by Calculated Risk on 10/10/2012 09:56:00 PM

Wednesday, October 10, 2012

Thursday: Trade Deficit, Unemployment Claims

From the Financial Times Alphaville: S&P downgrades Spain

On Oct. 10, 2012, Standard & Poor’s Ratings Services lowered its long-term sovereign credit rating on the Kingdom of Spain to ‘BBB-’ from ‘BBB+’. At the same time, we lowered the short-term sovereign credit rating to ‘A-3′ from A-2′. The outlook on the long-term rating is negative.Alphaville has the entire S&P press release.

And from the LA Times: Gasoline prices fall for first time in a week, barely

Motorists in the state paid an average of $4.666 for a gallon of regular gasoline Wednesday, down half a cent overnight, according to AAA's daily survey of fuel prices.Ouch!

On Oct. 1, the day Exxon Mobil Corp.'s Torrance refinery went out of service temporarily because of a power outage, the average was $4.168. The average leaped to record levels, peaking Monday at $4.671, or 50 cents higher than a week earlier.

On Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 367 thousand.

• Also at 8:30 AM, the Trade Balance report for August will be released by the Census Bureau. The consensus is for the U.S. trade deficit to increase to $44.0 billion in August, up from from $42.0 billion in July. Export activity to Europe will be closely watched due to economic weakness.

• Also at 8:30 AM, Import and Export Prices for September will be released. The consensus is a for a 0.7% increase in import prices.

• At 10:00 AM, Fed Governor Jeremy Stein will speak, "Evaluating Large-Scale Asset Purchases", At the Brookings Institution Discussion, Washington, D.C.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

CoStar: Commercial Real Estate prices increase in August

by Calculated Risk on 10/10/2012 05:50:00 PM

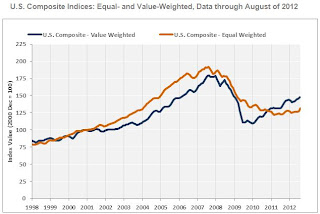

The two broadest measures of aggregate pricing for commercial properties within the CCRSI — the U.S. Value-Weighted Composite Index and the U.S. Equal-Weighted Composite Index — each posted significant gains in August 2012.

The U.S. Value-Weighted Composite Index, which weights each repeat-sale by transaction size or value and therefore is heavily influenced by larger transactions, reached its highest level since early 2009. It has now improved by a cumulative 34.1% since the start of 2010, reflecting strong investor demand for primary gateway metro areas and institutional-grade multifamily assets that have been at the forefront of the pricing recovery for commercial property.

The rate of improvement in the U.S. Equal-Weighted Composite Index, which weights each repeat-sale equally and therefore reflects the influence of the more numerous smaller transactions, has accelerated. The 7.6% year-over–year increase of the Equal-Weighted Composite Index in August 2012 was the largest such gain since August 2006. Despite the increase, cumulative gains in the Equal-Weighted Index have lagged behind those in the Value-Weighted Index, reflecting a slower rate of recovery of tenant demand in the General Commercial segment.

Aggregate net absorption of available space for three major property types—office, retail, and industrial—slowed during the third quarter of 2012 to less than one third of levels in the second quarter of 2012 and less than half of that in the first quarter of this year. The slowdown in leasing activity stems mainly from negative absorption in the General Commercial segment. Should this drawback in tenant demand be sustained by further macroeconomic weakness, near-term transaction volume and pricing could suffer.

The percentage of commercial property selling at distressed prices in August 2012 was the lowest since mid-2009.

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 34.1% from the bottom (showing the demand for higher end properties), however the Equal-Weighted index is only up 8.2% from the bottom.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Fed's Beige Book: Economic activity "expanded modestly", Residential real estate showed "widespread improvement"

by Calculated Risk on 10/10/2012 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicated that economic activity generally expanded modestly since the last report.And on real estate:

Consumer spending was generally reported to be flat to up slightly since the last report. A number of Districts characterized retail sales as expanding at a modest pace ...

Residential real estate showed widespread improvement since the last report. All twelve Districts reported that existing home sales strengthened, in some cases substantially. Selling prices were steady or rising. Boston, Atlanta, Minneapolis, Dallas and San Francisco noted declining or tight inventories, which have put upward pressure on prices. Modest price increases were reported in the New York, Richmond, Chicago, and Kansas City Districts. New York and Richmond reported relatively strong demand at the high and low ends of the market, whereas Philadelphia and Kansas City noted relative strength for mid-range homes; Boston indicated a shift in the mix toward lower or medium priced homes. New home construction and sales were more mixed but still mostly improved: increased construction and/or new home sales were reported in the Atlanta, Chicago, St. Louis, Kansas City, Dallas and San Francisco Districts. Multi-family construction, in particular, was described as robust in the Boston, New York, Atlanta, Chicago, and Dallas Districts. Residential rental markets continued to be characterized as strong, even in the New York and Atlanta Districts where rents increased somewhat less strongly than in recent months."Prepared at the Federal Reserve Bank of New York and based on information collected on or before September 28, 2012."

Commercial real estate markets were mixed since the last report. Office markets showed signs of softening in the northeastern Districts--Boston, New York and Philadelphia--with New York remarking on substantial new supply coming on the market in early 2013. In contrast, Atlanta, Minneapolis and San Francisco noted some improvement, while most other Districts reported stable or mixed market conditions. Industrial markets showed some strength in the New York, Philadelphia, Cleveland and Atlanta Districts, while conditions were described as sluggish in Richmond and mixed in St. Louis. Atlanta noted weakness in the market for retail space. Commercial construction activity was also mixed: Atlanta, Minneapolis and Kansas City reported some improvement in non-residential construction activity, while Richmond and Dallas noted that activity was sluggish.

More sluggish "modest" growth. And more positive comments on residential real estate ...

Further Discussion on Labor Force Participation Rate

by Calculated Risk on 10/10/2012 12:26:00 PM

On a Monday I wrote Understanding the Decline in the Participation Rate. Here are a few definitions - and a couple of graphs - that might help understand the issues.

Definitions from the BLS:

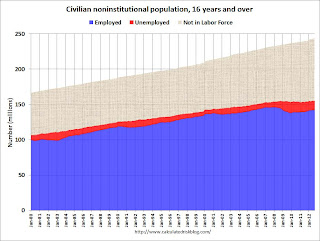

Civilian noninstitutional population: "consists of persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities and homes for the aged) and who are not on active duty in the Armed Forces". If you look at the first graph below, the total of the Blue, Red, and light brown areas is the Civilian noninstitutional population.

"The civilian labor force consists of all persons classified as employed or unemployed". This is Blue and Red combined on the first graph.

"The labor force participation rate represents the proportion of the civilian noninstitutional population that is in the labor force." So this is Blue and Red, divided by all areas combined.

"The employment-population ratio represents the proportion of the civilian noninstitutional population that is employed." This is Blue divided by the total area.

"The unemployment rate is the number of unemployed as a percent of the civilian labor force." This is Red divided by Red and Blue combined. This is the REAL unemployment rate (some claim U-6 is the "real rate", but that is nonsense - although U-6 is an alternative measure of underemployment, it includes many people working part time).

Click on graph for larger image.

Click on graph for larger image.

There are some bumps in the total area - usually when there is a decennial census. These are due to changes in population controls.

Note that the Blue area collapsed in 2008 and early 2009, and started increasing in 2010. This shows the increase in employment over the last few years. Over the last few years, the red area (unemployment) has been decreasing.

However the combined area, the civilian labor force, has not increased much - even though the civilian noninstitutional population has been increasing. Some people argue that this evidence of a large number of people who left the labor force because of the weak labor market - and that the actual unemployment rate should be much higher than 7.8%.

However, as I noted on Monday, some decrease in the labor force participation rate was expected, and it appears most of the decline in the participation rate can be explained by demographic shifts.

The second graph shows the number of people in the US by age group from both the 2000 and 2010 decennial Census.

The second graph shows the number of people in the US by age group from both the 2000 and 2010 decennial Census.

This graph shows two key shifts. First, baby boomers now moving into lower participation rate age groups (look at increase in the 55-to-59 and 60-to-64 groups from 2000 to 2010).

A second key demographic is the significant increase in people in the 15-to-19 and 20-to-24 age groups. These groups have lower participation rates usually because of school enrollment - and enrollment has been increasing.

Taken together, it is clear why the labor force hasn't increase as quickly as the civilian noninstitutional population, and therefore, why a decline in the labor force participation rate was expected.

BLS: Job Openings "essentially unchanged" in August, Up year-over-year

by Calculated Risk on 10/10/2012 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

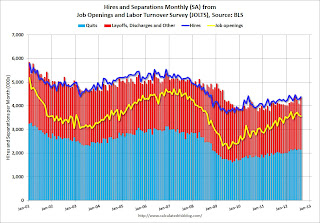

The number of job openings in August was 3.6 million, essentially unchanged from July.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The level of total nonfarm job openings in August was up from 2.4 million at the end of the recession in June 2009. ... The number of job openings in August (not seasonally adjusted) increased over the year for total nonfarm and total private, and was little changed for government.

...

In August, the quits rate was unchanged for total nonfarm, total private, and government. The number of quits was 2.1 million in August, up from 1.8 million at the end of the recession in June 2009. ... Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011.

Quits decreased slightly in August, and quits are up about 5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

This suggests a gradually improving labor market.

MBA: Mortgage Purchase activity highest since June

by Calculated Risk on 10/10/2012 07:02:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

“Refinance applications declined somewhat last week although volume is still near three-year highs, and purchase applications increased to the highest level since June, with both conventional and government volumes increasing,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Rates on 30-year fixed-rate loans remain historically low, benefitting both prospective homebuyers and those seeking to refinance.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.56 percent from 3.53 percent, with points increasing to 0.39 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The 30 year contract rate increased for the first time after declining for six consecutive weeks.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index is up about 7% over the last three weeks and is at the highest level since June.

However the purchase index has been mostly moving sideways over the last two years.

Tuesday, October 09, 2012

Wednesday: Beige Book, JOLTS

by Calculated Risk on 10/09/2012 09:11:00 PM

On Wednesday:

• At 7:00 AM, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect refinance activity to remain strong with low mortgage rates.

• At 10:00 AM, the Job Openings and Labor Turnover Survey (JOLTS) for August will be released by the BLS. The number of job openings has generally been trending up.

• Also at 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories report for August will be released. The consensus is for a 0.4% increase in inventories.

• At 2:00 PM, the Federal Reserve will release the "Beige Book". This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

Lawler: "Distressed" home sales shares in Reno, Vegas, and Phoenix

by Calculated Risk on 10/09/2012 04:32:00 PM

Economist Tom Lawler sent me the table below with a one word discussion: "Wow".

CR Note: We've been tracking several distressed areas across the country, and a couple of clear patterns have developed:

1) There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up just about everywhere. For two of the cities below, short sales are three times foreclosures - and more than double in Phoenix. That is a huge change. A year ago, there were many more foreclosures than short sales.

2) The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year.

The three cities in the table below - Reno, Vegas, and Phoenix - were some of the hardest hit areas in the country. The decline in in distressed sales in Phoenix (from 64.1% in Sept 2011 to 39.9% in Sept 2012) is stunning. But we have to remember that 40% distressed is still extremely high.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Sep | 11-Sep | 12-Sep | 11-Sep | 12-Sep | 11-Sep | |

| Las Vegas | 44.8% | 23.5% | 13.6% | 49.4% | 58.4% | 72.9% |

| Reno | 41.0% | 29.0% | 12.0% | 38.0% | 53.0% | 67.0% |

| Phoenix | 27.0% | 27.0% | 12.9% | 37.1% | 39.9% | 64.1% |

Las Vegas September Real Estate: Sales decline, Inventory down year-over-year

by Calculated Risk on 10/09/2012 12:49:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

From the GLVAR: GLVAR reports local home prices, short sales continuing to climb

According to GLVAR, the total number of local homes, condominiums and townhomes sold in September was 3,298. That’s down from 3,688 in August and down from 4,108 total sales in September 2011.A few key points:

...

GLVAR reported a total of 3,805 condos and townhomes listed for sale on its MLS at the end of September, down 0.7 percent from 3,830 condos and townhomes listed for sale on its MLS at the end of August and down 7.8 percent from one year ago.

The number of available homes listed for sale without any sort of pending or contingent offer also fell from the previous month and year. By the end of September, GLVAR reported 3,943 single-family homes listed without any sort of offer. That’s down 1.0 percent from 3,981 such homes listed in August and down 63.1 percent from one year ago.

...

Meanwhile, 44.8 percent of all existing local homes sold during September were short sales. That’s up from 43.7 percent in August, up from 23.5 percent one year ago, and the highest short sale percentage GLVAR has ever recorded.

Continuing a trend of declining foreclosure sales in recent months, bank-owned homes accounted for 13.6 percent of all existing home sales in September, down from 16.9 percent in August.

• Inventory declined slightly in September, and total inventory is down 7.8% from September 2011. However, for single family homes without contingent offers, inventory is still down sharply from a year ago (down 63.1% year-over-year).

• Short sales are more than triple foreclosures now. The GLVAR reported 44.8% of sales were short sales, and only 13.6% foreclosures. We've seen a shift from foreclosures to short sales in most areas (not just in areas with new foreclosure laws).

• The percent distressed sales was extremely high at 58.4% in September (short sales and foreclosures), but down from 60.6% in August.

• There is a push to complete short sales, from the article:

[H]omeowners have been rushing to short-sell their homes by the end of 2012, when the Mortgage Forgiveness Debt Relief Act is set to expire unless Congress acts to extend it. If Congress does not extend this law by Dec. 31, she said any amount of money a bank writes off in agreeing to sell a home as part of a short sale will become taxable when sellers file their income taxes.

Fannie Mae: Consumer Attitudes on Housing continues to gradually Improve

by Calculated Risk on 10/09/2012 10:49:00 AM

From Fannie Mae: Consumer Attitudes on Housing Continue Summer Season's Gradual Upward Trend

Results from Fannie Mae’s September 2012 National Housing Survey show Americans’ optimism about the recovery of the housing market and with regard to homeownership continued its gradual climb, bolstered by a fseries of mortgage rate decreases experienced throughout the summer. Consumer attitudes about the economy also improved substantially last month, breaking the progression of waning confidence seen during much of this year.I usually don't these survey results, but it does appear consumers are gaining confidence in the housing market.

“Consumers are showing increasing faith in the nascent housing recovery,” said Doug Duncan, senior vice president and chief economist of Fannie Mae. “Home price change expectations have remained positive for 11 straight months, and the share expecting home price declines has stabilized at a survey low of only 11 percent. Furthermore, the Federal Reserve’s latest round of quantitative easing has caused a large drop in mortgage rate expectations. Friday's September jobs report, including the strong upward revisions for prior months, a sizable increase in earnings, and a sharp decline in the unemployment rate, should provide further impetus for improving consumer confidence in the housing market.”

Keeping a relatively steady pace with recent periods, survey respondents expect home prices to increase an average of 1.5 percent in the next year. The share who say mortgage rates will increase in the next 12 months dropped 7 percentage points to 33 percent. Nineteen percent of those surveyed say now is a good time to sell, marking the highest level since the survey began in June 2010. Tying the June 2012 level (and the all-time high since the survey’s inception), 69 percent of respondents said they would buy if they were going to move.

With regard to the economy overall, 41 percent of consumers now believe the economy is on the right track, up from 33 percent last month, while 53 percent believe the economy is on the wrong track, compared with 60 percent the prior month. Both the right track and wrong track figures mark the highest and the lowest readings, respectively, since the survey began in June 2010.

CoreLogic: Existing Home Shadow Inventory declines 10% year-over-year

by Calculated Risk on 10/09/2012 08:39:00 AM

From CoreLogic: CoreLogic® Reports Shadow Inventory Continues to Decline in July 2012

CoreLogic ... reported today that the current residential shadow inventory as of July 2012 fell to 2.3 million units, representing a supply of six months. This was a 10.2 percent drop from July 2011, when shadow inventory stood at 2.6 million units, which is approximately the same level the country was experiencing in March 2009. Currently, the flow of new seriously delinquent (90 days or more) loans into the shadow inventory has been roughly offset by the equal volume of distressed (short and real estate owned) sales.

...

“The decline in shadow inventory has recently moderated reflecting the lower outflow of distressed sales over the past year,” said Mark Fleming, chief economist for CoreLogic. “While a lower outflow of distressed sales helps alleviate downward home price pressure, long foreclosure timelines in some parts of the country causes these pools of shadow inventory to remain in limbo for an extended period of time.”

...

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of properties that are seriously delinquent, in foreclosure and held as real estate owned (REO) by mortgage servicers but not currently listed on multiple listing services (MLSs). Roll rates are the transition rates of loans from one state of performance to the next. Beginning with this report, cure rates are factored in as well to capture the rise in foreclosure timelines and further enhance the accuracy of the shadow inventory analysis. Transition rates of “delinquency to foreclosure” and “foreclosure to REO” are used to identify the currently distressed non-listed properties most likely to become REO properties. Properties that are not yet delinquent but may become delinquent in the future are not included in the estimate of the current shadow inventory. Shadow inventory is typically not included in the official metrics of unsold inventory.

...

Of the 2.3 million properties currently in the shadow inventory, 1 million units are seriously delinquent (2.9 months’ supply), 900,000 are in some stage of foreclosure (2.5-months’ supply) and 345,000 are already in REO (1.0-months’ supply).

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows the breakdown of "shadow inventory" by category.

Note: The "shadow inventory" could be higher or lower using other numbers and methods; the key is that their estimate of the shadow inventory is declining.

Monday, October 08, 2012

Get the Lead Out Update

by Calculated Risk on 10/08/2012 09:26:00 PM

Tuesday: Nixon goes to China (uh, Merkel goes to Greece). There are no US economic data releases scheduled on Tuesday.

Last year I wrote Labor Force Participation Rate: The Kids are Alright. I linked to some data on the impact of the phase out of lead in gasoline and paint, and how this could be leading to more enrollment in school. Of course higher school enrollment is the mirror image of a falling participation rate for young people (see graph below).

From Brad Plumer at the WaPo: Study: Getting rid of lead does wonders for school performance

Over the past 50 years, after scientists realized that even minute doses of lead can have harmful effects, policymakers have been steadily pushing to eradicate the stuff from the environment. In the United States, no one uses lead-based paint or fills up their cars with leaded gasoline anymore—those were phased out back in the 1970s and 1980s. Lead levels in the air have dropped 92 percent since then.

By most accounts, this was a savvy investment. There’s ample evidence that lead exposure is extremely damaging for young children. Kids with higher lead levels in their blood tend to act more aggressively and perform more poorly in school. Economists have pegged the value of the leaded gasoline phase-out in the billions or even trillions of dollars. Some criminologists have even argued that the crackdown on lead was a major reason why U.S. crime rates plunged so sharply during the 1990s.

Click on graph for larger image.

Click on graph for larger image.This graph uses data from the BLS on participation rate (through September), and the National Center for Education Statistics (NCES through 2010) on enrollment rates.

This graph shows the participation and enrollment rates for the 18 to 19 year old age group. These two lines are a "mirror image".

If reducing lead exposure is the reason for the higher enrollment rate - and lower participation rate - that would be a great success! In the long run, more education is a positive for the economy (although I am concerned about the surge in student loans).

Lawler: Discussion of recent jump in House Listings in Phoenix

by Calculated Risk on 10/08/2012 04:49:00 PM

From economist Tom Lawler:

The Arizona Regional MLS reported that residential home sales by realtors in the Greater Phoenix, Arizona area totaled 6,478 in September, down 17.9% from last September’s pace. REO properties were just 12.9% (835) of last month’s sales, down from 37.1% (2,931) last September, while last month’s short-sales share was 27.0%, unchanged from a year ago. Active listings in September totaled 22,862, up 9.2% from August but down 15.2% from a year ago. The median home sales price last month was $150,000, up 30.5% from last September. Citing data from the Cromford Report, the ARMLS also reported that foreclosures pending in Maricopa County totaled 14,584 in September, down 38.1% from a year ago.

Click on graph for larger image.

Click on graph for larger image.

Here is a chart showing active listings in the Greater Phoenix area (from ARMLS) from January 2002 through September 2012 (note: the ARMLS reports available to the public only show active listings “rightly defined” back to April 2005. The data from January 2002 through March 2005 in the chart below were derived from a chart from a realtor with direct access to ARMLS data).

One thing worth watching is the recent uptick in listings over the past few months – listings increased by 2.7% in both July and August, and jumped up by 9.2% last month. Over the past few years investor buying of residential properties on a low to no leverage basis with the intent to rent the properties out has been quite substantial.

In the middle of last decade, in contrast, Phoenix saw a surge in highly-leveraged real estate investment purchases by folks looking to make a “quick” flip – see 2nd graph.

In the middle of last decade, in contrast, Phoenix saw a surge in highly-leveraged real estate investment purchases by folks looking to make a “quick” flip – see 2nd graph.

However, over the past year home prices in Phoenix have rebounded sharply. The very recent jump up in listings may reflect some investors’ desire to “cash out” of their real estate investments, especially given the recent (though late in the cycle) increase in the number of “big-money” investors looking for SF rental properties.

CR Note: the increase in inventory hasn't been huge, and it could be sellers "waiting for a better market". More listings seems like a normal response to a sharp increase in prices.

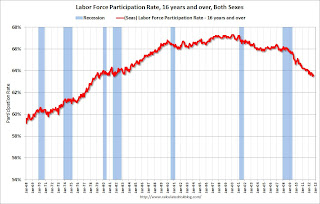

Understanding the Decline in the Participation Rate

by Calculated Risk on 10/08/2012 01:52:00 PM

I've been writing about the expected decline in the labor force participation rate for years. On Sunday, I posted another update: Employment: A decline in the participation rate was expected due to the aging population

I made a couple of key points on Sunday:

1) A decline in the participation rate was expected.

2) Although some of the recent decline in the participation rate has been to due to cyclical issues (severe recession), MOST of the decline in the overall participation rate has been due to changing demographics.

This morning Mish disagreed with me. His conclusion was: "While the Participation Rate trend is certainly down, and down was expected, most of the decline in participation rate since the start of the recession is due to economic weakness, not demographics."

I consider this progress! It wasn't long ago that I was still arguing with people that we should expect a decline in the participation rate. Now the question has shifted to what portion of the decline is cyclical (due to the recession) and what portion is due to demographics.

Mish looked at a paper I linked to on Sunday, written in 2002 by Austin State University Professor Robert Szafran, and Mish used Szafran's projection for the participation rate in 2015. However, as Szafran noted in his paper, for simplification purposes he assumed that the "age-specific participation rates do not change" after 2000. However if we look at the 16-to-19 age group, the participation rate declined from 51% in 2000 to 42% in 2007 - before the recession started. Although Szafran's paper is very useful, the actual numbers (because of the simplifying assumptions) are clearly too high.

First, what are we talking about? The headline participation rate is the percentage of people 16 years old and over who are in the labor force. Here is a graph of the headline participation rate:

Click on graph for larger image.

Click on graph for larger image.

The decline in the overall participation rate, especially since 2008, has been a cause of concern. But the headline number can be impacted by demographic changes (that is why Professor Szafran was estimating an "age adjusted" participation rate - his paper was titled: Age-adjusted labor force participation rates, 1960–2045).

Changing demographics makes projecting the overall participation rate very difficult. We do know that a fairly low percentage of people in the 16-to-19 age group participate in the labor force, this percentage increases for the 20-to-24 age group, and then remains high until people reach 55 or so. To project the overall rate, we need to know the trends for each age group, and we need to estimate how many people will be in each age group each year (this depends on mortality rates and immigration - and those change over time too).

Here is a graph based on BLS economist Mitra Toossi's projections (another paper I linked to on Sunday).

Note that Toossi is expecting a couple of recent trends to continue: lower participation rates for people in the 16 to 24 year age group (I think this decline is mostly due to more people attending college), and an increase in the participation for older age groups (I think this increase is due to several factors including less physically strenuous jobs, and, unfortunately, financial need).

Note that Toossi is expecting a couple of recent trends to continue: lower participation rates for people in the 16 to 24 year age group (I think this decline is mostly due to more people attending college), and an increase in the participation for older age groups (I think this increase is due to several factors including less physically strenuous jobs, and, unfortunately, financial need).

An increase in the participation rate for an age group (like the 60 to 64 group) is just one part of the equation. We also have to recognize that a large cohort is moving from the 55 to 59 age category into the 60 to 64 age group, and the participation rate for that cohort is falling.

The baby boom generation is obvious. This graph is from two years ago, and shows that a large number of people are moving into the 55-to-65 age group now. Even though the participation rate is rising for the age group, it is lower than for the 45-to-55 age groups - so that pushes down the overall participation rate.

There are changes for other groups too. A fairly large group just moved into the 20-to-24 age group, and they will be moving into higher participation age groups soon (it isn't all bad news).

Here is the trend for men in the 16-to-19 age group. As I noted before, for his purposes, Szafran assumed this would stay at the 2000 rate. Instead the rate declined sharply from 2000 through 2007 - before the recession started.

Here is the trend for men in the 16-to-19 age group. As I noted before, for his purposes, Szafran assumed this would stay at the 2000 rate. Instead the rate declined sharply from 2000 through 2007 - before the recession started.

How can we tell if the decline since 2008 was just a continuation of the trend, or if it was because of the severe recession? It is very difficult.

One idea is to look at a very narrow group (men in the 35-to-44 age group) and look for the impact of the recession.

These people aren't going back to school in large numbers, and they are not retiring early in large numbers.

These people aren't going back to school in large numbers, and they are not retiring early in large numbers.

What do we see? A long term down trend from about 97% participation in 1968 to about 91% participation now. If we look at a short term trend - from 1995 through 2007 - it appears there is about a 1% decline in the participation rate due to the recession (from 92% to 91%). But if we look at a long term trend, it appears the participation rate is about what we'd expect.

Other groups were probably impacted more by the recession than 35-to-44 year old males (younger groups tend to be impacted more), but I don't think there is evidence of a huge cyclical decline in the overall participation rate. I've looked at many age groups, and although I think some of the decline in the overall participation rate is due to the recession, it appears most of the recent decline in the participation rate is due to changing demographics.

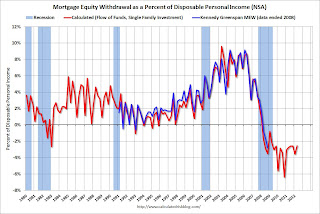

Q2 2012: Mortgage Equity Withdrawal strongly negative

by Calculated Risk on 10/08/2012 11:22:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q2 2012, the Net Equity Extraction was minus $75 billion, or a negative 2.5% of Disposable Personal Income (DPI). This is not seasonally adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q2. Mortgage debt has declined by $1.05 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

For reference:

Dr. James Kennedy also has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Greece, Troika talks to resume later

by Calculated Risk on 10/08/2012 09:13:00 AM

From the WSJ: Greece, Troika to Resume Talks This Week

Talks between Greece and a visiting troika of international inspectors made progress ... but no deal has yet been reached and the negotiations will resume next week.And from the Athens News: Police announce ban on rallies during Merkel visit

The inspectors, from the European Commission, the International Monetary Fund and the European Central Bank, will depart Athens ... to attend a meeting of euro-zone finance ministers in Luxembourg Monday, the officials said.

"There has been progress on all fronts, fiscal and structural," one official, speaking to reporters after more than three hours of talks in the Greek capital, said. "The work will continue next week." ...

[As the talks drag on, overshooting their early October deadline, hopes of securing that aid by an Oct. 18 European summit--when European leaders were expected to sign off on Greece's latest aid tranche--now look dim.

The police on Monday announced that all open-air gatherings and rallies will be banned in large sections of central Athens between 9am and 10pm on Tuesday, as a security precaution to "preserve the peace" during a visit by German Chancellor Angela Merkel.

Sunday, October 07, 2012

Sunday Night Futures

by Calculated Risk on 10/07/2012 09:44:00 PM

It appears gasoline prices in California have peaked following several refinery problems, see Jim Hamilton's California gas price spike. These refinery issues happened at a terrible time - just as the refineries were about to change to the winter blend.

From the LA Times: Gov. Brown takes emergency action to try to reduce gas prices

Gov. Jerry Brown took “emergency steps” Sunday to try to bring down record gas prices in the state.The week will start with a focus on Europe. On Monday:

He directed the California Air Resources Board to increase the fuel supply by allowing the immediate sale and import of cheaper and more available winter-blend gasoline.

The move would reduce the price of gas in California by 15 to 20 cents per gallon, probably within a few days, said energy expert Chris Faulkner of Dallas-based Breitling Oil and Gas.

• Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open.

• At 6:00 AM ET, Europe's European Stability Mechanism (ESM) will become active.

• Also at 6:00 AM, the "Troika" Report On Greece will be released.

• At 12:00 PM, the EU Finance Minsters meet in Luxembourg.

The Asian markets are mostly red tonight, with the Hang Seng down 0.3% and the Shanghai down 0.1%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2, and the DOW futures are down 17.

Oil prices are down with WTI futures down to $89.88 and Brent down at $111.69 per barrel.

Yesterday:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th

Two more questions this week for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

More Europe

by Calculated Risk on 10/07/2012 06:32:00 PM

Earlier today I posted a few key dates this month in Europe. Here are a few more articles on Europe:

From the Financial Times: UK austerity squeeze set to run until 2018

George Osborne is set to be told this autumn by the Office for Budget Responsibility he will have to plug another large hole in the public finances, extending austerity until 2018 and throwing the coalition’s deficit reduction strategy into doubt.From Bloomberg: Europe Seeks to Contain Spanish Troubles as Finance Chiefs Meet

Excerpt with permission.

European officials will move to prevent Spain from dragging the single currency into a new round of convulsions this week as a series of high-level meetings aim to ease the three-year-old European debt crisis.With a 25.1% unemployment rate in Spain, maybe they should call it an "unemployment crisis".

European finance ministers meet in Luxembourg today to discuss Spain’s overhaul effort and closer banking cooperation, while on Oct. 10, Spanish Prime Minister Mariano Rajoy travels for talks with French President Francois Hollande in Paris. Germany’s Chancellor Angela Merkel tomorrow makes her first visit to Greece since the crisis began in 2009.

“It feels as if we are in for a month or so of Spanish trouble,” Erik Nielsen, London-based chief global economist at UniCredit SpA (UCG), wrote in a note yesterday.

And from Bloomberg: Greece’s Coalition Government, Troika Pause on Budget Talks

Greece and its European Union and International Monetary Fund creditors made progress on talks on a 13.5 billion-euro ($18 billion) package of austerity measures for the next two years and said negotiations would continue next week.I doubt Merkel would be visiting Greece on Tuesday if the report was going to be "bad".

Finance Minister Yannis Stournaras told reporters in Athens after briefing Prime Minister Antonis Samaras on the latest round of negotiations that he hoped the inspectors would give euro-area finance ministers meeting on Oct. 8 a good report.

Employment: A decline in the participation rate was expected due to the aging population

by Calculated Risk on 10/07/2012 02:19:00 PM

I've written extensively on the reasons for the decline in the participation rate. Unfortunately some people haven't been paying attention.

Two key points:

• Some of the recent decline in the participation rate has been to due to cyclical issues (severe recession), but MOST of the decline in the overall participation rate over the last decade has been due to the aging of the population. There are also some long term trends toward lower participation for younger workers pushing down the overall participation rate.

• This decline in the participation rate has been expected for years. Here are three projections (two from before the recession started). The key to these projections is that the decline in the participation rates was expected:

1) From BLS economist Mitra Toossi in November 2006: A new look at long-term labor force projections to 2050

2) From Austin State University Professor Robert Szafran in September 2002: Age-adjusted labor force participation rates, 1960–2045

3) BLS economist Mitra Toossi released some new projections for the participation rate as of January 2012: Labor force projections to 2020: a more slowly growing workforce.

Click on graph for larger image.

Click on graph for larger image.

Here is a graph of the actual overall participation rate and a few projections through 2040. The participation rate might increase a little over the next year or two, but in the longer term, the overall participation rate will probably continue to decline until 2040.

Once again, this is not a surprise. Sven Jari Stehn at Goldman Sachs put out a research note early last year arguing:

[T]here is little evidence for the idea that an “unduly” low participation rate is masking an even weaker labor market than indicated by the ... unemployment rate. Instead, we find that most of the drop in participation in recent years reflects changes in the underlying demographics and the “normal” effects of the economic cycle (i.e., the fact that [the] unemployment rate in itself is very high).Bottom line: If someone says the "actual" unemployment rate is much higher than reported because of the decline in the participation rate, they are unaware of a key demographic shift.

Friday on employment:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

• Employment: Somewhat Better (also more graphs)

• All Employment Graphs

Yesterday:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th

Europe: Merkel Visits Greece on Tuesday and a few key dates

by Calculated Risk on 10/07/2012 09:18:00 AM

A few key dates in Europe:

• Monday, Oct 8th, at 6 AM ET, Europe's European Stability Mechanism (ESM) will become active.

• Monday, Oct 8th, at 6 AM ET, The "Troika" Report On Greece will be released.

• Monday, Oct 8th, at 12 PM, EU Finance Ministers meeting in Luxembourg.

• Tuesday, Oct 9th, at 6 AM: Eurozone Finance Minsters Meet

• Tuesday, Oct 9th: German Chancellor Angela Merkel will visit Athens and meet with Greek Prime Minister Antonis Samaras. Press conference to follow.

• European Council meeting, October 18th and 19th in Brussels.

From the WSJ: Chancellor Merkel to Pay Visit to Athens

Ms. Merkel's trip is meant to show her support for Greek Prime Minister Antonis Samaras as his government struggles to agree on a new round of unpopular austerity measures, analysts say. The trip will signal the two leaders' attempt at easing strains between indebted Greece and its most powerful creditor, Germany.Since Merkel is visiting Greece, it seems like the Troika report will be somewhat positive.

...

Ms. Merkel will likely express sympathy with the Greek people's economic sacrifices, say analysts, while standing firm on Greece's need to implement promised spending cuts and economic overhauls.

...

A massive security presence is likely during the visit of Ms. Merkel, who plans to return to Berlin by Tuesday night. ... The expected protests could turn violent, as many demonstrations in Athens have in the past three years, which could sully the two governments' attempt to show a renewed fellowship.

Friday on employment:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

• Employment: Somewhat Better (also more graphs)

• All Employment Graphs

Yesterday:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th