by Calculated Risk on 10/02/2012 09:16:00 PM

Tuesday, October 02, 2012

Wednesday: Apartment Vacancy Rate, ISM Service Index, ADP Employment

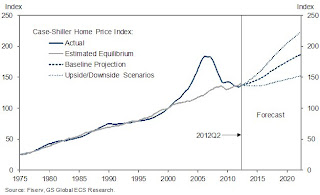

Goldman Sachs released a research note today on house prices: "House Price News Continues to Be Good". In the note, economists Hui Shan and Sven Jari Stehn provide some projections:

[W]e provide an upside and a downside scenario for house prices in addition to our baseline projection. ... We construct the upside and downside cases by incorporating both economic scenarios and modeling uncertainties. ... Although our methodology does not allow us to precisely estimate the probability of each constructed scenario, one can roughly consider the upside and downside as the one standard deviation above and below the baseline.

[Our] model now projects house price gains of 2.0% from mid-2012 to mid-2013, and 2.8% in the year thereafter (Exhibit 1). This baseline forecast is broadly in line with the latest consensus forecast. Exhibit 1 also shows our scenario analysis, pointing to house price appreciation of 9.1% (4.1% for 2012Q2-2013Q2 and 5.0% for 2013Q2-2014Q2) and -0.4% (-0.2% for 2012Q2-2013Q2 and -0.2% for 2013Q2-2014Q2) over the next two years, respectively, for the upside and downside alternative scenarios.

Click on graph for larger image.

Click on graph for larger image.Here is exhibit 1 from the research note showing Goldman's baseline forecast, and upside and downside scenarios.

On Wednesday:

• Early: Reis will release the Q3 2012 Apartment vacancy rates. Last quarter Reis reported that the apartment vacancy rate declined to 4.7% in Q2 from 4.9% in Q1 2012. This was the lowest vacancy rate since Q4 2001.

• At 7:00 AM, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Excerpt a surge in refinance activity with low mortgage rates.

• At 8:15 AM, the ADP Employment Report for September will be released. This report is for private payrolls only (no government). The consensus is for 140,000 payroll jobs added in August, down from the 201,000 reported last month.

• At 10:00 AM, the ISM non-Manufacturing Index for September will be released. The consensus is for a decrease to 53.5 from 53.7 in August. Note: Above 50 indicates expansion, below 50 contraction.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Housing: Inventory down 21% year-over-year in early October

by Calculated Risk on 10/02/2012 07:25:00 PM

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

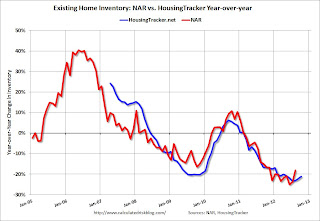

According to the deptofnumbers.com for (54 metro areas), inventory is off 21.4% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through August (left axis) and the HousingTracker data for the 54 metro areas through early October.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. Inventory only increased a little this spring and has been declining for the last five months by this measure. It looks like inventory peaked early this year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early October listings, for the 54 metro areas, declined 21.4% from the same period last year.

HousingTracker reported that the early October listings, for the 54 metro areas, declined 21.4% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already pretty low. I doubt we will see 20% year-over-year declines next summer!

U.S. Light Vehicle Sales at 14.96 million annual rate in September, Highest since Feb 2008

by Calculated Risk on 10/02/2012 03:47:00 PM

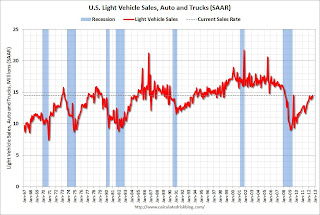

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.96 million SAAR in September. That is up 14% from September 2011, and up 3% from the sales rate last month.

This was above the consensus forecast of 14.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for September (red, light vehicle sales of 14.96 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

Sales have averaged a 14.25 million annual sales rate through the first nine months of 2012, up from 12.5 million rate for the same period of 2011. Last year sales were depressed for several months (May through August) due to supply chain issues related to the tsunami in Japan. By September 2011, the supply chain issues were mostly resolved, and this year-over-year increase for September is significant.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

It looks like auto sales were up about 2.7% in Q3 compared to Q2, and auto sales will make another small positive contribution to GDP. However it appears there is a shift to smaller cars, so total revenue might not increase much.

Auto Sales: Small Car Sales Strong

by Calculated Risk on 10/02/2012 02:03:00 PM

Note: I'll post an estimate of the total sales rate around 4 PM ET after all the results are reported. It looks like consumers are responding to high gasoline prices and buying smaller cars ...

From MarketWatch: Chrysler’s September sales soar; GM, Ford flat

It was a mixed bag for U.S. auto makers in September as Chrysler Group LLC reported Tuesday some of its best sales increases in years, while results for Ford Motor Co. and General Motors Co. were largely flat.

Foreign car makers were pretty much up across the board, with Toyota’s sales surging 42% and Volkswagen’s jumping 34%.

Overall, sales have been “slightly better than expected,” said Jesse Toprak, analyst at Truecar.com.

...

The pace of sales wasn’t so brisk for Ford ... One bright spot for the company however, was in small cars.

...

Sales of GM’s mini, small and compact cars rose a combined 97%, the company said.

Sam Zell's Poor Forecasting Record

by Calculated Risk on 10/02/2012 12:23:00 PM

I've been writing about real estate for years, and I've received several emails over the years saying "Sam Zell disagrees with you, and he knows!". Hmmm ... well, one of us has been wrong.

Sam Zell was on CNBC today arguing the US economy is heading back into recession:

"Nobody wants to make commitments beyond tomorrow," Zell said during a"Squawk Box" interview. "One of these (recession) triggers is when enterprise projects start getting delayed. We're heading for a recession and that's exactly what you're looking at now. You're looking at capital expenditures across the board being deferred for a reason: There's no confidence."Actually a recession is unlikely right now. Of course Zell's economic forecasting track record is very poor. A few examples ...

Sam Zell in April 2005 at the Milken Institute Global Conference:

"The housing bubble has been created more by the business press than reality," said Sam Zell, chairman of Equity Office Properties Trust and Equity Group Investments LLC. "You can't have a crash without oversupply."According to Sam Zell there was no housing bubble, and there would be no crash. How did that work out?

And from my notes at the April 2008 Milken conference:

Commercial [real estate] will be fine in his view (not my view). Also Zell thinks losses are overstated for investment banks and CDOs.Actually losses for investment banks were understated (ask Lehman) and commercial real estate was about to be hit hard (look at the office vacancy rate released this morning).

And here is Sam Zell calling the price bottom for houses in 2009:

[T]he residential real estate market has reached an equilibrium where prices will stop falling, said Sam Zell, founder and chairman of Equity Group Investments.According to Case-Shiller house prices declined another 5% in nominal terms and about 11% adjusted for inflation.

Obviously Zell was a very successful commercial real estate investor, but I rarely agree with him on the economy.

CoreLogic: House Price Index increased in August, Up 4.6% Year-over-year

by Calculated Risk on 10/02/2012 09:58:00 AM

Notes: This CoreLogic House Price Index report is for August. The Case-Shiller index released last week was for July. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® August Home Price Index Rises 4.6 Percent Year-Over-Year

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 4.6 percent in August 2012 compared to August 2011. This change represents the biggest year-over-year increase since July 2006. On a month-over-month basis, including distressed sales, home prices increased by 0.3 percent in August 2012 compared to July 2012. The August 2012 figures mark the sixth consecutive increase in home prices nationally on both a year-over-year and month-over-month basis. The HPI analysis from CoreLogic shows that all but six states are experiencing price gains.

Excluding distressed sales, home prices nationwide increased on a year-over-year basis by 4.9 percent in August 2012 compared to August 2011. On a month-over-month basis excluding distressed sales, home prices increased 1 percent in August 2012 compared to July 2012, also the sixth consecutive month-over-month increase. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that September 2012 home prices, including distressed sales, are expected to rise by 5 percent on a year-over-year basis from September 2011 and fall by 0.3 percent on a month-over-month basis from August 2012 as the summer buying season closes out. Excluding distressed sales, September 2012 house prices are poised to rise 6.3 percent year-over-year from September 2011 and by 0.6 percent month-over-month from August 2012

“Again this month prices rose on a year-over-year basis and our expectation is for that to continue in September based on our pending HPI forecast,” said Mark Fleming, chief economist for CoreLogic. “The housing markets gains are increasingly geographically diverse with only six states continuing to show declining prices.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.3% in August, and is up 4.6% over the last year.

The index is off 26.7% from the peak - and is up 10.1% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has been positive for six consecutive months suggesting house prices bottomed earlier this year on a national basis.

The second graph is from CoreLogic. The year-over-year comparison has been positive for six consecutive months suggesting house prices bottomed earlier this year on a national basis.Excluding the tax credit bump in 2010, these are the first year-over-year increases since 2006 - and this is the largest year-over-year increase since 2006.

On a month-to-month basis, this index will probably turn negative in September (normal seasonal decline); the key will be the year-over-year change.

Reis: Office Vacancy Rate declines slightly in Q3 to 17.1%

by Calculated Risk on 10/02/2012 08:36:00 AM

From Reuters: U.S. office market barely gains in third quarter

[T]he vacancy rate dipped in the third quarter by a scant 0.1 percentage point to 17.2 percent from the second quarter. The vacancy rate declined by just 0.30 percentage points compared with a year earlier.

...

[T]he average asking rent for U.S. office space rose only 1.4 percent over the past 12 months and just 0.2 percent to $28.23 per square foot from the second quarter.

Effective rent, which takes into account months of free rent and other perks landlords offer to lure or keep tenants, rose 0.3 percent to $22.78 per square foot.

...

"We're stuck," said Ryan Severino, senior economist for Reis Inc, which released its third-quarter office report on Tuesday.

Reis also sees no significant improvement for the rest of the year.

"The office market is not going to move in the right direction until the labor market starts to move in the right direction," Severino said. "Nobody is going to lease space until they're hiring, and nobody is going to hire until they feel more confident about the direction of the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis is reporting the vacancy rate declined in Q3 to 17.1%, down slightly from 17.2% in Q2, and down from 17.4% in Q3 2011. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010.

This is a sluggish recovery for office space.

Monday, October 01, 2012

Tuesday: Office Vacancy Rate, Auto Sales

by Calculated Risk on 10/01/2012 07:38:00 PM

First, from Reuters: JPMorgan Sued for Fraud by NY Attorney General

New York Attorney General Eric Schneiderman on Monday filed a lawsuit against JPMorgan Chase for fraud over faulty mortgage-backed securities packaged and sold by the former Bear Stearns.Some of those Bear Stearns deals were really ugly. I remember an Ambac presentation about a Bear Stearns deal in 2008 with "100 people in the round ... 82 have walked out and not paid you a whole lot back". Ouch. It probably ended up with close to 100 out of 100 walking ...

The Residential Mortgage-Backed Securities Working Group was formed to probe the pooling and sale of risky mortgages in the run-up to the 2008 financial crisis.

On Tuesday:

• Early: Reis Q3 2012 Office vacancy rates. Last quarter Reis reported that the office vacancy rate was unchanged at 17.2%.

• All day: Light vehicle sales for September. The consensus is for light vehicle sales to be unchanged at 14.5 million SAAR in September (Seasonally Adjusted Annual Rate).

A question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Lawler: Some Home Builder Results

by Calculated Risk on 10/01/2012 02:54:00 PM

From economist Tom Lawler:

Below is a table showing reported net home orders for the quarter ended August 31st, 2012 from the third, fifth, and seventh largest US home builders in 2012. Hovnanian Enterprises, of course, reported operating results for the quarter ended July 31st, 2012, but in its quarterly presentation it included net order results for August, 2012 as well.

| Net Home Orders, Quarter Ended: | ||

|---|---|---|

| 8/31/2012 | 8/31/2011 | |

| Lennar Corporation | 4,198 | 2,914 |

| Hovnanian | 1,419 | 1,180 |

| KB Home | 1,900 | 1,838 |

| Total of above | 7,517 | 5,932 |

| % Chg | 26.7% | |

For the quarter ended June 30th, 2012, nine publicly traded home builders reported combined net home orders of 20,375, up 27.3% from the comparable quarter of 2011.

Here are some excerpts from Lennar’s press release.

“Stuart Miller, Chief Executive Officer of Lennar Corporation, said, "The housing market has stabilized and the recovery is well underway."And here are some excerpts from KB Home’s press release.

“While materials and labor costs are moving higher, sales price increases and incentive reductions should continue to offset the impact of increasing costs. “The average sales price of homes delivered increased to $258,000 in the third quarter of 2012 from $247,000 in the same period last year. Sales incentives offered to homebuyers were $26,100 per home delivered in the third quarter of 2012, or 9.2% as a percentage of home sales revenue, compared to $33,600 per home delivered in the same period last year, or 12.0% as a percentage of home sales revenue, and $29,800 per home delivered in the second quarter of 2012, or 10.7% as a percentage of home sales revenue.”

"We are pleased to report a profit for the third quarter," said Jeffrey Mezger, president and chief executive officer. "During the quarter, we continued to generate improvement in several key financial and operating metrics. The favorable year-over-year performance in our deliveries; revenues; operating income; net orders; and backlog were particularly encouraging as we operated with fewer communities. These trends illustrate that the strategic repositioning of our operations to restore profitability is starting to yield tangible results, as we also saw significant increases in our overall average selling price and gross profit margin, and substantial improvement in our selling, general and administrative expense ratio. At the same time, it is clear that the recovery in housing is gaining momentum across the country as inventory levels are declining and home prices are on the rise. In particular, we are seeing dramatic improvement in California, where we are the state's largest homebuilder, as the continued strengthening in the coastal markets is now spreading inland to Sacramento, the Central Valley and the Inland Empire."Finally, here is an excerpt from Hovnanian’s press release (from early last month).

“Unlike the past few years, the market for new homes has been resilient through both the spring selling season and throughout the summer months this year. We believe the housing market's recent overall strength and our significantly improved sales pace this year indicates that the market for new homes has bounced off the bottom and is already in a period of gradual recovery.”The “verbiage” from publicly-traded home builders was in general significant more upbeat in their latest quarterly releases than was the case last year and earlier this year. Moreover, several builders have recently raised capital for “general corporate purposes,” mainly because of the improved outlook. This suggests to me that the pace of SF home building is likely to pick up both during the remainder of this and into 2013.

Bernanke: "Five Questions about the Federal Reserve and Monetary Policy"

by Calculated Risk on 10/01/2012 01:05:00 PM

From Fed Chairman Ben Bernanke: Five Questions about the Federal Reserve and Monetary Policy. Here are the five questions Bernanke tried to answer:

1. What are the Fed's objectives, and how is it trying to meet them?An excerpt on inflation:

2. What's the relationship between the Fed's monetary policy and the fiscal decisions of the Administration and the Congress?

3. What is the risk that the Fed's accommodative monetary policy will lead to inflation?

4. How does the Fed's monetary policy affect savers and investors?

5. How is the Federal Reserve held accountable in our democratic society?

With monetary policy being so accommodative now, though, it is not unreasonable to ask whether we are sowing the seeds of future inflation. A related question I sometimes hear--which bears also on the relationship between monetary and fiscal policy, is this: By buying securities, are you "monetizing the debt"--printing money for the government to use--and will that inevitably lead to higher inflation? No, that's not what is happening, and that will not happen. Monetizing the debt means using money creation as a permanent source of financing for government spending. In contrast, we are acquiring Treasury securities on the open market and only on a temporary basis, with the goal of supporting the economic recovery through lower interest rates. At the appropriate time, the Federal Reserve will gradually sell these securities or let them mature, as needed, to return its balance sheet to a more normal size. Moreover, the way the Fed finances its securities purchases is by creating reserves in the banking system. Increased bank reserves held at the Fed don't necessarily translate into more money or cash in circulation, and, indeed, broad measures of the supply of money have not grown especially quickly, on balance, over the past few years.

For controlling inflation, the key question is whether the Federal Reserve has the policy tools to tighten monetary conditions at the appropriate time so as to prevent the emergence of inflationary pressures down the road. I'm confident that we have the necessary tools to withdraw policy accommodation when needed, and that we can do so in a way that allows us to shrink our balance sheet in a deliberate and orderly way. For example, the Fed can tighten policy, even if our balance sheet remains large, by increasing the interest rate we pay banks on reserve balances they deposit at the Fed. Because banks will not lend at rates lower than what they can earn at the Fed, such an action should serve to raise rates and tighten credit conditions more generally, preventing any tendency toward overheating in the economy.

Of course, having effective tools is one thing; using them in a timely way, neither too early nor too late, is another. Determining precisely the right time to "take away the punch bowl" is always a challenge for central bankers, but that is true whether they are using traditional or nontraditional policy tools. I can assure you that my colleagues and I will carefully consider how best to foster both of our mandated objectives, maximum employment and price stability, when the time comes to make these decisions.

Construction Spending decreased in August

by Calculated Risk on 10/01/2012 11:36:00 AM

Note: There were upward revisions to construction spending for June and July (especially for residential investment). Without the upward revisions, construction spending would have increased in August compared to July.

This morning the Census Bureau reported that overall construction spending decreased in August:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2012 was estimated at a seasonally adjusted annual rate of $837.1 billion, 0.6 percent below the revised July estimate of $842.0 billion. The August figure is 6.5 percent above the August 2011 estimate of $786.3 billion.Both private construction spending and public spending declined:

Spending on private construction was at a seasonally adjusted annual rate of $562.2 billion, 0.5 percent below the revised July estimate of $564.8 billion. ... In August, the estimated seasonally adjusted annual rate of public construction spending was $274.9 billion, 0.8 percent below the revised July estimate of $277.2 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 60% below the peak in early 2006, and up 23% from the post-bubble low. Non-residential spending is 30% below the peak in January 2008, and up about 27% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and near the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 18%. Non-residential spending is also up 7% year-over-year mostly due to energy spending (power and electric). Public spending is down 3% year-over-year.

UPDATE: Apparently I wasn't clear - spending in August would have been up compared to July without the upward revision to July spending. With both June and July revised up, this report was decent. Residential construction spending was up in August, and the solid year-over-year increase in private residential investment is a positive for the economy (the increase in 2010 was related to the tax credit).

ISM Manufacturing index increases in September to 51.5

by Calculated Risk on 10/01/2012 10:00:00 AM

The ISM index indicated expansion after three consecutive months of contraction. PMI was at 51.5% in September, up from 49.6% in August. The employment index was at 54.7%, up from 51.6%, and the new orders index was at 52.3%, up from 47.1%.

From the Institute for Supply Management: September 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in September following three consecutive months of slight contraction, and the overall economy grew for the 40th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 51.5 percent, an increase of 1.9 percentage points from August's reading of 49.6 percent, indicating a return to expansion after contracting for three consecutive months. The New Orders Index registered 52.3 percent, an increase of 5.2 percentage points from August, indicating growth in new orders after three consecutive months of contraction. The Production Index registered 49.5 percent, an increase of 2.3 percentage points and indicating contraction in production for the second time since May 2009. The Employment Index increased by 3.1 percentage points, registering 54.7 percent. The Prices Index increased 4 percentage points from its August reading to 58 percent. Comments from the panel reflect a mix of optimism over new orders beginning to pick up, and continued concern over soft global business conditions and an unsettled political environment."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 49.7% and suggests manufacturing expanded in September. The internals were positive too with new orders and employment increasing.

Sunday, September 30, 2012

Sunday Night Futures: ISM Mfg Index, Construction Spending, Bernanke Speech

by Calculated Risk on 9/30/2012 09:07:00 PM

For the economic question contest in September, the leaders were (Congratulations all!):

1st: Andrew Marrinson

2nd: Daniel Brawdy

3rd tie: Billy Forney, Walt Tucker

On Monday:

• At 10:00 AM ET, the ISM Manufacturing Index for September will be released. The ISM index has shown contraction for three consecutive months; the first contraction in the ISM index since the recession ended in 2009. The consensus is for an increase to 49.7, up from 49.6 in August. (below 50 is contraction).

• At 10:00 AM, the Construction Spending report for August will be released. The consensus is for a 0.6% increase in construction spending.

• At 12:30 PM, Fed Chairman Ben Bernanke will speak: "Five Questions about the Federal Reserve and Monetary Policy", At the Economic Club of Indiana, Indianapolis, Indiana

The Asian markets are mixed tonight, with the Nikkei down 0.6%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly, and the DOW futures up slightly.

Oil prices are mixed with WTI futures up slightly at $92.19 and Brent down at $112.07 per barrel.

Yesterday:

• Summary for Week Ending Sept 28th

• Schedule for Week of Sept 30th

Five questions this week for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Analysis: Mark Zandi wrong about housing tax credit

by Calculated Risk on 9/30/2012 12:40:00 PM

Some of Mark Zandi's analysis has been excellent, but I think he is wrong about the housing tax credit and confused about some of the timing of the housing bust.

First, from Mark Zandi, chief economist at Moody’s Analytics in the WaPo: Obama policies ended housing free fall

Temporary tax credits also enticed home buyers to act sooner rather than later, breaking a self-reinforcing deflationary cycle in the housing market. Prospective buyers had remained on the sidelines, waiting for prices to stop falling, and their reluctance caused prices to drop still more.First, house prices declined about 7.5% from January 2009 to the recent low earlier this year. In real terms, house prices declined about 16% from January 2009 to the recent low!. How can Zandi say the tax credit ended "the downdraft in prices"? That is incorrect.

The tax credits didn’t spark additional home sales so much as pull sales forward from the future; sales weakened sharply as soon as the credits expired. The credits also were expensive, costing the Treasury tens of billions of dollars, and much of the benefit went to home buyers who would have bought homes anyway. But the tax benefit gave buyers a reason to stop waiting, ending the downdraft in prices.

Critics charge that the government’s intervention was costly and ineffective, that the administration should have let the housing market sort things out on its own. This would have been a reasonable position if house prices had been too high when Obama’s policies kicked in; but they weren’t. By the time Obama took office, prices had fallen substantially; with low mortgage rates factored in, homes were as affordable as ever. Investors knew this, and as soon as they saw prices nearing the bottom, they began snapping up distressed properties. These investors weren’t house flippers, like those who fueled the housing bubble, but long-term players seeing bargains. Obama’s efforts to shore up housing were well timed.

Most of the decline in house prices happened before January 2009, but the decline since early 2009 would still have been the largest decline in house prices nationally from the Depression through 2006. Only a few regional house price declines (like California in the early '90s) were larger than the 16% real decline over the last 3+ years!

In fact the housing tax credit was expensive and ineffective. I opposed the tax credit early and often. The tax credit for buying new homes was especially dumb. A key problem during the housing bust was the excess supply of vacant housing units, and incentivizing people to buy new homes (and add to the supply) made no sense at all.

Of course the Obama Administration doesn't deserve all the blame for the housing tax credit blunder; the tax credit was originally proposed by Senators Johnny Isakson (R) and Joe Lieberman (I).

Zandi makes another mistake when he conflates investor buying and affordability: "with low mortgage rates factored in, homes were as affordable as ever". The buy-and-rent investors really started buying in late 2008 and early 2009 - and those investors paid cash (low mortgage rates were NOT a factor). At that time the private label securities (Wall Street) were dumping foreclosed properties in mostly low priced areas, and investors responded by buying for the cash flow opportunity. It is correct that prices bottomed earlier in many of those areas (the "destickification" of prices due to PLS dumping), but prices declined in most areas for a few more years.

By now I'd hope that everyone would realize 1) that the housing tax credit was a policy mistake, and 2) most house prices declined significantly over the last 3+ years.

Yesterday:

• Summary for Week Ending Sept 28th

• Schedule for Week of Sept 30th

Gasoline Prices down 8 cents over last 2 weeks

by Calculated Risk on 9/30/2012 09:18:00 AM

Another update: Gasoline prices declined recently, and are down about 8 cents nationally over the last 2 weeks. Brent crude spot prices increased to $117.48 per barrel two weeks ago, and then declined sharply to $108.49. However Brent has increased over the last few days to $113 per barrel.

We are still paying over $4 per gallon in California (I filled up on Friday and paid $4.15 per gallon.

.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.67 per gallon. That is about 10 cents below the current level according to Gasbuddy.com (see graph below).

The following graph shows the recent decrease in gasoline prices. Gasoline prices have been on a roller coaster all year.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Yesterday:

• Summary for Week Ending Sept 28th

• Schedule for Week of Sept 30th

Saturday, September 29, 2012

Unofficial Problem Bank List and Quarterly Transition Matrix

by Calculated Risk on 9/29/2012 06:47:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 28, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

FDIC released its enforcement action activity through August 2012 and closed a bank this week leading to many changes in the Unofficial Problem Bank List. In total, there were 12 removals and eight additions that leave the list with 874 institutions with assets of $334.9 billion. While the number of banks on the list declined, it was the first weekly increase in assets since June 29th. A year ago, the list held 986 institutions with assets of $405 billion. For the month, assets increased by $3.4 billion while the institutions count fell by 17 institutions after 18 action terminations, nine unassisted mergers, three failures, and a voluntary liquidation.

Actions were terminated against Ames Community Bank, Ames, IA ($406 million); Farmers & Merchants Bank & Trust, Burlington, IA ($195 million); Bank of Lincoln County, Fayetteville, TN ($130 million); Lake Community Bank, Long Lake, MN ($128 million); EuroBank, Coral Gables, FL ($104 million); Twin City Bank, Longview, WA ($41 million); Beartooth Bank, Billings, MT ($38 million); America's Community Bank, Blue Springs, MO ($28 million).

First United Bank, Crete, IL ($328 million)was removed because of failure. Desert Commercial Bank, Palm Desert, CA ($139 million Ticker: DCBC); The Exchange National Bank of Cottonwood Falls, Cottonwood Falls, KS ($34 million); and Colorado Valley Bank, SSB, La Grange, TX ($28 million) were acquired through unassisted mergers.

The eight additions were Doral Bank, San Juan, PR ($7.6 billion Ticker: DRL); Northwestern Bank, Traverse City, MI ($869 million Ticker: NWBM); Alliance Bank Central Texas, Waco, TX ($208 million); Flathead Bank of Bigfork, Montana, Bigfork, MT ($207 million); Bay Bank, Green Bay, WI ($99 million); Colonial Co-operative Bank, Gardner, MA ($72 million); Elysian Bank, Elysian, MN ($45 million); and Community Bank and Trust - West Georgia, LaGrange, GA ($95 million), which joins its sister bank Community Bank and Trust – Alabama on the list.

With the end of the third quarter, it is time to refresh the transition matrix. As seen in the table below, there have been a total of 1,588 institutions with assets of $810.9 billion that have appeared on the list. Removals have totaled 714 institutions or 45 percent of the total. Failures continue to be the leading removal cause as 340 institutions with assets of $288.2 billion have failed since appearing on the list. Removals from unassisted mergers and voluntary liquidations total 122 institutions. This year, there has been an acceleration in action terminations. In all, actions have been terminated against 252 institutions with assets of $112.9 billion, with 53 termination occurring in this quarter.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 87 | (25,157,616) | |

| Unassisted Merger | 25 | (3,781,599) | |

| Voluntary Liquidation | 2 | (4,855,164) | |

| Failures | 148 | (182,228,947) | |

| Asset Change | (16,422,867) | ||

| Still on List at 9/30/2012 | 127 | 43,867,236 | |

| Additions | 747 | 291,097,603 | |

| End (9/30/2012) | 874 | 334,964,839 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 165 | 87,707,680 | |

| Unassisted Merger | 88 | 48,052,527 | |

| Voluntary Liquidation | 7 | 1,760,816 | |

| Failures | 192 | 105,953,675 | |

| Total | 452 | 243,474,698 | |

| 1Institutions not on 8/7/2009 or 9/30/2012 list but appeared on a list between these dates. | |||

Earlier:

• Summary for Week Ending Sept 28th

• Schedule for Week of Sept 30th

Schedule for Week of Sept 30th

by Calculated Risk on 9/29/2012 01:10:00 PM

Earlier:

• Summary for Week Ending Sept 28th

The key report for this week will be the September employment report to be released on Friday, Oct 5th. Other key reports include the ISM manufacturing index on Monday, vehicle sales also on Tuesday, and the ISM non-manufacturing (service) index on Wednesday.

On Monday, Fed Chairman Ben Bernanke will speak on monetary policy, and on Thursday, October 4th, there is a Governing Council meeting of the European Central Bank with a press conference to follow.

Reis will release their Q3 Office, Mall and Apartment vacancy rate reports this week. Last quarter Reis reported falling vacancy rates for apartments, a slight decline in vacancy rates for malls, and that the office vacancy rate was unchanged.

10:00 AM ET: ISM Manufacturing Index for September.

10:00 AM ET: ISM Manufacturing Index for September. Here is a long term graph of the ISM manufacturing index. The ISM index has shown contraction for three consecutive months; the first contraction in the ISM index since the recession ended in 2009. The consensus is for an increase to 49.7, up from 49.6 in August. (below 50 is contraction).

10:00 AM: Construction Spending for August. The consensus is for a 0.6% increase in construction spending.

12:30 PM: Speech, Fed Chairman Ben Bernanke, "Five Questions about the Federal Reserve and Monetary Policy", At the Economic Club of Indiana, Indianapolis, Indiana

All day: Light vehicle sales for September. The consensus is for light vehicle sales to be unchanged at 14.5 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate. TrueCar is forecasting:

The September 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.6 million new car sales, up from 13.1 million in September 2011 and up from 14.5 million in August 2012Edmunds.com is forecasting:

Edmunds.com ... forecasts that 1,145,344 new cars and trucks will be sold in the U.S. in September for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.4 million light vehicles.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 140,000 payroll jobs added in August, down from the 201,000 reported last month.

10:00 AM: ISM non-Manufacturing Index for September. The consensus is for a decrease to 53.5 from 53.7 in August. Note: Above 50 indicates expansion, below 50 contraction.

9:00 PM: First Presidential Debate: President Obama and former Governor Romney.

7:45 AM: Governing Council meeting of the European Central Bank with a press conference to follow. Here is the ECB website and press conference page.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 359 thousand.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is for a 6.0% decrease in orders.

10:00 AM: Trulia Price Rent Monitors for September. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

2:00 PM: FOMC Minutes for Meeting of September 12-13, 2012. The minutes might provide additional information about the recent Fed decision.

8:30 AM: Employment Report for September. The consensus is for an increase of 113,000 non-farm payroll jobs in September; there were 96,000 jobs added in August.

8:30 AM: Employment Report for September. The consensus is for an increase of 113,000 non-farm payroll jobs in September; there were 96,000 jobs added in August.The consensus is for the unemployment rate to be unchanged at 8.1% in August.

Note: Analysts at Nomura point out a special issue: "We expect the Chicago teacher strike to reduce local government payrolls by roughly 25k in September ..."

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through June.

The economy has added 5.1 million private sector jobs since employment bottomed in February 2010 including benchmark revision (4.4 million total jobs added including all the public sector layoffs).

The economy has added 5.1 million private sector jobs since employment bottomed in February 2010 including benchmark revision (4.4 million total jobs added including all the public sector layoffs).There are still 3.8 million fewer private sector jobs now than when the recession started in 2007 (including benchmark revision). There are 4.3 million fewer total nonfarm jobs (including benchmark).

3:00 PM: Consumer Credit for August from the Federal Reserve. The consensus is for credit to increase $7.8 billion in August.

Summary for Week Ending Sept 28th

by Calculated Risk on 9/29/2012 08:11:00 AM

The economic data was mostly weak last week. Q2 GDP growth was revised down to 1.3% annualized (from an already anemic 1.7%), durable goods orders declined sharply (although mostly due to the volatile transportation sector), personal income barely increased in August, and the September Chicago PMI declined to the lowest level in 3 years.

There were a few positives: Even though new home sales were slightly below expectations, sales are still up solidly from last year. House prices, according to Case-Shiller, are now up 1.2% year-over-year. Mortgage delinquencies continued to decline. And initial weekly unemployment claims declined in the previous week.

This suggests the economy is still growing sluggishly.

Here is a summary of last week in graphs:

• New Home Sales at 373,000 SAAR in August

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 373 thousand. This was down slightly from a revised 374 thousand SAAR in July (revised up from 372 thousand). Sales in June were revised up.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate. This was below expectations of 380,000, but this was another fairly solid report and indicates an ongoing sluggish recovery in residential investment.

"The seasonally adjusted estimate of new houses for sale at the end of August was 141,000. This represents a supply of 4.5 months at the current sales rate."

"The seasonally adjusted estimate of new houses for sale at the end of August was 141,000. This represents a supply of 4.5 months at the current sales rate."

This graph shows the three categories of inventory starting in 1973: Completed, under construction and not started.

The inventory of completed homes for sale was at a record low 38,000 units in August. The combined total of completed and under construction is at the lowest level since this series started.

• Case-Shiller: House Prices increased 1.2% year-over-year in July

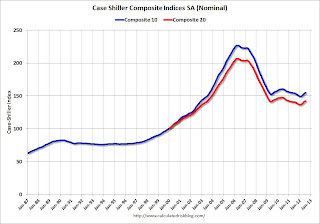

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of May, June and July).

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of May, June and July).This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.7% from the peak, and up 0.4% in July (SA). The Composite 10 is up 3.7% from the post bubble low set in March (SA).

The Composite 20 index is off 31.2% from the peak, and up 0.4% (SA) in July. The Composite 20 is up 4.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 0.6% compared to July 2011.

The Composite 20 SA is up 1.2% compared to July 2011. This was the second year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

This was at the consensus forecast and the recent change to a year-over-year increase is significant.

• Real House Prices, Price-to-Rent Ratio

Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

This graph shows the Case-Shiller National index, Case-Shiller composite 20 and Corelogic indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the Case-Shiller National index, Case-Shiller composite 20 and Corelogic indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to July 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation early in the last decade is gone.

Here is a graph of the price-to-rent ratio using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a graph of the price-to-rent ratio using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

• Personal Income increased 0.1% in August, Spending increased 0.5%

The BEA released the Personal Income and Outlays report for August: "Personal income increased $15.0 billion, or 0.1 percent ... in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $57.2 billion, or 0.5 percent."

The BEA released the Personal Income and Outlays report for August: "Personal income increased $15.0 billion, or 0.1 percent ... in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $57.2 billion, or 0.5 percent."This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

Using the two-month method, it appears real PCE will increase around 1.3% annualized in Q3 - another weak quarter for GDP growth (June PCE was weak, so maybe PCE will increase 1.6%).

A key point is the PCE price index has only increased 1.5% over the last year, and core PCE is up only 1.6%. In August, core PCE increase at a 1.3% annualized rate.

• Regional Manufacturing Surveys mixed

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed Somewhat

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed Somewhat From the Dallas Fed: Texas Manufacturing Growth Picks Up

From the Richmond Fed: Manufacturing Activity Ticked Up in September; New Orders Turned Positive

The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 1st, and these surveys suggest another weak reading close to 50.

• Weekly Initial Unemployment Claims decline to 359,000

And here is a long term graph of weekly claims:

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 374,000.

This was below the consensus forecast of 376,000.

Mostly moving sideways this year, but moving up recently.

• Consumer Sentiment in September at 78.3

The final Reuters / University of Michigan consumer sentiment index for September was 78.3, down from the preliminary reading of 79.2, and up from the August reading of 74.3.

The final Reuters / University of Michigan consumer sentiment index for September was 78.3, down from the preliminary reading of 79.2, and up from the August reading of 74.3.This was below the consensus forecast of 79.0 and still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

• Other Economic Stories ...

• Chicago Fed: Economic Activity Weakened in August

• LPS: Mortgage delinquencies decreased in August

• Restaurant Performance Index increases in August

• DOT: Vehicle Miles Driven decreased 0.3% in July

• NAR: Pending home sales index declined 2.6% in August

Friday, September 28, 2012

Bank Failure #43 in 2012: First United Bank, Crete, Illinois

by Calculated Risk on 9/28/2012 07:13:00 PM

Green leaves shift from gold to red

As have balance sheets

by Soylent Green is People

From the FDIC: Old Plank Trail Community Bank, National Association, New Lenox, Illinois, Assumes All of the Deposits of First United Bank, Crete, Illinois

As of June 30, 2012, First United Bank had approximately $328.4 million in total assets and $316.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $48.6 million. ... First United Bank is the 43rd FDIC-insured institution to fail in the nation this year, and the seventh in Illinois.The FDIC has really slowed down!

Fannie Mae and Freddie Mac Serious Delinquency rates declined in August

by Calculated Risk on 9/28/2012 05:01:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in August to 3.44% from 3.50% July. The serious delinquency rate is down from 4.03% in August last year, and this is the lowest level since April 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in August to 3.36%, from 3.42% in July. Freddie's rate is down from 3.49% in August 2011. Freddie's serious delinquency rate peaked in February 2010 at 4.20%. This is the lowest level for Freddie since August 2009.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

In 2009, Fannie's serious delinquency rate increased faster than Freddie's rate. Since then, Fannie's rate has been falling faster - and now the rates are at about the same level.

Although this indicates some progress, the "normal" serious delinquency rate is under 1% - and it looks like it will be several years until the rates back to normal.