by Calculated Risk on 11/14/2012 02:00:00 PM

Wednesday, November 14, 2012

FOMC Minutes: "Participants generally favored" Thresholds

It seems very likely that the Fed will adopt a threshold rule for the Feds Fund Rate based on inflation and unemployment, and remove the forward guidance sentence from the statement at the December 11th and 12th meeting. Note: The forward guidance includes the sentence: "currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015".

From the Fed: Minutes of the Federal Open Market Committee, October 23–24, 2012. Excerpt:

A staff presentation focused on the potential effects of using specific threshold values of inflation and the unemployment rate to provide forward guidance regarding the timing of the initial increase in the federal funds rate. The presentation reviewed simulations from a staff macroeconomic model to illustrate the implications for policy and the economy of announcing various threshold values that would need to be attained before the Federal Open Market Committee (FOMC) would consider increasing its target for the federal funds rate. Meeting participants discussed whether such thresholds might usefully replace or perhaps augment the date-based guidance that had been provided in the policy statements since August 2011. Participants generally favored the use of economic variables, in place of or in conjunction with a calendar date, in the Committee's forward guidance, but they offered different views on whether quantitative or qualitative thresholds would be most effective. Many participants were of the view that adopting quantitative thresholds could, under the right conditions, help the Committee more clearly communicate its thinking about how the likely timing of an eventual increase in the federal funds rate would shift in response to unanticipated changes in economic conditions and the outlook. Accordingly, thresholds could increase the probability that market reactions to economic developments would move longer-term interest rates in a manner consistent with the Committee's view regarding the likely future path of short-term rates. A number of other participants judged that communicating a careful qualitative description of the indicators influencing the Committee's thinking about current and future monetary policy, or providing more information about the Committee's policy reaction function, would be more informative than either quantitative thresholds or date-based forward guidance. Several participants were concerned that quantitative thresholds could confuse the public by giving the impression that the FOMC focuses on a small number of economic variables in setting monetary policy, when the Committee in fact uses a wide range of information. Some other participants worried that the public might mistakenly interpret quantitative thresholds as equivalent to the Committee's longer-run objectives or as triggers that, when reached, would prompt an immediate rate increase; but it was noted that the Chairman's postmeeting press conference and other venues could be used to explain the distinction between thresholds and these other concepts.There are still many details to work out, but it appears likely the Fed will adopt thresholds based on the unemployment rate and inflation. It sounds like the thresholds will be for the Fed Funds rate, and not QE3.

Participants generally agreed that the Committee would need to resolve a number of practical issues before deciding whether to adopt quantitative thresholds to communicate its thinking about the timing of the initial increase in the federal funds rate. These issues included whether to specify such thresholds in terms of realized or projected values of inflation and the unemployment rate and, in either case, what values for those thresholds would best balance the Committee's objectives of promoting maximum employment and price stability. Another open question was whether to supplement thresholds expressed in terms of the unemployment rate and inflation with additional indicators of economic and financial conditions that might signal a need either to raise the federal funds rate before a threshold is crossed or to delay until well afterward. A final question was whether the statement should also provide forward guidance about the likely path of the federal funds rate after the initial increase. It was noted that such guidance could have significant effects on financial conditions and the economy. At the conclusion of the discussion, the Chairman asked the staff to provide additional background material, taking into account the range of participants' views.

emphasis added

Report: Housing Inventory declines 17% year-over-year in October

by Calculated Risk on 11/14/2012 11:11:00 AM

From Realtor.com: October 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops remained at historic lows, with 1.76 million units for sale in October 2012, down -17.00% compared to a year ago.For sale inventories declined on a year-over-year basis in 141 of the 146 markets tracked by Realtor.com. Forty four cities saw year-over-year declines greater than 20%.

The median age of inventory was down -11.81% compared to one year ago.

On a month-over-month basis, inventory declined in 127 of 146 markets.

Going forward, I expect to see smaller year-over-year declines simply because inventory is already very low.

The NAR is scheduled to report October existing home sales and inventory next week on Monday, November 19th. The key number in the NAR report will be inventory, and inventory will be down sharply again year-over-year in October.

Retail Sales declined 0.3% in October

by Calculated Risk on 11/14/2012 08:30:00 AM

On a monthly basis, retail sales declined 0.3% from September to October (seasonally adjusted), and sales were up 3.8% from October 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $411.6 billion, a decrease of 0.3 percent from the previous month, but 3.8 percent above October 2011. ... The August to September 2012 percent change was revised from 1.1 percent to 1.3 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for September were revised up to a 1.3% increase (from 1.1% increase).

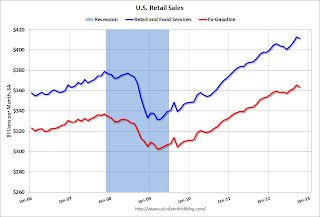

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.2% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in October.

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in October.Excluding gasoline, retail sales are up 20.2% from the bottom, and now 8.0% above the pre-recession peak (not inflation adjusted).

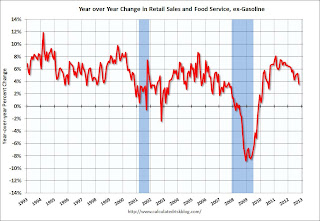

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 3.5% on a YoY basis (3.8% for all retail sales).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

MBA: Mortgage Applications rebound after Hurricane Sandy, Mortgage Rates fall to Record Low

by Calculated Risk on 11/14/2012 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 13 percent from the previous week, ending a five-week decline. The seasonally adjusted Purchase Index increased 11 percent from one week earlier.Some of this decline in activity was related to Hurricane Sandy.

“Following the decrease in applications two weeks ago due to the effects of superstorm Sandy, mortgage applications in many East Coast states rebounded strongly this week,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Application volume in New Jersey more than doubled over the week, while volume in Connecticut and New York increased more than 60 percent. In addition to the rebound in the states impacted by the storm, the 30 year fixed mortgage rate reached a new record low in the survey.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.52 percent from 3.61 percent, with points decreasing to 0.41 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This record low rate for 30 year fixed mortgages beats the previous survey low of 3.53 percent for the week ending September 28, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

The increase this week was mostly just a rebound from the sharp decline the previous week due to Hurricane Sandy.

Tuesday, November 13, 2012

Wednesday: Retail Sales, Producer Price Index, FOMC Minutes

by Calculated Risk on 11/13/2012 09:05:00 PM

From Jon Hilsenrath and Kristina Peterson at the WSJ: Fed Leans Toward Clearer Guidance

Under a new approach being considered by senior officials, the Fed would state how high inflation would have to rise or how low unemployment would have to fall before it would begin moving rates ...There might be a mention of possible targets in the FOMC minutes to be released on Wednesday.

"Several of my [Fed] colleagues have advocated such an approach, and I am also strongly supportive," Janet Yellen, the Fed's vice chairwoman, said ...

...

Chicago Fed President Charles Evans wants the Fed to offer assurances it will keep short-term rates low at least until the unemployment rate falls to 7%, as long as inflation remains below 3%. Minneapolis Fed President Narayana Kocherlakota has proposed thresholds of 5.5% for the unemployment rate and 2.25% for inflation.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Look for activity to rebound following Hurricane Sandy.

• At 8:30 AM, Retail sales for October will be released. Retail sales (especially auto sales) were impacted by Hurricane Sandy. The consensus is for retail sales to decrease 0.2% in October, and for retail sales ex-autos to increase 0.1%.

• Also at 8:30 AM, the Producer Price Index for October will be released. The consensus is for a 0.1% increase in producer prices (0.1% increase in core).

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales report for September (Business inventories). The consensus is for 0.6% increase in inventories.

• At 2:00 PM, the FOMC Minutes for Meeting of October 23-24, 2012 will be released. Look for a possible discussion of setting targets for exiting QE3.

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Fiscal Slope: Alternative Minimum Tax (AMT)

by Calculated Risk on 11/13/2012 05:52:00 PM

Earlier I posted on the Fiscal Slope: 2 Million to Lose Emergency Unemployment Benefits

Here is another part of the fiscal slope from the WSJ: IRS Warns: AMT Poised to Bite 33 Million Taxpayers

If Congress doesn’t act to extend relief from the alternative minimum tax by the end of 2012 – an important element of the fiscal cliff – the IRS said Tuesday that it would have to enforce the AMT against about 33 million households ...AMT relief is renewed every year. Maybe someday they'll just index it for inflation.

"If there is no AMT patch enacted by the end of the year, the IRS would be forced to operate the 2013 tax filing season based on the expiration of the AMT patch,” the acting IRS commissioner, Steven Miller, wrote in a letter to GOP Sen. Orrin Hatch of Utah on Tuesday. “There would be serious repercussions for taxpayers.”

The AMT was created in the 1960s to make sure that very wealthy people who accumulate a lot of deductions still paid some tax. Over the years, it has begun to hit many middle-class households, at least on paper, in part because it’s not indexed for inflation.

DataQuick: SoCal Home Sales increase in October

by Calculated Risk on 11/13/2012 02:07:00 PM

From DataQuick: Southland Home Sales, Median Price Rise Above Year Ago

Southern California home sales rose sharply in October as move-up buyers joined investors, shifting the mix of homes selling up a notch as foreclosure resales hit a five-year low. ... A total of 21,075 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 18.0 percent from 17,859 sales in September, and up 25.2 percent from 16,829 sales in October 2011, according to San Diego-based DataQuick.The median price is being impacted by the mix, with fewer low end distressed sales pushing up the median. This is why I focus on the repeat sales indexes.

...

The Southland’s lower-cost areas continued to post the weakest sales compared with last year. The number of homes that sold below $200,000 fell 11.2 percent year-over-year, while sales below $300,000 dipped 0.3 percent. Sales in these more affordable markets have been hampered by the slowdown in foreclosure activity, which results in fewer foreclosed properties listed for sale, as well as the high percentage of homeowners who still owe more than their homes are worth, meaning they can’t sell and move on.

Sales rose sharply in most mid- to-higher-cost markets in October. Sales between $300,000 and $800,000 – a range that would include many move-up buyers – jumped 41.5 percent year-over-year. October sales over $500,000 rose 55.2 percent year-over-year, while sales over $800,000 rose 52.4 percent compared with October 2011.

Foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 16.3 percent of the Southland resale market last month. That was down from 16.6 percent the month before and 32.8 percent a year earlier. Last month’s level was the lowest since it was 16.0 percent in October 2007. In the current cycle, the foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 26.0 percent of Southland resales last month. That was down slightly from an estimated 27.6 percent the month before and up from 25.4 percent a year earlier.

This report shows why we need to focus on the composition of sales (conventional vs. distressed) as opposed to just overall sales. Sales are declining in the high foreclosures areas because the number of foreclosed properties is declining. But sales are now picking up in other areas, and these are mostly conventional sales.

The NAR is scheduled to report October existing home sales and inventory next week on Monday, November 19th.

Fiscal Slope: 2 Million to Lose Emergency Unemployment Benefits

by Calculated Risk on 11/13/2012 11:14:00 AM

As I noted last week, the "fiscal cliff" includes expiring Bush tax cuts for high, middle and low income earners, the expiring 2% payroll tax cut, expiring Alternative Minimum Tax (AMT) relief, expiring emergency unemployment benefits, and scheduled defense spending cuts (aka "sequestration").

Here is an article on the emergency unemployment benefits from Michael Fletcher at the WaPo: 2 million could lose unemployment benefits unless Congress extends program

More than 2 million Americans stand to lose their jobless benefits unless Congress reauthorizes federal emergency unemployment help before the end of the year.

...

These workers have exhausted their state unemployment insurance, leaving them reliant on the federal program.

In addition to those at risk of abruptly losing their benefits in December, 1 million people would have their checks curtailed by April if the program is not renewed ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of workers unemployed for 27 weeks or more.

According to the BLS, in October there were 5.00 million workers who had been unemployed for more than 26 weeks and still want a job. This is generally trending down, but is still very high.

As the WaPo article notes, many of these people are surviving on their unemployment benefits.

NFIB: Small Business Optimism Index increases slightly in October

by Calculated Risk on 11/13/2012 08:33:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Ticks Up Slightly

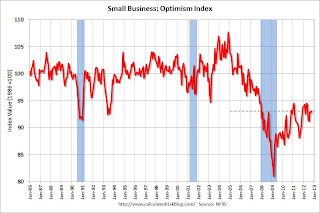

The National Federation of Independent Business (NFIB) Small Business Optimism Index rose 0.3 in October to 93.1; the slight uptick in the reading did not seem to indicate a dramatic shift in owner sentiment over the course of the month.

...

One indicator that rose slightly in October is the frequency of reported capital outlays in the past six months, increasing 3 points to 54 percent. ... Weak sales is still the reported No. 1 business problem for 22 percent of owners surveyed. ... October was another weak job creation month, though better than September due primarily to a reduction in terminations which will raise the net jobs number. According to the October survey, owners stopped releasing workers; the average change in employment per firm rose to just 0.02 workers—essentially zero.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 93.1 in October from 92.8 in September.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. This index remains low, and once again, lack of demand is a huge problem for small businesses.

Monday, November 12, 2012

Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in October

by Calculated Risk on 11/12/2012 07:08:00 PM

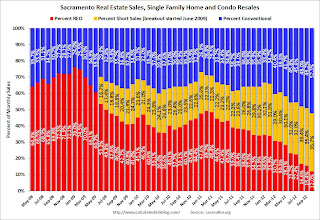

Economist Tom Lawler sent me the following preliminary table today of short sales and foreclosures for a few selected cities in October. Over the weekend I posted some data from Sacramento showing a sharp increase in conventional sales, and that distressed sales have fallen to the lowest level since the Sacramento Association started tracking the data.

There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up in all of these cities. In most areas, short sales far out number foreclosures, although Minneapolis is an exception with more foreclosures than short sales.

The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year almost everywhere. In the cities listed below, distressed sales are down about 25% from a year ago.

And previously from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Oct | 11-Oct | 12-Oct | 11-Oct | 12-Oct | 11-Oct | |

| Las Vegas | 44.7% | 25.4% | 11.6% | 48.1% | 56.3% | 73.5% |

| Reno | 40.0% | 32.0% | 12.0% | 38.0% | 52.0% | 70.0% |

| Phoenix | 26.2% | 29.2% | 12.9% | 35.6% | 39.1% | 64.8% |

| Sacramento | 35.7% | 26.8% | 12.0% | 37.3% | 47.7% | 64.1% |

| Minneapolis | 10.5% | 12.6% | 25.1% | 33.6% | 35.6% | 46.2% |

| Mid-Atlantic (MRIS) | 11.7% | 15.2% | 9.1% | 16.0% | 20.7% | 31.2% |

| Charlotte | 13.2% | 17.4% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Birmingham AL | 30.8% | 35.5% | ||||

| *share of existing home sales, based on property records | ||||||

Lawler on Builder Results

by Calculated Risk on 11/12/2012 02:51:00 PM

A few comments and a table from economist Tom Lawler:

D.R. Horton and Beazer Homes released their operating results for the quarter ended September 30th today. Here is a table showing some summary stats for nine large publicly-traded home builders. The net orders and settlements figures include results from “discontinued operations.”

The combined order backlog of the builders on September 30th, 2012 was 30,461, up 44.6% from last September.

CR Note: I broke Tom's table into two sections - the first for orders and settlements, and the second for prices.

This increase in net orders was about the same as last quarter (year-over-year), and the backlog is continuing to increase.

| Net Orders | Settlements | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg | 9/30/2012 | 9/30/2011 | % Chg |

| D.R. Horton | 5,276 | 4,241 | 24.4% | 5,575 | 4,987 | 11.8% |

| PulteGroup | 4,544 | 3,564 | 27.5% | 4,418 | 4,198 | 5.2% |

| NVR | 2,558 | 2,218 | 15.3% | 2,656 | 2,255 | 17.8% |

| The Ryland Group | 1,507 | 1,008 | 49.5% | 1,322 | 1,015 | 30.2% |

| Beazer Homes | 1,110 | 1,023 | 8.5% | 1,608 | 1,404 | 14.5% |

| Standard Pacific | 989 | 764 | 29.5% | 861 | 697 | 23.5% |

| Meritage Homes | 1,204 | 906 | 32.9% | 1,197 | 840 | 42.5% |

| MDC Holdings | 1,008 | 595 | 69.4% | 1,039 | 707 | 47.0% |

| M/I Homes | 757 | 587 | 29.0% | 746 | 582 | 28.2% |

| Total | 18,953 | 14,906 | 27.2% | 19,422 | 16,685 | 16.4% |

| Average Closing Price | |||

|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg |

| D.R. Horton | $231,085 | $215,300 | 7.3% |

| PulteGroup | $279,000 | $262,000 | 6.5% |

| NVR | $321,700 | $308,900 | 4.1% |

| The Ryland Group | $264,000 | $249,000 | 6.0% |

| Beazer Homes | $228,600 | $228,100 | 0.2% |

| Standard Pacific | $369,000 | $346,000 | 6.6% |

| Meritage Homes | $280,000 | $259,000 | 8.1% |

| MDC Holdings | $308,600 | $289,800 | 6.5% |

| M/I Homes | $266,000 | $238,000 | 11.8% |

| Total | $271,027 | $254,436 | 6.5% |

A few more thoughts on Fiscal Agreement

by Calculated Risk on 11/12/2012 01:38:00 PM

It is always difficult to guess what policymakers will do!

On Friday I outlined the major components of the "fiscal cliff" and provided my initial guess at a compromise (actually more of a slope, hillock or bluff since Jan 1st is not a drop dead date). The components include expiring Bush tax cuts for high, middle and low income earners, the expiring 2% payroll tax cut, expiring Alternative Minimum Tax (AMT) relief, expiring emergency unemployment benefits, and scheduled defense spending cuts (aka "sequestration").

According to the updated CBO analysis, this fiscal tightening would cut the deficit in half, but would probably also lead to a new recession in 2013 (the CBO is forecasting unemployment would rise to 9.1% in Q4 2013).

My initial guess was a compromise would be reached and there will be no recession in 2013. My guess is the compromise would include allowing the tax cuts for high income earners and the payroll tax cut to expire, however the tax cuts for low and middle income earners would be extended, the AMT relief would be extended, and the defense cuts would be scaled back. Of course there are many more details.

My initial guess on timing was early in 2013. That was based on a two assumptions:

1) the tax cuts for high income earners would be allowed to expire, and

2) the GOP would not vote for any package that included a tax rate increase.

Since the tax cuts expire on Jan 1st, I figured the GOP could then vote for tax cuts for the middle class. But it is also possible that this agreement could be reached this year, and the bill could be written so there are no tax rate increases (since the tax increases will happen automatically, the bill doesn't have to include the increases).

So it is possible that some agreement will be reached this year. My baseline forecast is that some agreement will be reached and that there will be some Federal fiscal tightening, but the tightening will not lead to a new recession.

Merrill Lynch Revises up 2012 House Price Forecast to 5% increase

by Calculated Risk on 11/12/2012 12:08:00 PM

From Chris Flanagan and Michelle Meyer at Merrill Lynch: Another upward revision to home prices

Back in March, we called the bottom in national home prices. It appears that while we are correct on the timing, we understated the magnitude of the turn. We revised up our forecast in August, but did not go far enough and hence are revising our trajectory again. We now look for S&P Case Shiller prices to be up 5.0% YoY this year (Q4/Q4), compared to our prior forecast of 2.0%. ... Taking a longer perspective, we look for average home price appreciation of 3.3% over the next ten years or a cumulative gain of about 36%. This will modestly outpace the rate of inflation.And on the economic impact:

Our forecast still assumes some slowing in home prices into the end of the year. We forecast S&P Case Shiller national prices to be up 5.6% q/q saar in Q3, following a 9.3% gain in Q2. We look for essentially flat prices in Q4 and a decline of 1.6% in Q1 before prices resume their upward trend. It is important to remember that the housing market is subject to volatility in the best of times; in this distorted market, we cannot expect a smooth pattern.

The key factor driving the increase in home prices is a better alignment of housing supply and demand. Inventory of homes for sale has declined markedly. On an absolute level, listed inventory is at the lowest since 1Q05. And even after accounting for the slow pace of sales, it only takes 5.9 months to clear inventory. Supply is even lower for new construction homes ...

While the initial turn higher in demand was driven by investors, it appears that more recent gains can be attributable to primary homebuyers. The latest results from the Campbell HousingPulse survey shows an increase in the share of sales to current homeowners and a decline in investor share over the past few months ...

The gain in home prices will support economic growth. The traditional way we think about the link between home prices and the economy is through the "wealth effect." The wealth effect captures the amount of additional spending power created (lost) from an increase (decrease) in household wealth. The conventional wisdom is that the marginal propensity to consume out of housing wealth is about 3 to 5 cents per dollar over a three year period. This suggests that the gain in housing wealth will only be a gradual tailwind for the economy.CR Note: Merrill Lynch analysts are using the quarterly Case-Shiller National index (most reporting uses the monthly Case-Shiller Composite 20 index). The Case-Shiller National Index was up 1.1% in Q2 (compared to Q2 2011). Looking at the recent monthly data, Merrill's forecast for 2012 appears about right.

There is also another important link which can show up more quickly – consumer confidence. The turn in home prices, although modest at the start, will help to boost consumer confidence. Simply believing that prices have stopped falling should provide a sense of relief to households. It will also allow households to have greater mobility, generating a more efficient labor market and greater churn in the housing stock. We have already seen a turn higher in consumer sentiment, which is likely correlated with the gain in home prices.

Merrill analysts are expecting prices to increase 3% in 2013. My guess is most of the sharp decline in inventory is now behind us, and I think there are many potential sellers waiting for a better market, and slightly higher prices will probably mean a little more inventory keeping prices from rising quickly.

Note: I wrote about The economic impact of a slight increase in house prices back in August.

Also note the comment about more "primary homebuyers" - that is an important transition along with more conventional sales (as opposed to foreclosures and short sales).

Homebuilders D.R. Horton and Beazer Report Sales Increase

by Calculated Risk on 11/12/2012 09:14:00 AM

D.R. Horton continues to see strong sales growth and expect sales to increase in 2013. Beazer is a laggard, but also expects sales to increase next year. I'll have more on the builders in a couple weeks.

From RTTNews.com: D.R. Horton Q4 Profit Climbs, Tops View

Homebuilder D.R. Horton Inc. Monday reported a sharp increase in fourth-quarter profit, that exceeded analysts' view, as the company benefited from continued improvement in housing market ...Quote from Donald R. Horton, Chairman of the Board:

Homebuilding revenues for the quarter climbed 21 percent to $1.3 billion, while analysts estimated $1.35 billion. The company closed 5,575 homes in the period, up 12 percent from a year earlier.

Net sales orders increased 24 percent and value of net sales orders were up 35 percent from the preceding year.

As at September 30, D.R. Horton sales order backlog of homes under contract jumped 49 percent to 7,240 homes and the value of the backlog increased 61 percent to $1.7 billion.

“We are positioned for a strong start to fiscal 2013, with our highest year-end backlog since fiscal 2007. We have continued to see strong sales demand through October and into November. With 13,000 homes in inventory and 60,000 finished lots controlled, we have the home and lot position to continue to grow our market share and meet increasing customer demand. We look forward to continued improvement in our operating metrics and increased profitability in fiscal 2013.”And from MarketWatch: Beazer Homes's loss widens, sales up double-digits

Beazer Homes fiscal fourth-quarter loss widened as the home builder recorded a large debt extinguishment loss that overshadowed a double-digit revenue rise.

...

Revenue rose 11% to $370.9 million as home construction and land sales climbed. Analysts polled by Thomson Reuters expected a loss of $1.22 a share on $335.1 million in revenue.

The builder's cancellation rate was down at 31.1% from 34.2%. Total home closings were up 17% to 1,608.

New orders rose 10% to 1,110 homes, a rate that is slower than many of the homebuilder's peers. Total backlog units rose 31% from the year-ago quarter.

Sunday, November 11, 2012

Monday: Veterans Day

by Calculated Risk on 11/11/2012 08:21:00 PM

Monday:

• Bond markets and banks will be closed in observance of Veterans Day. The stock market will be open.

• 4:00 AM ET: Eurozone Finance Ministers Meeting

On Greece, from the Financial Times: Greece battles to avert €5bn default

Greece is battling to raise funds to avoid defaulting on a €5bn debt repayment this week ...From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 1 and DOW futures are slightly down.

The country’s debt management office has announced plans to cover the full amount through a treasury bill auction on Tuesday, but Greek banks expected to buy the issue can only raise about €3.5bn of collateral acceptable to the European Central Bank ...

Senior EU officials, however, said they remain doubtful a deal can be struck at Monday’s meeting of finance ministers in Brussels ...

excerpt with permission

Oil prices are down slightly with WTI futures at $85.96 per barrel and Brent at $109.03 per barrel. Gasoline prices have been falling.

Weekend:

• Summary for Week Ending Nov 9th

• Schedule for Week of Nov 11th

Two more questions this week for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

AAR: Rail Traffic "mixed" in October

by Calculated Risk on 11/11/2012 04:54:00 PM

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for October

The Association of American Railroads (AAR) today reports U.S. rail traffic continues to show mixed results in monthly rail data, and that impacts from Hurricane Sandy can be seen in decreased traffic for week 44.

“The fundamentals of U.S. rail traffic remained roughly the same in October as in recent months: weakness in coal, remarkable growth in petroleum and petroleum products, a slight slowing of growth in intermodal and autos, and mixed results for everything else,” said AAR Senior Vice President John T. Gray.

Intermodal traffic in October saw an increase for the 35th straight month, totaling 1,233,475 containers and trailers, up 1.5 percent (18,710 units) compared with October of 2011. Carloads originated in October totaled 1,422,654 carloads, down 6.1 percent (92,601 carloads) compared with the same month last year. Carloads excluding coal were up 1.9 percent for the month, or 15,609 carloads, compared with the same month last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

Total U.S. rail carload traffic fell 6.1% (92,601 carloads) to 1,422,654 in October 2012 from October 2011 on a non-seasonally adjusted basis (see charts below). That’s the largest year-over-year carload percentage decline since November 2009.The second graph is for intermodal traffic (using intermodal or shipping containers):

As was the case last month too, coal alone more than accounted for the total carload decline in October. Coal carloads were down 16.0% (108,210 carloads) in October 2012 from October 2011.

...

Hurricane Sandy negatively affected rail traffic in the last week of October in the East. As is always the case when bad weather affects rail traffic, some of the lost traffic will be made up, some will not, and it is not possible to precisely determine how much falls into each category.

Graphs reprinted with permission.

Graphs reprinted with permission.On Intermodal traffic:

U.S. rail intermodal traffic rose 1.5% (18,710 containers and trailers) in October 2012 over October 2011 to 1,233,475 units. That’s the 35th straight year-over-year monthly increase, though it was the smallest percentage gain in 14 months.This is more evidence of sluggish growth.

Yesterday:

• Summary for Week Ending Nov 9th

• Schedule for Week of Nov 11th

Sacramento October House Sales: Conventional Sales up 55% year-over-year

by Calculated Risk on 11/11/2012 11:14:00 AM

Note: I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement in the Sacramento market.

In October 2012, 47.7% of all resales (single family homes and condos) were distressed sales. This was down from 50.8% last month, and down from 64.1% in October 2011. The is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs fell to 12.0%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 35.7%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were almost three times as many short sales as REO sales in October. The gap between short sales and REO sales is increasing.

Total sales were up 7% from October 2011, and conventional sales were up 55% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 60.4% from last October, although listings were up 4% in October compared to the previous month.

Cash buyers accounted for 36.9% of all sales (frequently investors), and median prices were up 4.1% from last October.

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.

Chicago Fed Letter: "Detecting early signs of financial instability"

by Calculated Risk on 11/11/2012 09:09:00 AM

Here is another possible tool for predicting financial stress. From Scott Brave, senior business economist, and R. Andrew Butters, graduate student, Kellogg School of Management, Northwestern University: Detecting early signs of financial instability. A few excerpts:

Following the financial crisis, policymakers and researchers have sought to identify new indicators that may be useful in gauging the relationship between the financial and nonfinancial sectors of the economy in the hope of detecting early signs of financial instability. The ratio of private credit to gross domestic product (GDP) has received a lot of attention in this regard.1 This leverage ratio serves as an early warning indicator of financial instability, insofar as it captures instances where the nonfinancial sector’s financial obligations form an outsized share of the broader economy’s resources.

In this Chicago Fed Letter, we propose an alternative early warning indicator to the private-credit-to-GDP ratio. Our measure is constructed as a subindex made up of two nonfinancial leverage measures used in the Chicago Fed’s National Financial Conditions Index (NFCI). We show that this subindex has performed well as a leading indicator for historical periods of financial stress and their accompanying recessions in the United States; we also demonstrate that it has been more accurate than the private-credit-to-GDP ratio in predicting both at longer forecast horizons.

Click on graph for larger image.

Click on graph for larger image.The solid black line is the nonfinancial leverage subindex of the Chicago Fed’s National Financial Conditions Index, and the solid blue line is the ratio of private credit to gross domestic product (GDP) detrended as explained in note 4. For ease of comparison, both measures have been scaled to have a mean of zero and a standard deviation of one over the period 1973–2012.And their conclusion:

The horizontal (time) axis is measured in weeks. We assign the quarterly private-credit-to-GDP ratio to the last week of each quarter to be able to plot it on the same figure panel as the weekly nonfinancial leverage subindex. The shaded regions in panel A correspond with historical periods of financial stress based on the analysis in Brave and Butters (2012).

The dashed black line is the two-year-ahead prediction threshold for a financial crisis (panel A) ... calculated for the nonfinancial leverage subindex, as explained in the text.

Our nonfinancial leverage indicator signals both the onset and duration of financial crises and their accompanying recessions more reliably at longer lead times than the private-credit-to-GDP ratio.This might be useful some time in the future. The Chicago Fed will include this as part of the NFCI release.

Beginning with the November 15, 2012, NFCI release, we will include the nonfinancial leverage subindex in the publicly available materials for the NFCI at www.chicagofed.org/nfci.

Saturday, November 10, 2012

Unofficial Problem Bank list declines to 860 Institutions

by Calculated Risk on 11/10/2012 05:11:00 PM

CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 9, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Only one action termination this week for the Unofficial Problem Bank List. The Federal Reserve terminated the Written Agreement against Community First Bank, Boscobel, WI ($217 million). After the change, the list holds 860 institutions with assets of $328.2 billion. A year ago, the list held 981 institutions with assets of $405.9 billion.Earlier:

Next week, activity should pick-up as the OCC will publish it actions through mid-October and perhaps the FDIC will execute a few closings to get ahead of the Thanksgiving Day holiday.

• Summary for Week Ending Nov 9th

• Schedule for Week of Nov 11th

Schedule for Week of Nov 11th

by Calculated Risk on 11/10/2012 01:10:00 PM

Earlier:

• Summary for Week Ending Nov 9th

Several economic reports this week will be impacted by Hurricane Sandy including retail sales, weekly unemployment claims, and the regional NY and Philly Fed manufacturing surveys.

The key report for the week is retail sales for October. For manufacturing, the November NY Fed (Empire state) and Philly Fed surveys, and the October Industrial Production and Capacity Utilization report will all be released this week.

On prices, CPI for October will be released on Thursday.

Also Fed Chairman Ben Bernanke speaks Thursday on "Housing and Mortgage Markets".

4:00 AM ET: Eurozone Finance Ministers Meeting

8:30 AM: Producer Price Index for October. The consensus is for a 0.1% increase in producer prices (0.1% increase in core).

8:30 AM ET: Retail sales for October will be released. Note: Retail sales (especially auto sales) were impacted by Hurricane Sandy.

8:30 AM ET: Retail sales for October will be released. Note: Retail sales (especially auto sales) were impacted by Hurricane Sandy.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 24.6% from the bottom, and now 9.0% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to decrease 0.2% in October, and for retail sales ex-autos to increase 0.1%.

10:00 AM: Manufacturing and Trade: Inventories and Sales for September (Business inventories). The consensus is for 0.6% increase in inventories.

2:00 PM: FOMC Minutes for Meeting of October 23-24, 2012.

8:30 AM: Consumer Price Index for October. The consensus is for CPI to increase 0.1% in October and for core CPI to increase 0.1%.

8:30 AM: NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of minus 9, down from minus 6.2 in October (below zero is contraction).

10:00 AM: Philly Fed Survey for November. The consensus is for a reading of minus 1.0, down from 5.7 last month (above zero indicates expansion).

1:20 PM: Speech, Fed Chairman Ben Bernanke, Housing and Mortgage Markets, At the HOPE Global Financial Dignity Summit, Atlanta, Georgia

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This shows industrial production since 1967.

The consensus is for no change in Industrial Production in October, and for Capacity Utilization to decrease to 78.2%.