by Calculated Risk on 8/08/2012 07:00:00 AM

Wednesday, August 08, 2012

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from a week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.76 percent from 3.75 percent, with points decreasing to 0.46 from 0.51 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

There is no evidence in this index of an increase in purchase applications. However the Fed Senior Loan Officer survey showed the opposite, from Nick Timiraos at the WSJ: Home Prices Climb as Supply Dwindles

The Federal Reserve said Monday demand for mortgages to purchase homes jumped during the second quarter by the largest amount in at least three years, according to a survey of bank lending officers.The following table is from the Senior Loan Officer survey:

Over half the banks surveyed reported moderately to substantially strong demand for mortgage to purchase homes. It isn't clear why the MBA index and the Fed survey results are different.

Tuesday, August 07, 2012

Monthly Economic Contest: New Login Added

by Calculated Risk on 8/07/2012 10:10:00 PM

The only economic release scheduled for Wednesday is the weekly MBA mortgage activity index at 7 AM ET.

By request, the monthly contest (on right sidebar and two questions below) uses both Facebook and OpenID logins. More new features soon.

For bloggers, you can contact Ehpik and add your own contest to your site. It is easy to use (people are using it for sports, American Idol and more).

Here are two more questions for August (both on Thursday):

The economic impact of a slight increase in house prices

by Calculated Risk on 8/07/2012 08:13:00 PM

If I’m correct about house prices bottoming earlier this year – and the CoreLogic report released this morning is another indicator that prices might be increasing a little - a key question is: What will be the economic impact of slightly increasing house prices?

We saw the impact on Freddie Mac this morning. Freddie reported net income of $3 billion compared to a $2.4 billion loss in Q2 2011. Freddie noted that the decline in its loss provision was due to “improvements in the number of newly impaired loans and to lower estimated future losses due to the positive impact of an increase in national home prices.”

Also I expect CoreLogic and Zillow to report a meaningful decline in the number of homeowners with negative equity in Q2. We might see something like 1 million households that regained a positive equity position at the end of Q2 2012. These are borrowers who might find it easier to refinance, or sell if needed.

We will probably also see a meaningful decline in the number of newer mortgage delinquencies. Note: The MBA Q2 National Delinquency Survey results will be released this Thursday.

Another impact that we've discussed before is the impact on listed “For sale” inventory. Seller psychology is very different if prices are perceived to be falling, as opposed to if prices are stabilizing or even increasing. If potential sellers think prices will fall further, then they will rush to sell and list their homes right away. That behavior pushes up inventory. But if potential sellers think prices are stabilizing, and may increase, then they are more willing to wait until it is more convenient to sell. I think we've been seeing this change in psychology for some time.

And private mortgage lenders and homebuilders will regain confidence in the mortgage and housing market. Flat to rising prices give homebuilders a better idea of the pricing needed to compete in the market - while more consumer confidence in house prices is leading to more demand for new homes. Note: Residential investment is the best leading indicator for the economy, so this pickup in new home sales and housing starts suggests a pickup in the overall economy (barring exogenous events - like the European crisis - or policy mistakes).

In conclusion: There are many positive economic impacts from flat to rising house prices and we are just beginning to see the positive impact on the overall economy.

Freddie Mac: Increase in Home Prices contributes to Lower Credit Losses

by Calculated Risk on 8/07/2012 03:30:00 PM

From Tom Lawler:

Freddie Mac reported that its GAAP net income “attributable” to Freddie Mac was $3.020 billion last quarter, up from $577 million in the previous quarter and a net loss of $2.371 billion in the second quarter of 2011. The biggest “swing” factor last quarter was a sharp drop in the provision for credit losses -- $155 million last quarter compared to $1.825 billion in the previous quarter and $2.529 billion in the comparable quarter of last year.

Freddie attributed the sharp drop in its loss provision – which fell far short of charge-offs, resulting in a steep drop in its loan loss reserves – to “improvements in the number of newly impaired loans and to lower estimated future losses due to the positive impact of an increase in national home prices.” Freddie’s internal national home price index, which is based on repeat transactions of homes backed by mortgages owned or guaranteed by Freddie or Fannie with state weights based on Freddie’s SF mortgage book, jumped by 4.8% from March to June, and the June HPI was up about 1.0% from a year ago.

Freddie’s GAAP net income “attributable” to stockholders last quarter was $1.212 billion, reflecting the $1.808 billion in dividends paid to Treasury’s senior preferred stock. Freddie’s GAAP net worth at the end of June was $1.086 billion, and as a result Freddie does not need another Treasury “draw.”

On the SF REO front, Freddie’s SF REO acquisitions last quarter totaled 20,003, down from 23,805 in the previous quarter and 24,788 in the second quarter of last year. Freddie’s SF REO dispositions last quarter totaled 26,069, up from 25,033 in the previous quarter but down from 29,348 in the second quarter of last year. As a result, Freddie’s SF REO inventory at the end of June was 53,271, down from 59,307 at the end of March and 60,599 a year ago.

Freddie attributed the relatively low level of REO acquisitions last quarter to (1) the length of the foreclosure process, especially in states that require a judicial foreclosure process; and (2) resource constraints on foreclosure activities for five large servicers involved in a recent settlement with a coalition of state attorneys general and federal agencies.

Click on graph for larger image.

Click on graph for larger image.

From CR: The following graph shows REO inventory for Freddie.

REO inventory for Freddie decreased in Q2. After Fannie announces results I'll post a graph of REO for the F's (Fannie, Freddie, and the FHA). FHA REO increased in Q2 to 40,217 from 35,613 in Q1.

Fed's Bernanke: Teacher Town Hall Meeting

by Calculated Risk on 8/07/2012 02:30:00 PM

Teacher town hall meeting with Fed Chairman Ben Bernanke: Financial Education

Follow on Twitter #FedTownHall

If Bernanke hints at QE3, it will probably happen in the Q&A.

Live broadcasting by Ustream

Trulia: Asking House Prices increased in July

by Calculated Risk on 8/07/2012 11:38:00 AM

Press Release: Trulia Reveals Asking Prices Up for Sixth Straight Month

Trulia today released the latest findings from the Trulia Price Monitor and the Trulia Rent Monitor ... Based on the for-sale homes and rentals listed on Trulia, these monitors take into account changes in the mix of listed homes and reflect trends in prices and rents for similar homes in similar neighborhoods through July 31, 2012.More from Jed Kolko, Trulia Chief Economist: Step Aside, Florida: Biggest Price Gains Now in the West

Asking prices on for-sale homes–which lead sales prices by approximately two or more months – increased 0.5 percent in July month over month (M-o-M), seasonally adjusted, for a sixth straight monthly gain. Meanwhile, asking prices rose nationally 1.2 percent quarter over quarter (Q-o-Q), seasonally adjusted. Year-over-year (Y-o-Y) asking prices rose by 1.1 percent; excluding foreclosures, asking prices rose Y-o-Y by 2.7 percent. For the first time, a majority (62 out of 100) of large metros had Y-o-Y price increases.

...

Rents increased Y-o-Y in 24 of the 25 largest rental markets, with rent increases topping 10 percent in San Francisco, Miami, Oakland, Denver, Seattle and Boston. Three months ago, only two large rental markets – San Francisco and Miami – had Y-o-Y rent increases of 10 percent or more. Rents are rising faster than asking prices in 21 of the 25 largest rental markets Y-o-Y.

Asking prices were up once again month over month in July, by 0.5%. Asking prices have moved up six straight months since February (the May number was revised slightly upward). This means that the sales price gains starting to be reported by Case-Shiller and other indexes should continue throughout the year.Note: In a few months, Case-Shiller, CoreLogic and others will probably report a month-over-month decline in house prices, Not Seasonally Adjusted (NSA). That is the normal seasonal pattern and doesn't mean prices are turning down. These asking prices are SA (Seasonally Adjusted) and suggest further house price increases through August and September on a SA basis. The key later this year will be to look at the SA indexes and the year-over-year change in prices.

BLS: Job Openings increased in June

by Calculated Risk on 8/07/2012 10:16:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.8 million job openings on the last business day of June, little changed from 3.7 million in May, the U.S. Bureau of Labor Statistics reported today.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The level of total nonfarm job openings in June was up from 2.4 million at the end of the recession in June 2009.

...

In June, the quits rate was unchanged for total nonfarm, total private, and government. The number of quits was 2.1 million in June, up from 1.8 million at the end of the recession in June 2009. ... Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in June to 3.762 million, up from 3.657 million in May. The number of job openings (yellow) has generally been trending up, and openings are up about 16% year-over-year compared to June 2011. This is the most job openings since mid-2008.

Quits decreased slightly in June, however quits are up about 9.5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

CoreLogic: House Price Index increases in June, Up 2.5% Year-over-year

by Calculated Risk on 8/07/2012 08:52:00 AM

Notes: This CoreLogic House Price Index report is for June. The Case-Shiller index released last week was for May. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® June Home Price Index Rises 2.5 Percent—Representing Fourth Consecutive Year-Over-Year Increase

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 2.5 percent in June 2012 compared to June 2011. On a month-over-month basis, including distressed sales, home prices increased by 1.3 percent in June 2012 compared to May 2012. The June 2012 figures mark the fourth consecutive increase in home prices nationally on both a year-over-year and month-over-month basis.

Excluding distressed sales, home prices nationwide increased on a year-over-year basis by 3.2 percent in June 2012 compared to June 2011. On a month-over-month basis excluding distressed sales, home prices increased 2.0 percent in June 2012 compared to May 2012, the fifth consecutive month-over-month increase. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that July home prices, including distressed sales, will rise by at least 0.4 percent on a month-over-month basis from June 2012 and by 2.0 percent on a year-over-year basis from July 2011.

“Home prices are responding positively to reductions in both visible and shadow inventory over the past year,” said Mark Fleming, chief economist for CoreLogic. “This trend is a bright spot because the decline in shadow inventory translates to fewer distressed sales, which helps sustain price appreciation.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.3% in May, and is up 2.5% over the last year.

The index is off 29% from the peak - and is up 7% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has turned positive.

The second graph is from CoreLogic. The year-over-year comparison has turned positive.This is the fourth consecutive month with a year-over-year increase, and excluding the tax credit bump, these are the first year-over-year increases since 2006.

WSJ: "Momentum building" for QE3

by Calculated Risk on 8/07/2012 08:33:00 AM

From the WSJ: Fed Official Calls for Bond Buying

Eric Rosengren, president of the Federal Reserve Bank of Boston, called on the Fed to launch an aggressive, open-ended bond buying program that the central bank would continue until economic growth picks up and unemployment starts falling again.Rosengren isn't currently a voting member, but it does seem like momentum is building for QE3.

His call came in an interview with The Wall Street Journal ... His decision to speak out forcefully is a sign of the momentum building inside the Fed for a new phase of action.

Mr. Rosengren said the Fed should buy more mortgage-backed securities and possibly U.S. Treasury securities in an open-ended program, and state that it will continue to buy bonds "until we start seeing some pretty significant improvements in growth and income."

Monday, August 06, 2012

Tuesday: JOLTs, Bernanke

by Calculated Risk on 8/06/2012 09:25:00 PM

Fed Chairman Ben Bernanke will take questions on Tuesday, and his comments will be closely scrutinized for hints about QE3.

• On Tuesday, at 10:00 AM ET, the Job Openings and Labor Turnover Survey for June will be released by the BLS. The number of job openings has generally been trending up for the last three years. "Quits" have been increasing too - quits are frequently a sign of more confidence in the labor market.

• Also at 10:00 AM, the Trulia house asking Price Monitor for July will be released. This monitor is based on asking prices and is adjusted for seasonality and mix. This is a leading indicator for the repeat sales indexes. This monitor has been showing rising prices and will probably show another increase in July.

• At 2:30 PM, Fed Chairman Ben Bernanke will speaks at "A Teacher Town Hall Meeting". The event will be broadcast live and the Q&A might provide hints about QE3. The Twitter discussion is at hashtag: #FedTownHall

• At 3:00 PM, Consumer Credit for July will be released. The consensus is for credit to increase $10.5 billion.

Housing: Inventory down 23% year-over-year in early August

by Calculated Risk on 8/06/2012 06:25:00 PM

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), inventory is off 22.8% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through June (left axis) and the HousingTracker data for the 54 metro areas through early August.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then starts to increase again through the summer. Inventory only increased a little this spring and has been declining for the last three months by this measure. It looks like inventory has peaked for this year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early August listings, for the 54 metro areas, declined 22.7% from the same period last year.

HousingTracker reported that the early August listings, for the 54 metro areas, declined 22.7% from the same period last year.

This decline in active inventory remains a huge story, and the lower level of inventory is pushing up house prices.

Fed: Some domestic banks "eased lending standards", seeing "stronger demand"

by Calculated Risk on 8/06/2012 02:00:00 PM

From the Federal Reserve: The July 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the July survey, modest fractions of domestic banks, on balance, continued to report having eased their lending standards across most loan types over the past three months.

Relatively large fractions reported stronger demand for many types of loans over that period.

...

Regarding loans to households, reported changes in standards were mixed across loan categories, while demand increased somewhat. Lending standards over the past three months were little changed, on net, for prime mortgages and tightened somewhat for nontraditional mortgages. However, a relatively large fraction of respondents reported having experienced stronger demand for prime mortgages over the same time period.

...

A sizable fraction of domestic banks reported that their business had increased due to decreased competition from European banks and that they remain willing to accommodate additional such business. In response to the second set of special questions, about one-third of the respondents that are participating in HARP 2.0 reported that HARP refinance applications accounted for a significant share of total refinance applications over the past three months, and a large majority of respondents indicated that they anticipate that more than 60 percent of received HARP applications will be approved and successfully completed.

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in demand for CRE (commercial real estate) loans.

Increasing demand and some easing in standards suggests some increase in CRE activity.

The second graph shows the change in demand for mortgages. Note the break in the graph - in recent years, the Fed has asked about demand for different types of mortgages.

The second graph shows the change in demand for mortgages. Note the break in the graph - in recent years, the Fed has asked about demand for different types of mortgages.It appears demand for mortgages is picking up.

The survey also has some discussion on Europe. Whereas domestic banks are easing standards slightly and seeing an increase in demand, they are tightening standards for lending to European banks:

large fractions of both domestic and foreign banks that extend credit to banks headquartered in Europe or their affiliates or subsidiaries indicated that they had tightened standards on such loans over the past three months.

Weekly Hotel Occupancy Rate above 75% for the first time since 2007

by Calculated Risk on 8/06/2012 12:44:00 PM

From HotelNewsNow.com: STR: US results for week ending 28 July

In year-over-year comparisons for the week, occupancy ended the week with a 3.3-percent increase to 75.1 percent, average daily rate increased 4.8 percent to US$108.95 and revenue per available room ended the week with an increase of 8.2 percent to US$81.87.The 4-week average is still above last year, and is close to pre-recession levels. The occupancy rate has been above 75% for the last two weeks - for the first time since 2007.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

This could be the peak weekly occupancy rate for 2012 (the 4-week average will move up some more). Overall occupancy is back to normal, and will probably move higher over the next couple of years since there is limited new supply being built.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Gasoline Prices up 20 cents over last 5 weeks

by Calculated Risk on 8/06/2012 09:01:00 AM

From CBSAtlanta: Gas prices in Metro Atlanta still on the rise

Average retail gasoline prices in Atlanta rose 5.7 cents per gallon last week, averaging $3.52/g Sunday ... The national average increased 9.3 cents per gallon in the last week to $3.60/g.Professor Hamilton presented a calculator from Political Calculations that estimates the cost of gasoline based on Brent oil prices. Currently this suggests a price of around $3.55 per gallon - about the current price.

...

"Watching the national average last week, one might have expected war broke out in the Middle East or a major hurricane shutting down production, neither of which happened, yet gasoline prices spiked," said GasBuddy.com Senior Petroleum Analyst Patrick DeHaan. "... The good news for motorists is that the end to the summer driving season and change to winter-spec fuel is in view, which will likely put downward pressure on gasoline prices."

The following graph shows the recent increase in gasoline prices. Gasoline prices are down from the peak in early April, but up about 20 cents over the last five weeks.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Weekend:

• Summary for Week Ending Aug 3rd

• Schedule for Week of Aug 5th

Sunday, August 05, 2012

Monday: Senior Loan Officer Opinion Survey

by Calculated Risk on 8/05/2012 10:03:00 PM

Off topic: The Mars Rover Lands tonight. NASA TV has the coverage. The landing is at 10:31 PM PT tonight or 1:31 AM ET in the early morning.

• On Monday, at 9:00 AM ET, pre-recorded speech by Fed Chairman Ben Bernanke, "Economic Measurement".

• At 2:00 PM, the Fed is expected to release the July 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices. This survey might show if there has been any tightening in financial standards due to the European crisis, or if loan demand has weakened in the US.

The Asian markets are green tonight, with the Nikkei up 1.8% and the Shanghai Composite up 2.0%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are up about 3, and the DOW futures up about 15.

Oil: WTI futures are at $91.29 and Brent is at $108.60 per barrel.

Yesterday:

• Summary for Week Ending Aug 3rd

• Schedule for Week of Aug 5th

Payroll Employment and Seasonal Factors

by Calculated Risk on 8/05/2012 01:08:00 PM

Brad Plummer at the WaPo discusses two issues with employment and seasonal factors: Wait, the U.S. economy actually lost 1.2 million jobs in July?

The U.S. economy lost 1.2 million jobs between June and July. But that’s not how it got reported. When the Bureau of Labor Statistics (BLS) released its jobs figures for July, it said the economy gained 163,000 jobs. So what gives?The first point that Plummer made was that there is a distinct seasonal pattern for employment. Even in the best of years there are a significant number of jobs lost in January and July. In 1994, when the economy added almost 3.9 million jobs, there were 2.25 million lost in January 1994, and almost 1 million payroll jobs lost in July 1994.

BLS isn’t hiding anything. The discrepancy just has to do with what’s known as “seasonal adjustments.” The U.S. economy follows certain predictable patterns in hiring and layoffs every year. School districts always let workers go for the summer and hire in the fall. Retailers always staff up for the Christmas holidays and lay people off afterwards. Students always flood the labor market in June.

So if we want to know how well the economy is doing, we want to know how many jobs were added after taking these predictable fluctuations into account. ...

In theory, that makes sense. But some economists and analysts now wonder if the BLS seasonal adjustments are somehow off a bit. If the financial crisis and recession mucked with the seasonal ebb and flow of the economy, then the adjustments that BLS makes for its monthly reports might be a bit skewed. Some jobs reports might look much better than they actually are. And others might look worse.

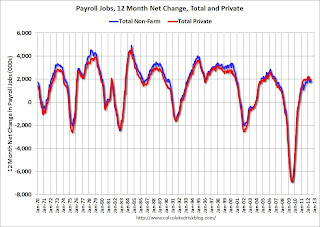

Click on graph for larger image.

Click on graph for larger image.This graph shows the seasonal pattern for the last decade for both total nonfarm jobs and private sector only payroll jobs. Notice the large spike down every January.

In July, private sector hiring is weak, but the decline in non-farm payrolls is from the public sector (teacher layoffs). Usually those teachers return to the payrolls in September and early October.

Since this happens every year, the BLS applies a seasonal adjustment before reporting the headline number. The key point is this is a series that NEEDS a seasonal adjustment!

The second issue Plummer mentioned is that the seasonal factor might be off a little (skewed by the deep recession). It is possible that the BLS is understating employment every spring and early summer, and overstating employment in the fall and winter. I mentioned this possibility last week in the employment preview.

One way to remove the seasonal factors is to look at the 12 month net change in payroll jobs. This graph shows the 12 month net change for both total employment and private employment.

One way to remove the seasonal factors is to look at the 12 month net change in payroll jobs. This graph shows the 12 month net change for both total employment and private employment.Over the last 12 months, the economy has added 1.94 million private sector jobs, and 1.83 total non-farm payroll jobs (the public sector has lost 111 thousand jobs over the last 12 months).

Note that the red line has been above the blue line for the last few years - this is very unusual and is due to the decline in employment at all levels of government (especially state and local).

It is possible that the BLS overstated the strength of the labor market last winter, and understated the strength over the last several months (any seasonally skew could have been exaggerated this year by the mild winter). Of course the 12 month net change lags changes in the labor market - and that is why the BLS reports the seasonally adjusted payroll numbers.

Update: Recovery Measures

by Calculated Risk on 8/05/2012 09:40:00 AM

Here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

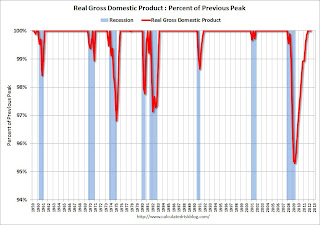

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that several major indicators are still significantly below the pre-recession peaks.

Click on graph for larger image.

Click on graph for larger image.

This graph is for real GDP through Q2 2012. Real GDP returned to the pre-recession peak in Q4 2011, and has been at new post-recession highs for three consecutive quarters.

At the worst point - in Q2 2009 - real GDP was off 4.7% from the 2007 peak.

Real GDP has performed better than other indicators ...

Real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through the June report.

This measure was off 11.2% at the trough in October 2009.

Real personal income less transfer payments are still 3.0% below the previous peak.

The third graph is for industrial production through June.

The third graph is for industrial production through June.

Industrial production was off over 17% at the trough in June 2009, and has been one of the stronger performing sectors during the recovery.

However industrial production is still 3.3% below the pre-recession peak.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 3.5% below the pre-recession peak.

All of these indicators collapsed in 2008 and early 2009, and only real GDP is back to the pre-recession peak. At the current pace of improvement, industrial production will be back to the pre-recession peak in early 2013, personal income less transfer payments late in 2013, and employment in late 2014.

Saturday, August 04, 2012

Unofficial Problem Bank list declines to 899 Institutions

by Calculated Risk on 8/04/2012 04:59:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 3, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Quiet week for the Unofficial Problem Bank List with the only change being the removal of the failed Waukegan Savings Bank, Waukegan, IL ($89 million). After removal, the list stand at 899 institutions with assets of $349.4 billion.Earlier:

The list has not been less than 900 institutions since November 12, 2010. A year ago, the list had 988 institutions with assets of $411.7 billion. Next week will likely be as quiet.

• Summary for Week Ending Aug 3rd

• Schedule for Week of Aug 5th

Schedule for Week of August 5th

by Calculated Risk on 8/04/2012 01:25:00 PM

Earlier:

• Summary for Week Ending Aug 3rd

The key report this week is the June Trade Balance report.

The July Fed Senior Loan Officer Survey will be released on Monday, and Fed Chairman Ben Bernanke holds a town hall meeting on Tuesday and is expected to take questions from the audience.

9:00 AM ET: Speech by Fed Chairman Ben Bernanke, "Economic Measurement", At the 32nd General Conference of the International Association for Research in Income and Wealth, via prerecorded video.

2:00 PM: The July 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in May to 3.642 million, up from 3.447 million in April. The number of job openings (yellow) has generally been trending up, and openings were up about 18% year-over-year compared to May 2011.

2:30 PM: Conversation with the Fed Chairman: A Teacher Town Hall Meeting Event will be broadcast live and the Twitter discussion is at hashtag: #FedTownHall

3:00 PM: Consumer Credit for July. The consensus is for credit to increase $10.5 billion.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase slightly to 367 thousand from 365 thousand.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. Exports increased in May and imports decreased. Exports are 10% above the pre-recession peak and up 4% compared to May 2011; imports are at the pre-recession peak, and up about 4% compared to May 2011.

The consensus is for the U.S. trade deficit to decrease to $47.5 billion in June, down from from $48.7 billion in May. Export activity to Europe will be closely watched due to economic weakness. Also oil prices started to decline in April, and that will probably reduce the value of oil imports in June.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for June. The consensus is for a 0.3% increase in inventories.

8:30 AM: Import and Export Prices for June. The consensus is a for a 0.2% increase in import prices.

Summary for Week ending Aug 3rd

by Calculated Risk on 8/04/2012 08:05:00 AM

The week started with expectations of central bank action. The Fed went first, and although the FOMC statement acknowledged that “economic activity decelerated”, the FOMC took no action. Then it was the European Central Bank’s turn; the eurozone economy has taken a turn for the worse, and the ECB took no action.

However, after further reflection, some analysts felt the ECB has laid the groundwork for sovereign bond buying, and that the Fed will announce QE3 in September. We will see.

In the meantime, the data was mixed. The employment report showed more payroll jobs added in July than in June, but the unemployment rate also increased to the highest level this year (the same rate as in January and February).

A key story early in the week was that the Case-Shiller house price indexes increased in May and are close to being up year-over-year. Also residential construction spending was up again in June.

However manufacturing was weak; the ISM index was below 50 (contraction) for the 2nd consecutive month. As a reminder, housing is usually a better leading indicator for the US economy than manufacturing. Manufacturing is more coincident. The ISM index suggests some weakness now, whereas housing suggests an ongoing sluggish recovery - and that appears to be what is happening.

Here is a summary of last week in graphs:

• July Employment Report: 163,000 Jobs, 8.3% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

There were 163,000 payroll jobs added in July, with 172,000 private sector jobs added, and 9,000 government jobs lost. The economy has added 1.06 million jobs over the first seven months of the year (1.12 million private sector jobs). At this pace, the economy would add around 1.9 million private sector jobs in 2012; less than the 2.1 million added in 2011. Also, at this pace of payroll job growth, the unemployment rate will probably still be above 8% at the end of the year.

This was above expectations of 100,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.3% (red line).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.3% (red line).

The Labor Force Participation Rate declined slightly to 63.7% in July (blue line). This is the percentage of the working age population in the labor force.

The Employment-Population ratio declined to 58.4% in July (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

• Case Shiller: House Prices increased 2.2% in May

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.6% from the peak, and up 0.9% in May (SA). The Composite 10 is up from the post bubble low set in March, Not Seasonally Adjusted (NSA).

The Composite 20 index is off 32.3% from the peak, and up 0.9% (SA) in May. The Composite 20 is also up from the post-bubble low set in March (NSA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is down 1.0% compared to May 2011.

The Composite 20 SA is down 0.7% compared to May 2011. This was a smaller year-over-year decline for both indexes than in April, and the smallest year-over-year decline since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in April seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.4% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through May 2012) is above previous declines for most cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in April seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.4% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through May 2012) is above previous declines for most cities.

This was better than the consensus forecast and it is now possible that prices will turn positive year-over-year in June.

• Real House Prices, Price-to-Rent Ratio

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through May) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through May) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to March 2001, and the CoreLogic index back to May 2000.

As we've discussed before, in real terms, all of the appreciation early in the last decade is gone.

Here is a graph using a ratio of the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes to Owners' Equivalent Rent (a price-to-rent ratio)..

Here is a graph using a ratio of the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes to Owners' Equivalent Rent (a price-to-rent ratio)..This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1998 levels, the Composite 20 index is back to May 2000 levels, and the CoreLogic index is back to June 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

• ISM Manufacturing index increases slightly in July to 49.8

This is the second consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.8% in July, up slightly from 49.7% in June. The employment index was at 52.0%, down from 56.6%, and new orders index was at 48.0%, up slightly from 47.8%.

This is the second consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.8% in July, up slightly from 49.7% in June. The employment index was at 52.0%, down from 56.6%, and new orders index was at 48.0%, up slightly from 47.8%.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.1%.

• U.S. Light Vehicle Sales at 14.1 million annual rate in July

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.09 million SAAR in July. That is up 14% from July 2011, and down 1.7% from the sales rate last month (14.33 million SAAR in June 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.09 million SAAR in July. That is up 14% from July 2011, and down 1.7% from the sales rate last month (14.33 million SAAR in June 2012).This graph shows light vehicle sales since the BEA started keeping data in 1967.

This was slightly above the consensus forecast of 14.0 million SAAR (seasonally adjusted annual rate).

Sales have averaged a 14.12 million annual sales rate through the first seven months of 2012, up sharply from the same period of 2011.

• ISM Non-Manufacturing Index increases slightly, Employment index declines in July

The July ISM Non-manufacturing index was at 52.6%, up from 52.1% in June. The employment index decreased in July to 49.3%, down from 52.3% in June. Note: Above 50 indicates expansion, below 50 contraction.

The July ISM Non-manufacturing index was at 52.6%, up from 52.1% in June. The employment index decreased in July to 49.3%, down from 52.3% in June. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 52.0% and indicates slightly faster expansion in July than in June. The internals were mixed with the employment index weaker, and new orders stronger.

• Construction Spending in June: Private spending increases, Public Spending flat

The Census Bureau reported that overall construction spending increased in June: "The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2012 was estimated at a seasonally adjusted annual rate of $842.1 billion, 0.4 percent above the revised May estimate of $838.3 billion. The June figure is 7.0 percent above the June 2011 estimate of $786.8 billion."

The Census Bureau reported that overall construction spending increased in June: "The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2012 was estimated at a seasonally adjusted annual rate of $842.1 billion, 0.4 percent above the revised May estimate of $838.3 billion. The June figure is 7.0 percent above the June 2011 estimate of $786.8 billion."This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 61% below the peak in early 2006, and up 19.4% from the recent low. Non-residential spending is 27% below the peak in January 2008, and up about 33% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and near the post-bubble low.

This graph shows the year-over-year change in construction spending.

This graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The solid year-over-year increase in private residential investment is a positive for the economy (the increase in 2010 was related to the tax credit). However the recent improvement in residential construction is being somewhat offset by declines in public construction spending.

• Weekly Initial Unemployment Claims increase to 365,000

The DOL reports:

The DOL reports:In the week ending July 28 the advance figure for seasonally adjusted initial claims was 365,000, an increase of 8,000 from the previous week's revised figure of 357,000. The 4-week moving average was 365,500, a decrease of 2,750 from the previous week's revised average of 368,250.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 365,500.

The sharp swings over the last few weeks are apparently related to difficulty adjusting for auto plant shutdowns.

This was below the consensus forecast of 370,000 and is the lowest level for the four week average since March - and is near the post bubble low of 363,000.

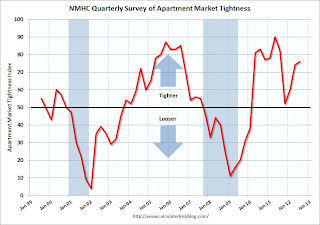

• NMHC Apartment Survey: Market Conditions Tighten in Q2 2012

From the National Multi Housing Council (NMHC): Apartment Market Hot Streak Continues "For the sixth quarter in a row, the apartment industry improved across all indexes in the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (76), Sales Volume (54), Equity Financing (58) and Debt Financing (77) all measured at 50 or higher, indicating growth from the previous quarter."

From the National Multi Housing Council (NMHC): Apartment Market Hot Streak Continues "For the sixth quarter in a row, the apartment industry improved across all indexes in the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (76), Sales Volume (54), Equity Financing (58) and Debt Financing (77) all measured at 50 or higher, indicating growth from the previous quarter."This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last ten quarters and suggests falling vacancy rates and or rising rents.

• Other Economic Stories ...

• Dallas Fed: "Slower Growth" in July Regional Manufacturing Activity

• Personal Income increased 0.5% in June, Spending decreased slightly

• Misc: Chicago PMI increases slightly, Consumer Confidence up, CoreLogic 60,000 Foreclosures in June

• Fannie Mae and Freddie Mac Serious Delinquency rates declined in June

• ADP: Private Employment increased 163,000 in July

• AAR: Rail Traffic "mixed" in July, Intermodal at Record Level

• FOMC Statement: "Economic activity decelerated", Takes no action