by Calculated Risk on 6/09/2012 07:36:00 PM

Saturday, June 09, 2012

Unofficial Problem Bank list declines to 923 Institutions

This is an unofficial list of Problem Banks compiled only from public sources. (Only US banks).

Here is the unofficial problem bank list for June 8, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Four failures meant four removals from the Unofficial Problem Bank List. The list stands at 923 institutions with assets of $355.7 billion. A year ago, the list held 1,002 institutions with assets of $417.4 billion. After three weeks off, the FDIC got back to closings leading to the following removal s -- Waccamaw Bank, Whiteville, NC ($533 million Ticker: WBNK); Carolina Federal Savings Bank, Charleston, SC ($54 million); First Capital Bank, Kingfisher, OK ($46 million); and Farmers' and Traders' State Bank, Shabbona, IL ($43 million).Earlier:

F & M Bank, Edmond, Oklahoma paid a 7.65 percent deposit premium to acquire First Capital Bank. This appears to be the highest deposit premium paid to complete an assisted acquisition during this crisis. Although the FDIC likes to receive a deposit premium when selling a failed bank, buyers have only been willing to pay one in about one-third of the 443 failures since 2008 and in four transactions buyers have bid a discount.. When paid, the average deposit premium is 1.09 percent. Thus, the premium paid by F&M Bank is very high at 4.7 standard deviations above the average. In a few months, the FDIC will release bidding information for First Capital Bank, which should allow some insight if the premium paid F&M Bank was necessary to close the deal. There have been some transactions where bidders have been too aggressive. For instance, in January 2010, United Valley Bank, Cavalier, ND, paid a 7.35 percent deposit premium to acquire the failed Marshall Bank, National Association, Hallock, MN with the next highest bid was a 1.32 percent premium.

Next week, we anticipate the OCC will release its actions through mid-June 2012.

• Summary for Week Ending June 8th

• Schedule for Week of June 10th

And on Spain:

• Eurogroup statement on Spain

• WSJ: Spain Asks EU for Aid For Its Banks

• NY Times: Spain to Accept Rescue From Europe for Its Ailing Banks

• Financial Times: Spain seeks eurozone bail out

Spain to ask EU for Bank Bailout

by Calculated Risk on 6/09/2012 02:09:00 PM

From the Financial Times: Spain to ask EU for bail out

The Spanish government agreed to seek EU bailout aid for its struggling financial sector on a conference call of eurozone finance ministers Saturday evening.It sounds like the maximum will be €100 billion. Apparently policymakers wanted to get something in place before the Greek election on June 17th.

In exchange, the ministers agreed not to attach any new conditions on Madrid other than its current commitments ...

Excerpt with permission

Earlier:

• Summary for Week Ending June 8th

• Schedule for Week of June 10th

Schedule for Week of June 10th

by Calculated Risk on 6/09/2012 01:05:00 PM

Earlier:

• Summary for Week Ending June 8th

The key report this week is the May retail sales report. For manufacturing, the May NY Fed (Empire state) survey, and the May Industrial Production and Capacity Utilization report will be released this week.

For prices, the May Producer Price Index and Consumer Price Index will be released on Wednesday and Thursday, respectively.

No economic releases scheduled.

7:30 AM: NFIB Small Business Optimism Index for May.

7:30 AM: NFIB Small Business Optimism Index for May. Click on graph for larger image in graph gallery.

The index increased to 94.5 in April from 92.5 in March. This tied February 2011 as the highest level since December 2007

The consensus is for a slight decrease to 94.2 in May.

8:30 AM: Import and Export Prices for April. The consensus is a for a 1.1% decrease in import prices.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record low mortgage rates and probably an increase in refinance activity.

8:30 AM: Producer Price Index for May. The consensus is for a 0.6% decrease in producer prices (0.2% increase in core).

8:30 AM ET: Retail Sales for May.

8:30 AM ET: Retail Sales for May. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 23.1% from the bottom, and now 7.7% above the pre-recession peak.

The consensus is for retail sales to decrease 0.2% in May, and for retail sales ex-autos to decrease 0.1%.

10:00 AM: Manufacturing and Trade: Inventories and Sales for April (Business inventories). The consensus is for 0.3% increase in inventories.

8:30 AM: Consumer Price Index for May. The consensus is for headline CPI to decline 0.2% (with the decline in energy prices). The consensus is for core CPI to increase 0.2%.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 375 thousand from 377 thousand last week.

8:30 AM ET: NY Fed Empire Manufacturing Survey for June. The consensus is for a reading of 13.8, down from 17.1 in May (above zero is expansion).

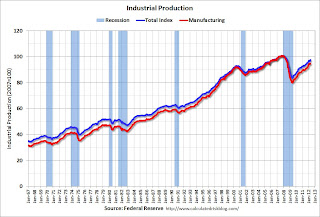

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May. This shows industrial production since 1967.

The consensus is for no change in Industrial Production in May, and for Capacity Utilization to be unchanged at 79.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for sentiment to decline to 77.5 from 79.3 in May.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for May 2012

Report: Euro zone discussing €100 billion aid for Spanish Banks

by Calculated Risk on 6/09/2012 10:16:00 AM

From the WSJ: Ministers to Discuss $125 Billion in Spain Bank Support

Euro-zone finance ministers will discuss a commitment to provide as much as €100 billion ($125 billion) in support for Spain's ailing banking sector on Saturday afternoon, an official from a euro-zone country said Saturday.

Summary for Week Ending June 8th

by Calculated Risk on 6/09/2012 08:01:00 AM

Most of the news last week was about either Europe or the Fed, especially comments from Fed Chairman Bernanke. The Fed debate is on the possibility and timing of "QE3". The next FOMC meeting is on June 19th and 20th, just after the election in Greece.

This was a light week for US economic data. The trade deficit declined slightly - and will probably decline further in May with falling oil prices. However the weakness in the euro zone is showing up in the trade data as US exports to the euro area declined from $17.1 billion in April 2011 to $16.3 billion in April 2012.

Other data was a little more positive. Initial weekly unemployment claims declined slightly, and the ISM non-manufacturing index increased in May.

Also CoreLogic reported house prices were up year-over-year in April. This is the first year-over-year increase in prices since the bubble burst - except for a brief increase related to the tax credit.

Here is a summary of last week in graphs:

• Trade Deficit declines in April to $50.1 Billion

The first graph shows the monthly U.S. exports and imports in dollars through April 2012.

Click on graph for larger image.

Click on graph for larger image.

Exports decreased in April. Imports decreased even more. Exports are 11% above the pre-recession peak and up 4% compared to April 2011; imports are 2% above the pre-recession peak, and up about 6% compared to April 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Oil averaged $109.94 per barrel in April, up from $107.95 in March. Import oil prices will probably start to decline in May. The trade deficit with China increased to $24.6 billion in April, up from $21.6 billion in April 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $16.3 billion in April, down from $17.1 billion in April 2011, so the euro area recession appears to be a drag on US exports.

• ISM Non-Manufacturing Index indicates slightly faster expansion in May

The May ISM Non-manufacturing index was at 53.7%, up from 53.5% in April. The employment index decreased in May to 50.8%, down from 54.2% in April - the lowest level since November 2011. Note: Above 50 indicates expansion, below 50 contraction.

The May ISM Non-manufacturing index was at 53.7%, up from 53.5% in April. The employment index decreased in May to 50.8%, down from 54.2% in April - the lowest level since November 2011. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 53.5% and indicates faster expansion in May than in April.

• CoreLogic: House Price Index increases in April, Up 1.1% Year-over-year

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.2% in April, and is up 1.1% over the last year.

The index is off 32% from the peak - and is just above the post-bubble low set two months ago.

Excluding the tax credit period, this is the first year-over-year increase since 2006 (March was revised up to a year-over-year increase too). This "stabilization" of house prices is a significant story.

• Fed's Q1 Flow of Funds: Household Real Estate Value increased in Q1

The Federal Reserve released the Q1 2012 Flow of Funds report this week: Flow of Funds.

The Fed estimated that the value of household real estate increased $372 billion to $16.05 trillion in Q1 2012. The value of household real estate has fallen $6.3 trillion from the peak.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $85 billion in Q1. Mortgage debt has now declined by $885 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, is near the lows of the last 30 years, however household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• Weekly Initial Unemployment Claims decline to 377,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.

The average has been between 363,000 and 384,000 all year, and this is the highest level since early May.

This was close to the consensus forecast of 379,000.

• Other Economic Stories ...

• Testimony by Chairman Bernanke on economic outlook and policy

• Fed's Beige Book: Economic activity increased at "moderate" pace, Residential real estate "activity improved"

• Comparing Housing Recoveries

• Housing: Dude, Where's my inventory?

• Trulia Reports Flat Asking Prices in May After Three Straight Months of Increases, as Foreclosure Prices Decline

Friday, June 08, 2012

IMF reports Spanish Banks need €37 billion; China CPI up 3.0%

by Calculated Risk on 6/08/2012 10:05:00 PM

Earlier today there were reports that Spain could request a bank bailout this weekend. From the Financial Times: Spain poised to seek bailout and from Reuters: Exclusive: Spain poised to request EU bank aid Saturday

Spain is expected to ask the euro zone for help with recapitalizing its banks this weekend, sources in Brussels and Berlin said on Friday, becoming the fourth country to seek assistance since Europe's debt crisis began.However, later in the day, from MarketWatch:

Five senior EU and German officials said deputy finance ministers from the single currency area would hold a conference call on Saturday morning to discuss a Spanish request for aid, although no figure for the assistance has yet been fixed.

Later the Eurogroup, which consists of the euro zone's 17 finance ministers, will hold a separate call to discuss approving the request, the sources said.

"The announcement is expected for Saturday afternoon," one of the EU officials said.

Deputy Prime Minister Soraya Saenz de Santamaria told reporters Friday that the government would make no decisions on any aid request before the results of various reports on Spanish banks were known.However the IMF released the report today, from the WSJ: Pressure Mounts on Spain to Request a Bailout

“The government has to respect the process before taking any decisions about the data of the banks,” said Sáenz de Santamaría, in the televised press conference. She also said there were no plans for any meetings in the coming days, but sidestepped questions about whether a teleconference call would be held.

The Economics Ministry said Friday that the results of the independent audit and stress-testing of Spanish banks will publish June 21. The government has also hired a second set of independent auditors to value the banks, with results expected July 31. As well, said Sáenz de Santamaría, the government was waiting on results expected next Monday, June 11, from the International Monetary Fund report on the banking sector.

In conference calls Saturday, euro-zone finance officials are expected to press Spain's government to request aid before the June 17 Greek elections, according to European officials familiar with the negotiations.And on China from MarketWatch: China data deluge

On the eve of those calls, the International Monetary Fund rushed out a report late Friday saying the banks need at least €37 billion ($46 billion); the report had been expected Monday.

Chinese data will be closely watched for signs that country’s economy is slowing more dramatically than previously projected. Over the weekend, China is scheduled to release its latest data on inflation, industrial production and retail sales for May, as well as monthly trade results.From the WSJ headline: "China's consumer price index rose 3.0% in May from the same month a year earlier, slower than April's 3.4% rise."

Bank Failures #26 to #28 in 2012

by Calculated Risk on 6/08/2012 06:08:00 PM

What the hell’s a Waccamaw?

Carolina too?

by Soylent Green is People

From the FDIC: Bank of North Carolina, Thomasville, North Carolina, Assumes All of the Deposits of Carolina Federal Savings Bank, Charleston, South Carolina

As of March 31, 2012, Carolina Federal Savings Bank had approximately $54.4 million in total assets and $53.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $15.2 million. ... Carolina Federal Savings Bank is the 26th FDIC-insured institution to fail in the nation this year, and the second in South Carolina.From the FDIC: First State Bank, Mendota, Illinois, Assumes All of the Deposits of Farmers and Traders State Bank, Shabbona, Illinois

As of March 31, 2012, Farmers and Traders State Bank had approximately $43.1 million in total assets and $42.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.9 million. ... Farmers and Traders State Bank is the 27th FDIC-insured institution to fail in the nation this year, and the second in Illinois.From the FDIC: First Community Bank, Bluefield, Virginia, Assumes All of the Deposits of Waccamaw Bank, Whiteville, North Carolina

As of March 31, 2012, Waccamaw Bank had approximately $533.1 million in total assets and $472.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $51.1 million. ... Waccamaw Bank is the 28th FDIC-insured institution to fail in the nation this year, and the first in North Carolina.That makes four so far today.

Bank Failure #25 in 2012: First Capital Bank, Kingfisher, Oklahoma

by Calculated Risk on 6/08/2012 05:11:00 PM

Capital base denuded

Bank apprehended.

by Soylent Green is People

From the FDIC: F & M Bank, Edmond, Oklahoma, Assumes All of the Deposits of First Capital Bank, Kingfisher, Oklahoma

As of March 31, 2012, First Capital Bank had approximately $46.1 million in total assets and $44.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.6 million. ... First Capital Bank is the 25th FDIC-insured institution to fail in the nation this year, and the first in Oklahoma.The FDIC gets back to work ...

Las Vegas House sales up YoY in May, Inventory down sharply

by Calculated Risk on 6/08/2012 03:41:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities. Prices, as of the March Case-Shiller report, were off 61.5% from the peak, and off 7.5% over the last year.

Sales in 2011 were at record levels - even more than during the bubble - and it looks like 2012 will be an even stronger year, even with some new rules that slow the foreclosure process.

From the GLVAR: GLVAR reports local home prices and sales are rising, as local housing inventory shrinks

“Basically, we’re seeing a classic case of supply and demand,” said GLVAR President Kolleen Kelley, a longtime local REALTOR®. “Our local housing supply is going down, primarily because banks are putting fewer homes on the market. As a result, prices are going up.”Inventory continues to decline (down 66.3% year-over-year for single family homes) and sales are on a record pace. Still over 2/3s of all sales are distressed (short and REO), as the shift from foreclosure to short sales continues.

The local housing inventory was already tightening throughout 2011. But Kelley said it has been shrinking at a more rapid rate in 2012. Based on the current sales pace, she said “our local housing supply is down to about a month’s worth of inventory.”

Even with fewer homes listed for sale, Kelley said existing home sales remain ahead of the record sales pace set in 2011, when GLVAR reported that 48,186 existing properties were sold in Southern Nevada.

According to GLVAR, the total number of local homes, condominiums and townhomes sold in May was 4,134. That’s up from 3,924 in April and up from 3,991 total sales in May 2011.

...

GLVAR reported a total of 3,728 condos and townhomes listed for sale on its MLS at the end of May. That’s down 2.8 percent from 3,836 condos and townhomes listed at the end of April, and down 29.1 percent from one year ago. As in recent months, the number of available homes listed for sale without any sort of pending or contingent offer also dropped sharply compared to the previous month and year. By the end of May, GLVAR reported 3,800 single-family homes listed without any sort of offer. That’s down 8.7 percent from 4,162 such homes listed in April and down 66.3 percent from one year ago. ...

32.6 percent of all existing local homes sold during May were short sales ... That’s up from 29.9 percent in April

Bank-owned homes accounted for 34.7 percent of all existing home sales in May, down from 36.9 percent in April.

AAR: Rail Traffic "mixed" in May

by Calculated Risk on 6/08/2012 12:18:00 PM

Once again rail traffic was "mixed". This was mostly due to the sharp decline in coal traffic (mild winter, low natural gas prices). Most commodities were up, such as building related commodities such as lumber and crushed stone, gravel, sand. Lumber was up 16.9% from May 2011.

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for May

The Association of American Railroads (AAR) today reported U.S. rail carloads originated in May 2012 totaled 1,392,352, down 40,405 carloads or 2.8 percent, compared with May 2011. Intermodal volume in May 2012 was 1,178,312 trailers and containers, up 39,696 units or up 3.5 percent, compared with May 2011. The May 2012 weekly intermodal average of 235,662 trailers and containers is the highest May average in history.

...

Thirteen of the 20 commodity categories tracked by the AAR saw carload gains in May 2012 compared with May 2011, including: motor vehicles, up 17,066 cars or 27.7 percent; petroleum and petroleum products, up 16,460 carloads, or 49.2 percent; crushed stone, sand and gravel, up 7,535 carloads, or 8.2 percent; lumber and wood products, up 2,357 carloads, or 16.9 percent, and primary metal products, up 2,260 carloads, or 4.3 percent.

Commodities with carload declines in May were led by coal, down 74,469 carloads, or 12.1 percent compared with May 2011. Other commodities with declines included grain, down 13,322 carloads, or 11.8 percent; chemicals, down 3,563 carloads, or 2.4 percent, and nonmetallic minerals, down 2,181 carloads, or 8.7 percent. Carloads excluding coal and grain were up 47,386 carloads, or 6.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

It’s a broken record (for those of who you still remember what that phrase means) to say this, but coal and grain were again to blame for the U.S. carload decline in May. Coal carloads were down 12.1% (74,469 carloads) in May 2012 to 542,503 carloads. To look on the bright side, that’s an improvement over the 16.6% decline in April 2012 and the 15.8% decline in March 2012.Grains are down due to fewer exports.

U.S. rail grain carloads totaled 99,372 in May 2012, down 11.8% (13,322 carloads) from May 2011.

The second graph is just for coal and shows the sharp decline this year.

The second graph is just for coal and shows the sharp decline this year.From AAR:

It was another tough month for coal, in the U.S. at least. Coal carloads on U.S. railroads in May 2012 were down 12.1% (74,469 carloads) from May 2011, equivalent to 573 130-car coal trains. ... It would take a really, really hot summer for coal consumption in 2012 to come close to what it was in 2011.The third graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now at peak levels.

U.S. intermodal traffic, which is not included in carloads, was up 3.5% (39,696 containers and trailers) in May 2012 over May 2011 to 1,178,312 units. The weekly average in May 2012 was 235,662 intermodal units, which is the highest average of any May in history and the 16th highest of any month in history.The top months for intermodal are usually in the fall.

Trade Deficit declines in April to $50.1 Billion

by Calculated Risk on 6/08/2012 08:30:00 AM

The Department of Commerce reported:

[T]otal April exports of $182.9 billion and imports of $233.0 billion resulted in a goods and services deficit of $50.1 billion, down from $52.6 billion in March, revised. April exports were $1.5 billion less than March exports of $184.4 billion. April imports were $4.1 billion less than March imports of $237.1 billion.The trade deficit was above the consensus forecast of $49.3 billion.

The first graph shows the monthly U.S. exports and imports in dollars through April 2012.

Click on graph for larger image.

Click on graph for larger image.Exports decreased in April. Imports decreased even more. Exports are 11% above the pre-recession peak and up 4% compared to April 2011; imports are 2% above the pre-recession peak, and up about 6% compared to April 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $109.94 per barrel in April, up from $107.95 in March. Import oil prices will probably start to decline in May. The trade deficit with China increased to $24.6 billion in April, up from $21.6 billion in April 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $16.3 billion in April, down from $17.1 billion in April 2011, so the euro area recession appears to be a drag on US exports.

Thursday, June 07, 2012

Look Ahead: Trade Deficit, China data on Saturday

by Calculated Risk on 6/07/2012 09:57:00 PM

First, the next two key dates in Europe:

• Monday, June 11th: IMF Report on Spanish Banks

• Sunday, June 17th: Greek Election.

And the last two weeks of June will be very busy!

Also China will be releasing several key economic indicators on Saturday. From Reuters: China rate cut raises fears of grim May economic data

China's surprise rate cut unveiled late on Thursday boosted hopes that cheaper credit would help combat its faltering economic growth ...In the US on Friday:

But the central bank's cut ... has also raised concerns about a deluge of May Chinese data due this weekend, with Asian shares losing ground on Friday, bracing for ugly numbers.

"The concern is that with industrial production and CPI data coming out of China at the weekend that it's indicative of them knowing something about weak data going forward," said Adrian Schmidt, currency strategist at Lloyds Bank in London.

• At 8:30 AM ET, the Trade Balance report for April will be released. The consensus is for the U.S. trade deficit to decrease to $49.3 billion in April, down from from $51.8 billion in March. Export activity to Europe will be closely watched due to economic weakness. Also oil prices started to decline in April, but that probably won't reduce import prices until May.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for April will be released. The consensus is for a 0.5% increase in inventories.

Lower Costs on FHA's Streamline Refinance Program are effective on June 11th

by Calculated Risk on 6/07/2012 07:29:00 PM

Just an update because the effective date is next week ... As announced back in March, HUD is lowering the costs on the FHA's Streamline Refinance Program effective Monday, June 11th.

From HUD back in March: FHA Announces Price Cuts to Encourage Streamline Refinancing

Acting Federal Housing (FHA) Commissioner Carol Galante announced significant price cuts to FHA’s Streamline Refinance Program that could benefit millions of borrowers whose mortgages are currently insured by FHA. Beginning June 11, 2012, FHA will lower its Upfront Mortgage Insurance Premium (UFMIP) to just .01 percent and reduce its annual premium to .55 percent for certain FHA borrowers.I expect this program will add to the recent increase in refinance activity.

To qualify, borrowers must be current on their existing FHA-insured mortgages which were endorsed on or before May 31, 2009. [In February], FHA also announced it will increase its upfront premiums on most other loans by 75 basis points to 1.75 percent. In addition, FHA will raise annual premiums 10 basis points and 35 basis points on mortgages higher than $625,500. ...

Currently, 3.4 million households with loans endorsed on or before May 31, 2009, pay more than a five percent annual interest rate on their FHA-insured mortgages. By refinancing through this streamlined process, it’s estimated that the average qualified FHA-insured borrower will save approximately $3,000 a year or $250 per month. FHA’s new discounted prices assume no greater risk to its Mutual Mortgage Insurance (MMI) Fund and will allow many of these borrowers to refinance into a lower cost FHA-insured mortgage without requiring additional underwriting.

Record Low Mortgage Rates and Increasing Refinance Activity

by Calculated Risk on 6/07/2012 03:45:00 PM

Below is a graph comparing mortgage rates from the Freddie Mac Primary Mortgage Market Survey® (PMMS®) and the refinance index from the Mortgage Bankers Association (MBA).

Freddie Mac reported earlier today that 30 year mortgage rates had fallen to a record low 3.67% in the PMMS®.

And the MBA reported yesterday that refinance activity increased another 2 percent last week.

Earlier from Freddie Mac: Record-Setting Low Fixed Mortgage Rates Persist

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates falling to new all-time record lows for the sixth consecutive week ...

30-year fixed-rate mortgage (FRM) averaged 3.67 percent with an average 0.7 point for the week ending June 7, 2012, down from last week when it averaged 3.75 percent. Last year at this time, the 30-year FRM averaged 4.49 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently at the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates are there! The 30 year conforming mortgage rates were at 4.23% in October 2010, so a 50 bps drop would be 3.73% - and rates hit 3.67% last week.

There has also been an increase in refinance activity from borrowers with negative equity and loans owned or guaranteed by Fannie or Freddie.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey. The Primary Mortgage Market Survey® started in 1971 (15 year in 1991). Both rates are at record lows for the Freddie Mac survey, and rates for 15 year fixed loans are now below 3%.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey. The Primary Mortgage Market Survey® started in 1971 (15 year in 1991). Both rates are at record lows for the Freddie Mac survey, and rates for 15 year fixed loans are now below 3%.Note: The Ten Year treasury yield is just off the record low at 1.65% (the record low was last week at 1.44%).

Fed's Q1 Flow of Funds: Household Real Estate Value increased in Q1

by Calculated Risk on 6/07/2012 12:00:00 PM

The Federal Reserve released the Q1 2012 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth peaked at $67.5 trillion in Q3 2007, and then net worth fell to $51.3 trillion in Q1 2009 (a loss of $16.2 trillion). Household net worth was at $62.9 trillion in Q1 2012 (up $11.6 trillion from the trough, but still down $4.6 trillion from the peak).

The Fed estimated that the value of household real estate increased $372 billion to $16.05 trillion in Q1 2012. The value of household real estate has fallen $6.3 trillion from the peak.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles. The ratio has been increasing a little recently.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2012, household percent equity (of household real estate) was at 40.7% - up from Q4, and the highest since 2008. This was because of a small increase in house prices in Q1 (the Fed uses CoreLogic) and a reduction in mortgage debt..

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 40.7% equity - and over 10 million have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $85 billion in Q1. Mortgage debt has now declined by $885 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, is near the lows of the last 30 years, however household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

Bernanke Senate Testimony: "Prepared to take action as needed"

by Calculated Risk on 6/07/2012 10:04:00 AM

Federal Reserve Chairman Ben Bernanke testimony "Economic Outlook and Policy" before the Joint Economic Committee, U.S. Senate:

Concerns about sovereign debt and the health of banks in a number of euro-area countries continue to create strains in global financial markets. The crisis in Europe has affected the U.S. economy by acting as a drag on our exports, weighing on business and consumer confidence, and pressuring U.S. financial markets and institutions. European policymakers have taken a number of actions to address the crisis, but more will likely be needed to stabilize euro-area banks, calm market fears about sovereign finances, achieve a workable fiscal framework for the euro area, and lay the foundations for long-term economic growth. U.S. banks have greatly improved their financial strength in recent years, as I noted earlier. Nevertheless, the situation in Europe poses significant risks to the U.S. financial system and economy and must be monitored closely. As always, the Federal Reserve remains prepared to take action as needed to protect the U.S. financial system and economy in the event that financial stresses escalate.Here is the CNBC feed.

Here is the C-Span Link

Weekly Initial Unemployment Claims decline to 377,000

by Calculated Risk on 6/07/2012 08:30:00 AM

The DOL reports:

In the week ending June 2, the advance figure for seasonally adjusted initial claims was 377,000, a decrease of 12,000 from the previous week's revised figure of 389,000. The 4-week moving average was 377,750, an increase of 1,750 from the previous week's revised average of 376,000.The previous week was revised up from 383,000 to 389,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.

The average has been between 363,000 and 384,000 all year, and this is the highest level since early May.

And here is a long term graph of weekly claims:

Initial weekly claims remain elevated.

Initial weekly claims remain elevated. This was close to the consensus forecast of 379,000.

Wednesday, June 06, 2012

Look Ahead: Bernanke, Weekly unemployment claims, Q1 Flow of Funds

by Calculated Risk on 6/06/2012 09:53:00 PM

The focus on Thursday will be on the comments from Fed Chairman Ben Bernanke during his Senate testimony. Here is the schedule:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decline to 379 thousand from 383 thousand last week.

• At 10:00 AM, Fed Chairman Ben Bernanke will testify before the Joint Economic Committee, U.S. Senate, "Economic Outlook and Policy"

• At noon, the Fed will release the Q1 Flow of Funds report.

• And at 3:00 PM, the Fed will release Consumer Credit for April. The consensus is for a $12.0 billion increase in consumer credit.

Fed's Yellen: "Scope remains for further policy accommodation"

by Calculated Risk on 6/06/2012 08:00:00 PM

From Vice Chair Janet Yellen: Perspectives on Monetary Policy. Excerpt:

Recent labor market reports and financial developments serve as a reminder that the economy remains vulnerable to setbacks. Indeed, the simulations I described above did not take into account this new information. In our policy deliberations at the upcoming FOMC meeting we will assess the effects of these developments on the economic forecast. If the Committee were to judge that the recovery is unlikely to proceed at a satisfactory pace (for example, that the forecast entails little or no improvement in the labor market over the next few years), or that the downside risks to the outlook had become sufficiently great, or that inflation appeared to be in danger of declining notably below its 2 percent objective, I am convinced that scope remains for the FOMC to provide further policy accommodation either through its forward guidance or through additional balance-sheet actions.Clearly Yellen is considering QE3.

Housing Inventory and Price Expectations

by Calculated Risk on 6/06/2012 03:30:00 PM

Yesterday I asked "Dude, Where's my inventory?"

In the comments, 'TJ and The Bear' wrote: "My take is that when there's an expectation of rising prices buyers are motivated but sellers are not."

Exactly! This is something I mentioned earlier this year. And it doesn't even take rising prices to change the dynamics.

When the expectation is that prices will fall further, marginal sellers will try to sell their homes immediately. And marginal buyers will decide to wait for a lower price. This leads to more inventory on the market.

But when the expectation is that prices are stabilizing (the current situation), sellers will wait until it is convenient to sell. And buyers will start feeling a little more confident. Also, as prices stabilize, private lenders will start thinking about entering the mortgage market (something we are starting to see).

So expectations matter. And so do price fundamentals. Since we are close to normal prices, based on real prices (inflation adjusted) and the price-to-rent ratio, I think expectations of price stabilization have now taken over, and buyers, sellers and lenders are acting accordingly - and that is a key reason inventory has fallen sharply.

There are other reasons for the decline in inventory, but price expectations are probably a key factor.