by Calculated Risk on 7/10/2012 12:37:00 PM

Tuesday, July 10, 2012

Las Vegas Real Estate: Inventory down sharply

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities. Prices, as of the March Case-Shiller report, were off 61.1% from the peak, and off 5.8% over the last year.

Sales in 2011 were at record levels - even more than during the bubble - and it looks like 2012 might be an even stronger year, even with some new rules that slow the foreclosure process.

From the GLVAR: GLVAR reports local home prices up for fifth straight month, while local housing supply continues to shrink

According to GLVAR, the total number of local homes, condominiums and townhomes sold in June was 3,945. That’s down from 4,134 in May and down from 4,540 total sales in June 2011.Inventory continues to decline (down 67.5% year-over-year for single family homes) and sales are slowing, but still on pace for a record year.

Even with fewer sales last month and fewer homes listed for sale each month this year, [GLVAR President Kolleen] Kelley said existing home sales are ahead of the record pace set in 2011, when GLVAR reported 48,186 existing properties were sold in Southern Nevada.

The total number of homes listed for sale on GLVAR’s Multiple Listing Service again decreased from May to June, with a total of 16,930 single-family homes listed for sale at the end of the month. That’s down 2.4 percent from 17,346 single-family homes listed for sale at the end of May and down 25.4 percent from one year ago. GLVAR reported a total of 3,713 condos and townhomes listed for sale on its MLS at the end of June. That’s down 0.4 percent from 3,728 condos and townhomes listed for sale on its MLS at the end of May, and down 29.2 percent from one year ago.

...

By the end of June, GLVAR reported 3,690 single-family homes listed without any sort of offer. That’s down 2.9 percent from 3,800 such homes listed in May and down 67.5 percent from one year ago. For condos and townhomes, the 1,083 properties listed without offers in June represented a 2.4 percent increase from 1,058 such properties listed without offers in May and a decrease of 59.2 percent from one year ago. ...

34.2 percent of all existing local homes sold during June were short sales, which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage.

Bank-owned homes accounted for 27.8 percent of all existing home sales in June, down from 32.6 percent in May.

“Since banks have been encouraging short sales and doing fewer foreclosures, short sales have finally surpassed (the sale of) foreclosures,” Kelley said.

The percent distressed sales was extremely high at 62% in June (short sales and foreclosures), but that was down from 67.3% in May. Some of this decline was due to the new foreclosure rules in Nevada.

It is important to understand that sales in these highly distressed markets will probably decline as the percent of distressed sales declined (sales are at record levels in Las Vegas - even above the bubble pace!). The key is to watch inventory (listed inventory is down 25.4% from a year ago, and non-contingent inventory is down 67.5%) and to watch the number of conventional sales.

BLS: Job Openings increased in May

by Calculated Risk on 7/10/2012 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.6 million job openings on the last business day of May, little changed from 3.4 million in April, the U.S. Bureau of Labor Statistics reported today.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The level of total nonfarm job openings in May was up from 2.4 million at the end of the recession in June 2009.

...

In May, the quits rate displayed little or no change for total nonfarm, total private, and government. The number of quits was 2.1 million in May, up from 1.8 million at the end of the recession in June 2009.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs. According to JOLTS, the economy gained a few jobs in May (update: initial post had incorrect number for total separations).

Jobs openings increased in May to 3.642 million, up from 3.447 million in April. The number of job openings (yellow) has generally been trending up, and openings are up about 18% year-over-year compared to May 2011.

Quits increased slightly in May, and quits are now up about 6% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

NFIB: Small Business Optimism Index declines in June

by Calculated Risk on 7/10/2012 08:22:00 AM

From the National Federation of Independent Business (NFIB): June Small-Business Optimism Lowest Since October 2011

In a disappointing reversal of several months of slow but positive growth, June’s Index of Small Business Optimism dove three points, falling to 91.4. The decline is significant, and relinquished the gains achieved earlier this year. Only one of the ten Index components improved; labor market indicators and spending plans for capital equipment and inventories accounted for about 40 percent of the decline.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Nearly one-quarter of owners cite weak sales as their most important business problem (23 percent) [up from 20 percent in May].

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 91.4 in June from 94.4 in May.

This index remains low, and once again, lack of demand is the biggest problem for small businesses. (In the survey, the "single most important problem" was "poor sales".

Monday, July 09, 2012

Tuesday: Small Business Confidence, JOLTS

by Calculated Risk on 7/09/2012 10:21:00 PM

Another light day for economic data.

• At 7:30 AM ET, the NFIB Small Business Optimism Index for June will be released. The consensus is for a decrease to 92.0 in June.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for May will be released by the BLS. The number of job openings has generally been trending up.

On the Fed, from Bloomberg: Goldman Sachs, Bank Of America Say Fed To Hold Rate

Goldman Sachs Group Inc. and Bank of America Corp. say a weaker-than-forecast June jobs gain in the U.S. will lead the Federal Reserve to keep its benchmark interest rate at almost zero until the middle of 2015.And from Tim Duy today at EconomistsView: Fedspeak - And Lots of It

...

“The ‘late 2014’ formulation has now ‘aged’ by six months since it was first adopted, but the economy still looks no better,” Jan Hatzius, the chief economist at Goldman Sachs in New York, wrote in a report yesterday. The central bank may announce the change as soon as its next policy meeting July 31 to Aug. 1, Hatzius wrote.

Lots of Fed chatter today. Most of it points toward quantitative easing, but with a caveat: In general, we are getting a rehash of already stated views, views that should have pointed in the direction of QE3 at the last meeting.QE3 or extend the extended period? That is probably the debate for the next FOMC meeting.

...

Bottom Line: Lots of Fed chatter, on average pointing in the direction of additional easing, but none of it really that new, and all of which would have pointed to QE3 at the last meeting. Enough chatter, though, that it makes me suspect that the minutes from the last FOMC meeting will have plenty of talk like "several participants saw the need for additional easing." If so, expectations for the Fed to step up in August will become even more entrenched.

Phoenix Housing: Sharp decline in Foreclosure Sales

by Calculated Risk on 7/09/2012 05:38:00 PM

Tom Lawler sent me an update on Phoenix today:

The Arizona MLS reported that residential home sales by realtors in the Greater Phoenix, Arizona area totaled 9,129 in June, down 17.9% from last June’s pace. Bank-owned properties were 14.1% of last month’s sales, down from 40.8% last June, while last month’s short-sales share was 32.8%, up from 27.0% last June. Active listings in June totaled 19,857, down 1.5% from May and down 32.0% from a year ago. The median sales price last month was $141,000, up 27.6% from last June. Citing data from the Cromford Report, ARMLS said that foreclosures pending in Maricopa County in June totaled 17,910, down 35.1% from a year ago.Look at the sharp decline in bank owned properties sold - this was down to 14.1% of all sales, down from 40.8% last June.

Short sales were up - from 27.0% to 32.8% - but total distressed sales were down to 46.9% of sales (still high) from 67.8% last June.

Lawler didn't mention it, but conventional sales were up about 19% compared to June 2011. So the decline in overall sales is actually a positive! I mentioned this last month: Home Sales Reports: What Matters

When we look at sales for existing homes, the focus should be on the composition between conventional and distressed. ... Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. Look at inventory and the percent of conventional sales.And another key point; look at the decline in foreclosures pending. This was down from close to 44,000 in June 2010, to 27,616 in June 2011, and 17,910 in June 2012. Note: Arizona is a non-judicial foreclosure state, and as LPS noted this morning, the non-judicial states are recovering much faster than the judicial foreclosure states.

Also inventory (active listings) is down from around 42,000 in June 2010, and from 29,203 in June 2011, to 19,857 in June 2012. And months-of-supply is now close to 2 months in Phoenix.

We should have data on other distressed markets over the next few days, but I wanted to highlight this sharp decline in Phoenix.

Q1 2012: Mortgage Equity Withdrawal strongly negative

by Calculated Risk on 7/09/2012 03:01:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q1 2012, the Net Equity Extraction was minus $107 billion, or a negative 3.6% of Disposable Personal Income (DPI). This is not seasonally adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q1. Mortgage debt has declined by $885 billion over the last four years. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

For reference:

Dr. James Kennedy also has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Fed's Williams: Unemployment above Target, Inflation below Target, QE3 "most effective tool"

by Calculated Risk on 7/09/2012 11:55:00 AM

From San Francisco Fed President John Williams: The Economic Outlook and Challenges to Monetary Policy. Excerpt:

I expect that the unemployment rate will remain at or above 8 percent until the second half of 2013. What that means is that progress on bringing down the unemployment rate has probably slowed to a snail’s pace and perhaps even stalled.A strong push for QE3 from a key member of the FOMC.

Turning to inflation, I expect the inflation rate to come in below the Fed’s 2 percent target both this year and next. This forecast reflects several factors. A sluggish labor market is keeping a lid on compensation costs. A stronger dollar is holding down import prices. And the global growth slowdown has pushed down the prices of crude oil and other commodities.

My forecast is based on what I consider the most likely scenario. However, I am much more uncertain than usual about this forecast. I’ve mentioned the threat of automatic large tax increases and spending cuts at the start of 2013. But the most important wild card for the U.S. economy is Europe.

My forecast assumes that Europe’s distressed pattern of the past two years will continue, but that the situation won’t spin out of control. However, it is impossible to predict with any certainty how these circumstances will play out. Europe’s crisis could escalate much more than I expect.

...

What does this mean for the Fed? We are falling short on both our employment and price stability mandates, and I expect that we will make only very limited progress toward these goals over the next year. Moreover, strains in global financial markets raise the prospect that economic growth and progress on employment will be even slower than I anticipate. In these circumstances, it is essential that we provide sufficient monetary accommodation to keep our economy moving towards our employment and price stability mandates.

...

If further action is called for, the most effective tool would be additional purchases of longer-maturity securities, including agency mortgage-backed securities. These purchases have proven effective in lowering borrowing costs and improving financial conditions.

At the Fed, we take our dual mandate with the utmost seriousness. This is a period when extraordinary vigilance is demanded. We stand ready to do what is necessary to attain our goals of maximum employment and price stability.

LPS: Mortgages in Foreclosure still near record high, Much higher in Judicial States

by Calculated Risk on 7/09/2012 08:45:00 AM

LPS released their Mortgage Monitor report for May today. According to LPS, 7.20% of mortgages were delinquent in May, up slightly from 7.12% in April, and down from 7.96% in May 2011.

LPS reports that 4.12% of mortgages were in the foreclosure process, down slightly from 4.14% in April, and up slightly from 4.11% in May 2011.

This gives a total of 11.32% delinquent or in foreclosure. It breaks down as:

• 1,967,000 loans less than 90 days delinquent.

• 1,575,000 loans 90+ days delinquent.

• 2,027,000 loans in foreclosure process.

For a total of 5,569,000 loans delinquent or in foreclosure in May. This is down from 6,350,000 in May 2011.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

Click on graph for larger image.

Click on graph for larger image.

The total delinquency rate has fallen to 7.20% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.12%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.03 million).

The second graph shows percent of loans in the foreclosure process by process (Judicial vs. non-judicial).

The second graph shows percent of loans in the foreclosure process by process (Judicial vs. non-judicial).

From LPS: "Foreclosure inventory in judicial states is 6.5% - more than 2.5X that of non-judicial states (2.46%); national average is 4.14%. ... Aged foreclosure inventory - loans delinquent more than two years - is also much higher in judicial states, where it accounts for 53% of total foreclosure inventory, as opposed to just over 30% in non-judicial states ... The average YoY change in percentage of non-current loans for judicial states is -0.8%; in non-judicial states, it's -7.1%"

The third graph shows new problem loan rates continue to decline...

This graph shows the percent of loans that are seriously delinquent that were current 6 months ago.

This graph shows the percent of loans that are seriously delinquent that were current 6 months ago.

From LPS: "New problem loan rates continue to improve, reaching a low not seen since July of 2007, after eight consecutive monthly declines"

There is much more in the Mortgage Monitor report.

The good news is the flow into the pipeline has slowed. The bad news - especially in judicial states - is that the pipeline is still very full.

Sunday, July 08, 2012

Monday: LPS Mortgage Delinquency Report, Consumer Credit

by Calculated Risk on 7/08/2012 10:26:00 PM

This will be a light week for economic data.

• At 8:45 AM ET, the LPS Mortgage Monitor for May will be released. This report provides monthly data on the mortgage market, especially on delinquencies.

• At 3:00 PM, the consumer credit report for June will be released. The consensus is for credit to increase $8.5 billion..

Also, at 11:55 AM, San Francisco Fed President John Williams will speak on the economic outlook.

The Asian markets are red tonight. The Nikkei is off 0.75%, and the Shanghai Composite is off 0.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the US futures are mostly flat.

Oil: WTI futures are up to $84.89 (this is down from $109.77 in February, but up last week) and Brent is at $97.69 per barrel. According to a formula from Professor Hamilton, the price of Brent would suggest gasoline at around $3.28 per gallon (the current national average price is $3.36) so gasoline prices might fall a little further.

Yesterday:

• Summary for Week Ending July 6th

• Schedule for Week of July 8th

A couple of questions for the July contest (to be released later in the week):

Fed Speak and a few Key Fed Dates

by Calculated Risk on 7/08/2012 06:22:00 PM

There is a renewed focus on the Fed following the weak employment report for June.

First, on Friday, Jon Hilsenrath wrote at the WSJ: Weak Report Lifts Chance of Fed Action

Friday's disappointing jobs report increases the likelihood that the Federal Reserve will launch a new bond-buying program to boost economic growth, though it doesn't ensure such a move.Dennis Lockhart is a voting member of the FOMC and he speaks this week to the Mississippi Economic Council on Friday at 1:20 PM ET. As Hilsenrath notes, Lockhart is in the "middle", and his speech will be analyzed to see if he is moving towards QE3.

...

The central bank's more activist camp believes more action is already justified because the economy isn't making progress toward reducing unemployment and inflation is low. Its hawkish wing, which worries more about inflation and which has been skeptical of the central bank's responses to financial crisis and recession, accepts that more action might be needed but wants to hold it in reserve for serious threats like recession or deflation.

Some Fed officials in the middle don't have as high a bar to action as the hawks but are waiting to see if the outlook deteriorates anymore. "I am more leaning toward the view further action would be a response to deteriorating conditions and a deteriorating outlook," Atlanta Fed president Dennis Lockhart said in an interview with Dow Jones Newswires last month.

Note: On Monday, FOMC voting member San Francisco Fed President John Willams will speak at 11:55 AM in Idaho, and on Wednesday the minutes from the FOMC meeting of June 19-20, 2012 will be released.

The following week, on July 17th, Fed Chairman Ben Bernanke will testify before the Senate Banking Committee, and on July 18th he will testify House Financial Services Committee. The next FOMC meeting is on July 31st and August 1st.

The key piece of economic data to be released before the next FOMC meeting is the Q2 advance GDP report on Friday, July 27th. Right now this report is expected to show GDP growth of around 1.5% annualized in Q2.

Some analysts think the Fed will wait for more data, so they think August 1st is too soon for QE3. Still the debate about QE3 will pickup over the next few weeks.

Yesterday:

• Summary for Week Ending July 6th

• Schedule for Week of July 8th

And on Employment:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• Percent Job Losses: Great Recession and Great Depression

• All Employment Graphs

Employment Report Graphs: Participation Rate, Duration of Unemployment and Diffusion Indexes

by Calculated Risk on 7/08/2012 11:24:00 AM

Below are three more graphs based on the June employment report.

For more employment graphs and analysis, see:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• Percent Job Losses: Great Recession and Great Depression

• All Employment Graphs

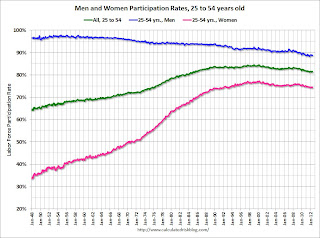

The following graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The participation rate for women increased significantly from the mid 30s to the mid 70s. This rate was at 75.5% prior to the recession, and declined to a post-recession low of 74.3%. There has been almost no recovery in the participation rate for prime working age women. This rate has mostly flattened out this year, and was still near the low in June at 74.4%.

The participation rate for men has decreased from the high 90s a few decades ago, to a low of 88.3% after the recession. This rate has increased a little and was at 88.8% in June.

There might be some "bounce back" for both men and women (some of the recent decline is probably cyclical), but the long term trend for men is down.

For more on this, see The Declining Participation Rate.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down, but there was an increase in the less than 5 week category in June. The other categories remain elevated.

Unfortunately the long term unemployed remains very high at 3.5% of the labor force in June.

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS:

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS: Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The BLS diffusion index for total private employment was at 57.9 in June, down from 59.8 in May. For manufacturing, the diffusion index declined to 51.2 from 53.7 in May.

Even though job growth was weak in June, job growth was still somewhat widespread across industries (a small positive).

Yesterday:

• Summary for Week Ending July 6th

• Schedule for Week of July 8th

Saturday, July 07, 2012

Percent Job Losses: Great Recession and Great Depression

by Calculated Risk on 7/07/2012 10:04:00 PM

The causes of the Great Recession were similar to the Great Depression - as opposed to most post war recessions that were caused by Fed tightening to slow inflation - and I'm frequently asked if we could compare the percent job losses during the two periods. Unfortunately there is very little data for the Great Depression.

Back in February I posted a graph based on some rough annual data.

In April, Treasury released a slide deck titled Financial Crisis Response In Charts. One of the charts shows the percentage jobs lost in the current recession compared to the Great Depression.

Here is that graph (I've added a couple of dots to update the current recession).

This graph compares the job losses from the start of the employment recession, in percentage terms for the Great Depression, the 2007 recession, and the average for several recent recession following financial crisis.

Although the 2007 recession is much worse than any other post-war recession, the employment impact was much less than during the Depression. Note the second dip during the Depression - that was in 1937 and the result of austerity measures.

For reference, the second graph shows the job losses from the start of the employment recession, in percentage terms, compared to other post WWII recessions.

For reference, the second graph shows the job losses from the start of the employment recession, in percentage terms, compared to other post WWII recessions.

Earlier:

• Summary for Week Ending July 6th

• Schedule for Week of July 8th

Unofficial Problem Bank list declines to 913 Institutions

by Calculated Risk on 7/07/2012 06:32:00 PM

Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

So this is an unofficial list of Problem Banks compiled only from public sources. (And only US banks).

Here is the unofficial problem bank list for July 6, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Changes to the Unofficial Problem Bank List this week were limited to four removals. Afterward, the list holds 913 institutions with assets of $353.4 billion. A year ago, the list hit its high at 1,004 institutions with assets of $418.8 billion.Earlier:

There were three action terminations -- First Community Bank, National Association, Lexington, SC ($602 million Ticker: FCCO); Profinium Financial, Inc., Truman, MN ($307 million); and Solera National Bank, Lakewood, CO ($146 million Ticker: SLRK).

The other removal was the failed Montgomery Bank & Trust, Ailey, GA ($174 million), which is the 80th bank to fail in Georgia since August 2008. This failure was costly as FDIC estimated the loss at 75.2 million or 43.3 percent of MB&T's assets. There is some intrigue with the failure as a director apparently has gone missing with $17 million of the bank's monies according to the Wall Street JournalOn Tuesday, the U.S. attorney's office in New York announced that missing director Aubrey Lee Price has been charged with wire fraud involving the embezzlement of $17 million from the bank. After telling upper management that he was investing in U.S. Treasury securities, Mr. Price wired bank funds to accounts he controlled and prepared falsified statements to cover his tracks, the federal complaint said. The banker has been missing since at least June 16. He vanished after writing friends to tell them he had lost large amounts of client funds on trades and wanted to kill himself, authorities said. Investigators say Mr. Price, 46 years old, was last seen boarding a ferry in Key West, Fla., bound for Fort Myers, Fla. He had "previously stated that he owns real estate in Venezuela" and "may own a boat that would be large enough to travel to Venezuela from Florida," the complaint says.There are 67 banks in Georgia still on the Unofficial Problem Bank List, so there is a good chance the state could experience 100 failures during this banking crisis. Next week, we anticipate the OCC will release its enforcement actions through mid-June 2012.

• Summary for Week Ending July 6th

• Schedule for Week of July 8th

Schedule for Week of July 8th

by Calculated Risk on 7/07/2012 01:04:00 PM

Earlier:

• Summary for Week Ending July 6th

The key report this week is the May Trade Balance report.

The FOMC minutes, to be released on Wednesday, will receive extra attention for clues about QE3. Also several regional Fed presidents will speak this week.

8:45 AM ET: LPS Mortgage Monitor for May.

3:00 PM: Consumer Credit for June. The consensus is for credit to increase $8.5 billion.

7:30 AM: NFIB Small Business Optimism Index for June.

7:30 AM: NFIB Small Business Optimism Index for June. Click on graph for larger image in graph gallery.

The index decreased slightly to 94.4 in May from 94.5 in April.

The consensus is for a decrease to 92.0 in June.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings declined in April to 3.416 million, down from 3.741 million in March. However the number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to April 2011.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. Exports decreased in April. Imports decreased even more. Exports are 11% above the pre-recession peak and up 4% compared to April 2011; imports are 2% above the pre-recession peak, and up about 6% compared to April 2011.

The consensus is for the U.S. trade deficit to decrease to $48.7 billion in May, down from from $50.1 billion in April. Export activity to Europe will be closely watched due to economic weakness. Also oil prices started to decline in April, and that will probably reduce the value of oil imports in May.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for May. The consensus is for a 0.3% increase in inventories.

2:00 PM: FOMC Minutes, Meeting of June 19-20, 2012.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase slightly to 375 thousand.

8:30 AM: Import and Export Prices for May. The consensus is a for a 1.9% decrease in import prices.

8:30 AM: Producer Price Index for June. The consensus is for a 0.4% decrease in producer prices (0.2% increase in core).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for sentiment to increase slightly to 73.5 from 73.2 in June.

Summary for Week ending July 6th

by Calculated Risk on 7/07/2012 08:01:00 AM

The week started off with the ISM manufacturing index showing contraction for the first time since 2009, and ended with a disappointing employment report. Those were the key reports for the week - and they were dismal.

However, sandwiched in the middle of the week - around the July 4th Holiday - there was a little better news. Auto sales were stronger than expected, initial weekly unemployment claims declined, construction spending increased, and vacancy rates declined for two categories of commercial real estate in Q2 (but not for offices).

I'll have more on the employment report later today.

Here is a summary of last week in graphs:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

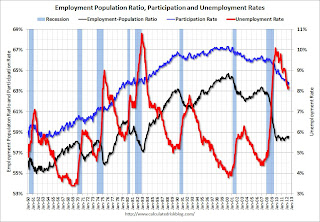

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was unchanged at 8.2% (red line).

The Labor Force Participation Rate was unchanged at 63.8% in June (blue line). This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio was unchanged at 58.6% in June (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

The economy has added 902,000 jobs over the first half of the year (952,000 private sector jobs). At this pace, the economy would add around 1.9 million private sector jobs in 2012; less than the 2.1 million added in 2011.

However job growth has really slowed over the last three months with only 225,000 payroll jobs added (a 900,000 annual pace), and only 274,000 private sector jobs (a 1.1 million annual pace). This is very sluggish employment growth.

• ISM Manufacturing index declines in June to 49.7

This is the first contraction in the ISM index since the recession ended in 2009. PMI was at 49.7% in June, down from 53.5% in May. The employment index was at 56.6%, down from 56.9%, and new orders index was at 47.8%, down from 60.1%.

This is the first contraction in the ISM index since the recession ended in 2009. PMI was at 49.7% in June, down from 53.5% in May. The employment index was at 56.6%, down from 56.9%, and new orders index was at 47.8%, down from 60.1%.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 52.0%. This suggests manufacturing contracted in June for the first time since July 2009.

This was a weak report, and the decline in new orders was especially significant.

• U.S. Light Vehicle Sales at 14.1 million annual rate in June

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.08 million SAAR in June. That is up 22% from June 2011, and up 2.6% from the sales rate last month (13.73 million SAAR in May 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.08 million SAAR in June. That is up 22% from June 2011, and up 2.6% from the sales rate last month (13.73 million SAAR in May 2012).This was above the consensus forecast of 13.9 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for June (red, light vehicle sales of 14.08 million SAAR from Autodata Corp).

Sales have averaged a 14.28 million annual sales rate through the first half of 2012, up sharply from the same period of 2011.

• ISM Non-Manufacturing Index declines, indicates slower expansion in June

The June ISM Non-manufacturing index was at 52.1%, down from 53.7% in May. The employment index increased in June to 52.3%, up from 50.8% in May. Note: Above 50 indicates expansion, below 50 contraction.

The June ISM Non-manufacturing index was at 52.1%, down from 53.7% in May. The employment index increased in June to 52.3%, up from 50.8% in May. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 53.0% and indicates slower expansion in June than in May.

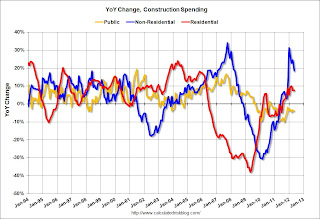

• Construction Spending in May: Private spending increases, Public Spending declines

This week the Census Bureau reported that overall construction spending increased in May:

This week the Census Bureau reported that overall construction spending increased in May: The U.S. Census Bureau of the Department of Commerce announced today that construction spending during May 2012 was estimated at a seasonally adjusted annual rate of $830.0 billion, 0.9 percent above the revised April estimate of $822.5 billion. The May figure is 7.0 percent above the May 2011 estimate of $775.8 billion.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 61% below the peak in early 2006, and up 17% from the recent low. Non-residential spending is 28% below the peak in January 2008, and up about 30% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at a new post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit). Construction is now the "bright spot" for the economy, however the improvement in residential construction is being somewhat offset by declines in public construction spending.

• Reis: Office, Mall and Apartment Vacancy Rates for Q2

This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).Reis is reporting the vacancy rate was unchanged at 17.2% in Q2, and down from 17.5% in Q2 2011. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010.

As Reis noted, there are very few new office buildings being built in the US, and new construction will probably stay low for several years.

Reis reported that the apartment vacancy rate (82 markets) fell to 4.7% in Q2 from 4.9% in Q1 2012. The vacancy rate was at 5.9% in Q2 2011 and peaked at 8.0% at the end of 2009.

Reis reported that the apartment vacancy rate (82 markets) fell to 4.7% in Q2 from 4.9% in Q1 2012. The vacancy rate was at 5.9% in Q2 2011 and peaked at 8.0% at the end of 2009.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates - and increase in rents - is happening just about everywhere.

Reis also reported a strong increase in apartment rents.

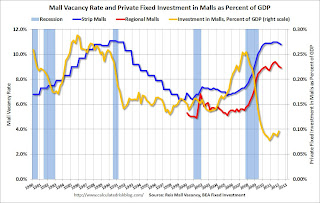

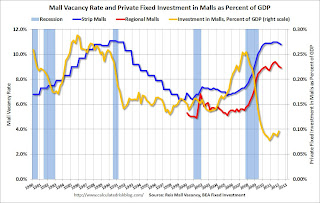

Reis reported that the vacancy rate for regional malls declined slightly to 8.9% in Q2 from 9.0% in Q1. This is down from a cycle peak of 9.4% in Q3 of last year.

Reis reported that the vacancy rate for regional malls declined slightly to 8.9% in Q2 from 9.0% in Q1. This is down from a cycle peak of 9.4% in Q3 of last year.For Neighborhood and Community malls (strip malls), the vacancy rate declined to 10.8% in Q2, from 10.9% in Q1. For strip malls, the vacancy rate peaked at 11.0% in Q2 of last year.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The yellow line shows mall investment as a percent of GDP. This isn't zero because this includes renovations and improvements. New mall investment has essentially stopped following the financial crisis.

• Weekly Initial Unemployment Claims decline to 374,000

The DOL reports:

The DOL reports:In the week ending June 30, the advance figure for seasonally adjusted initial claims was 374,000, a decrease of 14,000 from the previous week's revised figure of 388,000. The 4-week moving average was 385,750, a decrease of 1,500 from the previous week's revised average of 387,250.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined slightly to 385,750.

This is just off the high for the year.

• Other Economic Stories ...

• ADP: Private Employment increased 176,000 in June

• AAR: Rail Traffic "mixed" in June, Intermodal at Record Level

• CoreLogic: House Price Index increases in May, Up 2.0% Year-over-year

Friday, July 06, 2012

Bank Failure #32 in 2012: Montgomery Bank & Trust, Ailey, Georgia

by Calculated Risk on 7/06/2012 08:49:00 PM

From the FDIC: Ameris Bank, Moultrie, Georgia, Assumes All of the Deposits of Montgomery Bank & Trust, Ailey, Georgia

As of March 31, 2012, Montgomery Bank & Trust had approximately $173.6 million in total assets and $164.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $75.2 million. Compared to other alternatives, Ameris Bank's acquisition was the least costly resolution for the FDIC's DIF. Montgomery Bank & Trust is the 32nd FDIC-insured institution to fail in the nation this year, and the sixth in Georgia.That is a pretty high loss rate!

Update: From Bill Dawers at the Peach Pundit:

Some folks might have seen this closure coming. From the AJC a couple days ago:Earlier on employment:The Securities and Exchange Commission said Monday it has received a federal court order to freeze the assets of Aubrey Lee Price, and several associated businesses.

In a 22-page letter to investors, Price allegedly admitted he made false statements to conceal losses of $20 million to $23 million.

Regulators said Price told clients he was investing their money in traditional stocks, but he also put money into “illiquid” bets including South American real estate and shares of Montgomery Bank & Trust.

...

William P. Hicks, associate director of the SEC in Atlanta, said Price “made woeful financial transactions” that he hid from his investors.

“Now both the money and Price are missing,” Hicks said.

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

AAR: Rail Traffic "mixed" in June, Intermodal at Record Level

by Calculated Risk on 7/06/2012 04:34:00 PM

Once again rail traffic was "mixed". This was mostly due to the year-over-year decline in coal traffic. Building related commodities were up such as lumber and crushed stone, gravel, sand. Lumber was up 11.4% from June 2011.

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for June

The Association of American Railroads (AAR) today reported U.S. rail carloads originated in June 2012 totaled 1,140,271, down 1.3 percent compared with June 2011. Intermodal volume in June 2012 totaled 996,022 containers and trailers, up 49,168 units or 5.2 percent compared with June 2011. The June 2012 average weekly intermodal volume of 249,006 units is the highest average for any June on record and the third highest for any month, behind August and October 2006.

...

“U.S. intermodal originations in 2012 through June are slightly ahead of 2006’s record pace, setting up the very real possibility that 2012 will be the highest-volume intermodal year ever for U.S. railroads,” said AAR Senior Vice President John T. Gray. “The recovery in intermodal traffic since the recession has been remarkable and is due in large part to railroads’ huge investments in their intermodal business that have improved rail intermodal’s reliability and efficiency.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

U.S. rail carload traffic in June 2012 wasn’t as encouraging as intermodal traffic, but it was better than it’s been lately. U.S. freight railroads originated 1,140,271 carloads in June, an average of 285,068 carloads per month and down 1.3% from June 2011.Grains are down due to fewer exports.

That’s the lowest percentage decline in five months, mainly because coal carloads weren’t as lousy as they have been. Coal carloads in June 2012 averaged 114,485 per week, the highest weekly average in four months and down just 6.2% from June 2011. Normally, a 6.2% year-over year decline is terrible, but compared to the 11% to 17% declines in the previous four months, it’s not so bad.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now at peak levels.

U.S. railroads originated 996,022 intermodal containers and trailers in June 2012, up 5.2% (49,168 units) over June 2011 and an average of 249,006 units per week. That’s the highest average for any June in history and the third highest average for any month in historyThe top months for intermodal are usually in the fall, and it looks like intermodal traffic will be at record levels this year.

Earlier on employment:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

Where are the construction jobs?

by Calculated Risk on 7/06/2012 02:21:00 PM

Back in 2006, I predicted we'd see construction job losses in the seven figures. All through 2006 and into 2007, I was constantly asked: "Where are the construction job losses you predicted?"

And then it started ... and the BLS reported construction employment fell 2.27 million from peak to trough. No one asks that question any more.

There were several reasons why construction jobs didn't decline at the same time as housing starts. First, construction includes residential, commercial and other construction (like roads). Even after housing starts began to collapse, commercial real estate was still booming and workers shifted from residential to commercial (many commercial projects have long time frames - and many developers remained in denial). Also some construction workers are paid in cash (illegal immigrants), and these workers weren't counted on the BLS payrolls.

Now people are asking "Where are the construction jobs?"

Oh, Grasshopper ... the construction jobs are coming.

The graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969 compared to housing starts. Unfortunately the BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Right away we can see that construction employment isn't just tied to housing starts. There are other categories that have been generally increasing over the decades.

Click on graph for larger image.

Click on graph for larger image.

Notice that housing starts collapsed in 2006, but construction employment didn't start falling until 2007 - and didn't collapse until 2008. Some people will look at the sub-categories for construction, but there are two problems: 1) construction workers shift between categories, and 2) the BLS hasn't been tracking these categories for very long.

Even though construction is down since the beginning of the year, and only increased by 2,000 jobs in June, construction employment appears to have bottomed, and should add to both GDP and employment growth in 2012.

Other construction indicators - housing starts, new home sales, construction spending, builder comments - are all improving (although public construction spending is decreasing), and construction employment will follow.

A little Kung Fu:

Young Caine: "Old man, how is it that you hear these things?"

Master Po: "Young man, how is it that you do not?"

The housing recovery is here. The construction jobs are coming.

Earlier on employment:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

Reis: Mall Vacancy Rate declines slightly in Q2

by Calculated Risk on 7/06/2012 12:42:00 PM

Reis reported that the vacancy rate for regional malls declined slightly to 8.9% in Q2 from 9.0% in Q1. This is down from a cycle peak of 9.4% in Q3 of last year.

For Neighborhood and Community malls (strip malls), the vacancy rate declined to 10.8% in Q2, from 10.9% in Q1. For strip malls, the vacancy rate peaked at 11.0% in Q2 of last year.

Comments from Reis Senior Economist Ryan Severino:

[Strip mall] The national vacancy rate fell by 10 bps during the second quarter to 10.8%. This is the second consecutive quarterly decline in the vacancy rate after vacancies had generally been rising between the second quarter of 2005 and the fourth quarter of 2011. Although demand for space remains weak, new construction remains moored at such low levels that even weak demand is sufficient to push vacancy rates downward. Only 572,000 SF of neighborhood and community center space were delivered during the quarter. That is the second-lowest quarterly figure on record since Reis began publishing quarterly data in 1999 and a fairly substantial decline from the already scant 1.554 million SF that were delivered during the first quarter.

Despite the second consecutive quarterly vacancy decline, Reis is not yet convinced that a recovery for shopping centers has commenced. Just as much of the recent improvement in the market is owed to limited increases in supply as the somewhat resurgent demand. New completions remain just above historically low levels. With supply growth once again falling back to such trivial levels, the modest demand we observed pushed vacancy down slightly. Two consecutive quarters of vacancy decline is a notable result, but nonetheless only represents the nascent stages of stabilization. With construction projected to remain at low levels, Reis expects vacancies to continue moving slowly downward in 2012 as demand for space outpaces new construction.

...

Regional malls posted another quarter of modest improvement, with national vacancies declining by 10 bps to 8.9%. This is the third consecutive quarter with a vacancy decline. Asking rents grew by 0.3%, marking the fifth consecutive quarter of rent increases. Although regional malls continue to perform better then neighborhood and community centers at this juncture, demand for space remains weak.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

The yellow line shows mall investment as a percent of GDP. This isn't zero because this includes renovations and improvements. New mall investment has essentially stopped following the financial crisis.

The good news is, as Severino noted, "new [mall] completions remain just above historically low levels", and, with very little new supply, the vacancy rate will probably continue to decline slowly.

Mall vacancy data courtesy of Reis.

Earlier on employment:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

Employment: Another Weak Report (more graphs)

by Calculated Risk on 7/06/2012 10:54:00 AM

Another month, another disappointing employment report.

The economy has added 902,000 jobs over the first half of the year (952,000 private sector jobs). At this pace, the economy would add around 1.9 million private sector jobs in 2012; less than the 2.1 million added in 2011.

However job growth has really slowed over the last three months with only 225,000 payroll jobs added (a 900,000 annual pace), and only 274,000 private sector jobs (a 1.1 million annual pace). This is very sluggish employment growth.

The unemployment rate was unchanged at 8.2% in June The household survey showed a another increase in employment (128,000 jobs added), and since the participation rate was unchanged at 63.8%, that was just enough to keep with the increase in the labor force.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased slightly to 14.9%.

The bottom line is this was another disappointing employment report. Here are a few more graph ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.6% in June (this was down slightly in June.)

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

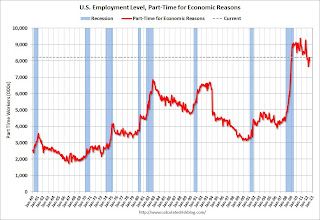

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 8.2 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in June to 8.21 millon.

These workers are included in the alternate measure of labor underutilization (U-6) that increased in June to 14.9%, up from 14.8% in May.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.37 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.41 million in May. This is generally trending down, but very slowly. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

So far in 2012 - through June - state and local government have lost 20,000 jobs (3,000 jobs were added in June). In the first six months of 2011, state and local governments lost 133,000 payroll jobs - and 230,000 for the year. So the layoffs have slowed.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is still losing workers (52,000 over the last 12 months and another 7,000 in June alone), but it looks like state and local government employment losses might be ending (or at least slowing sharply).

Overall this was another weak report.