by Calculated Risk on 9/25/2012 09:00:00 AM

Tuesday, September 25, 2012

Case-Shiller: House Prices increased 1.2% year-over-year in July

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of May, June and July).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Increase Again in July 2012 According to the S&P/Case-Shiller Home Price Indices

Data through July 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed average home prices increased by 1.5% for the 10-City Composite and by 1.6% for the 20-City Composite in July versus June 2012. For the third consecutive month, all 20 cities and both Composites recorded positive monthly changes. It would have been a fourth had prices not fallen by 0.6% in Detroit back in April.

The 10- and 20-City Composites posted annual returns of +0.6% and +1.2% in July 2012, up from their unchanged and +0.6% annual rates posted for June 2012. Fifteen of the 20 MSAs and both Composites posted better annual returns in July as compared to June 2012.

...

“Home prices increased again in July,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “All 20 cities and both Composites were up on the month for the third time in a row. Even better, 16 of the 20 cities and both Composites rose over the last year. Atlanta remains the weakest city but managed to cut the annual loss to just under 10%.

“Among the cities, Miami and Phoenix are both well off their bottoms with positive monthly gains since the end of 2011. Many of the markets we follow have seen some decent recovery from their respective lows – San Francisco up 20.4%, Detroit up 19.7%, Phoenix up 17.0% and Minneapolis up 16.5%, to name the top few. These were some of the markets that were hit the hardest when the housing bubble burst in 2006.

Click on graph for larger image.

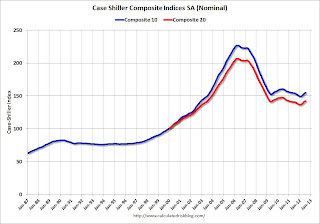

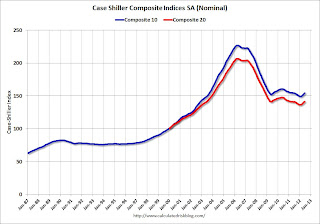

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.7% from the peak, and up 0.4% in July (SA). The Composite 10 is up 3.7% from the post bubble low set in March (SA).

The Composite 20 index is off 31.2% from the peak, and up 0.4% (SA) in July. The Composite 20 is up 4.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 0.6% compared to July 2011.

The Composite 20 SA is up 1.2% compared to July 2011. This was the second year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in July seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 5.9% from the peak. Note that the red column (cumulative decline through July 2012) is above previous declines for all cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in July seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 5.9% from the peak. Note that the red column (cumulative decline through July 2012) is above previous declines for all cities.This was at the consensus forecast and the recent change to a year-over-year increase is significant. I'll have more on prices later.

Monday, September 24, 2012

Tuesday: House Prices

by Calculated Risk on 9/24/2012 09:27:00 PM

On Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for July will be released. The consensus is for a 1.2% year-over-year increase in the Composite 20 index (NSA) for July. The Zillow forecast is for the Composite 20 to increase 1.6% year-over-year, and for prices to increase 1.0% month-to-month seasonally adjusted.

• At 10:00 AM, the FHFA House Price Index for July 2012 will be released. The consensus is for a 0.8% increase in house prices.

• Also at 10:00 AM, the Conference Board's consumer confidence index for September will be released. The consensus is for an increase to 64.8 from 60.6 last month.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for September will be released. The consensus is for an increase to -4 for this survey from -9 in August (below zero is contraction).

A question for the September economic prediction contest:

Tim Duy: "Policy is effective even in the aftermath of a financial crisis"

by Calculated Risk on 9/24/2012 06:18:00 PM

This is an excellent followup to Josh Lehner's post (and the graph I posted) earlier today showing that the US recovery is doing better than most recoveries following a financial crisis.

From Tim Duy at EconomistsView: Excuses Not To Do More. Duy discusses Reinhart and Rogoff and excerpts from a piece by Ezra Klein:

...if you look at the leaked memo that the Obama administration was using when they constructed their stimulus, you’ll find, on page 10 and 11, a list of prominent economists the administration consulted as to the proper size for the stimulus package. And there, on page 11, is Rogoff, with a recommendation of “$1 trillion over two years” — which is actually larger than the American Recovery and Reinvestment Act. So if they’d been following Rogoff’s advice, the initial stimulus would have been even bigger — not nonexistent.Then Duy added this update:

As for Reinhart, I asked her about this for a retrospective I did on the Obama administration’s economic policy. “The initial policy of monetary and fiscal stimulus really made a huge difference,” she told me. “I would tattoo that on my forehead. The output decline we had was peanuts compared to the output decline we would otherwise have had in a crisis like this. That isn’t fully appreciated.”

Update: I notice some Twitter chatter of surprise that Rogoff was not completely opposed to fiscal stimulus (I thought everyone read Ezra Klein).The key point here is that short term stimulus, in a depressed economy, can actually reduce the long term deficit.

Fed's Williams: Economic Outlook

by Calculated Risk on 9/24/2012 03:25:00 PM

From San Francisco Fed President John Williams: The Economic Outlook and Challenges to Monetary Policy. A few excerpts:

In considering what maximum employment is, economists look at the unemployment rate. We tend to think of maximum employment as the level of unemployment that pushes inflation neither up nor down. This is the so-called natural rate of unemployment. It is a moving target that depends on how efficient the labor market is at matching workers with jobs. Although we can’t know exactly what the natural rate of unemployment is at any point in time, a reasonable estimate is that it is currently a little over 6 percent.5 In other words, right now, an unemployment rate of about 6 percent would be consistent with the Fed’s goal of maximum employment. In terms of the Fed’s other statutory goal—price stability—our monetary policy body, the Federal Open Market Committee, or FOMC, has specified that a 2 percent inflation rate is most consistent with our dual mandate.And on the economic outlook:

So, how are we doing on these goals? As I said earlier, the economy continues to grow and add jobs. However, the current 8.1 percent unemployment rate is well above the natural rate, and progress on reducing unemployment has nearly stalled over the past six months. If we hadn’t taken additional monetary policy steps, the economy looked like it could get stuck in low gear. That would have meant that, over the next few years, we would make relatively modest further progress on our maximum employment mandate. What’s more, the job situation could get worse if the European crisis intensifies or we go over the fiscal cliff. Progress on our other mandate, price stability, might also have been threatened. Inflation, which has averaged 1.3 percent over the past year, could have gotten stuck below our 2 percent target.

For the FOMC, this was the sobering set of circumstances we were staring at during our most recent policy meeting. Faced with this situation, it was essential that we at the Fed provide the stimulus needed to keep our economy moving toward maximum employment and price stability. So, at our meeting, we took two strong measures aimed at achieving this goal.

First, we announced a new program to purchase $40 billion of mortgage-backed securities every month. This is in addition to our ongoing program to expand our holdings of longer-term Treasury securities by $45 billion a month. Second, we announced that we expect to keep short-term interest rates low for a considerable time, even after the economy strengthens. Specifically, we expect exceptionally low levels of our benchmark federal funds rate at least through mid-2015.

Thanks in part to the recent policy actions, I anticipate the economy will gain momentum over the next few years. I expect real gross domestic product to expand at a modest pace of about 1¾ percent this year, but to improve to 2½ percent growth next year and 3¼ percent in 2014. With economic growth trending upward, I see the unemployment rate gradually declining to about 7¼ percent by the end of 2014. Despite improvement in the job market, I expect inflation to remain slightly below 2 percent for the next few years as increases in labor costs remain subdued and public inflation expectations stay at low levels.With this forecast, QE3 will continue for some time.

Of course, my projections, like any forecast, may turn out to be wrong. That’s something we kept in mind when we designed our new policy measures. Specifically, an important new element is that our recently announced purchase program is intended to be flexible and adjust to changing circumstances. Unlike our past asset purchase programs, this one doesn’t have a preset expiration date. Instead, it is explicitly linked to what happens with the economy. In particular, we will continue buying mortgage-backed securities until the job market looks substantially healthier. We said we might even expand our purchases to include other assets.

This approach serves as a kind of automatic stabilizer for the economy. If conditions improve faster than expected, we will end the program sooner, cutting back the degree of monetary stimulus. But, if the economy stumbles, we will keep the program in place as long as needed for the job market to improve substantially, in the context of price stability. Similarly, if we find that our policies aren’t doing what we want or are causing significant problems for the economy, we will adjust or end them as appropriate.

Employment Losses: Comparing Financial Crises

by Calculated Risk on 9/24/2012 01:15:00 PM

Last year economist Josh Lehner posted a number of charts and graphs as an update to work by Carmen Reinhart and Kenneth Rogoff: This Time is Different, An Update

Today, Lehner updated a few graphs again (through August, 2012). See: Checking in on Financial Crises Recoveries. Here is one graph and an excerpt:

Click on graph for larger image.

Click on graph for larger image.

From Lerner:

[W]hen the Great Recession is compared ... to the Big 5 financial crises and the U.S. Great Depression ... the current cycle actually compares pretty favorably. This is likely due to the coordinated global response to the immediate crises in late 2008 and early 2009. While the initial path of both the global and U.S. economies in 2008 and 2009 effectively matched the early years of the Great Depression – or worse – the strong policy response employed by nearly all major economies – both monetary and fiscal – helped stop the economic free fall.

Dallas Fed: Texas factory activity increased in September

by Calculated Risk on 9/24/2012 10:38:00 AM

From the Dallas Fed: Texas Manufacturing Growth Picks Up

Texas factory activity increased in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 6.4 to 10, suggesting stronger output growth.This is still weak, and the general business activity index has been negative 5 of last 6 months.

Other measures of current manufacturing activity also indicated growth in September. The new orders index rose to 5.3 following a reading of zero last month, suggesting a pickup in demand. The capacity utilization index advanced from 1.7 to 9.3, largely due to fewer manufacturers noting a decrease. The shipments index rose to 4.5, bouncing back into positive territory after falling to -2.3 in August.

Indexes reflecting broader business conditions were mixed. The general business activity index remained slightly negative but edged up from -1.6 to -0.9. The company outlook index was positive for the fifth month in a row but fell slightly to 2.4 from a reading of 4.1 in August.

Labor market indicators reflected slower labor demand growth and slightly longer workweeks. The employment index remained positive but fell to 5.9, its lowest reading in more than a year. Sixteen percent of firms reported hiring new workers, while 10 percent reported layoffs. The hours worked index moved up from -0.9 to 2.8.

LPS: Mortgage delinquencies decreased in August

by Calculated Risk on 9/24/2012 09:08:00 AM

LPS released their First Look report for August today. LPS reported that the percent of loans delinquent decreased in August from July, and declined about 10% year-over-year. The percent of loans in the foreclosure process also decreased in August, but remain at a very high level.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 6.87% from 7.03% in July. The percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.57%, so delinquencies have fallen over half way back to normal. The percent of loans in the foreclosure process declined to 4.04%.

The table below shows the LPS numbers for August 2012, and also for last month (July 2012) and one year ago (August 2011).

The number of delinquent properties, but not in foreclosure, is down about 10% year-over-year (530,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 5% or 100,000 year-over-year.

The percent of loans less than 90 days delinquent is close to normal, but the percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| August 2012 | July 2012 | August 2011 | |

| Delinquent | 6.87% | 7.03% | 7.68% |

| In Foreclosure | 4.04% | 4.08% | 4.12% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,910,000 | 1,960,000 | 2,240,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,520,000 | 1,560,000 | 1,720,000 |

| Number of properties in foreclosure pre-sale inventory: | 2,020,000 | 2,042,000 | 2,120,000 |

| Total Properties | 5,450,000 | 5,562,000 | 6,080,000 |

Chicago Fed: Economic Activity Weakened in August

by Calculated Risk on 9/24/2012 08:39:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Weakened in August

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.87 in August from –0.12 in July. All four broad categories of indicators that make up the index deteriorated from July, with each making a negative contribution to the index in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased from –0.26 in July to –0.47 in August—its lowest level since June 2011 and its sixth consecutive reading below zero. August’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests growth was below trend in August.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, September 23, 2012

Sunday Night Futures

by Calculated Risk on 9/23/2012 09:11:00 PM

On Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for August will be released. This is a composite index of other data.

• At 9:00 AM, the LPS "First Look" Mortgage Delinquency report for August will be released. Look for a decline in the delinquency rate.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for September will be released. The consensus is for 0.5 for the general business activity index, up from -1.6 in August.

• At 3:00 PM, San Francisco Fed President John Williams (voting member) speaks at The City Club of San Francisco, Jamison Roundtable Luncheon. This speech will be closely watched for any hints of possible "thresholds" with regard to QE3 and the unemployment rate and inflation.

The Asian markets are down tonight, with the Nikkei down 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down almost 2 points, and the DOW futures down 10 points.

Oil prices are mixed with WTI futures up slightly at $92.61 and Brent down at $111.74 per barrel. Both are down sharply from a week ago.

Yesterday:

• Summary for Week Ending Sept 21st

• Schedule for Week of Sept 23rd

• Goldman Estimate: QE3 could be $1.2 to $2.0 Trillion

Four more questions this week for the September economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Update: House Prices will decline month-to-month Seasonally later in 2012

by Calculated Risk on 9/23/2012 12:53:00 PM

I've mentioned this before, but it is probably worth repeating ...The Not Seasonally Adjusted (NSA) house price indexes will show month-to-month declines later this year. This should come as no surprise and will not be a sign of impending doom.

• There is a seasonal pattern for house prices. Prices tend to be stronger in the spring and early summer, and then weaker in the fall and winter.

• Currently there is a stronger than normal seasonal pattern. This is because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have a larger negative impact on prices in the fall and winter.

• Two of the most followed house price indexes are three month averages. This means the indexes lag the month-to-month change. The Case-Shiller report for "July", to be released on Tuesday, is actually an average of May, June and July. The CoreLogic index is a three month average, but weighted to the most recent month. Prices have probably started declining month-to-month seasonally in August or September, but this will not show up in the indexes for several months. (Several real estate agents have told me the seasonal slowdown has started in their areas).

• The key is to watch the year-over-year change and to compare to the NSA lows earlier this year. I think house prices have already bottomed, and will be up slightly year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic (through July) and NSA Case-Shiller Composite 20 index (through June) over the last several years. There is a clear seasonal pattern.

Right now I'm guessing the CoreLogic index will report negative month-to-month price changes for August or September, and Case-Shiller for September or October. Just something to be aware of ...

Yesterday:

• Summary for Week Ending Sept 21st

• Schedule for Week of Sept 23rd

• Goldman Estimate: QE3 could be $1.2 to $2.0 Trillion

Unofficial Problem Bank list declines to 878 Institutions

by Calculated Risk on 9/23/2012 10:37:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 21, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the OCC released its actions through mid-August 2012 that led to many changes in the Unofficial Problem Bank List. This week there 13 removals and five additions leaving the list with 878 institutions with assets of $327.4 billion. A year ago, the list held 986 institutions with assets of $400.4 billion.Yesterday:

Removals from action termination include NCB, FSB, Hillsboro, OH ($1.6 billion); Farmers Bank & Trust, National Association, Great Bend, KS ($655 million); Coconut Grove Bank, Miami, FL ($617 million); Alaska Pacific Bank, Juneau, AK ($177 million Ticker: ALPB); The First National Bank of Milaca, Milaca, MN ($169 million); Peoples National Bank of Mora, Mora, MN ($157 million); The Farmers National Bank of Cynthiana Cynthiana, KY ($104 million); The Mason National Bank, Mason, TX ($90 million).

Removals through unassisted merger were Gateway Business Bank, Cerritos, CA ($181 million); Bank of Naples, Naples, FL ($116 million); Northwest Bank, Lake Oswego, OR ($94 million); and Sonoran Bank, N.A., Phoenix, AZ ($28 million) Border Trust Company, Augusta, ME ($45 million) voluntarily liquidated on August 14, 2012.

The additions were Community Bank, Staunton, VA ($502 million Ticker: CFFC); Slavie Federal Savings Bank, Bel Air, MD ($177 million); Amory Federal Savings and Loan Association, Amory, MS ($99 million); First Capital Bank, Bennettsville SC ($60 million Ticker: FCPB); and United Trust Bank, Palos Heights, IL ($45 million).

Next week, we anticipate for the FDIC to release its actions through August 2012.

Recently, the Treasury Department issued its monthly Congressional TARP update report, which included bank holding companies or institutions that failed to make their August 15th TARP dividend or interest payment. There are 112 institutions on the Unofficial Problem Bank List that directly or are controlled by a parent company that did not make the August 15th payment. Within this group are 43 institutions, including 9 with assets over $1 billion, that have missed 10 or more quarterly payments. See the table for additional details. Theoretically, only healthy banks were eligible for an infusion of capital through the various TARP programs. At least 15 TARP recipients have failed and given the large number of TARP recipients on the Unofficial Problem Bank List, it appears that reality does not comport with theory.

• Summary for Week Ending Sept 21st

• Schedule for Week of Sept 23rd

• Goldman Estimate: QE3 could be $1.2 to $2.0 Trillion

Saturday, September 22, 2012

Goldman Estimate: QE3 could be $1.2 to $2.0 Trillion

by Calculated Risk on 9/22/2012 10:56:00 PM

A few excerpts from a research note by Goldman Sachs chief economist Jan Hatzius:

• ... We now view the Fed as following a looser version of the “threshold rule” championed by Chicago Fed President Charles Evans.The keys will be to watch the unemployment rate and several core measures of inflation. As of August, the unemployment rate was at 8.1% - and mostly moving sideways - and core PCE for July was up 1.6% year-over-year (plenty of room to the 2½%-2¾% range).

• What are the thresholds? We read the committee as signaling that the federal funds rate will not rise until the unemployment rate has fallen to the 6½%-7% range. The corresponding threshold for the end of QE3 may be in the 7%-7½% range.

•These implicit commitments are undoubtedly subject to an inflation ceiling ... may be a year-on-year core PCE reading of 2½%-2¾%.

• All this is subject to change ... The flexibility to respond to such changes is a key advantage of keeping the thresholds implicit rather than explicit.

• ... Under the committee’s economic forecasts, we estimate that the funds rate would stay near zero until mid-2015, while QE3 would run through mid-2014 and total $1.2trn.

• Under our own economic forecasts, we estimate that the funds rate would stay near zero until mid-2016, while QE3 would run through mid-2015 and total just under $2trn.

• If the recovery continues to disappoint, additional steps are possible.

Earlier:

• Summary for Week Ending Sept 21st

• Schedule for Week of Sept 23rd

Summary for Week Ending Sept 21st

by Calculated Risk on 9/22/2012 01:05:00 PM

Once again, the housing news was mostly positive last week and manufacturing was mostly disappointing.

Housing starts were a little below expectations - mostly because of the volatile multi-family sector - but starts are still up sharply from a year ago. Two-thirds of the way through 2012, single family starts are on pace for 515 thousand this year, and total starts are on pace for about 740 thousand.

In 2011, there were 609 total starts, and a record low 430 thousand single family starts. So housing starts are on pace for about a 20% increase from 2011. No wonder builder confidence was at the highest level since June 2006. That is a significant increase and will give the economy a boost.

Existing home sales increased too. The key numbers in the existing home sales report are inventory and months-of-supply. Inventory was down 18.2% year-over-year in August, and months-of-supply declined to 6.1 months - the lowest for the month of August since 2005.

The decline in inventory has been stunning, even for those of us expecting a significant decline - and I expect the year-over-year declines will start to decrease in the coming months.

Unfortunately both regional manufacturing surveys released this week (Empire State and Philly Fed) both showed contraction in September (although the Philly Fed index was close to unchanged).

A final note: The Fed's Flow of Funds survey showed household mortgage debt has decreased by over $1 trillion from the peak. Some of this decline is from homeowners paying down their mortgage (perhaps to refinance), but most of the decline was due to foreclosures or short sales (defaults). This reminded me of some of my posts from years ago ... new readers might not realize I was once one of the biggest bears around, see: The Trillion Dollar Bear

Here is a summary of last week in graphs:

• Housing Starts increased to 750 thousand in August

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 750 thousand (SAAR) in August, up 2.3% from the revised July rate of 733 thousand (SAAR). Note that July was revised from 746 thousand.

Single-family starts increased 5.5% to 535 thousand in August.

Total starts are up 57% from the bottom start rate, and single family starts are up 51% from the low.

This was below expectations of 768 thousand starts in August, but the key is starts are up solidly from last year. Right now starts are on pace to be up about 25% from 2011. Also total permits are up sharply from last year.

• Existing Home Sales in August: 4.82 million SAAR, 6.1 months of supply

The NAR reports: August Existing-Home Sales and Prices Rise

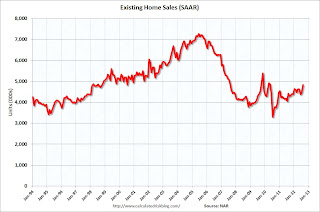

The NAR reports: August Existing-Home Sales and Prices RiseThis graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2012 (4.82 million SAAR) were 7.8% higher than last month, and were 9.3% above the August 2011 rate.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 18.2% year-over-year in August from August 2011. This is the eighteenth consecutive month with a YoY decrease in inventory.

Months of supply declined to 6.1 months in August.

This was above expectations of sales of 4.55 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• AIA: Architecture Billings Index shows slight expansion in August

From AIA: Architecture Billings Index Inches Back into Positive Territory

From AIA: Architecture Billings Index Inches Back into Positive TerritoryThis graph shows the Architecture Billings Index since 1996. The index was at 50.2 in August, up from 48.7 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

• Weekly Initial Unemployment Claims at 382,000

The DOL reports: "In the week ending September 15, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 3,000 from the previous week's revised figure of 385,000." The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.

The DOL reports: "In the week ending September 15, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 3,000 from the previous week's revised figure of 385,000." The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.This was above the consensus forecast of 373,000.

• Empire State and Philly Fed Manufacturing Surveys show contraction in September

From the Philly Fed: September Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 5 points, to a reading of -1.9."

From the Philly Fed: September Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 5 points, to a reading of -1.9."From MarketWatch: Empire State index hits nearly two-year low

This graph compares the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys increased slightly in September, and has remained negative for four consecutive months. This suggests another weak reading for the ISM manufacturing index.

• Fed's Q2 Flow of Funds: Household Mortgage Debt down $1 Trillion from Peak

The Federal Reserve released the Q2 2012 Flow of Funds report this week: Flow of Funds.

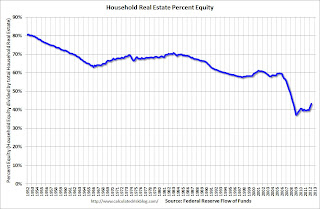

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2012, household percent equity (of household real estate) was at 43.1% - up from Q1, and the highest since Q2 2008. This was because of a small increase in house prices in Q2 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 43.1% equity - and over 10 million have negative equity.

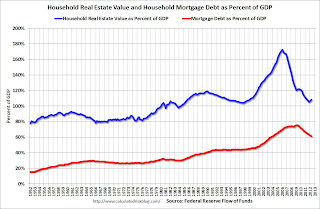

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt declined by $51 billion in Q2. Mortgage debt has now declined by $1.05 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up slightly in Q2 (as house prices increased), but is still near the lows of the last 30 years. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging (defaulting) ahead for households.

• Other Economic Stories ...

• LA area Port Traffic: Imports and Exports down YoY in August

• NAHB Builder Confidence increases in September, Highest since June 2006

• The Trillion Dollar Bear

Schedule for Week of Sept 23rd

by Calculated Risk on 9/22/2012 08:01:00 AM

Note: I'll post the weekly summary soon ... There are two key housing reports to be released this week: Case-Shiller house price index for July on Tuesday, and August New Home sales on Wednesday.

Other key reports include the third estimate of Q2 GDP on Thursday, and August Personal Income and Spending on Friday.

9:00 AM: LPS "First Look" Mortgage Delinquency Survey for August.

10:30 AM: Dallas Fed Manufacturing Survey for September. The consensus is for 0.5 for the general business activity index, up from -1.6 in August.

3:00 PM: San Francisco Fed President John Williams (voting member) speaks at The City Club of San Francisco, Jamison Roundtable Luncheon.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through June 2012 (the Composite 20 was started in January 2000).

The consensus is for a 1.2% year-over-year increase in the Composite 20 index (NSA) for July. The Zillow forecast is for the Composite 20 to increase 1.6% year-over-year, and for prices to increase 1.0% month-to-month seasonally adjusted.

10:00 AM: FHFA House Price Index for July 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.8% increase in house prices.

10:00 AM: Conference Board's consumer confidence index for September. The consensus is for an increase to 64.8 from 60.6 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September. The consensus is for an increase to -4 for this survey from -9 in August (above zero is expansion).

10:00 AM ET: New Home Sales for August from the Census Bureau.

10:00 AM ET: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for an increase in sales to 380 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 372 thousand in July. Watch for possible upgrades to the sales rates for previous months.

8:30 AM: Gross Domestic Product, 2nd quarter 2012 (third estimate); Corporate Profits, 2nd quarter 2012 (revised estimate) . This is the third estimate from the BEA. The consensus is that real GDP increased 1.7% annualized in Q2, unchanged form the second estimate.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 5.0% decrease in durable goods orders.

10:00 AM ET: Pending Home Sales Index for September. The consensus is for a 0.3% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for September. This is the last of the regional surveys for September. The consensus is for an a reading of 5, down from 8 in August (above zero is expansion).

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for an increase to 53.1, up from 53.0 in August.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 79.0, down from the preliminary September reading of 79.2, and up from the August reading of 74.3.

Friday, September 21, 2012

Sheila Bair: Former BofA CEO considered a "country bumpkin"

by Calculated Risk on 9/21/2012 06:43:00 PM

From former FDIC Chairperson Sheila Bair writing at Fortune: Sheila Bair and the bailout bank titans (ht Soylent Green is People)

I let my gaze drift toward Kenneth Lewis, who stood awkwardly at the end of the big conference table, away from the rest of the group. Lewis, the head of the North Carolina-based Bank of America (BAC) -- had never really fit in with this crowd. He was viewed somewhat as a country bumpkin by the CEOs of the big New York banks, and not completely without justification. He was a decent traditional banker, but as a dealmaker his skills were clearly wanting, as demonstrated by his recent, overpriced bids to buy Countrywide Financial, a leading originator of toxic mortgages, and Merrill Lynch, a leading packager of securities based on toxic mortgages originated by Countrywide and its ilk. His bank had been healthy going into the crisis but would now be burdened by those ill-timed, overly generous acquisitions of two of the sickest financial institutions in the country.I don't know about Lewis being a "country bumpkin", but the Countrywide acquisition had to be one of the worst ever - and it was obvious to many of us at the time.

Ouch!

Zillow forecasts Case-Shiller House Price index to show 1.6% Year-over-year increase for July

by Calculated Risk on 9/21/2012 02:22:00 PM

Note: The Case-Shiller report to be released next Tuesday is for July (really an average of prices in May, June and July).

Zillow Forecast: July Case-Shiller Composite-20 Expected to Show 1.6% Increase from One Year Ago

On Tuesday, Sept. 25, the Case-Shiller Composite Home Price Indices for July will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 1.6 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be up 1.1 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from June to July will be 1 percent for both the 20-City Composite and the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below and are based on a model incorporating the previous data points of the Case-Shiller series and the July Zillow Home Value Index data, and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close.

Case-Shiller July data confirms what we have been seeing for several months in other data points: The housing market has started its recovery, albeit appreciation is not back to “normal” pre-housing recession levels and most likely won’t be for the next few years. Zillow’s Home Value Index for August was released on Wednesday and shows a small decline in home values across the nation after nine consecutive months of appreciation. We expect Case-Shiller indices to moderate and likely report monthly declines toward the end of the year tracking the Zillow Home Value Index. Monthly depreciation toward the end of the year is largely a function of declining overall monthly sales volume which will increase the percentage of foreclosure re-sales in the transactional mix being tracked by Case-Shiller.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | July 2011 | 156.33 | 154.12 | 142.89 | 141.12 |

| Case-Shiller (last month) | June 2012 | 155.02 | 154.38 | 142.21 | 141.31 |

| Zillow June Forecast | YoY | 1.1% | 1.1% | 1.6% | 1.6% |

| MoM | 1.9% | 1.0% | 2.1% | 1.0% | |

| Zillow Forecasts1 | 158.0 | 155.9 | 145.2 | 143.1 | |

| Current Post Bubble Low | 146.52 | 149.19 | 134.10 | 136.45 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 7.8% | 4.5% | 8.3% | 4.8% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

State Unemployment Rates increased in 26 States in August

by Calculated Risk on 9/21/2012 10:49:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in August. Twenty-six states recorded unemployment rate increases, 12 states and the District of Columbia posted rate decreases, and 12 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 12.1 percent in August. Rhode Island and California posted the next highest rates, 10.7 and 10.6 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Two states - New Jersey and New York - are at the maximum unemployment rate for the recession, and New Jersey set a new cycle high in August at 9.9%.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009, although New Jersey is close. In early 2010, 18 states and D.C. had double digit unemployment rates.

Over There: Greek and Spanish Aid

by Calculated Risk on 9/21/2012 08:46:00 AM

A plan for Spain will probably be announced next Thursday, and Greece will need additional aid by November.

From the Financial Times: EU in talks over Spanish rescue plan

EU authorities are working behind the scenes to pave the way for a new Spanish rescue programme and unlimited bond buying by the European Central Bank, by helping Madrid craft an economic reform programme ...From the WSJ: Fight Looms on Greek Bailout

...

The plan, due to be unveiled next Thursday, will focus on structural reforms to the Spanish economy long requested by Brussels, rather than new taxes and spending cuts.

Excerpt with permission.

A report by international inspectors, due in October, will state how big the funding shortfall is in Greece's bailout program, but European officials say the deficit is far too big for Greece to close on its own.

That means the International Monetary Fund, the European Central Bank, and euro-zone governments such as Germany will have to negotiate over which of them will make painful concessions to ease Greece's debt-service burden.

...

The trio must agree to a plan by November at the latest, when the government in Athens—already in financial arrears—could run out of money altogether.

...

The €173 billion ($226 billion) bailout plan agreed with Athens in March this year—Greece's second bailout since 2010—is already badly off track, euro-zone officials admit.

Thursday, September 20, 2012

Friday: State Employment Report

by Calculated Risk on 9/20/2012 09:01:00 PM

First, from Freddie Mac: Mortgage Rates Back To Record Lows

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates at or near their all-time record lows helping to keep homebuyer affordability high. The average 30-year fixed rate mortgage matched its all-time record low at 3.49 percent, and the average 15-year fixed fell to a new all-time record low at 2.77 percent.And from David Wessel at the WSJ: Depression Lessons: Should Fed Stand Down to Compel Congressional Action?

As [economist James] Tobin put it in the American Economic Review in June 1965: “The monetary authorities should have tried harder to promote expansion in 1933-36 and 1937-40 — nothing would have been lost and something might have been gained. Throughout the period the authorities were too little concerned with deflationary risks immediately at hand and too much concerned to forestall the hypothetical future dangers of excess liquidity.”Friday:

... Friedman and co-author Anna Schwartz quote at length from a December 1935 technical memo from Fed files that made the case for tightening the credit spigot. ... The subsequent tightening by the Fed was, Friedman and Schwartz concluded, a mistake followed by “a failure to recognize that the action had misfired.”

• At 10:00 AM ET, the BLS will release the Regional and State Employment and Unemployment (Monthly) report for August 2012.

Earlier: The Trillion Dollar Bear

Lawler: ACS 2011: Big Shift to Rental Market

by Calculated Risk on 9/20/2012 05:49:00 PM

CR Note: This is a fairly long technical piece. These are just excerpts. The complete article is here.

From housing economist Tom Lawler: ACS 2011: Big Shift to Rental Market; Gross Vacancy Rate Virtually Unchanged Despite Drop in Vacant Homes for Rent and For Sale; Household “Estimate” Shockingly Low

The Census Bureau released it ACS 2011 one-year estimates, and for housing folks the data were in some cases interesting and in other cases quite puzzling. ...

A few things jump out: first, the ACS estimate for occupied housing units increased by just 424,306 in 2011, and at 114.992 million was 1.724 million lower than the “official” Census household count on April 1, 2010. Second, the ACS’ estimate of the gross vacancy rate in 2011 was virtually unchanged from 2010, despite a decline in the number of homes for rent or for sale. The reason was an increase in both housing units for seasonal/recreational/occasional use (up 181,000) and an increase in “other” – homes vacant and held of the market for unknown reasons (in the above I included “usual residence elsewhere” and migrant workers” in “other” to be consistent with the other measures.)

Third, the ACS homeownership rate fell from 65.4% in 2010 to 64.6% in 2011, which is a full 1.5 percentage points lower than the HVS.

In terms of the jump in the ACS’ estimate of the number of renters in 2011 vs. 2010, almost half of the 1.033 million increase reflected a jump in the number of householders renting SF detached homes. The ACS estimate of the percent of the occupied SF detached home market that was occupied by renters for 2011 was 15.7%, up from 15.1% in 2010 and 13.1% in 2006. The renter-share of the occupied SF detached housing market increased by over three percentage points from 2006 to 2011 in eleven states plus DC, with the biggest increases coming in Nevada, Arizona, Oregon, and California. (The full list is Arizona, California, Colorado, DC, Florida, Georgia, Michigan, Nevada, Ohio, Oregon, Utah, and Washington.)

...

what is a reasonable assumption to make about the increase in US households in 2011, much less so far in 2012? HVS and ACS data suggest very slow growth in 2011, but neither has been consistent with decennial Census results, and HVS data suggest only a modest pickup in 2012. CPS/ASEC data, in contrast, suggest much faster growth in households since early 2010, but CPS/ASEC data are not consistent with decennial Census data either!

Gosh, it’s no wonder there’s so much confusion on the US housing outlook!

CR Note: This was an excerpt from an article by Tom Lawler.