by Calculated Risk on 7/13/2012 05:44:00 PM

Friday, July 13, 2012

Bank Failure #33 in 2012: Glasgow Savings Bank, Glasgow, Missouri

Not so with Clan Missouri

Penny, pound foolish

by Soylent Green is People

From the FDIC: Regional Missouri Bank, Marceline, Missouri, Assumes All of the Deposits of Glasgow Savings Bank, Glasgow, Missouri

As of March 31, 2012, Glasgow Savings Bank had approximately $24.8 million in total assets and $24.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $0.1 million. ... Glasgow Savings Bank is the 33rd FDIC-insured institution to fail in the nation this year, and the first in Missouri.A small one ... but it is Friday! On pace for around 60 bank failures this year, the fewest since 25 banks failed in 2008.

Market Update: More than a Lost Decade

by Calculated Risk on 7/13/2012 04:23:00 PM

Click on graph for larger image.

I haven't posted these graphs in a few months. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in April 1999; over 13 years ago.

The second graph (click on graph for larger image) from Doug Short shows the S&P 500 since the 2007 high ...

Hotels: Occupancy Rate declines in latest weekly survey

by Calculated Risk on 7/13/2012 01:05:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 7 July

In year-over-year comparisons for the week, occupancy ended the week with a 3.7-percent decrease to 61.4 percent, average daily rate increased 3.0 percent to US$101.67 and revenue per available room ended the week virtually flat with a 0.8-percent decrease to US$62.37.The decline in occupancy last week was due to the timing of July 4th (and probably impacted by the mid-week holiday). The 4-week average is still above last year, and is close to the pre-recession levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Looking forward, leisure travel usually increases over the summer months, and occupancy rates will probably average 70% for the next couple of months. It looks like 2012 will have higher occupancy than 2011, and be close to the pre-recession median. But it will be sometime before investment increases again.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Consumer Sentiment declines in July to 72.0

by Calculated Risk on 7/13/2012 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for July declined to 72.0, down from the June reading of 73.2.

This was below the consensus forecast of 73.5 and the lowest level this year. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy.

PPI increases 0.1%, JPMorgan reports $4.4 billion CIO Loss

by Calculated Risk on 7/13/2012 08:46:00 AM

From MarketWatch: U.S. wholesale prices rise 0.1% in June

U.S. wholesale prices rose a seasonally adjusted 0.1% in June as higher costs for food, light trucks and appliances offset another decline in energy costs, the Labor Department said Friday. Excluding the volatile categories of food and energy, core wholesale prices rose a slightly faster 0.2%.Press release from JPMorgan: JPMORGAN CHASE REPORTS SECOND-QUARTER 2012 NET INCOME OF $5.0 BILLION, OR $1.21 PER SHARE, ON REVENUE OF $22.9 BILLION

...

Over the past year wholesale prices have risen an unadjusted 0.7%.

"$4.4 billion pretax loss ($0.69 per share after-tax reduction in earnings) from CIO trading losses and $1.0 billion pretax benefit ($0.16 per share after-tax increase in earnings) from securities gains in CIO’s investment securities portfolio in Corporate"

Much more at FT/alphaville: US Markets Live, Jamie beaches the Whale special edition and 'CIO Risk Management was ineffective in dealing with Synthetic Credit Portfolio’

Thursday, July 12, 2012

Friday: JPMorgan Results, PPI, Consumer sentiment

by Calculated Risk on 7/12/2012 09:17:00 PM

• At 7:00 AM ET, J.P. Morgan will report second Quarter 2012 Financial Results. The press release and conference call will provide an update on the CIO losses. ft.com/alphaville will be following the conference call on US Markets Live starting at 7:30 AM.

The WSJ Deal Journal will also be blogging the 2 hour conference call (2 hour call?). From the WSJ: J.P. Morgan Earnings: What to Watch

The bank is so full of news that Chairman and CEO Jamie Dimon, along with his CFO Doug Braunstein, will host a 2-hour conference call tomorrow morning at 7:30 a.m., shortly after the results hit.I've seen CIO loss estimates as high as $6.5 billion.

WSJ has reported the bank expects the loss to be about $5 billion, and many analysts are looking for that number too.

Analysts expect total revenue to fall 20% to $21.9 billion for the bank.

• At 8:30 AM, the Producer Price Index for June will be released. The consensus is for a 0.4% decrease in producer prices (0.2% increase in core).

• At 9:55 AM, the preliminary Reuter's/University of Michigan's Consumer sentiment index will be released. The consensus is for sentiment to increase slightly to 73.5 from 73.2 in June.

For the economic question contest:

Foreclosure Report: California "Homebuyers should brace themselves for significantly less inventory next year"

by Calculated Risk on 7/12/2012 05:47:00 PM

Two foreclosure reports: one national predicting an increase in distressed sales; the other regional (west) predicting less foreclosure inventory. Both could be correct ... (Update: the reports have conflicting data for California - on that one is probably wrong!)

RealtyTrac released their midyear foreclosure report this morning: 1 Million Properties With Foreclosure Filings in First Half of 2012

Overall foreclosure activity was down in the second quarter, driven primarily by a drop in bank repossessions (REOs), but 311,010 properties started the foreclosure process during the quarter, a 9 percent increase from the previous quarter and a 6 percent increase from the second quarter of 2011 — the first year-over-year increase in quarterly foreclosure starts since the fourth quarter of 2009.And from Foreclosure Radar (just a few states): Foreclosure Inventory Continues To Decline

A total of 31 states posted year-over-year increases in foreclosure starts in the second quarter — 17 judicial foreclosure states and 14 non-judicial foreclosure states.

"Additional scrutiny on how lenders and servicers process foreclosures, along with aggressive foreclosure prevention efforts by the federal government and several state governments, continue to keep a lid on the foreclosure problem at a national level,” said Brandon Moore, CEO of RealtyTrac. “Still, foreclosure starts began boiling over in more markets in the first half of the year, particularly in the second quarter, when rising foreclosure starts spread from primarily judicial foreclosure states in the first quarter to more than half of all non-judicial foreclosure states in the second quarter.

“Lenders and servicers are slowly but surely catching up with the backlog of delinquent loans that under normal circumstances would have started the foreclosure process last year, and that catching up is why the average time to complete the foreclosure process started to level off or decrease in some states in the second quarter,” Moore added. “The increases in foreclosure starts in the first half of the year will likely translate into more short sales and bank repossessions in the second half of the year and into next year.”

June 2012 Foreclosure Sales were significantly down in the three largest foreclosure states in our coverage area. California Foreclosure Sales were down 13.4 percent over last month, and down 48.8 percent vs. June 2011. Arizona Foreclosure Sales were down 18.5 percent over last month, and down 42.1 percent vs. June 2011. Nevada Foreclosure Sales were down 14.6 percent over last month, and down 72.1 percent vs. June 2011 driven by the new regulation that took effect in October 2011. In addition, Foreclosure Filings are flat to down in all states in our coverage area, both on a month over month basis and vs. previous year. Arizona Notice of Sales were down 27.7 percent over last month, Nevada Notice of Defaults were down 22.7 percent over last month, and California Notice of Defaults were basically flat, being down 0.9 percent over last month.

... with the declining level of Foreclosure Sales the inventory will continue to decrease. In California, banks take on average 272 days to resell properties they take back at auction, thus, Realtors, investors, and homebuyers should brace themselves for significantly less inventory in next years' selling season.

CoreLogic: Negative Equity Decreases in Q1 2012

by Calculated Risk on 7/12/2012 03:05:00 PM

From CoreLogic: CORELOGIC® Reports Negative Equity Decreases in First Quarter of 2012

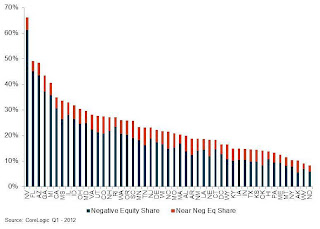

CoreLogic ... today released new data showing that 11.4 million, or 23.7 percent, of all residential properties with a mortgage were in negative equity at the end of the first quarter of 2012. This is down from 12.1 million properties, or 25.2 percent, in the fourth quarter of 2011. An additional 2.3 million borrowers had less than 5 percent equity, referred to as near-negative equity, in the first quarter.Note: CoreLogic revised their methodology, and they provided revised historical data here.

Together, negative equity and near-negative equity mortgages accounted for 28.5 percent of all residential properties with a mortgage nationwide in the first quarter, down from 30.1 percent in Q4 2011. More than 700,000 households regained a positive equity position in the Q1 2012. Nationally, negative equity decreased from $742 billion in Q4 2011 to $691 billion in the first quarter, a fall of $51 billion in large part due to an improvement in house price levels.

“In the first quarter of 2012, rebounding home prices, a healthier balance of real estate supply and demand, and a slowing share of distressed sales activity helped to reduce the negative equity share,” said Mark Fleming, chief economist for CoreLogic. “This is a meaningful improvement that is driven by quickly improving outlooks in some of the hardest hit markets. While the overall stagnating economic recovery will likely slow housing market recovery in the second half of this year, reducing the number of underwater households is an important step toward reducing future mortgage default risk.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest negative equity percentage with 61 percent of all mortgaged properties underwater, followed by Florida (45 percent), Arizona (43 percent), Georgia (37 percent) and Michigan (35 percent). These top five states combined have an average negative equity share of 44.5 percent, while the remaining states have a combined average negative equity share of 15.9 percent."

The second graph shows the historical negative equity share using the new CoreLogic methodology.

The second graph shows the historical negative equity share using the new CoreLogic methodology.More from CoreLogic: "As of Q1 2012, there were 1.9 million borrowers who were only 5 percent underwater. If home prices continue increasing over the next year, these borrowers could move out of a negative equity position."

This is some improvement, but there are still 11.4 residential properties with negative equity.

Redfin: House prices increased in June, Inventory declined

by Calculated Risk on 7/12/2012 02:12:00 PM

Another house price index, this one is based on prices per sq ft ...

From Glenn Kelman at Redfin: June Prices Increased 3.0%, But Sales Slowing

Across 19 major metropolitan markets, June prices increased 3.0% year over year, and 2.6% month over month. The number of homes for sale declined 25.3% from June 2011 to June 2012, and by 2.4% since May. Sales increased 4.3% over last year, but actually slipped 1.1% since May. The percentage of listings that sold within 14 days of their debut remained steady since May at 28.5%.There is limited historical data for this index. In 2011, sales were fairly weak in the April through July period, and a 4.3% increase in year-over-year sales for June would be less than the approximately 10% year-over-year increase in sales NAR reported for April and May of this year.

...

Inventory has been slow to rise because some home-owners can’t sell; their home is worth less than they owe the bank. Many others more don’t want to sell, because they can rent their house for more each month than their bank payment, and because they believe prices may improve. With vacancies are on the decline and rents rising, for many sellers it just makes more sense to rent out the home rather than sell.

The reported 25.3% decrease in inventory is similar to other sources and is a key driver for the small year-over-year price increase.

Buffett: US Housing Picking Up, Rest of economy slowing down

by Calculated Risk on 7/12/2012 11:15:00 AM

From CNBC: Warren Buffett: US Economic Growth Slowing, Europe Slipping 'Pretty Fast'

In a live CNBC interview from Sun Valley with Becky Quick of "Squawk Box," Buffett says the general economy's growth has "tempered down" so that it is now "more or less flat."Warren Buffett (my transcript):

He does, however, see a "noticeable" pickup for residential housing from a "very low base" that "doesn't amount to a whole lot yet, but it's getting better."

For months, Buffett had been seeing general U.S. economic growth held back by a weak residential housing market.

Buffett also says things are beginning to "slip pretty fast" in Europe, especially over the past six weeks.

"I have a different story this time. For a couple of years, I've been telling you that everything except residential housing was improving at a moderate rate, not crawling, but not galloping either. But that residential housing was flat lining.His comments on Europe were very negative.

The last two months have been sort of the opposite. The general economy in the US has been more or less flat; the growth has tempered down. But residential housing - we're seeing a pickup - it is noticeable, it is from a very low base, and it doesn't amount to a whole lot yet - but it is getting better. You have a flip-flop on that."

...

The rest of the economy is slowing down - it is not heading downward - but it is not growing at the rate that it was earlier."

Weekly Initial Unemployment Claims decline to 350,000 due to onetime factors

by Calculated Risk on 7/12/2012 08:40:00 AM

The DOL reports:

In the week ending July 7, the advance figure for seasonally adjusted initial claims was 350,000, a decrease of 26,000 from the previous week's revised figure of 376,000. The 4-week moving average was 376,500, a decrease of 9,750 from the previous week's revised average of 386,250.The previous week was revised up from 374,000 to 376,000.

From MarketWatch: "onetime factors such as fewer auto-sector layoffs than normal likely caused the sharp decline, the Labor Department said Thursday".

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 376,500.

The sharp decline was probably due to onetime factors, plus this included the holiday week.

And here is a long term graph of weekly claims:

This was well below the consensus forecast of 375,000. With the holiday week and onetime factors, it is difficult to tell if there is any improvement - but this is the lowest level for the four week average since May.

This was well below the consensus forecast of 375,000. With the holiday week and onetime factors, it is difficult to tell if there is any improvement - but this is the lowest level for the four week average since May.Wednesday, July 11, 2012

Thursday: Weekly Unemployment Claims, Import and Export Prices

by Calculated Risk on 7/11/2012 08:48:00 PM

Thursday will be another light day for economic data, but there will be plenty of discussion about the possibility of QE3. A few key dates for the Fed:

On Friday, Atlanta Fed President Dennis Lockhart, a voting member of the FOMC and someone in the "middle", will speak on the economic outlook. Next week, on July 17th, Fed Chairman Ben Bernanke will testify before the Senate Banking Committee, and on July 18th he will testify House Financial Services Committee.

The next FOMC meeting is on July 31st and August 1st, and the key piece of economic data to be released before the meeting is the Q2 advance GDP report on Friday, July 27th. Also there will be more data on inflation (especially CPI on July 17th, and Q2 / June PCE price index).

On the FOMC minutes from Tim Duy: FOMC Minutes Not a Smoking Gun

The minutes of the June FOMC meeting are out, and they did not deliver the much-anticipated smoking gun that would indicate QE3 was on its way. In fact, I think the minutes raise questions about another round of QE3 at all. The minutes hold many hints that policymakers are struggling to find a new direction for policy, one not necessarily dependent on balance sheet expansion.And from Binyamin Appelbaum at the NY Times: Fed Is Torn on Tipping Point for Action

...

Bottom Line: The minutes leaves me with the sense that it isn't so much the outlook that is holding back the Fed from further stimulus, but a lack of faith in the beneficial effects of further quantitative easing. That lack of faith may be why the bar to QE3 seems so high. So high that Fed officials are searching for other tools as the next step. Until I see more specific suggestions of other tools, I would continue to expect QE as the tool of choice. Given concerns about the functioning of the Treasuries market, MBS would seem a suitable alternative. But a building desire to explore new tools could mean a delay in any additional action. Hopefully Fed officials will give us more guidance on specific alternatives in the weeks ahead.

Paul Ashworth, chief United States economist at Capital Economics, was among the analysts who chose a position in the middle, writing to clients that “officials are edging closer to launching a third round of large-scale asset purchases, but it won’t become a reality unless the recovery loses even more momentum.”• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase slightly to 375 thousand.

• Also at 8:30 AM, Import and Export Prices for May will be released. The consensus is a for a 1.9% decrease in import prices.

Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in June

by Calculated Risk on 7/11/2012 03:32:00 PM

CR Note: Yesterday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). There has been a clear shift to fewer distressed sales in Sacramento.

Economist Tom Lawler has been digging up similar data, and he sent me the following table yesterday for several more distressed areas (I added Sacramento). For all of these areas the share of distressed sales is down from June 2011 - and for the areas that break out short sales, the share of short sales has increased (Mid-Atlantic only increased slightly) and the share of foreclosure sales are down - and down significantly.

Previous comments from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

The most striking shift from a year ago, of course, is the sharp drop in the foreclosure share of home sales ...

CR Note: So far there is no evidence of an increase in distressed sales this summer following the mortgage settlement.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-June | 11-June | 12-June | 11-June | 12-June | 11-June | |

| Las Vegas | 34.2% | 21.6% | 27.8% | 47.2% | 62.0% | 68.8% |

| Reno | 37.0% | 25.0% | 21.0% | 41.0% | 58.0% | 66.0% |

| Phoenix | 32.8% | 27.0% | 14.1% | 40.8% | 46.8% | 67.8% |

| Sacramento | 31.0% | 22.2% | 23.2% | 43.0% | 54.2% | 65.2% |

| Mid-Atlantic (MRIS) | 10.2% | 10.0% | 8.7% | 14.9% | 18.9% | 24.9% |

| Charlotte | 14.2% | 30.6% | ||||

FOMC Minutes: Several Members noted "additional policy action could be warranted" if economy loses "momentum"

by Calculated Risk on 7/11/2012 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, June 19-20, 2012 . Excerpt:

Several participants commented that it would be desirable to explore the possibility of developing new tools to promote more-accommodative financial conditions and thereby support a stronger economic recovery.This seems to suggest that a "few" members were already prepared to vote for QE3, and "several" were willing to support QE3 if the economy loses momentum or downside risks increase or inflation is "persistently below the Committee's longer-run objective".

...

A few members expressed the view that further policy stimulus likely would be necessary to promote satisfactory growth in employment and to ensure that the inflation rate would be at the Committee's goal. Several others noted that additional policy action could be warranted if the economic recovery were to lose momentum, if the downside risks to the forecast became sufficiently pronounced, or if inflation seemed likely to run persistently below the Committee's longer-run objective. The Committee agreed that it was prepared to take further action as appropriate to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability. A few members observed that it would be helpful to have a better understanding of how large the Federal Reserve's asset purchases would have to be to cause a meaningful deterioration in securities market functioning, and of the potential costs of such deterioration for the economy as a whole.

WSJ: The U.S. Housing Bust Is Over

by Calculated Risk on 7/11/2012 12:24:00 PM

Something I've been saying for months, from the WSJ: The U.S. Housing Bust Is Over

Builders began work on 26% more single-family homes in May 2012 than the depressed levels of May 2011. The stock of unsold newly built homes is back to 2005 levels. In each of the past four quarters, housing construction has added to economic growth. In the first quarter, it accounted for 0.4 percentage points of the meager 1.9% growth rate.For the housing industry, the recovery has started. As I've noted before, the debate is now about the strength of the recovery, not whether there is a recovery. The question about house prices is not as clear, although I think prices have bottomed for the national repeat sales indexes.

"Even with the overall economy slowing," Wells Fargo Securities economists said, cautiously, in a note to clients, "the budding recovery in the housing market appears to be gradually gaining momentum."

...

Housing is still far from healthy ... Still, the upturn in housing is a milestone, a particularly welcome one amid a distressing dearth of jobs. For some time, housing has been one of the biggest causes of economic weakness. It has now—barely—moved to the plus side. "A little tail wind is a lot better than a headwind," says economist Chip Case, the "Case" in Case-Shiller.

"Manufacturing had led growth and construction had lagged," JPMorgan Chase economists said last week."Now the roles are reversed: Manufacturing growth has slowed as private construction comes to life."

Trade Deficit declines in May to $48.7 Billion

by Calculated Risk on 7/11/2012 08:30:00 AM

The Department of Commerce reported:

[T]otal May exports of $183.1 billion and imports of $231.8 billion resulted in a goods and services deficit of $48.7 billion, down from $50.6 billion in April, revised. May exports were $0.4 billion more than April exports of $182.7 billion. May imports were $1.6 billion less than April imports of $233.3 billion.The trade deficit was at the consensus forecast of $48.7 billion.

The first graph shows the monthly U.S. exports and imports in dollars through May 2012.

Click on graph for larger image.

Click on graph for larger image.Exports increased in May and imports decreased. Exports are 10% above the pre-recession peak and up 4% compared to May 2011; imports are at the pre-recession peak, and up about 4% compared to May 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $107.91 per barrel in May, down from $109.94 per barrel in April. This will decline further in June. The trade deficit with China increased to $26 billion in May, up from $24.9 billion in May 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $17 billion in May, up from $16.4 billion in May 2011; so the euro area recession didn't lead to less US exports to the euro area in May.

MBA: Record low mortgage rates, Mortgage Purchase activity increases slightly

by Calculated Risk on 7/11/2012 07:42:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. ... This week’s results include an adjustment for the Fourth of July holiday.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.79 percent, the lowest rate in the history of the survey, from 3.86 percent, with points decreasing to 0.36 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The decline in refinance activity was from a very high level.

The purchase index has increased for two consecutive weeks, but is mostly moving sideways.

Tuesday, July 10, 2012

Wednesday: Trade Balance, FOMC Minutes

by Calculated Risk on 7/10/2012 09:31:00 PM

On Wednesday the focus will be on the May trade balance report and the minutes of the June FOMC meeting:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the weekly mortgage purchase applications index.

• At 8:30 AM, the Trade Balance report for May is scheduled to be released by the Census Bureau. The consensus is for the U.S. trade deficit to decrease to $48.7 billion in May, down from from $50.1 billion in April. Export activity to Europe will be closely watched due to economic weakness. Also oil prices started to decline in April, and that will probably reduce the value of oil imports in May.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories report for May will be released. The consensus is for a 0.3% increase in inventories.

• At 2:00 PM, the FOMC Minutes for the Meeting of June 19-20 will be released.

A question for the July economic contest:

Sacramento: Percentage of Distressed House Sales lowest in years in June

by Calculated Risk on 7/10/2012 07:05:00 PM

Note: A couple of years ago I started watching several distressed markets very closely for a shift in the mix. We are now seeing a shift, although it is still early in the process ...

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

So far there has been a shift from REO to short sales, and the percentage of distressed sales has been declining year-over-year. This data would suggest some improvement although there are still more distressed sales to come.

In June 2012, 54.2% of all resales (single family homes and condos) were distressed sales. This was down from 58.3% last month, and down from 65.2% in June 2011. This is lowest level since the Sacramento Realtors started tracking distressed sales, but 54% distressed is still extremely high!

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales. There is a seasonal pattern for conventional sales (stronger in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

There has been a sharp increase in conventional sales, and there were more short sales than REO sales in June for the third consecutive month.

Total sales were down 0.8% compared to June 2011, but conventional sales were up 30% year-over-year. Active Listing Inventory for single family homes declined 65.5% from last June, and total inventory, including "short sale contingent", was off 39% year-over-year.

Cash buyers accounted for 33.4% of all sales (frequently investors), and median prices were up 3.2% from last June.

This appears to be a little more progress, although the market is still in distress - and the full impact of the mortgage settlement is still unknown.

We are seeing similar patterns in other distressed areas.

Foreclosure Supply and the Housing Market

by Calculated Risk on 7/10/2012 05:01:00 PM

First a few excerpts from this article by Diana Olick at CNBC: When Foreclosure Supplies Fall, the Bottom Falls Out of Housing

While foreclosures brought home prices down initially, they are now driving them up because there is so much demand from investors and first time buyers, looking for bargains. Supplies of these cheap homes are also dwindling, because banks are still working to modify many troubled loans, and states that require a judge in the foreclosure process are still facing a huge backlog.Look at the headline "When Foreclosure Supplies Fall, the Bottom Falls Out of Housing". Really? I think we need to define "housing" and what a "housing recovery" looks like.

...

This new lack of distressed supply may lead to what housing analyst Mark Hanson calls, “an investor gut check.” He sees early results that sales volume in many of the markets that were deemed to be “recovering” are actually falling.

“First is the artificial lack of distressed supply, which is the market in all of the miracle 'recovery' regions. As I have pounded the table over for years ... 'investors and first timers are thin and volatile cohorts that have been known to up and leave markets in a matter of a month or two leading to a demand collapse'. But equally responsible are Zombie Homeowners; those without enough equity to pay a Realtor 6 percent and put 20 percent down on a new house and/or good enough credit or strong enough income to secure a new mortgage loan,” writes Hanson.

Hanson calls the lack of distressed supply “artificial” because he believes banks are holding back some distressed inventory and/or that many of the loan modifications being worked out will inevitably fail. He points out that distressed supply is vital to a market like Phoenix, because 66 percent of its current borrowers owe more on their mortgages than their homes are currently worth, and are therefore stuck in place, unable to buy or sell.

“Without repeat buyers in the market leaving a unit of supply when they move up, laterally or down (in the case of empty nesters), supply is simply removed from the market and not replaced,” notes Hanson.

When I think of "housing", I think of 1) residential investment, especially housing starts and new home sales, and 2) house prices for existing homes. When the supply falls - especially foreclosure supply - I'd expect there to be less downward pressure on house prices, and also more opportunity for new home sales. That is what we are seeing.

So what does the headline mean? A decline in existing home sales? Yes, sales have declined year-over-year in some distressed markets (like Phoenix and Las Vegas), but that is not bad news. As I've pointed out before, those looking at the number of existing home sales to judge a "housing recovery" are looking in the wrong place.

Mark Hanson makes some interesting points, and this raises the question again of why supply has fallen so sharply. There are probably several reasons for the decline in supply: 1) negative equity keeps people from selling (and buying as Hanson notes), 2) banks aren't foreclosing quickly and are focusing more on modifications and short sales, 3) cash-flow investors have purchased a substantial number of houses, especially at the low end, and they will not be sellers for some time, and 4) seller price expectations (when sellers expect prices to stabilize, they no longer rush to sell).

For these reasons (and probably others), there is less supply. And this in turn might lead to fewer sales since investors and first time buyers are focused on the low end of the market (I also expect sales to decline from record levels in areas like Las Vegas). But lower existing home sales doesn't mean the "bottom falls out of housing". Actually it could mean the housing market is improving!

To look for a "housing recovery", we need to focus on residential investment (new home sales and housing starts) and existing home prices. Lower supply is a positive for both.