by Calculated Risk on 11/17/2012 09:20:00 PM

Saturday, November 17, 2012

California: Unemployment Rate falls to 10.1% in October, Payroll jobs increase 45,800

Recently I've been talking to a few friends from around the country, and they all seemed unaware that the California economy is clearly improving. California is seeing a pickup in employment, the delinquency rate is falling, and I wouldn't be surprised if California reports a balanced budget soon.

Note: when the MBA quarterly delinquency data was released earlier this week, Mike Fratantoni, MBA’s Vice President of Research and Economics, said there has been "dramatic" improvement in California and Arizona.

From California's Employment Development Department: California’s unemployment rate decreases to 10.1 percent, Nonfarm payroll jobs increase by 45,800

California’s unemployment rate decreased to 10.1 percent in October, and nonfarm payroll jobs increased by 45,800 during the month for a total gain of 574,900 jobs since the recovery began in February 2010, according to data released today by the California Employment Development Department (EDD) from two separate surveys.This is the lowest unemployment rate for California since Jan 2009. There are only three states still with double digit unemployment: Nevada, Rhode Island, and California.

The BLS will release data for all states on Tuesday.

Earlier:

• Summary for Week Ending Nov 16th

• Schedule for Week of Nov 18th

Unofficial Problem Bank list declines to 857 Institutions

by Calculated Risk on 11/17/2012 04:34:00 PM

CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 16, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the OCC released its latest actions this Friday, which contributed to many changes to the Unofficial Problem Bank List. This week, there were seven removals and four additions that leave the list at 857 institutions with assets of $329.2 billion. A year ago, the list held 903 institutions with assets of $419.6 billion.Earlier:

The OCC or the Federal Reserve terminated actions against The Citizens National Bank, Putnam, CT ($354 million Ticker: CTZR); Bankers' Bank of the West, Denver, CO ($348 million); North Cascades National Bank, Chelan, WA ($333 million); Incommons Bank, N.A., Mexia, TX ($98 million); Prairie National Bank, Stewardson, IL ($54 million); and Butte State Bank, Butte, NE ($42 million). Amazingly, the FDIC closed another bank in Georgia -- Hometown Community Bank, Braselton, GA ($134 million), which is the 84th failure in the state since 2008.

Additions this week include Roma Bank, Robbinsville, NJ ($1.7 billion); First National Bank, Ronceverte, WV ($262 million); Interamerican Bank, A FSB, Miami, FL ($240 million); and St Tammany Homestead Savings and Loan Association, Covington, LA ($96 million).

We wish all readers a Happy Thanksgiving as the next update will be published after the holiday. As such, it is likely to be a quiet weekend as the FDIC will take the long weekend off from closings and they will likely not publish their latest actions until Friday the 30th.

• Summary for Week Ending Nov 16th

• Schedule for Week of Nov 18th

Schedule for Week of Nov 18th

by Calculated Risk on 11/17/2012 01:11:00 PM

Earlier:

• Summary for Week Ending Nov 16th

This is a short week (Happy Thanksgiving!), but there are several key releases early in the week.

On Monday, the NAR will release existing home sales for October, and the NAHB will release their homebuilder confidence survey. On Tuesday, Housing Starts for October will be released. Housing has been the bright spot for the U.S. economy recently.

Also on Tuesday, Fed Chairman Ben Bernanke will speak on "The Economic Recovery and Economic Policy".

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 4.74 million on seasonally adjusted annual rate (SAAR) basis. Sales in September 2012 were 4.75 million SAAR.

Economist Tom Lawler estimates the NAR will report sales at 4.84 million SAAR. Goldman Sachs is forecasting a decline in sales to 4.67 million, and Merrill Lynch is forecasting 4.60 million.

A key will be inventory and months-of-supply.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 41, unchanged from October. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. Total housing starts were at 872 thousand (SAAR) in September, up 15.0% from the revised August rate of 758 thousand (SAAR). Single-family starts increased 11.0% to 603 thousand in September.

The consensus is for total housing starts to decline to 840,000 (SAAR) in October, down from 872,000 in September.

Goldman Sachs is forecasting a decline in starts to 840,000, and Merrill Lynch is forecasting 815,000.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for October 2012

12:15 PM: Speech by Fed Chairman Ben Bernanke, The Economic Recovery and Economic Policy, At the Economic Club of New York, New York, New York

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 400 thousand from 439 thousand. Note: Claims increased sharply last week due to Hurricane Sandy.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for November. This index was at 51.5 in October.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for November). The consensus is for no change from the preliminary reading of 84.9. Goldman Sachs is forecasting a decline in confidence to 81.0, and Merrill Lynch is forecasting a decline to 83.

10:00 AM: Conference Board Leading Indicators for October. The consensus is for a 0.2% decrease in this index.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

All US markets will be closed in observance of the Thanksgiving Day Holiday.

Europe: Two day EU Leaders Summit Meeting

SIFMA recommends US markets close at 2:00 PM ET following the Thanksgiving Day Holiday. The NYSE will close at 1:00 PM ET.

Summary for Week Ending Nov 16th

by Calculated Risk on 11/17/2012 05:01:00 AM

Hurricane Sandy impacted the economic data released last week, especially retail sales, industrial production and initial weekly unemployment claims. The Fed reported that Sandy "reduced the rate of change in total output by nearly 1 percentage point". Also the Philly Fed and Empire State manufacturing surveys were weak due to Sandy. Since we are usually looking for the trend in the data, we have to be careful to look through short term event driven increases or decreases in the data. Overall I'd expect the data to return to trend fairly quickly.

Most of the discussion last week was related to the "fiscal slope", or more accurately, how much austerity the US should enact in 2013. This will be an ongoing discussion, and I expect some reasonable compromise to be reached - although I expect taxes will increase on just about everyone in 2013 with a combination of the payroll tax cut expiring and tax rates for higher income earners increasing.

Fed Chairman Ben Bernanke spoke this week and expressed concern that mortgage lending standards might be "overly tight". Also the FOMC minutes suggested the Fed is considering setting unemployment rate and inflation thresholds for raising the Fed Funds rate. I'll have more on thresholds before the FOMC meeting in December.

There was some good news on mortgage delinquencies. The MBA reported that delinquencies declined again in Q3, although they believe there is several years of "in foreclosure" inventory that still needs to be resolved.

Here is a summary of last week in graphs:

• Retail Sales declined 0.3% in October

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales declined 0.3% from September to October (seasonally adjusted), and sales were up 3.8% from October 2011. Sales for September were revised up to a 1.3% increase (from 1.1% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

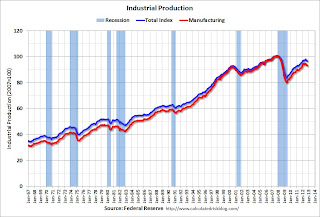

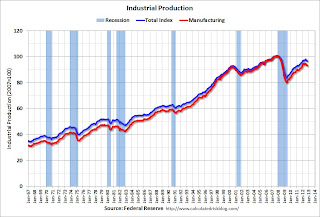

• Industrial Production decreased 0.4% in October due to Hurricane Sandy, Capacity Utilization decreased

The Fed reported: "Hurricane Sandy, which held down production in the Northeast region at the end of October, is estimated to have reduced the rate of change in total output by nearly 1 percentage point."

The Fed reported: "Hurricane Sandy, which held down production in the Northeast region at the end of October, is estimated to have reduced the rate of change in total output by nearly 1 percentage point."

This graph shows Capacity Utilization. This series is up 10.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.5 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production decreased in October to 96.6. This is 15% above the recession low, but still 4.1% below the pre-recession peak.

IP was slightly below expectations due to the impact of Hurricane Sandy. We will probably see some bounce back over the next couple of months.

• Weekly Initial Unemployment Claims increased sharply to 439,000

The DOL reported: "In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000."

The DOL reported: "In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,750.

This sharp increase is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were higher than the consensus forecast.

• Key Measures show low inflation in October

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 2.2%, and the CPI less food and energy rose 2.0%. Core PCE is for September and increased 1.7% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 2.2%, and the CPI less food and energy rose 2.0%. Core PCE is for September and increased 1.7% year-over-year.On a monthly basis, two of these measure were above the Fed's target; median CPI was at 2.3% annualized, core CPI increased 2.2% annualized. However trimmed-mean CPI was at 1.7% annualized, and core PCE for September increased 1.4% annualized. These measures suggest inflation is close to the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis.

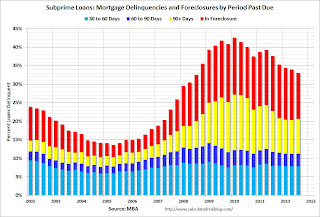

• MBA: Mortgage Delinquencies decreased in Q3

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.From the MBA: Mortgage Delinquency and Foreclosure Rates Decreased During Third Quarter

This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.25% from 3.18% in Q2. This is just above 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.19% in Q3, from 1.22% in Q2.

The 90 day bucket decreased to 2.96% from 3.19%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.07% from 4.27% and is now at the lowest level since Q1 2009.

Friday, November 16, 2012

Lawler: Early Read on October Existing Home Sales

by Calculated Risk on 11/16/2012 07:48:00 PM

From economist Tom Lawler:

Based on what I've seen, I expect the NAR's existing home sales number will come in at a seasonally adjusted annual rate of 4.84 million.

The unadjusted YOY change will be a boatload higher in October than in September, but October this year had two more business days than last October, so...

Closed sales were only slightly impacted by Sandy; a bigger impact in some hit markets is more likely to show up in November.

Best guess on inventories is a monthly decline of 3.4%.

CR Notes: The consensus is for the NAR to report sales of 4.74 million on seasonally adjusted annual rate (SAAR) basis on Monday. Based on Lawler's estimates, the NAR will report inventory around 2.3 million units for October, and months-of-supply will be around 5.7 months. This will be the lowest level of inventory for October since 2001 or 2002, and the lowest months-of-supply since early 2006.

Bank Failure #50 in 2012: Hometown Community Bank, Braselton, Georgia

by Calculated Risk on 11/16/2012 05:12:00 PM

Hometown Bank on the buffet

Bad asset stuffing.

by Soylent Green is People

From the FDIC: CertusBank, National Association, Easley, South Carolina, Assumes All of the Deposits of Hometown Community Bank, Braselton, Georgia

As of September 30, 2012, Hometown Community Bank had approximately $124.6 million in total assets and $108.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $36.7 million. ... Hometown Community Bank is the 50th FDIC-insured institution to fail in the nation this year, and the tenth in Georgia.There are still banks in Georgia? Ten out of fifty failures this year have been in Georgia.

FNC: Residential Property Values increased 2.3% year-over-year in September

by Calculated Risk on 11/16/2012 01:39:00 PM

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their September index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values were unchanged in September from August (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.2% and 0.4% in September. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Since these indexes are NSA, the month-to-month changes will probably turn negative in October. The key is to watch the year-over-year change and also to compare the month-to-month change to previous years.

The year-over-year trends continued to show improvement in September, with the 100-MSA composite up 2.3% compared to September 2011. The FNC index turned positive on a year-over-year basis in July - that was the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

Click on graph for larger image.

Click on graph for larger image.

This graph is based on the FNC index (four composites) through September 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The key is the indexes are now showing a year-over-year increase.

The September Case-Shiller index will be released on Tuesday, November 27th.

2012 FHA Actuarial Review Press Release and Report

by Calculated Risk on 11/16/2012 12:22:00 PM

Note: Apparently the web release yesterday was accidental. Oops!

Here is the press release: FHA ISSUES ANNUAL FINANCIAL STATUS REPORT TO CONGRESS

The U.S. Department of Housing and Urban Development (HUD) today released its annual report to Congress on the financial condition of the Federal Housing Administration (FHA) Mutual Mortgage Insurance (MMI) Fund. In reporting on findings of the independent actuarial study, HUD indicates that while FHA continues to be impacted by losses from mortgages originated prior to 2009, this report does not directly affect the adequacy of capital balances in the MMI Fund.On earlier loans and DAPs (DAPs were a hot topic on this blog from early 2005 until they were banned):

The independent study found that as the housing market continues to recover, the capital reserve ratio of the MMI Fund used to support FHA’s single family mortgage and reverse mortgage insurance programs fell below zero to -1.44 percent. This represents a negative economic value of $16.3 billion. This does not mean FHA has insufficient cash to pay insurance claims, a current operating deficit, or will need to immediately draw funds from the Treasury. The need to draw on Treasury funds is determined not by the economic assumptions of this actuarial review but those used in the President’s FY 2014 budget proposal to be released in February, with a final determination on a potential draw made in September. Also, the actuary’s estimate of the Fund’s economic value excludes $11 billion in expected capital accumulation through the end of FY 2013. Finally, HUD’s report includes additional actions designed to contribute billions of dollars in added value to the MMI Fund over the next several years.

...

Three factors are driving the change in FHA’s position compared to last year:

First, the house-price appreciation forecasts used for this actuarial review are significantly lower than those used in last year’s report, as the actual turnaround in the housing market occurred later than was projected last year. These house-price appreciation estimates do not include improvements to home prices that occurred since June and were depressed by a high level of refinance activity.

Second, the continued decline in interest rates, while good for the overall economy, costs the FHA revenue as its borrowers pay off their mortgages to refinance into lower rates. Again, this is clearly a positive, but it impacts the actuary’s estimate of the value of the Fund. In addition, the actuary predicts that borrowers with higher interest rates who are unable to refinance will default at higher than normal rates, increasing losses from foreclosures for FHA.

Third, based on recommendations made by the Government Accountability Office (GAO), HUD’s Inspector General and others, FHA directed the actuary to employ a refined methodology this year to more precisely predict the way losses from defaulted loans and reverse mortgages are reflected in the economic value of the MMI Fund.

Losses on loans insured between Fiscal Years 2007 and 2009 continue to place a significant strain on the Fund with $70 billion in FHA claims attributable to loans insured in those years. Though they were prohibited in 2009, the ongoing effect of “seller-funded downpayment assistance loans” is still significant. The net expected cost of those loans, as projected by the independent actuaries, is more than $15 billion. By contrast, the actuary found that the FHA’s books of business since FY2010 are expected to be very beneficial, providing billions of dollars in net revenues to offset losses on earlier books.The FHA had a very low market share in 2005 and 2006, but many of those insured loans were "seller-funded downpayment assistance loans" - and those loans performed horribly (as expected with no money down and buying at the peak).

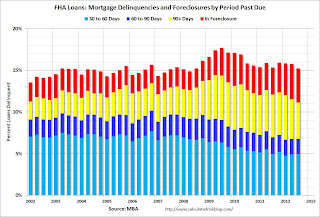

Mortgage Delinquencies by Loan Type in Q3

by Calculated Risk on 11/16/2012 11:25:00 AM

The following graphs show the percent of loans delinquent by loan type based on the MBA National Delinquency Survey: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q3 2012 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last five years; the number of subprime loans is down by about 32%. Meanwhile the number of FHA loans has more than doubled and VA loans have increased sharply.

Note: There are about 41.8 million first-lien loans in the survey, and the MBA survey is about 88% of the total. In the MBA universe, there are under 600 thousand seriously delinquent FHA loans. However, in the entire market, according to the FHA, there are over 700 thousand seriously delinquent FHA loans.

For Prime and Subprime, a majority of the seriously delinquent loans were originated in the 2005 to 2007 period - and these loans are still in the process of being resolved through foreclosure or short sales. However, for the FHA, about 45% of the seriously delinquent loans were originated in 2008 and 2009. That is the period when private capital disappeared, and the FHA share of the market increased sharply.

Luckily the FHA had a small market share in 2005 and 2006; however they did make quite a few bad loans in that period because of seller financed Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible. (The DAPs were finally eliminated in late 2008).

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q3 2012 | Change | Q3 2012 Seriously Delinquent | |

| Prime | 33,916,830 | 29,242,787 | -4,674,043 | 1,371,487 |

| Subprime | 6,204,535 | 4,207,315 | -1,997,220 | 914,670 |

| FHA | 3,030,214 | 6,770,134 | 3,739,920 | 578,169 |

| VA | 1,096,450 | 1,553,812 | 457,362 | 68,989 |

| Survey Total | 44,248,029 | 41,774,048 | -2,473,981 | 2,933,316 |

Click on graph for larger image.

Click on graph for larger image.First a repeat: This graph shows the percent of loans delinquent by days past due. Loans 30 days delinquent increased to 3.25% from 3.18% in Q2. This is just above 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.19% in Q3, from 1.22% in Q2.

The 90 day bucket decreased to 2.96% from 3.19%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.07% from 4.27% and is now at the lowest level since Q1 2009.

Note: Scale changes for each of the following graphs.

The second graph is for all prime loans.

The second graph is for all prime loans. This is the category with the most seriously delinquent loans. Back in early 2007 when Fed Chairman Ben Bernanke said "the problems in the subprime market seems likely to be contained", my former co-blogger Tanta responded "We are all subprime!" - she was correct.

Since there are far more prime loans than any other category (see table above), about 47% of the loans seriously delinquent now are prime loans - even though the overall delinquency rate is much lower than other loan types.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans has declined sharply.

This graph is for FHA loans. It might surprise people, but the percent of FHA delinquent loans (not including in foreclosure) is at the lowest level in a decade. That is because the recently originated loans (2010 through 2012) are performing very well, and the FHA originated a large number of loans in that period.

This graph is for FHA loans. It might surprise people, but the percent of FHA delinquent loans (not including in foreclosure) is at the lowest level in a decade. That is because the recently originated loans (2010 through 2012) are performing very well, and the FHA originated a large number of loans in that period.Of course there are still a large number of loans in the foreclosure process, and the remaining DAPs and the loans originated in 2008 and 2009 are performing poorly.

The last graph is for VA loans. This is a fairly small but growing category (see table above).

The last graph is for VA loans. This is a fairly small but growing category (see table above).The good news is every category is improving. There are still quite a few subprime loans that are in distress, but the real keys going forward are prime loans and FHA loans.

Industrial Production decreased 0.4% in October due to Hurricane Sandy, Capacity Utilization decreased

by Calculated Risk on 11/16/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.4 percent in October after having increased 0.2 percent in September. Hurricane Sandy, which held down production in the Northeast region at the end of October, is estimated to have reduced the rate of change in total output by nearly 1 percentage point. The largest estimated storm-related effects included reductions in the output of utilities, of chemicals, of food, of transportation equipment, and of computers and electronic products. In October, the index for manufacturing decreased 0.9 percent; excluding storm-related effects, factory output was roughly unchanged from September. The output of utilities edged down 0.1 percent in October, and production at mines advanced 1.5 percent. At 96.6 percent of its 2007 average, total industrial production in October was 1.7 percent above its year-earlier level. Capacity utilization for total industry decreased 0.4 percentage point to 77.8 percent, a rate 2.5 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.5 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in October to 96.6. This is 15% above the recession low, but still 4.1% below the pre-recession peak.

IP was slightly below expectations due to the impact of Hurricane Sandy. We will probably see some bounce back over the next couple of months.

Thursday, November 15, 2012

Friday: Industrial Production and Capacity Utilization

by Calculated Risk on 11/15/2012 09:18:00 PM

Note: The report linked to in 2012 FHA Actuarial Review Released: Negative $13.5 Billion economic value appears to have been taken down (maybe released early by mistake). Nick Timiraos at the WSJ writes: Report: FHA to Exhaust Capital Reserves

[T]he latest forecasts show that while the FHA currently has reserves of $30.4 billion, it expects to lose $46.7 billion on the loans it has guaranteed, resulting in a $16.3 billion deficit.Friday:

...

"If [the FHA] were a private company, it would be declared insolvent and probably put under conservatorship like Fannie and Freddie," said Thomas Lawler, an independent housing economist in Leesburg, Va.

...

Overall, the FHA insured nearly 739,000 loans that were 90 days or more past due or in foreclosure at the end of September, an increase of more than 100,000 loans from a year ago. That represents about 9.6% of all insured loans.

Most of the agency's losses stem from loans made between 2007 and 2009, as the housing bust deepened. Loans made since 2010 are expected to be very profitable.

• At 9:15 AM ET, the Fed will release Industrial Production and Capacity Utilization for October. The consensus is for 0.2% increase in Industrial Production in October, and for Capacity Utilization to increase to 78.4%.

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

2012 FHA Actuarial Review Released: Negative $13.5 Billion economic value

by Calculated Risk on 11/15/2012 06:08:00 PM

From HUD: Actuarial Review of the Mutual Mortgage Insurance Fund. Excerpts:

Based on our stochastic simulation analysis, we estimate that the economic value of the Fund as of the end of FY 2012 is negative $13.48 billion. This represents a $14.67 billion drop from the $1.19 billion estimated economic value as of the end of FY 2011.Update: A few comments from Tom Lawler:

...

We project that there is approximately a 5 percent chance that the Fund’s capital resources could turn negative during the next 7 years. We also estimate that under the most pessimistic economic scenario, the economic value could stay negative until at least FY 2019.

The latest review concluded that the “economic value” of the FHA MMIF (ex HECMs) – defined as the sum of the MMIFs existing capital resources plus the present value of the current books of business, was NEGATIVE $13.478 billion at the end of FY 2012. Stated another way, the present value of expected future cash flows on outstanding business – a sizable negative $39.052 billion – outstrips the MMIF’s current capital resources (of $25.574 billion) by $13.478 billion. The FY actuarial review of FHA’s HECM business concluded that the “economic value” of the current FHA HECM book was NEGATIVE $2.799 billion at the end of FY 2012.

In last year’s actuarial review the “economic value” of the FHA MMIF (ex HECMs) at the end of FY 2011 was +$1.193 billion, and the projected economic value of the MMIF at the end of FY 2012 (under the “base case) scenario) was a POSITIVE $9.351 billion. In recent years, however, these “projections,” based on “reasonable” benign projections, have been ridiculously optimistic.

Contrary to what at least one press report said, the actuarial “unsoundness” of the FHA MMIF is NOT the result of mortgage loans insured at or near the peak of the housing bubble. The “honkingly big” losses (in dollars) are concentrated in the FY 2008 and FY 2009 “books (October 2007 – October 2009) – that is, loans insured in the first few years AFTER the peak in the housing bubble, when “private capital” for risky loans dried up and FHA experienced a surge in market share, AND took on a lot of very risky (by any standard) mortgages, a significant % of which should not have been made.

The “walk-forward” of the FY 2012’s economic value from a projection of positive $9.351 billion a year ago to negative $13.478 billion today is a little hard to follow or understand. On the positive side, the money FHA extorted from lenders in the mortgage settlement added about $1.1 billion, and higher-than-projected 2011-12 volumes, actual performance, and different-than-projected portfolio composition added about $3.8 billion. On the negative side, various model changes, especially in the loss severity model, took out about $11.0 billion; lower interest rate assumptions took out $8.4 billion; just slightly lower home price assumptions (beyond 2012) took out a surprisingly large $10.5.

Key Measures show low inflation in October

by Calculated Risk on 11/15/2012 03:57:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in October. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for October here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.8% annualized rate) in October. The CPI less food and energy increased 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 2.2%, and the CPI less food and energy rose 2.0%. Core PCE is for September and increased 1.7% year-over-year.

On a monthly basis, two of these measure were above the Fed's target; median CPI was at 2.3% annualized, core CPI increased 2.2% annualized. However trimmed-mean CPI was at 1.7% annualized, and core PCE for September increased 1.4% annualized. These measures suggest inflation is close to the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis.

Bernanke suggests Mortgage Lending Standards are "Overly Tight", "Pendulum has swung too far"

by Calculated Risk on 11/15/2012 01:20:00 PM

From Fed Chairman Ben Bernanke: Challenges in Housing and Mortgage Markets. Excerpt:

Although the decline in the number of willing and qualified potential homebuyers explains some of the contraction in mortgage lending of the past few years, I believe that tight credit nevertheless remains an important factor as well. The Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices indicates that lenders began tightening mortgage credit standards in 2007 and have not significantly eased standards since. Terms and standards have tightened most for borrowers with lower credit scores and with less money available for a down payment. For example, in April nearly 60 percent of lenders reported that they would be much less likely, relative to 2006, to originate a conforming home-purchase mortgage to a borrower with a 10 percent down payment and a credit score of 620--a traditional marker for those with weaker credit histories. As a result, the share of home-purchase borrowers with credit scores below 620 has fallen from about 17 percent of borrowers at the end of 2006 to about 5 percent more recently. Lenders also appear to have pulled back on offering these borrowers loans insured by the Federal Housing Administration (FHA).Clearly Bernanke and the Fed are concerned that credit isn't flowing to a large segment of the population.

When lenders were asked why they have originated fewer mortgages, they cited a variety of concerns, starting with worries about the economy, the outlook for house prices, and their existing real estate loan exposures. They also mention increases in servicing costs and the risk of being required by government-sponsored enterprises (GSEs) to repurchase delinquent loans (so-called putback risk). Other concerns include the reduced availability of private mortgage insurance for conventional loans and some program-specific issues for FHA loans as reasons for tighter standards. Also, some evidence suggests that mortgage originations for new purchases may be constrained because of processing capacity, as high levels of refinancing have drawn on the same personnel who would otherwise be available for handling loans for purchase. Importantly, however, restrictive mortgage lending conditions do not seem to be linked to any insufficiency of bank capital or to a general unwillingness to lend.

Certainly, some tightening of credit standards was an appropriate response to the lax lending conditions that prevailed in the years leading up to the peak in house prices. Mortgage loans that were poorly underwritten or inappropriate for the borrower's circumstances ultimately had devastating consequences for many families and communities, as well as for the financial institutions themselves and the broader economy. However, it seems likely at this point that the pendulum has swung too far the other way, and that overly tight lending standards may now be preventing creditworthy borrowers from buying homes, thereby slowing the revival in housing and impeding the economic recovery.

emphasis added

Q3 MBA National Delinquency Survey Graph and Comments

by Calculated Risk on 11/15/2012 11:13:00 AM

A few comments from Mike Fratantoni, MBA’s Vice President of Research and Economics, on the Q3 MBA National Delinquency Survey conference call.

• Significant drop in "shadow inventory" with the declines in the 90+ day delinquency and in foreclosure categories.

• This was the largest decline in foreclosure inventory ever recorded.

• Significant difference between judicial and non-judicial states. The judicial foreclosure inventory was at 6.61%, and the non-judicial inventory was at 2.42%. Both are now declining.

• There has been "dramatic" improvement in California and Arizona. Overall there is continued improvement, "perhaps more quickly than expected".

• There has been some improvement in FHA delinquencies because of the strong credit quality of recent originations. Most of the delinquent loans are from the 2008 and 2009 vintages.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (13.04% in foreclosure down from 13.70% in Q2), New Jersey (8.87% up from 7.65%), Illinois (6.83% down from 7.11%), New York (6.46% down from 6.47%) and Nevada (the only non-judicial state in the top 13 at 5.93% down from 6.09%).

As Fratantoni noted, California (2.63% down from 3.07%) and Arizona (2.51% down from 3.24%) are now well below the national average.

The second graph shows the percent of loans delinquent by days past due.

The second graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.25% from 3.18% in Q2. This is just above 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.19% in Q3, from 1.22% in Q2.

The 90 day bucket decreased to 2.96% from 3.19%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.07% from 4.27% and is now at the lowest level since Q1 2009.

Note: "MBA’s National Delinquency Survey covers 41.8 million loans on one-to-four-unit residential properties, representing approximately 88 percent of all “first-lien” residential mortgage loans outstanding in the United States. This quarter’s loan count saw a decrease of about 733,000 loans from the previous quarter, and a decrease of 1,752,000 loans from one year ago. Loans surveyed were reported by approximately 120 lenders, including mortgage banks, commercial banks and thrifts."

MBA: Mortgage Delinquencies decreased in Q3

by Calculated Risk on 11/15/2012 10:00:00 AM

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.

From the MBA: Mortgage Delinquency and Foreclosure Rates Decreased During Third Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 7.40 percent of all loans outstanding as of the end of the third quarter of 2012, a decrease of 18 basis points from the second quarter of 2012, and a decrease of 59 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 7.40% (SA) and 4.07% equals 11.47%.

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. ... The percentage of loans in the foreclosure process at the end of the third quarter was 4.07 percent, down 20 basis points from the second quarter and 36 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.03 percent, a decrease of 28 basis points from last quarter, and a decrease of 86 basis points from the third quarter of last year.

...

“Mortgage delinquencies decreased compared to last quarter overall, driven mainly by a decline in loans that are 90 days or more delinquent,” observed Mike Fratantoni, MBA’s Vice President of Research and Economics. “The 90 day delinquency rate is at its lowest level since 2008, and together with the decline in the percentage of loans in foreclosure, this indicates a significant drop in the shadow inventory of distressed loans-a real positive for the housing market. The 30 day delinquency rate increased slightly, but remains close to the long-term average for this metric. Given the weak economic and job growth in third quarter, it is not surprising that this metric has not improved. ”

“The improvement in total delinquency rates was accompanied by a further drop in the foreclosure starts rate, which hit its lowest level since 2007. Moreover, the foreclosure inventory rate decreased by 20 basis points over the quarter, the largest quarterly drop in the history of the survey. The level however, is still roughly four times the long-run average for this series as we continue to see back logs of loans in the foreclosure process in states with a judicial foreclosure system. The foreclosure rate for judicial states decreased slightly to 6.6 percent and the foreclosure rate for non-judicial states showed a steeper drop to 2.4 percent. The difference in the foreclosure rates of the two regimes is at its widest since we started tracking this metric in 2006."

I'll have more (and graphs) later after the conference call this morning.

Weekly Initial Unemployment Claims increased sharply to 439,000

by Calculated Risk on 11/15/2012 08:30:00 AM

The DOL reports:

In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000. The 4-week moving average was 383,750, an increase of 11,750 from the previous week's revised average of 372,000.The previous week was revised up from 355,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,750.

This sharp increase is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were higher than the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year ...

Zillow: 1.3 million fewer U.S. homeowners were in negative equity in Q3

by Calculated Risk on 11/15/2012 12:01:00 AM

From Zillow: Negative Equity Recedes in Third Quarter; Fewer than 30% of Homeowners with Mortgages Now Underwater

Negative equity fell in the third quarter, with 28.2 percent of all homeowners with mortgages underwater, down from 30.9 percent in the second quarter, according to the third quarter Zillow® Negative Equity Report. ...According to Zillow, 1.7 homeowners have moved out of negative equity over the least two quarters.

Slightly more than 14 million U.S. homeowners with a mortgage were in negative equity, or underwater, in the quarter, owing more on their mortgages than their homes are worth. That was down from 15.3 million in the second quarter.

Much of the decline in negative equity can be attributed to U.S. home values rising 1.3 percent in the third quarter compared to the second quarter ...

“The fall in negative equity rates means homeowners have additional options for refinancing or selling their homes,” said Zillow Chief Economist Dr. Stan Humphries. “But while we’re moving in the right direction, a substantial number of homes are still locked up in negative equity, unable to enter the existing re-sale market despite the desires of their owner. The housing market has found real momentum of its own, but is not immune from shocks to the broader economy. If negotiations centered on resolving the fiscal cliff don’t inspire confidence in investors and consumers alike, recent home value gains – and, as a result, falling negative equity rates – could stall.”

Click on graph for larger image.

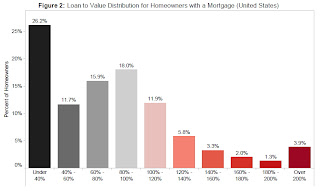

Click on graph for larger image.Zillow provided this chart of Zillow's estimate of the Loan-to-Value (LTV) for homeowners with a mortgage.

The homeowners with a little negative equity are probably at low risk of foreclosure, but at the far right - like the 3.9% who owe more than double what their homes are worth - are clearly at risk.

Here is an interactive map of Zillow's negative equity data.

Wednesday, November 14, 2012

Thursday: Unemployment Claims, CPI, MBA Mortgage Delinquency Survey, Bernanke and much more

by Calculated Risk on 11/14/2012 08:01:00 PM

November 15th is Doris "Tanta" Dungey's birthday. Happy Birthday T!

For new readers, Tanta was my co-blogger back in 2007 and 2008. She was a brilliant, writer - very funny - and a mortgage expert. Sadly, she passed away in 2008, and I like to celebrate her life on her birthday.

I strongly recommend Tanta's "The Compleat UberNerd" posts for an understanding of the mortgage industry. And here are many of her other posts.

On her passing, from the NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47, from the WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis, from me: Sad News: Tanta Passes Away

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 376 thousand from 355 thousand. Note: Claims are expected to increase following Hurricane Sandy.

• Also at 8:30 AM, the Consumer Price Index for October will be released. The consensus is for CPI to increase 0.1% in October and for core CPI to increase 0.2%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of minus 5, up from minus 6.2 in October (below zero is contraction). I'm expecting a decline due to Hurricane Sandy.

• At 10:00 AM, MBA's 3rd Quarter 2012 National Delinquency Survey. As usual, I will be on the conference call and take notes.

• Also at 10:00 AM, the Philly Fed Survey for November. The consensus is for a reading of minus 4.5, down from 5.7 last month (above zero indicates expansion).

• At 1:20 PM, Fed Chairman Ben Bernanke will speak, Housing and Mortgage Markets, At the HOPE Global Financial Dignity Summit, Atlanta, Georgia.

WSJ: FHA Close to Exhausting Reserves

by Calculated Risk on 11/14/2012 04:07:00 PM

As we discussed last week, the FHA Fiscal Year 2012 Actuarial Review is due this week. Nick Timiraos at the WSJ has a preview: Housing Agency Close to Exhausting Reserves

The Federal Housing Administration is expected to report later this week that it could exhaust its reserves because of rising mortgage delinquencies ... That could result in the agency needing to draw on taxpayer funding for the first time in its 78-year history.As Timiraos notes, the FHA's market share was small during the peak of the bubble (luckily) and most of the really horrible loans were made by Wall Street related mortgage lenders. However, Timiraos doesn't mention that many of the loans that the FHA insured at the peak were so-called Downpayment Assistance Programs (DAPs). These DAPs circumvented the FHA down payment requirements by having the seller funnel the "down payment" to the buyer through a "charity" (for a small fee of course). The FHA attempted to stop this practice - the IRS called it a "scam" - but thanks to Congress, the DAPs led to billions of losses for the FHA.

... The New Deal-era agency, which doesn't actually make loans but instead insures lenders against losses, has played a critical role stabilizing the housing market by backing mortgages of borrowers who make down payments of as little as 3.5%—loans that most private lenders won't originate without a government guarantee. ... Overall, the FHA insured nearly 739,000 loans that were 90 days or more past due or in foreclosure at the end of September, an increase of more than 100,000 loans from one year ago. That represents around 9.6% of its $1.08 trillion in mortgages guarantees.

The FHA's annual audit estimates how much money the agency would need to pay off all claims on projected losses, against how much it has in reserves. Last year, that buffer stood at $1.2 billion ...

The decision over whether the FHA will need money from Treasury won't be made until next February, when the White House typically releases its annual budget. Because the FHA has what is known as "permanent and indefinite" budget authority, it wouldn't need to ask Congress for funds; it would automatically receive money from the U.S. Treasury.

Most of the agency's losses now stem from loans made as the housing bust deepened. Around 25% of mortgages guaranteed in 2007 and 2008 are seriously delinquent, compared with around 5% of those insured in 2010.

Of course, as Timiraos mentioned, the FHA also saw a sharp increase in demand in the 2007 through 2009 period as private lenders disappeared and Fannie and Freddie tightened standards - and those loans have performed poorly. Now the bill is coming due ...