by Calculated Risk on 7/06/2012 08:30:00 AM

Friday, July 06, 2012

June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

From the BLS:

Nonfarm payroll employment continued to edge up in June (+80,000), and the unemployment rate was unchanged at 8.2 percent, the U.S. Bureau of Labor Statistics reported today.

...

Both the civilian labor force participation rate and the employment-population ratio were unchanged in June at 63.8 and 58.6 percent, respectively.

...

The change in total nonfarm payroll employment for April was revised from +77,000 to +68,000, and the change for May was revised from +69,000 to +77,000.

Click on graph for larger image.

Click on graph for larger image.This was another weak month, and the revisions for the previous two months were offsetting.

This was below expectations of 90,000 payroll jobs added.

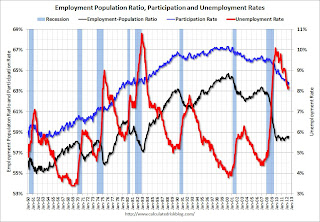

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was unchanged at 8.2% (red line).

The Labor Force Participation Rate was unchanged at 63.8% in June (blue line). This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 63.8% in June (blue line). This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio was unchanged at 58.6% in June (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 90,000). More later ...

Thursday, July 05, 2012

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 7/05/2012 10:23:00 PM

With an 8%+ unemployment rate, every day should be about jobs ...

• At 8:30 AM ET, the Employment Report for June will be released. The consensus is for an increase of 90,000 non-farm payroll jobs in June, up from the 69,000 jobs added in May. Earlier today I wrote Employment Situation Preview. Here are some comments from Goldman Sachs:

We expect a middling June employment report to be released on Friday morning, with a 125,000 gain in nonfarm payrolls and a flat 8.2% unemployment rate. We raised our payroll number from 75,000 earlier today in response to 1) more online help-wanted advertising, 2) fewer layoff announcements, 3) a better ADP, 4) slightly lower initial jobless claims in the latest (post-survey) week, and 5) decent readings in the employment components of the ISM manufacturing and nonmanufacturing survey (despite disappointments in most other components).And from Patti Domm at CNBC: June Jobs Report Could Put the Fed in Play

If the report broadly matches our expectations, it would probably dampen speculation about an imminent return to balance sheet expansion from the Federal Reserve.

“I think the whisper is closer to 110,000, 120,000," said John Briggs, senior Treasury strategist at RBS. "Anything between 80,000 and 130,000 doesn’t matter. It shouldn’t be a major market mover,” he said. However, Briggs said the equity market is being supported by the idea of Fed easing and a really good number might actually be a negative to some in risk markets.• Early: Reis is expected to release their Q2 Mall vacancy report.

If the number is better than expected, “I don’t think that would take QE off the table. It would just have us waiting for the July 17 testimony” of Fed Chairman Ben Bernanke before Congress, he said.

Consumer Bankruptcy filings Decrease 13 Percent in First Half of 2012

by Calculated Risk on 7/05/2012 05:09:00 PM

From the American Bankruptcy Institute: Bankruptcy Filings Fall 14 Percent for the First Half of 2012, Commercial Filings Drop 22 Percent

The 601,184 total noncommercial filings for the first half of 2012 represented a 13 percent drop from the noncommercial filing total of 691,902 for the first half of 2011. Total commercial filings during the first six months of the year were 30,946, representing a 22 percent decrease from the 39,598 filings during the same period in 2011.

“We are on pace for perhaps the lowest total new bankruptcies since before the financial crisis in 2008,” said ABI Executive Director Samuel J. Gerdano. “With sustained low interest rates and weak consumer spending, we expect bankruptcies to stay at relatively low levels through the end of 2012.”

The 99,057 total bankruptcy filings for the month of June represented an 18 percent decrease compared to the 120,698 filings in June 2011.

Click on graph for larger image.

Click on graph for larger image.This graph shows the non-business bankruptcy filings by quarter using quarterly data from the ABI.

Note: The spike in 2005 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation).

It is possible that consumer bankruptcy filings peaked in 2010, but filings might increase again next year as pre-bankruptcy act filers file bankruptcy again.

Earlier:

• Reis: Apartment Vacancy Rate falls to 4.7% in Q2

• ADP: Private Employment increased 176,000 in June

• Weekly Initial Unemployment Claims decline to 374,000

• ISM Non-Manufacturing Index declines, indicates slower expansion in June

• Employment Situation Preview

Employment Situation Preview

by Calculated Risk on 7/05/2012 01:10:00 PM

With only 77,000 payroll jobs added in April, and just 69,000 in May - and evidence that the economy slowed further in June - the June employment report to be released tomorrow is especially important. Another weak report, combined with sluggish Q2 GDP numbers to be released later this month, would increase the likelihood of QE3 being announced on August 1st.

However the weak payroll numbers for the last two months might have been "payback" for the mild weather in January and February. And not all is bleak. Vehicle sales were solid in June, and the sluggish recovery in housing is ongoing.

Bloomberg is showing the consensus is for an increase of 90,000 payroll jobs in June, and for the unemployment rate to remain unchanged at 8.2%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 176,000 private sector payroll jobs in June. This would seem to suggest that the consensus for the increase in total payroll employment is too low, although the ADP report hasn't been very useful in predicting the BLS report for any one month. Also, ADP doesn't include government payrolls, and government payrolls have been shrinking for some time.

• The ISM manufacturing employment index decreased slightly in June to 56.6%, down from 56.9% in May. A historical correlation between the ISM index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing increased about 16,000 in June.

The ISM service employment index increased in June to 52.3%, up from 50.8% in May. Based on a historical correlation between the ISM non-manufacturing employment index and the BLS employment report for service, this reading suggests the gain of around 120,000 private payroll jobs for services in June.

Combined the ISM surveys suggest an employment report above the consensus.

• Initial weekly unemployment claims averaged about 385,000 in June, up slightly from the 380,000 average for April and May. This was the highest average this year, and about the same level as in November and December of last year when the economy added 190,000 jobs per month.

For the BLS reference week (includes the 12th of the month), initial claims were at 392,000; the highest this year.

• The final June Reuters / University of Michigan consumer sentiment index declined to 73.2, down from the May reading of 79.3. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. Gasoline prices have been falling, so this decline suggests a weaker labor market.

• The small business index from Intuit showed 70,000 payroll jobs added, up from 40,000 in May.

• And on the unemployment rate from Gallup: U.S. Unadjusted Unemployment Unchanged in June

U.S. unemployment, as measured by Gallup without seasonal adjustment, was 8.0% in June, unchanged from May, but significantly better than the 8.7% from a year ago. Gallup's seasonally adjusted number, based on applying an estimate of the government's June adjustment, is 7.8%, an improvement from 8.3% in May, and down considerably from 8.5% in June 2011. Both the unadjusted and the adjusted numbers are at least tied for the lowest Gallup has recorded since it began collecting employment data in 2010.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats). Note: So far the Gallup numbers haven't been useful in predicting the BLS unemployment rate.

• Conclusion: The overall feeling is that the economy weakened further in June, and that would seem to suggest another weak employment report this month. However, if the "payback" is over (as several analysts have argued), the number of payroll jobs could be better than the last couple of months.

Recently I've taken the "under" on the employment report, but looking at these data points surprised me a little. The combined ISM reports suggest a number in the 130,000+ range, and the ADP report (private only), suggest the consensus is too low. And the Intuit numbers improved sharply. Note: The ISM survey is conducted all month, with most respondents replying at the end of the month - so the timing doesn't line up with the BLS reference week.

On the negative side, weekly claims increased in June to the highest level this year, and consumer sentiment declined - even with falling gasoline prices.

There always seems to be some randomness to the employment report, but this month I'll take the over (over 90,000 payroll jobs).

For the economic contest in July:

ISM Non-Manufacturing Index declines, indicates slower expansion in June

by Calculated Risk on 7/05/2012 10:07:00 AM

The June ISM Non-manufacturing index was at 52.1%, down from 53.7% in May. The employment index increased in June to 52.3%, up from 50.8% in May. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 30th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 52.1 percent in June, 1.6 percentage points lower than the 53.7 percent registered in May. This indicates continued growth this month at a slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 51.7 percent, which is 3.9 percentage points lower than the 55.6 percent reported in May, reflecting growth for the 35th consecutive month. The New Orders Index decreased by 2.2 percentage points to 53.3 percent, and the Employment Index increased by 1.5 percentage points to 52.3 percent, indicating continued growth in employment at a faster rate. The Prices Index decreased 0.9 percentage point to 48.9 percent, indicating lower month-over-month prices for the second consecutive month. According to the NMI, 12 non-manufacturing industries reported growth in June. Respondents' comments are mixed and vary by industry and company."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 53.0% and indicates slower expansion in June than in May.

Weekly Initial Unemployment Claims decline to 374,000

by Calculated Risk on 7/05/2012 08:37:00 AM

The DOL reports:

In the week ending June 30, the advance figure for seasonally adjusted initial claims was 374,000, a decrease of 14,000 from the previous week's revised figure of 388,000. The 4-week moving average was 385,750, a decrease of 1,500 from the previous week's revised average of 387,250.The previous week was revised up from 386,000 to 388,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined slightly to 385,750.

This is just off the high for the year.

And here is a long term graph of weekly claims:

This was below the consensus forecast of 386,000. This is just one week of improvement, and the four week average suggests some renewed weakness in the labor market.

This was below the consensus forecast of 386,000. This is just one week of improvement, and the four week average suggests some renewed weakness in the labor market.ADP: Private Employment increased 176,000 in June

by Calculated Risk on 7/05/2012 08:20:00 AM

ADP reports:

According to today‟s ADP National Employment Report, employment in the nonfarm private business sector rose 176,000 from May to June on a seasonally adjusted basis. Employment in the private, service-providing sector rose 160,000 in June, after rising a revised 137,000 in May.This was way above the consensus forecast of an increase of 95,000 private sector jobs in June. The BLS reports on Friday, and the consensus is for an increase of 90,000 payroll jobs in June, on a seasonally adjusted (SA) basis.

According to Joel Prakken, chairman of Macroeconomic Advisers, LLC, “The gain in private employment is strong enough to suggest that the national unemployment rate may have declined in June. Today‟s estimate, if reinforced by a comparable reading on employment from the Bureau of Labor Statistics tomorrow, likely will ease concerns that the economy is heading into a downturn.”

Prakken added: “There seems little doubt that recent employment gains have been restrained by heightened uncertainty over the European financial crisis and by growing concerns about domestic fiscal policy. However, the acceleration of employment since April does lend credence to the argument that unseasonably warm weather boosted employment during the winter months, with a "payback" spread over April and May.”

ADP hasn't been very useful in predicting the BLS report, but this suggests a stronger than consensus report.

Note - it was rate cutting day too: ECB cuts rates.

China cuts rates.

BOE expands QE.

MBA: Mortgage Applications Decrease, Record Low Mortgage Rates

by Calculated Risk on 7/05/2012 07:00:00 AM

From the MBA: Mortgage Applications Decrease Driven by a Drop in Refinances in Latest MBA Weekly Survey

The Refinance Index was down about 8 percent overall this week, largely driven by a significant drop in refinance applications for government loans. The HARP 2.0 share of refinance applications has been 24 percent over the past two weeks, up slightly from 20 percent three weeks ago. The seasonally adjusted Purchase Index increased less than 1 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.86 percent from 3.88 percent, with points increasing to 0.41 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This is the lowest 30-year fixed rate since MBA began tracking the series.

Click on graph for larger image.

Click on graph for larger image.The decline in refinance activity was from a very high level. This just offset the surge in refinance activity two weeks ago related to the change in FHA streamline refinancing.

The purchase index is mostly moving sideways.

Reis: Apartment Vacancy Rate falls to 4.7% in Q2

by Calculated Risk on 7/05/2012 01:20:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 4.7% in Q2 from 4.9% in Q1 2012. The vacancy rate was at 5.9% in Q2 2011 and peaked at 8.0% at the end of 2009.

From Reuters: US apartment rents rise at highest rate since '07 -Reis

Renting an apartment in the U.S. became even more expensive during the second quarter, as vacancies set a new 10-year low and rents rose at a pace not seen since before the financial crisis, according to real estate research firm Reis Inc. ...

The average U.S. vacancy rate of 4.7 percent was the lowest since the fourth quarter of 2001 ...

Asking rents jumped to $1,091 per month, 1 percent higher than the first quarter and the biggest increase since the third quarter of 2007. Excluding special perks designed to lure tenants, like months of free rent, the average effective rent rose 1.3 percent to $1,041.

"The improvement in rents is pretty pervasive," said Ryan Severino, Senior Economist at Reis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates - and increase in rents - is happening just about everywhere.

Wednesday, July 04, 2012

Thursday: ISM Service, ADP Employment, ECB, Unemployment Claims

by Calculated Risk on 7/04/2012 09:43:00 PM

Back to work ... there are several key economic reports that will be released on Thursday. Also the European Central Bank (ECB) is expected to cut the benchmark interest rate from 1.0% to 0.75%.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This report will probably show record low mortgages rates.

• At 8:15 AM: The ADP Employment Report for June will be released. This report is for private payrolls only (no government). The consensus is for 95,000 payroll jobs added in June, down from the 133,000 reported in May.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 386 thousand.

• At 10:00 AM, the ISM non-Manufacturing Index for June will be released. The consensus is for a decrease to 53.0 from 53.7 in May. Note: Above 50 indicates expansion, below 50 contraction.

• Early: Reis is expected to release their Q2 Apartment vacancy report.

The Asian markets are mostly green tonight. The Nikkei is up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 are down 3 and Dow futures are down 30.

Oil: WTI futures are up to $86.85 (this is down from $109.77 in February, but up last week) and Brent is up to $99.89 per barrel.

Professor Hamilton has a new post on gasoline prices: Update on U.S. gasoline prices

Two weeks ago, I commented on the tendency of U.S. retail gasoline prices to follow the price of Brent crude oil, anticipating on the basis of the price of Brent, then at $91.50, that we might expect to see average U.S. retail gasoline prices, then at $3.47, to fall an additional 35 cents/gallon. The gasoline price has since come down about 11 cents. But with Brent now surging back up near $100, this is about all we can expect.See his post for several charts.

"The Handoff – Manufacuturing to Housing"

by Calculated Risk on 7/04/2012 04:33:00 PM

I was going to write about this, but economist Josh Lehner beat me to it.

From Lehner: The Handoff – Manufacuturing to Housing

As you may have heard, the latest reading on the ISM Manufacturing index declined in June to a level of 49.7. The index is designed such that values of over 50 indicate expansion while values below 50 indicate contraction. This marked the first time since July 2009 that the index registered in contraction territory ...Lehner has a couple of graphs showing the "handoff".

Now, does that mean the economy is doomed? Not neccessarily. Even after a slowdown in manufacturing, the industry can and likely will continue to grow in the coming years, just that the growth is and was not expected to remain consistently strong. Second and more importantly ... is the transition from manufacturing to housing as a major economic driver. ... Residential Investment (new home construction) is now growing nearly 10% year-over-year while the manufacturing cycle is slowing.

In the recovery so far, beyond personal consumer expenditures, exports and investment – largely the manufacturing cycle – have been significant contributors, while the housing downturn continued to languish. Now, housing growth has returned but the industry is not yet doing the heavy lifting. The much stronger growth in housing is not expected until 2013 and 2014 in our forecast ...

As I noted yesterday in Manufacturing vs. Housing, housing is usually a better leading indicator for the US economy than manufacturing. Manufacturing is more coincident. So the ISM index suggests some weakness now - mostly abroad - whereas housing suggests an ongoing sluggish recovery.

Housing: Seriously Dude, Where's my inventory?

by Calculated Risk on 7/04/2012 12:52:00 PM

Happy 4th!

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), inventory is off 24.2% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through May (left axis) and the HousingTracker data for the 54 metro areas through early July.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then starts to increase again through the summer. So inventory might still increase a little over the next month or two, but the forecasts for a "surge" in inventory this summer were incorrect. In fact inventory might have already peaked for the year!

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early July listings, for the 54 metro areas, declined 24.2% from the same period last year. So far in 2012, the NAR has reported only a small seasonal increase in inventory - and the housing tracker numbers are lower in early July than for January!

HousingTracker reported that the early July listings, for the 54 metro areas, declined 24.2% from the same period last year. So far in 2012, the NAR has reported only a small seasonal increase in inventory - and the housing tracker numbers are lower in early July than for January!

This decline in active inventory remains a huge story, and the lower level of inventory is helping stabilize house prices.

Martin Wolf on Europe: A Step in the Right Direction

by Calculated Risk on 7/04/2012 09:55:00 AM

Martin Wolf has been a consistent critic of eurozone policymakers ...

From Martin Wolf at the Financial Times: A Step At Last in the Right Direction and here at CNBC.

The 19th crisis summit was better than many of its disappointing predecessors. But the game has not yet changed. Helpful steps were taken.Wolf provides an overview of the steps taken, and concludes:

Let us not be too grudging: the decision to allow the ESM to recapitalize banks directly is possibly very important, both in itself and for what it portends.This is the least pessimistic I've seen Wolf, and his view is still very grim. Note: The ECB is expected to cut rates tomorrow.

... Nevertheless, the biggest danger is that the economics of the euro zone are deteriorating fast. Joblessness reached 11.1 percent in May, the highest on record for the zone.

Worse ... the ECB is hopelessly late in taking necessary monetary action. ...

It is conceivable that the euro zone will struggle through this economic trench warfare over the next several years. However, the costs – not just economic but also political – are likely to be enormous.

Tuesday, July 03, 2012

House Prices: Goldman sort of Calls the Bottom

by Calculated Risk on 7/03/2012 08:50:00 PM

Goldman Sachs put out a research note today: House Prices Finding a Bottom. This isn't a strong call, and is only a slight upward revision to their previous forecast. As they note, there are many factors adding to the "noise" in the house price indexes (distressed sales, foreclosure moratorium, recent warm weather), and a 0.2% increase in prices over the next year isn't much.

A few brief excerpts:

[O]ur model projects a nominal house price gain of 0.2% from 2012Q1 to 2013Q1 and another 1.4% from 2012Q1 to 2013Q1. Taken literally, this would imply that the bottom in nominal house prices is now behind us.

While the recent house price news is encouraging, we would not yet sound the "all clear" for the housing market or the broader economy. First, the instability in the seasonal factors over the past few years is a potential source of noise in the recent house price indicators, and also in our model. ... In addition, the seasonal factors can be also distorted by one-off items ... All of these complications ... adds to the uncertainty as to whether the better recent numbers indicate a true turnaround in the US housing market.

Second, even if the market is gradually turning, as our model implies, the difference between a slightly declining and a slightly increasing national average for home prices is minor, especially given the wide variation between stronger and weaker markets. Our broad view remains that national home prices will remain close to flat over the next 1-2 years, or at a minimum that the recovery will remain very "U-shaped."

U.S. Light Vehicle Sales at 14.1 million annual rate in June

by Calculated Risk on 7/03/2012 03:52:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.08 million SAAR in June. That is up 22% from June 2011, and up 2.6% from the sales rate last month (13.73 million SAAR in May 2012).

This was above the consensus forecast of 13.9 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for June (red, light vehicle sales of 14.08 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

June was the weakest month this year, and the year-over-year increase was large because of the impact of the tsunami and related supply chain issues in May 2011.

Sales have averaged a 14.28 million annual sales rate through the first half of 2012, up sharply from the same period of 2011.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

Sales will probably increase some more, but most of the recovery from the depth of the recession has already happened.

Manufacturing vs. Housing

by Calculated Risk on 7/03/2012 01:28:00 PM

Note on Auto Sales: I should have an estimate for the June Seasonally Adjusted Annual Rate (SAAR) around 4 PM ET.

A note on manufacturing vs. housing: The ISM manufacturing index dropped below 50 for the first time since July 2009 (below 50 indicates contraction). And the JPMorgan Global Manufacturing PMI also fell below 50.

Meanwhile, in the US, housing is picking up. Housing starts have been increasing, residential construction spending is up 17% from the recent low, and new home sales have averaged 353 thousand on an annual rate basis over the first 5 months of 2012, after averaging under 300 thousand for the previous 18 months.

If someone looked at just manufacturing, they might think the US is near a recession. And if they just looked at housing, they'd think the economy is recovering. Which is it?

First, the decline in the ISM index was partially driven by exports (no surprise given the problems in Europe and slowdown in China). The ISM export index declined to 47.5 in June from 53.5 in May, the lowest level since early 2009. However some of this export weakness will probably be offset by lower oil and gasoline prices.

Second, the current ISM reading of 49.7 isn't all that weak. Goldman Sachs analysts noted yesterday: "A reading such as this has historically been associated with just under 2% real GDP growth--very near our current second-quarter tracking estimate of 1.6%."

Third, housing is usually a better leading indicator for the US economy than manufacturing. Historically housing leads the economy both into and out of recessions (not out of the recession this time because of the excess supply in 2009). Manufacturing is more coincident. So the ISM index suggests some weakness now - mostly abroad - whereas housing suggests an ongoing sluggish recovery.

Who ya gonna call? Housing.

FHFA: "Robust" Market Reponse to Bulk REO Pilot Program

by Calculated Risk on 7/03/2012 11:54:00 AM

From the FHFA: FHFA Announces Next Steps in REO Pilot Program

The Federal Housing Finance Agency (FHFA) today announced that the winning bidders in a real estate owned (REO) pilot initiative have been chosen and transactions are expected to close early in the third quarter. Market response has been robust with strong qualified bidder interest.This transaction will close soon, but will this program be expanded? I'm trying to find out ...

“FHFA undertook this initiative to help stabilize communities and home values in areas hard-hit by the foreclosure crisis,” said Edward J. DeMarco, Acting Director of FHFA. “As conservator of Fannie Mae and Freddie Mac, we believe this pilot program will assist us in achieving our objectives and help to maximize the benefit to taxpayers. We are pleased with the response from the market and look forward to closing transactions in the near future.”

FHFA launched the pilot program in late February, and in the second quarter bids were solicited from qualified investors to purchase approximately 2,500 single-family Fannie Mae foreclosed properties. Fannie Mae offered for sale pools of properties in geographically concentrated locations across the United States.

Trulia: Asking House Prices increased in June

by Calculated Risk on 7/03/2012 10:15:00 AM

Press Release: Rent increases outpace home prices rises, reports Trulia

Trulia today released the latest findings from the Trulia Price Monitor and the Trulia Rent Monitor ... Based on the for-sale homes and rentals listed on Trulia, these monitors take into account changes in the mix of listed homes and reflect trends in prices and rents for similar homes in similar neighborhoods through June 30, 2012.More from Jed Kolko, Trulia Chief Economist: Rising Home Prices Can’t Keep Up with Rent Increases

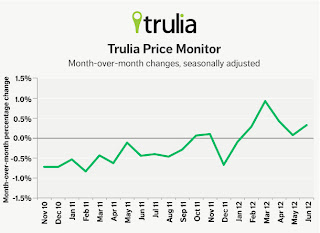

Asking prices on for-sale homes–which lead sales prices by approximately two or more months – increased 0.3 percent in June month over month (M-o-M), seasonally adjusted. With the exception of nearly flat prices in May, prices rose in four of the past five months. Asking prices in June rose nationally 0.8 percent quarter over quarter (Q-o-Q), seasonally adjusted. Year-over-year (Y-o-Y) asking prices rose by 0.3 percent; excluding foreclosures, asking prices rose Y-o-Y by 1.7 percent. Nationally, 44 out of the 100 largest metros had Y-o-Y price increases, and 84 out of the 100 largest metros had Q-o-Q price increases, seasonally adjusted.

However, seven of the 10 metros with the largest increase in asking prices also have a high share of homes in foreclosure, including Phoenix, the Florida metros, and Detroit and its suburbs. These coming foreclosures threaten to reduce or reverse recent price gains in those markets. In contrast, Denver, San Jose, Pittsburgh, Little Rock, Austin and Colorado Springs all had price gains of more than 4 percent with a moderate or low share of homes in foreclosure.

According to Trulia, rents are increasing even faster than house prices.

On rents from Bloomberg: Manhattan First-Time Apartment Buyers Grab Deals in Slow Market (ht Mike In Long Island)

“Rents are just so high right now that for a lot of people it doesn’t make sense” to continue leasing, said Sofia Song, vice president of research at StreetEasy. “A lot of people are saying, ‘You know what? For this amount of money I can probably buy something.’”Of course Manhattan is its own world, but it does appear rents are increasing in many communities.

Click on graph for larger image.

Click on graph for larger image.This graph shows the change in asking house prices in June, adjusted for the mix and seasonal factors. Although these are just asking prices, this suggests prices have continued to increase through June, and that seasonally adjusted closing prices will continue to increase through July and August on the repeat sales indexes.

Reis: Office Vacancy Rate unchanged in Q2 at 17.2%

by Calculated Risk on 7/03/2012 08:42:00 AM

Reis reports that the office vacancy rate was unchanged in Q2 at 17.2%. Comments from Reis Senior Economist Ryan Severino:

The office sector absorbed 4.138 million SF during the second quarter, the sixth consecutive quarterly gain in occupied stock since the beginning of 2011. However, national vacancies ceased falling. This is reflective of the ongoing weakness in the labor market recovery.

...

National asking and effective rent both grew by 0.3% during the second quarter, but this represents a slowdown from the 0.5% and 0.6% growth rates that asking and effective rents respectively achieved during the first quarter. Annual gains of 1.6 and 2.0 percent, respectively, are virtually unchanged from last quarter, and remain feeble.

...

Supply growth in the office sector remains muted. During the second quarter of 2012 only 1.606 million square feet of office space were completed, the equivalent of one large office building. This represents the lowest quarterly level on record since Reis began tracking quarterly market data in 1999. Nonetheless, demand for space during the quarter was so weak that even with such little supply being delivered, the level of absorption that we observed during the quarter was insufficient to generate a vacancy rate decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis is reporting the vacancy rate was unchanged at 17.2% in Q2, and down from 17.5% in Q2 2011. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010.

As Reis noted, there are very few new office buildings being built in the US, and new construction will probably stay low for several years.

Monday, July 02, 2012

Tuesday: Auto Sales, Factory Orders

by Calculated Risk on 7/02/2012 08:38:00 PM

Special Note: Stephen Campbell, frequent commenter under the name Nova, and author of "American Apocalypse" has passed away. Very sad news. Nova wrote parts of American Apocalypse several years ago in the comments of CR, and many of us followed along. He will be greatly missed.

The key report on Tuesday will be auto sales. Remember sales were depressed last year because of the tsunami in Japan, and the automakers report a comparison to the same month in the previous year. Some automakers were hit harder than others, so what will matter is the Seasonally Adjusted Annual Rate (SAAR).

• All day: Light vehicle sales for June. Light vehicle sales are expected to increase to 13.9 million SAAR from 13.8 million in May.

• At 10:00 AM ET, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May will be released. The consensus is for a 0.1% increase in orders.

• Also at 10:00 AM, the Trulia Price & Rent Monitors for June will be released. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• Early: Reis is expected to released their Q2 Office Vacancy report.

The Asian markets are mostly green tonight. The Nikkei is up 0.4%, and the Shanghai Composite is up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 and Dow futures are down slightly.

Oil: WTI futures are down to $83.43 (this is down from $109.77 in February, but up last week) and Brent is at $97.21 per barrel. According to a formula from Professor Hamilton, the price of Brent would suggest gasoline at $3.27 per gallon (the current national average price is $3.35, so even with the increase in Brent, gasoline prices will probably fall further).

Note: SIFMA recommends US markets close at 2:00 PM ET in advance of the Independence Day Holiday on July 4th.