by Calculated Risk on 6/02/2012 04:50:00 PM

Saturday, June 02, 2012

Summary for Week Ending June 1st

This was a banner week for economic observers who scream "Miss!" every time an economic report is weaker than expected. The list of disappointing reports is long: a weak employment report, a downward revision to Q1 GDP growth, a disappointing ISM manufacturing index, weaker than expected auto sales, an increase in weekly unemployment claims, house prices at new post-bubble lows, pending home sales were down, and the Chicago PMI was weaker than expected.

Meanwhile the European crisis is grabbing headlines again, and June is another "kick-the-can or break" month for Europe (Usually the saying is "make or break", but there is no "make" on the horizon in Europe).

The weak data is a reminder: Every time the data is better than expected, some observers start predicting robust growth. And every time the data is weak, like last week, other observers start predicting another recession. Both groups have consistently been wrong; this is more of the sluggish and choppy growth that is typical following a financial crisis.

I'll have more on the economic outlook this week (the negatives and a few positives).

Here is a summary of last week in graphs:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

This was a weak month with only 69,000 payroll jobs added. Also the previous two months were revised down.

There appeared to be some additional weather related "payback" in May offsetting the relatively solid job growth during the winter months. As an example, construction employment was down 28,000 (seasonally adjusted), and "leisure and hospitality" declined by 9,000 jobs. Both were up solidly Not Seasonally Adjusted (NSA) in May. Construction was up 169,000 jobs, and leisure and leisure and hospitality increased 312,000 jobs NSA, but this is less than usual in May - probably because of the hiring during the winter - and the seasonally adjusted numbers were down. This weather "payback" is probably over now.

However weather payback probably only accounts for some of the recent slowdown in hiring.

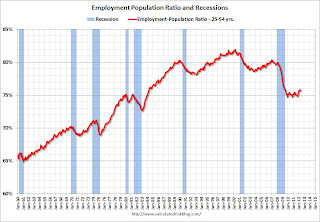

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.2% (red line).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.2% (red line).

The household survey showed a strong increase in employment (422,000 jobs added), but the participation rate increased too from 63.6% to 63.8% (blue line) so that pushed up the unemployment rate. The household survey job gains - and increase in the participation rate - are small positives.

The Employment-Population ratio increased to 58.6% in May from 58.4% in April (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 150,000).

• ISM Manufacturing index declines in May to 53.5

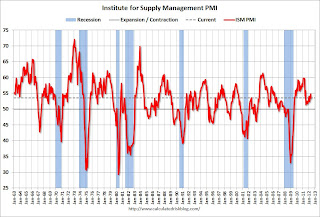

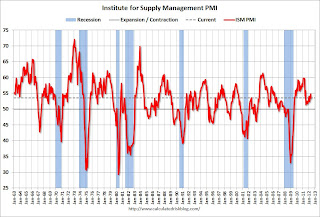

PMI was at 53.5% in May, down from 54.8% in April. The employment index was at 56.9%, down from 57.3%, and new orders index was at 60.1%, up from 58.2%.

PMI was at 53.5% in May, down from 54.8% in April. The employment index was at 56.9%, down from 57.3%, and new orders index was at 60.1%, up from 58.2%.From the Institute for Supply Management: May 2012 Manufacturing ISM Report On Business®

Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.0%. This suggests manufacturing expanded at a slower rate in May than in April.

Although this was slightly weaker than expected, new orders were up and prices were down. Not all bad.

• U.S. Light Vehicle Sales at 13.8 million annual rate in May

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.78 million SAAR in May. That is up 17.9% from May 2011, and down 4.1% from the sales rate last month (14.37 million SAAR in April 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.78 million SAAR in May. That is up 17.9% from May 2011, and down 4.1% from the sales rate last month (14.37 million SAAR in April 2012).This was the weakest month this year. The year-over-year increase was large because of the impact of the tsunami and related supply chain issues in May 2011. This was below the consensus forecast of 14.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 13.78 million SAAR from Autodata Corp).

• Case Shiller: House Prices fall to new post-bubble lows in March

S&P/Case-Shiller released the monthly Home Price Indices for March (a 3 month average of January, February and March).

S&P/Case-Shiller released the monthly Home Price Indices for March (a 3 month average of January, February and March).The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.1% from the peak, and up 0.2% in March (SA). The Composite 10 is at a new post bubble low Not Seasonally Adjusted.

The Composite 20 index is off 33.8% from the peak, and up 0.2% (SA) from March. The Composite 20 is also at a new post-bubble low NSA.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 2.8% compared to March 2011.

The Composite 20 SA is down 2.6% compared to March 2011. This was a smaller year-over-year decline for both indexes than in February.

• Real House Prices and Price-to-Rent Ratio at late '90s Levels

Another Update: Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to January 2000, and the CoreLogic index back to May 1999.

In real terms, all appreciation in the '00s is gone.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000 levels, and the CoreLogic index is back to August 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

• Weekly Initial Unemployment Claims increase to 383,000

The DOL reports:

The DOL reports:In the week ending May 26, the advance figure for seasonally adjusted initial claims was 383,000, an increase of 10,000 from the previous week's revised figure of 373,000. The 4-week moving average was 374,500, an increase of 3,750 from the previous week's revised average of 370,750.This was above the consensus forecast of 370,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,500.

The average has been between 363,000 and 384,000 all year.

Private residential spending is 62% below the peak in early 2006, and up 14% from the recent low. Non-residential spending is 29% below the peak in January 2008, and up about 20% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at a new post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit).

• Other Economic Stories ...

• Personal Income increased 0.2% in April, Spending 0.3%

• Fannie Mae Serious Delinquency rate declined in April, Freddie Mac unchanged

• LPS: Foreclosures Sales declined in April, FHA foreclosure starts increased sharply

• Chicago PMI declines to 52.7

• ADP: Private Employment increased 133,000 in May

• NAR: Pending home sales index declined 5.5% in April

Employment Report Graphs: Construction, Duration of Unemployment and Diffusion Indexes

by Calculated Risk on 6/02/2012 11:53:00 AM

The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment decreased by 28,000 thousand jobs in May, seasonally adjusted. Not seasonally adjusted, construction employment increased 169,000 in May. This suggests some weather related "payback" in May, as opposed to a new round of job losses in construction.

Last year was the first year with an increase in construction employment since 2006, and the first with an increase in residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Click on graph for larger image.

Click on graph for larger image.

Construction employment appears to have bottomed, and should add to both GDP and employment growth in 2012.

Other construction indicators - housing starts, new home sales, construction spending - are all increasing (public construction spending is decreasing), and construction employment should also increase this year.

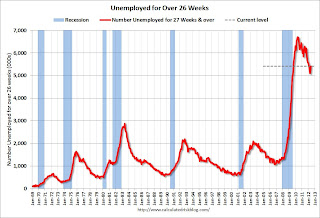

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down. The less than 5 week category is back to normal levels, but the other categories remain elevated.

Unfortunately the long term unemployed increased to 3.5% of the labor force in May. This was offset by a decline in the '15 to 26 weeks' category. Apparently a number of people just moved from the '15 to 26 weeks' category to the '27 week or more' category.

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS:

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS: Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The BLS diffusion index for total private employment was at 59.4 in May, up from 55.6 in April. For manufacturing, the diffusion index increased to 54.3, up from 53.7 in April.

So job growth was a little more widespread in May than in April. A small positive.

Yesterday employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

Update: State and Local Government Job Losses

by Calculated Risk on 6/02/2012 08:49:00 AM

Back in January I wrote:

It is looking like there will be less drag from state and local governments in 2012, and that most of the drag will be over by the end of Q2 (end of FY 2012). This doesn't mean state and local government will add to GDP in the 2nd half of 2012, just that the drag on GDP and employment will probably end. Just getting rid of the drag will help.It is time for an update since we are almost halfway through the year.

So far in 2012 - through May - state and local government have lost 7,000 jobs (8,000 jobs were lost in May alone though). In the first five months of 2011, state and local governments lost 126,000 payroll jobs - and 230,000 for the year.

Click on graph for larger image.

Click on graph for larger image.This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is still losing workers (50,000 over the last 12 months), but it looks like state and local government employment losses might be ending (or at least slowing sharply).

Yesterday employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

Friday, June 01, 2012

Fannie Mae Serious Delinquency rate declined in April, Freddie Mac unchanged

by Calculated Risk on 6/01/2012 10:13:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in April to 3.63%, down from 3.67% in March. The serious delinquency rate is down from 4.19% in April last year, and is at the lowest level since April 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate was unchanged at 3.51% in April. Freddie's rate is only down from 3.67% in April 2011. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

With the mortgage servicer settlement, I'd expect the delinquency rate to start to decline faster over the next year or so. I don't know why Fannie's delinquency rate is falling faster than for Freddie.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Note: HUD also released the quarterly FHA Single-Family Mutual Mortgage Insurance Fund Programs report. This showed the FHA serious delinquency rate declined in Q1 to 9.4% from 9.6%, but this was probably just a seasonal decline.

Earlier employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

Personal Income increased 0.2% in April, Spending 0.3%

by Calculated Risk on 6/01/2012 07:02:00 PM

This is worth mentioning, from earlier today: The BEA released the Personal Income and Outlays report for April:

Personal income increased $31.7 billion, or 0.2 percent ... in April, according to the Bureau of Economic Analysis. Personal Personal consumption expenditures (PCE) increased $31.8 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in April, compared with an increase of less than 0.1 percent in March. ... PCE price index -- The price index for PCE increased less than 0.1 percent in April, compared with an increase of 0.2 percent in March. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.2 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. You can really see the slow down in Q2 of last year. Even if May and June are flat compared to April this year, real PCE would increase around 2% in Q2.

Another key point is the PCE price index has only increased 1.8% over the last year, and core PCE is up 1.9%. And it looks like the year-over-year increases will decline further in May.

Also the personal saving rate declined to 3.4% in April.

Earlier employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

U.S. Light Vehicle Sales at 13.8 million annual rate in May

by Calculated Risk on 6/01/2012 03:28:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.78 million SAAR in May. That is up 17.9% from May 2011, and down 4.1% from the sales rate last month (14.37 million SAAR in April 2012).

This was below the consensus forecast of 14.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 13.78 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

This was the weakest month this year. The year-over-year increase was large because of the impact of the tsuanmi and related supply chain issues in May 2011.

Sales have averaged a 14.43 million annual sales rate through the first five months of 2012, up sharply from the same period of 2011.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

Earlier employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Graphs

Construction Spending in April: Private spending increases, Public Spending declines

by Calculated Risk on 6/01/2012 01:50:00 PM

Catching up ... This morning the Census Bureau reported that overall construction spending increased in April:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during April 2012 was estimated at a seasonally adjusted annual rate of $820.7 billion, 0.3 percent above the revised March estimate of $818.1 billion. The April figure is 6.8 percent above the April 2011 estimate of $768.2 billion.Private construction spending increased while public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $549.7 billion, 1.2 percent above the revised March estimate of $543.4 billion. ... In April, the estimated seasonally adjusted annual rate of public construction spending was $271.0 billion, 1.4 percent below the revised March estimate of $274.7 billion..

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 62% below the peak in early 2006, and up 14% from the recent low. Non-residential spending is 29% below the peak in January 2008, and up about 20% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at a new post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit).

May Employment Summary and Discussion

by Calculated Risk on 6/01/2012 11:50:00 AM

Another month, another disappointing employment report.

There appeared to be some additional weather related "payback" in May offsetting the relatively solid job growth during the winter months. As an example, construction employment was down 28,000 (seasonally adjusted), and "leisure and hospitality" declined by 9,000 jobs. Both were up solidly Not Seasonally Adjusted (NSA) in May. Construction was up 169,000 jobs, and leisure and leisure and hospitality increased 312,000 jobs NSA, but this is less than usual in May - probably because of the hiring during the winter - and the seasonally adjusted numbers were down. This weather "payback" is probably over now.

If we average over the first five months of the year, the economy has added 164,600 jobs per month (169,400 private sector per month). At this pace, the economy would add around 2 million private sector jobs in 2012; about the same as in 2011.

However weather payback probably only accounts for some of the recent slowdown in hiring.

Some numbers: There were 69,000 payroll jobs added in May, with 82,000 private sector jobs added, and 13,000 government jobs lost. The unemployment rate increased to 8.2%. The household survey showed a strong increase in employment (422,000 jobs added), but the participation rate increased too (from 63.6% to 63.8%) so that pushed up the unemployment rate. The household survey job gains - and increase in the participation rate - are small positives.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased so 14.8%.

The change in March payroll employment was revised down from +154,000 to +143,000, and April was revised down from +115,000 to +77,000.

The average workweek declined to 34.4 hours, and average hourly earnings increased slightly. "The average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.4 hours in May. ... In May, average hourly earnings for all employees on private nonfarm payrolls edged up by 2 cents to $23.41. Over the past 12 months, average hourly earnings have increased by 1.7 percent.

There are a total of 12.7 million Americans unemployed and 5.4 million have been unemployed for more than 6 months.

The bottom line is this was another disappointing employment report.

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.7% in May (this was unchanged in May from April.)

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) edged up to 8.1 million over the month. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in May to 8.1 millon.

These workers are included in the alternate measure of labor underutilization (U-6) that increased in May to 14.8%, up from 14.5% in April.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.4 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 5.1 million in April. This reversed the decline over the previous two months, although the number is still down since the beginning of the year. Long term unemployment remains one of the key labor problems in the US.

ISM Manufacturing index declines in May to 53.5

by Calculated Risk on 6/01/2012 10:00:00 AM

I'll have more on the employment report soon. PMI was at 53.5% in May, down from 54.8% in April. The employment index was at 56.9%, down from 57.3%, and new orders index was at 60.1%, up from 58.2%.

From the Institute for Supply Management: May 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in May for the 34th consecutive month, and the overall economy grew for the 36th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 53.5 percent, a modest decrease of 1.3 percentage points from April's reading of 54.8 percent, indicating expansion in the manufacturing sector for the 34th consecutive month. The New Orders Index continued its growth trend for the 37th consecutive month, registering 60.1 percent in May. This represents an increase of 1.9 percentage points from April and also the highest level recorded by the index since April 2011. The Prices Index for raw materials fell to 47.5 percent in May, dropping 13.5 percentage points from April, indicating lower prices for the first time since December 2011. Comments from the panel generally reflect stable-to-strong orders, with sales showing steady improvement over the first five months of 2012."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.0%. This suggests manufacturing expanded at a slower rate in May than in April.

Although this was slightly weaker than expected, new orders were up and prices were down. Not all bad.

May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

by Calculated Risk on 6/01/2012 08:30:00 AM

From the BLS:

Nonfarm payroll employment changed little in May (+69,000), and the unemployment rate was essentially unchanged at 8.2 percent, the U.S. Bureau of Labor Statistics reported today.

...

The civilian labor force participation rate increased in May by 0.2 percentage point to 63.8 percent, offsetting a decline of the same amount in April. The employment-population ratio edged up to 58.6 percent in May.

...

The change in total nonfarm payroll employment for March was revised from +154,000 to +143,000, and the change for April was revised from +115,000 to +77,000.

Click on graph for larger image.

Click on graph for larger image.This was a weak month, and the previous two months were revised down.

This was below expectations of 150,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.2% (red line).

The Labor Force Participation Rate increased to 63.8% in May (blue line). This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 63.8% in May (blue line). This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the recent decline is due to demographics.

The Employment-Population ratio increased to 58.6% in May from 58.4% in April (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 150,000). More later ...

Thursday, May 31, 2012

May Contest Winners and Look Ahead

by Calculated Risk on 5/31/2012 09:09:00 PM

The June contest starts on Friday with four questions (see below). For the economic question contest in May, the leaders were (Congratulations all!):

1) Bill Dawers

2) Bill (Calculated Risk)

3) (2 way tie) Liye Ma

3) Jon Fader

5) (3 way tie) David Fiene

5) Joey Cordero

5) Andrew Marrinson

Friday will be another busy day:

• At 8:30 AM ET, the BLS is scheduled to release the employment situation report for May. The consensus is for an increase of 150,000 non-farm payroll jobs in May, up from the 115,000 jobs added in April. Earlier I posted an employment preview.

• Also at 8:30 AM the Personal Income and Outlays report for April will be released. The consensus is for a 0.3% increase in personal income in April, and a 0.3% increase in personal spending, and for the Core PCE price index to increase 0.1%.

• At 10:00 AM ET, the ISM Manufacturing Index for May is scheduled for release. The consensus is for a slight decrease to 54.0 from 54.8 in April. The regional Fed surveys were mixed this month. Also the Chicago PMI released this morning was weaker than expected, and Markit has introduced a new "Flash PMI" for the US showing "the seasonally adjusted PMI falling from 56.0 in April to 53.9". This would suggest a larger decrease in the ISM index.

• Also at 10:00 AM, the Census Bureau will release Construction Spending for April. The consensus is for a 0.4% increase in construction spending.

• And during the day, the auto manufacturers will report light vehicle sales for May. Light vehicle sales are expected to increase to 14.5 million from 14.4 million in April (Seasonally Adjusted Annual Rate).

LPS: Foreclosures Sales declined in April, FHA foreclosure starts increased sharply

by Calculated Risk on 5/31/2012 04:15:00 PM

Note: U.S. District Court Judge Collyer approved the consent order for the mortgage servicer settlement on April 5th, and so far there hasn't been a significant impact from the agreement on delinquencies or foreclosure sales.

LPS released their Mortgage Monitor report for April today. According to LPS, 7.12% of mortgages were delinquent in April, up slightly from 7.09% in March, and down from 7.97% in April 2011.

LPS reports that 4.14% of mortgages were in the foreclosure process, unchanged from March, and also unchanged from April 2011.

This gives a total of 11.26% delinquent or in foreclosure. It breaks down as:

• 1,927,000 loans less than 90 days delinquent.

• 1,595,000 loans 90+ days delinquent.

• 2,048,000 loans in foreclosure process.

For a total of 5,570,000 loans delinquent or in foreclosure in April. This is down from 6,388,000 in April 2011.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

Click on graph for larger image.

Click on graph for larger image.

The total delinquency rate has fallen to 7.12% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.14%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.05 million).

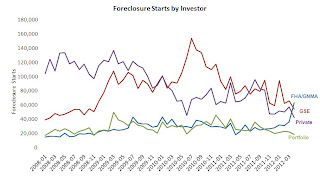

The second graph shows foreclosure starts by investor.

The second graph shows foreclosure starts by investor.

From LPS: "[O]verall foreclosure starts were down 2.6 percent in April, FHA foreclosure starts spiked significantly, jumping 73 percent during the month. The rise was driven primarily by defaults in 2008 and 2009 vintage loans, though all FHA vintages saw increases in foreclosure starts in April, despite that fact that the more recent vintages – from 2009 forward – have shown improved relative credit performance."

The third graph shows the FHA performance by vintage.

This graph shows the 90%+ delinquency rate by month since origination (number of payments).

This graph shows the 90%+ delinquency rate by month since origination (number of payments).

The worst performing loans were in 2006, 2007 and 2008. The best performing loans were made in recent years.

However, as the last graph shows, the FHA made a huge number of loans in 2008, 2009 and 2010. According to the Case-Shiller national index, prices have fallen about about 18% since mid-2008, putting most of those FHA borrowers "underwater" on their mortgages. The price declines since mid-2009 and mid-2010 are much less.

From LPS: “In 2008, when the loan origination market virtually dried up, the FHA stepped in to fill the void,” explained Herb Blecher, senior vice president for LPS Applied Analytics. “FHA

originations tripled that year, and increased to five times historical averages in 2009. High volumes like that, even with low default rates, can produce larger numbers of foreclosure starts.

That represents a lot of loans to work through – the 2008 vintage alone represents some $14 billion of unpaid balances in foreclosure, and the overall FHA foreclosure inventory continues torise.”

From LPS: “In 2008, when the loan origination market virtually dried up, the FHA stepped in to fill the void,” explained Herb Blecher, senior vice president for LPS Applied Analytics. “FHA

originations tripled that year, and increased to five times historical averages in 2009. High volumes like that, even with low default rates, can produce larger numbers of foreclosure starts.

That represents a lot of loans to work through – the 2008 vintage alone represents some $14 billion of unpaid balances in foreclosure, and the overall FHA foreclosure inventory continues torise.”

There is much more in the Mortgage Monitor report.

Employment Situation Preview

by Calculated Risk on 5/31/2012 02:36:00 PM

Tomorrow the BLS will release the May Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 150,000 payroll jobs in May, and for the unemployment rate to remain unchanged at 8.1%.

• More weather "payback"? The weather was mild in January and February, and Goldman Sachs analysts think there will be some more payback in the May report, they wrote last month: "[O]ur current best guess is that weather has boosted the level of payrolls by around 100,000 as of February, and may have shaved about 20,000 from the March report ... 50,000 in April and the remaining 30,000 in May." Goldman's forecast is that "nonfarm payroll employment increased by 125,000 in May".

Here is a summary of recent data:

• The ADP employment report showed an increase of 133,000 private sector payroll jobs in May. This would seem to suggest that the consensus for the increase in total payroll employment is too high - especially since public employment probably declined again - although the ADP report hasn't been very useful in predicting the BLS report for any one month. However ADP report has frequently been weaker than the BLS report for the month of May (although this is based on only 11 years of data).

• We don't have the May ISM manufacturing and service indexes to look at for employment, since the employment report is being released earlier than usual this month (on June 1st), so the ISM indexes will be released after the employment report.

• Initial weekly unemployment claims averaged about 375,000 in May, down slightly from the 377,000 average in April. Claims have been at about this level all year.

For the BLS reference week (includes the 12th of the month), initial claims were at 372,000; down from 389,000 for the reference week in April.

• The final May Reuters / University of Michigan consumer sentiment index increased to 79.3, up from the April reading of 76.4 This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This suggests a weak but slightly improving labor market.

• The small business index from Intuit showed 40,000 payroll jobs added, down from 60,000 in April.

• And on the unemployment rate from Gallup: U.S. Unemployment Edges Down in Mid-May

U.S. unemployment, as measured by Gallup without seasonal adjustment, declined slightly to 8.2% in mid-May from 8.3% in April. Gallup's seasonally adjusted unemployment rate is 8.5% in mid-May, down slightly from 8.6% last month. ... Incorporating the upward seasonal adjustment of 0.3 percentage points that the BLS applied last May yields a seasonally adjusted rate for mid-May of 8.5%.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats).

• Conclusion: The overall feeling is that the economy weakened a little in May, and that might mean the employment report will disappoint tomorrow. Also there could be a little more "payback" from extra hiring during the mild winter. However the combined ISM reports suggest the consensus is close. On the positive side, weekly claims improved slightly compared to April, and consumer sentiment improved - but that might be because of lower gasoline prices.

There always seems to be some randomness to the employment report, but once again I'll take the under this month (under 150,000 payroll jobs).

For the economic contest in June:

NY Fed: Consumer Deleveraging Continued in Q1, but Student Loan Debt Continued to Grow

by Calculated Risk on 5/31/2012 11:27:00 AM

From the NY Fed: New York Fed Quarterly Report Shows Student Loan Debt Continues to Grow

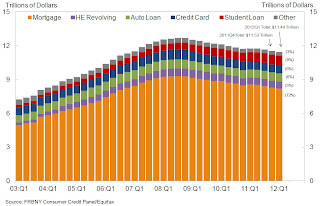

In its latest Quarterly Report on Household Debt and Credit, the Federal Reserve Bank of New York today announced that student loan debt reported on consumer credit reports reached $904 billion in the first quarter of 2012, a $30 billion increase from the previous quarter. In addition, consumer deleveraging continued to advance as overall indebtedness declined to $11.44 trillion, about $100 billion (0.9 percent) less than in the fourth quarter of 2011. Since the peak in household debt in the third quarter of 2008, student loan debt has increased by $293 billion, while other forms of debt fell a combined $1.53 trillion.Here is the Q1 report: Quarterly Report on Household Debt and Credit

Mortgage balances shown on consumer credit reports fell again ($81 billion or 1.0%) during the quarter; home equity lines of credit (HELOC) balances fell by $15 billion (2.4%). Household mortgage and HELOC indebtedness are now 11.9% and 14.3%, respectively, below their peaks. Consumer indebtedness excluding mortgage and HELOC balances stood at $2.64 trillion at the close of the quarter. Student loan indebtedness, the largest component of household debt other than mortgages, rose 3.4% in the quarter, to $904 billion.Here are two graphs:

...

About 291,000 individuals had a foreclosure notation added to their credit reports between December 31 and March 31, about the same as in 2011Q4, but 20.8% below the 2011Q1 level.

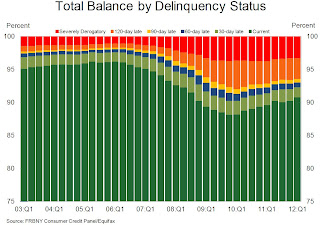

Total household delinquency rates continued their downward trend in 2012Q1. As of March 31, 9.3% of outstanding debt was in some stage of delinquency, compared to 9.8% on December 31, 2011.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased slightly in Q1. This was mostly due to a decline in mortgage debt.

However student debt is still increasing. From the NY Fed:

Over the one year period ending March 31, 2012, student loan balances rose $64 billion. Over the same period, all other forms of household debt (mortgages, HELOCs, auto loans and credit card balances) fell a combined $383 billion.

Since the peak in household debt in 2008Q3, student loan debt has increased by $293 billion, while other forms of debt fell a combined $1.53 trillion.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached. From the NY Fed:

About $1.06 trillion of consumer debt is currently delinquent, with $796 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

Chicago PMI declines to 52.7

by Calculated Risk on 5/31/2012 09:55:00 AM

Chicago PMI: The overall index declined to 52.7 in May, down from 56.2 in April. This was below consensus expectations of 56.1 and indicates slower growth in May. Note: any number above 50 shows expansion. From the Chicago ISM:

The Chicago Purchasing Managers reported the May Chicago Business Barometer decreased for a third consecutive month to its lowest level since September 2009. The short term trend of the Chicago Business Barometer, and all seven Business Activity indexes, declined in May. Among the Business Activity measures, only the Supplier Delivery index expanded faster while Order Backlogs and Inventories contracted.New orders declined to 52.7 from 57.4, and employment decreased to 57.0 from 58.7.

...

• PRODUCTION and NEW ORDERS lowest since September 2009;

• PRICES PAID lowest since September 2010;

• EMPLOYMENT rate of growth slowed

This is another weak reading, and suggests a decline in the ISM PMI to be released tomorrow.

Weekly Initial Unemployment Claims increase to 383,000

by Calculated Risk on 5/31/2012 08:38:00 AM

Note: The BEA reported that the second estimate of Q1 real GDP growth was 1.9%, lower than the advance estimate of 2.2% and at the consesnus expectation. Real Gross Domestic Income (GDI) was reported at 2.7% annual rate.

The DOL reports:

In the week ending May 26, the advance figure for seasonally adjusted initial claims was 383,000, an increase of 10,000 from the previous week's revised figure of 373,000. The 4-week moving average was 374,500, an increase of 3,750 from the previous week's revised average of 370,750.The previous week was revised up from 370,000 to 373,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,500.

The average has been between 363,000 and 384,000 all year.

And here is a long term graph of weekly claims:

This was above the consensus forecast of 370,000.

ADP: Private Employment increased 133,000 in May

by Calculated Risk on 5/31/2012 08:11:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 133,000 from April to May on a seasonally adjusted basis. The estimated gain from March to April was revised down modestly, from the initial estimate of 119,000 to a revised estimate of 113,000.This was below the consensus forecast of an increase of 154,000 private sector jobs in May. The BLS reports on Friday, and the consensus is for an increase of 150,000 payroll jobs in May, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector increased 132,000 in May, after rising a revised 119,000 in April. Employment in the private, goods-producing sector increased 1,000 in May. Manufacturing employment dropped 2,000 jobs, the second consecutive monthly decline.

Note: ADP hasn't been very useful in predicting the BLS report, but this suggests a somewhat weaker than consensus report.

Wednesday, May 30, 2012

Look Ahead: GDP, ADP Employment, Weekly Unemployment Claims, Chicago PMI

by Calculated Risk on 5/30/2012 09:16:00 PM

There are a number of US economic indicators to be released over the next two days, and that may take some of the focus off of Europe (probably not). For Thursday:

• At 8:15 AM ET, the ADP employment report is scheduled for release. This report is for private payrolls only (no government). The consensus is for 154,000 payroll jobs added in May, up from the 119,000 reported last month.

• At 8:30 AM ET, the second estimate of Q1 GDP will be released by the BEA. The consensus is that real GDP increased 1.9% annualized in Q1, slower than the advance estimate of 2.2%. The BEA will also release Q1 Gross Domestice Income (GDI).

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 370 thousand.

• At 9:45 AM, the Chicago Purchasing Managers Index for May will be released. The consensus is for a decrease to 56.1, down slightly from 56.2 in April.

• At 11:00 AM, the New York Fed will release the Q1 2012 Report on Household Debt and Credit (filled with data!)

For the monthly economic question contest (one more questions for May):

Lawler: Pending Home Sales and updated Table of Short Sales and Foreclosures for Selected Cities

by Calculated Risk on 5/30/2012 05:25:00 PM

CR Note: Earlier this month I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler has been digging up similar data, and he sent me the updated table below for several more distressed areas. For all of these areas, with the exception of Rhode Island, the share of distressed sales is down from April 2011 - and for the areas that break out short sales, the share of short sales has increased and the share of foreclosure sales are down - and down significantly in some areas.

In five of the seven cities that break out short sales, there are now more short sales than foreclosure sales!

Lawler noted "all of the below shares are based on MLS data save for California [that uses] Dataquick estimates based on property records."

And Lawler on Pending Home Sales:

Click on graph for larger image.

Click on graph for larger image.

"The National Association of Realtors reported that its Pending Home Sales Index declined by 5.5% on a seasonally adjusted basis in April, after jumping by 3.8% (downwardly revised) in March. April’s PHSI was up 14.4% (SA) from last April. By region, April’s PHSI increased by 0.9% in the Northeast, fell by 0.3% in the Midwest, dropped by 6.8% in the South, and plunged by 12.0% in the West (after jumping by 8.5% in March).

The jump in contracts signed in March, and decline in April, could well have been related to the FHA’s announcement in late February that it was increasing its up-front and annual mortgage insurance premiums effective for FHA case numbers assigned in early April or later."

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Apr | 11-Apr | 12-Apr | 11-Apr | 12-Apr | 11-Apr | |

| Las Vegas | 29.9% | 23.8% | 36.9% | 46.3% | 66.8% | 70.1% |

| Reno | 32.0% | 31.0% | 26.0% | 38.0% | 58.0% | 69.0% |

| Phoenix | 25.2% | 19.7% | 18.8% | 44.5% | 44.0% | 64.2% |

| Sacramento | 30.4% | 22.2% | 30.3% | 44.6% | 60.7% | 66.8% |

| Minneapolis | 10.9% | 10.0% | 32.0% | 43.3% | 42.9% | 53.3% |

| Mid-Atlantic (MRIS) | 12.2% | 11.8% | 11.0% | 20.9% | 23.2% | 32.7% |

| Orlando | 29.4% | 25.4% | 25.5% | 40.2% | 54.9% | 65.6% |

| Northeast Florida | 38.1% | 50.3% | ||||

| Hampton Roads | 31.0% | 35.0% | ||||

| Rhode Island | 32.6% | 31.3% | ||||

| California | 18.3% | 16.9% | 30.3% | 36.4% | 48.6% | 53.3% |

| Miami-Dade | 47.0% | 59.0% | ||||

| Broward | 38.0% | 50.0% | ||||

House Prices: The Turning Point

by Calculated Risk on 5/30/2012 03:11:00 PM

A post by CR on Yahoo: House Prices: The Turning Point

Edit: I meant "turning" instead of "inflection"

Some data and articles mentioned in the post:

• Real House prices and price-to-rent ratio

• S&P Case-Shiller: Pace of Decline in Home Prices Moderates as the First Quarter of 2012 Ends

• Zillow: Home Values Continue to Climb in April

• CoreLogic: House Price Index increases in March, Down 0.6% Year-over-year

• Trulia: Strong Housing Demand and Tightening Inventories Spark Nearly 2 Percent Rise in Asking Prices over Previous Quarter

• April Existing Home Sales and Inventory

• LPS: “First Look” Mortgage Report