by Calculated Risk on 6/06/2012 02:00:00 PM

Wednesday, June 06, 2012

Fed's Beige Book: Economic activity increased at "moderate" pace, Residential real estate "activity improved"

Reports from the twelve Federal Reserve Districts suggest overall economic activity expanded at a moderate pace during the reporting period from early April to late May.This is a slight upgrade from the previous beige book that reported "modest to moderate" growth.

And on real estate:

Activity in residential real estate markets improved in most Districts since the previous report. Several Districts noted consistent indications of recovery in the single-family housing market, although the recovery was characterized as fragile. The apartment market continued to improve, and multifamily construction increased in several Districts.Prepared at the Federal Reserve Bank of Dallas and based on information collected on or before May 25, 2012.

Home sales were above year-ago levels in most areas of the country and several Districts noted sales had improved since the previous report, although some noted that the pace was well below the historical average. In particular, the New York, Cleveland, and Richmond Districts noted a pickup in the pace of distressed sales. Residential brokers and some builders in the Philadelphia, Atlanta, and Dallas Districts said home sales were exceeding expectations. Contacts in the Richmond District said homes were being snapped up as investors become more confident in the housing recovery, and the Atlanta report noted stronger sales to cash buyers and investors in Florida. Chicago said more sales had multiple offers. Apartment rental markets improved in the New York, Atlanta, and Dallas Districts. One contact from the New York District noted rising apartment rents have made buying more attractive, contributing to a slight uptick in sales.

Most Districts reported that home inventories decreased. Overall, home prices remained unchanged in many Districts, although reports were mixed. There were a few reports that sellers were lowering asking prices, leading to downward pressure on housing prices.

New home construction increased in a number of Districts, including Cleveland, Atlanta, Chicago, St. Louis, Minneapolis, and San Francisco. Contacts in the Philadelphia District said demand for new home construction eased slightly. Builders in Kansas City noted housing starts were down, but they expected an increase in the next three months. The Boston, Atlanta, and Chicago Districts reported an increase in multifamily construction, and the Minneapolis District noted numerous multifamily projects were in the pipeline.

Commercial real estate conditions improved in most Districts, and there were some reports that commercial construction picked up.

More sluggish growth - but not a slow down. And a few positive comments on residential real estate ...

WSJ: ECB's Draghi see "heightened risks", Takes no action

by Calculated Risk on 6/06/2012 10:58:00 AM

From the WSJ: Draghi Sees Increased Risks to Economy

European Central Bank President Mario Draghi said the euro-zone economy faces "increased downside risks" and that inflation will fall below 2% early next year."Heightened risks"? Hoocoodanode? I doubt that the Eurozone economy will gradually recover in the 2nd half ... more likely the recession will get worse.

...

"Growth remains weak with heightened risks," the ECB chief said in his opening statement to the monthly news conference following the governing council's meeting.

...

Mr. Draghi noted that growth was flat in the first three months of the year and that so far indicators point to it weakening in the second quarter. However, he said the bank was sticking to its view that the economy would recover gradually in the course of the year.

Meanwhile in Greece: Greece Warns of Going Broke as Tax Proceeds Dry Up

Government coffers could be empty as soon as July, shortly after this month’s pivotal elections. ...

Officials, scrambling for solutions, have considered dipping into funds that are supposed to be for Greece’s troubled banks. Some are even suggesting doling out i.o.u.’s.

Greek leaders said that despite their latest bailout of 130 billion euros, or $161.7 billion, they face a shortfall of 1.7 billion euros because tax revenue and other sources of potential income are drying up. A wrenching recession and harsh budget cuts have left businesses and individuals with less and less to give for taxes — and growing incentive to avoid paying what they owe.

MBA: Refinance Activity increases as Mortgage Rates fall to New Record Low

by Calculated Risk on 6/06/2012 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 2 percent from the previous week to its highest level since February 10, 2012. The seasonally adjusted Purchase Index decreased slightly from one week earlier to its lowest level since April 13, 2012.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.87 percent, the lowest rate in the history of the survey, from 3.91 percent, with points remaining unchanged at 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The purchase index is still very weak. The purchase index has mostly moved sideways for the last two years.

Refinance activity continues to increase as mortgage rates fell to another record low last week.

Tuesday, June 05, 2012

Look Ahead

by Calculated Risk on 6/05/2012 09:25:00 PM

The most interesting information tomorrow are the ECB meeting in Europe (no rate change expected), and the speech by Fed Vice Chair Janet Yellen. Here is a story on the Fed from Jon Hilsenrath at the WSJ: Fed Considers More Action Amid New Recovery Doubts

Disappointing U.S. economic data, new strains in financial markets and deepening worries about Europe's fiscal crisis have prompted a shift at the Federal Reserve, putting back on the table the possibility of action to spur the recovery.And the economic releases on Wednesday:

...

The Fed's next meeting, June 19 and 20, could be too soon for conclusive decisions. Fed policy makers have many unanswered questions and have had trouble forming consensus in the past. Top Fed officials have said that they would support new measures if they became convinced the U.S. wasn't making progress on bringing down unemployment. Recent disappointing employment reports have raised this possibility, but the data might be a temporary blip.

...

Their options include doing nothing and continuing to assess the economic outlook—or more strongly signaling a willingness to act later if the outlook more clearly worsens. Fed policy makers could take a small precautionary measure, like extending for a short period its "Operation Twist" program, in which the Fed is selling short-term securities and using the proceeds to buy long-term securities. Or, policy makers could take bolder action such as launching another large round of bond purchases if they become convinced of a significant slowdown.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record low mortgage rates and probably an increase in refinance activity.

• At 8:30 AM, the final Productivity and Costs for Q1 will be released.

• At 2:00 PM the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This will receive extra attention this month as investors look for signs of a slowdown.

• And at 7:00 PM, Fed Vice Chair Janet Yellen will speak on "The Economic Outlook and Monetary Policy" at the Boston Economic Club Dinner, Boston, Massachusetts.

Comparing Housing Recoveries

by Calculated Risk on 6/05/2012 04:38:00 PM

Yesterday I mentioned a post I wrote over four years ago - back when I was a housing grizzly bear - where I discussed housing and recoveries and pointed out that 1) housing is usually "an engine of recovery" and 2) "Given the current [back in early 2008] fundamentals of housing – significant oversupply, falling demand – it is very unlikely that housing will act as an engine of growth any time soon. We need to see a significant reduction in supply before there will be any increase in residential investment."

I've been asked to update the last two graphs in that post comparing the current recovery with previous recoveries.

The first graph is constructed by normalizing new home sales at the end of the previous six recessions. Then the median is plotted as a percent from the recession bottom. Note that month zero is the last month of each recession. Since sales are normalized, this doesn't show the recent historic collapse in sales - rather this is intended to show the relative strength of the recovery in percentage terms.

Click on graph for larger image.

Click on graph for larger image.

I've made two updates to the graph since four years ago: 1) I added the current recession and recovery, and 2) I extended the period after the end of the recession

Usually housing bottoms a few months before the rest of the economy, and then acts as an engine of growth coming out of the recession. Obviously housing performed terribly following the recent recession - with a small increase due to the tax credit, and then new lows and moving sideways for several years - just as predicted.

The second graph is the data for each of the last 7 recessions (including 2007). Housing didn't boom coming out of the 2001 recession because there was no significant collapse during the recession (an investment led recession). And new home sales faltered following the recession ending in July 1980 (green line) because of the double dip recession of 1980 and '81/'82.

The second graph is the data for each of the last 7 recessions (including 2007). Housing didn't boom coming out of the 2001 recession because there was no significant collapse during the recession (an investment led recession). And new home sales faltered following the recession ending in July 1980 (green line) because of the double dip recession of 1980 and '81/'82.

These graphs show exactly what I expected over four years ago - a long period before housing recovers - and even now the recovery is sluggish.

Technical Note: For the median in the first graph, I used the median sales after normalizing to the low for the recession. Then I calculated the percent recovery from the median. This shows an increase of about 52% over 3 years for the median - less than the usual recovery. This is because the recessions bottomed at different points (relative to the end of the recession), so the bottom for the median was higher (and the percent recovery less). If anything, this understates the usual strength of a housing recovery.

Housing: Dude, Where's my inventory?

by Calculated Risk on 6/05/2012 01:45:00 PM

I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), inventory is off 22.0% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through April (left axis) and the HousingTracker data for the 54 metro areas through early June.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then starts to increase again through the summer. So inventory might increase a little over the next couple of months, but the forecasts for a "surge" in inventory this summer appear to be incorrect.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early June listings, for the 54 metro areas, declined 22.0% from the same period last year. So far in 2012, there has only been a small seasonal increase in inventory.

HousingTracker reported that the early June listings, for the 54 metro areas, declined 22.0% from the same period last year. So far in 2012, there has only been a small seasonal increase in inventory.

This decline in active inventory remains a huge story, and lower levels of inventory will help with the stabilization of house prices.

Trulia: Asking House Prices Unchanged in May

by Calculated Risk on 6/05/2012 12:43:00 PM

Press Release: Trulia Reports Flat Asking Prices in May After Three Straight Months of Increases, as Foreclosure Prices Decline

Based on the for-sale homes and rentals listed on Trulia, these monitors take into account changes in the mix of listed homes and reflect trends in prices and rents for similar homes in similar neighborhoods through May 31, 2012.More from Jed Kolko, Trulia Chief Economist: Home Prices Stall, Breaking 3-Month Streak of Rising Prices

Asking prices on for-sale homes–which lead sales prices by approximately two or more months – were unchanged in May month-over-month, seasonally adjusted. Together with increases in April and March, asking prices in May rose nationally 1.6 percent quarter over quarter (Q-o-Q), seasonally adjusted. The price increase unadjusted for seasonality was even higher: 5.2 percent Q-o-Q, since prices typically jump in springtime. Year over year (Y-o-Y) asking prices fell slightly by 0.2 percent. Nationally, 41 out of the 100 largest metros had Y-o-Y price increases, and 86 out of the 100 largest metros had Q-o-Q price increases, seasonally adjusted.

On Rents:

In May, rents were 6.0 percent higher than they were a year ago, up from the 5.4 percent Y-o-Y rent increase in April, and 4.8 percent in MarchNote that Trulia adjusts asking prices for both mix and seasonality. A 1.6% increase for the quarter is pretty significant.

ISM Non-Manufacturing Index indicates slightly faster expansion in May

by Calculated Risk on 6/05/2012 10:00:00 AM

The May ISM Non-manufacturing index was at 53.7%, up from 53.5% in April. The employment index decreased in May to 50.8%, down from 54.2% in April - the lowest level since November 2011. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in May for the 29th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 53.7 percent in May, 0.2 percentage point higher than the 53.5 percent registered in April. This indicates continued growth this month at a slightly faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55.6 percent, which is 1 percentage point higher than the 54.6 percent reported in April, reflecting growth for the 34th consecutive month. The New Orders Index increased by 2 percentage points to 55.5 percent, and the Employment Index decreased by 3.4 percentage points to 50.8 percent, indicating continued growth in employment at a slower rate. The Prices Index decreased 3.8 percentage points to 49.8 percent, indicating lower month-over-month prices for the first time since July 2009. According to the NMI, 13 non-manufacturing industries reported growth in May. The majority of the respondents' comments are positive and optimistic about business conditions and the direction of the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 53.5% and indicates faster expansion in May than in April.

CoreLogic: House Price Index increases in April, Up 1.1% Year-over-year

by Calculated Risk on 6/05/2012 09:22:00 AM

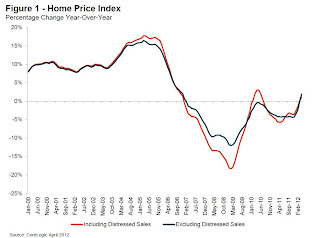

Notes: This CoreLogic House Price Index report is for April. The Case-Shiller index released last week was for March. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Increase of Just Over One Percent

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 1.1 percent in April 2012 compared to April 2011. This was the second consecutive year-over-year increase this year, and the first time two consecutive increases have occurred since June 2010. On a month-over-month basis, home prices, including distressed sales, increased by 2.2 percent in April 2012. This marks the second consecutive month-over-month increase this year.

Excluding distressed sales, prices increased 2.6 percent in April 2012 compared to March 2012, the third month-over-month increase in a row. The CoreLogic HPI also shows that year-over-year prices, excluding distressed sales, rose by 1.9 percent in April 2012 compared to April 2011. Distressed sales include short sales and real estate owned (REO) transactions.

Beginning with the April 2012 HPI report, CoreLogic is introducing a ... pending HPI that provides the most current indication of trends in home prices. The pending HPI indicates that house prices will rise by at least another 2.0 percent, from April to May. Pending HPI is based on Multiple Listing Service (MLS) data that measure price changes in the most recent month.

“We see the consistent month-over-month increases within our HPI and Pending HPI as one sign that the housing market is stabilizing,” said Anand Nallathambi, president and chief executive officer of CoreLogic. “Home prices are responding to a restricted supply that will likely exist for some time to come—an optimistic sign for the future of our industry.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.2% in April, and is up 1.1% over the last year.

The index is off 32% from the peak - and is just above the post-bubble low set two months ago.

The second graph is from CoreLogic. The year-over-year comparison has turned positive.

The second graph is from CoreLogic. The year-over-year comparison has turned positive.Excluding the tax credit period, this is the first year-over-year increase since 2006 (March was revised up to a year-over-year increase too). This "stabilization" of house prices is a significant story.

WSJ: Spain Warns of Losing Access to Markets for Borrowing

by Calculated Risk on 6/05/2012 08:51:00 AM

From the WSJ: Spain Warns Market Access Being Shut

Spain's Budget Minister Cristobal Montoro on Tuesday urged euro-zone partners to act faster to help support its enfeebled banks, saying that the government has effectively lost access to capital markets because of steep risk premiums demanded by sovereign bond investors.

In making this dramatic admission, Mr. Montoro joined recent calls by the Spanish government for direct aid from European Union institutions for Spanish banks as the government hopes to avoid a full-blown bailout package ...

"What this premium tells us is that the state, and Spain as a whole, has a problem when it comes to accessing markets, when we need to refinance our debt," Mr. Montoro said in a radio interview. "What that premium says is that Spain doesn't have the market's door open, as such, the challenge is to open that door and regain the confidence of those markets, our creditors."

Monday, June 04, 2012

Look Ahead: ISM non-manufacturing index

by Calculated Risk on 6/04/2012 10:16:00 PM

• At 9:00 AM ET, Ceridian-UCLA Pulse of Commerce Index will be released. This is the diesel fuel index for May (a measure of transportation).

• At 10:00 AM AM, the ISM non-manufacturing (service) index will be released. The consensus is for the index to be unchanged at 53.5.

• Also at 10:00 AM ET, the Trulia House Price & Rent Monitors for May. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

The focus will be on Europe and the "emergency" G7 talks. Also three Fed regional presidents will speak in the afternoon.

The Misfiring Engine of Recovery

by Calculated Risk on 6/04/2012 06:31:00 PM

Gad Levanon at the Conference Board makes some interesting points: Why is Employment Growth Still Disappointing and When Will it be “Normal” Again?

In a typical recovery, rapid economic growth is driven by pent-up demand for consumer durable goods, housing, and business equipment. Also, in a typical recovery the government moderately adds jobs, and economies outside of the U.S. are enjoying robust growth, which helps boost American exports and raises the revenues of American multinationals. So what’s different this time? There are several combined factors that are dragging down the U.S. economy and labor market:Usually housing is an engine of recovery following a recession, but this time, due to the excess supply of vacant homes, housing has lagged the economy.

1) Government spending is shrinking. The hope was that the federal stimulus would create jobs while the private sector was in recession, and that this federal stimulus would eventually wind down while the private sector would pick up. This wind-down has occurred, but the private sector is not generating enough jobs by itself yet. At the same time, state and local governments... have been cutting back for several years now ... In the past year, state and local governments have slowed down their layoffs, but the number of employees in the federal government is still rapidly shrinking -- down by 1.8%. Overall, the public sector has reduced its workforce for three years in a row, cutting a total of about 700,000 workers.

2) The housing market has barely started recovering, and employers in related industries are barely adding jobs. This typically strong driver of growth during expansions is missing in this economy.

3) The global economy is weak. Many countries in Europe are in recession, and the main emerging countries’ economies are significantly slowing down. As a result, U.S. exports and revenues of multinationals and overall consumer and business confidence are suffering.

4) Commodity prices are now at a much higher level than two-to-three years ago. This has caused large price increases in food, energy, and other commodity related products. In the past 2 years, as a result of the price hikes and weakness in housing, the consumption of food, gasoline, public transportation, housing, and utilities have increased by just 0.5% of their annual rate.

And usually government hiring contributes moderately to a recovery, but this time we've seen a significant decline in government employment. This decline has been mostly from state and local cutbacks, but the Federal government has been cutting back too.

And of course, as Levanon notes, the global economy is weak with several key countries in recession.

The little bit of good news is housing is finally starting to slowly recover, and perhaps state and local government layoffs might end mid-year. So far GDP growth has been heavily car driven, and that growth might slow - and, of course, the global economy is a drag.

It seems like one or two cylinders of the growth engine are always misfiring. This is why sluggish and choppy growth has been my general forecast for almost 3 years now.

G7 Emergency Talks on Tuesday

by Calculated Risk on 6/04/2012 03:26:00 PM

From Reuters: G7 to hold emergency euro zone talks, Spain top concern

Finance chiefs of the Group of Seven leading industrialized powers will hold emergency talks on the euro zone debt crisis on Tuesday ...Over the weekend, I put together a short list of key dates this month for Europe. There will probably be plenty of "emergency" discussions too.

Canadian Finance Minister Jim Flaherty said ministers and central bankers of the United States, Canada, Japan, Britain, Germany, France and Italy would hold a special conference call, raising pressure on the Europeans to act.

"The real concern right now is Europe of course - the weakness in some of the banks in Europe, the fact they're undercapitalized, the fact the other European countries in the euro zone have not taken sufficient action yet to address those issues of undercapitalization of banks and building an adequate firewall," Flaherty told reporters.

BIS Quarterly Review: Global Banks Cut Lending

by Calculated Risk on 6/04/2012 01:30:00 PM

From the Bank for International Settlements (BIS): Quarterly Review(ht mp)

And from Mark Scott at the NY Times DealBook: Global Banks Cut Lending in Response to Economic Slowdown

International lending by global banks in the fourth quarter last year fell by the largest amount since the collapse of Lehman Brothers in 2008, according to the Bank for International Settlements, an association of the world’s central banks.This pullback in lending is global, but it is concentrated in Europe. However there appears to be some tightening in the U.S. too. In a research note on Friday, Goldman Sachs noted this:

In total, financial firms cut overseas lending by $799 billion in the last three months of 2011, the latest figures available. Around 80 percent of the reduction came from the so-called interbank market where institutions lend money to one another.

...

As the ripple effects of the European debt crisis have been felt across the United States and emerging economies in Asia and Latin America, banks in both developed and emerging economies have been looking to pullback on credit to risky borrowers.

Attention has focused on Europe and its beleaguered banking system. In its quarterly review published on Monday, the Bank for International Settlements, based in Basel, Switzerland, said international banks had cut lending to financial firms in the so-called euro zone region by $364 billion in the fourth quarter last year. The reduction represents almost half of the global pullback in lending over the period.

US financial conditions have tightened by about 40bp since April, according to our GSFCI. If the current stress were sustained, the tightening would mechanically imply a 0.6% hit to real GDP. Our analysis suggests that perhaps half of this can be explained by the European crisis.

Gasoline prices declining

by Calculated Risk on 6/04/2012 09:09:00 AM

Oil prices have fallen sharply. West Texas Intermediate (WTI) futures are down to $82.36, and Brent is down to $96.93 per barrel.

Note on Europe: There are two main channels that could impact the U.S. economy: trade, and financial spillover / credit tightening. The impact on trade will probably be minimal, even as the euro falls sharply against the dollar, because a small percentage of U.S. GDP is from exports to Europe - and some of decline in trade will be offset by lower oil prices (and lower US interest rates). The financial channel is much more of an unknown, and that is the significant downside risk.

From the Indystar.com: Gasoline prices expected to continue to fall in Indiana, analyst says

“With significant downward pressure on oil last week, motorists will continue to see prices sliding east of the Rockies, and even the West Coast will start to get in on the action, thanks to a supply situation that appears to be turning around.”The following graph shows the decline in gasoline prices. Gasoline prices are down significantly from the peak in early April, and should fall further following the steep decline in oil prices last week. Gasoline prices in the west have been impacted by refinery issues, but prices are now falling there too.

Average retail gas prices in Indianapolis have dropped by 17 cents a gallon last week, averaging $3.53 Sunday and $3.52 this morning. That’s about 40 cents lower than last month and about half a dollar cheaper than last year, according to Gasbuddy.com.

Note: The graph shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Sunday, June 03, 2012

Sunday Night Futures

by Calculated Risk on 6/03/2012 10:06:00 PM

The only release on Monday is Factory Orders at 10:00 AM. The consensus is for a 0.1% increase in orders.

The focus will probably be on Europe again, although the FTSE 100 is closed for the Queen's Diamond Jubilee. The ECB meets on Wednesday (see Europe: A few Key Dates this Month )

The Asian markets are all red tonight. The Nikkei is down about 2.2%, and the Shanghai Composite is down 1.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down about 10, and Dow futures are down 100.

Oil: WTI futures are at $82.30 (this is down from $109.77 in February) and Brent is at $97.73 per barrel. Both are down about 10% over the last week.

Saturday:

• Summary for Week Ending June 1st

• Schedule for Week of June 3rd

For the monthly economic question contest (two more questions for June):

Sluggish Growth and Payroll Employment: An Update

by Calculated Risk on 6/03/2012 04:15:00 PM

Last November I posted a graph showing two possible paths for payroll employment if sluggish growth continued. I've received several requests to update that graph.

The two rates were 125,000 jobs added per month, and 200,000 jobs added per month.

Since I posted that graph, payroll growth has averaged 172,000 jobs per month. Also, with the annual benchmark revision, the previous year was revised up - so at 125,000 per month from November 2011, it would have taken 48 months just to get back to the pre-recession level of payroll employment. From the current level, at 125,000 per month, it will take an additional 40 months (Sept 2015).

At 200,000 payroll jobs per month, it will take an additional 25 months (June 2014) to get back to the pre-recession level from the current level. (The graph shows April 2014 at 200,000 per month, but that is from November 2011, and we are behind that pace).

The following two graphs show these projections from last November.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month.

Click on graph for larger image.

Click on graph for larger image.

If we followed the red line path from last year, payroll jobs would return to the pre-recession level in November 2015. The dashed blue line returns to the pre-recession level in April 2014.

And this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

The second graph shows the same data but aligned at peak job losses.

The second graph shows the same data but aligned at peak job losses.

Last November the debate was been between another recession and sluggish growth - and I correctly took sluggish growth. But as I noted last year, even sluggish growth is a disaster for payroll employment.

Europe: A few Key Dates this Month

by Calculated Risk on 6/03/2012 12:46:00 PM

Just a few dates ... the last two weeks will be very busy.

• Wednesday, June 6th: ECB Governing Council meeting. Here are a few comments from analysts at Nomura:

We expect the ECB to keep its policy rate unchanged at 1%, keeping the powder dry until there is more clarity on Greece's euro-area membership. ... We think the tone of the press conference and the statement will be significantly more dovish than last month given that the ECB's assumption of a mid-summer recovery is currently at risk. We also expect the June quarterly forecast update to show downward revisions to both the inflation and the output outlook. In our view, such a dovish signal would firm expectations that the ECB will cut rates as soon as at the July meeting. ... At the moment, we see a 30% probability of a 25bp rate cut next week.• Thursday, June 7th: BoE rate decision. From the Telegraph: Bank of England to consider £50bn stimulus for economy

Worsening economic prospects could force the hand of the Bank’s Monetary Policy Committee, which last month voted to pause its purchase of government bonds after pumping £325bn into the market through quantitative easing. ... The International Monetary Fund has recommended that the MPC consider a further reduction in interest rates, which have been at an all-time low of 0.5pc since March 2009, to help the UK weather the eurozone debt crisis.• Monday, June 11th: IMF Report on Spanish Banks

• Sunday, June 17th: Greek Election.

Monday, June 18th: Independent Spanish Bank Stress Tests. This is the preliminary results of the tests by Oliver Wyman Ltd. and Roland Berger Strategy Consultants. From Reuters: "Big Four" to audit Spain's banking sector

Spain has picked the "Big Four" accounting firms KPMG KPMG.UL, PwC PWC.UL, Deloitte DLTE.UL and Ernst & Young ERNY.UL to carry a full, individual audit of its ailing banks, a source with knowledge of the decision told Reuters on Saturday.Monday, June 18th: Start of two day G20 summit meeting in Los Cabos, Mexico

The review, which should take a few months, will complement an ongoing exercise to stress test Spain's banking sector by consultors Oliver Wyman and Roland Berger, whose first results are expected around mid-June.

Thursday, June 21st: Meeting of euro zone finance ministers

Thursday, June 28th: Start of two day European summit in Brussels

Saturday, June 30th: Greece required to enact new austerity measures as part of the bailout agreement. Greece is currently funded until the end of June.

Yesterday:

• Summary for Week Ending June 1st

• Schedule for Week of June 3rd

Employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Report Graphs: Construction, Duration of Unemployment and Diffusion Indexes

• Employment Graphs

Unofficial Problem Bank list declines to 927 Institutions

by Calculated Risk on 6/03/2012 09:17:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 1, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, most changes to the Unofficial Problem Bank List were removals. In all, there were four removals that include one unassisted merger --Bank of Anderson, National Association, Anderson, SC ($139 million) -- and three action terminations -- Preferred Bank, Los Angeles, CA ($1.4 billion Ticker: PFBC); Castle Rock Bank, Castle Rock, CO ($106 million); and Battle Creek State Bank, Battle Creek, NE ($26 million). After the removals, the list holds 927 institutions with assets of $356.4 billion. A year ago, the list held 997 institutions with assets of $416.7 billion. The other change this week is the Federal Reserve issuing a Prompt Corrective Action order against Premier Bank, Denver, CO ($53 million).Yesterday:

• Summary for Week Ending June 1st

• Schedule for Week of June 3rd

Employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Report Graphs: Construction, Duration of Unemployment and Diffusion Indexes

• Employment Graphs

Saturday, June 02, 2012

Schedule for Week of June 3rd

by Calculated Risk on 6/02/2012 08:59:00 PM

Earlier:

• Summary for Week Ending June 1st

Employment posts:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

• May Employment Summary and Discussion

• Employment Report Graphs: Construction, Duration of Unemployment and Diffusion Indexes

• Employment Graphs

The key report this week is the April Trade Balance report.

Also the ISM non-manufacturing (service) index will be released on Tuesday.

Fed Chairman Ben Bernanke will provide Senate testimony on Thursday. There are several Fed speeches scheduled this week, and the Fed Beige Book will be released on Wednesday.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 0.1% increase in orders.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for May (a measure of transportation).

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for the index to be unchanged at 53.5. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for the index to be unchanged at 53.5. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index. The index declined sharply in April.

10:00 AM: Trulia Price & Rent Monitors for May. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record low mortgage rates and probably an increase in refinance activity.

8:30 AM: Productivity and Costs for Q1 (Final). The consensus is for a 2.1% increase in unit labor costs.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This will receive extra attention this month as investors look for signs of a slowdown.

7:00 PM: Speech by Fed Vice Chair Janet Yellen, "The Economic Outlook and Monetary Policy", At the Boston Economic Club Dinner, Boston, Massachusetts

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 379 thousand from 383 thousand last week.

10:00 AM: Testimony, Fed Chairman Ben Bernanke, "Economic Outlook and Policy", before the Joint Economic Committee, U.S. Senate.

3:00 PM: Consumer Credit for April. The consensus is for a $12.0 billion increase in consumer credit.

12:00 PM: Q1 Flow of Funds Accounts from the Federal Reserve.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. Exports increased in March, and were at record levels. Imports increased even more. Exports are 13% above the pre-recession peak and up 7% compared to March 2011; imports are 3% above the pre-recession peak, and up about 8% compared to March 2011.

The consensus is for the U.S. trade deficit to decrease to $49.3 billion in April, down from from $51.8 billion in March. Export activity to Europe will be closely watched due to economic weakness. Also oil prices started to decline in April, but that probably won't reduce imports until May.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.5% increase in inventories.