by Calculated Risk on 10/18/2012 12:12:00 PM

Thursday, October 18, 2012

Downside Risks

Occasionally, over the last several years, I've posted a list of downside risks to economic growth - and here is another one. Currently my forecast is still for sluggish and choppy growth, but I think there are reasons to expect US economic growth to pickup in the next year or two, perhaps to trend growth. As I noted last month in Two Reasons to expect Economic Growth to Increase, residential investment is now a tailwind for the economy, and the drag from state and local government cutbacks is mostly behind us.

There are always many downside risks (meteor strikes, major terrorist attack, war somewhere - possibly with Iran), but I think these are the most probable downside risks:

• The European financial crisis. The European crisis has been threatening to spill over into the US for several years. Looking back, I was writing about Greece, Ireland and Spain sovereign debt issues in 2009. This year the recession in Europe is hitting US exports, but so far there is little financial contagion.

The European situation could spin out of control at any time. Currently the unemployment rate is 25.1% in both Spain and Greece, and that is political unsustainable. There are decisions to made soon regarding Greece (another round of financial help) and Spain (when will they ask for a bailout?) - and also about fiscal union and easing back on austerity.

• The economic slowdown in China. The recession in Europe has spilled over into China, and has led to fears of a sharp slowdown. From the WSJ: China's Growth Continues to Slow

Growth in China's gross domestic product fell to 7.4% in the third quarter compared with a year earlier, China's National Bureau of Statistics said Thursday, down from 7.6% in the second quarter and the weakest since the beginning of 2009. The seventh consecutive deceleration reflected a combination of weak demand from abroad, flagging investment at home, and insufficient spending by China's households to pick up the slack.China reports GDP on a year-over-year basis (the US reports an annualized rate quarterly). A sharp slowdown in China might lead to a higher trade deficit with the US - and also might reveal some financial issues in China. As Warren Buffett said "It's only when the tide goes out that you learn who's been swimming naked."

Data for September showed some signs of stabilization. Industrial output growth rose to 9.2% year-over-year, from 8.9% in August. Exports also bounced back, up 9.9% year-over-year in September, after 2.7% in the previous month. And Chinese refineries processed a record high amount of crude oil, 7% more than a year earlier.

Of course a slowdown in China might lead to lower commodity prices, and that would help many sectors in the US.

• The Fiscal Slope. This is commonly called the "fiscal cliff", but it is more of a slope. This refers to several federal tax increases and spending cuts that are scheduled to happen at the beginning of 2013. This includes ending the Bush-era tax cuts, ending the temporary payroll tax reduction, ending extended unemployment benefits, and some large budget cuts mostly for defense spending. No one expect this to be resolved before the election, but after the election this could become a significant issue. This doesn't have to be resolved immediately - policymakers could wait a few months - but this probably has to be resolved fairly early next year.

My assumption is that some sort of reasonable agreement will be reached and the fiscal slope will only have a minor impact on economic growth in 2012. My guess could be wrong, and policymakers might not be able to reach a deal.

Note: There is also the possibility of stronger than expected growth next year. This could lead to the Federal Reserve slowing or even stopping QE3 - but I think that would be considered a strong positive. Right now, sluggish growth with some pickup in 2013, seems most likely.

Philly Fed: "modest improvement" in Region’s manufacturing sector

by Calculated Risk on 10/18/2012 10:00:00 AM

The Philly Fed manufacturing index showed expansion in October after five consecutive months of contraction. From the Philly Fed: October Manufacturing Survey

Firms responding to the October Business Outlook Survey reported a modest improvement in business activity this month. The survey’s indicators for general activity returned to positive territory, while new orders and shipments recorded levels near zero. But firms reported continuing declines in employment and hours worked. Indicators for the firms’ expectations over the next six months remained positive.Earlier in the week, the NY Fed reported:

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 8 points, to 5.7, marking the first positive reading since April.

Labor market conditions at the reporting firms remained weak this month. The current employment index dipped 3 points, to ‐10.7, its lowest reading since September 2009.

emphasis added

The October Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to decline for a third consecutive month. The general business conditions index increased four points but remained negative at -6.2.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.

The average of the Empire State and Philly Fed surveys increased in October but was still slightly negative. This suggests another weak reading for the ISM manufacturing index.

Weekly Initial Unemployment Claims increase sharply to 388,000

by Calculated Risk on 10/18/2012 08:30:00 AM

The DOL reports:

In the week ending October 13, the advance figure for seasonally adjusted initial claims was 388,000, an increase of 46,000 from the previous week's revised figure of 342,000. The 4-week moving average was 365,500, an increase of 750 from the previous week's revised average of 364,750.The previous week was revised up from 339,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 365,500. This is just above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were higher than the consensus forecast of 365,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but near the cycle bottom. The large swings over the last two weeks were related to timing and technical factors, and is a reason to use the 4-week average.

Wednesday, October 17, 2012

Thursday: Weekly Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 10/17/2012 08:24:00 PM

A couple of articles on housing:

An interesting comment via Nick Timiraos at the WSJ: Why Housing Construction Is Rebounding

Gains in construction should lift the economy. Glenn Kelman, chief executive of real-estate brokerage Redfin, writes in an op-ed at Quartz that builders have been completing “half-built projects” with “skeleton crews” for much of the past year. That hasn’t done too much for job growth. “It takes fewer cooks to prepare leftovers for dinner,” he writes.This could be part of the reason that construction employment is lagging, but I also think we will see upward revisions (the preliminary benchmark revision indicated a fairly large upward revision for construction employment). The construction jobs are coming ...

And from Neil Irwin at the WaPo: September figures may provide signs of a housing recovery

First, it helps to understand how deep, and sustained, this housing depression has been. Residential investment — essentially, housing construction and sales activity — has been below 3 percent of gross domestic product every quarter since the fourth quarter of 2008, closing in on four years. Before this downturn, it had never fallen below 3 percent for even a single quarter (the data go back to 1947).Here is a graph to go along with Irwin's article:

...

Here’s the thing, however: The overbuilding of houses during the boom years, while real, was not extraordinary by historical standards. The underbuilding of houses has been far greater than the excess housing construction during the boom relative to demographic trends.

... other factors are probably major culprits in the housing weakness of the past four years: A terrible job market that has made people unwilling or unable to get a mortgage, an overhang of foreclosures that has kept the market for houses from clearing and extreme caution by banks and other lenders that has made it hard to get mortgages.

Now each of those trends seems to be healing.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of residential investment (RI) as a percent of GDP. Currently RI is 2.4% of GDP; just above the record low. I expect RI to recover back towards 4% of GDP over the next few years giving a boost to GDP and employment.

On Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 339 thousand. Look for a larger than normal upward revision to last week's report (apparently one large state was late with their quarterly filing).

• At 10:00 AM, the Philly Fed Survey for October will be released. The consensus is for a reading of 0.5, up from minus 1.9 last month (above zero indicates expansion).

• Also at 10:00 AM, the Conference Board Leading Indicators for September will be released. The consensus is for a 0.2% increase in this index.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

LA area Port Traffic: Moving Sideways

by Calculated Risk on 10/17/2012 05:41:00 PM

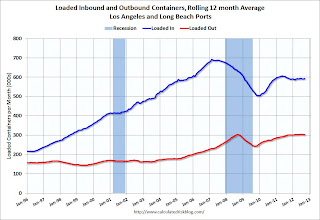

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for September. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is up slightly, and outbound traffic is down slightly compared to the 12 months ending in August.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of September, loaded outbound traffic was down 2% compared to September 2011, and loaded inbound traffic was up 3% compared to September 2011.

For the month of September, loaded outbound traffic was down 2% compared to September 2011, and loaded inbound traffic was up 3% compared to September 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports might increase next month, but probably not by much.

DataQuick: California Foreclosure Activity Lowest Since Early 2007

by Calculated Risk on 10/17/2012 02:54:00 PM

From DataQuick: California Foreclosure Activity Lowest Since Early 2007

Three and a half years after peaking, the number of California homes entering the foreclosure process fell last quarter to the lowest level since the early stages of the housing bust. Mortgage default filings hit their lowest point since first-quarter 2007, due in large part to a stronger economy and housing market and more short sales, a real estate information service reported.

A total of 49,026 Notices of Default (NoD) were recorded on residential properties during the third quarter. That was down 10.2 percent from 54,615 for the prior three months, and down 31.2 percent from 71,275 in third-quarter 2011, according to San Diego-based DataQuick.

Last quarter's number was the lowest since 46,760 NoDs were recorded in first-quarter 2007. NoDs peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

...

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 26.0 percent of statewide resale activity last quarter. That was up from an estimated 24.0 percent the prior quarter and up from 22.9 percent of all resales a year earlier. The estimated number of short sales last quarter rose 19.0 percent from a year earlier.

Foreclosure resales accounted for 20.0 percent of all California resale activity last quarter, down from a revised 27.8 percent the prior quarter and 34.2 percent a year ago. The figure peaked at 57.8 percent in the first quarter of 2009. The level of foreclosure resales - homes foreclosed on in the prior 12 months - varied significantly by county last quarter, from 5.5 percent in San Francisco County to 35.5 percent in Sutter County.

NoD filings fell last quarter across all home price categories. But mortgage defaults remained far more concentrated in California's most affordable neighborhoods.

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. This year will probably the lowest since 2006.

The current level is still far above the peak of the previous housing bust (in 1996). Note: House prices stopped falling in 1996 in California, even though foreclosure activity was still historically high in 1997.

Lawler: Table of Short Sales and Foreclosures for Selected Cities in September

by Calculated Risk on 10/17/2012 01:35:00 PM

CR Note: On Monday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional).

Economist Tom Lawler has been digging up similar data, and he sent me the following table yesterday for several more distressed areas. A couple of clear patterns have developed:

1) There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up in most areas. For two cities, Las Vegas and Reno, short sales are now three times foreclosures, although that is related to the new foreclosure rules in Nevada. Both Phoenix and Sacramento had over twice as many short sales as foreclosures. A year ago, there were many more foreclosures than short sales in most areas. Minneapolis is an exception with more foreclosures than short sales.

2) The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year almost everywhere. Chicago is essentially unchanged from a year ago.

Previous comments from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Sep | 11-Sep | 12-Sep | 11-Sep | 12-Sep | 11-Sep | |

| Las Vegas | 44.8% | 23.5% | 13.6% | 49.4% | 58.4% | 72.9% |

| Reno | 41.0% | 29.0% | 12.0% | 38.0% | 53.0% | 67.0% |

| Phoenix | 27.0% | 27.0% | 12.9% | 37.1% | 39.9% | 64.1% |

| Minneapolis | 10.1% | 13.1% | 25.2% | 32.9% | 35.3% | 46.0% |

| Mid-Atlantic (MRIS) | 12.4% | 12.6% | 9.4% | 14.4% | 21.8% | 27.0% |

| California* | 27.0% | 23.8% | 17.7% | 33.8% | 44.7% | 57.6% |

| Orlando | 28.0% | 25.6% | 24.0% | 35.9% | 52.0% | 61.5% |

| Sacramento | 35.4% | 26.1% | 15.4% | 37.9% | 50.8% | 64.0% |

| Charlotte | 15.3% | 20.9% | ||||

| Chicago | 40.6% | 40.0% | ||||

| Hampton Roads VA | 25.4% | 31.6% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Houston | 16.1% | 19.4% | ||||

| Birmingham AL | 26.6% | 31.8% | ||||

| *share of existing home sales, based on property records | ||||||

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 10/17/2012 10:54:00 AM

Three-fourths of the way through 2012, single family starts are on pace for about 520 thousand this year, and total starts are on pace for about 750 thousand. That is an increase of about 20% from 2011.

The following table shows annual starts (total and single family) since 2005 and an estimate for 2012.

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 20121 | 750.0 | 23.2% | 520.0 | 20.8% |

| 12012 estimated | ||||

And the growth in housing starts should continue. My estimate is the US will probably add around 12 million households this decade, and assuming no excess supply, total housing starts would be 1.2 million per year, plus demolitions and 2nd home purchases. So housing starts could come close to doubling the 2012 level over the next several years - and that is one of the key reasons I think the US economy will continue to grow.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up over the course of the year (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year, but still well below the 1997 through 2007 level of multi-family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Starts are moving up, but the increase in completions has just started (wait a few months!).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Starts are moving up, but the increase in completions has just started (wait a few months!).

Housing Starts increased sharply to 872 thousand SAAR in September

by Calculated Risk on 10/17/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 872,000. This is 15.0 percent above the revised August estimate of 758,000 and is 34.8 percent above the September 2011 rate of 647,000.

Single-family housing starts in September were at a rate of 603,000; this is 11.0 percent above the revised August figure of 543,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 894,000. This is 11.6 percent above the revised August rate of 801,000 and is 45.1 percent above the September 2011 estimate of 616,000.

Single-family authorizations in September were at a rate of 545,000; this is 6.7 percent above the revised August figure of 511,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Total housing starts were at 872 thousand (SAAR) in September, up 15.0% from the revised August rate of 758 thousand (SAAR). Note that August was revised up from 750 thousand.

Single-family starts increased 11.0 to 603 thousand in September.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up about 80% from the bottom start rate, and single family starts are up 70% from the low.

This was way above expectations of 765 thousand starts in September. This was partially because of the volatile multi-family sector, but single family starts were up sharply too - and above 600 thousand SAAR for the first time since 2008. Right now starts are on pace to be up about 25% from 2011.

MBA: Mortgage Purchase activity highest since June

by Calculated Risk on 10/17/2012 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. This is the highest Purchase Index observed in the survey since early June 2012.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.57 percent from 3.56 percent, with points increasing to 0.44 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index is up about 8 over the last four weeks and is at the highest level since June.

But even with the recent increase, the purchase index has mostly moved sideways for the last 2 1/2 years.

Tuesday, October 16, 2012

Wednesday: Housing Starts

by Calculated Risk on 10/16/2012 09:05:00 PM

An update from economists Carmen Reinhart and Kenneth Rogoff at Bloomberg: Sorry, U.S. Recoveries Really Aren’t Different

Five years after the onset of the 2007 subprime financial crisis, U.S. gross domestic product per capita remains below its initial level. Unemployment, though down from its peak, is still about 8 percent. Rather than the V- shaped recovery that is typical of most postwar recessions, this one has exhibited slow and halting growth.Ouch!

This disappointing performance shouldn’t be surprising. We have presented evidence that recessions associated with systemic banking crises tend to be deep and protracted and that this pattern is evident across both history and countries. Subsequent academic research using different approaches and samples has found similar results.

...

Recently, however, a few op-ed writers have argued that, in fact, the U.S. is “different” and that international comparisons aren’t relevant because of profound institutional differences from one country to another. ... We have not publicly supported or privately advised either campaign. We well appreciate that during elections, academic economists sometimes become advocates. It is entirely reasonable for a scholar, in that role, to try to argue that a candidate has a better economic program that will benefit the country in the future. But when it comes to assessing U.S. financial history, the license for advocacy becomes more limited, and we have to take issue with gross misinterpretations of the facts.

And their conclusion:

The most recent U.S. crisis appears to fit the more general pattern of a recovery from severe financial crisis that is more protracted than with a normal recession or milder forms of financial distress. There is certainly little evidence to suggest that this time was worse. Indeed, if one compares U.S. output per capita and employment performance with those of other countries that suffered systemic financial crises in 2007-08, the U.S. performance is better than average.On Wednesday:

• At 7:00 AM, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for September will be released. The consensus is for total housing starts to increase to 765,000 (SAAR) in September, up from 750,000 in August.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

The HARP Refinance Boom Continued in August

by Calculated Risk on 10/16/2012 06:49:00 PM

The Federal Housing Finance Agency (FHFA) today released its August Refinance Report, which shows that Fannie Mae and Freddie Mac loans refinanced through the Home Affordable Refinance Program (HARP) accounted for nearly one-quarter of all refinances in August. Nearly 99,000 homeowners refinanced their mortgage in August through the HARP program with more than 618,000 loans refinanced since the beginning of this year. This continues the strong pace of HARP refinancing with the program on target to reach a million borrowers in 2012.Just wait until the September and October reports are released (when rates declined sharply)!

...

In August, borrowers with loan-to-value (LTV) ratios greater than 105 percent continued to account for more than half the volume of HARP loans as HARP enhancements were fully implemented in the second quarter of 2012.

In August, nearly 18 percent of HARP refinances for underwater borrowers were for shorter-term 15- and 20-year mortgages, which help build equity faster.

In August, HARP refinances represented nearly half or more of total refinances in states hard-hit by the housing downturn – Nevada, Arizona and Florida –compared with 24 percent of total refinances nationwide.

Also in August, HARP refinances for borrowers with LTV ratios greater than 105 percent accounted for more than 70 percent of HARP volume in Nevada, Arizona and Florida and more than 60 percent of the HARP refinances in Idaho and California.

Note: the automated system wasn't released until the end of March - and there were some issues with that system - so HARP refinances didn't really pickup until sometime in Q2. Now they are on pace for 1 million refinances this year.

These "underwater" borrowers are current (most took out loans 5 to 7 years ago), and they will probably stay current with the lower interest rate.

This table shows the number of HARP refinances by LTV through August of this year compared to all of 2011. Clearly there has been a sharp increase in activity.

| HARP Activity | |||

|---|---|---|---|

| 2012, Through August | All of 2011 | Since Inception | |

| Total HARP | 618,217 | 400,024 | 1,640,068 |

| LTV >80% to 105% | 361,697 | 340,033 | 1,292,932 |

| LTV >105% to 125% | 138,050 | 59,991 | 228,666 |

| LTV >125% | 118,470 | 0 | 118,470 |

Lawler: Early Read on September Existing Home Sales

by Calculated Risk on 10/16/2012 05:04:00 PM

From economist Tom Lawler:

While I’m missing reports from several key areas of the country, realtor/MLS data I’ve seen so far suggest to me that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.70 million in September, down 2.5% from August’s pace but up 9.8% from last September’s pace. At first glance the unadjusted reports suggest a much steeper slowdown in September sales than the above numbers suggest, as YOY sales growth in September was significantly lower than in August in most (though not all markets), and the number of areas seeing a decline in sales from a year ago increased noticeably. This September, however, there were two fewer business days than last September, and this September’s seasonal factor will be materially lower than last September’s (meaning the YOY increase in seasonally adjusted sales will be materially higher than the YOY increase in unadjusted sales).

On the inventory front, there is little doubt that there were fewer homes listed for sale nationally at the end of September than at the end of August. How that will translate into the NAR’s inventory estimate, however, is unclear. Based on very limited historical data comparing the NAR’s numbers (which are “consistently” derived only going back to 2007), to other sources of home listings, I “gueestimate” that the NAR will report a monthly decline in the inventory of existing homes for sale of about 3.2% in September, which would be inventories down about 17.6% from last September.

On the median home sales price front, the NAR’s estimates of late have significantly exceeded my estimates using a “weighted-sales” approach, but my “best guess” is that the NAR will report that the national median existing home sales price in September was up about 10.4% from last September.

CR Note: Based on Lawler's estimates, the NAR will report inventory around 2.39 million units for September, and months-of-supply will be around 6.1 months (unchanged from August). This will be the lowest level of inventory for September since 2004. The consensus is the NAR will report sales of 4.75 million on Friday.

Key Measures show low inflation in September

by Calculated Risk on 10/16/2012 01:42:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.6% annualized rate) in September. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for September here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.6% (7.1% annualized rate) in September. The CPI less food and energy increased 0.1% (1.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and core CPI rose 2.0%. Core PCE is for August and increased 1.6% year-over-year.

On a monthly basis, two of these measure were above the Fed's target; trimmed-mean CPI was at 2.6% annualized, median CPI was at 2.6% annualized. However core CPI increased 1.8% annualized, and core PCE for August increased 1.3% annualized. These measures suggest inflation is close to the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target (year-over-year and on a monthly basis).

Report: Housing Inventory declines 17.8% year-over-year in September

by Calculated Risk on 10/16/2012 12:25:00 PM

From Realtor.com: September 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops remained at historic lows, with 1.8 million units for sale in September 2012, down -17.77% compared to a year ago.For sale inventories declined on a year-over-year basis in 143 of the 146 markets tracked by Realtor.com. Fifty two cities saw year-over-year declines greater than 20%.

The median age of inventory was down -11.21% compared to one year ago.

On a month-over-month basis, inventory declined in 126 of 146 markets.

I expect to see smaller year-over-year declines going forward simply because inventory is already very low.

The NAR is scheduled to report September existing home sales and inventory on Friday. The key number in the NAR report will be inventory, and inventory will be down sharply year-over-year again in September.

NAHB Builder Confidence increases in October, Highest since June 2006

by Calculated Risk on 10/16/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 1 point in October to 41. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Edges Higher in October

Builder confidence in the market for newly built, single-family homes edged slightly higher for a sixth consecutive month in October, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The latest, one-point gain brings the index to 41, its strongest level since June of 2006.

“The slight gain in builder confidence this month is an indication that, while still moving forward, the speed at which the housing recovery is proceeding is being moderated by the various constraints such as tight credit, difficult appraisals and more recently, the limited inventory of buildable lots in certain markets,” explained NAHB Chief Economist David Crowe. “These are the complicating factors that make it difficult for builder confidence to reach and surpass the 50-point mark, at which an equal number of builders view sales conditions as good versus poor.”

...

Following substantial increases in the previous month, the HMI components measuring current sales conditions and sales prospects for the next six months each remained unchanged in October at 42 and 51, respectively. Meanwhile, the component measuring traffic of prospective buyers increased 5 points to 35, its highest level since April of 2006.

Builder confidence continued to improve in three out of four regions in October. Looking at three-month moving averages, the HMI gained two points in the Midwest and West to 42 and 44, respectively, and three points in the South, to 39. A three-month moving average for the Northeast’s HMI held unchanged at 29.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September housing starts will be released tomorrow). This was at the consensus estimate of a reading of 41.

Industrial Production increased 0.4% in September, Capacity Utilization increased

by Calculated Risk on 10/16/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.4 percent in September after having fallen 1.4 percent in August. For the third quarter as a whole, industrial production declined at an annual rate of 0.4 percent. Manufacturing output increased 0.2 percent in September but moved down at an annual rate of 0.9 percent in the third quarter. Production at mines advanced 0.9 percent in September, and the output of utilities moved up 1.5 percent. Roughly 0.3 percentage point of the decline in overall industrial production in August reflected the effect of precautionary idling of production in late August along the Gulf of Mexico in anticipation of Hurricane Isaac, and part of the rise in September is a result of the subsequent resumption of activity at idled facilities. At 97.0 percent of its 2007 average, total industrial production in September was 2.8 percent above its year-earlier level. Capacity utilization for total industry moved up 0.3 percentage point to 78.3 percent, a rate 2.0 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.3% is still 2.0 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in September to 97.0. This is 16% above the recession low, but still 3.7% below the pre-recession peak.

The consensus was for Industrial Production to increase 0.2% in September, and for Capacity Utilization to increase to 78.3%. IP was slightly above expectations (some bounce back from shut downs related to Hurricane Isaac) and Capacity Utilization was at expectations. Overall Industrial Production has moved sideways this year.

BLS: CPI increases 0.6% in September, Core CPI 0.1%, Cost-Of-Living Adjustment about 1.66%

by Calculated Risk on 10/16/2012 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in September on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.0 percent before seasonal adjustment. For the second month in a row, the substantial increase in the all items index was mostly the result of an increase in the gasoline index, which rose 7.0 percent in September after increasing 9.0 percent in August.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was above the consensus forecast of a 0.5% increase for CPI, and below the consensus for a 0.2% increase in core CPI.

...

The index for all items less food and energy rose 0.1 percent for the third month in a row.

The increase in CPI was mostly due to the sharp increase in gasoline prices.

Cost-Of-Living Adjustment (COLA): The BLS reported CPI-W increased to 2281.84 in September, for a Q3 average of 226.936. In Q3 2011, CPI-W average 223.33. The annual Social Security Cost-Of-Living Adjustment will be 1.66% (will be rounded).

Monday, October 15, 2012

Tuesday: CPI, Industrial Production, Homebuilder Confidence

by Calculated Risk on 10/15/2012 08:54:00 PM

From the WSJ: Proposal Would Give Banks Protection in Cases Involving Top-Quality Mortgages

The proposal for the first time would establish a basic national standard for loans, known as a "qualified mortgage."On Tuesday:

As part of its deliberation, the Consumer Financial Protection Bureau is considering providing a full legal shield for high-quality loans that qualify, mandating that judges rule in lenders' favor if consumers contest foreclosures, these people say.

For a smaller category of loans that still meet the "qualified mortgage" guidelines but carry higher interest rates—a group similar to "subprime loans"—lenders would receive fewer protections. In those cases, consumers could argue in court that lenders should have known that they couldn't afford the mortgage.

• At 8:30 AM ET, the Consumer Price Index for September will be released. The consensus is for CPI to increase 0.5% in September and for core CPI to increase 0.2%. This release will determine the Cost-of-living-adjustment for Social Security. Currently I expect COLA to be around 1.6%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for September. The consensus is for Industrial Production to increase 0.2% in September, and for Capacity Utilization to increase to 78.3%.

• At 10:00 AM, the October NAHB homebuilder survey will be released. The consensus is for a reading of 41, up from 40 in September. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good. This index bottomed at 8 in January 2009, and was at or below 22 for over 4 1/2 years.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

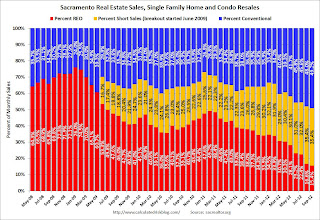

Sacramento September House Sales: Percentage of distressed sales lowest in years

by Calculated Risk on 10/15/2012 06:54:00 PM

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement although the percent of distressed sales is still very high.

In September 2012, 50.8% of all resales (single family homes and condos) were distressed sales. This was down from 52.0% last month, and down from 64.0% in September 2011. The percentage of REOs fell to 15.4%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 35.4%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were over twice as many short sales as REO sales in September. The gap between short sales and REO sales is increasing.

Total sales were down 10% from September 2011, however conventional sales were up 23% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - some decline in overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 63.4% from last September, and listings were down 11.1% in September compared to August.

Cash buyers accounted for 35.9% of all sales (frequently investors), and median prices were up 9.6%% from last September.

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.