by Calculated Risk on 9/17/2012 11:38:00 AM

Monday, September 17, 2012

FNC: Residential Property Values increased 0.8% in July

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and other house price indexes.

FNC released their July index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.8% in July compared to June (Composite 100 index). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.8% and 0.9% in July. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Since this index is NSA, the month-to-month changes will probably turn negative later this year. However this is the first month-to-month increase for the month of July since 2006.

The year-over-year trends continued to show improvement in July, with the 100-MSA composite up 0.6% compared to July 2011. This is the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

Click on graph for larger image.

Click on graph for larger image.

This graph is based on the FNC index (four composites) through July 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Some of the month-to-month gain is seasonal since this index is NSA. The key is the indexes are now showing a year-over-year increase in July.

The July Case-Shiller index will be released next week on Tuesday, September 25th.

NY Fed Empire State Mfg Index declines in September

by Calculated Risk on 9/17/2012 08:41:00 AM

From MarketWatch: Empire State index hits nearly two-year low

The Empire State index decreased to negative 10.4 in September from negative 5.9 in August, according to the manufacturing survey released by the New York Federal Reserve. It is the lowest reading since November 2010.The number of employees fell from 16.47 in August to 4.3 in September. This was significantly below expectations of a reading of minus 2.0.

The new-orders index worsened to negative 14.0 in September from negative 5.5 in August.

One bright spot in the report was an increase in a key barometer of future activity that asks manufacturers about expectations six months ahead. The forward-looking index rose to 27.2 in September from 15.2 in August.

The index of the number of employees fell sharply in September but remained slightly above negative territory at 4.3.

Manufacturing remains a weak spot for the US economy.

Sunday, September 16, 2012

Sunday Night Futures

by Calculated Risk on 9/16/2012 09:55:00 PM

This could slow down the QE3 mortgage transmission mechanism, from the Financial Times: QE3 hit by mortgage processing delays

“In the very near term [QE3] has virtually no transfer mechanism whatsoever to the customer,” said one executive at a leading lender, who requested anonymity. “Originators are massively backlogged in terms of origination volumes.”The Asian markets are mixed tonight, with the Shanghai down 0.3% and the Hang Seng up 0.3%.

Excerpt with permission

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down almost 5 points, and the DOW futures down 32 points.

Oil prices are moving up WTI futures are at $99.00 and Brent is at $117.44 per barrel.

On Monday:

• At 8:30 AM ET, the NY Fed will release the Empire State Manufacturing Survey for September. The consensus is for a reading of minus 2.0, up from minus 5.8 in August (below zero is contraction).

Yesterday:

• Summary for Week Ending Sept 14th

• Schedule for Week of Sept 16th

Three more questions this week for the September economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

QE3 and the Residential Investment Transmission Mechanism

by Calculated Risk on 9/16/2012 01:29:00 PM

From Paul Krugman: How Could QE Work?

[A]t this point it’s not at all clear that we have an overhang of excess housing capacity; we might even have a shortfall.This is similar to the argument I made last weekend:

And we’re seeing a modest housing recovery starting ...

...

This means that we actually can hope that the Fed’s new policy will boost housing as well as operating through other channels, and therefore that it can act more like conventional monetary policy in fostering recovery.

That said, I’m still skeptical about whether monetary policy alone can come close to doing enough — a skepticism shared by Ben Bernanke:

So looking at all the different channels of effect, we think it does have impact on the economy, it will have impact on the labor market but as again, the way I would describe it is a meaningful effect, a significant effect but not a panacea, not a solution for the whole issue.We still need fiscal policy. But it’s good to see the Fed doing more.

[O]ne of the key transmission channels for monetary policy is through residential investment and mortgages. The previous rounds of QE (and "twist") have lowered mortgage rates and allowed homeowners with excellent credit and income to refinance. However this channel has been limited ...Note: Krugman's comment on "overhang of excess housing" is very important. Although there isn't good timely data on household formation and the housing stock, I do think most of the excess supply has been absorbed.

As residential investment recovers, and house prices increase (or at least stabilize), this channel will probably become more effective.

Last month I summarized some of The economic impact of a slight increase in house prices. This includes mortgage lenders and appraisers becoming more confident in the mortgage and housing markets. I think that is starting to happen, and I think QE might have more traction now through the housing channel.

For another view on QE3, see Jim Hamilton's: Effects of QE3

I think the correct interpretation of QE3 is that the Fed has unambiguously signaled that it's not going to re-run the Japanese experiment to see what happens when the central bank stands by and watches wages and prices fall even while unemployment remains very high. The Fed can and will keep U.S. inflation from falling much below 2%, and that may help a little. Investors should expect that, and not a whole lot more.And for those who think commodity prices will soar, I suggest Michael Pettis' analysis of supply and demand: By 2015 hard commodity prices will have collapsed

Yesterday:

• Summary for Week Ending Sept 14th

• Schedule for Week of Sept 16th

Housing: Year over Year change in Asking Prices

by Calculated Risk on 9/16/2012 10:00:00 AM

According to housingtracker, median asking prices are up 2.1% year-over-year in early September. We can't read too much into this increase because these are just asking prices, and median prices can be distorted by the mix. As an example, the median asking price might have increased just because there are fewer low priced foreclosures listed for sale.

Note: The Trulia asking price index is adjusted for both mix and seasonality, but the housingtracker data is just the median, the 25th percentile and 75th percentile - and is impacted by both changes in the mix and seasonality.

But with those caveats, here is a graph of asking prices compared to the year-over-year change in the Case-Shiller composite 20 index.

Click on graph for larger image.

Click on graph for larger image.

The Case-Shiller index is in red. The brief period in 2010 with a year-over-year increase in the repeat sales index was related to the housing tax credit.

Also note that the 25th percentile took the biggest hit (that was probably the flood of low end foreclosures on the market).

Now the year-over-year change in median asking prices has been positive for ten consecutive months. We have to be careful about the mix (fewer foreclosures on the market), but this suggests year-over-year selling prices will stay positive.

On seasonality, asking prices peaked in June and are down slightly over the last three months. That is a reminder that the Not Seasonally Adjusted repeat sales indexes will show month-to-month declines later this year - and the focus will be on the year-over-year change.

Yesterday:

• Summary for Week Ending Sept 14th

• Schedule for Week of Sept 16th

Saturday, September 15, 2012

Unofficial Problem Bank list declines to 886 Institutions

by Calculated Risk on 9/15/2012 07:07:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 14, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

There were two removals and one addition to the Unofficial Problem Bank List, which leaves it standing at 886 institutions with assets of $330.5 billion. A year ago, the list held 984 institutions with assets of $402.4 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

The failed Truman Bank, St. Louis, MO ($282 million) and Alliant Bank, Sedgwick, KS, which merged out of existence on an unassisted basis. Added this week was The State Bank of Geneva, Geneva, IL ($84 million). Next week, we anticipate the OCC will release its actions through mid-August 2012.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Sept 14th

• Schedule for Week of Sept 16th

Schedule for Week of Sept 16th

by Calculated Risk on 9/15/2012 01:10:00 PM

Earlier:

• Summary for Week Ending Sept 14th

There are three key housing reports to be released this week: September homebuilder confidence on Tuesday, and August housing starts and August Existing Home sales, both on Wednesday.

For manufacturing, the September NY Fed (Empire state) and Philly Fed surveys will be released this week.

Also, for data nerds, the Fed's Q2 Flow of Funds report, and the Census Bureau's 2011 American Community Survey will be released.

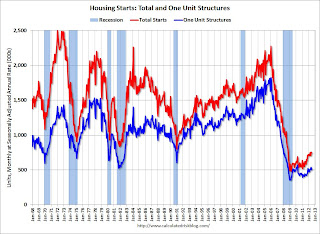

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. Total housing starts were at 746,000 (SAAR) in July, down 1.1% from the revised June rate of 754,000 (SAAR).

The consensus is for total housing starts to increase to 768,000 (SAAR) in August, up from 746,000 in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for sales of 4.55 million on seasonally adjusted annual rate (SAAR) basis. Sales in July 2012 were 4.47 million SAAR.

A key will be inventory and months-of-supply.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for September. The consensus is for a reading of 51.5, down from 51.9 in August.

10:00 AM: Philly Fed Survey for September. The consensus is for a reading of minus 4.0, up from minus 7.1 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for September. The consensus is no change in this index.

12:00 PM: Q2 Flow of Funds Accounts from the Federal Reserve.

Note: On Thursday, the Census Bureau will release the 2011 American Community Survey estimates.

Summary for Week Ending Sept 14th

by Calculated Risk on 9/15/2012 08:07:00 AM

The key event of the week was the FOMC announcement. Here were my posts:

• FOMC Statement: QE3 $40 Billion per Month, Extend Guidance to mid-2015

• FOMC Projections and Bernanke Press Conference

• Analysis: Bernanke Delivered

In other news, retail sales were strong due to higher gasoline prices. From Merrill Lynch:

Gasoline prices surged in the month, forcing consumers to spend more at the pump. Gasoline station sales climbed 5.5%, contributing to the majority of the gain in total sales. Netting out gasoline station sales, spending was only up 0.3%. ...Some of the other data was impacted by hurricane Isaac: Industrial production declined although this was partially due to the impact of Hurricane Isaac and weekly unemployment claims increased - also partially blamed on the hurricane.

Outside of gasoline, autos and building materials, core control sales fell 0.1%. This was a decidedly weak report, showing a pullback in consumer spending. ...

The combination of weak August core retail sales and a downward revision to July and June (0.1pp in each month), slices 0.4pp from our Q3 GDP tracking model. We are now looking for GDP growth of only 1.1% in Q3.

In a little good news, consumer sentiment increased some in September.

Overall this suggests more sluggish growth.

Here is a summary of last week in graphs:

• Retail Sales increased 0.9% in August

Click on graph for larger image.

Click on graph for larger image.On a monthly basis, retail sales were up 0.9% from July to August (seasonally adjusted), and sales were up 4.7% from August 2011. This increase was largely due to higher gasoline prices.

Sales for July were revised down to a 0.6% increase (from 0.8% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.7% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted)

This was above the consensus forecast for retail sales of a 0.8% increase in August, and above (edit) the consensus for a 0.7% increase ex-auto.

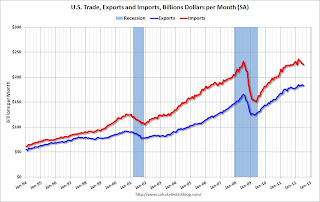

• Trade Deficit at $42.0 Billion in July

The Department of Commerce reported: "[T]otal July exports of $183.3 billion and imports of $225.3 billion resulted in a goods and services deficit of $42.0 billion, up from $41.9 billion in June, revised. July exports were $1.9 billion less than June exports of $185.2 billion. July imports were $1.8 billion less than June imports of $227.1 billion."

The Department of Commerce reported: "[T]otal July exports of $183.3 billion and imports of $225.3 billion resulted in a goods and services deficit of $42.0 billion, up from $41.9 billion in June, revised. July exports were $1.9 billion less than June exports of $185.2 billion. July imports were $1.8 billion less than June imports of $227.1 billion."The trade deficit was below the consensus forecast of $44.3 billion.

This graph shows the monthly U.S. exports and imports in dollars through July 2012.

Exports are 10% above the pre-recession peak and up 3% compared to July 2011; imports are just below the pre-recession peak, and up about 1% compared to July 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

• Industrial Production declined 1.2% in August, Capacity Utilization decreased

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 78.2% is still 2.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.Industrial production decreased in August to 96.8. This is 16% above the recession low, but still 3.9% below the pre-recession peak.

The consensus was for Industrial Production to decrease 0.1% in August, and for Capacity Utilization to decline to 79.2%. Both IP and Capacity Utilization were below expectations.

• Consumer Sentiment increases in September to 79.2

The preliminary Reuters / University of Michigan consumer sentiment index for September increased to 79.2, up from the August reading of 74.3.

The preliminary Reuters / University of Michigan consumer sentiment index for September increased to 79.2, up from the August reading of 74.3.This was above the consensus forecast of 73.5 but still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

• Weekly Initial Unemployment Claims increase to 382,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.This was above the consensus forecast of 370,000.

Via MarketWatch: "The government said about 9,000 claims stemmed from the storm that passed through the Gulf Coast in late August."

The 4-week average of unemployment claims has mostly moved sideways this year.

• BLS: Job Openings "little changed" in July

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings decreased in July to 3.664 million, down from 3.722 million in June. The number of job openings (yellow) has generally been trending up, and openings are up about 9% year-over-year compared to July 2011.

Quits increased slightly in July, and quits are up about 8% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• Other Economic Stories ...

• Key Measures show slowing inflation in August

• Lawler: Where has the increase in the number of renters of Single Family homes come from?

• CoreLogic: Negative Equity Decreases in Q2 2012

• Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in August

Friday, September 14, 2012

Fiscal Cliff: Goldman note and Merle Hazard

by Calculated Risk on 9/14/2012 08:52:00 PM

An excerpt from a Goldman Sachs research note by Alec Phillips today: The Fiscal Cliff Moves to Center Stage

While we are hopeful that lawmakers will manage to reach an agreement before year-end, we expect that the road to such an agreement will be a bumpy one.I've just been ignoring the "fiscal cliff" until after the election. I suspect some sort of deal will be reached - but you never know.

Ahead of the election, lawmakers seem unlikely to reach any sort of compromise on major tax or spending policies, particularly now that the window for a legislative agreement is essentially closed. Once the election results are known, lawmakers will work toward compromise, but members of both parties have an incentive to make the threat of “falling off the cliff” appear as credible as possible, so a resolution in November, or even early December, seems unlikely. Indeed, under a status quo election outcome, for example, a decision on even a short-term extension of expiring policies seems unlikely until late December, since political compromise would presumably come only after all other options have been exhausted.

... we think there is at least a one in three likelihood that lawmakers fail to agree by December 31. ... if a deal is reached by the end of the year it may not provide much certainty in 2013. After all, the debt limit may still need to be raised, and the since the most likely scenario seems to be a short-term extension of fiscal cliff-related policies, the risks from fiscal policy seem likely to continue into 2013, regardless of how the fiscal cliff is dealt with at year end.

Meanwhile, here is an animated version of Merle Hazard's "Fiscal Cliff"

Bank Failure #42 in 2012: Truman Bank, Saint Louis, Missouri

by Calculated Risk on 9/14/2012 06:13:00 PM

Presidential paraphrase

“The buck won’t stop here”.

by Soylent Green is People

From the FDIC: Simmons First National Bank, Pine Bluff, Arkansas, Assumes All of the Deposits of Truman Bank, Saint Louis, Missouri

As of June 30, 2012, Truman Bank had approximately $282.3 million in total assets and $245.7 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $34.0 million. ... Truman Bank is the 42nd FDIC-insured institution to fail in the nation this year, and the second in Missouri.Friday is here!

August Update: Early Look at 2013 Cost-Of-Living Adjustments indicates 1.4% increase

by Calculated Risk on 9/14/2012 02:50:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.7 percent over the last 12 months to an index level of 227.056 (1982-84=100). For the month, the index increased 0.7 percent prior to seasonal adjustment."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

SPECIAL NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could happen next year and impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained

Since the highest Q3 average was last year (2011), at 223.233, we only have to compare to last year. Note: The last few years we needed to compare to Q3 2008 since that was the previous highest Q3 average.

Click on graph for larger image.

Click on graph for larger image.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Currently CPI-W is above the Q3 2011 average. If the current level holds, COLA would be around 1.4% for next year (the current 226.312 average divided by the Q3 2011 level of 223.233). With the recent increases in oil and gasoline prices, CPI COLA might be closer to 1.6% once the September data is released.

This is early - we need the data for September - but COLA will be slightly positive next year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.This is based on a one year lag. The National Average Wage Index is not available for 2011 yet, but wages probably didn't increase much from 2010. If wages increased the same as last year, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $112,500 from the current $110,100.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.

Key Measures show slowing inflation in August

by Calculated Risk on 9/14/2012 01:03:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.8% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for August here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.6% (7.5% annualized rate) in August. The CPI less food and energy increased 0.1% (0.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and core CPI rose 1.9%. Core PCE is for July and increased 1.6% year-over-year.

On a monthly basis (annualized), two of these measure were at or below the Fed's target; trimmed-mean CPI was at 2.0%, Core CPI at 0.6% - although median CPI was at 2.8%. Core PCE for July was at 0.3%. These measures suggest inflation is now mostly below the Fed's target of 2% on a year-over-year basis and it appears the inflation rate is slowing.

Consumer Sentiment increases in September to 79.2

by Calculated Risk on 9/14/2012 09:58:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for September increased to 79.2, up from the August reading of 74.3.

This was above the consensus forecast of 73.5 but still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

Industrial Production declined 1.2% in August, Capacity Utilization decreased

by Calculated Risk on 9/14/2012 09:31:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production fell 1.2 percent in August after having risen 0.5 percent in July. Hurricane Isaac restrained output in the Gulf Coast region at the end of August, reducing the rate of change in total industrial production by an estimated 0.3 percentage point. Manufacturing output decreased 0.7 percent in August after having risen 0.4 percent in both June and July. Precautionary shutdowns of oil and gas rigs in the Gulf of Mexico in advance of the hurricane contributed to a drop of 1.8 percent in the output of mines for August. The output of utilities declined 3.6 percent. At 96.8 percent of its 2007 average, total industrial production in August was 2.8 percent above its year-earlier level. Capacity utilization for total industry moved down 1.0 percentage point to 78.2 percent, a rate 2.1 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.2% is still 2.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in August to 96.8. This is 16% above the recession low, but still 3.9% below the pre-recession peak.

The consensus was for Industrial Production to decrease 0.1% in August, and for Capacity Utilization to decline to 79.2%. Both IP and Capacity Utilization were below expectations.

Retail Sales increased 0.9% in August

by Calculated Risk on 9/14/2012 08:47:00 AM

On a monthly basis, retail sales were up 0.9% from July to August (seasonally adjusted), and sales were up 4.7% from August 2011. This increase was largely due to higher gasoline prices. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $406.7 billion, an increase of 0.9 percent from the previous month and 4.7 percent (±0.7%) above August 2011. ... The June to July 2012 percent change was revised from 0.8 percent to 0.6 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for July were revised down to a 0.6% increase (from 0.8% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.7% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). This shows that much of the recent increase is due to gasoline.

The second graph shows the same data, but just since 2006 (to show the recent changes). This shows that much of the recent increase is due to gasoline.Excluding gasoline, retail sales are up 19.3% from the bottom, and now 7.2% above the pre-recession peak (not inflation adjusted).

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.9% on a YoY basis (4.7% for all retail sales). Retail sales ex-gasoline increased 0.3% in August.

This was above the consensus forecast for retail sales of a 0.8% increase in August, and above (edit) the consensus for a 0.7% increase ex-auto.

This was above the consensus forecast for retail sales of a 0.8% increase in August, and above (edit) the consensus for a 0.7% increase ex-auto. Thursday, September 13, 2012

Friday: Retail Sales, Industrial Production, CPI

by Calculated Risk on 9/13/2012 08:49:00 PM

First, Tom Lawler has been discussing the rental demand for single family homes. He sent me this article today: Phoenix-area rental homes a red-hot commodity

In the Valley’s most popular communities, desperate renters are submitting applications for multiple single-family homes to secure a place to live. ... The unprecedented demand for rentals is fueled by former homeowners whose houses were foreclosed on or sold in short sales and now need a place to live. Some of them can no longer qualify to buy a home. For others, the housing bubble sullied the aura of owning a home.On Friday:

With the trend showing no sign of slowing, more investors than ever are buying homes to rent. Popular areas such as central and north Phoenix, south Scottsdale, Glendale, central Tempe, Chandler and Gilbert are hot spots for rentals.

Multiple indicators show demand for rentals has never been higher:

More rental contracts were signed in June and July than in any other months in the past decade, according to the Arizona Regional Multiple Listing Service.

The percentage of single-family homes purchased to be rented out hit a record 32 percent in July, more than triple the typical rate, said Mike Orr, a real-estate analyst at Arizona State University.

In July, the average rental home was empty for only 38 days, tied for the shortest period in 12 years, Orr said.

The vacancy rate for big apartment complexes recently hit an almost six-year low as of June 30, according to commercial broker Marcus & Millichap.

“It’s a crazy rental market right now,” said Liza Asbury of Realty One Group. “There are multiple offers for properties. If it (the home) is nice, it is definitely going fast.”

• At 8:30 AM ET, the Consumer Price Index for August will be released. The consensus is for CPI to increase 0.6% in August and for core CPI to increase 0.2%.

• Also at 8:30 AM, Retail Sales for August will be released. The consensus is for retail sales to increase 0.8% in August, and for retail sales ex-autos to increase 0.7%.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is that Industrial Production declined 0.1% in August, and that Capacity Utilization declined to 79.2%.

• At 9:55 AM, the Reuters/University of Michigan's Consumer sentiment index will be released (preliminary for September). The consensus is for sentiment to decrease to 74.0 from 73.5 in August.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales report for July (Business inventories) will be released. The consensus is for 0.5% increase in inventories.

Two more questions for the September economic prediction contest:

Analysis: Bernanke Delivered

by Calculated Risk on 9/13/2012 04:45:00 PM

The FOMC delivered everything I expected - and more. This was a very strong move and I suspect many analysts are underestimating the potential positive impact on the economy.

However, as Fed Chairman said, monetary policy is "not a panacea". I do think this will help, but this will not solve the unemployment problem.

Here are a few key points:

• Forward guidance is a critical part of Fed policy (see Michael Woodford's paper presented at Jackson Hole). The FOMC didn't go as far as targeting nominal GDP, but they took two key steps today: 1) they extended the forward guidance until mid-2015, and 2) the FOMC made it clear that "a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens". "AFTER the economic recovery strengthens" is key.

• This easing was not based on new economic weakness. From the FOMC statement: "economic activity has continued to expand at a moderate pace in recent months". This easing was intended to help increase the pace of recovery.

• Another key change was the FOMC tied this easing directly to the labor market: "If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability."

• I think this will be more effective than most analysts expect. As I noted last weekend, housing is usually a key transmission channel for monetary policy, and now that residential investment has started to recover - and house price have stabilized, or even started to increase, this channel will probably become more effective.

I also liked that Bernanke addressed three concerns that have been raised about monetary policy. Note: The replay of the press conference is available here.

The first "concern" was that some people are confusing fiscal and monetary policy. Monetary policy is NOT spending (see Bernanke's comments at 7:00).

The other two are legitimate concerns - that the Fed policies can hurt savers, and that there is a risk of inflation down the road. I agree with Bernanke that a stronger economy will lead to better returns for savers, and that inflation is not an immediate concern.

FOMC Projections and Bernanke Press Conference

by Calculated Risk on 9/13/2012 02:00:00 PM

Here are the updated projections from the FOMC meeting.

Fed Chairman Ben Bernanke's press conference starts at 2:15 PM ET. Here is the video stream.

Live Video streaming by Ustream

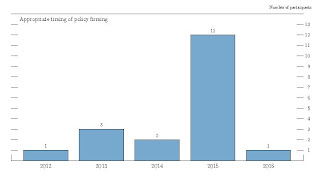

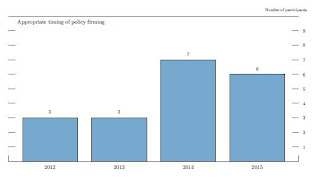

Below are the updated projections starting with when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate. I've included the chart from the June meeting to show the change.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

There was a clear shift to 2015.

Another key is very few participants think the FOMC should raise rates before 2015.

Most participants still think the Fed Funds rate will be in the current range through 2014.

The four tables below show the FOMC Sept meeting projections, and the June projections to show the change.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 2.0 | 2.5 to 3.0 | 3.0 to 3.8 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

GDP projections have been revised down for 2012, and revised up for 2013 and 2014.

The unemployment rate was at 8.1% in August, and the projection for 2012 is unchanged. The projection for 2014 was revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 8.0 to 8.2 | 7.6 to 7.9 | 6.7 to 7.3 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

The forecasts for overall and core inflation show the FOMC is still not concerned about inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.8 | 1.6 to 2.0 | 1.6 to 2.0 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.9 | 1.7 to 2.0 | 1.8 to 2.0 |

| June 2012 Projections | 1.7 to 2.0 | 1.6 to 2.0 | 1.6 to 2.0 |

FOMC Statement: QE3 $40 Billion per Month, Extend Guidance to mid-2015

by Calculated Risk on 9/13/2012 12:33:00 PM

Information received since the Federal Open Market Committee met in August suggests that economic activity has continued to expand at a moderate pace in recent months. Growth in employment has been slow, and the unemployment rate remains elevated. Household spending has continued to advance, but growth in business fixed investment appears to have slowed. The housing sector has shown some further signs of improvement, albeit from a depressed level. Inflation has been subdued, although the prices of some key commodities have increased recently. Longer-term inflation expectations have remained stable.Here is the previous FOMC Statement for comparison.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee is concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely would run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed additional asset purchases and preferred to omit the description of the time period over which exceptionally low levels for the federal funds rate are likely to be warranted.

Weekly Initial Unemployment Claims increase to 382,000

by Calculated Risk on 9/13/2012 08:30:00 AM

The DOL reports:

In the week ending September 8, the advance figure for seasonally adjusted initial claims was 382,000, an increase of 15,000 from the previous week's revised figure of 367,000. The 4-week moving average was 375,000, an increase of 3,250 from the previous week's revised average of 371,750The previous week was revised up from 365,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.

This was above the consensus forecast of 370,000.

Update via MarketWatch: "The government said about 9,000 claims stemmed from the storm that passed through the Gulf Coast in late August."

And here is a long term graph of weekly claims:

Mostly moving sideways this year.