by Calculated Risk on 10/15/2012 04:47:00 PM

Monday, October 15, 2012

The Housing Bottom and the Unemployment Rate

Early this year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it is, and here is another update to that graph (and a repeat of some analysis).

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the current housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

Housing plays a key role for employment too. Here is an update to a graph I've been posting for a few years. This graph shows single family housing starts (through August) and the unemployment rate (inverted) also through September. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing last year. This was one of the reasons the unemployment rate remained elevated.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However, following the recent recession with the huge overhang of existing vacant housing units, this key sector didn't participate. This time the unemployment rate started falling before housing starts picked up. Going forward I expect housing activity to increase and help push down the unemployment rate. Unfortunately I expect the housing recovery to be somewhat sluggish.

Correction on Mortgage Modifications

by Calculated Risk on 10/15/2012 01:48:00 PM

On Sunday, I wrote that private modifications were performing better than HAMP. According to the Q2 OCC report, HAMP modifications have a lower redefault rate than private mods:

HAMP modifications perform better than other modifications. Of the 565,751 HAMP modifications implemented since the third quarter of 2009, 68.2 percent remained current, compared with 53.4 percent of other modifications implemented during the same period.The OCC report covers about "60% of all first-lien mortgages in the United States" whereas the Hope Now report I mentioned on Sunday includes data from the non-bank servicers (not included in the OCC report) and is scaled to cover the entire first lien market. I'll have more on modifications soon (Mark Hanson called modifications the "new subprime").

...

Servicers modified 2,543,133 mortgages from the beginning of 2008 through the end of the fourth quarter of 2011. At the end of the first quarter of 2012, 50.7 percent of these modifications remained current or were paid off. Another 7.1 percent were 30 to 59 days delinquent, and 15.1 percent were seriously delinquent. Almost 11 percent were in the process of foreclosure, and 6.3 percent had completed the foreclosure process. More recent modifications that emphasized reduced payments, affordability and sustainability have outperformed modifications implemented in earlier periods.

Also, as a followup to a question in the comments, here is a "heat map" from Zillow on where properties owners have negative equity. Note: you can zoom in on the map, and put the cursor over an area - it will show the distribution of equity.

FNC: Residential Property Values increased 0.3% in August

by Calculated Risk on 10/15/2012 10:57:00 AM

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their August index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.3% in August compared to July (Composite 100 index). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.5% and 0.8% in August. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Since this index is NSA, the month-to-month changes will probably turn negative in September or October. The key then will be to watch the year-over-year change and also to compare the month-to-month change to previous years. This was the first month-to-month increase for the month of August since 2005.

The year-over-year trends continued to show improvement in August, with the 100-MSA composite up 1.5% compared to August 2011. The FNC index turned positive on a year-over-year basis last month - that was the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

Click on graph for larger image.

Click on graph for larger image.

This graph is based on the FNC index (four composites) through August 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Some of the month-to-month gain is seasonal since this index is NSA. The key is the indexes are now showing a year-over-year increase.

The August Case-Shiller index will be released in two weeks, on Tuesday, October 30th.

Retail Sales increased 1.1% in September

by Calculated Risk on 10/15/2012 08:30:00 AM

On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted), and sales were up 5.4% from September 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $412.9 billion, an increase of 1.1 percent from the previous month and 5.4 percent above September 2011.. ... The July to August 2012 percent change was revised from 0.9 percent to 1.2 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for August were revised up to a 1.2% increase (from 0.9% increase).

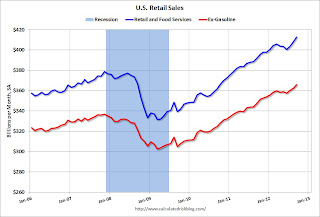

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.6% from the bottom, and now 9.0% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). This shows that retail sales ex-gasoline are increasing, but that gasoline prices have boosted retails sales over the last two months.

The second graph shows the same data, but just since 2006 (to show the recent changes). This shows that retail sales ex-gasoline are increasing, but that gasoline prices have boosted retails sales over the last two months.Excluding gasoline, retail sales are up 20.9% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted).

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.3% on a YoY basis (5.4% for all retail sales). Retail sales ex-autos increased 1.1% in September.

This was above the consensus forecast for retail sales of a 0.7% increase in September, and above the consensus for a 0.5% increase ex-auto.

This was above the consensus forecast for retail sales of a 0.7% increase in September, and above the consensus for a 0.5% increase ex-auto.

Sunday, October 14, 2012

Monday: Retail Sales, Empire State Mfg Survey

by Calculated Risk on 10/14/2012 09:25:00 PM

This is something I wrote about last year, from the WSJ: Buyers Back After Foreclosure

Millions of families lost their homes to foreclosure after the housing crash hit six years ago. Now, some of those families are back in the housing market. Call them the "boomerang" buyers.They're back!

...

On a recent conference call with investors, Stuart Miller, chief executive of Miami-based home builder Lennar Corp., said the company was seeing more people "coming out of the penalty box." At Cornerstone Communities, a San Diego home builder, roughly 20 of the 110 closings they have had this year came from buyers who have been through a foreclosure or short sale, estimates Ure Kretowicz, the company's chief executive.

...

Using the three-year benchmark it takes to get an FHA-guaranteed loan, in this year's second quarter there were 729,000 households that were foreclosed upon during the bust that are now eligible to apply for an FHA mortgage, up from 285,000 in the second quarter of 2011, according to an analysis of foreclosure data by Moody's Analytics. The company projects that number will grow to 1.5 million by the first quarter of 2014.

On Monday:

• At 8:30 AM ET, Retail sales for September will be released. The consensus is for retail sales to increase 0.7% in September, and for retail sales ex-autos to increase 0.5%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for October will be released. The consensus is for a reading of minus 3, up from minus 10.4 in September (below zero is contraction).

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales report for August (Business inventories) will be released. The consensus is for 0.5% increase in inventories.

Note: Also on Monday, several regional Fed presidents will speak including NY Fed president William Dudley in the morning.

The Asian markets are mixed tonight, with the Hang Seng up slightly, and the Nikkei down 0.2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 3, and the DOW futures are down 22.

Oil prices are down with WTI futures down to $91.86 and Brent down at $113.80 per barrel.

Weekend:

• Summary for Week Ending Oct 12th

• Schedule for Week of Oct 14th

• Zillow Housing Forum and The Bearish View

Five more questions this week for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

The recovery in U.S. Heavy Truck Sales

by Calculated Risk on 10/14/2012 05:01:00 PM

The following article inspired me to look up some data today on heavy truck sales in the US.

Neil Irwin wrote in the WaPo on Friday: What cars and big rigs say about the economy

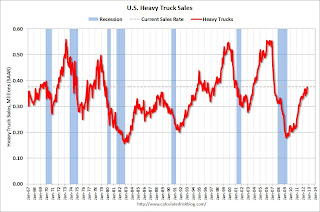

Less trucking activity, of course, means less demand for trucks. That is ... evident from this week’s earnings. Cummins, an Indiana company that makes truck engines, said it will cut up to 1,500 jobs by the end of the year amid weakening demand. “As a result of the heightened uncertainty, end customers are delaying capital expenditures in a number of markets, lowering demand for our products,” Cummins chief executive Tom Linebarger said in a statement Tuesday.I think the key quote is truck sales are "down compared to the view that we had in the first quarter" - actually heavy truck sales are up, and at the highest level since April 2007.

And Alcoa, the giant aluminum company, cited less demand from the trucking industry as it downgraded its forecasts. “Heavy trucks and trailer,” Alcoa chief executive Klaus Kleinfeld said in a conference call with analysts Tuesday, is “down compared to the view that we had in the first quarter. North America is really driving it. We believe that heavy truck production will slow down in the second half of the year.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate (SAAR). Since then sales have doubled and hit 376 thousand SAAR in September 2012.

This is up 12% from September 2011, and the highest level since April 2007 (over 5 years ago). That is pretty strong growth, but I guess Alcoa was expecting more.

Earlier:

• Summary for Week Ending Oct 12th

• Schedule for Week of Oct 14th

• Zillow Housing Forum and The Bearish View

Zillow Housing Forum and The Bearish View

by Calculated Risk on 10/14/2012 12:28:00 PM

I attended the Zillow housing forum in San Francisco on Friday. The first panel discussed "Is it a Good Time to Buy in California?: The Housing Market’s New Normal".

The participants were John Burns, CEO, John Burns Real Estate Consulting, Bert Selva, President and CEO, Shea Homes, Eric Gutshall, President and COO, Haven Realty Capital and Mark Hanson, Mark Hanson Advisors. And the moderator was Colleen Edwards, Owner, EMC Creative.

John Burns has turned positive on housing (he commented that some of his colleagues have been calling him a "raging bull"). Bert Selva said that sales are up about 40% this year for Shea Homes the year, and Eric Gutshall talked about their single family rental program (REO-to-rental) and also that they've seen house price increases in the markets where they are active.

Note: I had an offline discussion with Bert Selva and John Burns, and I asked about the possibility that some new home builders will be land constrained next year (that they may not have enough finished lots to meet demand in some locations). Selva said it probably depended on the builder, but there could be a period next year were sales are limited by lack of lot supply - although he seemed to think that would be resolved by 2014. John Burns shared his 2013 new home sales forecast with me, and it was around 450 thousand (he was close for 2012).

I was very interested in the comments of Mark Hanson since he has a different view on housing than me (I think prices bottomed earlier this year and that residential investment will continue to increase). Hanson thinks we are just seeing a stimulus bounce and that prices will start falling again. Here are a few of Hanson's comments (from notes and memory - Zillow will have a video of the forum available this week).

Hanson argued there is a substantial "shadow inventory" that will come on the market. He talked about the number of homes with negative equity (CoreLogic puts the number at 10.8 million, Zillow put the number at 15.1 million). Hanson also mentioned 6 million delinquent mortgages (LPS puts the number of properties delinquent or in foreclosure at 5.45 million).

And Hanson also mentioned the 6 million recent modifications (he called modified loans the "new subprime" because he thought a large number would default again). Hanson talked about the high "Back-End Debt-to-Income Ratio" even after modification. What Hanson was referring to was the HAMP programs were the borrowers have substantial debt payments in addition to their mortgage payment (student loan, car, other installment loans). In the most recent HAMP report, the back-end DTI was 53.6% after modification, and the front end DTI (principal, interest, taxes, insurance and homeowners association and/or condo fees) was 31%. With these high back-end ratios, Hanson argued many of these people would default (that is why he called it the "new subprime").

Hanson also discussed low mortgage rates (he called "stimulus"), and asked what would happen when mortgage rates increase.

Let's take a deep breathe.

Hanson mentioned several big numbers: 15 million with negative equity, 6 million modifications (more counting other retention programs), 6 million properties currently delinquent. No question there are significant issues for borrowers with negative equity, as an example they will have difficulty moving for a new job, and, as Hanson noted this limits the move-up market. But we can't add these numbers together because that would mostly be double counting. Most (but not all) of the seriously delinquent borrowers have negative equity - and if they don't, they can sell their homes and avoid foreclosure.

And most of the modifications have negative equity. And probably all of the listed (visible inventory) contingent short sales have negative equity. So when we are talking about unlisted inventory that will be forced on the market over the next 2 to 3 years, we can mostly ignore negative equity and focus on current and expected delinquencies.

As far as modifications, Hanson focused on the HAMP data (about 1.08 total permanent modifications so far, and about 23% have defaulted). And I agree that many more of these HAMP modifications will default over the next couple years. But there are another 4.6 million proprietary modification programs completed too (these are lender specific programs). Some of this data is available from Hope Now. The lenders also offered additional retention plans. (removed) These borrowers may redefault when the mortgage rates adjust, but that is several years from now - so this isn't imminent forced inventory on the market.

Update: HAMP modifications have performed better than private mods according to data from the OCC:

HAMP modifications perform better than other modifications. Of the 565,751 HAMP modifications implemented since the third quarter of 2009, 68.2 percent remained current, compared with 53.4 percent of other modifications implemented during the same period(end update)

The most important short term numbers are the 2.02 million properties currently in foreclosure pre-sale inventory (in the foreclosure process) and the 1.52 million properties that are 90 or more days delinquent, but not currently in foreclosure. Many of these properties will be sold as short sales (many are already listed as "short sale contingent"). A large number of these properties that are in foreclosure are located in judicial states, and that means there will not be a huge wave of foreclosures, but a steady stream in those states as the foreclosures work through the courts (and that could keep house prices from increasing).

Two months ago I wrote: House Prices and a Foreclosure Supply Shock. In that post I argued the peak of the foreclosure supply shock is behind us, and that suggests prices have probably bottomed. I think the coming modification redefaults and current delinquencies will keep prices from rising quickly, but I don't think this will push house prices to new lows. There are still large problems to work through, but nothing in Hanson's discussion changed my views on housing.

Bernanke: On the international impact of US accommodative Monetary Policy

by Calculated Risk on 10/14/2012 09:13:00 AM

Bernanke's conclusion is: [US monetary] "policy not only helps strengthen the U.S. economic recovery, but by boosting U.S. spending and growth, it has the effect of helping support the global economy as well."

From Fed Chairman Ben Bernanke: U.S. Monetary Policy and International Implications.

Although the monetary accommodation we are providing is playing a critical role in supporting the U.S. economy, concerns have been raised about the spillover effects of our policies on our trading partners. In particular, some critics have argued that the Fed's asset purchases, and accommodative monetary policy more generally, encourage capital flows to emerging market economies. These capital flows are said to cause undesirable currency appreciation, too much liquidity leading to asset bubbles or inflation, or economic disruptions as capital inflows quickly give way to outflows.Update note: Emphasis added.

I am sympathetic to the challenges faced by many economies in a world of volatile international capital flows. And, to be sure, highly accommodative monetary policies in the United States, as well as in other advanced economies, shift interest rate differentials in favor of emerging markets and thus probably contribute to private capital flows to these markets. I would argue, though, that it is not at all clear that accommodative policies in advanced economies impose net costs on emerging market economies, for several reasons.

First, the linkage between advanced-economy monetary policies and international capital flows is looser than is sometimes asserted. Even in normal times, differences in growth prospects among countries--and the resulting differences in expected returns--are the most important determinant of capital flows. The rebound in emerging market economies from the global financial crisis, even as the advanced economies remained weak, provided still greater encouragement to these flows. Another important determinant of capital flows is the appetite for risk by global investors. Over the past few years, swings in investor sentiment between "risk-on" and "risk-off," often in response to developments in Europe, have led to corresponding swings in capital flows. All told, recent research, including studies by the International Monetary Fund, does not support the view that advanced-economy monetary policies are the dominant factor behind emerging market capital flows.1 Consistent with such findings, these flows have diminished in the past couple of years or so, even as monetary policies in advanced economies have continued to ease and longer-term interest rates in those economies have continued to decline.

Second, the effects of capital inflows, whatever their cause, on emerging market economies are not predetermined, but instead depend greatly on the choices made by policymakers in those economies. In some emerging markets, policymakers have chosen to systematically resist currency appreciation as a means of promoting exports and domestic growth. However, the perceived benefits of currency management inevitably come with costs, including reduced monetary independence and the consequent susceptibility to imported inflation. In other words, the perceived advantages of undervaluation and the problem of unwanted capital inflows must be understood as a package--you can't have one without the other.

Of course, an alternative strategy--one consistent with classical principles of international adjustment--is to refrain from intervening in foreign exchange markets, thereby allowing the currency to rise and helping insulate the financial system from external pressures. Under a flexible exchange-rate regime, a fully independent monetary policy, together with fiscal policy as needed, would be available to help counteract any adverse effects of currency appreciation on growth. The resultant rebalancing from external to domestic demand would not only preserve near-term growth in the emerging market economies while supporting recovery in the advanced economies, it would redound to everyone's benefit in the long run by putting the global economy on a more stable and sustainable path.

Finally, any costs for emerging market economies of monetary easing in advanced economies should be set against the very real benefits of those policies. The slowing of growth in the emerging market economies this year in large part reflects their decelerating exports to the United States, Europe, and other advanced economies. Therefore, monetary easing that supports the recovery in the advanced economies should stimulate trade and boost growth in emerging market economies as well. In principle, depreciation of the dollar and other advanced-economy currencies could reduce (although not eliminate) the positive effect on trade and growth in emerging markets. However, since mid-2008, in fact, before the intensification of the financial crisis triggered wide swings in the dollar, the real multilateral value of the dollar has changed little, and it has fallen just a bit against the currencies of the emerging market economies.

Conclusion

To conclude, the Federal Reserve is providing additional monetary accommodation to achieve its dual mandate of maximum employment and price stability. This policy not only helps strengthen the U.S. economic recovery, but by boosting U.S. spending and growth, it has the effect of helping support the global economy as well. Assessments of the international impact of U.S. monetary policies should give appropriate weight to their beneficial effects on global growth and stability.

Saturday, October 13, 2012

Unofficial Problem Bank list declines to 872 Institutions

by Calculated Risk on 10/13/2012 06:00:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 13, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, minor changes were made to the Unofficial Problem Bank List this week. The First National Bank of Southern Kansas, Mount Hope, KS ($67 million) merged on an unassisted basis causing its removal. The other change was the Federal Reserve terminating the Prompt Corrective Action order against Sunrise Bank, Cocoa Beach, FL ($100 million).Earlier:

The list holds 872 institutions with assets of $334.9 billion. A year ago, the list had 979 institutions with assets of $403.8 billion.

Next week we anticipate the OCC will release its actions through mid-September 2012. Also, the FDIC will likely be back in the closure business before the month is over.

• Summary for Week Ending Oct 12th

• Schedule for Week of Oct 14th

Schedule for Week of Oct 14th

by Calculated Risk on 10/13/2012 01:05:00 PM

Earlier:

• Summary for Week Ending Oct 12th

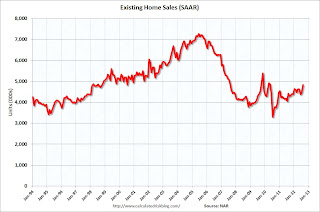

This will be a very busy week for economic data. There are three key housing reports to be released this week: October homebuilder confidence on Tuesday, September housing starts on Wednesday, and September existing home sales on Friday.

Another key report is retail sales for September. For manufacturing, the October NY Fed (Empire state) and Philly Fed surveys, and the September Industrial Production and Capacity Utilization report will be released this week.

On prices, CPI for September will be released on Tuesday.

8:30 AM ET: Retail sales for September will be released.

8:30 AM ET: Retail sales for September will be released. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 22.7% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted).

The consensus is for retail sales to increase 0.7% in September, and for retail sales ex-autos to increase 0.5%.

8:30 AM: NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of minus 3, up from minus 10.4 in September (below zero is contraction).

10:00 AM: Manufacturing and Trade: Inventories and Sales for August (Business inventories). The consensus is for 0.5% increase in inventories.

8:30 AM: Consumer Price Index for September. The consensus is for CPI to increase 0.5% in September and for core CPI to increase 0.2%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This shows industrial production since 1967.

The consensus is for Industrial Production to increase 0.2% in September, and for Capacity Utilization to increase to 78.3%.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 41, up from 40 in September. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. Total housing starts were at 750 thousand (SAAR) in August, up 2.3% from the revised July rate of 733 thousand (SAAR). Single-family starts increased 5.5% to 535 thousand in August.

The consensus is for total housing starts to increase to 765,000 (SAAR) in September, up from 750,000 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 339 thousand.

10:00 AM: Philly Fed Survey for October. The consensus is for a reading of 0.5, up from minus 1.9 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for September. The consensus is for a 0.2% increase in this index.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 4.75 million on seasonally adjusted annual rate (SAAR) basis. Sales in August 2012 were 4.82 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for September 2012

Summary for Week Ending Oct 12th

by Calculated Risk on 10/13/2012 08:01:00 AM

This was a very light week for US economic data. Don't worry, there will be plenty of data next week!

Weekly initial unemployment claims dropped sharply, but a DOL official said the decline was mostly related to one state not reporting quarterly claims - so we might see a large upward revision next week.

From Kathleen Pender at the San Francisco Chronicle: California EDD denies it under-reported jobless claims

[A] DOL spokesman, who spoke on condition of anonymity ... said the department was expecting an 18.5 percent increase in new claims last week; instead it reported only an 8.6 percent increase. (These numbers are not seasonally adjusted; the seasonally adjusted jobless claims fell by 30,000 from the week before).Consumer sentiment was at the highest level since 2007 - still weak, but improving. The trade deficit is increased in August, and shows an ongoing structural imbalance.

Unadjusted claims often shoot up the first week of a new quarter ... state employment departments have to review certain unemployment recipients to make sure they are not collecting benefits when they have a job. They also have to check up on some people who are receiving federal extended benefits, which start after a person has exhausted their regular state benefits. Sometimes, people who are getting extended benefits and get a part-time job or freelance work have to start over with a new state claim. As part of their quarterly review, the states are supposed to weed these people out and put them on a new state claim, which for statistical purposes counts as a new jobless claim.

States normally do this at the end of a quarter, which contributes to a jump in new claims at the beginning of the next quarter. The labor department spokesman said, “One large state has not completed this process,” which is why the data reported [this week] was better than expected.

He would not name the state but said it would be clear when the department issues a state-by-state breakdown of this week’s report next week. EDD spokeswoman Loree Levy could not tell me whether California is the state that had not yet finished this task. “We have been completing this on a timely basis for years,” she said.

Here is a summary of last week in graphs:

• Trade Deficit increased in August to $44.2 Billion

The Department of Commerce reported:

The Department of Commerce reported: [T]otal August exports of $181.3 billion and imports of $225.5 billion resulted in a goods and services deficit of $44.2 billion, up from $42.5 billion in July, revised. August exports were $1.9 billion less than July exports of $183.2 billion. August imports were $0.2 billion less than July imports of $225.7 billion.July was revised from $42.0 billion. The trade deficit was larger than the consensus forecast of $44.0 billion.

Oil averaged $94.36 in August, up slightly from $93.83 per barrel in July. Import oil prices will probably increase further in September. The trade deficit with China decreased slightly to $28.7 billion in August, down from $29.0 billion in August 2011. Still, most of the trade deficit is due to oil and China.

The trade deficit with the euro area was $9.7 billion in August, up from $7.8 billion in August 2011.

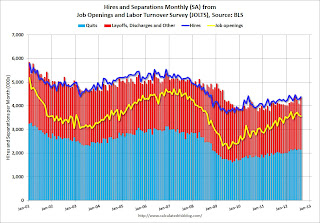

• BLS: Job Openings "essentially unchanged" in August, Up year-over-year

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011.

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011. Quits decreased slightly in August, and quits are up about 5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

This suggests a gradually improving labor market.

• Weekly Initial Unemployment Claims declined sharply to 339,000

The DOL reports:

The DOL reports:In the week ending October 6, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 30,000 from the previous week's revised figure of 369,000. The 4-week moving average was 364,000, a decrease of 11,500 from the previous week's revised average of 375,500.The previous week was revised up from 367,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined sharply to 364,000. This is just above the cycle low for the 4-week average of 363,000 in March.

• Consumer Sentiment increased to 83.1, Highest since 2007

The preliminary Reuters / University of Michigan consumer sentiment index for October increased to 83.1, up from the September reading of 78.3.

This is still fairly weak, but this is the highest level since 2007.

Friday, October 12, 2012

Consumer Sentiment Graph

by Calculated Risk on 10/12/2012 09:44:00 PM

Notes: Looks like the FDIC took another week off! I'm back from the housing forum in San Francisco. I'll write down a few thoughts on the forum this weekend. Here is a graph of consumer sentiment released this morning.

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for October increased to 83.1, up from the September reading of 78.3.

This is still fairly weak, but this is the highest level since 2007.

Alphaville: A Grexit Delayed

by Calculated Risk on 10/12/2012 01:32:00 PM

An interesting article from David Keohane at Alphaville: A Grexit delayed if not deniedCiti are pushing that fateful day back:

We have held the view, since May 2012, that a Greek exit from the euro area (“Grexit”) in the next 12 to 18 months is a high-probability event (90%) which we assume, for the sake of argument, would happen on January 1 2013. We are now cutting the probability of Grexit over the next 12-18 months to 60% and judge that this event will probably happen later than we previously thought, most likely in 1H 2014.There is much more in the article.

It’s all about German politics, something we have gone over before and won’t do again now. ... But essentially, everything is pointing to a slower evolution of this crisis with both Spain and Greece edging towards decisions rather than careening.

Note: I'm at the Zillow housing forum in San Francisco. The first panel just concluded "Is it a good time to buy in California?". The consensus was yes, but mortgage / housing analyst Mark Hanson thought there was a new bubble developing in some areas like Phoenix (at the low end), and that the current improvement was just a "stimulus high" and that there would be a hangover to follow.

Misc: Consumer Sentiment increases to 83.1, JPMorgan on Housing

by Calculated Risk on 10/12/2012 09:55:00 AM

• JPMorgan's Jamie Dimon on housing:

Importantly, we believe the housing market has turned the corner. In our Mortgage Banking business, we were encouraged that credit trends continued to modestly improve, and, as a result, the Firm reduced the related loan loss reserves by $900 million. Despite this improvement, the absolute level of charge-offs remains elevated. We also expect to see high default-related expense for a while longer.• The Reuter's/University of Michigan's Consumer sentiment index (preliminary for October) increased to 83.1. This is the highest level since 2007. The consensus was for sentiment to be unchanged at 78.3. (I'll post a graph later after I return from housing forum).

BLS: Producer Prices increased 1.1% in September

by Calculated Risk on 10/12/2012 08:30:00 AM

The Producer Price Index for finished goods rose 1.1 percent in September, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Prices for finished goods advanced 1.7 percent in August and moved up 0.3 percent in July. At the earlier stages of processing, prices received by manufacturers of intermediate goods rose 1.5 percent in September, and the crude goods index advanced 2.8 percent. On an unadjusted basis, prices for finished goods climbed 2.1 percent for the 12 months ended September 2012, the largest rise since a 2.8-percent increase for the 12 months ended March 2012.The PPI is very volatile and is impacted by energy prices. Note the core PPI was unchanged. CPI will be released next Tuesday.

...

Finished energy: Prices for finished energy goods advanced 4.7 percent in September after rising 6.4 percent in August. A 9.8-percent jump in the gasoline index accounted for over eighty percent of the September increase. Advances in the indexes for diesel fuel and residential natural gas also contributed to the rise in finished energy goods prices.

...

Finished core: Prices for finished goods less foods and energy were unchanged in September after rising 0.2 percent a month earlier.

Thursday, October 11, 2012

Friday: PPI, Consumer Sentiment

by Calculated Risk on 10/11/2012 06:54:00 PM

Note: I'm in San Francisco attending the Zillow real estate forum. Best to all.

From Jim Hamilton at Econbrowser: Governor Brown solves California's gas price problem

California has separate gasoline requirements from the rest of the nation, and also requires a different, more-expensive fuel for summer sales relative to winter. Because refiners don't want to be stuck holding the summer blend through the winter, inventories of summer blend are intentionally low this time of year. That creates a problem when two of the main refineries producing the California summer blend get knocked out, as we just observed.On Friday:

...

But two important developments have changed the picture. First, the Torrance refinery was back in operation by Friday. Second, on Sunday Governor Jerry Brown (D-CA) directed the California Air Resources Board to allow use right now of the winter blend instead of waiting as usual until the first of November, a move that the Board has implemented. This allows existing stocks of the winter fuel to be sold to add to the supply of the summer blend. ...

Several reporters have asked me what economic effects this episode may have. My answer is they should be pretty limited-- I'm expecting the retail price to come down almost as quickly and dramatically as it went up.

• At 8:30 AM, the Producer Price Index for September will be released. The consensus is for a 0.8% increase in producer prices (0.2% increase in core).

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for October) will be released. The consensus is for sentiment to be unchanged at 78.3.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Redfin: House prices up 5% Year-over-year in September

by Calculated Risk on 10/11/2012 02:35:00 PM

From Redfin: Home Prices Dip Slightly from August to September, Still Up 5% from 2011 in Redfin Real-Time Home Price Tracker

Redfin today released its Real-Time Home Price Tracker for September 2012, showing an annual price gain of 5 percent across 19 major U.S. markets. From August to September, prices declined just 0.8% percent, which is a smaller decline than is typical at this time of year.This house price index is based on prices per sq ft. This is a reminder that prices will decline month-to-month in the fall and winter on the Case-Shiller and CoreLogic Not Seasonally Adjusted (NSA) indexes - and it will be important to watch the year-over-year change. Right now I'm guessing the CoreLogic index will report negative month-to-month price changes for August or September, and Case-Shiller for September or October.

...

Inventory still low: The number of homes for sale declined 29.3% from September 2011 to September 2012, and by 4.3% since August.

Homes selling quickly: The percentage of listings that sold within 14 days of their debut held steady in September at 27%.

Home sales up year-over-year, down since August: Home sales increased 4% from last year, and fell 17% since August—a typical seasonal decline.

"September is usually the month that real estate goes on sale, like Christmas toys in January," said Redfin CEO Glenn Kelman. "Whatever didn't sell in the summer gets marked down for a September closing. This September, we saw only a modest decline in prices, with inventory still dropping and demand fairly steady. In the most volatile markets, including Southern California, Phoenix and Las Vegas, we continued to see big price gains."

The reported 29.3% year-over-year decrease in inventory is similar to other sources and is a key driver for the year-over-year price increase.

RealtyTrac: Foreclosure Activity Drops to 5-Year Low in September

by Calculated Risk on 10/11/2012 11:08:00 AM

From RealtyTrac: Foreclosure Activity Drops to 5-Year Low in September

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for September and the third quarter of 2012, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 180,427 U.S. properties in September, a decrease of 7 percent from the previous month and down 16 percent from September 2011. September’s total was the lowest U.S. total since July 2007.

...

“We’ve been waiting for the other foreclosure shoe to drop since late 2010, when questionable foreclosure practices slowed activity to a crawl in many areas, but that other shoe is instead being carefully lowered to the floor and therefore making little noise in the housing market — at least at a national level,” said Daren Blomquist, vice president at RealtyTrac. “Make no mistake, however, the other shoe is dropping quite loudly in certain states, primarily those where foreclosure activity was held back the most last year.

Click on graph for larger image.

Click on graph for larger image.This graph from RealtyTrac shows foreclosure activity for the last three years.

Some of the decline in foreclosure activity this year is related to the increased emphasis on short sales and modifications.

More from the press release:

“Meanwhile, several states where the foreclosure flow was not so dammed up last year could see a roller-coaster pattern in foreclosure activity going forward because of recent legislation or court rulings that substantively change the rules to properly foreclose,” Blomquist added. “A backlog of delayed foreclosures will likely build up in those states as lenders adjust to the new rules, with many of those delayed foreclosures eventually hitting down the road.”

The national decrease in September and the third quarter was driven mostly by sizable decreases in the non-judicial foreclosure states such as California, Georgia, Texas, Arizona and Michigan.

Several judicial foreclosure states — including Florida, Illinois, Ohio, New Jersey and New York — continued to buck the national trend, registering substantial year-over-year increases in foreclosure activity in September and the third quarter.

The second graph from RealtyTrac shows the percent change for the largest states. Judicial states, like New Jersey, are seeing an increase in activity (they are backed up for years), but non-judicial states like California are seeing less foreclosure activity.

The second graph from RealtyTrac shows the percent change for the largest states. Judicial states, like New Jersey, are seeing an increase in activity (they are backed up for years), but non-judicial states like California are seeing less foreclosure activity.

Trade Deficit increased in August to $44.2 Billion

by Calculated Risk on 10/11/2012 09:08:00 AM

The Department of Commerce reported:

[T]otal August exports of $181.3 billion and imports of $225.5 billion resulted in a goods and services deficit of $44.2 billion, up from $42.5 billion in July, revised. August exports were $1.9 billion less than July exports of $183.2 billion. August imports were $0.2 billion less than July imports of $225.7 billion.June was revised from $42.0 billion. The trade deficit was larger than the consensus forecast of $44.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through July 2012.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in August. It appears that the global economic weakness is impacting both exports and imports.

Exports are 9% above the pre-recession peak and up 2% compared to August 2011; imports are 3% below the pre-recession peak, and up about 1% compared to August 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through August.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $94.36 in August, up slightly from $93.83 per barrel in July. Import oil prices will probably increase further in September. The trade deficit with China decreased slightly to $28.7 billion in August, down from $29.0 billion in August 2011. Still, most of the trade deficit is due to oil and China.

The trade deficit with the euro area was $9.7 billion in August, up from $7.8 billion in August 2011.

Weekly Initial Unemployment Claims declined sharply to 339,000

by Calculated Risk on 10/11/2012 08:30:00 AM

The DOL reports:

In the week ending October 6, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 30,000 from the previous week's revised figure of 369,000. The 4-week moving average was 364,000, a decrease of 11,500 from the previous week's revised average of 375,500.The previous week was revised up from 367,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined sharply to 364,000. This is just above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were lower than the consensus forecast of 370,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but starting to decline again recently.