by Calculated Risk on 9/28/2012 12:55:00 PM

Friday, September 28, 2012

Restaurant Performance Index increases in August

From the National Restaurant Association: Stronger Sales, Traffic Bolster Restaurant Performance Index in August

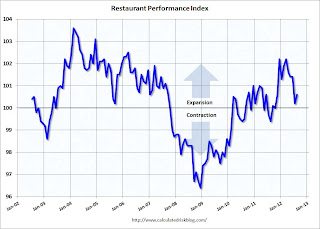

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.6 in August, up 0.4 percent from July and the first increase in five months. August represented the tenth consecutive month that the RPI stood above 100, which signifies continued expansion in the index of key industry indicators.

“Growth in the RPI was driven largely by improving same-store sales and customer traffic results in August,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Six out of 10 restaurant operators reported positive same-store sales in August, while customer traffic readings bounced back from July’s net decline.”

“In contrast, the Expectations Index remained dampened compared to recent stronger levels, with restaurant operators retaining a cautious outlook for sales growth and the economy in the months ahead,” Riehle added.

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.6 in August, up from 100.2 in July (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Misc: Chicago PMI declines, Consumer Sentiment in September at 78.3

by Calculated Risk on 9/28/2012 09:58:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for September was 78.3, down from the preliminary reading of 79.2, and up from the August reading of 74.3.

This was below the consensus forecast of 79.0 and still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

From the Chicago ISM:

The Chicago Purchasing Managers reported the Chicago Business Barometer fell to 49.7, its lowest level in three years.The Chicago PMI was well below the consensus forecast of 53.1.

• EMPLOYMENT: 2 1/2 year low; [declined to 52.0 from 57.1 in August]

• NEW ORDERS, ORDER BACKLOGS, and SUPPLIER DELIVERIES: 3 month moving averages lowest since mid 2009; [new orders declined to 47.4 from 54.8]

• PRICES PAID: third consecutive monthly gain

Personal Income increased 0.1% in August, Spending increased 0.5%

by Calculated Risk on 9/28/2012 08:45:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $15.0 billion, or 0.1 percent ... in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $57.2 billion, or 0.5 percent.The following graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in August, compared with an increase of 0.4 percent in July. ... The price index for PCE increased 0.4 percent in August, compared with an increase of less than 0.1 percent in July. The PCE price index, excluding food and energy, increased 0.1 percent in August, the same increase as in July.

...

Personal saving -- DPI less personal outlays -- was $444.8 billion in August, compared with $492.2 billion in July. Personal saving as a percentage of disposable personal income was 3.7 percent in August, compared with 4.1 percent in July

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

Using the two-month method, it appears real PCE will increase around 1.3% annualized in Q3 - another weak quarter for GDP growth (June PCE was weak, so maybe PCE will increase 1.6%).

A key point is the PCE price index has only increased 1.5% over the last year, and core PCE is up only 1.6%. In August, core PCE increase at a 1.3% annualized rate.

Thursday, September 27, 2012

Friday: Personal Income and Outlays, Consumer Sentiment, Chicago PMI

by Calculated Risk on 9/27/2012 08:50:00 PM

The beatings continue in Europe ...

From the NY Times: Despite Public Protests, Spain’s 2013 Budget Plan Includes More Austerity

The Spanish government on Thursday presented a draft budget for 2013 with a package of tax increases and spending cuts that it said would guarantee the country could meet deficit-cutting targets agreed to with the rest of the euro zone.And from the NY Times: Greece Agrees on New Package of Budget Cuts and Taxes

...

The 2013 budget plan released Thursday is meant to help carry out a sweeping long-term austerity package outlined by Mr. Rajoy in July, which is aimed at reducing the central government’s budget deficit by 65 billion euros, or $84 billion, over two and a half years.

The plan involves an average cut of almost 9 percent in the spending of each government ministry next year. The salaries of civil servants will be frozen for a third consecutive year.

The government of Prime Minister Antonis Samaras must now present the proposed actions — $15 billion in cuts to pensions, salaries and state spending, and at least $2.6 billion in new taxes — for further discussion with the foreign lenders, who have demanded them in return for releasing the next portion of aid to the stricken country.On Friday:

...

The government did not release specifics of the agreement, though it is said to call for a rise in the retirement age to 67 from 65.

• At 8:30 AM ET, the Personal Income and Outlays report for August will be released. The consensus is for a 0.2% increase in personal income in August, and for 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

This will give us two months of data (July and August) to estimate consumer spending in Q3.

• At 9:45 AM, the Chicago Purchasing Managers Index for September. The consensus is for an increase to 53.1, up from 53.0 in August.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 79.0, down from the preliminary September reading of 79.2, and up from the August reading of 74.3.

A final question for the September economic prediction contest:

Freddie Mac: Record Low Mortgage Rates

by Calculated Risk on 9/27/2012 05:57:00 PM

Another month, another record ...

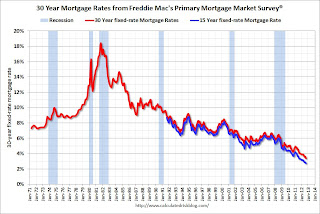

From Freddie Mac today: All-Time Low: 30-Year Fixed-Rate Mortgage Averages 3.40 Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates breaking their previous average record lows ... All mortgage products, except the 5-year ARM, averaged new all-time record lows.

30-year fixed-rate mortgage (FRM) averaged 3.40 percent with an average 0.6 point for the week ending September 27, 2012, down from last week when it averaged 3.49 percent. Last year at this time, the 30-year FRM averaged 4.01 percent.

"Fixed mortgage rates continued to decline this week, largely due to the Federal Reserve's purchases of mortgage securities, and should support an already improving housing market." [said Frank Nothaft, vice president and chief economist, Freddie Mac]

Click on graph for larger image.

Click on graph for larger image.This graph shows the 15 and 30 year fixed rates from the Freddie Mac survey. The Primary Mortgage Market Survey® started in 1971 (15 year in 1991). Both rates are at record lows for the Freddie Mac survey. Rates for 15 year fixed loans are now at 2.73%.

Two Reasons to expect Economic Growth to Increase

by Calculated Risk on 9/27/2012 02:52:00 PM

There is plenty of focus on the downside risks to the US economy - the European crisis and recession, the slowdown in China, the US fiscal cliff and more - but there are at least two reasons to expect an increase in US economic activity.

The first reason is a little addition by subtraction. Over the last 3+ years, state and local governments have lost over 700 thousand payroll jobs (including the preliminary estimate of the benchmark revision - assuming most of the additional government jobs lost were state and local).

The following graph is for state and local government employment. So far in 2012 - through August (and using the Benchmark estate) - state and local governments have lost about 78,000 jobs (61,000 not counting the revision). In 2011, state and local governments lost about 280,000 jobs (230,000 not counting revision). So the layoffs are ongoing, but have slowed.

Click on graph for larger image.

Click on graph for larger image.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 280,000 in 2011.

It looks like the layoffs are mostly over, although I don't expect much hiring over the next year. Just ending the drag from state and local governments will give a boost to GDP and employment growth

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005 (including the Q2 GDP revision today).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 5 quarters (through Q2 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 5 quarters (through Q2 2012).

However the drag from state and local governments is ongoing. State and local governments have been a drag on GDP for eleven consecutive quarters. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented.

In real terms, state and local government spending is now back to Q4 2001 levels, even with a larger population.

The second reason I expect growth to pickup is I think the recovery in residential investment will pick up next year. I'm not as optimistic as the NAR (the NAR is forecasting housing starts will increase about 50% next year), but I do think there will be a large increase in housing starts and new home sales in 2013.

Here is a graph of residential investment (RI) as a percent of GDP. Currently RI is 2.4% of GDP; just above the record low.

Here is a graph of residential investment (RI) as a percent of GDP. Currently RI is 2.4% of GDP; just above the record low.

I expect RI will increase to 4%+ of GDP over the next few years, and that will give GDP and employment a strong boost.

Employment: Preliminary annual benchmark revision shows 386,000 additional jobs

by Calculated Risk on 9/27/2012 11:36:00 AM

This morning the BLS released the preliminary annual benchmark revision showing an additional 386,000 payroll jobs as of March 2012. The final revision will be published next February when the January 2012 employment report is released on February 1, 2013. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

Establishment survey benchmarking is done on an annual basis to a population derived primarily from the administrative file of employees covered by unemployment insurance (UI). The time required to complete the revision process—from the full collection of the UI population data to publication of the revised industry estimates—is about 10 months. The benchmark adjustment procedure replaces the March sample-based employment estimates with UI-based population counts for March. The benchmark therefore determines the final employment levels ...Using the preliminary benchmark estimate, this means that payroll employment in March 2012 was 386,000 higher than originally estimated. In February 2013, the payroll numbers will be revised up to reflect this estimate. The number is then "wedged back" to the previous revision (March 2011).

This means the BLS under counted payroll jobs by 386,000 as of March 2012. This preliminary estimate showed an additional 453,000 private sector jobs, but 67,000 fewer government jobs (as of March 2012).

For details on the benchmark revision process, see from the BLS: Benchmark Article and annual benchmark revision for the new preliminary estimate.

The following table shows the benchmark revisions since 1979.

| Year | Percent benchmark revision | Benchmark revision (in thousands) |

|---|---|---|

| 1979 | 0.5 | 447 |

| 1980 | -0.1 | -63 |

| 1981 | -0.4 | -349 |

| 1982 | -0.1 | -113 |

| 1983 | * | 36 |

| 1984 | 0.4 | 353 |

| 1985 | * | -3 |

| 1986 | -0.5 | -467 |

| 1987 | * | -35 |

| 1988 | -0.3 | -326 |

| 1989 | * | 47 |

| 1990 | -0.2 | -229 |

| 1991 | -0.6 | -640 |

| 1992 | -0.1 | -59 |

| 1993 | 0.2 | 263 |

| 1994 | 0.7 | 747 |

| 1995 | 0.5 | 542 |

| 1996 | * | 57 |

| 1997 | 0.4 | 431 |

| 1998 | * | 44 |

| 1999 | 0.2 | 258 |

| 2000 | 0.4 | 468 |

| 2001 | -0.1 | -123 |

| 2002 | -0.2 | -313 |

| 2003 | -0.2 | -122 |

| 2004 | 0.2 | 203 |

| 2005 | -0.1 | -158 |

| 2006 | 0.6 | 752 |

| 2007 | -0.2 | -293 |

| 2008 | -0.1 | -89 |

| 2009 | -0.7 | -902 |

| 2010 | -0.3 | -378 |

| 2011 | 0.1 | 162 |

| 2012 | 0.3 | 386 |

| * less than 0.05% | ||

Kansas City Fed: Regional Manufacturing Activity "slowed somewhat" in September

by Calculated Risk on 9/27/2012 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed Somewhat

The Federal Reserve Bank of Kansas City released the September Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity slowed somewhat, although producers’ expectations for future activity remained relatively positive.This was below expectations of a 5 reading for the composite index. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Factories reported only minimal overall growth in our region in September, and both production and new orders fell slightly” said Wilkerson. “But firms anticipate growth to pick up later this year and on into next year.”

...

The month-over-month composite index was 2 in September, down from 8 in August and 5 in July, and the lowest in nine months. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index dropped from 7 to -4, and the shipments, new orders, and order backlog indexes also moved into negative territory. The employment index eased from 2 to 1, while the new orders for export index inched higher but remained below zero. Both inventory indexes eased but were still in positive territory.

Despite the overall slowdown, most future factory indexes were little changed and remained at generally favorable levels. The future composite index was unchanged at 16, while the future shipments, new orders, and order backlog indexes increased slightly. The future employment index was stable at 16, while the future production index eased somewhat from 31 to 29. The future capital expenditures index fell for the second straight month, while the new orders for export index posted no change.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 1st, and these surveys suggest another weak reading close to 50.

NAR: Pending home sales index declined 2.6% in August

by Calculated Risk on 9/27/2012 10:03:00 AM

From the NAR: Pending Home Sales Decline in August

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 2.6 percent to 99.2 in August from an upwardly revised 101.9 in July but is 10.7 percent above August 2011 when it was 89.6. The data reflect contracts but not closings.This was below the consensus forecast of a slight increase.

The PHSI in the Northeast rose 0.9 percent to 78.2 in August and is 19.9 percent above August 2011. In the Midwest the index declined 2.6 percent to 95.0 in August but is also 19.9 percent higher than a year ago. Pending home sales in the South slipped 1.1 percent to an index of 110.4 in August but are 13.2 percent above August 2011. With broad inventory shortages in the West, the index fell 7.2 percent in August to 102.5 and is 4.2 percent below a year ago.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in September and October.

Weekly Initial Unemployment Claims decline to 359,000

by Calculated Risk on 9/27/2012 08:30:00 AM

Other releases: From the BEA, Q2 GDP was revised down to 1.3% from 1.7%.

From the Census Bureau:

New orders for manufactured durable goods in August decreased $30.1 billion or 13.2 percent to $198.5 billion, the U.S. Census Bureau announced today. This decrease, down following three consecutive monthly increases, was the largest decrease since January 2009 and followed a 3.3 percent July increase.The decline was due to the volatile transportation sector.

The DOL reports:

In the week ending September 22, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 26,000 from the previous week's revised figure of 385,000. The 4-week moving average was 374,000, a decrease of 4,500 from the previous week's revised average of 378,500.The previous week was revised up from 382,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,000.

This was below the consensus forecast of 376,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but moving up recently.

Wednesday, September 26, 2012

Thursday: Unemployment Claims, Durable Goods, GDP

by Calculated Risk on 9/26/2012 08:04:00 PM

On Europe ...

From the Financial Times: Rajoy fights Spanish turmoil

Mariano Rajoy will on Thursday attempt to stave off a backlash from financial markets by announcing budget plans for next year ... His government is also preparing to unveil a new reform programme and the results of a banking stress test.From the NY Times: European Markets Jolted Amid Protests in Greece and Spain

Excerpt with permission.

On Tuesday in Spain, tens of thousands of demonstrators besieged Parliament to protest austerity measures planned by Mr. Rajoy. ...On Thursday:

In Athens, trade unions called a nationwide strike Wednesday to contest billions of dollars in new salary and pension cuts being discussed by the government and its international creditors. ...

[Prime Minister Antonis] Samaras is negotiating a $15 billion austerity package that is needed to persuade Greece’s so-called troika of lenders — the International Monetary Fund, the European Central Bank and the European Commission — to release nearly $40.7 billion in financial aid that the country needs to stay solvent.

Mr. Rajoy has been trying for months to convince investors that Spain can handle its own problems and that it will not need a bailout that would force Madrid to cede some authority over its fiscal affairs to its lenders, and is set to introduce new cutbacks to meet budgetary goals. Those will include restrictions on early retirement and various measures to streamline regulations and fight unemployment ...

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 376 thousand from 382 thousand.

• Also at 8:30 AM, the Durable Goods Orders report for August will be released by the Census Bureau. The consensus is for a 5.0% decrease in durable goods orders.

• Also at 8:30 AM, the BEA will released the third estimate of Q2 Gross Domestic Product. The consensus is that real GDP increased 1.7% annualized in Q2, unchanged form the second estimate.

• At 10:00 AM, the NAR will release the Pending Home Sales Index for September. The consensus is for a 0.3% increase in the index.

• At 10:30 AM, the Kansas City Fed regional Manufacturing Survey for September will be released. This is the last of the regional surveys for September. The consensus is for a reading of 5, down from 8 in August (above zero is expansion).

A question for the September economic prediction contest:

Earlier on new home sales:

• New Home Sales at 373,000 SAAR in August

• New Home Sales and Distressing Gap

• New Home Sales graphs

New Home Prices: Average Highest since 2008

by Calculated Risk on 9/26/2012 03:20:00 PM

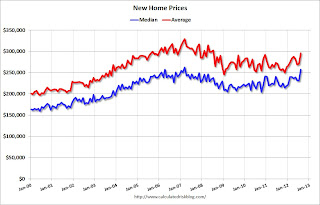

As part of the new home sales report, the Census Bureau reported that the average price for new homes increased to the highest level since August 2008.

From the Census Bureau: "The median sales price of new houses sold in August 2012 was $256,900; the average sales price was $295,300."

The following graph shows the median and average new home prices.

Click on graph for larger image.

Click on graph for larger image.

During the bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. With fewer foreclosures now, it appears the builders are moving to slightly higher price points.

The second graph shows the percent of new home sales by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 35%. And less than 10% were under $150K.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 35%. And less than 10% were under $150K.

Earlier:

• New Home Sales at 373,000 SAAR in August

• New Home Sales and Distressing Gap

• New Home Sales graphs

New Home Sales and Distressing Gap

by Calculated Risk on 9/26/2012 12:51:00 PM

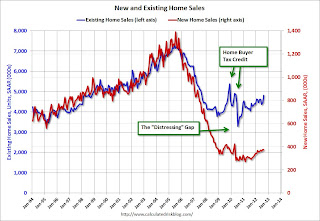

New home sales have averaged 362,000 on an annual rate basis through August. That means sales are on pace to increase 18% from last year (and based on the last few months, sales will probably increase more than 20% this year).

Here is a table showing sales and the change from the previous year since the peak in 2005:

| Year | New Home Sales (000s) | Change |

|---|---|---|

| 2005 | 1,283 | |

| 2006 | 1,051 | -18% |

| 2007 | 776 | -26% |

| 2008 | 485 | -38% |

| 2009 | 375 | -23% |

| 2010 | 323 | -14% |

| 2011 | 306 | -5% |

| 20121 | 362 | 18% |

| 12012 pace through July. | ||

But even with a 20%+ increase this year, 2012 will be the 3rd lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, and it is possible - with a fairly strong last four months - that sales will be close to the level in 2009.

Given the current low level of sales, and current market conditions (supply and demand), sales will probably continue to increase over the next few years. I don't expect sales to increase to 2005 levels, but something close to 800,000 is possible once the number of distressed sales declines to more normal levels.

Here is an update to the distressing gap graph.

Click on graph for larger image.

Click on graph for larger image.This "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through August. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 373,000 SAAR in August

• New Home Sales graphs

New Home Sales at 373,000 SAAR in August

by Calculated Risk on 9/26/2012 10:00:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 373 thousand. This was down slightly from a revised 374 thousand SAAR in July (revised up from 372 thousand). Sales in June were revised up.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in August 2012 were at a seasonally adjusted annual rate of 373,000... This is 0.3 percent below the revised July rate of 374,000, but is 27.7 percent above the August 2011 estimate of 292,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply was unchanged in August at 4.5 months. July was revised down from 4.6 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of August was 141,000. This represents a supply of 4.5 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at a record low 38,000 units in August. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In August 2012 (red column), 31 thousand new homes were sold (NSA). Last year only 25 thousand homes were sold in August. This was the third weakest August since this data has been tracked. The high for August was 110 thousand in 2005.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 362 thousand SAAR over the first 8 months of 2012, after averaging under 300 thousand for the previous 18 months. Most of the recent revisions have been up too.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 362 thousand SAAR over the first 8 months of 2012, after averaging under 300 thousand for the previous 18 months. Most of the recent revisions have been up too.This was below expectations of 380,000, but this was another fairly solid report and indicates an ongoing sluggish recovery in residential investment.

MBA: Mortgage Refinance Activity increases as mortgage rates fall to new survey lows

by Calculated Risk on 9/26/2012 07:03:00 AM

From the MBA: Mortgage Rates Drop to New Survey Lows

The Refinance Index increased 3 percent from the previous week to the highest level in six weeks. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.63 percent, the lowest rate in the history of the survey, from 3.72 percent, with points decreasing to 0.41 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

So far the purchase index has not indicated an increase in purchase activity, although the recent Fed survey of loan officers suggested there has been some increase.

The second graph shows the refinance index.

The second graph shows the refinance index.The refinance activity is at the highest level in six weeks and has been generally moving up over the last year.

Tuesday, September 25, 2012

Wednesday: New Home Sales

by Calculated Risk on 9/25/2012 08:53:00 PM

A couple of "zingers" from the WSJ: Seven Zingers in Sheila Bair’s New Book

On Mr. Paulson not having time to meet with her early on: “Clearly, the former CEO of Goldman Sachs didn’t think the head of an agency that insured $100,000 bank deposits was worth his time. That would change...”On Wednesday:

Ms. Bair got zinged herself by a protester outside the Treasury building during TARP negotiations, mistaking her for a “fat cat” banker as she exited. “How much did that suit cost?” the protester asked. $139 at Macy’s, Bair replied.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Look for record low mortgage rates and some pickup in refinance activity.

• At 10:00 AM, the Census Bureau will release the New Home Sales report for August. The consensus is for an increase in sales to 380 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 372 thousand in July. Watch for possible upgrades to the sales rates for previous months.

A question for the September economic prediction contest:

DOT: Vehicle Miles Driven decreased 0.3% in July

by Calculated Risk on 9/25/2012 05:54:00 PM

The Department of Transportation (DOT) reported today:

Travel on all roads and streets changed by -0.3% (-0.8 billion vehicle miles) for July 2012 as compared with July 2011. Travel for the month is estimated to be 258.3 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by +0.9% (14.8 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 56 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.Gasoline prices were down in July to an average of $3.50 per gallon according to the EIA. Last year, prices in July averaged $3.70 per gallon - and even with the decline in gasoline prices, miles driven declined year-over-year in July.

Just looking at gasoline prices suggest miles driven will be down in August too.

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 4+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers. With all these factors, it may be years before we see a new peak in miles driven.

Earlier on house prices:

• Case-Shiller: House Prices increased 1.2% year-over-year in July

• House Price Comments, Real House Prices, Price-to-Rent Ratio

Misc: Richmod Fed Mfg Survey Improves, Consumer Confidence increases

by Calculated Risk on 9/25/2012 04:06:00 PM

Catching up on a few earlier releases ...

• From the Richmond Fed: Manufacturing Activity Ticked Up in September; New Orders Turned Positive

In September, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — gained thirteen points to 4 from August's reading of −9. Among the index's components, shipments rose eight points to 9, new orders picked up twenty-seven points to end at 7, and the jobs index held steady at −5.This expansion followed three months of contraction in this index and was better than expected.

• From the Conference Board: Consumer Confidence Index® Increases in September. Index Improves Nine Points

The Conference Board Consumer Confidence Index®, which had declined in August, improved in September. The Index now stands at 70.3 (1985=100), up from 61.3 in August.This was above expectations.

• From the FHFA: FHFA House Price Index Up 0.2 Percent in July

U.S. house prices rose 0.2 percent on a seasonally adjusted basis from June to July, according to the Federal Housing Finance Agency’s monthly House Price Index. ... For the 12 months ending in July, U.S. prices rose 3.7 percent.Earlier on house prices:

• Case-Shiller: House Prices increased 1.2% year-over-year in July

• House Price Comments, Real House Prices, Price-to-Rent Ratio

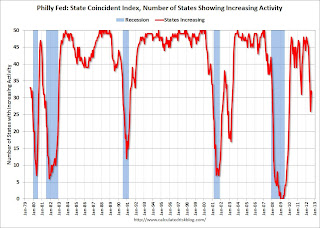

Philly Fed: State Coincident Indexes in August show weakness

by Calculated Risk on 9/25/2012 02:00:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for August 2012. In the past month, the indexes increased in 25 states, decreased in 12 states, and remained stable in 13 states, for a one-month diffusion index of 26. Over the past three months, the indexes increased in 28 states, decreased in 16 states, and remained stable in six states, for a three-month diffusion index of 24.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In August, 32 states had increasing activity, up from 26 in July. The last four months have been weak following eight months of widespread growth geographically.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. And the map was all green just earlier this year.

Now there are a number of red states again.

Earlier on house prices:

• Case-Shiller: House Prices increased 1.2% year-over-year in July

• House Price Comments, Real House Prices, Price-to-Rent Ratio

House Price Comments, Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 9/25/2012 11:08:00 AM

Case-Shiller reported the second consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in July suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

On a Not Seasonally Adjusted (NSA) basis, the Case-Shiller 10-City composite is up 7.4% from the post-bubble low earlier this year, and the 20-City is up 7.8% from the post-bubble low. That is a significant increase, and even when NSA prices start to decline month-over-month in the September or October reports, I expect that house prices will remain above the recent low.

On a seasonally adjusted (SA) basis, prices are up 3.7% and 4.0% from the March lows for the 10-city and 20-city composite indexes.

However, no one should expect the strong price increases to continue. The Case-Shiller Composite 20 index NSA was up 1.6% from June to July. However a large portion of that increase was seasonal. On a Seasonally Adjusted (SA) basis, the Composite 20 index was up 0.4%. That is a 5% annualized rate - and that will probably not continue. I suspect much of the increase over the last few months was a "bounce off the bottom" and prices increases over the next year or two will probably be more gradual.

Here is another update to a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through July) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q4 2010), and the Case-Shiller Composite 20 Index (SA) is back to July 2003 levels, and the CoreLogic index (NSA) is back to December 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to July 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation early in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.