by Calculated Risk on 10/22/2012 04:15:00 PM

Monday, October 22, 2012

LPS: Mortgage delinquencies increased sharply in September, Percent in foreclosure process lowest in 2 years

LPS released their First Look report for September today. LPS reported that the percent of loans delinquent increased in September compared to August, but declined about 4% year-over-year. On the other hand, the percent of loans in the foreclosure process declined sharply in September to the lowest level in almost 2 years.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.40% from 6.87% in August. The percent of loans in the foreclosure process declined to 3.87% from 4.04% in August. Note: the normal rate for delinquencies is around 4.5% to 5%.

LPS is looking into the reasons for the increase in the delinquency rate, and will probably provide a discussion in the Mortgage Monitor that will be released in early November. Looking at the table below - that shows the LPS numbers for September 2012, and also for last month (August 2012) and one year ago (September 2011) - most of the increase in delinquencies was in the short term category. The number of serious delinquent properties (90+ days and in-foreclosure) declined 70 thousand from August.

The number of delinquent properties, but not in foreclosure, is down about 7% year-over-year (280,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 9% or 190,000 year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Sept 2012 | August 2012 | Sept 2011 | |

| Delinquent | 7.40% | 6.87% | 7.72% |

| In Foreclosure | 3.87% | 4.04% | 4.18% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 2,170,000 | 1,910,000 | 2,250,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,530,000 | 1,520,000 | 1,730,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,940,000 | 2,020,000 | 2,130,000 |

| Total Properties | 5,640,000 | 5,450,000 | 6,130,000 |

FOMC Preview

by Calculated Risk on 10/22/2012 12:25:00 PM

The Federal Open Market Committee (FOMC) meets on Tuesday and Wednesday, with a statement expected at 2:15 PM ET on Wednesday. The FOMC is expected to take no action at this meeting, although the members will probably discuss setting explicit economic targets for ending QE3 purchases or tightening policy ...

From Cardiff Garcia at Alphaville: Early FOMC preview

... there are a few things that might happen, even if we not get the full picture until the minutes come out a few weeks later.Although the Fed might mention the recent pickup in economic activity, they will not change course quickly. From Neil Irwin at the WaPo: How an improving economy makes new Fed policies more potent

The most important item is that the committee will continue discussing whether to adopt explicit economic targets to determine when tightening (ie raising rates from exceptionally low levels) would begin, replacing the current approach of giving a calendar date, which now mid-2015.

A key part of the Fed’s new strategy last month was to announce that the FOMC “expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.” In other words, the central bank aimed to assure the world that it would not pull away the support strut of low interest rates until the economy was well along in recovering, so long as inflation doesn’t threaten to get much above the Fed’s 2 percent target.It looks like the unemployment rate will decline more than the Fed projected (see second table below), but the rate is still high at 7.8% - and 2% GDP is nothing to get too excited about.

Here are the FOMC Sept meeting projections for GDP and unemployment, and the June projections to show the change.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 2.0 | 2.5 to 3.0 | 3.0 to 3.8 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

The BEA reported GDP increased at a 2.0% annual pace in Q1, and at a 1.3% annual pace in Q2. Forecasts for Q3 have been revised up recently, but the consensus is only for 1.9% annualized in Q3. So this is still close to the recent projections.

The unemployment rate was at 7.8% in September, and that is below the most recent projections for Q4 2012. That is just one month of data. It is possible that the unemployment situation might not be as bad as the FOMC projected, but the unemployment rate is still very high. The key is there is nothing in the recent data that will make the Fed change course any time soon.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 8.0 to 8.2 | 7.6 to 7.9 | 6.7 to 7.3 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

So the FOMC will probably take no action, might mention the recent slight improvement in economic data, and will probably reiterate "If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability." and "To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens."

"The US bright spot"

by Calculated Risk on 10/22/2012 09:13:00 AM

From Kate Mackenzie at FT Alphaville: The US bright spot

It seems odd — and it may well be short-lived — but the US is beginning to shape up as a rare bright spot in the world economy. Or indeed almost the only bright spot in the world’s economy, except for the Gulf petro-states. That is, if you were to base such an assessment solely on Japan’s September export data, released on Monday.Actually it isn't that "odd" as Mackenzie mentions in a note at the bottom: "The FT’s Martin Wolf made a comment along these lines in Sydney last week. Plus, Cardiff has been looking at (very) tentative signs of an upturn in housing and construction for some time now, and that was before Jamie Dimon picked up on it."

Japan’s preliminary September trade data tell a story not dissimilar to China’s — exports to Europe are slowing (unsurprisingly) by a lot, down 26 per cent for the month, year-on-year. Asian exports also fell, by 8.3 per cent. But US exports rose 0.9 per cent. The six months between April and September show a more striking contrast: exports to North America rose 16.6 per cent; while for Asia they fell 4.7 per cent and for Western Europe, there was a 20.8 per cent decline.

This is another reminder that Europe and China pose downside risks, but right now the US is doing better than most other areas.

Sunday, October 21, 2012

Sunday Night Futures

by Calculated Risk on 10/21/2012 09:14:00 PM

Later in the week, there are several key economic releases (Q3 GDP, New Home sales, Durable Goods) and an FOMC announcement on Wednedsy. There are no releases scheduled for tomorrow ...

• Expected: LPS "First Look" Mortgage Delinquency Survey for September.

• At 9:00 PM ET, the Third Presidential Debate: President Obama and former Governor Romney debate Foreign policy at Lynn University in Boca Raton, Florida.

The Asian markets are red tonight, with the Nikkei down 1.2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are down slightly.

Oil prices are down with WTI futures down to $90.05 and Brent down at $110.66 per barrel.

Weekend:

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

Three more questions this week for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Gasoline Prices down 8 cents over last 2 weeks

by Calculated Risk on 10/21/2012 06:24:00 PM

From Reuters: Average U.S. retail gas prices drop 8 cents in two weeks: survey

Gasoline prices averaged $3.7529 per gallon on October 19, down from $3.8375 on October 5, Trilby Lundberg, editor of the Lundberg Survey, said.Those of us in California are still waiting for the "dramatic crash"! We are still paying well over $4 per gallon because of the recent refinery issues (I filled up Friday and paid $4.50 per gallon, but it looks like prices have fallen further over the last 2 days).

...

Lundberg said further declines in retail gas prices are expected if the cost of crude oil does not rise substantially. She added that in California, gasoline prices could have a "dramatic crash" after refinery problems caused a spike two weeks ago.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.60 per gallon. That is about 8 cents below the current level according to Gasbuddy.com, and I expect prices to fall further. Note: Brent crude spot prices is at $110.76 per barrel (WTI is down to $90.05)

Gasoline prices have been on a roller coaster all year. Add a California city to the graph - like Los Angeles or San Francisco - and you will see the recent spike.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Yesterday:

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

DOT: Vehicle Miles Driven increased 1.2% in August

by Calculated Risk on 10/21/2012 12:21:00 PM

The Department of Transportation (DOT) reported Friday:

Travel on all roads and streets changed by 1.2% (3.0 billion vehicle miles) for August 2012 as compared with August 2011. Travel for the month is estimated to be 262.4 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by 0.9% (17.8 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 57 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in August compared to August 2011. In August 2012, gasoline averaged of $3.78 per gallon according to the EIA. Last year, prices in August averaged $3.70 per gallon - but even with the increase in gasoline prices, miles driven increased year-over-year in August.

Gasoline prices were up in August compared to August 2011. In August 2012, gasoline averaged of $3.78 per gallon according to the EIA. Last year, prices in August averaged $3.70 per gallon - but even with the increase in gasoline prices, miles driven increased year-over-year in August.Just looking at gasoline prices suggest miles driven will be down in September - especially with the very high prices in California. Nationally gasoline prices averaged $3.91 in September, up sharply from $3.67 a year ago.

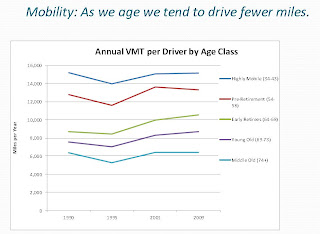

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.I also suspect miles driven has been falling for lower age groups over the last few years, and the next survey will probably show that decline.

With all these factors, it may be years before we see a new peak in miles driven.

Yesterday:

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

On Greece: More Austerity, More Recession, More Extremism

by Calculated Risk on 10/21/2012 09:42:00 AM

The first two articles discuss the rise of extremism in Greece as the country suffers through another year of recession (the unemployment rate in Greece is over 25%). The third article notes that the next tranche of aid is expected by mid-November.

From the NY Times: Amid the Echoes of an Economic Crash, the Sounds of Greek Society Being Torn (ht Ann). An excerpt:

The government just passed a law allowing supermarkets to sell expired food at discounted prices. The price of home heating oil has tripled since 2009, and many apartment blocks are voting not to buy any since too many tenants can’t afford it.And from the WaPo: Anti-immigrant Golden Dawn rises in Greece

As he stood outside a supermarket in a middle-class neighborhood here, a man who gave his name only as Stefanos, 70, said that his biggest fear was that Greece would reach a point “where for every five people unemployed, only one is working.”

“When that one person comes out of the supermarket, the other five are waiting for him outside to grab his groceries,” he said.

As the talks drag on between the government of Prime Minister Antonis Samaras and Greece’s foreign lenders over politically toxic new austerity measures in exchange for more aid, the news media are filled every day with leaks about possible cuts to salaries and pensions, leading to a state of constant, low-grade panic.

...

As she shopped for vegetables at an outdoor market recently, Angeliki Christaki, 58, said she was growing more worried. “We’re heading toward a scenario of civil war,” she said. “But that’s only natural when the rich are against the poor, when the extreme right wing fights the extreme left wing.”

“I was personally crushed when I saw young kids in a Golden Dawn protest,” she said. “I could not believe my eyes.”

At first glance, the shop on a nondescript street in this chaotic capital looks standard-issue military. Fatigues. Camouflage. Hunting gear. Deeper inside, the political message emerges. Black T-shirts emblazoned with modified swastikas — the symbol of the far-right Golden Dawn party — are on sale. A proudly displayed sticker carries a favorite party slogan: “Get the Stench out of Greece.”From the Athens News: Samaras: Certainty of next loan tranche by mid-November

By “stench,” the Golden Dawn — which won its first-ever seats in the Greek Parliament this spring and whose popularity has soared ever since — means immigrants, broadly defined as anyone not of Greek ancestry.

Prime Minister Antonis Samaras on Friday expressed certainty that a 31.5-billion-euro tranche of the EC-ECB-IMF bailout package will be disbursed by mid-November, preferably in its entirety, as soon as a report by the troika is adopted.Yesterday:

Speaking in Brussels at the end of a two-day EU summit, Samaras explained that a new summit will not be required to approve the disbursement, adding that the country's current cash reserves would run out on November 16.

emphasis added

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

Saturday, October 20, 2012

Unofficial Problem Bank list declines to 865 Institutions

by Calculated Risk on 10/20/2012 05:33:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 19, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The OCC released its enforcement actions through mid-September 2012 and the FDIC got back to closing a few banks, which led to many changes to the Unofficial Problem Bank List. For the week, there were nine removals and two additions leaving the list at 865 institutions with assets of $333.2 billion. A year ago, the list held 976 institutions with assets of $401.9 billion.Earlier:

They were six action terminations and three failures this week. The OCC terminated actions against The National Bank, Moline, IL ($1.0 billion); Peoples National Bank, Colorado Springs, CO ($194 million); United Community Bank, National Association, Highland Village, TX ($107 million); First National Bank MidWest, Oskaloosa, IA ($104 million); and First National Bank of Kansas, Burlington, KS ($72 million). The three failures were Excel Bank, Sedalia, MO ($201 million); GulfSouth Private Bank, Destin, FL ($159 million); and First East Side Savings Bank, Tamarac, FL ($67 million).

The two additions were Central Federal Savings and Loan Association, Cicero, IL ($183 million) and F&M Bank and Trust Company, Hannibal, MO ($165 million).

The OCC also issued a Prompt Corrective Action Order against One Bank & Trust, National Association, Little Rock, AR ($475 million). Next week, we anticipate the FDIC will release its actions through September 2012.

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

Schedule for Week of Oct 21st

by Calculated Risk on 10/20/2012 01:10:00 PM

Earlier:

• Summary for Week Ending Oct 19th

The key U.S. economic report for the coming week is the Q3 advance GDP report to be released on Friday. Also New Home sales will be released on Wednesday.

For manufacturing, two regional manufacturing reports will be released (Richmond and Kansas City Fed surveys).

There is an FOMC meeting on Tuesday and Wednesday, with an announcement scheduled for Wednesday at 2:15 PM ET. No significant announcement is expected.

Expected: LPS "First Look" Mortgage Delinquency Survey for September.

9:00 PM: Third Presidential Debate: President Obama and former Governor Romney debate Foreign policy at Lynn University in Boca Raton, Florida.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October. The consensus is for an increase to 6 for this survey from 4 in September (above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for October. The consensus is for a reading of 51.5, unchanged from September.

10:00 AM ET: New Home Sales for September from the Census Bureau.

10:00 AM ET: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for an increase in sales to 385 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 373 thousand in August. Watch for possible upgrades to the sales rates for previous months.

10:00 AM: FHFA House Price Index for August 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.4% increase in house prices.

2:15 PM: FOMC Meeting Announcement. No significant announcement is expected.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 372 thousand from 388 thousand.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 7.0% decrease in durable goods orders.

8:30 AM ET: Chicago Fed National Activity Index (September). This is a composite index of other data.

10:00 AM ET: Pending Home Sales Index for September. The consensus is for a 2.5% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for October. The consensus is for an a reading of 4, up from 2 in September (above zero is expansion).

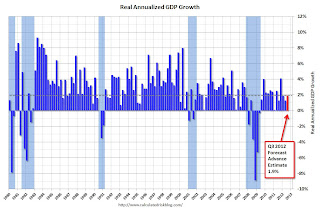

8:30 AM: Q3 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.9% annualized in Q3.

8:30 AM: Q3 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.9% annualized in Q3.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the consensus forecast for Q3 GDP.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for no change from the preliminary reading of 83.1.

Summary for Week Ending Oct 19th

by Calculated Risk on 10/20/2012 08:01:00 AM

The US economic data clearly improved last week. This was the third week in a row with mostly better than expected data, and suggests some recent pickup in economic activity.

The week started off with a strong retail sales report for September. Although some of the increase in sales was related to higher gasoline prices, sales excluding gasoline picked up too.

And once again the housing reports showed significant improvement. Housing starts were up sharply (as were permits), and residential investment is now a fairly strong tailwind for the economy (I expect this to continue in 2013 and beyond). On Friday, existing home sales disappointed a few people, but the underlying details were solid. For some analysis, see: Existing Home Sales: A few comments and NSA Sales Graph

There was even a little improvement in the regional manufacturing reports (these have been showing contraction for months). The Empire State report still showed contraction in October, but at a slower pace than in September, and the Philly Fed report showed expansion for the first time since April.

One negative report was for initial weekly unemployment claims. Claims were down significantly in the prior week, and increased sharply last week. The large swings over the last two weeks were related to timing and technical factors, and are a reminder to use the 4-week average. On a 4-week average basis, unemployment claims are still elevated, but near the cycle low.

Here is a summary of last week in graphs:

• Housing Starts increased sharply to 872 thousand SAAR in September

Click on graph for larger image.

Click on graph for larger image.

The first graph shows single family and total housing starts.

Total housing starts were at 872 thousand (SAAR) in September, up 15.0% from the revised August rate of 758 thousand (SAAR). Note that August was revised up from 750 thousand.

Single-family starts increased 11.0 to 603 thousand in September.

This was way above expectations of 765 thousand starts in September. This was partially because of the volatile multi-family sector, but single family starts were up sharply too - and above 600 thousand SAAR for the first time since 2008. Right now starts are on pace to be up about 25% from 2011.

• Existing Home Sales in September: 4.75 million SAAR, 5.9 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in September 2012 (4.75 million SAAR) were 1.7% lower than last month, and were 11.0% above the September 2011 rate.

According to the NAR, inventory declined to 2.32 million in September down from 2.40 million in August. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 20.0% year-over-year in September from September 2011. This is the 19th consecutive month with a YoY decrease in inventory. Months of supply declined to 5.9 months in September.

This was at expectations of sales of 4.75 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• Retail Sales increased 1.1% in September

On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted), and sales were up 5.4% from September 2011.

On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted), and sales were up 5.4% from September 2011.Sales for August were revised up to a 1.2% increase (from 0.9% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.6% from the bottom, and now 9.0% above the pre-recession peak (not inflation adjusted)

Excluding gasoline, retail sales are up 20.9% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted).

Excluding gasoline, retail sales are up 20.9% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted).This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.3% on a YoY basis (5.4% for all retail sales). Retail sales ex-autos increased 1.1% in September.

This was above the consensus forecast for retail sales of a 0.7% increase in September, and above the consensus for a 0.5% increase ex-auto.

• Industrial Production increased 0.4% in September, Capacity Utilization increased

From the Fed: "Capacity utilization for total industry moved up 0.3 percentage point to 78.3 percent, a rate 2.0 percentage points below its long-run (1972--2011) average."

From the Fed: "Capacity utilization for total industry moved up 0.3 percentage point to 78.3 percent, a rate 2.0 percentage points below its long-run (1972--2011) average."This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.3% is still 2.0 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.4 percent in September to 97.0. This is 16% above the recession low, but still 3.7% below the pre-recession peak.

The consensus was for Industrial Production to increase 0.2% in September, and for Capacity Utilization to increase to 78.3%. IP was slightly above expectations (some bounce back from shut downs related to Hurricane Isaac) and Capacity Utilization was at expectations. Overall Industrial Production has moved sideways this year.

• Key Measures show low inflation in September

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and core CPI rose 2.0%. Core PCE is for August and increased 1.6% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and core CPI rose 2.0%. Core PCE is for August and increased 1.6% year-over-year.On a monthly basis, two of these measure were above the Fed's target; trimmed-mean CPI was at 2.6% annualized, median CPI was at 2.6% annualized. However core CPI increased 1.8% annualized, and core PCE for August increased 1.3% annualized. These measures suggest inflation is close to the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target (year-over-year and on a monthly basis).

• Weekly Initial Unemployment Claims increase sharply to 388,000

The DOL reports:

The DOL reports:In the week ending October 13, the advance figure for seasonally adjusted initial claims was 388,000, an increase of 46,000 from the previous week's revised figure of 342,000. The 4-week moving average was 365,500, an increase of 750 from the previous week's revised average of 364,750.The previous week was revised up from 339,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 365,500. The 4-week average has mostly moved moving sideways this year, but is now near the cycle bottom.

The large swings over the last two weeks were related to timing and technical factors, and is a reason to use the 4-week average.

Weekly claims were higher than the consensus forecast of 365,000.

• Regional Fed Surveys were mixed

The Philly Fed manufacturing index showed expansion in October after five consecutive months of contraction. From the Philly Fed: October Manufacturing Survey: "Firms responding to the October Business Outlook Survey reported a modest improvement in business activity this month. ... The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 8 points, to 5.7, marking the first positive reading since April."

Earlier in the week, the NY Fed reported: "The October Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to decline for a third consecutive month. The general business conditions index increased four points but remained negative at -6.2."

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.The average of the Empire State and Philly Fed surveys increased in October but was still slightly negative. This suggests another weak reading for the ISM manufacturing index - but maybe slightly better than last month.

Friday, October 19, 2012

Bank Failure #46 in 2012: Excel Bank, Sedalia, Missouri

by Calculated Risk on 10/19/2012 07:36:00 PM

Our spreadsheets aren’t adding up

Big Excel problem.

by Soylent Green is People

From the FDIC: Simmons First National Bank, Pine Bluff, Arkansas, Assumes All of the Deposits of Excel Bank, Sedalia, Missouri

As of June 30, 2012, Excel Bank had approximately $200.6 million in total assets and $187.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $40.9 million. ... Excel Bank is the 46th FDIC-insured institution to fail in the nation this year, and the third in Missouri.FDIC hat trick today!

Earlier on Existing Home Sales:

• Existing Home Sales in September: 4.75 million SAAR, 5.9 months

• Existing Home Sales: A few comments and NSA Sales Graph

• Existing Home Sales graphs

Bank Failure #45: First East Side Savings Bank, Tamarac, Florida

by Calculated Risk on 10/19/2012 06:40:00 PM

Said the Feds to East Side Bank

To a deluxe Stearns.

by Soylent Green is People

From the FDIC: Stearns Bank National Association, St. Cloud, Minnesota, Assumes All of the Deposits of First East Side Savings Bank, Tamarac, Florida

As of June 30, 2012, First East Side Savings Bank had approximately $67.2 million in total assets and $65.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $9.1 million. ... First East Side Savings Bank is the 45th FDIC-insured institution to fail in the nation this year, and the seventh in Florida.Two down today.

Bank Failure #44 in 2012: GulfSouth Private Bank, Destin, Florida

by Calculated Risk on 10/19/2012 05:07:00 PM

Hours before SmartBank arrived

Smarter cash made off.

by Soylent Green is People

From the FDIC: SmartBank, Pigeon Forge, Tennessee, Assumes All of the Deposits of GulfSouth Private Bank, Destin, Florida

As of June 30, 2012, GulfSouth Private Bank had approximately $159.1 million in total assets and $151.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $36.1 million. ... GulfSouth Private Bank is the 44th FDIC-insured institution to fail in the nation this year, and the sixth in Florida.The FDIC gets back to work.

Earlier on Existing Home Sales:

• Existing Home Sales in September: 4.75 million SAAR, 5.9 months

• Existing Home Sales: A few comments and NSA Sales Graph

• Existing Home Sales graphs

Lawler: Comments on the Existing Home Sales Report

by Calculated Risk on 10/19/2012 04:01:00 PM

Economist Tom Lawler sent me his comments on the NAR report:

The National Association of Realtors estimated that US existing home sales ran at a seasonally adjusted annual rate of 4.75 million in September, down 1.7% from August’s slightly upwardly revised (to 4.83 million from 4.82 million) pace. The upward revision to August’s seasonally-adjusted pace was puzzling/mildly amusing, as unadjusted sales were revised downward to 476,000 from 477,000! The NAR’s September seasonally-adjusted sales estimate was close to consensus and just a tad higher than my estimate based on regional tracking, though all of my “miss” was in the seasonal factor for September – my unadjusted sales estimate was “right on.” While seasonally adjusted sales in September were up 11.0% from last September’s pace, unadjusted sales showed a YOY gain of just 2.2% (mainly but not totally reflecting the lower business day count).

The NAR’s estimate of the inventory of existing homes for sale at the end of September was 2.32 million, down 3.3% from August’s downwardly revised (by a hefty 2.8% to 2.40 million from 2.47 million) level and down 20.0% from last September.

According to the NAR, the median existing US home sales price last month was $183,900, up 11.3% from last September, and the median existing SF home sales price was $184,300, up 11.4% from a year ago. August’s median home sales price was revised down by 1.3%, and August’s median SF home sales price was revised down by 1.7% -- resulting in a revised YOY increase of 8.4%, vs. last month’s estimate of 10.2%. The NAR’s median sales price numbers continued to come in higher than what state and local realtor reports would suggest, for unknown reasons.

In its press release the NAR misleading said that “(d)istressed homes3 - foreclosures and short sales sold at deep discounts - accounted for 24 percent of September sales (13 percent were foreclosures and 11 percent were short sales), up from 22 percent in August; they were 30 percent in September 2011.” A footnote in the press release notes that the distressed sales shares are from a monthly survey of realtors (for the Realtor Confidence Index), generally taken from the last week of a given report month through the first week of the subsequent month. The sample size is small and varies over time; is voluntary; and the results often do not represent trends in the market as a whole. Based on available data from various regional reports, the short-sale share of home sales was higher this September than last September, while the foreclosure-sale share was down sharply.

If, in fact, the “distressed” sales share of total home sales had been 24% last month and 30% last September, and if the NAR unadjusted sales estimates AND seasonal factors were correct, then “non-distressed” home sales last month were up about 10.9% from a year ago on an unadjusted basis, and up about 20.5% from a year ago on a seasonally adjusted basis.

Of course, in many markets, especially some hard-hit ones, the distressed share of total sales last month fell by a lot more than that implied by the NAR’s survey. Here’s an updated table for selected markets.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Sep | 11-Sep | 12-Sep | 11-Sep | 12-Sep | 11-Sep | |

| Las Vegas | 44.8% | 23.5% | 13.6% | 49.4% | 58.4% | 72.9% |

| Reno** | 41.0% | 29.0% | 12.0% | 38.0% | 53.0% | 67.0% |

| Phoenix | 27.0% | 27.0% | 12.9% | 37.1% | 39.9% | 64.1% |

| Minneapolis | 10.1% | 13.1% | 25.2% | 32.9% | 35.3% | 46.0% |

| Mid-Atlantic (MRIS) | 12.4% | 12.6% | 9.4% | 14.4% | 21.8% | 27.0% |

| California* | 27.0% | 23.8% | 17.7% | 33.8% | 44.7% | 57.6% |

| Orlando | 28.0% | 25.6% | 24.0% | 35.9% | 52.0% | 61.5% |

| Sacramento | 35.4% | 26.1% | 15.4% | 37.9% | 50.8% | 64.0% |

| King Co. WA** | 16.0% | 10.0% | 10.0% | 22.0% | 25.0% | 32.0% |

| Lee County, FL*** | 21.4% | 15.9% | 37.3% | 54.0% | ||

| Charlotte | 15.3% | 20.9% | ||||

| Chicago | 40.6% | 40.0% | ||||

| Hampton Roads VA | 25.4% | 31.6% | ||||

| Northeast Florida | 44.7% | 49.0% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Houston | 16.1% | 19.4% | ||||

| Birmingham AL | 26.6% | 31.8% | ||||

| *share of existing home sales, based on property records | ||||||

| ** Third Quarter: total may not add up due to rounding | ||||||

| *** SF Only | ||||||

The “big” story in the above table, of course, was the huge decline in foreclosure sales this September vs. last September. Foreclosure sales, of course, tend to be “uber-distressed”/”highly motivated.” Short sales, in contrast, are more “mixed” in terms of urgency and distress.

Earlier on Existing Home Sales:

• Existing Home Sales in September: 4.75 million SAAR, 5.9 months

• Existing Home Sales: A few comments and NSA Sales Graph

• Existing Home Sales graphs

State Unemployment Rates decreased in 41 States in September

by Calculated Risk on 10/19/2012 02:38:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in September. Forty-one states and the District of Columbia recorded unemployment rate decreases, six states posted rate increases, and three states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 11.8 percent in September. Rhode Island and California posted the next highest rates, 10.5 and 10.2 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - obviously Michigan and Ohio have seen the most improvement - New Jersey and New York are the laggards.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. In early 2010, 18 states and D.C. had double digit unemployment rates.

I expect the unemployment rate in California to fall below 10% very soon.

Earlier on Existing Home Sales:

• Existing Home Sales in September: 4.75 million SAAR, 5.9 months

• Existing Home Sales: A few comments and NSA Sales Graph

• Existing Home Sales graphs

Existing Home Sales: A few comments and NSA Sales Graph

by Calculated Risk on 10/19/2012 11:36:00 AM

This was a solid report, not because of sales, but because of the level of inventory. Based on historical turnover rates, I think "normal" sales would be in the 4.5 to 5.0 million range. So, existing home sales at 4.75 million are in the normal range.

Of course a "normal" market would have very few distressed sales, so there is still a long ways to go, but the market is headed in the right direction. Note: No one should expect existing home sales to go back to 6 or 7 million per year. Instead the key to returning to "normal" are more conventional sales and fewer distressed sales.

From the NAR this morning:

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 24 percent of September sales (13 percent were foreclosures and 11 percent were short sales), up from 22 percent in August; they were 30 percent in September 2011I'm not confident in the NAR distressed sales measurement (it is from an unscientific survey of Realtors), but other sources also suggest distressed sales have fallen in many areas.

Some quick calculations: According to the NAR, existing home sales in September were at a 4.75 million annual rate with 24% distressed sales. That would suggest conventional sales at a 3.61 million annual rate.

In September 2011, sales were at a 4.28 million annual rate with 30% distressed. That would suggest conventional sales were at a 3.0 million annual rate in September 2011. So conventional sales in September 2012 were up about 20% from a year ago.

Also, according to the NAR, the percent of distressed sales peaked in March 2009 at just under 50% when total sales were at a 3.94 million sales rate. That would suggest conventional sales were at a 2.0 million sales rate in March 2009, and that conventional sales are up about 80% from the bottom! If we were confident in the NAR data, this would be the number to watch.

Of course what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

The NAR reported inventory decreased to 2.32 million units in September, down from 2.40 million in August. This is down 20.0% from September 2011, and down 16% from the inventory level in September 2005 (mid-2005 was when inventory started increasing sharply). This is the lowest level for the month of September since 2002.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red for 2012) inventory is at the lowest level for the month of September since 2002, and inventory is below the level in September 2005 (not counting contingent sales). All year I've been arguing months-of-supply would be below 6 towards the end of the year, and months-of-supply fell to 5.9 months in September (a normal range).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in September (red column) are only slightly above last year (there were 2 fewer selling days). Sales are well below the bubble years of 2005 and 2006, and also below 2007.

Sales NSA in September (red column) are only slightly above last year (there were 2 fewer selling days). Sales are well below the bubble years of 2005 and 2006, and also below 2007.Earlier:

• Existing Home Sales in September: 4.75 million SAAR, 5.9 months

• Existing Home Sales graphs

Existing Home Sales in September: 4.75 million SAAR, 5.9 months

by Calculated Risk on 10/19/2012 10:00:00 AM

The NAR reports: September Existing-Home Sales Down but Prices Continue to Improve

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 1.7 percent to a seasonally adjusted annual rate of 4.75 million in September from an upwardly revised 4.83 million in August, but are 11.0 percent above the 4.28 million-unit pace in September 2011.

...

Total housing inventory at the end September fell 3.3 percent to 2.32 million existing homes available for sale, which represents a 5.9-month supply at the current sales pace, down from a 6.0-month supply in August. Listed inventory is 20.0 percent below a year ago when there was an 8.1-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September 2012 (4.75 million SAAR) were 1.7% lower than last month, and were 11.0% above the September 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 2.32 million in September down from 2.40 million in August. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory declined to 2.32 million in September down from 2.40 million in August. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.0% year-over-year in September from September 2011. This is the 19th consecutive month with a YoY decrease in inventory.

Inventory decreased 20.0% year-over-year in September from September 2011. This is the 19th consecutive month with a YoY decrease in inventory.Months of supply declined to 5.9 months in September.

This was at expectations of sales of 4.75 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

Report: Seasonal Retail Hiring to be about the same as in 2011

by Calculated Risk on 10/19/2012 08:36:00 AM

Each year I track seasonal retail hiring during October, November and December. This usually provides an early clue on holiday retail sales. Currently the NRF is forecasting about the same level of seasonal hiring as last year.

From the National Retail Federation: Expect Solid Growth This Holiday Season

Tempered by political and fiscal uncertainties but supported by signs of improvement in consumer confidence, holiday sales this year will increase 4.1 percent to $586.1 billion. NRF’s 2012 holiday forecast is higher than the 10-year average holiday sales increase of 3.5 percent.Last year was the highest level of seasonal hiring since 2007 (seasonal hiring was especially weak in 2008, and then improved some in 2009). There is also a shift towards online buying that is keeping down seasonal hiring.

...

According to NRF, retailers are expected to hire between 585,000 and 625,000 seasonal workers this holiday season, which is comparable to the 607,500 seasonal employees they hired last year.

Thursday, October 18, 2012

Friday: Existing Home Sales

by Calculated Risk on 10/18/2012 08:37:00 PM

The most important numbers in the existing home sales report, to be released Friday morning, are inventory and percent conventional sales - not total sales (although that will be the focus of most of the media).

Inventory is important because this is "visible inventory" (as opposed to "shadow inventory"), and visible inventory that has the largest impact on prices. The percent of conventional sales is important because this gives a hint as to the health of the overall market.

Imagine if sales move mostly sideways for the next few years, but the number of distressed sales steadily declines. That would be a sign of an improving market.

Unfortunately I'm not very confident in the NAR methodology for estimating the percent of distressed sales. This data comes from a monthly survey for the Realtors® Confidence Index and is an unscientific sample. However the regional data Tom Lawler and I have been tracking suggests the percent of conventional sales is increasing.

In August 2012, the NAR reported "Distressed homes ... accounted for 22 percent of August sales (12 percent were foreclosures and 10 percent were short sales), down from 24 percent in July and 31 percent in August 2011" and last year, the NAR reported "Distressed homes ... accounted for 30 percent of sales in September (18 percent were foreclosures and 12 percent were short sales), down from ... 35 percent in September 2010."

So it appears the percent of distressed sales is declining (the percent of conventional sales is increasing), and I'd expect the NAR to report distressed sales in the low 20 percent range.

Housing economist Tom Lawler estimates the NAR will report sales of 4.70 million and a monthly decline in the inventory of existing homes for sale of about 3.2% in September.

On Friday:

• At 10:00 AM, the National Association of Realtors (NAR) will releases Existing Home Sales for September. The consensus is for sales of 4.75 million on seasonally adjusted annual rate (SAAR) basis. Sales in August 2012 were 4.82 million SAAR.

• Also at 10:00 AM, the BLS will release the Regional and State Employment and Unemployment report for September 2012.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Low Mortgage Rates and Refinance Activity

by Calculated Risk on 10/18/2012 03:18:00 PM

Freddie Mac reported earlier today: Mortgage Rates Near Record Lows As Home Construction Builds Up Steam

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates edging slightly lower with the 30-year fixed averaging 3.37 percent, just above its all-time record low of 3.36 percent, and the average 15-year fixed dipping to a new all-time record low at 2.66 percent.And the MBA reported yesterday that refinance activity decreased last week, but is still near the highest level since early 2009.

Here is a graph comparing mortgage rates from the Freddie Mac Primary Mortgage Market Survey® (PMMS®) and the refinance index from the Mortgage Bankers Association (MBA).

UPDATE: left axis is MBA refinance index, 1990=100.

Click on graph for larger image.

Click on graph for larger image.It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and that is what we are seeing!

There has also been an increase in refinance activity from borrowers with negative equity and loans owned or guaranteed by Fannie or Freddie (see The HARP Refinance Boom Continued in August) .

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey.The Primary Mortgage Market Survey® started in 1971 (15 year in 1991). The 30 year rate is near a record low for the Freddie Mac survey, and rates for 15 year fixed loans is at a now low this week.