by Calculated Risk on 8/31/2012 01:54:00 PM

Friday, August 31, 2012

Fannie Mae and Freddie Mac Serious Delinquency rates declined in July

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in July to 3.50% from 3.53% June. The serious delinquency rate is down from 4.08% in July last year, and this is the lowest level since April 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in July to 3.42%, from 3.45% in June. Freddie's rate is only down slightly from 3.51% in July 2011. Freddie's serious delinquency rate peaked in February 2010 at 4.20%. This is the lowest level for Freddie since August 2009.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

In 2009, Fannie's serious delinquency rate increased faster than Freddie's rate. Since then, Fannie's rate has been falling faster - and now the rates are at about the same level.

Although this indicates some progress, the "normal" serious delinquency rate is under 1% - and it looks like it will be several years until the rates back to normal.

Analysis: Bernanke Clears the way for QE3 in September

by Calculated Risk on 8/31/2012 12:33:00 PM

First from Jon Hilsenrath and Kristina Peterson at the WSJ: Bernanke Signals Readiness to Do More

Federal Reserve Chairman Ben Bernanke offered a robust defense of the effectiveness of the central bank's easy-money policies in his speech Friday at the Fed conference here, and left little doubt that he is looking toward doing more to give the economy a lift at the Fed's next policy meeting in September.As Hilsenrath notes, Bernanke argued: 1) QE has been effective, 2) Additional QE would be helpful, 3) the costs of additional QE "appear manageable", and 4) the economy is "far from satisfactory.

• In Bernanke's view, QE has been effective. From his speech:

How effective are balance sheet policies? After nearly four years of experience with large-scale asset purchases, a substantial body of empirical work on their effects has emerged. Generally, this research finds that the Federal Reserve's large-scale purchases have significantly lowered long-term Treasury yields. ... These effects are economically meaningful.• The costs of additional QE are "manageable":

... a study using the Board's FRB/US model of the economy found that, as of 2012, the first two rounds of LSAPs may have raised the level of output by almost 3 percent and increased private payroll employment by more than 2 million jobs, relative to what otherwise would have occurred. The Bank of England has used LSAPs in a manner similar to that of the Federal Reserve, so it is of interest that researchers have found the financial and macroeconomic effects of the British programs to be qualitatively similar to those in the United States.

To be sure, these estimates of the macroeconomic effects of LSAPs should be treated with caution. ... Overall, however, a balanced reading of the evidence supports the conclusion that central bank securities purchases have provided meaningful support to the economic recovery while mitigating deflationary risks.

[T]he costs of nontraditional policies, when considered carefully, appear manageable, implying that we should not rule out the further use of such policies if economic conditions warrant.• The economy is still very weak:

[T]he economic situation is obviously far from satisfactory ... The unemployment rate remains more than 2 percentage points above what most FOMC participants see as its longer-run normal value ... Further, the rate of improvement in the labor market has been painfully slow. I have noted on other occasions that the declines in unemployment we have seen would likely continue only if economic growth picked up to a rate above its longer-term trend. In fact, growth in recent quarters has been tepid, and so, not surprisingly, we have seen no net improvement in the unemployment rate since January.Bernanke's comments suggest QE3 will be launched very soon, perhaps on September 13th following the next FOMC meeting.

Unless the economy begins to grow more quickly than it has recently, the unemployment rate is likely to remain far above levels consistent with maximum employment for some time.

I thought the odds of QE3 in August were high - and the minutes of the meeting indicated they were very very close. It is possible that the FOMC in September will announce an extension of the extended period until 2015 (from late 2014), and wait again for QE3, but that would seem at odds with Bernanke's comments today.

Bernanke: Monetary Policy since the Onset of the Crisis

by Calculated Risk on 8/31/2012 10:06:00 AM

From Fed Chairman Ben Bernanke at the Jackson Hole Economic Symposium: Monetary Policy since the Onset of the Crisis

The potential benefit of policy action, of course, is the possibility of better economic outcomes--outcomes more consistent with the FOMC's dual mandate. In light of the evidence I discussed, it appears reasonable to conclude that nontraditional policy tools have been and can continue to be effective in providing financial accommodation, though we are less certain about the magnitude and persistence of these effects than we are about those of more-traditional policies.QE has been effective and costs appear manageable.

...

In sum, both the benefits and costs of nontraditional monetary policies are uncertain; in all likelihood, they will also vary over time, depending on factors such as the state of the economy and financial markets and the extent of prior Federal Reserve asset purchases. Moreover, nontraditional policies have potential costs that may be less relevant for traditional policies. For these reasons, the hurdle for using nontraditional policies should be higher than for traditional policies. At the same time, the costs of nontraditional policies, when considered carefully, appear manageable, implying that we should not rule out the further use of such policies if economic conditions warrant.

...

the economic situation is obviously far from satisfactory.

...

Early in my tenure as a member of the Board of Governors, I gave a speech that considered options for monetary policy when the short-term policy interest rate is close to its effective lower bound. I was reacting to common assertions at the time that monetary policymakers would be "out of ammunition" as the federal funds rate came closer to zero. I argued that, to the contrary, policy could still be effective near the lower bound. Now, with several years of experience with nontraditional policies both in the United States and in other advanced economies, we know more about how such policies work. It seems clear, based on this experience, that such policies can be effective, and that, in their absence, the 2007-09 recession would have been deeper and the current recovery would have been slower than has actually occurred.

As I have discussed today, it is also true that nontraditional policies are relatively more difficult to apply, at least given the present state of our knowledge. Estimates of the effects of nontraditional policies on economic activity and inflation are uncertain, and the use of nontraditional policies involves costs beyond those generally associated with more-standard policies. Consequently, the bar for the use of nontraditional policies is higher than for traditional policies. In addition, in the present context, nontraditional policies share the limitations of monetary policy more generally: Monetary policy cannot achieve by itself what a broader and more balanced set of economic policies might achieve; in particular, it cannot neutralize the fiscal and financial risks that the country faces. It certainly cannot fine-tune economic outcomes.

As we assess the benefits and costs of alternative policy approaches, though, we must not lose sight of the daunting economic challenges that confront our nation. The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years.

Over the past five years, the Federal Reserve has acted to support economic growth and foster job creation, and it is important to achieve further progress, particularly in the labor market. Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.

Chicago PMI declines to 53.0

by Calculated Risk on 8/31/2012 09:51:00 AM

From Chicago ISM: Chicago Business Barometer Anemic

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER posted a small gain in August but remained steady for the last four months. Among the Business Activity measures, declines into contraction for both Order Backlogs and Supplier Deliveries offset minor gains in Production, New Orders, and Employment in August.The PMI decreased to 53.0 from 53.7. Expectations were for a decrease to 53.0.

• EMPLOYMENT recovered more than half of last month's slowing; • PRICES PAID slight gain; • ORDER BACKLOGS lowest since September 2009; • SUPPLIER DELIVERIES lowest since July 2009.

The employment index increased to 57.1 from 53.3, and new orders increased to 54.8 from 52.9.

Thursday, August 30, 2012

Friday: Bernanke, Bernanke, Bernanke

by Calculated Risk on 8/30/2012 09:10:00 PM

The focus on Friday will be Fed Chairman Ben Bernanke's speech at the Jackson Hole Economic Symposium.

Earlier this week, ECB President Mario Draghi cancelled his speech on Saturday. Here is an update on Europe, from the Financial Times: Brussels pushes for wide ECB powers

The European Central Bank would be given sweeping authority over all 6,000 eurozone banks under a plan being drawn up by the European Commission ... The plan, agreed at a meeting this week between top aides to José Manuel Barroso, commission president, and Michel Barnier, the EU’s senior financial regulator, would strip existing national supervisors of almost all authority to shut down or restructure their countries’ failing banks, giving those powers to Frankfurt.Europe will be back on the front pages next week.

Excerpt with permission.

On Friday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for August will be released. The consensus is for a decrease to 53.0, down from 53.7 in July.

• At 9:55 AM ET, the final Reuter's/University of Michigan's Consumer sentiment index for August will be released. The consensus is for a reading of 73.5, down from the preliminary August reading of 73.6, and up from the July reading of 72.3.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July will be released. The consensus is for a 0.9% increase in orders.

• Also at 10:00 AM, Fed Chairman Ben Bernanke will speak at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, "Monetary Policy Since the Crisis"

Lawler: On the relationship between pending home sales and closed sales

by Calculated Risk on 8/30/2012 06:55:00 PM

Yesterday the National Association of Realtors reported that its “National” Pending Home Sales Index increased by 2.4% on a seasonally adjusted basis in July to its highest level since April 2010.

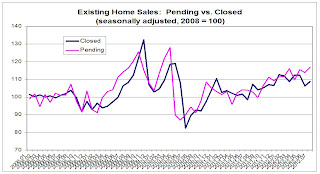

The NAR’s PHSI did not signal the “dip” in June/July closed existing home sales, for reasons that are difficult to discern. It’s not easy to figure out “fallout” rates from the PHSI for several reasons: first, the PHSI is an index number with 2001 “activity” equal to 100, making numerical comparisons to the NAR’s existing home sales estimate difficult, especially since there is a “discontinuity” in the NAR’s existing home sales methodology in 2007; and second, the NAR’s PHSI is based on a sample size not much more than half that used to estimate existing home sales. To really delve into the relationship between pending sales and closed sales, one needs to get local data—which unfortunately isn’t available to the public in that many places.

Click on graph for larger image.

Click on graph for larger image.

CR Note: This graph from Tom Lawler shows Pending and Closed home sales since January 2008. For this graph, Tom Lawler set both series to 100 in 2008.

More from Lawler: For fun, however, I looked at pending sales vs. closed sales data reported by MRIS for the mid-Atlantic region. While I have limited historical data, that data suggests that (1) contract fallout over the past two and a half years is up considerably from earlier periods; and (2) that increased fallout coincided with a significant increase in the share of pending sales that were “contingent. Other MRIS data/analyses suggests that a rise in the share of pending contracts that are short-sales, which (1) take much longer time to close; and (2) which have very high contract fall-out rates, has significantly impacted the relationship between pending sales and closed sales.

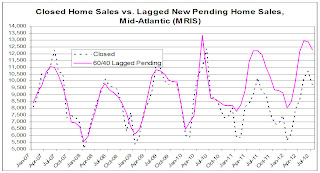

Here is a chart showing closed home sales by MRIS for the mid-Atlantic region compared to lagged new pending contracts, using a weighting of 60% for the previous month and 40% for two months earlier.

Here is a chart showing closed home sales by MRIS for the mid-Atlantic region compared to lagged new pending contracts, using a weighting of 60% for the previous month and 40% for two months earlier.

This chart suggests that over the last two years the number of closed home sales has been significantly lower than one would have expected based on the past relationship between past new pending sales and closed sales. While not shown here, a more “sophisticated” look at leads and lags suggests that the reason is not simply delayed closings, but is mainly contract fallout.

CR Note: It appears short sales are distorting the relationship between pending and closed sales, and the "pending home sales" report should currently be taken with an extra grain of salt.

WSJ: Bernanke Jackson Hole Speech Preview

by Calculated Risk on 8/30/2012 03:51:00 PM

Fed Chairman Ben Bernanke is scheduled to speak on Friday at 10 AM ET at the Jackson Hole Economic Symposium.

From Jon Hilsenrath at the WSJ: Bernanke's Dilemma Over His Legacy

[W]hen the chairman speaks Friday morning at the central bank's annual retreat here, he must once again address whether there is more the Fed can do to get the economy going and whether it is worth taking chances on controversial new programs. All along he has argued these efforts are worth it and appears likely to stick to that line in his speech.I'd like to think that Bernanke isn't thinking about his legacy, but that he is focused on what is best for the economy. So far the inflation critics have been wrong, and high inflation still seems very unlikely with a depressed economy, and significant resource slack.

Beyond big issues of the moment—such as whether the Fed will launch a new bond-buying program—a broader question looms in Jackson Hole about Mr. Bernanke's legacy. Long after his term as chairman ends in 17 months, will he be remembered as the Fed chief who did too little to combat high unemployment or the one who did too much and unleashed inflation and financial instability with the actions he took? Critics make both arguments.

More from Hilsenrath:

The Fed signaled strongly in the minutes of its August 1 policy meeting that in September it is likely to offer new assurances that interest rates will stay low beyond 2014 and that it is seriously considering more bond purchases. One issue Mr. Bernanke might clear up on Friday: Whether U.S. economic data since that meeting—some of it modestly stronger—has changed his outlook.Bernanke will not announce a new program at Jackson Hole. The most he will do is argue the Fed can do more and still has tools that will be effective - and he will probably say that help from fiscal authorities to provide more stimulus in the short term, and a credible long term plan to reduce the deficit, would be very helpful (good luck).

Goldman Sachs chief U.S. economist Jan Hatzius estimates that a $500 billion bond-buying program would boost growth by 0.2 percentage points for a year and bring down the unemployment rate by 0.1 percentage point.

I think the key will be how he describes the economy and his view of growth prospects.

Forecasts: Light Vehicle Sales expected to increase in August

by Calculated Risk on 8/30/2012 02:29:00 PM

In addition to the decent personal income and outlays report for July released this morning, and solid retailer results for August, it appears auto (and light truck) sales increased in August.

TrueCar is forecasting: August 2012 New Car Sales Expected to Be Up 17 Percent

For August 2012, new light vehicle sales in the U.S. (including fleet) is expected to be 1,255,392 units, up 17.2 percent from August 2011 and up 8.9 percent from July 2012 (on an unadjusted basis)Edmunds.com is forecasting: August Car Sales Offer a Pleasant Summer Surprise for the Auto Industry

...

The August 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.2 million new car sales, up from 12.1 million in August 2011 and up from 14.1 million in July 2012

Edmunds.com ... forecasts that 1,287,603 new cars will be sold in August for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.5 million light vehicles. If the numbers hold, August will be the second best month of 2012 in terms of SAAR and the third best month in terms of unit sales.The cash-for-clunkers spike was at a SAAR of 14.546, and the Edmunds forecast is close. Note: There was one more selling day in August 2012 than in August 2011. Light vehicle sales for August will be released on Tuesday, Sept 4th.

“Sales showed signs of flattening out in the first couple months of summer, so August’s sales figures will come as a nice surprise for everyone in the auto industry,” says Edmunds.com Senior analyst Jessica Caldwell.

...

Edmunds.com estimates that August’s projected sales will be an 11.7 percent increase from July 2012, and a 20.1 percent increase (unadjusted for number of selling days) from August 2011. Retail SAAR will come in at 12.0 million vehicles in August, with fleet transactions accounting for 17.0 percent of total sales. An estimated 3.1 million used cars will be sold in August, for a SAAR of 36.9 million (compared to 3.2 million – or a SAAR of 36.3 million – used car sales in July).

This doesn't suggest "a substantial and sustainable strengthening in the pace of the economic recovery" (from the FOMC minutes), but it does suggest some pickup in Q3.

Kansas City Fed: "Moderate" growth in Regional Manufacturing Activity in August

by Calculated Risk on 8/30/2012 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Improved Moderately

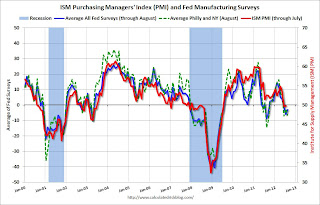

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity improved moderately, and producers’ optimism continued to edge higher.This was below expectations of a 5 reading for the composite index. However the regional manufacturing surveys were mostly weak in August. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Factory activity in our region grew slightly faster this month, in spite of the ongoing drought having a negative effect on producers of agricultural equipment” said Wilkerson. “Firms also expected production to accelerate in coming months.”

...

Growth in Tenth District manufacturing activity improved moderately in August, and producers’ optimism continued to edge higher. Price indexes were relatively stable, although the share of producers planning to raise prices increased further. Several respondents said the ongoing drought has negatively affected their business, mainly through higher input costs and slower sales for agricultural-related products.

The month-over-month composite index was 8 in August, up from 5 in July and 3 in June. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index climbed from 2 to 7, and the shipments, new orders, and order backlog indexes all moved back into positive territory. The new orders for export index inched higher but remained below zero, while the employment index dipped slightly from 6 to 2.

Most future factory indexes improved further after rebounding last month. The future composite index edged up from 13 to 16, and future production and shipments indexes increased notably after no change last month. The future order backlog index jumped from 3 to 14, while the employment index remained unchanged.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

The ISM index for August will be released Tuesday, Sept 4th, and these surveys suggest another weak reading.

Personal Income increased 0.3% in July, Spending increased 0.4%

by Calculated Risk on 8/30/2012 09:02:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $42.3 billion, or 0.3 percent, and disposable personal income (DPI) increased $39.9 billion, or 0.3 percent, in July, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $46.0 billion, or 0.4 percent. In June, personal income increased $46.1 billion, or 0.3 percent, DPI increased $37.4 billion, or 0.3 percent, and PCE increased $3.5 billion, or less than 0.1 percent, based on revised estimates.The following graph shows real Personal Consumption Expenditures (PCE) through July (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in July, in contrast to a decrease of 0.1 percent in June. ... The PCE price index increased less than 0.1 percent in July, compared to an increase of 0.1 percent in June. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared to an increase of 0.2 percent.

...

Personal saving -- DPI less personal outlays -- was $506.3 billion in July, compared with $516.2 billion in June. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 4.2 percent in July, compared with 4.3 percent in June.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

A key point is the PCE price index has only increased 1.3% over the last year, and core PCE is up only 1.6%. The PCE price index - and core PCE - hardly increased in July.

Weekly Initial Unemployment Claims at 374,000

by Calculated Risk on 8/30/2012 08:30:00 AM

The DOL reports:

In the week ending August 25, the advance figure for seasonally adjusted initial claims was 374,000, unchanged from the previous week's revised figure of 374,000. The 4-week moving average was 370,250, an increase of 1,500 from the previous week's revised average of 368,750.The previous week was revised up from 372,000, so this was an increase from the reported level a week ago.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 370,250.

This was above the consensus forecast of 370,000.

And here is a long term graph of weekly claims:

Wednesday, August 29, 2012

Thursday: Personal Income for July, Weekly Unemployment Claims

by Calculated Risk on 8/29/2012 09:51:00 PM

A few excerpts from Michelle Meyer at Merrill Lynch: Home is where the heart is

The turn in home prices, although modest at the start, will help to boost consumer confidence. Simply believing that prices have stopped falling should provide a sense of relief to households. It will also allow households to have greater mobility, generating a more efficient labor market and greater churn in the housing stock.I made a similar argument a few weeks ago: The economic impact of a slight increase in house prices.

...

While the housing market is far from normal, the bottoming in home prices marks an important shift for the economy. Home-price appreciation will slowly start to support household balance sheets and improve confidence, creating a positive feedback loop with the credit market and broader economy. It is gradual and fragile, but we believe it has finally begun.

On Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 370 thousand from 372 thousand.

• Also at 8:30 AM, the BEA will release the Personal Income and Outlays report for July. The consensus is for a 0.3% increase in personal income in July, and for 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for August will be released. The consensus is for an a reading of 5, unchanged from 5 in July (above zero is expansion). This is the last of the regional surveys for August, and all of them have been weak.

A question for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

ATA Trucking index unchanged in July

by Calculated Risk on 8/29/2012 04:44:00 PM

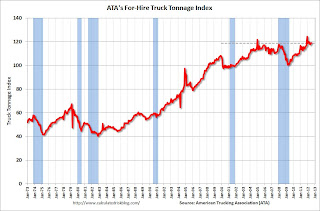

From ATA: ATA Truck Tonnage was Unchanged in July

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index was unchanged in July after increasing 1.1% in June. (June’s gain was slightly smaller than the 1.2% increase ATA reported on July 25.) In July, the SA index stayed at 118.8 (2000=100). Compared with July 2011, the SA index was 4.1% higher, which was the largest year-over-year gain since February 2012. Year-to-date, compared with the same period last year, tonnage was up 3.7%.Note from ATA:

...

“July’s reading reflects an economy that has lost some steam, but hasn’t stalled,” ATA Chief Economist Bob Costello said. “Certainly there has been some better economic news recently, but I continue to believe we will see some deceleration in tonnage during the second half of the year, if for nothing else but very tough comparisons on a robust August through December period in 2011.” ... Costello kept his tonnage outlook for 2012 to the 3% to 3.5% range as reported last month.

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 3.7% year-over-year - but has been moving mostly sideways in 2012.

Fed's Beige Book: Economic activity increased "gradually", Residential real estate shows "signs of improvement"

by Calculated Risk on 8/29/2012 02:07:00 PM

Reports from the twelve Federal Reserve Districts suggest economic activity continued to expand gradually in July and early August across most regions and sectors. Six Districts indicated the local economy continued to expand at a modest pace and another three cited moderate growth; among the latter, Chicago noted that the pace of growth had slowed from the prior period.This is a downgrade from the previous beige book that reported "modest to moderate" growth.

And on real estate:

Housing markets across most Districts exhibited signs of improvement, with sales and construction continuing to increase. Dallas reported significant levels of buyer traffic, Richmond noted strong pending sales, and Minneapolis and St. Louis mentioned increases in building permits. New York, Philadelphia, and Chicago indicated improvements as well, but characterized the progress as slow and modest. Declines in inventory levels were reported in Boston, New York, Philadelphia, Atlanta, Dallas, and San Francisco; these declining inventories put some upward pressure on prices according to Boston, Atlanta, and Dallas. A reduction in the stock of distressed properties was mentioned in New York, Richmond, and San Francisco. In Philadelphia and Kansas City, the possibility of shadow inventory entering the market remains a concern. In general, outlooks were positive, with continued increases in activity expected, although the projected gains were more modest in Boston, Cleveland, and Kansas City."Prepared at the Federal Reserve Bank of Boston and based on information collected on or before August 20, 2012."

Commercial real estate market conditions held steady or improved in nearly all Districts in recent weeks.

Another downgrade ... from "moderate growth" two reports ago, to "modest to moderate" in the last report ... and now "expand gradually". On the positive side, there were more positive comments about residential real estate.

Fed: Consumer Deleveraging Continued in Q2

by Calculated Risk on 8/29/2012 11:00:00 AM

From the NY Fed: Overall Delinquency Rates Down as Americans Paying More Debt on Time

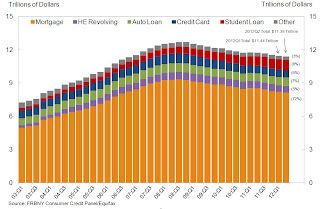

In its latest Quarterly Report on Household Debt and Credit, the Federal Reserve Bank of New York today announced that delinquency rates for mortgages (6.3 percent), credit cards (10.9 percent), and auto loans (4.2 percent) decreased from the previous quarter. However, rates for student loans (8.9 percent) and home equity lines of credit (HELOC) (4.9 percent) increased from March.Here is the Q2 report: Quarterly Report on Household Debt and Credit

Household indebtedness declined to $11.38 trillion, a $53 billion decline from the first quarter of 2012. Outstanding household debt has decreased $1.3 trillion since its peak in Q3 2008. The reduction was led by a decline in real estate-related debt like mortgages and HELOC. More information about how Americans are paying down their debt is available in our corresponding blog post.

"The continuing decrease in delinquency rates suggests that consumers are managing their debts better," said Wilbert van Der Klaauw, vice president and economist at the New York Fed. "As they continue to pay down debt and take advantage of low interest rates, Americans are moving forward with rebalancing their household finances."

... Mortgage originations, which we measure as the appearance of new mortgages on consumer credit reports, rose to $463 billion.

Mortgage balances shown on consumer credit reports continued to fall, and now stand at $8.15 trillion, a 0.5% decrease from the level in 2012Q1. Home equity lines of credit (HELOC) balances dropped by $23 billion (3.7%). Household debt balances excluding mortgages and HELOCS increased by 0.4% in the second quarter to $2.6 trillion, boosted by increases of $14 billion in auto loans and $10 billion in student loans.Here are two graphs:

...

About 256,000 individuals had a new foreclosure notation added to their credit reports between March 31 and June 30, a slowdown of 12% since the first quarter and the lowest number seen since mid-2007. ... Foreclosures are down 55% from its peak in Q2 of 2009, which coincided with the bottom of the recession.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased in Q2. This was mostly due to a decline in mortgage debt.

However student debt is still increasing. From the NY Fed:

Student loan debt rose $10 billion to $914 billion. ... Since the peak in household debt in 2008Q3, student loan debt has increased by $303 billion, while other forms of debt fell a combined $1.6 trillion.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Overall delinquencies improved in 2012Q2. As of June 30, 9.0% of outstanding debt was in some stage of delinquency, compared with 9.3% at the end of 2012Q1. About $1.02 trillion of debt is delinquent, with $765 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

NAR: Pending home sales index increased 2.4% in July

by Calculated Risk on 8/29/2012 10:05:00 AM

From the NAR: July Pending Home Sales Rebound

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 2.4 percent to 101.7 in July from 99.3 in June and is 12.4 percent above July 2011 when it was 90.5. The data reflect contracts but not closings.This was above the consensus forecast of a 1.0% increase for this index and is the highest level in two years (since the expiration of the housing tax credit).

The PHSI in the Northeast increased 0.5 percent to 77.0 in July and is 13.4 percent higher than a year ago. In the Midwest the index grew 3.4 percent to 97.4 in July and is 20.2 percent above July 2011. Pending home sales in the South rose 5.2 percent to an index of 111.7 in July and are 15.6 percent above a year ago. In the West the index slipped 1.7 percent in July to 109.9 but is 1.3 percent higher than July 2011.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in August and September.

Q2 GDP Growth Revised up to 1.7% Annualized

by Calculated Risk on 8/29/2012 08:47:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.7 percent in the second quarter of 2012 (that is, from the first quarter to the second quarter), according to the "second" estimate released by the Bureau of Economic Analysis.The main revisions were:

PCE was revised up from 1.5% to 1.7% (services were revised up).

Investment was revised down (the contribution to GDP from Change in private inventories was revised from +0.32 percentage points to -0.23 in the second release).

Imports are revised down. PCE prices increased at only 0.7% annualized (same as advance release), and core PCE prices increased at a 1.7% annual rate. Overall these changes are minor and were at expectations. This is still sluggish growth.

MBA: Mortgage Refinance Activity declines

by Calculated Risk on 8/29/2012 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6 percent from the previous week to its lowest level since May 11, 2012. The seasonally adjusted Purchase Index increased more than 1 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.80 percent from 3.86 percent, with points remaining unchanged at 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years.

I'm still puzzling over why the MBA index is moving sideways but the recent Senior Loan Officer survey showed "moderately to stronger" demand for mortgages to purchase homes:

Over half the banks surveyed reported moderately to substantially strong demand for mortgage to purchase homes. It isn't clear why the MBA index and the Fed survey results are different.

Tuesday, August 28, 2012

Wednesday: Q2 GDP update, Pending Home Sales, Beige Book

by Calculated Risk on 8/28/2012 08:37:00 PM

First an excerpt from a research note by Jan Hatzius at Goldman Sachs:

At a minimum, we expect an extension of the forward rate guidance to "mid-2015" at the September 12-13 FOMC meeting. We also expect an eventual return to QE, although in terms of timing we believe that either December or early 2013 is still more likely than September.On Wednesday:

...

The tone of the data has clearly improved a bit since the [last FOMC] meeting. ... we estimate that Q3 GDP is on track for a 2.4% annualized gain versus an advance estimate of 1.5% for Q2.

However, a return to QE in September is clearly possible if the upcoming data, especially the August employment report released on September 7, fall short of expectations or if financial conditions tighten again--e.g., in the wake of any disappointment around the European situation and the ECB meeting on September 6.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, the BEA will release the 2nd estimate of Q2 GDP. The consensus is that real GDP increased 1.7% annualized in Q2, revised up from 1.5% in the advance release.

• At 10:00 AM, the Pending Home Sales Index for August will be released. The consensus is for a 1.0% increase in the index.

• At 11:00 AM, the New York Fed will release the Q2 2012 Report on Household Debt and Credit

• 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

A question for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Housing: Two Bearish Views on House Prices and Foreclosures

by Calculated Risk on 8/28/2012 05:04:00 PM

First a couple of bearish views on house prices - clearly residential investment has bottomed, but some analysts think house prices will fall further.

• From RadarLogic: Apparent Strength in Home Price Metrics Driven by Decline in Distressed Sales

A decline in sales of homes in bank inventories, coupled with an increase in the rate of all other sales, helped drive the 25 metropolitan area RPX Composite price to a year-over-year gain in June, according to the June 2012 RPX Monthly Housing Market Report ...• From Mark Hanson posted at the Big Picture: Hanson On Case Shiller

"The absence of real price appreciation when distressed sales are excluded from the analysis suggests that traditional home buyers remain hesitant to return to the market in strength," said Michael Feder, Radar Logic's CEO. "We continue to be concerned that this negative psychology could be the biggest risk threatening any real recovery in housing values. If it continues, the resultant imbalance between supply and demand could trigger another decline in home values."

The gains of the first half of 2012 could be short lived. They were the result of seasonal factors and REO disposition strategies that could reverse in the fall. The unusually rapid price appreciation could give way to equally rapid declines in the second half of the year.

[T]oday’s CS is disappointing…a YoY 15% increase in purchasing power and 25% decrease in foreclosure resales and still the CS-20 NSA only managed a 0.5% gain over last year. To me, normalized, that means real house prices are still falling.My view is house prices probably bottomed early this year (back when I wrote "The Bottom is Here").

And on foreclosures: CoreLogic® Reports 58,000 Completed Foreclosures in July

According to the report, there were 58,000 completed foreclosures in the U.S. in July 2012 down from 69,000 in July 2011 and 62,000* in June 2012. Since the financial crisis began in September 2008, there have been approximately 3.8 million completed foreclosures across the country. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure.Earlier:

...

“Completed foreclosures were down again in July, this time by 16 percent versus a year ago, as servicers increasingly rely on alternatives to the foreclosure process, such as short sales and modifications,” said Mark Fleming, chief economist for CoreLogic. “Completed foreclosures remain concentrated in five states, California, Florida, Michigan, Texas and Georgia, accounting for 48 percent of all completed foreclosures nationwide in July.”

• Case-Shiller: House Prices increased 0.5% year-over-year in June

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs