by Calculated Risk on 7/24/2012 09:28:00 PM

Tuesday, July 24, 2012

Wednesday: New Home Sales

Perhaps a little good housing news on Wednesday, but first, on Europe from Tim Duy: Is There Even a Panic Button in Europe?

I didn't think it was possible, but my confidence in the ability of European policymakers to pull the Continent out of crisis continues to fall. This is saying a lot because I had virtually no confidence to begin with.Europe is still getting "Schäuble'd" as policymakers continue to repeat the same mistakes. Oh well, the beatings will continue until morale improves.

...

The Greeks were never given a bailout plan that had any hope of success.

...

Whether or not Greece can be forced from the Euro with little impact elsewhere remains to be seen. I doubt we will need to wait much longer to learn the outcome of Grexit. But the devastating train that is the debt crisis keeps rolling right along, currently crashing through Spain's economy.

And make no mistake, European policymakers have learned nothing from the Greek experience. One gets the sense that policymakers think the prescription was correct, but that the patient was simply unwilling to take the medicine. Where Greece failed, Spain will succeed ...

On Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications and refinance indexes. I expect record low mortgage rates and more refinance activity.

• At 10:00 AM, the New Home Sales report for June is scheduled to be released by the Census Bureau. The consensus is for an increase in sales to 370 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 369 thousand in May.

WSJ: Fed Moving Closer to more Accommodation

by Calculated Risk on 7/24/2012 04:34:00 PM

From Jon Hilsenrath at the WSJ: Fed Sees Action if Growth Doesn't Pick Up Soon

Federal Reserve officials, impatient with the economy's sluggish growth and high unemployment, are moving closer to taking new steps to spur activity and hiring.There are arguments for waiting until September (more data, updated projections), but I think there is a reasonable chance they will move on August 1st since their current projections are already unacceptable - and the data has been mostly disappointing since their last meeting.

Since their June policy meeting, officials have made clear—in interviews, speeches and testimony to Congress—that they find the current state of the economy unacceptable. Many officials appear increasingly inclined to move unless they see evidence soon that activity is picking up on its own.

Amid the recent wave of disappointing economic news, conversation inside the Fed has turned more intensely toward the questions of how and when to move. Central-bank officials could take new steps at their meeting next week, July 31 and Aug. 1, though they might wait until their September meeting to accumulate more information on the pace of growth and job gains before deciding whether to act. ... There are several reasons why Fed officials might wait for their September meeting to decide whether to proceed. By then they will have seen two more monthly unemployment reports and two more months of data on output, spending and investment. Fed officials update their economic projections at the September meeting and Mr. Bernanke holds his a quarterly news conference after, which would give him an opportunity to publicly explain the Fed's thinking.

...

A new round of bond-buying would be politically controversial so close to the November presidential election. ... Another option is a change in the Fed's public communication about its plans.

The Q2 GDP report to be released on Friday will be an important piece of data - not just the Q2 growth rate, but the annual revisions. If GDP is revised down, then that would suggest a larger "output gap" - and that would probably influence many FOMC members to vote for more accommodation now.

Philly Fed: State Coincident Indexes show weakness

by Calculated Risk on 7/24/2012 01:14:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for June 2012. In the past month, the indexes increased in 30 states, decreased in nine states, and remained stable in 11 states, for a one-month diffusion index of 42. Over the past three months, the indexes increased in 39 states, decreased in nine states, and remained stable in two states, for a three-month diffusion index of 60.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In June, 35 states had increasing activity, unchanged from May. The last two months have been weak following eight months of widespread growth geographically. The number of states with increasing activity is at the lowest level since June of last year.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. And the map was all green just just a couple of months ago.

Now there are a number of red states.

Misc: FHFA house prices increase 0.8%, Richmond Fed index declines sharply, UPS Comments

by Calculated Risk on 7/24/2012 10:14:00 AM

• From the FHFA: House Price Index Up 0.8 Percent in May

U.S. house prices rose 0.8 percent on a seasonally adjusted basis from April to May, according to the Federal Housing Finance Agency’s monthly House Price Index. ... For the 12 months ending in May of 2012, U.S. prices rose 3.7 percent. The U.S. index is 17.0 percent below its April 2007 peak and is roughly the same as the May 2004 index level.This is GSE loans only, and these loans have performed better than the non-GSE loans.

The FHFA monthly index is calculated using purchase prices of houses with mortgages that have been sold to or guaranteed by Fannie Mae or Freddie Mac.

• From the Richmond Fed: Manufacturing Activity Contracted in July; Manufacturers' Optimism Waned

The pullback in manufacturing activity in the central Atlantic region deepened in July, after edging lower in June, according to the Richmond Fed's latest seasonally adjusted survey. The index of overall activity was pushed lower as shipments and new orders declined further into negative territory. Employment remained in positive territory, but grew at a pace below June's rate. Other indicators also suggested additional softness.• Comments from UPS (ht Brian):

...

In July, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — fell sixteen points to −17 from June's reading of −1. Among the index's components, shipments declined twenty-three points to −23, new orders dropped eighteen points to end at −25, and the jobs index moved down seven points to 1.

Global trade is lagging GDP growth currently. Only 2nd time in last 10 years that this has happened. Think this is temporary.

They see US GDP growth at 1% in 2nd half ... ”we think current 2H econ forecasts are too high”

Non-US domestic volumes down 3.2%. Southern Europe had double digit declines

US outlook see rev up 1-2%, see B2B deteriorating further – weaker US outlook is primary driver behind reduced outlook “sees concerning trends in US”

Markit Flash PMI falls to 51.8

by Calculated Risk on 7/24/2012 09:07:00 AM

From Markit: PMI signals slowest manufacturing expansion since December 2010

The July Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) indicated the weakest improvement in U.S. manufacturing sector business conditions in 19 months, according to the preliminary ‘flash’ reading which is based on around 85% of usual monthly replies. At 51.8, down from 52.5 in June, the headline index was the second-lowest since the manufacturing recovery was first signalled by the PMI in late-2009 (only December 2010 saw a weaker PMI reading).This suggests another weak ISM PMI (due next week).

PMI index readings above 50.0 signal an increase or improvement on the prior month, while readings below 50.0 indicate a decrease.

Commenting on the flash PMI data, Chris Williamson, Chief Economist at Markit said:

“The U.S. manufacturing sector is clearly struggling under the pressure from falling exports ... Reassuringly, domestic demand appears to be showing ongoing signs of resilience, encouraging firms to take on more staff.

“Overall, the third quarter is so far shaping up to be worse than the second quarter in terms of growth, which is a growing concern for policymakers. Some comfort can be drawn from the fall in prices, which should help keep inflation at bay and increase the scope for further stimulus. However, falling prices are also a worrying sign of just how much demand has weakened in recent weeks.”

Zillow: "Housing Market Turns Corner"

by Calculated Risk on 7/24/2012 12:14:00 AM

From Zillow: U.S. Home Values Post First Annual Increase In Nearly Five Years

Home values in the United States have reached a bottom. The Zillow Home Value Index (ZHVI) rose on an annual basis for the first time since 2007, increasing 0.2 percent year-over-year to $149,300, according to Zillow’s second quarter Real Estate Market Reports. Values have risen for four consecutive months.

...

“After four months with rising home values and increasingly positive forecast data, it seems clear that the country has hit a bottom in home values,” said Zillow Chief Economist Dr. Stan Humphries. “The housing recovery is holding together despite lower-than-expected job growth, indicating that it has some organic strength of its own.

“Of course, there is still some risk as we look down the foreclosure pipeline and see foreclosure starts picking up. This will translate into more homes on the market by the end of the year, but we think demand will rise to absorb that, particularly in markets where there are acute inventory shortages now. Looking forward, we expect home values to remain relatively flat as the market works through a backlog of foreclosures and high rates of negative equity.”

Monday, July 23, 2012

Tuesday: Flash PMI, Richmond Fed Survey, FHFA House Prices

by Calculated Risk on 7/23/2012 10:08:00 PM

The key stories today were about Europe (once again). The yields on Spanish and Italian bond yields increased. Ezra Klein calls a graph of Spanish bond yields the scariest chart in the world today.

Also Spain and Italy banned some short selling and Moody's downgraded their outlook on Germany's rating to negative. Another day in the eurozone crisis.

On Tuesday:

• At 9:00 AM ET, the Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for July. The consensus is for a reading of 52.6, down slightly from 52.9 in June.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for July will be released. The consensus is for an increase to 0 for this survey from -3 in June (above zero is expansion).

• Also at 10:00 AM, the FHFA House Price Index for May is scheduled to be released. The consensus is for a 0.3% increase in house prices.

DataQuick: California Foreclosure Activity Lowest in Five Years

by Calculated Risk on 7/23/2012 04:12:00 PM

From DataQuick: California Q2 Foreclosure Activity Lowest in Five Years

The number of California homes entering the formal foreclosure process dropped in the second quarter to its lowest level since early 2007. The decline stems from a combination of factors, including an improving housing market, the gradual burning off of the most egregious mortgages originated from 2005 through 2007, and the growing use of short sales, a real estate information service reported.

A total of 54,615 Notices of Default (NODs) were recorded on houses and condos during the April-though-June period. That was down 2.9 percent from 56,258 for the prior three months, and down 3.6 percent from 56,633 in second-quarter 2011, according to San Diego-based DataQuick.

...

Most of the loans going into default are still from the 2005-2007 period. The median origination quarter for defaulted loans is still third-quarter 2006. That has been the case for three years, indicating that weak underwriting standards peaked then. ...

The all-time peak for Trustees Deeds was 79,511 in third-quarter 2008. The state's all-time low was 637 in the second quarter of 2005, DataQuick reported.

...

Foreclosure resales accounted for 27.9 percent of all California resale activity last quarter, down from a revised 33.6 percent the prior quarter and 35.6 percent a year ago. It peaked at 57.8 percent in the first quarter of 2009. Foreclosure resales varied significantly by county last quarter, from 7.3 percent in San Francisco County to 47.4 percent in Madera County.

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 18.0 percent of statewide resale activity last quarter. That was down from an estimated 20.1 percent the prior quarter and up from 17.4 percent a year earlier. In terms of the number of short sales, last quarter's estimated 20,141 was up 13.0 percent from the prior quarter and up 10.2 percent from a year earlier.

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of NODs filed per year (according to DataQuick). The estimate for 2012 is twice the Q1 and Q2 level.

The number of NODs is still very high - well above the peak of the early '90s bust, but the number of NODs has been falling. When the number of NODs falls below the 1996 level (peak of previous housing bust) - that will really be progress.

Leonhardt: "A Closer Look at Middle-Class Decline"

by Calculated Risk on 7/23/2012 01:55:00 PM

Here is a series I'm looking forward to reading ... from David Leonhardt at the NY Times: A Closer Look at Middle-Class Decline

Arguably no question is more central to the country’s global standing than whether the economy will perform better in the future than it has in the recent past.Leonhardt starts with:

Over the next few months on this blog, several colleagues and I will look in some detail at the challenge and at possible ways forward, and we’ll encourage you to weigh in with questions, ideas and other feedback.

Since median inflation-adjusted family income peaked in 2000 at $64,232, it has fallen roughly 6 percent. You won’t find another 12-year period with an income decline since the aftermath of the Depression.A very important topic.

This unhappy phenomenon has two major sources. First, economic growth in this country has been relatively slow in recent years, which means the total bounty that the American economy produces, to be shared by all of its citizens, has not been growing very rapidly. Even before the financial crisis began in 2008, economic growth in the decade that started in 2001 was on pace to be slower than growth in any decade since World War II.

Then of course came a deep recession that caused the economy to shrink.

...

In addition to the slow growth in overall size of the pie, the share that has been going to anyone but the richest Americans has been declining. ... In the simplest terms, the relatively meager gains the American economy has produced in recent years have largely flowed to a small segment of the most affluent households, leaving middle-class and poor households with slow-growing living standards.

Spain, Italy ban some short selling

by Calculated Risk on 7/23/2012 10:27:00 AM

Always a sign of desperation ...

From the Financial Times Alphaville: Spain and Italy take gold for flailing, banning short-selling

From Reuters: Spain Bans Short-Selling for 3 Months

Spain's stock market regulators banned short-selling on all Spanish securities on Monday for three months and said it may extend the ban beyond October 23.The yield on Spanish 10 year bonds is up to 7.5%; the yield on Italian 10 year bonds is up to 6.33%.

Earlier on Monday, Italy reintroduced a temporary ban on the short selling of financial stocks ...

Some related articles from the WSJ: Treasury Yields Hit New Record Lows, Oil Prices Plunge 4%, and Euro Hits New Multiyear Lows. The US 10 year treasury yield has fallen to 1.42%, Brent oil prices are down to $103.43, and the euro is down $1.21.

Chicago Fed: Growth in Economic Activity below trend in June

by Calculated Risk on 7/23/2012 08:40:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic activity increased in June

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to –0.15 in June from –0.48 in May. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased from –0.38 in May to –0.20 in June—its fourth consecutive reading below zero. June’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests growth was below trend in June.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, July 22, 2012

Monday: Chicago Fed National Activity Index

by Calculated Risk on 7/22/2012 10:15:00 PM

First, from the Financial Times on "open-ended QE": Bleak jobs outlook raises heat on Fed

In an interview with the Financial Times, [San Francisco Fed President John Williams] forecast that unless “further action” was taken, there would be a lack of progress in boosting the jobs market ...The key releases this week are the new home sales report on Wednesday and the advance Q2 GDP report on Friday.

He added that there would also be benefits in having an open-ended programme of QE, where the ultimate amount of purchases was not fixed in advance ... “The main benefit from my point of view is it will get the markets to stop focusing on the terminal date [when a programme of purchases ends] and also focusing on, ‘Oh, are they going to do QE3?’” he said. Instead, markets would adjust their expectation of Fed purchases as economic conditions changed.

excerpt with permission

• On Monday, at 8:30 AM ET, the Chicago Fed is schedule to release the National Activity Index for June. This is a composite index of other data and will probably be fairly weak.

The Asian markets are red tonight, with the Nikkei down 1.3% and the Shanghai Composite down 1.1%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down about 6, and the DOW futures down about 50.

Oil: WTI futures are at $91.12 (this is down from $109.77 in February, but up last week) and Brent is at $106.17 per barrel.

Yesterday:

• Summary for Week Ending July 13th

• Schedule for Week of July 15th

Two more questions this week for the July contest:

WSJ: "As Homes Go, So Do Pickups"

by Calculated Risk on 7/22/2012 08:34:00 PM

As residential investment increases, there will be positive spillover effects ... usually it is "As housing goes, so goes the economy!"

From Mike Ramsey at the WSJ: As Homes Go, So Do Pickups (ht Joe)

[I]n the past few months, more lots have been cleared for construction and [Hardwood's] phone has been ringing more frequently. So in June he went out and bought a new Chevrolet 2500 diesel truck with a backup camera and a hands-free Bluetooth phone link.Yesterday:

"There is a lot more steady and consistent work," said the 30-year-old Mr. Harwood, whose company Broadleaf Landscape, in Damascus, Md., does a lot of work at new homes. "I was more comfortable with buying a new truck at this point in time because of the market change."

...

In the first half of this year, sales of full-size pickups made by the Detroit Three increased 13%, to 707,175 vehicles.

• Summary for Week Ending July 20th

• Schedule for Week of July 22nd

DOT: Vehicle Miles Driven increased 2.3% in May

by Calculated Risk on 7/22/2012 03:03:00 PM

The Department of Transportation (DOT) reported on Friday:

Travel on all roads and streets changed by +2.3% (5.7 billion vehicle miles) for May 2012 as compared with May 2011. Travel for the month is estimated to be 258.4 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

The rolling 12 month total is mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 54 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.Gasoline prices were down in May to an average of $3.79 per gallon according to the EIA. Last year, prices in May averaged $3.96 per gallon, so it makes sense that miles driven are up year-over-year in May.

However, as I've mentioned before, gasoline prices is just part of the story. The lack of growth in miles driven over the last 4+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 50 drivers drive fewer miles) and changing driving habits of young drivers.

A new report suggests that driving preferences are changing for younger drivers:

From 2001 to 2009, the average annual number of vehicle miles traveled by young people (16 to 34-year-olds) decreased from 10,300 miles to 7,900 miles per capita—a drop of 23 percent.With all these factors, it may be years before we see a new peak in miles driven.

Yesterday:

• Summary for Week Ending July 20th

• Schedule for Week of July 22nd

Unofficial Problem Bank list declines to 905 Institutions

by Calculated Risk on 7/22/2012 08:03:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 20, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Closings and enforcement activities by the FDIC and OCC led to many changes to the Unofficial Problem Bank List. This week just about every type of change occurred except for the issuance/termination of a Prompt Corrective Action order. In all there were nine additions and 16 removals that included four failures, one voluntary liquidation, two unassisted mergers, and nine action terminations. These changes leave the list with 905 institutions with assets of $349.7 billion. A year ago, the list held 993 institutions with assets of $415.7 billion.Earlier:

The nine additions were First Federal Savings Bank, Ottawa, IL ($408 million); Newton Federal Bank, Covington, GA ($239 million); Borrego Springs Bank, National Association, La Mesa, CA ($141 million); Clay County Savings Bank, Liberty, MO ($102 million Ticker: CCFC); Pickens Savings and Loan Association, FA, Pickens, SC ($101 million); Central Federal Savings and Loan Association of Chicago, Chicago, IL ($97 million); The First National Bank of Wellston, Wellston, OH ($95 million Ticker: MDWE); Commonwealth National Bank, Mobile, AL ($68 million); and Summit National Bank, Hulett, WY ($67 million).

The nine action terminations were Meridian Bank, National Association, Wickenburg, AZ ($886 million); Great Lakes Bank, National Association, Blue Island, Il ($626 million); First Trade Union Bank, Boston, MA ($588 million); Metro United Bank, San Diego, CA ($396 million Ticker: MCBI); Premier Bank, Dubuque, IA ($260 million); Canon National Bank, Canon City, CO ($228 million); First National Bank of Wyoming, Laramie, WY ($172 million); Heritage Bank, National Association, Phoenix, AZ ($102 million); and The Federal Savings Bank, Overland Park, KS ($75 million Ticker: KCLI).

Union Bank, Kansas City, MO ($456 million) voluntarily surrender its charter. Unassisted mergers were done by First National Bank of the Mid-Cities, Bedford, TX ($35 million) and The First State Bank of Burlingame, Burlingame, KS ($25 million).

The four failures were First Cherokee State Bank, Woodstock, GA ($223 million); Second Federal Savings and Loan Association of Chicago, Chicago, IL ($199 million); Heartland Bank, Leawood, KS ($110 million); and The Royal Palm Bank of Florida, Naples, FL ($87 million). Heartland Bank and Royal Palm Bank were affiliates and commonly owned by Mercantile Bancorp, Inc., Quincy Il. Mercantile Bancorp also owns Mercantile Bank, Quincy, Il ($510 million), which is on the Unofficial Problem Bank List that was not closed. The FDIC failed bank press releases did not indicate if any of the affiliates were closed under cross guaranty authority or why Mercantile Bank was allowed to remain open. The other failure Friday night was Georgia Trust Bank, Buford, GA, which appears to have failed not being subject to a timely issued enforcement action. Hard to believe at this stage of the crisis, especially in Georgia where 82 banks have failed, for a bank to fail without a corrective plan in place.

There were three name changes that were made this week -- First Midwest Bank, Centerville, SD; is now known as One American Bank; Community Business Bank, Sauk City, WI; is now known as Wisconsin River Bank; and Madison National Bank, Merrick, NY, is now known as First National Bank of New York.

Next week we anticipate the FDIC will release its actions through June 2012.

• Summary for Week Ending July 20th

• Schedule for Week of July 22nd

Saturday, July 21, 2012

Bank makes $1 Million on Foreclosure

by Calculated Risk on 7/21/2012 08:10:00 PM

It looks like Capital One Bank made $1 million on this foreclosure.

From the O.C. Register: $8.1M oceanfront home sells as foreclosure

Located at 989 Cliff Drive on the oceanfront above Laguna Beach's Shaw's Cove, the Mission style villa sold for $8.1 million in an all cash deal ... The Cliff Drive property sold to the bank for $7,006,347 December 28, 2011.Actress Diane Keaton bought the house in 2004 for "around $7.5 million" and sold it in 2005 for $14.5 million (nice flip!).

Capital One Bank foreclosed on the home in December 2011. There were no bidders and the house went back to the bank for just over $7 million.

Of course Capital One Bank could have bid less than they were owed at auction (maybe someone can pull up the details), but with the house selling at the asking price of $8.1 million for all cash, it appears Bank One made $1.1 million minus expenses.

Update: Any extra proceeds probably go to the borrower above what the bank was owed - I'm trying to find the state law in California. (ht Shnaps)

Update2: It appears update 1 was incorrect in California. Also apparently the first was greater than $7 million (around $7.8 million with costs), and the bank wouldn't have made any money after selling expenses. But if there was some extra, it would go to the bank in California according to several sources.

Earlier:

• Summary for Week Ending July 20th

• Schedule for Week of July 22nd

Schedule for Week of July 22nd

by Calculated Risk on 7/21/2012 01:01:00 PM

Earlier:

• Summary for Week Ending July 20th

This will be an important week for economic data. The key U.S. economic report for the coming week is the Q2 advance GDP report to be released on Friday; this is the last major economic release before the FOMC meeting the following week.

Also New Home sales will be released on Wednesday.

For manufacturing, two regional manufacturing reports will be released (Richmond and Kansas City Fed surveys).

8:30 AM: Chicago Fed National Activity Index (June). This is a composite index of other data.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for July. The consensus is for a reading of 52.6, down slightly from 52.9 in June.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for an increase to 0 for this survey from -3 in June (above zero is expansion).

10:00 AM: FHFA House Price Index for May 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.3% increase in house prices.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

10:00 AM ET: New Home Sales for June from the Census Bureau.

10:00 AM ET: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for an increase in sales to 370 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 369 thousand in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 380 thousand from 386 thousand.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.6% increase in durable goods orders.

10:00 AM ET: Pending Home Sales Index for June. The consensus is for a 0.9% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for July. The consensus is for an increase to 4 from 3 in June (above zero is expansion).

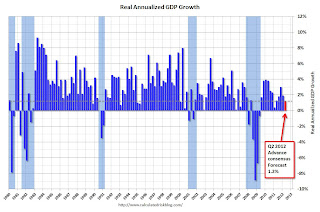

8:30 AM: Q2 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.2% annualized in Q2.

8:30 AM: Q2 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.2% annualized in Q2.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the consensus forecast for Q2 GDP. The BEA will also release the revised estimates for 2009 through First Quarter 2012.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for no change from the preliminary reading of 72.0.

10:00 AM: Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high. The Census Bureau is looking into the differences between the HVS, the ACS, and the decennial Census, and until the issues are resolved, this survey probably shouldn't be used to estimate the excess vacant housing supply.

Summary for Week ending July 20th

by Calculated Risk on 7/21/2012 08:01:00 AM

For the last few months, the economic data has been weak and disappointing. Last week I joked: "Luckily there are a few housing reports next week, so all the data will not be grim.", and sure enough the housing data was better than expected (still historically weak, but definitely improving).

Housing started the week off with July home builder confidence at the highest level since March 2007. Then housing starts for June were reported at 760 thousand, and finally the existing home sales report showed the largest year-over-year decline in inventory ever reported. (Sales were weaker than expected, but the key number in the NAR report is inventory).

Unfortunately some non-housing economic data was released too. Retail sales were especially weak in June, initial weekly unemployment claims increased sharply, the Architecture Billings Index (mostly commercial real estate) showed further contraction, and the regional manufacturing surveys suggested ongoing weakness in July.

There were a couple of non-housing positives: Industrial production was up in June, and inflation was benign.

Luckily there is another housing report next week: June New Home sales. But the key report next week will be Q2 GDP - and that will be UGLY (update: around 1%).

Here is a summary of last week in graphs:

• Housing Starts increased to 760 thousand in June, Highest since October 2008

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 760 thousand (SAAR) in June, up 6.9% from the revised May rate of 711 thousand (SAAR). Note that May was revised up from 708 thousand. April was revised up slightly too.

Single-family starts increased 4.7% to 539 thousand in June.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

Total starts are up 59% from the bottom start rate, and single family starts are up 53% from the low.

This was above expectations of 745 thousand starts in June. This is another fairly strong housing report.

• Existing Home Sales in June: 4.37 million SAAR, 6.6 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in June 2012 (4.37 million SAAR) were 5.4% lower than last month, and were 4.5% above the June 2011 rate.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 24.4% year-over-year in June from June 2011. This is the sixteenth consecutive month with a YoY decrease in inventory, and the largest year-over-year decline reported.

Inventory decreased 24.4% year-over-year in June from June 2011. This is the sixteenth consecutive month with a YoY decrease in inventory, and the largest year-over-year decline reported.Months of supply increased to 6.6 months in June.

This was below expectations of sales of 4.65 million. However, as I've noted before, those focusing on sales of existing homes, looking for a recovery for housing, are looking at the wrong number. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

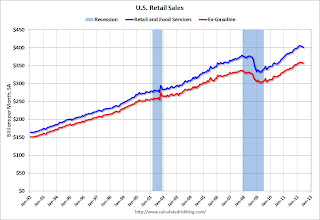

• Retail Sales declined 0.5% in June

On a monthly basis, retail sales were down 0.5% from May to June (seasonally adjusted), and sales were up 3.8% from June 2011.

On a monthly basis, retail sales were down 0.5% from May to June (seasonally adjusted), and sales were up 3.8% from June 2011.Sales for May were unchanged at a 0.2% decrease.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 21.2% from the bottom, and now 6.0% above the pre-recession peak (not inflation adjusted)

The next graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.2% on a YoY basis (3.8% for all retail sales). Retail sales ex-gasoline decreased 0.3% in June.

Retail sales ex-gasoline increased by 4.2% on a YoY basis (3.8% for all retail sales). Retail sales ex-gasoline decreased 0.3% in June.This was below the consensus forecast for retail sales of a 0.2% increase in June, and below the consensus for a 0.1% increase ex-auto.

Some of the decrease was related to the decline in gasoline prices, but this is another indicator of a weak June.

• Industrial Production increased 0.4% in June, Capacity Utilization increased

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization Industrial production increased 0.4 percent in June after having declined 0.2 percent in May. ... Capacity utilization for total industry moved up 0.2 percentage point in June to 78.9 percent, a rate 1.4 percentage points below its long-run (1972--2011) average.This graph shows Capacity Utilization. This series is up 12.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.9% is still 1.4 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in June to 97.4. This is 16.7% above the recession low, but still 3.3% below the pre-recession peak.

The consensus is for Industrial Production to increase 0.3% in June, and for Capacity Utilization to increase to 79.2%. The increase IP was slightly above expectations, but Capacity Utilization was below expectations.

• AIA: Architecture Billings Index shows "drop in design activity" in June

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Weak Market Conditions Persist According to Architecture Billings Index

From AIA: Weak Market Conditions Persist According to Architecture Billings IndexThis graph shows the Architecture Billings Index since 1996. The index was at 45.9 in June, up slightly from May. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

• Weekly Initial Unemployment Claims increase to 386,000

Here is a long term graph of weekly claims:

Here is a long term graph of weekly claims:The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 375,500.

The sharp decline last week due to onetime factors, and some increase was expected.

This was well above the consensus forecast of 365,000 and suggests ongoing weakness in the labor market.

• Regional Manufacturing Surveys

From the NY Fed: Empire State Manufacturing Survey

From the NY Fed: Empire State Manufacturing Survey The general business conditions index rose five points to 7.4. New orders, however, declined, as that index slipped into negative territory for the first time since November 2011, falling five points to -2.7.From the Philly Fed: July 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of −16.6 in June to −12.9. This marks the third consecutive negative reading for the index ...Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys increased in July, but the average is still negative (contraction).

• Other Economic Stories ...

• NAHB Builder Confidence increases strongly in July, Highest since March 2007

• First Look at 2013 Cost-Of-Living Adjustments and Maximum Contribution Base

• Bernanke: Semiannual Monetary Policy Report to the Congress

• State Unemployment Rates little changed in June

• Fed's Beige Book: Economic activity increased at "modest to moderate" pace, Residential real estate "largely positive"

• Key Measures show slowing inflation in June

Friday, July 20, 2012

Bank Failure #38: Second Federal Savings and Loan Association of Chicago, Chicago, Illinois

by Calculated Risk on 7/20/2012 08:53:00 PM

Pillaged the Chicago way

Illinois inept

by Soylent Green is People

From the FDIC: Hinsdale Bank & Trust Company, Hinsdale, Illinois, Assumes All of the Deposits of Second Federal Savings and Loan Association of Chicago, Chicago, Illinois

As of March 31, 2012, Second Federal Savings and Loan Association of Chicago had approximately $199.1 million in total assets and $175.9 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $76.9 million. ... Second Federal Savings and Loan Association of Chicago is the 38th FDIC-insured institution to fail in the nation this year, and the fifth in Chicago.Pretty large loss for the DIF. That makes five today ...

Bank Failure #37 in 2012: Heartland Bank, Leawood, Kansas

by Calculated Risk on 7/20/2012 06:07:00 PM

Asset drought wilts more bankers

Scorched earth arrives

by Soylent Green is People

From the FDIC: Metcalf Bank, Lees Summit, Missouri, Assumes All of the Deposits of Heartland Bank, Leawood, Kansas

As of March 31, 2012, Heartland Bank had approximately $110.0 million in total assets and $102.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.1 million. Compared ... Heartland Bank is the 37th FDIC-insured institution to fail in the nation this year, and the first in Kansas.Pretty small hit to the DIF. That makes four today so far ...