by Calculated Risk on 10/25/2012 04:17:00 PM

Thursday, October 25, 2012

Lawler: Home Builders: On Balance, Strong Results

From economist Tom Lawler:

Several publicly-traded home builders posted results for the quarter ended September 30th this week, and the general theme was strong net orders, slightly lower cancellation rates, higher margins/lower concessions, and higher home sales prices. Below are some summary stats.

Average sales prices, of course, don’t necessarily reflect gains in “constant-quality” homes, but are affected by changes in the type of homes sold and the regional mix of homes sold. Nevertheless, most home builders appear to be selling homes at “effective” prices well above a year ago.

The combined order backlog of the five builders on September 30th, 2012 was 17,907, up 42.2% from last September.

| New Orders | Settlements | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg | 9/30/2012 | 9/30/2011 | % Chg |

| PulteGroup | 4,544 | 3,564 | 27.5% | 4,418 | 4,198 | 5.2% |

| NVR | 2,558 | 2,218 | 15.3% | 2,656 | 2,255 | 17.8% |

| The Ryland Group | 1,507 | 1,008 | 49.5% | 1,322 | 1,015 | 30.2% |

| Meritage Homes | 1,204 | 906 | 32.9% | 1,197 | 840 | 42.5% |

| M/I Homes | 757 | 587 | 29.0% | 746 | 582 | 28.2% |

| Total | 10,570 | 8,283 | 27.6% | 10,339 | 8,890 | 16.3% |

| Average Closing Price | |||

|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg |

| PulteGroup | $279,000 | $262,000 | 6.5% |

| NVR | $321,700 | $308,900 | 4.1% |

| The Ryland Group | $264,000 | $249,000 | 6.0% |

| Meritage Homes | $280,000 | $259,000 | 8.1% |

| M/I Homes | $266,000 | $238,000 | 11.8% |

| Total | $287,229 | $270,558 | 6.2% |

Housing: What Numbers Matter (Part 2)

by Calculated Risk on 10/25/2012 02:28:00 PM

Apparently some people think if existing home sales go flat, or even decline, the housing recovery is in trouble ... or something ...

From Diana Olick at CNBC: Why Today's Housing Report Spooked Investors So Much

[T]he National Association of Realtors reported no change in signed contracts to buy existing homes in September. ...The number of existing home sales is just part of the story.

It wasn't so much the slight disappointment in the monthly index, it was more the comment from the Realtors' chief economist Lawrence Yun:

"This means only minor movement is likely in near-term existing-home sales, but with positive underlying market fundamentals they should continue on an uptrend in 2013.”

Not exactly a rave.

We know we're coming off the bottom of the housing crash, but over the summer it felt to some like we were rocketing off the bottom. Now, not so much.

...

Existing home sales are coming off lows from last year, but last year was the hangover from the 2010 home buyer tax credit ...

"The year-over-year gain was the smallest of the year and comps against last year when the housing market was in a full blown double-dip mode," notes analyst Mark Hanson.

Let me repeat what I wrote earlier this year: Home Sales Reports: What Matters: "When we look at sales for existing homes, the focus should be on the composition between conventional and distressed. Total sales are probably close to the normal level of turnover, but the composition of sales is far from normal - sales are still heavily distressed sales. Over time, existing home sales will probably settle around 5 million per year, but the percentage of distressed sales will eventually decline. Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. Look at inventory and the percent of conventional sales."

Unfortunately I have little confidence in the NAR's estimate of conventional sales, but most local data shows a fairly strong increase in conventional sales (as opposed to short sales and foreclosures). As an example, the percent of conventional sales in Phoenix increased from 35.9% in September 2011 to 60.1% in September 2012. Now overall sales were down sharply - the Arizona Regional MLS reported sales in September were down 17.9% from September 2011, but conventional sales were up 37%. I think this is a positive.

Of course the key housing numbers for the economy and jobs are housing starts and new home sales. Also house prices matter too. But the housing report this morning (pending home sales) was mostly irrelevant.

Misc: Pending Home Sales index increases slightly, KC Mfg Index contracts, Remodeling increases

by Calculated Risk on 10/25/2012 11:00:00 AM

A few miscellaneous releases:

• From the NAR: September Pending Home Sales Show Slight Improvement

The Pending Home Sales Index, a forward-looking indicator based on contract signings, edged up 0.3 percent to 99.5 in September from 99.2 in August and is 14.5 percent above September 2011 when it was 86.9. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this is for sales in October and November.

• From the Kansas City Fed: Tenth District Manufacturing Activity Declined Slightly

Tenth District manufacturing activity declined slightly in October, and producers’ expectations for future activity fell considerably but remained slightly positive. Several producers commented on growing uncertainty related to the upcoming election and fiscal situation, which has put a hold on many customers’ orders and spending. Price indexes were mixed, with minimal changes overall.Another weak regional manufacturing survey.

The month-over-month composite index was -4 in October, down from 2 in September and 8 in August, and the lowest in over three years ... The employment index moved into negative territory for the first time this year, while the shipments index inched higher but still remained negative.

“We saw factories pull back this month for the first time in quite a while, which many firms attributed to the impact of the uncertain political and fiscal situation on customers’ willingness to order” said [Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City]. “Expectations also weakened considerably for production and employment but, encouragingly, factories’ capital spending plans for early next year remained largely intact.”

• From the NAHB: Remodeling Market Index Climbs Five Points, Returns to 2005 Levels

The Remodeling Market Index (RMI) climbed to 50 in the third quarter of 2012, up from 45 in the previous quarter, according to the National Association of Home Builders (NAHB). Released today, the RMI is at its highest point since the third quarter of 2005, tracking the positive trends recently seen in the rest of the housing sector.

...

“The improvement in the RMI provides more evidence that the remodeling industry is making the orderly recovery from its low point in 2009 as we’ve been expecting,” said NAHB Chief Economist David Crowe. “Although remodeling projects over $25,000 are now showing some signs of strength, they are still lagging behind smaller property alterations and maintenance and repair jobs."

Chicago Fed: Economic Activity Improved in September

by Calculated Risk on 10/25/2012 09:58:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity improved in September

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to 0.00 in September from –1.17 in August. All four broad categories of indicators that make up the index increased from August, and each one except the consumption and housing category made a positive contribution to the index in September.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased from –0.53 in August to –0.37 in September—its seventh consecutive reading below zero. September’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity improved, but growth was still below trend in September.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Weekly Initial Unemployment Claims decline to 369,000

by Calculated Risk on 10/25/2012 08:30:00 AM

The DOL reports:

In the week ending October 20, the advance figure for seasonally adjusted initial claims was 369,000, a decrease of 23,000 from the previous week's revised figure of 392,000. The 4-week moving average was 368,000, an increase of 1,500 from the previous week's revised average of 366,500.The previous week was revised up from 388,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,000. This is 5,000 above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were lower than the consensus forecast of 372,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but near the cycle bottom. The large swings over the previous two weeks were related to timing and technical factors.

Wednesday, October 24, 2012

Thursday: Unemployment Claims, Durable Goods Orders, Pending Home Sales

by Calculated Risk on 10/24/2012 09:01:00 PM

From the NY Times Dealbook: Federal Prosecutors Sue Bank of America Over Mortgage Program

In a civil complaint that seeks to collect $1 billion from the bank, the Justice Department took aim at a home loan program known as the “hustle,” a venture that has become emblematic of the risk-fueled mortgage bubble.Thursday:

...

Bank of America inherited the “hustle” home loan program with its purchase of Countrywide Financial in 2008. Prosecutors say the effort, kept alive by Bank of America through 2009, was intended to churn out mortgages at a rapid pace without proper checks on wrongdoing. The bank then sold the “defective” loans without warning to Fannie Mae and Freddie Mac, the government-controlled housing giants, which were stuck with heavy losses and a glut of foreclosed properties.

“The fraudulent conduct alleged in today’s complaint was spectacularly brazen in scope,” Preet Bharara, the United States attorney in Manhattan, said in a statement.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 372 thousand from 388 thousand..

• Also at 8:30 AM, the Durable Goods Orders for September will be released by the Census Bureau. The consensus is for a 7.0% decrease in durable goods orders.

• Also at 8:30 AM, the Chicago Fed National Activity Index for September will be released. This is a composite index of other data.

• At 10:00 AM, the NAR will release the Pending Home Sales Index for September. The consensus is for a 2.5% increase in the index.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for October will be released. The consensus is for an a reading of 4, up from 2 in September (above zero is expansion).

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales and Distressing Gap

• New Home Sales graphs

Updates to the ADP Employment Report

by Calculated Risk on 10/24/2012 06:50:00 PM

ADP announced some changes to their monthly employment report today (ht Rob). Here is the press release, and here is the website with FAQs, methodology and more:

The newly expanded ADP National Employment Report will be issued each month by the ADP Research InstituteSM, a specialized group within ADP that provides insights around employment trends and workforce strategy. The first enhanced monthly report issued in collaboration with Moody’s Analytics will be released on November 1, and will report private payroll changes for the month of October 2012.Basically ADP/Moody's uses the ADP payroll data and attempts to predict the BLS report of private sector payroll jobs added or lost each month. They use matched pairs (companies that report for both the current month and the previous month), and adjust the data by category to align with the BLS data (final data after revisions). It is a fairly complicated process.

...

This new collaboration allows the ADP National Employment Report to increase the number of industry categories reported and expands the number of business sizes reported each month. Other key enhancements of the report include the development of a new methodology to further align with the final, revised U.S. Bureau of Labor Statistics (BLS) numbers. A look back at historical data from 2001 to present using the new methodology shows a very strong correlation (96%) with the revised BLS numbers. In addition, the overall sample size used to create the report has been increased from 344,000 U.S. companies to 406,000, and from 21 million employees to 23 million; which accounts for more than 20% of all U.S. private sector employees. Originally launched in 2006, the ADP National Employment Report is a derived from actual payroll data from an anonymous subset of ADP’s clients in the U.S.

However the ADP employment report is still a black box and we will not be able to judge the "improvements" for a few years. I think it would be much better for analysts if ADP just reported actual payroll gains or losses by industry (perhaps in percentage terms). That would be a useful and independent measure of the labor market.

The first "enhanced" report will be released next week on Nov 1st.

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales and Distressing Gap

• New Home Sales graphs

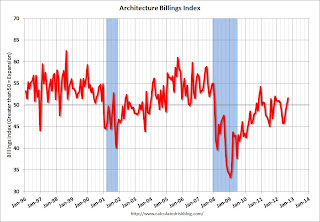

AIA: Architecture Billings Index increases in September

by Calculated Risk on 10/24/2012 04:08:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Increase for Architecture Billings Index

The American Institute of Architects (AIA) reported the September ABI score was 51.6, up from the mark of 50.2 in August. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 57.3, compared to a mark of 57.2 the previous month.

“Going back to the third quarter of 2011, the multi-family residential sector has been the best performing segment of the construction field,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “With high foreclosure levels in recent years, more stringent mortgage approvals and fewer people in the market to buy homes there has been a surge in demand for rental housing. The upturn in residential activity will hopefully spur more nonresidential construction.”

Sector index breakdown: multi-family residential (57.3), institutional (51.0), commercial / industrial (48.4), mixed practice (47.8)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.6 in September, up from 50.2 in August. Anything above 50 indicates expansion in demand for architects' services.

This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests increase in CRE investment next year (it will be some time before investment in offices and malls increases).

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales and Distressing Gap

• New Home Sales graphs

FOMC Statement: "Economic activity has continued to expand at a moderate pace"

by Calculated Risk on 10/24/2012 02:15:00 PM

Not much changed ...

FOMC Statement:

Information received since the Federal Open Market Committee met in September suggests that economic activity has continued to expand at a moderate pace in recent months. Growth in employment has been slow, and the unemployment rate remains elevated. Household spending has advanced a bit more quickly, but growth in business fixed investment has slowed. The housing sector has shown some further signs of improvement, albeit from a depressed level. Inflation recently picked up somewhat, reflecting higher energy prices. Longer-term inflation expectations have remained stable.Here is the previous FOMC Statement for comparison.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee remains concerned that, without sufficient policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely would run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of Treasury securities, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed additional asset purchases and disagreed with the description of the time period over which a highly accommodative stance of monetary policy will remain appropriate and exceptionally low levels for the federal funds rate are likely to be warranted.

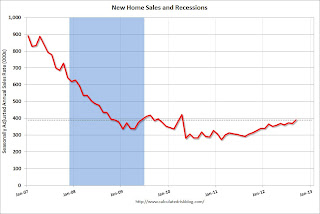

New Home Sales and Distressing Gap

by Calculated Risk on 10/24/2012 11:55:00 AM

New home sales have averaged 364,000 on an annual rate basis through September. That means sales are on pace to increase 19% from last year (and based on the last few months, sales will probably increase more than 20% this year).

Here is a table showing sales and the change from the previous year since the peak in 2005:

| Year | New Home Sales (000s) | Change |

|---|---|---|

| 2005 | 1,283 | |

| 2006 | 1,051 | -18% |

| 2007 | 776 | -26% |

| 2008 | 485 | -38% |

| 2009 | 375 | -23% |

| 2010 | 323 | -14% |

| 2011 | 306 | -5% |

| 20121 | 364 | 19% |

| 12012 pace through September. | ||

But even with a 20%+ increase this year, 2012 will be the 3rd or 4th lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, and it is possible - with a fairly strong last three months - that sales will be close to, or even above, the 375,000 sales in 2009.

Click on graph for larger image.

Click on graph for larger image.This graph shows new home sales over the last few years. Although sales have increased this year, total sales are still very low. The two tax credit related "peaks" were at 418 thousand and 422 thousand, and sales are still below those levels.

Given the current low level of sales, and current market conditions (supply and demand), sales will probably continue to increase over the next few years. I don't expect sales to increase to 2005 levels, but something close to 800,000 is possible once the number of distressed sales declines to more normal levels.

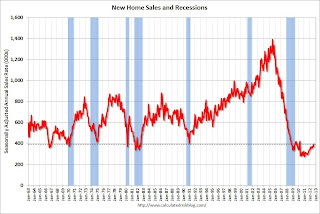

Here is an update to the distressing gap graph.

Note: I started posting this graph four years ago when the "distressing gap" first appeared!

Note: I started posting this graph four years ago when the "distressing gap" first appeared!This "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through September. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales graphs

New Home Sales at 389,000 SAAR in September

by Calculated Risk on 10/24/2012 10:00:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 389 thousand. This was up from a revised 368 thousand SAAR in August (revised down from 373 thousand). This is the highest level since April 2010 (tax credit related bounce).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in September 2012 were at a seasonally adjusted annual rate of 389,000 ... This is 5.7 percent above the revised August rate of 368,000 and is 27.1 percent above the September 2011 estimate of 306,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply declined in September to 4.5 months. August was revised up to 4.6 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of September was 145,000. This represents a supply of 4.5 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at a record low 38,000 units in September. The combined total of completed and under construction is just above the record low since "under construction" is starting to increase.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In September 2012 (red column), 31 thousand new homes were sold (NSA). Last year only 24 thousand homes were sold in September. This was the sixth weakest September since this data has been tracked (above 2011, 2010, 2009, 1981 and 1966). The high for September was 99 thousand in 2005.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 364 thousand SAAR over the first 9 months of 2012, after averaging under 300 thousand for the previous 18 months. Sales are finally above the lows for previous recessions too.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 364 thousand SAAR over the first 9 months of 2012, after averaging under 300 thousand for the previous 18 months. Sales are finally above the lows for previous recessions too.This was slightly above expectations of 385,000, and was another fairly solid report. This indicates an ongoing recovery in residential investment.

MBA:Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 10/24/2012 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 13 percent from the previous week to the lowest level since late August. The seasonally adjusted Purchase Index decreased 8 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.63 percent from 3.57 percent, with points increasing to 0.45 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is down about 20% over the last three weeks, but activity is still very high - and will probably remain high with mortgage rates near record lows.

The MBA expects mortgage originations to decline next year: MBA Sees 2013 Residential Mortgage Originations Hitting $1.3 Trillion, Revises 2012 Estimate Upward to $1.7 trillion

The Mortgage Bankers Association (MBA) expects to see $1.3 trillion in mortgage originations during 2013, largely driven by a spillover of refinances into the first half of the year. MBA also upwardly revised its estimate of originations for 2012 to $1.7 trillion. MBA expects to see purchase originations climb to $585 billion in 2013, up from a revised estimate of $503 billion for 2012. In contrast, refinances are expected to fall to $785 billion in 2013, down from a revised estimate of $1.2 trillion in 2012.

“We expected 2012 originations to be front-loaded in the first half of the year, with refis falling off with rate increases. Instead we saw the refinance market grow during the year due to a combination of low rates, thanks to QE3 and slowing global growth because of continuing problems in Europe, and adjustments in the HARP and FHA refinance programs,” said Jay Brinkmann, MBA’s Chief Economist. “We expect 2013 refinance originations to play out like our original expectations for 2012, with a long tail of refis extending through the first half of the year followed by a rapid drop-off in the second half.”

Brinkmann continued, “In contrast, we expect a 16% increase in purchase originations in 2013 over 2012, with every quarter in 2013 exceeding the same quarter of 2012. The increase in purchase volumes will be driven by continued modest growth in the economy, an increase in owner-occupied sales financed with mortgages as opposed to cash purchases by investors, an increase in new home sales and a small increase in average home prices. "

The second graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

The second graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.The MBA expects this index to start increasing in 2013.

Tuesday, October 23, 2012

Wednesday: New Home Sales, FOMC Announcement

by Calculated Risk on 10/23/2012 09:03:00 PM

The FHFA house price index for August was released late today (GSE loans). FHFA House Price Index Up 0.7 Percent in August:

U.S. house prices rose 0.7 percent on a seasonally adjusted basis from July to August, according to the Federal Housing Finance Agency’s monthly House Price Index (HPI). The previously reported 0.2 percent increase in July was revised downward to a 0.1 percent increase. For the 12 months ending in August, U.S. prices rose 4.7 percent. The U.S. index is 15.9 percent below its April 2007 peak and is roughly the same as the June 2004 index level.This was above the consensus of a 0.4% increase in August.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for October. The consensus is for a reading of 51.5, unchanged from September.

• At 10:00 AM, New Home Sales for September will be released by the Census Bureau. The consensus is for an increase in sales to 385 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 373 thousand in August. Watch for possible upgrades to the sales rates for previous months.

• At 2:15 PM, the FOMC Meeting statement will be released. No significant changes are expected. I posted a FOMC preview yesterday.

• During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Update: REO by State and Owner Occupied Units by State

by Calculated Risk on 10/23/2012 07:26:00 PM

To help put the previous post in perspective, I've added the number of owner occupied units as of April 1, 2010 (from the decennial Census), and the percent of units that are REO.

REOs are only part of the puzzle. This just shows how many lender Real Estate Owned (REO) units for each state. But look at New Jersey. There are very few REOs in New Jersey, but there are many properties in the foreclosure process.

If you look at the NY Fed site, they mark the judicial foreclosure states with a black square. Many of the judicial states are backlogged. See Serious Mortgage Delinquencies and In-Foreclosure by State for graphs of the percent of loans in foreclosure and serious delinquent by state (as of the end of Q2).

Here are a repeat of Tom Lawler's comments:

Folks interested in REO inventories by state might want to take at look at the website below from the FRB of New York. According to the FRBoNY, the data were “provided by CoreLogic under contract.”

An Assessment of the Distressed Residential Real Estate Situation

The site shows a map and you have to click on each state to get data, and I couldn’t get DC (I don’t think it was available!), but here’s the data for June 30, 2012

| Number of REO by State, June 2012 | |||

|---|---|---|---|

| Number of REO | Owner Occupied Housing Units April, 2010 | Percent of Units REO | |

| Northeast | |||

| Connecticut | 2,345 | 925,286 | 0.25% |

| Maine | 910 | 397,417 | 0.23% |

| Massachusetts | 7,501 | 1,587,158 | 0.47% |

| New Hampshire | 2,847 | 368,316 | 0.77% |

| New Jersey | 1,979 | 2,102,465 | 0.09% |

| New York | 2,557 | 3,897,837 | 0.07% |

| Pennsylvania | 7,712 | 3,491,722 | 0.22% |

| Rhode Island | 2,110 | 250,952 | 0.84% |

| Vermont | 264 | 181,407 | 0.15% |

| South | |||

| Alabama | 7,644 | 1,312,589 | 0.58% |

| Arkansas | 1,027 | 768,156 | 0.13% |

| Delaware | 1,163 | 246,724 | 0.47% |

| District of Columbia | NA | 112,055 | NA |

| Florida | 44,677 | 4,998,979 | 0.89% |

| Georgia | 33,537 | 2,354,402 | 1.42% |

| Kentucky | 4,442 | 1,181,271 | 0.38% |

| Louisiana | 4,756 | 1,162,299 | 0.41% |

| Maryland | 4,614 | 1,455,775 | 0.32% |

| Mississippi | 2,907 | 777,073 | 0.37% |

| North Carolina | 12,005 | 2,497,900 | 0.48% |

| Oklahoma | 3,009 | 981,760 | 0.31% |

| South Carolina | 5,775 | 1,248,805 | 0.46% |

| Tennessee | 10,575 | 1,700,592 | 0.62% |

| Texas | 22,528 | 5,685,353 | 0.40% |

| Virginia | 8,810 | 2,055,186 | 0.43% |

| West Virginia | 1,780 | 561,013 | 0.32% |

| Midwest | |||

| Illinois | 33,584 | 3,263,639 | 1.03% |

| Indiana | 7,548 | 1,747,975 | 0.43% |

| Iowa | 2,792 | 880,635 | 0.32% |

| Kansas | 3,540 | 753,532 | 0.47% |

| Michigan | 38,275 | 2,793,342 | 1.37% |

| Minnesota | 16,761 | 1,523,859 | 1.10% |

| Missouri | 10,821 | 1,633,610 | 0.66% |

| Nebraska | 1,184 | 484,730 | 0.24% |

| North Dakota | 128 | 183,943 | 0.07% |

| Ohio | 18,533 | 3,111,054 | 0.60% |

| South Dakota | 471 | 219,558 | 0.21% |

| Wisconsin | 9,807 | 1,551,558 | 0.63% |

| West | |||

| Alaska | 494 | 162,765 | 0.30% |

| Arizona | 12,465 | 1,571,687 | 0.79% |

| California | 49,299 | 7,035,371 | 0.70% |

| Colorado | 8,596 | 1,293,100 | 0.66% |

| Hawaii | 936 | 262,682 | 0.36% |

| Idaho | 2,131 | 404,903 | 0.53% |

| Montana | 826 | 278,418 | 0.30% |

| Nevada | 7,882 | 591,480 | 1.33% |

| New Mexico | 2,575 | 542,122 | 0.47% |

| Oregon | 4,452 | 944,485 | 0.47% |

| Utah | 4,193 | 618,137 | 0.68% |

| Washington | 7,461 | 1,673,920 | 0.45% |

| Wyoming | 905 | 157,077 | 0.58% |

| Total (ex-DC) | 443,133 | 75,986,074 | 0.58% |

Lawler: Estimated REO Inventories by State

by Calculated Risk on 10/23/2012 04:42:00 PM

CR Note: This is a very useful website. The estimate of lender Real Estate Owned (REO) in June was very close to the bottom up estimate using data from the FHA, Fannie, Freddie, the FDIC and more.

From economist Tom Lawler:

Folks interested in REO inventories by state might want to take at look at the website below from the FRB of New York. According to the FRBoNY, the data were “provided by CoreLogic under contract.”

An Assessment of the Distressed Residential Real Estate Situation

The site shows a map and you have to click on each state to get data, and I couldn’t get DC (I don’t think it was available!), but here’s the data for June 30, 2012

| Number of REO by State, June 2012 | |

|---|---|

| Northeast | |

| Connecticut | 2,345 |

| Maine | 910 |

| Massachusetts | 7,501 |

| New Hampshire | 2,847 |

| New Jersey | 1,979 |

| New York | 2,557 |

| Pennsylvania | 7,712 |

| Rhode Island | 2,110 |

| Vermont | 264 |

| South | |

| Alabama | 7,644 |

| Arkansas | 1,027 |

| Delaware | 1,163 |

| District of Columbia | |

| Florida | 44,677 |

| Georgia | 33,537 |

| Kentucky | 4,442 |

| Louisiana | 4,756 |

| Maryland | 4,614 |

| Mississippi | 2,907 |

| North Carolina | 12,005 |

| Oklahoma | 3,009 |

| South Carolina | 5,775 |

| Tennessee | 10,575 |

| Texas | 22,528 |

| Virginia | 8,810 |

| West Virginia | 1,780 |

| Midwest | |

| Illinois | 33,584 |

| Indiana | 7,548 |

| Iowa | 2,792 |

| Kansas | 3,540 |

| Michigan | 38,275 |

| Minnesota | 16,761 |

| Missouri | 10,821 |

| Nebraska | 1,184 |

| North Dakota | 128 |

| Ohio | 18,533 |

| South Dakota | 471 |

| Wisconsin | 9,807 |

| West | |

| Alaska | 494 |

| Arizona | 12,465 |

| California | 49,299 |

| Colorado | 8,596 |

| Hawaii | 936 |

| Idaho | 2,131 |

| Montana | 826 |

| Nevada | 7,882 |

| New Mexico | 2,575 |

| Oregon | 4,452 |

| Utah | 4,193 |

| Washington | 7,461 |

| Wyoming | 905 |

| Total (ex-DC) | 443,133 |

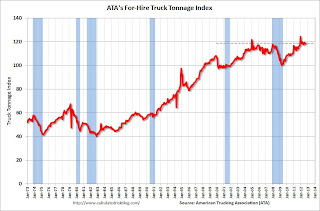

ATA Trucking Index increases in September

by Calculated Risk on 10/23/2012 01:58:00 PM

Note: ATA Chief Economist Bob Costello says, for trucking, the pickup in housing is offsetting the "flattening in manufacturing output".

From ATA: ATA Truck Tonnage Index Rose 0.4% in September

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 0.4% in September after falling 0.9% in August. In September, the SA index equaled 118.7 (2000=100). The level in September was the same as in January 2012, so the index has been on a flat trend-line over the past 9 months. Compared with September 2011, the SA index was 2.4% higher, the smallest year-over-year increase since December 2009.Note from ATA:

...

“The year-over-year deceleration in tonnage continued during September, although I was encouraged that the seasonally adjusted index edged higher from August,” ATA Chief Economist Bob Costello said. Costello noted again this month that the acceleration in housing starts, which is helping truck tonnage, is being countered by a flattening in manufacturing output and elevated inventories throughout the supply chain."

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 2.4% year-over-year - but has been mostly moving sideways in 2012.

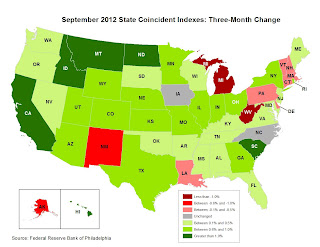

Fed: State Coincident Indexes in September show improvement

by Calculated Risk on 10/23/2012 12:08:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2012. In the past month, the indexes increased in 39 states, decreased in five states, and remained stable in six states, for a one-month diffusion index of 68. Over the past three months, the indexes increased in 37 states, decreased in 11 states, and remained stable in two states, for a three-month diffusion index of 52. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.2 percent in September and 0.6 percent over the past three months.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In September, 41 states had increasing activity, up from 33 in August (including minor increases). This is the second consecutive year with a weak spot during the summer, and improvement towards the end of the year.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map was all green earlier this year and is starting to turn mostly green again.

Richmod Fed Mfg Survey indicates contraction in October

by Calculated Risk on 10/23/2012 10:00:00 AM

From the Richmond Fed: Manufacturing Activity Pulled Back in October; Optimism Wanes

Manufacturing activity in the central Atlantic region pulled back in October after improving somewhat last month, according to the Richmond Fed's latest survey. The seasonally adjusted index of overall activity was pushed lower as all broad indicators of activity — shipments, new orders and employment — were in negative territory.This suggests contraction in manufacturing activity in the central Atlantic region. It appears some of this contraction may be due to the European recession and reduced exports to Europe.

...

Looking forward, assessments of business prospects for the next six months were less optimistic in October. Contacts at more firms anticipated that new orders, backlogs, capacity utilization, and vendor lead-times will grow more slowly than anticipated a month ago.

...

In October, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — lost eleven points to −7 from September's reading of 4. Among the index's components, shipments fell eighteen points to −9, new orders moved down thirteen points to finish at −6, and the jobs index held steady at −5.

Bank of Spain: Recession Continues, Deficit to Increase

by Calculated Risk on 10/23/2012 08:37:00 AM

From the WSJ: Bank of Spain Warns on Deficit Targets

Spain's central bank said Tuesday the country's economy contracted slightly less than expected in the third quarter but repeated a warning that tax-revenue shortfalls could cause the government to miss its 2012 budget-deficit target.Another austerity data point. Still the Spanish bond yields are down from the levels of a few months ago with the 10-year yield at 5.55%, and the 2-year yield at 2.98%.

The euro zone's fourth-largest economy contracted by 0.4%, the same as in the second quarter, the Bank of Spain said in a quarterly report. On an annual basis, the contraction was 1.7% ...

The government has said its deficit will rise to 7.4% of GDP this year ...

"The efforts to lower spending at the public sector have had a net contracting effect (on the economy) in the central months of the year," the central bank said. "We see drops in consumption and investment by all levels of government above those seen in previous quarters."

emphasis added

Monday, October 22, 2012

Tuesday: Richmond Fed Mfg Survey

by Calculated Risk on 10/22/2012 07:47:00 PM

There will be plenty of economic data released later this week! There is some sort of political debate tonight at 9 PM ET. The good news is the election will be over on November 6th. The bad news, as Atrios mentioned earlier, is the 2016 election cycle starts on Nov 7th.

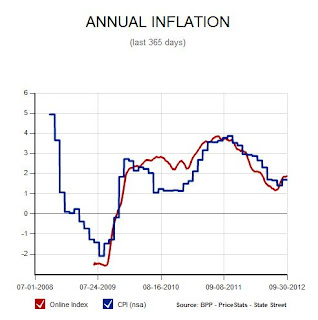

Here is something I like to check occasionally as a different measure for inflation in addition to to CPI from the BLS.

This is the US only index of the MIT Billion Prices Project.

This index uses prices for online goods. From MIT:

These indexes are designed to provide real-time information on major inflation trends, not to forecast official inflation announcements. We are constantly adding new categories of goods, but we do not cover 100% of CPI goods and services. The price of services, in particular, are not easy to find online and therefore are not included in our statistics.

Click on graph for larger image.

Click on graph for larger image.It appears that year-over-year inflation, according to this measure, is under 2.0%. This is another measure that suggests inflation is not currently a problem.

On Tuesday:

• At 10:00 AM ET, the Richmond Fed Survey of Manufacturing Activity for October will be released. The consensus is for an increase to 6 for this survey from 4 in September (above zero is expansion).