by Calculated Risk on 9/09/2012 09:33:00 AM

Sunday, September 09, 2012

LA Times: Boom Time in Bakersfield

Coastal California is doing better. And some inland areas are improving (I've mentioned the turnaround in Temecula before - one of the hardest hit areas during the recession). Here is another area doing better ...

From the LA Times: Many signs point to a Bakersfield boom

The state's economic recovery has largely been concentrated on the coast, leaving behind much of the hard-hit San Joaquin Valley. But Bakersfield, perhaps best known for oil, agriculture and country music, has reclaimed an old title: boomtown.High energy prices have really helped Bakersfield, but it appears the entire economy is growing.

Bakersfield has been adding population and jobs at a brisk pace and is a few thousand jobs from matching its peak employment level of five years ago. ... Employment has grown across many sectors, including manufacturing. Even construction, which suffered mightily statewide during the housing bust, has strengthened. And unlike many struggling municipalities, in Kern County officials have recommended a budget increase that would allow hiring of more than 150 people.

Yesterday:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

• Analysis: I expect QE3 on Sept 13th

Saturday, September 08, 2012

Analysis: I expect QE3 on Sept 13th

by Calculated Risk on 9/08/2012 06:46:00 PM

Since the Jackson Hole Symposium, I've been thinking it is very likely that so-called "QE3" would be announced at the next FOMC meeting (Sept 12th and 13th). And after thinking about Columbia University professor Michael Woodford's paper presented at Jackson Hole, I think this round of asset purchases might be more effective than most people expect.

Notes: QE3 is shorthand for another Large Scale Asset Purchases (LSAP) program. "QE" is monetary policy, not fiscal policy (not spending).

Yesterday, Goldman Sach economist Sven Jari Stehn beat me to the punch. He wrote:

[W]e expect the Federal Open Market Committee (FOMC) to announce a return to asset purchases as well as a lengthening of the FOMC’s forward guidance for the first hike in the funds rate to mid-2015 or beyond at the September 12-13 FOMC meeting. Our baseline forecast is an open-ended purchase program, focused on agency mortgage-backed securities.I'd like to add a few points:

[O]ur “double punch” Fed call relates to the much-discussed study presented by Columbia University professor Michael Woodford at Jackson Hole last Friday. Woodford argues that forward guidance is a powerful tool both in theory and practice. But in his view the effect of asset purchases is largely confined to their role in conveying guidance about future monetary policy actions. ...

We fully agree with Woodford’s view that such aggressive guidance measures could be a powerful tool. However, we also believe that Fed officials are unlikely to adopt them anytime soon.

Fortunately, we are somewhat more optimistic than Woodford with regard to the impact of Fed asset purchases. ... we believe that a more moderate strengthening of the forward guidance coupled with renewed asset purchases could provide a decent amount of monetary easing next week.

• Nothing in recent data suggests a "substantial and sustainable strengthening" in economic activity. This was the key sentence from the last FOMC minutes:

"Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery"• Note that Goldman Sachs expects BOTH "a lengthening of the forward guidance to mid-2015" AND "an open-ended purchase program". Atlanta Fed President Dennis Lockhart alluded to this in his interview in the WSJ last week:

If the Fed were to act, Mr. Lockhart said half-measures would not get the job done. While he didn't state what the steps could be, he said stimulus, if chosen, should be "a package. When I say package that means two or three things done at the same time to create maximum possible gains."• As far as additional forward guidance, imagine if Fed Chairman Ben Bernanke made it very clear that the 2% inflation target is symmetrical - not a ceiling, and that the FOMC would not move quickly to slow inflation if the unemployment rate was still high.

This isn't as strong a forward guidance as nominal GDP targeting (NGDP), but it would still provide guidance that the Fed will show patience before raising rates.

In fact, back in April, Fed Chairman Ben Bernanke said:

“[The 2 percent target is] not a ceiling, it’s a symmetric objective, and we attempt to bring inflation close to 2 percent. And in particular, if inflation were to jump for whatever reason—and we don’t have, obviously don’t have perfect control of inflation—we’ll try to return inflation to 2 percent at a pace which takes into account the situation with respect to unemployment.”I expect Bernanke to reiterate this again in the press conference this week.

• And on effectiveness, one of the key transmission channels for monetary policy is through residential investment and mortgages. The previous rounds of QE (and "twist") have lowered mortgage rates and allowed homeowners with excellent credit and income to refinance. However this channel has been limited as Bernanke noted in his Jackson Hole speech:

It is likely that the crisis and the recession have attenuated some of the normal transmission channels of monetary policy relative to what is assumed in the models; for example, restrictive mortgage underwriting standards have reduced the effects of lower mortgage rates.As residential investment recovers, and house prices increase (or at least stabilize), this channel will probably become more effective.

Last month I summarized some of The economic impact of a slight increase in house prices. This includes mortgage lenders and appraisers becoming more confident in the mortgage and housing markets. I think that is starting to happen, and I think QE might have more traction now through the housing channel.

Conclusion: I expect both QE, and an extended forward guidance, to be announced this week at the FOMC meeting.

Earlier:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

Schedule for Week of Sept 9th

by Calculated Risk on 9/08/2012 01:07:00 PM

Earlier:

• Summary for Week Ending Sept 7th

The key event this week is the two day FOMC meeting on Wednesday and Thursday. There is a very strong possibility that the Fed will provide additional accommodation.

The key reports for this week will be the July trade balance report on Tuesday, the August retail sales report on Friday, Industrial Production on Friday, and August CPI also on Friday.

In Europe, Germany's Constitutional Court is expected to rule if the European Stability Mechanism (ESM, the proposed permanent replacement for the EFSF or European Financial Stability Facility) is constitutional on Wednesday at 6 AM ET.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph is through June. Exports increased in June and imports decreased. Some of the decline in June was due to falling oil prices. According to the EIA, Brent futures average $110.34 in May, but declined to $95.16 in June, before increasing to $102.62 in July. There is a lag between future prices and import prices, but this suggests the dollar value of oil imports (per barrel) probably increased a little in July.

The consensus is for the U.S. trade deficit to increase to $44.3 billion in July, up from from $42.9 billion in June. Export activity to Europe will be closely watched due to economic weakness.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 3.762 million, up from 3.657 million in May. The number of job openings (yellow) has generally been trending up, and openings are up about 16% year-over-year compared to June 2011. This was the most job openings since mid-2008.

8:30 AM: Import and Export Prices for August. The consensus is a for a 1.5% increase in import prices

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.4% increase in inventories.

8:30 AM: Producer Price Index for August. The consensus is for a 1.4% increase in producer prices (0.2% increase in core).

12:30 PM: FOMC Meeting Announcement. Additional policy accommodation is very likely. The FOMC might lengthen their forward guidance for the first rate hike to mid-2015 or later, and / or also launch an open ended Large Scale Asset Purchases(LSAP) program (commonly called QE3).

2:00 PM: FOMC Forecasts The will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM ET: Retail Sales for August.

8:30 AM ET: Retail Sales for August. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 21.9% from the bottom, and now 6.6% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.8% in August, and for retail sales ex-autos to increase 0.7%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This shows industrial production since 1967.

The consensus is for Industrial Production a 0.1% decline in August, and for Capacity Utilization to decline to 79.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for sentiment to decrease to 74.0 from 73.5 in August.

10:00 AM: Manufacturing and Trade: Inventories and Sales for July (Business inventories). The consensus is for 0.5% increase in inventories.

Summary for Week Ending Sept 7th

by Calculated Risk on 9/08/2012 08:07:00 AM

The key event of the week was in Europe when ECB President Mario Draghi announced the Outright Monetary Transactions (OMT). It is hard to tell how effective these measures will be, although analysts at Nomura think the OMT bought policymakers three months at best: "This latest round of policy announcements could buy up to three months should countries call for help relatively quickly and conditions attached to the bail outs are light."

In the US, it was a busy week. The employment report was weak again with only 96,000 payroll jobs added in August, and the ISM manufacturing index suggested contraction in manufacturing for the fourth consecutive month.

Other data was a little better - vehicle sales in August were at 14.5 million SAAR, the ISM services index was above expectation, and initial weekly unemployment claims declined more than expected.

But the key report was employment, and payroll job growth remains sluggish.

Here is a summary of last week in graphs:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

There were 96,000 payroll jobs added in August, with 103,000 private sector jobs added, and 7,000 government jobs lost. The unemployment rate decreased to 8.1% (from the household survey), and the participation rate declined to 63.5%. The decline in the unemployment rate was mostly due to the lower participation rate.

There were 96,000 payroll jobs added in August, with 103,000 private sector jobs added, and 7,000 government jobs lost. The unemployment rate decreased to 8.1% (from the household survey), and the participation rate declined to 63.5%. The decline in the unemployment rate was mostly due to the lower participation rate.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.7%.

The change in payroll employment for July was revised down from +163,000 to +141,000, and June was revised down from +64,000 to +45,000, for a total revision of minus 41,000 over those two months.

This was below expectations of 125,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 8.1% (red line).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 8.1% (red line).

The Labor Force Participation Rate declined to 63.5% in August (blue line)- another new cycle low. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio declined to 58.3% in August (black line). This is a new low for the year, and just above the cycle low.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The economy has added 1.11 million jobs over the first eight months of the year (1.21 million private sector jobs). At this pace, the economy would add around 1.8 million private sector jobs in 2012; less than the 2.1 million added in 2011. Also, at this pace of payroll job growth, the unemployment rate will probably still be above 8% at the end of the year.

This was another weak employment report, especially with the downward revisions and slight decline in hourly earnings.

• ISM Manufacturing index decreases slightly in August to 49.6

This is the third consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.6% in August, down slightly from 49.8% in July. The employment index was at 51.6%, down from 52.0%, and the new orders index was at 47.1%, down from 48.0%.

This is the third consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.6% in August, down slightly from 49.8% in July. The employment index was at 51.6%, down from 52.0%, and the new orders index was at 47.1%, down from 48.0%.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.0%. This suggests manufacturing contracted in August for the third consecutive month.

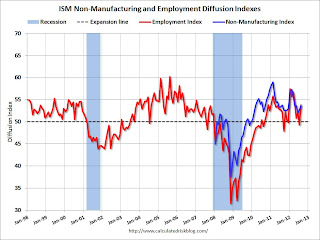

• ISM Non-Manufacturing Index increases in August

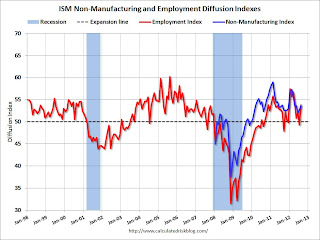

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction.

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.0% and indicates faster expansion in August than in July. The internals were mixed with the employment index up sharply, but new order down slightly.

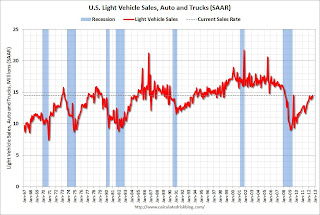

• U.S. Light Vehicle Sales at 14.5 million annual rate in August

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.52 million SAAR in August. That is up 17% from August 2011, and up 3% from the sales rate last month.

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.52 million SAAR in August. That is up 17% from August 2011, and up 3% from the sales rate last month.The year-over-year increase was fairly large because the auto industry was still recovering from the impact of the tsunami and related supply chain issues in 2011 (the issues were mostly over in September of 2011).

Sales have averaged a 14.17 million annual sales rate through the first seven months of 2012, up from 12.4 million rate for the same period of 2011.

This was above the consensus forecast of 14.3 million SAAR (seasonally adjusted annual rate).

It looks like auto sales will be up slightly in Q3 compared to Q2, and make another small positive contribution to GDP.

• Construction Spending decreased in July

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 61% below the peak in early 2006, and up 19% from the recent low. Non-residential spending is 29% below the peak in January 2008, and up about 30% from the recent low.

Public construction spending is now 15% below the peak in March 2009 and near the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 19%. Non-residential spending is also up year-over-year mostly due to energy spending (power and electric). Public spending is still down year-over-year, although it now appears public construction spending is moving sideways.

The slight decline in residential construction spending in July followed several months of solid gains. The solid year-over-year increase in private residential investment is a positive for the economy (the increase in 2010 was related to the tax credit).

• Weekly Initial Unemployment Claims decline to 365,000

The DOL reports:

The DOL reports:In the week ending September 1, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 12,000 from the previous week's revised figure of 377,000. The 4-week moving average was 371,250, an increase of 250 from the previous week's revised average of 371,000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 371,250.

This was below the consensus forecast of 370,000.

• ADP: Private Employment increased 201,000 in August

• AAR: Rail Traffic "mixed" in August, Building related commodities were up

• Trulia: Asking House Prices increased in August, Rent increases slow

• Housing: Inventory down 23% year-over-year in early September

Friday, September 07, 2012

Bank Failure #41 in 2012: First Commercial Bank, Bloomington, Minnesota

by Calculated Risk on 9/07/2012 08:03:00 PM

Autumn leaves yellow and fall

As do Mid-West Banks

by Soylent Green is People

From the FDIC: Republic Bank & Trust Company, Louisville, Kentucky, Assumes All of the Deposits of First Commercial Bank, Bloomington, Minnesota

As of June 30, 2012, First Commercial Bank had approximately $215.9 million in total assets and $206.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $63.9 million. ... First Commercial Bank is the 41st FDIC-insured institution to fail in the nation this year, and the fourth in Minnesota.It is Friday!

Earlier on employment:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

AAR: Rail Traffic "mixed" in August, Building related commodities were up

by Calculated Risk on 9/07/2012 05:32:00 PM

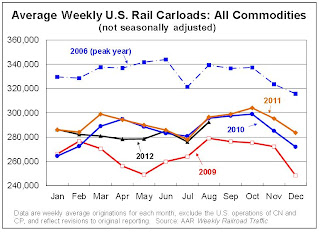

Once again rail traffic was "mixed". However building related commodities were up such as lumber and crushed stone, gravel, sand. Lumber was up 21% from August 2011.

From the Association of American Railroads (AAR): AAR Reports Mixed Weekly Rail Traffic for August

The Association of American Railroads (AAR) today reported U.S. rail carloads originated in August 2012 totaled 1,461,680, down 1.4 percent compared with August 2011. Intermodal traffic in August 2012 totaled 1,230,992 containers and trailers, up 51,145 units or 4.3 percent compared with August 2011. The August 2012 average weekly intermodal volume of 246,198 units is the second highest average for any August on record.

...

“U.S rail traffic in August was pretty much same song, different verse,” said AAR Senior Vice President John T. Gray. “Weakness in coal carloadings was largely but not entirely offset by increases in carloads of petroleum and petroleum products, autos, lumber, and several other commodities, with intermodal showing continued strength.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

On a non-seasonally adjusted basis, U.S. rail carload traffic fell 1.4% (21,050 carloads) in August 2012 from August 2011. Carloads totaled 1,461,680 for the month, an average of 292,336 per week, which is the highest weekly average since November 2011. It was the seventh straight year-over-year monthly decline.The second graph is for intermodal traffic (using intermodal or shipping containers):

Commodities with carload gains on U.S. railroads in August 2012 included petroleum and petroleum products (up 18,007 carloads, or 49.0%); motor vehicle and parts (up 8,966 carloads, or 13.0%); and crushed stone, sand, and gravel (up 6,905 carloads, or 7.3%). Carloads of lumber and wood products were up 21.3% (2,877 carloads) in August 2012; carloads of grain were up 1.7%.

Coal continues to suffer, with U.S. carloadings down 7.3% (48,493 carloads) in August 2012 from August 2011

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now near peak levels.

U.S. intermodal traffic rose 4.3% (51,145 containers and trailers) in August 2012 over August 2011 on a non-seasonally adjusted basis, totaling 1,230,992 units for the month. The weekly average in August 2012 was 246,198, the second highest for an August in history.The top months for intermodal are usually in the fall, and it looks like intermodal traffic will be at or near record levels this year.

This is more evidence of sluggish growth - and of residential investment making a positive contribution.

Earlier on employment:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

Market Update

by Calculated Risk on 9/07/2012 04:05:00 PM

Click on graph for larger image.

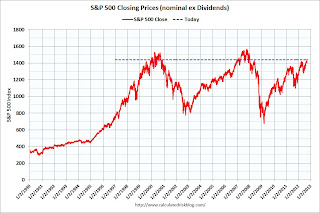

I haven't posted these graphs in a couple of months. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in December 1999; almost 13 years ago.

The second graph (click on graph for larger image) is from Doug Short shows the S&P 500 since the 2007 high ...

Earlier:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

LPS: House Price Index increased 0.7% in June

by Calculated Risk on 9/07/2012 02:00:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses June closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic) and the LPS index is seasonally adjusted.

From LPS: U.S. Home Prices Up 0.7 Percent for the Month; Up 0.9 Percent for the Past Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on June 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS index increased 0.7% in June (seasonally adjusted) and is up 4.0% this year, and up 0.9% year-over-year.

The LPS HPI is off 23.5% from the peak in June 2006.

Earlier:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

Employment: Another Weak Report (more graphs)

by Calculated Risk on 9/07/2012 10:26:00 AM

The economy has added 1.11 million jobs over the first eight months of the year (1.21 million private sector jobs). At this pace, the economy would add around 1.8 million private sector jobs in 2012; less than the 2.1 million added in 2011. Also, at this pace of payroll job growth, the unemployment rate will probably still be above 8% at the end of the year.

Government payrolls declined another 7 thousand in August, bringing government job losses to 93,000 for 2012 through August (61,000 state and local jobs losses so far in 2012, and 32,000 fewer Federal jobs).

Some numbers: There were 96,000 payroll jobs added in August, with 103,000 private sector jobs added, and 7,000 government jobs lost. The unemployment rate decreased to 8.1% (from the household survey), and the participation rate declined to 63.5%. The decline in the unemployment rate was mostly due to the lower participation rate.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.7%.

The change in payroll employment for July was revised down from +163,000 to +141,000, and June was revised down from +64,000 to +45,000, for a total revision of minus 41,000 over those two months.

The average workweek was unchanged at 34.4 hours, and average hourly earnings declined slightly. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.4 hours in August. ... In August, average hourly earnings for all employees on private nonfarm payrolls edged down by 1 cent to $23.52. Over the past 12 months, average hourly earnings rose by 1.7 percent." This is sluggish earnings growth.

There are a total of 12.5 million Americans unemployed and 5.0 million have been unemployed for more than 6 months.

This was another weak employment report, especially with the downward revisions and slight decline in hourly earnings. Here are a few more graph ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.6% in August (this was up slightly in August.)

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 8.0 million in August. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers decrease in August to 8.03 millon from 8.25 million in August.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased in August to 14.7%, down from 15.0% in July.

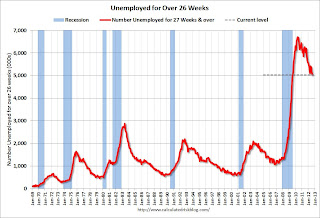

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.03 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.18 million in July. This is generally trending down and is at the lowest level since 2009. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

So far in 2012 - through August - state and local government have lost 61,000 jobs (10,000 jobs were added in August). In the first eight months of 2011, state and local governments lost 168,000 payroll jobs - and 230,000 for the year. So the layoffs have slowed, but they haven't stopped.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is losing workers too (43,000 over the last 12 months, although 3,000 added in August). I think state and local government employment losses might slow further over the next several months.

Overall this was another weak report.

August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

by Calculated Risk on 9/07/2012 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 96,000 in August, and the unemployment rate edged down to 8.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment increased in food services and drinking places, in professional and technical services, and in health care.

...

Both the civilian labor force (154.6 million) and the labor force participation rate (63.5 percent) declined in August. The employment-population ratio, at 58.3 percent, was little changed.

...

The change in total nonfarm payroll employment for June was revised from +64,000 to +45,000, and the change for July was revised from +163,000 to +141,000.

Click on graph for larger image.

Click on graph for larger image.This was another weak month, especially with the downward revisions to the June and July reports.

This was below expectations of 125,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 8.1% (red line).

The Labor Force Participation Rate declined to 63.5% in August (blue line)- another new cycle low. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate declined to 63.5% in August (blue line)- another new cycle low. This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio declined to 58.3% in August (black line). This is a new low for the year, and just above the cycle low.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was another weak report. (expected was 125,000). I'll have much more later ...

Thursday, September 06, 2012

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 9/06/2012 08:14:00 PM

At 8:30 AM ET on Friday, the employment report for August will be released. The consensus is for an increase of 125,000 non-farm payroll jobs in August, down from the 163,000 jobs added in July. The consensus is for the unemployment rate to be unchanged at 8.3%.

Some previews:

From Tim Duy at EconomistsView: Fed Watch: Quick Employment Report Preview

From me: Employment Situation Preview

From Nelson Schwartz at the NY Times Economix: Betting on Job Growth

[C]hief United States economist at Morgan Stanley, Vincent Reinhart, raised his prediction for Friday’s government report to 125,000 total nonfarm payroll jobs from an earlier estimate of 100,000.From the WSJ Real Time Economics: Jobs Gain of 200,000 Still Isn’t Enough

TrimTabs Investment Research, usually a Sad Sack when it comes to job estimates, said its calculations of tax-withholding data show August payrolls increased by a hefty 185,000.And two more questions for the September economic contest:

A Draghi Kind of Day

by Calculated Risk on 9/06/2012 04:15:00 PM

First, Tim Duy models a few employment indicators Fed Watch: Quick Employment Report Preview

The model forecasts a nonfarm payroll gain of 198k for August. To be sure, the standard error of 88k is large in terms of payroll forecasts; I wouldn't be surprised by anything between 110k and 290k. That said, the current consensus is 125k with a range of 70k to 177k, which seems low to me.And a few articles on the ECB:

From the NY Times: Central Bank to Snap Up Debt, Saying, ‘Euro Is Irreversible’

Mario Draghi, the E.C.B. president, overcame objections by Germany and won nearly unanimous support from the bank’s board for a program of buying government bonds that would effectively spread responsibility for repaying national debts to the euro zone countries as a group.From the WSJ: ECB Unveils Bond-Buying Program

The E.C.B. will buy bonds on open markets, without setting any limits, of countries that ask for help, which Spain is expected to do. The E.C.B. said it would act only after countries agreed on conditions with the euro zone rescue fund, which will be known as the European Stability Mechanism. The E.S.M. would buy bonds directly from governments, taking responsibility for imposing the conditions, while the E.C.B. would intervene in secondary markets.

The bank and its president, Mr. Draghi, have had the quiet support of all European leaders in taking this latest bold action ... Crucially, support for Mr. Draghi includes Berlin and the German chancellor, Angela Merkel.

From the Financial Times: Draghi outlines bond buying plan

And some in-depth analysis at Alphaville including OMT! and Seniority, the SMP, and the OMT

Here are the full ‘technical features’, which Mario Draghi read out at Thursday’s press conference. Three big things stick out:Much more at Alphaville.

- The ECB will apparently make a ‘legal act’ to confirm that its bond holdings under “Outright Monetary Transactions” are pari passu, not senior. ...

- The ECB will relax collateral requirements ... That’s a big, big move for Spanish banks in particular ...

- Conditionality. A slight chink? The ECB could buy bonds under an EFSF-ESM precautionary credit line for a sovereign, short of a maximal full bailout. Here’s the EFSF’s guidelines on the conditions of precautionary credit lines, for example.

Employment Situation Preview

by Calculated Risk on 9/06/2012 12:42:00 PM

In July, the BLS reported there were 163,000 payroll jobs added. This followed three weak months: 68,000 payroll jobs were added in April, 87,000 in May, and 64,000 in June. Some of the spring weakness might have been "payback" for the mild weather earlier in the year, so it might help to look at the average per month. So far this year, the economy has added 151,000 payroll jobs per month (161,000 private sector per month).

Also, there is a strong possibility that the seasonal factors are a little distorted by the deep recession and financial crisis - this is the third year in a row we've some late spring weakness. In 2010, payrolls picked up in October following a weak period (looking at the data ex-Census), in 2011, payrolls picked up in September. If there is a seasonal distortion, the next four months will probably see some increase too.

Bloomberg is showing the consensus is for an increase of 125,000 payroll jobs in August, and for the unemployment rate to remain unchanged at 8.3%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 201,000 private sector payroll jobs in August. This is the strongest ADP report since March, and this would seem to suggest that the consensus for the increase in total payroll employment is too low. However the ADP report hasn't been very useful in predicting the BLS report for any one month.

• The ISM manufacturing employment index decreased in August to 51.6%, down from 52.0% in July. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased about 12,000 in August.

The ISM non-manufacturing (service) employment index increased in August to 53.8%, up from 49.3% in July. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for services, suggests that private sector BLS reported payroll jobs for services increased about 160,000 in August.

Added together, the ISM reports suggests about 148,000 jobs added in August.

• Initial weekly unemployment claims averaged about 371,000 in August, up from the 366,000 average for July - but below the 382,000 average for April, May and June. This was about the same level as in the January, February and March period when the BLS reported an average of 226,000 payroll jobs added per month.

For the BLS reference week (includes the 12th of the month), initial claims were at 374,000; down from 388,000 during the reference week in July.

• The final July Reuters / University of Michigan consumer sentiment index increased to 74.3, up from the July reading of 72.3. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This level still suggests a weak labor market.

• The small business index from Intuit showed 30,000 payroll jobs added, down from 45,000 in July.

• And on the unemployment rate from Gallup: U.S. Unadjusted Unemployment Rate at 8.1% in August

U.S. unemployment, as measured by Gallup without seasonal adjustment, is 8.1% for the month of August, down slightly from 8.3% measured in mid-August and 8.2% for the month of July. Gallup's seasonally adjusted unemployment rate for August is also 8.1%, a slight uptick from 8.0% at the end of July.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats). Note: So far the Gallup numbers haven't been useful in predicting the BLS unemployment rate.

• Conclusion: The overall feeling is that economic activity picked up a little in August, and that would seem to suggest a stronger than consensus employment report. Also it is possible that there have been some seasonal factor distortions.

The ISM manufacturing reports suggest a gain of around 148,000 payroll jobs, and the ADP report (private only), also suggests the consensus is too low. Initial weekly unemployment claims were near the low for the year during August.

A negative is the weak small business numbers from Intuit.

Overall it seems like the August report will be somewhat stronger than expected.

ISM Non-Manufacturing Index increases in August

by Calculated Risk on 9/06/2012 10:00:00 AM

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 32nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 53.7 percent in August, 1.1 percentage points higher than the 52.6 percent registered in July. This indicates continued growth this month at a slighter faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55.6 percent, which is 1.6 percentage points lower than the 57.2 percent reported in July, reflecting growth for the 37th consecutive month. The New Orders Index decreased by 0.6 percentage point to 53.7 percent. The Employment Index increased by 4.5 percentage points to 53.8 percent, indicating growth in employment after one month of contraction. The Prices Index increased 9.4 percentage points to 64.3 percent, indicating substantially higher month-over-month prices when compared to July. According to the NMI™, 10 non-manufacturing industries reported growth in August. Respondents' comments continue to be mixed, and for the most part reflect uncertainty about business conditions and the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.0% and indicates faster expansion in August than in July. The internals were mixed with the employment index up sharply, but new order down slightly.

Weekly Initial Unemployment Claims decline to 365,000

by Calculated Risk on 9/06/2012 08:30:00 AM

The DOL reports:

In the week ending September 1, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 12,000 from the previous week's revised figure of 377,000. The 4-week moving average was 371,250, an increase of 250 from the previous week's revised average of 371,000.The previous week was revised up from 374,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 371,250.

This was below the consensus forecast of 370,000.

And here is a long term graph of weekly claims:

ADP: Private Employment increased 201,000 in August

by Calculated Risk on 9/06/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 201,000 from July to August, on a seasonally adjusted basis. The estimated gain from June to July was revised up from the initial estimate of 163,000 to 173,000.This was above the consensus forecast of an increase of 149,000 private sector jobs in August. The BLS reports on Friday, and the consensus is for an increase of 125,000 payroll jobs in August, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector expanded 185,000 in August, up from 156,000 in July. Employment in the private, goods-producing sector added 16,000 jobs in August. Manufacturing employment rose 3,000, following an increase of 6,000 in July.

ADP hasn't been very useful in predicting the BLS report, but this suggests a stronger than consensus report.

Wednesday, September 05, 2012

Thursday: Draghi, Unemployment Claims, ADP, ISM Services

by Calculated Risk on 9/05/2012 07:18:00 PM

Usually during the first week of the month, all of the discussion would be about the employment report. This month focus is on the ECB ...

ECB Governing Council meeting times:

• 7:45 AM ET (1.45 PM CET) Monetary Policy Decision. The expectation is rates will be cut 25 bps.

• 8:30 AM ET (2.30 PM CET) ECB President Mario Draghi Press conference. The expectation is Draghi will announce some sort of short term bond buying program.

Note: I'll post the US data in the morning. For updates on the ECB, I recommend Alphaville. Here is the ECB website and press conference page.

From Cardiff Garcia at Alphaville: More questions pre-Draghi

There are some obvious questions going into Draghi’s meeting on Thursday after a few of the early details were reported today — What will be the terms of conditionality? Where on the curve will the buying be concentrated? — and we’ve got a few more.From the WSJ: ECB Said to Ready Measures as Euro Zone Slide Deepens

The euro zone's economic downturn accelerated during the summer, economic reports Wednesday suggest, raising concerns that even aggressive anticrisis measures from the European Central Bank won't be enough to keep the euro bloc from sliding into a deep recession.On Thursday:

...

The reports raise a vexing problem for ECB policy makers. Even if they announce detailed plans to buy government bonds as a means to lower borrowing costs for crisis-hit countries, the measures' effectiveness may be limited by high unemployment, weak consumer confidence and stagnant growth prospects.

"In the next three to six months, there is nothing the ECB can do to prevent a further slowdown from materializing," said Carsten Brzeski, economist at ING Bank.

• At 8:15 AM ET, the ADP Employment Report for August will be released. This report is for private payrolls only (no government). The consensus is for 149,000 payroll jobs added in August, down from the 163,000 reported last month.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 370 thousand from 374 thousand.

• At 10:00 AM, the ISM non-Manufacturing Index (Services) for August will be released. The consensus is for an increase to 53.0 from 52.6 in July.

Another question for the September economic contest:

Lawler: Single Family Rental Market: Surging, But by How Much?

by Calculated Risk on 9/05/2012 02:31:00 PM

CR Note: Housing economist Tom Lawler estimates that there are about 2.1 million more single family home rented now than in 2006. This is a key reason for the decline in inventory.

From housing economist Tom Lawler:

Recently there have been a sizable number of media stories on the SF rental market, with the focus on its tremendous growth over the past few years. One reason for the jump in the number of articles is related to the significant increase in the number of entities who have entered this space. It seems almost as if everyone and their mother has either entered the SF rental market or is looking to enter it. Another is that investor demand for SF properties has been very strong while the supply of homes for sale, especially the supply of foreclosed homes, is down significantly, and as a result prices of “distressed” (and other) homes have increased significantly faster than many had expected. And finally, of course, there are stories that a “REO-to-Rental” securitization deal is in the works (if it comes it’ll probably be unrated, as (1) rating agencies don’t really have sufficient data to assign a rating; and (2) unlike in the past, currently rating agencies care about such things!)

Stories of the surge in the SF rental market are not, by the way, limited to California, Arizona, Nevada, or Florida, but are reasonably widespread across the country.

Of course, the explosion in the size of the SF rental market is not new: it was evident several years back. But the growing number of “new” players, combined with the sharply lower inventory of homes for sale and recent rebound in home prices, has made this an increasingly important “story” for the housing market.

It is, unfortunately, not easy to get a good handle on just how rapidly the SF rental market has grown, given the lack of good, timely information on the US housing market. Data from the American Community Survey, e.g., are only available for 2010, and there are some “issues” with that data (as evidenced by the ACS/decennial Census differences currently being explored by Census analysts). There are even bigger issues with data from the Housing Vacancy Survey, which deviated incredibly from the decennial Census (and ACS) on a wide range of “metrics,” and whose estimates appear to systematically understate the number of renter-occupied households. Moreover, the HVS does not explicitly release estimates of the number (or %) of owner vs. renter occupied homes by units in structure.

The HVS does, however, release estimates of (1) the rental and homeowner vacancy rates by units in structure; (2) the % of vacant homes that are 1-unit structures; and (3) the number of total homes for rent and for sale. While unfortunately a consistent time series of these estimates doesn’t go back very far, and unfortunately the HVS relies on the American Housing Survey for estimates of the characteristics of housing units (the AHS doesn’t come close to matching the ACS), the data may have some useful information on trends in the SF rental market.

Unfortunately (gosh, I use that adverb often when describing available US housing data), the HVS’ definition of “1-unit” structures includes not just SF detached and attached homes, but also mobile homes or trailers, tents, and boats.

With that in mind, here are some data on the share of occupied “SF” homes that were occupied by renters from (1) the American Community Survey, and (2) derived shares using the aforementioned tables from the Housing Vacancy Survey. The latter are for the second quarter of each year, as the tables released are quarterly, and it’s a pain to derive yearly average data. The ACS data are based on the one-year estimates. Also shown are comparable “SF” shares from Census 2000.

| Renter Share of Occupied "SF" Homes | ||||

|---|---|---|---|---|

| American Community Survey* | Housing Vacancy Survey** | |||

| SFD | SFD+SFA | SFD+SFA+ MH+Other | SFD+SFA+ MH+Other | |

| Census 2000 | 13.2% | 15.0% | 15.6% | |

| 2006 | 13.1% | 14.8% | 15.7% | 14.5% |

| 2007 | 13.4% | 15.0% | 15.9% | 14.7% |

| 2008 | 14.0% | 15.7% | 16.5% | 15.1% |

| 2009 | 14.8% | 16.5% | 17.3% | 15.4% |

| 2010 | 15.1% | 16.8% | 17.6% | 16.3% |

| 2011 | 18.0% | 16.7% | ||

| 2012 | 18.3% | 17.0% | ||

| SFD - Single family Detached SFA - Single family Attached MH - Manufactured Housing Other - Boats,RVs, Vans, Tents, Etc. * Yearly Average ** Q2 Average | ||||

As the table indicates, both surveys suggest that the renter share of the SF market has increased significantly since the beginning of the housing bust. Given the systematic tendency for the HVS to understate the renter share of the overall housing market (as well as the number of renter-occupied homes), it is not surprising that the HVS estimates (again, derived from table not in the press release) of the renter share of occupied “one-unit” homes is below that of the ACS, though the differential between the two hasn’t changed radically over time.

On September 20th Census plans to release the 2011 ACS results, and the above data strongly suggest that the rental share of the SF market increased from 2010 – and the 2012 ACS data will almost certainly show a gain form 2011. A “reasonable” best guess, based on the admittedly “iffy” HVS data, would be that the 2012 ACS data will show that the renter share of occupied SF detached homes this year will be about 15.7%.

Assuming ACS data were correct, such a share increase would imply that the number of renter-occupied SF detached homes in the US this year is about 11.4 million, almost 2.1 million (or 22%) higher than in 2006, with most of that increase coming after 2007. Not coincidentally, foreclosures ramped up sharply in the latter part of 2007, and REO sales increased significantly in 2008 and remained high through last year.

Renter Share of Occupied SF Detached Homes (ACS-based)

Click on graph for larger image.

Click on graph for larger image.These data are broadly consistent both with anecdotal evidence and by statements from some of the “larger” players in the SF investor space that a fairly large % of investors buying “distressed” SF properties have purchased the home with the intent to rent the home for “several” years – partly because in many parts of the country distressed home prices were low relative to realizable rents (in other words, the “rental yield” was good), and partly because investors expected home prices several years down the road would be higher than current prices.

The surge in the number of properties purchased with the intent to rent (at least for a while) has also almost certainly contributed to the sharp decline in the number of homes listed for sale.

Bloomberg: Merkel Said to Tell Lawmakers She Supports Draghi and Weidmann

by Calculated Risk on 9/05/2012 11:46:00 AM

Thursday is Draghi day (ECB meeting) and the following might seem like a contradiction ...

From Bloomberg: Merkel Said to Tell Lawmakers She Backs Draghi and Weidmann

Chancellor Angela Merkel told lawmakers in Berlin today that she supports both European Central Bank chief Mario Draghi and Bundesbank President Jens Weidmann ... both Draghi and Weidmann are carrying out their respective mandates ... she therefore sees no contradition in supporting them both ...From the Financial Times: Mood improves on hopes for ECB action

The ECB is expected to outline how it may help reduce the borrowing costs of heavily indebted countries in the eurozone – leaks from the ECB reported by news agencies on Wednesday seem to confirm the plan is afoot ...More from Bloomberg: ECB Plan Said to Pledge Unlimited, Sterilized Bond-Buying

Excerpt with permission

Under the blueprint, which may be called “Monetary Outright Transactions,” the ECB would refrain from setting a public cap on yields ... The plan will only focus on government bonds rather than a broader range of assets and will target short-dated maturities of up to about three years, two of the people said.The history of the European crisis has been for policymakers to over promise and under deliver, but the consensus is Draghi will announce some buying of short term bonds.

Trulia: Asking House Prices increased in August, Rent increases slow

by Calculated Risk on 9/05/2012 10:00:00 AM

Press Release: Trulia Reports Asking Home Prices up 2.3 Percent, Biggest Year Over Year Increase Since Recession

Trulia today released the latest findings from the Trulia Price Monitor and the Trulia Rent Monitor, the earliest leading indicators available of trends in home prices and rents. Based on the for-sale homes and rentals listed on Trulia, these monitors take into account changes in the mix of listed homes and reflect trends in prices and rents for similar homes in similar neighborhoods through August 31, 2012.These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a SA basis.

Asking prices on for-sale homes–which lead sales prices by approximately two or more months – increased 2.3 percent in August year over year (Y-o-Y) and rose in 68 of the 100 largest metros. Excluding foreclosures, prices rose 3.8 percent Y-o-Y. These are the largest Y-o-Y gains since the recession. Meanwhile, asking prices rose nationally 1.8 percent quarter over quarter (Q-o-Q), seasonally adjusted. Month-over-month (M-o-M) asking prices rose by 0.8 percent, the seventh consecutive month of increases.

...

Nationally, rents rose 4.7 percent Y-o-Y in August, compared to 5.8 percent Y-o-Y in May – making it the slowest rise since March. At the regional level, rents jumped more than 10 percent Y-o-Y in Houston and Seattle, but slowed in Denver, San Francisco, Miami, Oakland and Boston.

...

“Asking prices rose 2.3 percent year over year in August, hitting two housing recovery milestones,” said Jed Kolko, Trulia’s Chief Economist. “First, asking prices rose faster than at any time since the recession. Second, asking prices excluding foreclosures are now rising faster than wages, putting an end to many years of affordability gains. In addition, price gains are catching up with slowing rent increases, which will tip some renters in favor of staying put in their rentals rather than buying a home.”

More from Jed Kolko, Trulia Chief Economist: Asking Prices Rise 2.3% Year Over Year: Biggest Increase Since Recession