 and 384,000 all year.

This was close the consensus forecast of 371,000.

• Consumer Sentiment increases in May to 79.3

The final Reuters / University of Michigan consumer sentiment index for May increased to 79.3, up from the preliminary reading 77.8, and up from the April reading of 76.4.

The final Reuters / University of Michigan consumer sentiment index for May increased to 79.3, up from the preliminary reading 77.8, and up from the April reading of 76.4.This was above the consensus forecast of 77.8 and the highest level since October 2007 - before the recession started. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and the sluggish economy - but falling gasoline prices probably helped in May.

• Other Economic Stories ...

• Chicago Fed: Economic growth near historical trend in April

• DOT: Vehicle Miles Driven increased 0.9% in March

• LPS: Mortgage delinquencies increased slightly in April

• ATA Trucking index declined 1.1% in April

• FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q1

Friday, May 25, 2012

Friday Night Humor: Ivy League Hustle

by Calculated Risk on 5/25/2012 10:07:00 PM

Friday night humor ...

LANGUAGE WARNING (ht Catherine Rampell, Princeton Alum).

Lawler: Q1 REO inventory of "the F's", PLS, and FDIC-insured institutions combined down about 20% from a year ago

by Calculated Risk on 5/25/2012 03:44:00 PM

From economist Tom Lawler:

FDIC released its Quarterly Banking Profile for the first quarter of 2012, and according to the report the carrying value of 1-4 family REO properties at FDIC-insured institutions at the end of March was $11.0819 billion, down from $11.6736 billion at the end of December and $13.2795 billion at the end of March. FDIC does not release institutions’ REO inventory by property count. If FDIC institutions’ average carrying value were 50% higher than the average for Fannie and Freddie, then the number of 1-4 family REO properties at the end of March at FDIC institutions would be about 89,398, down from 93,215 at the end of December and 100,530 at the end of last March.

Using this assumption, here is a chart showing SF REO inventory for Fannie, Freddie, FHA, private-label ABS, and FDIC-insured institutions. The estimated total for this group in March was 450,194, down 19.9% from last March.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CR note: As Tom Lawler has noted before: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the 1-4 family REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is just around 500,000 at the end of Q1.

REO inventories have declined over the last year. This was a combination of more sales, fewer acquisitions due to the slowdown in the foreclosure process, and a focus on modifications and short sales. With the mortgage servicer settlement, and relaxed guidance on institutions holding REOs as rentals, the number of REOs will probably increase over the next few quarters.