by Calculated Risk on 8/03/2012 07:06:00 PM

Friday, August 03, 2012

Bank Failure #40 in 2012: Waukegan Savings Bank, Waukegan, Illinois

From the FDIC: First Midwest Bank, Itasca, Illinois, Assumes All of the Deposits of Waukegan Savings Bank, Waukegan, Illinois

As of March 31, 2012, Waukegan Savings Bank had approximately $88.9 million in total assets and $77.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $19.8 million. ... Waukegan Savings Bank is the 40th FDIC-insured institution to fail in the nation this year, and the sixth in Illinois.It is officially Friday!

Earlier on employment:

• July Employment Report: 163,000 Jobs, 8.3% Unemployment Rate

• Employment: Another Fairly Weak Report (more graphs)

• All Employment Graphs

AAR: Rail Traffic "mixed" in July, Intermodal at Record Level

by Calculated Risk on 8/03/2012 04:07:00 PM

Once again rail traffic was "mixed". Building related commodities were up such as lumber and crushed stone, gravel, sand. Lumber was up 9% from July 2011.

From the Association of American Railroads (AAR): AAR Reports Mixed Weekly and July Monthly Rail Traffic

The Association of American Railroads (AAR) today reported U.S. rail carloads originated in July 2012 totaled 1,103,733, down 7,787 carloads or 0.7 percent, compared with July 2011. Intermodal volume in July 2012 was 946,071 trailers and containers, up 50,431 units or up 5.6 percent, compared with July 2011. The July 2012 weekly intermodal average of 236,518 trailers and containers is the highest July average in history.

...

“Carloads of some of the more economically sensitive commodities, such as lumber and wood, steel, and autos, gave us a mixed message in July. While lumber related to home construction remained very positive, other manufactured goods either grew more slowly than they have been or actually fell in July,” said AAR Senior Vice President John T. Gray. “It remains to be seen if this is just a blip or something more serious. More positively, intermodal volume remains on track to see a record year in 2012.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

U.S. railroads originated 1,103,733 total carloads in July 2012, down 0.7% (7,787 carloads) from July 2011. It was the sixth straight year-over-year monthly decline, but at 0.7% it was the lowest percentage decline in those six months.Grains is off 10% year-over-year due to fewer exports.

Eight of the 20 commodity categories tracked by the AAR saw carload gains in July 2012 year over year, the lowest such number since May 2011. By contrast, 13 of the 20 categories are up year-to-date in 2012 compared with 2011.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now at peak levels.

U.S. intermodal traffic was up 5.6% (50,431 containers and trailers) in July 2012 over July 2011 to 946,071 units, its 32nd consecutive year-over-year monthly increase. Average weekly intermodal volume in July 2012 was 236,518 units, the highest of any July in historyThe top months for intermodal are usually in the fall, and it looks like intermodal traffic will be at record levels this year.

This is more evidence of sluggish growth - and of residential investment making a positive contribution.

Earlier on employment:

• July Employment Report: 163,000 Jobs, 8.3% Unemployment Rate

• Employment: Another Fairly Weak Report (more graphs)

• All Employment Graphs

ISM Non-Manufacturing Index increases slightly, Employment index declines in July

by Calculated Risk on 8/03/2012 12:51:00 PM

Earlier ... the July ISM Non-manufacturing index was at 52.6%, up from 52.1% in June. The employment index decreased in July to 49.3%, down from 52.3% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 31st consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 52.6 percent in July, 0.5 percentage point higher than the 52.1 percent registered in June. This indicates continued growth this month at a slighter faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 57.2 percent, which is 5.5 percentage points higher than the 51.7 percent reported in June, reflecting growth for the 36th consecutive month. The New Orders Index increased by 1 percentage point to 54.3 percent. The Employment Index decreased by 3 percentage points to 49.3 percent, indicating contraction in employment for the first time since December 2011. The Prices Index increased 6 percentage points to 54.9 percent, indicating higher month-over-month prices when compared to June. According to the NMI, 11 non-manufacturing industries reported growth in July. Respondents' comments are mixed and vary by industry and company."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 52.0% and indicates slightly faster expansion in July than in June. The internals were mixed with the employment index weaker, and new orders stronger.

Employment: Another Fairly Weak Report (more graphs)

by Calculated Risk on 8/03/2012 10:21:00 AM

The economy has added 1.06 million jobs over the first seven months of the year (1.12 million private sector jobs). At this pace, the economy would add around 1.9 million private sector jobs in 2012; less than the 2.1 million added in 2011. Also, at this pace of payroll job growth, the unemployment rate will probably still be above 8% at the end of the year.

Some numbers: There were 163,000 payroll jobs added in July, with 172,000 private sector jobs added, and 9,000 government jobs lost. The unemployment rate increased slightly to 8.3% (from the household survey), and the participation rate declined to 63.7%. Both are moving in the wrong direction.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased so 15.0%.

The change in May payroll employment was revised up from +77,000 to +87,000, but June was revised down from +80,000 to +64,000.

The average workweek was unchanged at 34.5 hours, and average hourly earnings increased slightly. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.5 hours in July. ... In July, average hourly earnings for all employees on private nonfarm payrolls edged up by 2 cents to $23.52. Over the year, average hourly earnings rose by 1.7 percent." This is sluggish earnings growth.

There are a total of 12.8 million Americans unemployed and 5.2 million have been unemployed for more than 6 months.

Even though the number of payroll jobs added was more than expected, the bottom line is this was another fairly weak employment report. Here are a few more graph ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.5% in July (this was down slightly in July.)

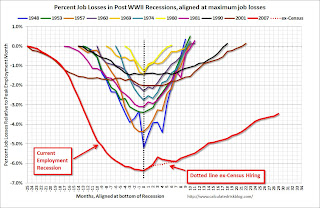

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

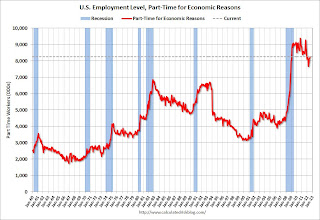

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 8.2 million in July. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased slightly in July to 8.25 millon.

These workers are included in the alternate measure of labor underutilization (U-6) that increased in July to 15.0%, up from 14.9% in June.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.19 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.37 million in June. This is generally trending down, but very slowly. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

So far in 2012 - through July - state and local government have lost 42,000 jobs (7,000 jobs were added in July). In the first seven months of 2011, state and local governments lost 205,000 payroll jobs - and 230,000 for the year. So the layoffs have slowed.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is still losing workers (38,000 over the last 12 months and another 2,000 in July), but it looks like state and local government employment losses might be slowing - but the job losses haven't stopped yet.

Overall this was another fairly weak report.

July Employment Report: 163,000 Jobs, 8.3% Unemployment Rate

by Calculated Risk on 8/03/2012 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 163,000 in July, and the unemployment rate was essentially unchanged at 8.3 percent, the U.S. Bureau of Labor Statistics reported today. Employment rose in professional and business services, food services and drinking places, and manufacturing.

...

Both the civilian labor force participation rate, at 63.7 percent, and the employment- population ratio, at 58.4 percent, changed little in July.

...

The change in total nonfarm payroll employment for May was revised from +77,000 to +87,000, and the change for June was revised from +80,000 to +64,000.

Click on graph for larger image.

Click on graph for larger image.This was a somewhat better month, and the revisions for the previous two months were mostly offsetting.

This was above expectations of 100,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.3% (red line).

The Labor Force Participation Rate declined slightly to 63.7% in July (blue line). This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate declined slightly to 63.7% in July (blue line). This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio declined to 58.4% in July (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was more payroll growth than expected, but still fairly weak. (expected was 100,000). I'll have much more later ...

Thursday, August 02, 2012

Friday: July Employment Report, ISM Services

by Calculated Risk on 8/02/2012 09:29:00 PM

From the Financial Times: Draghi kills hope of instant action

Financial markets recoiled on Thursday after Mario Draghi demanded eurozone governments turn to existing rescue funds before any intervention by the European Central Bank in bond markets to shore up Europe’s monetary union.Some analysis from the Joseph Cotterill at Alphaville: Was Draghi really a disaster? and from Tim Duy at EconomistsView: Second Policy Failure of the Week

Excerpt with Permission

On Friday:

• At 8:30 AM ET, the Employment Report for July will be released. The consensus is for an increase of 100,000 non-farm payroll jobs in July, up from the 80,000 jobs added in June. The consensus is for the unemployment rate to remain unchanged at 8.2%.

Some thoughts: Employment Situation Preview and from Binyman Appelbaum at Economix: Beware the Jobs Report of July

As ... Floyd Norris explained last month, one possible distortion that has arisen in recent years, thanks to the weakness of the economy, is that “seasonal adjustments make things look better than they are in the winter, when fewer workers are being let go than the government expects, and worse in the spring and summer, when the workers who were not let go cannot be rehired.”• 10:00 AM, the ISM non-Manufacturing Index for July will be released. The consensus is for a decrease to 52.0 from 52.1 in June.

For the economic contest in August:

The Gold Audit

by Calculated Risk on 8/02/2012 07:47:00 PM

For amusement ... from the LA Times: What's in your vault? Uncle Sam audits its stash of gold at the New York Fed

For decades, the U.S. government has stashed gold five stories beneath Manhattan in a vault under the Federal Reserve's fortress near Wall Street.This will probably launch more conspiracy theories ...

Or has it?

Some conspiracy theorists suspect that the billions of dollars' worth of bullion might have been looted in a dramatic heist, a la the movie "Die Hard: With a Vengeance." Others claim that the gold has been used in a shadowy government transaction, or swapped with gold-painted bars. It's even caught the attention of politicians like Rep. Ron Paul and members of Germany's Parliament.

Now all of us may finally get some answers.

The federal government has quietly been completing an audit of U.S. gold stored at the New York Fed. The effort included drilling small holes in the bars to test their purity.

The Treasury Department has refused to disclose what the audit has revealed so far, saying the results will be announced by year's end.

Employment Situation Preview

by Calculated Risk on 8/02/2012 02:00:00 PM

The last three employment reports were very weak: 68,000 payroll jobs added in April, 77,000 in May, and 80,000 in June. Some of this recent weakness might have been "payback" for the mild weather earlier in the year. Also there is the possibility that the seasonal factors are a little distorted by the deep recession and financial crisis - this is the third year in a row we've some late spring weakness.

Bloomberg is showing the consensus is for an increase of 100,000 payroll jobs in July, and for the unemployment rate to remain unchanged at 8.2%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 163,000 private sector payroll jobs in July. This would seem to suggest that the consensus for the increase in total payroll employment is too low, although the ADP report hasn't been very useful in predicting the BLS report for any one month.

• The ISM manufacturing employment index decreased in July to 52.0%, down from 56.6% in June. A historical correlation between the ISM index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased about 8,000 in July.

The ISM service index will be released tomorrow after the BLS report.

• Initial weekly unemployment claims averaged about 365,000 in July, down from the 382,000 average for April, May and June. This was about the same level as in March when the BLS reported 143,000 payroll jobs added (Note: weekly claims have apparently been impacted by the timing of auto plant shutdowns).

For the BLS reference week (includes the 12th of the month), initial claims were at 388,000; near the high for the year.

• The final July Reuters / University of Michigan consumer sentiment index declined to 72.3, down from the June reading of 73.2. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This level - and the slight monthly decline - suggest a weak labor market.

• The small business index from Intuit showed 35,000 payroll jobs added, down from 40,000 in June.

• And on the unemployment rate from Gallup: U.S. Unadjusted Unemployment Rate Increases in July

U.S. unemployment, as measured by Gallup without seasonal adjustment, was 8.2% in July, up slightly from 8.0% in June, but better than the 8.8% from a year ago. Gallup's seasonally adjusted number for July is 8.0%, an increase from 7.8% in June.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats). Note: So far the Gallup numbers haven't been useful in predicting the BLS unemployment rate.

• Conclusion: The overall feeling is that the economy weakened further in July, and that would seem to suggest another weak employment report. However, if the weather "payback" is over (as several analysts have argued), the number of payroll jobs could be better than the last few months. And it is possible that there have been some seasonal factor distortions.

The ISM manufacturing report suggest a loss of manufacturing jobs, however the ADP report (private only), suggests the consensus is too low. Initial weekly unemployment claims were mixed too: the monthly average was near the low for the year, but the reference week was near the high.

Other negatives include the weak small business numbers from Intuit, and the decline in consumer sentiment.

Overall it seems like the July report will be weaker than expected.

For the economic contest in August:

Another measure of household formation and vacancy rates

by Calculated Risk on 8/02/2012 10:31:00 AM

It is difficult to find good and timely data on the number of household formations in the US, and also for the number of excess vacant housing units. The decennial Census is probably the best measure (and also the ACS), but those two estimates aren't consistent (the Census Bureau is looking into the reasons why). Another Census Bureau survey, the Housing Vacancies and Homeownership (HVS) is clearly flawed. The HVS indicates that the number of occupied households increase by 809 thousand over the last year - and that seems too low.

Jed Kolko, chief economist at Trulia, has been looking at Postal Service data.

From Jed Kolko at Trulia: Housing Glut or Housing Shortage? America’s Got Both

With this post, we present a new measure of vacancies, based on U.S. Postal Service (USPS) monthly data on the number of addresses that are and are not receiving mail. ... Here’s what we found.There is much more in Kolko's post.

Nationally, the number of occupied housing units – that is, those receiving mail – rose by 970,000 in the last year, from mid-July 2011 to mid-July 2012. Over the same period, the total number of housing units – those that could receive mail – rose by 760,000. The difference – 210,000 – is the reduction in the number of vacant units. That’s a 5% drop in the number of vacant units nationally. As a percentage of all units, the vacancy rate declined from 3.6% one year ago to 3.4% now.

In fact, vacancies have declined in 90 of the 100 largest metros.

This data suggests close to 1 million household formations over the last year. I have less confidence in the count of housing units, since total completions only increased by a little more than 600 thousand last year (single family, multi-family and manufactured homes) - and there were also some demolitions.

Clearly the vacancy rate is falling - and the number of household formations exceeds the number of housing units added to the housing stock.

Weekly Initial Unemployment Claims increase to 365,000

by Calculated Risk on 8/02/2012 08:30:00 AM

The DOL reports:

In the week ending July 28 the advance figure for seasonally adjusted initial claims was 365,000, an increase of 8,000 from the previous week's revised figure of 357,000. The 4-week moving average was 365,500, a decrease of 2,750 from the previous week's revised average of 368,250.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 365,500.

The sharp swings over the last few weeks are apparently related to difficulty adjusting for auto plant shutdowns.

And here is a long term graph of weekly claims:

This was below the consensus forecast of 370,000 and is the lowest level for the four week average since March - and is near the post bubble low of 363,000.

This was below the consensus forecast of 370,000 and is the lowest level for the four week average since March - and is near the post bubble low of 363,000.Wednesday, August 01, 2012

Thursday: ECB Meeting, Weekly Unemployment Claims, Factory Orders

by Calculated Risk on 8/01/2012 09:36:00 PM

From Jon Hilsenrath and Kristina Peterson at the WSJ: Wary Fed Is Poised to Act

The Federal Reserve is heading toward launching a new round of stimulus to buck up the weak economy, but stopped short of doing so right away.The Fed has been saying "soon" for months.

The decision to make what amounted to a conditional promise of action came Wednesday at the end of the central bank's two-day policy meeting. In an uncharacteristically strong statement, the Fed said it will "closely monitor" the economy and "will provide additional accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions." Translation: The Fed will move if growth and employment don't pick up soon on their own.

On Thursday:

• At 7:45 AM ET, the European Central Bank (ECB) will announce their decision on rates. The key is the after meeting press conference. From the FT Alphaville:

Any further policy action would be announced during Draghi’s subsequent press conference. To recap, the likeliest options seem to be: another rate cut (note that earlier time), a revived Securities Markets Programme, and then (getting quite a bit less likely) another LTRO, approval of an eventual banking license for the ESM, or a yield targeting framework for bond-buying.• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 353 thousand last week.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May will be released. The consensus is for a 0.7% increase in orders.

I'll also post an employment preview tomorrow too.

Q2 2012 GDP Details: Office and Mall Investment increases slightly, Single Family investment increases

by Calculated Risk on 8/01/2012 06:16:00 PM

The BEA released the underlying details today for the Q2 Advance GDP report.

The first graph shows investment in offices, malls and lodging as a percent of GDP. With the annual revisions, it now appears office, mall and lodging investment has increased slightly - but from a very low level.

Investment in offices is down about 61% from the peak (as a percent of GDP). With the high office vacancy rate, investment will probably not increase significantly (as a percent of GDP) for several years.

Click on graph for larger image.

Click on graph for larger image.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 59% from the peak (note that investment includes remodels, so this will not fall to zero).

Lodging investment peaked at 0.32% of GDP in Q2 2008 and is down about 75%.

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures is finally increasing after mostly moving sideways for almost three years (the increase in 2009-2010 was related to the housing tax credit).

Investment in home improvement was at a $158 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (just over 1.0% of GDP), significantly above the level of investment in single family structures of $122 billion (SAAR) (or 0.78% of GDP). Eventually single family structure investment will overtake home improvement as the largest category of residential investment.

Brokers' commissions increased slightly in Q2 as a percent of GDP. And investment in multifamily structures increased in Q2. This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.

U.S. Light Vehicle Sales at 14.1 million annual rate in July

by Calculated Risk on 8/01/2012 03:18:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.09 million SAAR in July. That is up 14% from July 2011, and down 1.7% from the sales rate last month (14.33 million SAAR in June 2012).

This was slightly above the consensus forecast of 14.0 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 14.09 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

The year-over-year increase was fairly large because the auto industry was still recovering from the impact of the tsunami and related supply chain issues in 2011.

Sales have averaged a 14.12 million annual sales rate through the first seven months of 2012, up sharply from the same period of 2011.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

In 2012, sales are mostly moving sideways suggesting auto sales will probably not add significantly to GDP.

FOMC Statement: "Economic activity decelerated", Takes no action

by Calculated Risk on 8/01/2012 02:15:00 PM

Information received since the Federal Open Market Committee met in June suggests that economic activity decelerated somewhat over the first half of this year. Growth in employment has been slow in recent months, and the unemployment rate remains elevated. Business fixed investment has continued to advance. Household spending has been rising at a somewhat slower pace than earlier in the year. Despite some further signs of improvement, the housing sector remains depressed. Inflation has declined since earlier this year, mainly reflecting lower prices of crude oil and gasoline, and longer-term inflation expectations have remained stable.Here is the previous FOMC Statement for comparison.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects economic growth to remain moderate over coming quarters and then to pick up very gradually. Consequently, the Committee anticipates that the unemployment rate will decline only slowly toward levels that it judges to be consistent with its dual mandate. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee anticipates that inflation over the medium term will run at or below the rate that it judges most consistent with its dual mandate.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. The Committee will closely monitor incoming information on economic and financial developments and will provide additional accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who preferred to omit the description of the time period over which economic conditions are likely to warrant an exceptionally low level of the federal funds rate.

Construction Spending in June: Private spending increases, Public Spending flat

by Calculated Risk on 8/01/2012 11:31:00 AM

Catching up ... This morning the Census Bureau reported that overall construction spending increased in June:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2012 was estimated at a seasonally adjusted annual rate of $842.1 billion, 0.4 percent above the revised May estimate of $838.3 billion. The June figure is 7.0 percent above the June 2011 estimate of $786.8 billion.Private construction spending increased while public spending was flat:

Spending on private construction was at a seasonally adjusted annual rate of $567.9 billion, 0.7 percent above the revised May estimate of $564.2 billion. ... In June, the estimated seasonally adjusted annual rate of public construction spending was $274.2 billion, nearly the same as the revised May estimate of $274.1 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 61% below the peak in early 2006, and up 19.4% from the recent low. Non-residential spending is 27% below the peak in January 2008, and up about 33% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and near the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The solid year-over-year increase in private residential investment is a positive for the economy (the increase in 2010 was related to the tax credit). However the recent improvement in residential construction is being somewhat offset by declines in public construction spending.

ISM Manufacturing index increases slightly in July to 49.8

by Calculated Risk on 8/01/2012 10:00:00 AM

This is the second consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.8% in July, up slightly from 49.7% in June. The employment index was at 52.0%, down from 56.6%, and new orders index was at 48.0%, up slightly from 47.8%.

From the Institute for Supply Management: June 2012 Manufacturing ISM Report On Business®

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 49.8 percent, an increase of 0.1 percentage point from June's reading of 49.7 percent, indicating contraction in the manufacturing sector for the second consecutive month, following 34 consecutive months of expansion. The New Orders Index registered 48 percent, an increase of 0.2 percentage point from June and indicating contraction in new orders for the second consecutive month, but at a slightly slower rate. Both the Production Index and the Employment Index remained in growth territory, registering 51.3 percent and 52 percent, respectively. The Prices Index for raw materials registered 39.5 percent, an increase of 2.5 percentage points from the June reading of 37 percent, indicating lower prices on average for the third consecutive month. A growing number of comments from the panel this month reflect a slowdown in their businesses and general concern over increasing economic uncertainty."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.1%. This suggests manufacturing contracted in July for the second consecutive month.

This was another weak report.

ADP: Private Employment increased 163,000 in July

by Calculated Risk on 8/01/2012 08:20:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 163,000 from June to July, on a seasonally adjusted basis. The estimated gain from May to June was revised down slightly, from the initial estimate of 176,000 to 172,000.This was above the consensus forecast of an increase of 120,000 private sector jobs in July. The BLS reports on Friday, and the consensus is for an increase of 100,000 payroll jobs in July, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector expanded 148,000 in July after rising a revised 151,000 in June. The private, goods-producing sector added 15,000 jobs in July. Manufacturing employment rose 6,000 this month, following a revised increase of 9,000 in June.

ADP hasn't been very useful in predicting the BLS report, but this suggests a stronger than consensus report.

MBA: Refinance Activity Highest in Three Years

by Calculated Risk on 8/01/2012 07:00:00 AM

From the MBA: Refinance Applications Increase Again to Three-Year High in Latest MBA Weekly Survey

The Refinance Index increased 0.8 percent from the previous week to its highest level since the week ending April 17, 2009. The slight increase in refinance activity was muted by a 6 percent drop in government refinance applications, while conventional refinance activity increased about 2 percent over the week. The seasonally adjusted Purchase Index decreased about 2 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.75 percent from 3.74 percent, with points increasing to 0.51 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

Note: Yesterday Zillow reported record low mortgage rates in their survey: "The 30-year fixed mortgage rate on Zillow(R) Mortgage Marketplace is currently 3.34 percent, down one basis point from 3.35 percent at the same time last week."

The second graph shows the refinance index.

The second graph shows the refinance index.The refinance index is at the highest level in three years.

Tuesday, July 31, 2012

Wednesday: FOMC announcement, ISM Mfg, Auto Sales and much more

by Calculated Risk on 7/31/2012 09:38:00 PM

Wednesday will be a busy day with most of the focus on the FOMC announcement, auto sales and the ISM manufacturing index:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect more refinancing activity and record low mortgage rates.

• At 8:15 AM, the ADP Employment Report for June will be released. This report is for private payrolls only (no government). The consensus is for 120,000 payroll jobs added in June, down from the 176,000 reported last month.

• At 10:00 AM, the ISM Manufacturing Index for July will be released. The consensus is for an increase to 50.1, up from 49.7 in June. (below 50 is contraction).

• Also at 10:00 AM, construction spending for June will be released. The consensus is for a 0.5% increase in construction spending.

• At 2:15 PM, the FOMC announcement will be released. Expectations range from doing nothing, to extending the period that the FOMC expects "exceptionally low levels for the federal funds rate" through 2015, to launching QE3. The FOMC is under pressure with unemployment forecast to remain very high for years, and inflation below the target rate - and projected to remain below the target rate for several years.

• At around 4:00 PM, the SAAR rate for auto sales will be released. The automakers will report sales during the day, and light vehicle sales are expected to decrease to 14.0 million from 14.1 million in June SAAR.

Prediction Contest: July Winners, August Questions

by Calculated Risk on 7/31/2012 07:49:00 PM

For the economic question contest in July, the leaders were (Congratulations all!):

1st: Alexander Petrov (2nd month in a row!)

2nd: Mayson Lancaster

3rd: Bob Dellar

4th tie: Vad Yazvinski, Richard Plaster, Bill Dawers, James White

Questions this week for August contest: