by Calculated Risk on 11/21/2012 07:01:00 AM

Wednesday, November 21, 2012

MBA: Purchase Mortgage Applications increase, Refinance Applications decrease

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.54 percent from 3.52 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years, however the purchase index has increased 7 of the last 9 weeks and is now near the high for the year - but this index still isn't showing an increase like other housing reports.

Zillow: House Prices increased 4.7% Year-over-year in October

by Calculated Risk on 11/21/2012 12:22:00 AM

From Zillow: October Marks 12th Consecutive Month of National Home Value Increases

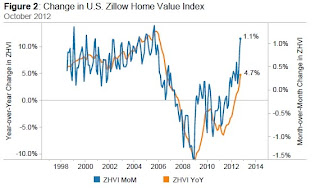

Zillow’s October Real Estate Market Reports, released today, show that national home values rose 1.1% from September to October to $155,400. This is the largest monthly increase since August 2005 when home values rose 1.2% month-over-month. October 2012 marks the 12th consecutive month of home value appreciation, further evidence of a durable housing market recovery. On a year-over-year basis, home values were up by 4.7% in October 2012 – a rate of annual appreciation we haven’t seen since September of 2006 ...

In October, 276 (75%) of the 366 markets showed monthly home value appreciation, and 228 (62%) of the 366 markets saw annual home value appreciation. Among the top 30 metros, 29 experienced monthly home value appreciation and 26 saw annual increases.

Click on graph for larger image.

Click on graph for larger image. The graph from Zillow shows both the year-over-year and month-over-month change for the Zillow HPI.

This is a very strong month-over-month increase, and the largest year-over-year increase since 2006.

Tuesday, November 20, 2012

Wednesday: Unemployment claims, Consumer sentiment

by Calculated Risk on 11/20/2012 09:04:00 PM

There is an EU summit meeting on Thursday, so there might be some news over the holiday.

From Reuters: Euro zone mulls Greek debt buy-back up to 40 billion euros

Euro zone finance ministers are considering allowing Athens to buy back up to 40 billion euros of its own bonds at a discount as one of a number of measures to cut Greek debt to 120 percent of GDP within the next eight years.Wednesday:

...

Under a proposal discussed by ministers, Greece would offer private-sector bondholders around 30 cents for every euro of Greek debt they hold ... The ministers, who failed to reach agreement last week, have also discussed granting Greece a 10-year moratorium on paying interest on about 130 billion euros of loans from the euro zone's emergency fund ...There is also the possibility of reducing the interest rate on loans made by euro zone countries directly to Greece in 2010, from 1.5 percent to just 0.25 percent ...

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 415 thousand from 439 thousand. Note: Claims increased sharply last week due to Hurricane Sandy.

• At 9:00 AM, The Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for November. The consensus is for a decline to 51.0 in November, from 51.5 in October.

• At 9:55 AM, the finale Reuters/University of Michigan's Consumer sentiment index for November will be released). The consensus is for a decline to 84.0 from the preliminary reading of 84.9. Goldman Sachs is forecasting a decline in confidence to 81.0, and Merrill Lynch is forecasting a decline to 83.

• At 10:00 AM, the Conference Board Leading Indicators for October. The consensus is for a 0.2% decrease in this index.

• During the day: The AIA's Architecture Billings Index for October will be released (a leading indicator for commercial real estate).

Earlier on Housing Starts:

• Housing Starts increased to 894 thousand SAAR in October

• Starts and Completions: Multi-family and Single Family

• Quarterly Housing Starts by Intent compared to New Home Sales

• All Housing Investment and Construction Graphs

WaPo: Price-to-rent ratio for Certain Cities

by Calculated Risk on 11/20/2012 05:46:00 PM

Neil Irwin at the WaPo looks at the price-to-rent ratio for several cities using Case-Shiller prices and Owner's equivalent rent (OER) from the BLS. This is the same approach I use with the national data very month.

From Neil Irwin at the WaPo: Why Atlanta, New York, and Chicago are poised to drive a housing recovery

A good way to look at which housing markets are potentially overvalued and which are undervalued—and where the market seems to be begging for new home construction and where there is still a surplus of unneeded houses—is to look at the relationship between rents and home prices. Over long periods of time, the price to rent a given house should rise at about the same rate as the price to buy one.Irwin only looked at Case-Shiller cities with monthly OER data. However the BLS has semi-annual OER data for several more Case-Shiller cities.

But over shorter periods of time, the two can diverge. And when they do, it is usually a sign that something curious is up in that market. For example, from 2000 to 2005, prices in the Miami metro area rose by 136 percentage points more than did rents, a sure sign that it was one of the nation’s most bubbly housing markets.

...

The best news out of this analysis, though, may be this: Most of the largest U.S. cities have housing markets that have been in pretty good balance over the last year, with prices rising at about the same rate as rents. That’s true of the Washington metro area ( where prices are up 4.3 percent, rents up 2.4 percent), and also of San Francisco, Los Angeles, Boston, Dallas, Seattle, and Cleveland.

And that may be the best sign for the housing market of all. After all these years of bubbles and busts, ups and downs, there finally is a measure of stability.

Click on graph for larger image.

Click on graph for larger image.This graph shows the price-to-rent ratio of Case-Shiller and OER for Denver, Portland and San Diego (cities Irwin didn't include).

The BLS only provides first and second half OER data for these cities, so I averaged six months of the Case-Shiller indexes to calculate the price-to-rent ratio. I set the ratio to 1.0 for the period 1997 through 2000.

It appears San Diego is back to normal, and prices in Denver and Portland might be a little high by this measure.

Quarterly Housing Starts by Intent compared to New Home Sales

by Calculated Risk on 11/20/2012 02:58:00 PM

In addition to housing starts for October, the Census Bureau released Housing Starts by Intent for Q3. Note: Most text is a repeat from last quarter with updated graphs.

First, we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 104,000 single family starts, built for sale, in Q3 2012, and that was above the 96,000 new homes sold for the same quarter, so inventory increased a little (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 33% compared to Q3 2011. This is still very low, and only back to 2008 levels.

Owner built starts were unchanged from Q3 2011. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly and is up about 33% year-over-year.

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are starting a few more homes than they are selling, and the inventory of under construction and completed new home sales increased slightly to 122,000 in Q3 (this is still near record lows).

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.

Bernanke: "The Economic Recovery and Economic Policy"

by Calculated Risk on 11/20/2012 12:15:00 PM

From Fed Chairman Ben Bernanke: The Economic Recovery and Economic Policy. A few excerpts:

A third headwind to the recovery--and one that may intensify in force in coming quarters--is U.S. fiscal policy. Although fiscal policy at the federal level was quite expansionary during the recession and early in the recovery, as the recovery proceeded, the support provided for the economy by federal fiscal actions was increasingly offset by the adverse effects of tight budget conditions for state and local governments. In response to a large and sustained decline in their tax revenues, state and local governments have cut about 600,000 jobs on net since the third quarter of 2008 while reducing real expenditures for infrastructure projects by 20 percent.Bernanke is mostly repeating what he has said before: address the budget deficit, but not too quickly: "the federal budget is on an unsustainable path" and "avoid unnecessarily adding to the headwinds that are already holding back the economic recovery". Hopefully policymakers will resolve the "fiscal slope" and not play politics again with the debt ceiling.

More recently, the situation has to some extent reversed: The drag on economic growth from state and local fiscal policy has diminished as revenues have improved, easing the pressures for further spending cuts or tax increases. In contrast, the phasing-out of earlier stimulus programs and policy actions to reduce the federal budget deficit have led federal fiscal policy to begin restraining GDP growth. Indeed, under almost any plausible scenario, next year the drag from federal fiscal policy on GDP growth will outweigh the positive effects on growth from fiscal expansion at the state and local level. However, the overall effect of federal fiscal policy on the economy, both in the near term and in the longer run, remains quite uncertain and depends on how policymakers meet two daunting fiscal challenges--one by the start of the new year and the other no later than the spring.

What are these looming challenges? First, the Congress and the Administration will need to protect the economy from the full brunt of the severe fiscal tightening at the beginning of next year that is built into current law--the so-called fiscal cliff. ...

As fiscal policymakers face these critical decisions, they should keep two objectives in mind. First, as I think is widely appreciated by now, the federal budget is on an unsustainable path. The budget deficit, which peaked at about 10 percent of GDP in 2009 and now stands at about 7 percent of GDP, is expected to narrow further in the coming years as the economy continues to recover. ...

Even as fiscal policymakers address the urgent issue of longer-run fiscal sustainability, they should not ignore a second key objective: to avoid unnecessarily adding to the headwinds that are already holding back the economic recovery. Fortunately, the two objectives are fully compatible and mutually reinforcing. Preventing a sudden and severe contraction in fiscal policy early next year will support the transition of the economy back to full employment; a stronger economy will in turn reduce the deficit and contribute to achieving long-term fiscal sustainability. At the same time, a credible plan to put the federal budget on a path that will be sustainable in the long run could help keep longer-term interest rates low and boost household and business confidence, thereby supporting economic growth today.

State Unemployment Rates decreased in 37 States in October

by Calculated Risk on 11/20/2012 11:05:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in October. Thirty-seven states and the District of Columbia recorded unemployment rate decreases, seven states posted rate increases, and six states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 11.5 percent in October. Rhode Island and California posted the next highest rates, 10.4 and 10.1 percent, respectively. North Dakota again registered the lowest jobless rate, 3.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Ohio have seen the most improvement - New Jersey, Connecticut and New York are the laggards.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. In early 2010, 18 states and D.C. had double digit unemployment rates.

I expect the unemployment rate in California to fall below 10% very soon, although New Jersey might hit double digits because of Hurricane Sandy.

Earlier on Housing Starts:

• Housing Starts increased to 894 thousand SAAR in October

• Starts and Completions: Multi-family and Single Family

• All Housing Investment and Construction Graphs

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 11/20/2012 09:56:00 AM

Ten months of the way through 2012, single family starts are on pace for about 530 thousand this year, and total starts are on pace for about 770 thousand. That is an increase of over 20% from 2011.

The following table shows annual starts (total and single family) since 2005 and an estimate for 2012.

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 20121 | 770.0 | 26% | 530.0 | 23% |

| 12012 estimated | ||||

And the growth in housing starts should continue over the next few years. Even with the significant increase this year, starts in 2012 will still be the 4th lowest year since the Census Bureau started tracking starts in 1959 (the three lowest years were 2009 through 2011).

My estimate is the US will probably add around 12 million households this decade, and if there was no excess supply, total housing starts would be 1.2 million per year, plus demolitions, plus 2nd home purchases. So housing starts could come close to doubling the 2012 level over the next several years - and that is one of the key reasons I think the US economy will continue to grow.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year, but still well below the 1997 through 2007 level of multi-family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Starts are moving up, but the increase in completions has just started. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Housing Starts increased to 894 thousand SAAR in October

by Calculated Risk on 11/20/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 894,000. This is 3.6 percent above the revised September estimate of 863,000 and is 41.9 percent above the October 2011 rate of 630,000.

Single-family housing starts in October were at a rate of 594,000; this is 0.2 percent below the revised September figure of 595,000. The October rate for units in buildings with five units or more was 285,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 866,000. This is 2.7 percent below the revised September rate of 890,000, but is 29.8 percent above the October 2011 estimate of 667,000.

Single-family authorizations in October were at a rate of 562,000; this is 2.2 percent above the revised September figure of 550,000. Authorizations of units in buildings with five units or more were at a rate of 280,000 in October.

Click on graph for larger image.

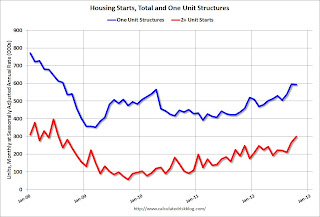

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Total housing starts were at 894 thousand (SAAR) in October, up 3.6% from the revised September rate of 863 thousand (SAAR). Note that September was revised down from 872 thousand.

Single-family starts decreased slightly to 594 thousand in October.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up about 87% from the bottom start rate, and single family starts are up about 70% from the low.

This was above expectations of 840 thousand starts in October. This was mostly because of the volatile multi-family sector that increased sharply in October. However single family starts have increased recently too. Right now starts are on pace to be up about 25% from 2011. I'll have more soon ...

Monday, November 19, 2012

Tuesday: Housing Starts, Bernanke on Economy and Policy

by Calculated Risk on 11/19/2012 09:06:00 PM

Tuesday:

• At 8:30 AM, the Census Bureau will release Housing Starts for October. The consensus is for total housing starts to decline to 840,000 (SAAR) in October, down from 872,000 in September. Goldman Sachs is forecasting a decline in starts to 840,000, and Merrill Lynch is forecasting 815,000.

• At 10:00 AM, the BLS will release the Regional and State Employment and Unemployment report for October 2012.

• At 12:15 PM, Fed Chairman Ben Bernanke will speak at the Economic Club of New York, New York, New York, The Economic Recovery and Economic Policy. Bernanke will most likely avoid specific policies, but urge policymakers to put the budget on a "sustainable long-run path" and "to avoid unnecessarily impeding the current economic recovery".

Both quotes are from a speech Bernanke gave in June when he also said: "Fortunately, avoiding the fiscal cliff and achieving long-term fiscal sustainability are fully compatible and mutually reinforcing objectives. Preventing a sudden and severe contraction in fiscal policy will support the transition back to full employment, which should aid long-term fiscal sustainability. At the same time, a credible fiscal plan to put the federal budget on a longer-run sustainable path could help keep longer-term interest rates low and improve household and business confidence, thereby supporting improved economic performance today."

Earlier on Existing Home Sales:

• Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

• Existing Home Sales: A Solid Report

• Existing Home Sales: The Increase in Conventional Sales

• Existing Home Sales graphs

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Existing Home Sales: The Increase in Conventional Sales

by Calculated Risk on 11/19/2012 06:40:00 PM

Earlier I pointed out that one the keys for housing to return to "normal" are more conventional sales and fewer distressed sales. Not all areas report the percentage of distressed sales, and the NAR uses an unscientific survey to estimate distressed sales.

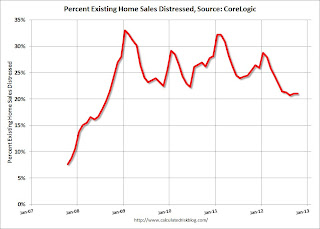

CoreLogic estimates the percent of distressed sales each month, and they were kind enough to send me their series. The first graph below shows CoreLogic's estimate of the distressed share starting in October 2007.

Click on graph for larger image.

Click on graph for larger image.

Note that the percent distressed increases every winter. This is because distressed sales happen all year, and conventional sales follow the normal seasonal pattern of stronger in the spring and summer, and weaker in the winter.

This is why the Case-Shiller seasonal adjustment increased in recent years.

Also note that the percent of distressed sales over the last 5 months is at the lowest level since mid-2008, but still very high.

The second graph shows the NAR existing home series using the CoreLogic share of distressed sales.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.

Using this method (NAR estimate for sales, CoreLogic estimate of share), conventional sales are now back up to around 3.8 million SAAR. The NAR reported total sales were up 10.9% year-over-year in October, but using this method, conventional sales were up almost 18% year-over-year.

Earlier:

• Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

• Existing Home Sales: A Solid Report

• Existing Home Sales graphs

Early: Housing Forecasts for 2013

by Calculated Risk on 11/19/2012 04:49:00 PM

Towards the end of each year I start to collect some housing forecasts for the following year. Here was a summary of forecasts for 2012. Right now it looks like new home sales will be around 365 thousand this year, and total starts around 750 thousand or so.

From Hui Shan, Sven Jari Stehn, Jan Hatzius at Goldman Sachs:

We project housing starts to continue to rise, reaching an annual rate of 1.0 million by the end of 2013 and 1.5 million by the end of 2016.Fannie Mae Chief Economist Doug Duncan is forecasting an 18.4% increase in housing starts in 2013 to 888 thousand, and single family starts increasing to 611 thousand.

Duncan projects new single family home sales to increase to 433 thousand from around 368 thousand this year. Duncan projects existing home sales will increase slightly to 4.76 million next year.

I'll be adding more forecasts, but I think we will see another solid percentage increase for housing starts and new home sales next year.

Existing Home Sales: A Solid Report

by Calculated Risk on 11/19/2012 12:35:00 PM

First, this report is a reminder that we have to be careful with the NAR data. The NAR revised down inventory for September from 2.32 million to 2.17 million (a downward revision of 6.5%). And the months-of-supply for September was revised down to 5.6 months from 5.9 months. These are very large revisions.

The percent distressed share (foreclosures and short sales) is also questionable. The NAR reported:

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 24 percent of October sales (12 percent were foreclosures and 12 percent were short sales), unchanged from September; they were 28 percent in October 2011.However this percentage is from an unscientific survey of Realtors, and other data suggests a larger decline in the share of distressed sales.

Oh well, I wish we had better data for the existing home market.

However, overall, this was a solid report. Based on historical turnover rates, I think "normal" sales would be in the 4.5 to 5.0 million range. So, existing home sales at 4.79 million are in the normal range.

Of course a "normal" market would have very few distressed sales, so there is still a long ways to go, but the market is headed in the right direction. The key to returning to "normal" are more conventional sales and fewer distressed sales. Not all areas report the percentage of distressed sales - that is why the NAR uses an unscientific survey - but the areas that do have shown a sharp decline in distressed sales, and a sharp increase in conventional sales.

Of course what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

The NAR reported inventory decreased to 2.14 million units in October, down from 2.17 million in September. This is down 21.9% from October 2011, and down 25% from the inventory level in October 2005 (mid-2005 was when inventory started increasing sharply). This is the lowest level for the month of October since 2001.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Click on graph for larger image.

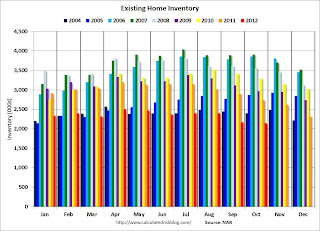

Click on graph for larger image.This graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red for 2012) inventory is at the lowest level for the month of October since 2001, and inventory is below the level in October 2005 (not counting contingent sales). Earlier this year I argued months-of-supply would be below 6 towards the end of the year, and months-of-supply fell to 5.4 months in October (a normal range).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in October (red column) are sharply above last year (there were 2 more selling days this year in October). Sales are well below the bubble years of 2005 and 2006.

Sales NSA in October (red column) are sharply above last year (there were 2 more selling days this year in October). Sales are well below the bubble years of 2005 and 2006.Earlier:

• Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

• Existing Home Sales graphs

NAHB Builder Confidence increases in November, Highest since May 2006

by Calculated Risk on 11/19/2012 11:12:00 AM

I'll have some more comments on the Existing Home Sales report later this morning, but this is important too ...

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 5 points in November to 46. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Five Points in November

Builder confidence in the market for newly built, single-family homes posted a solid, five-point gain to 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for November, released today. This marks the seventh consecutive monthly gain in the confidence gauge and brings it to its highest point since May of 2006.

“While our confidence gauge has yet to breach the 50 mark -- at which point an equal number of builders view sales conditions as good versus poor -- we have certainly made substantial progress since this time last year, when the HMI stood at 19,” observed NAHB Chief Economist David Crowe. “At this point, difficult appraisals and tight lending conditions for builders and buyers remain limiting factors for the burgeoning housing recovery, along with shortages of buildable lots that have begun popping up in certain markets.”

...

Two out of three of the HMI’s component indexes registered gains in November. The component gauging current sales conditions posted the biggest increase, with an eight-point gain to 49 – its highest mark in more than six years. Meanwhile, the component measuring sales expectations for the next six months held above 50 for a third consecutive month with a two-point gain to 53, and the component measuring traffic of prospective buyers held unchanged at 35 following a five-point gain in the previous month.

All four regions of the country posted gains in their HMI three-month moving averages as of November. The South posted a four-point gain to 43, while the Midwest and West each posted three-point gains, to 45 and 47, respectively, and the Northeast posted a two-point gain to 31. (Note, the HMI survey was conducted in the two weeks immediately following Hurricane Sandy and therefore does reflect builder sentiment during that period.)

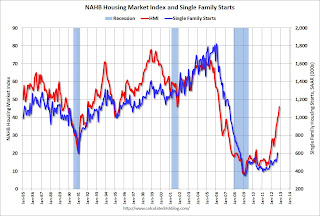

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October housing starts will be released tomorrow). This was above the consensus estimate of a reading of 41.

Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

by Calculated Risk on 11/19/2012 10:00:00 AM

The NAR reports: Existing-Home Sales Rise in October with Ongoing Price and Equity Gains

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 2.1 percent to a seasonally adjusted annual rate of 4.79 million in October from a downwardly revised 4.69 million in September, and are 10.9 percent above the 4.32 million-unit level in October 2011.

...

Total housing inventory at the end of October fell 1.4 percent to 2.14 million existing homes available for sale, which represents a 5.4-month supply at the current sales pace, down from 5.6 months in September, and is the lowest housing supply since February of 2006 when it was 5.2 months. Listed inventory is 21.9 percent below a year ago when there was a 7.6-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2012 (4.79 million SAAR) were 2.1% higher than last month, and were 10.9% above the October 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 2.14 million in October down from 2.17 million in September. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.

According to the NAR, inventory declined to 2.14 million in October down from 2.17 million in September. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.Months of supply declined to 5.4 months in October.

This was slightly above expectations of sales of 4.74 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

LA Times: "Most aid from mortgage settlement in California going to short sales"

by Calculated Risk on 11/19/2012 08:41:00 AM

Update: Here is the national report: Continued Progress: A Report from the National Mortgage Settlement

From Alejandro Lazo and Scott Reckard at the LA Times: Most aid from mortgage settlement in [California] going to short sales

Short sales, which allow underwater borrowers to sell their homes for less than they owe, have become the dominant type of relief offered in California by the big banks, according to a report on the settlement expected to be made public Monday.Short sales were becoming more frequent prior to the mortgage settlement, but this is probably why short sales now out number foreclosures in many areas.

Under the settlement, banks were required to give homeowners aid in the form of principal reduction, short sales and other modifications. Banks get credit for both principal reductions and short sales under the agreement, but must give 60% of the relief nationally through principal reduction to families who keep their homes. ...

Through Sept. 30, the three banks had provided $8.4 billion, according to data from [UC Irvine law professor Katherine Porter's] office, putting them well on track to fulfill their obligations. About 68% of that money went toward providing short sales for homeowners. Principal reductions on first and second mortgages made up the rest of the California aid.

Sunday, November 18, 2012

Monday: Existing Home Sales, Homebuilder Confidence

by Calculated Risk on 11/18/2012 09:00:00 PM

First on the recession in the Euro Zone from Jim Hamilton: Europe in recession

The Business Cycle Dating Committee of the Centre for Economic Policy Research (the European counterpart of the U.S. NBER) last week issued a declaration that Europe entered a new recession a year ago, dating the business cycle peak at 2011:Q3.This was pretty obvious a year ago.

Monday:

• At 10:00 AM ET, Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 4.74 million on seasonally adjusted annual rate (SAAR) basis. Sales in September 2012 were 4.75 million SAAR. Economist Tom Lawler estimates the NAR will report sales at 4.84 million SAAR. Goldman Sachs is forecasting a decline in sales to 4.67 million, and Merrill Lynch is forecasting 4.60 million.

• Also at 10:00 AM, the NAHB will release their November homebuilder survey. The consensus is for a reading of 41, unchanged from October. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

The Asian markets are green tonight, with the Nikkei up 1.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 6 and DOW futures are up 46.

Oil prices are up slightly with WTI futures at $87.48 per barrel and Brent at $109.46 per barrel. Gasoline prices are still falling a little.

Weekend:

• Summary for Week Ending Nov 16th

• Schedule for Week of Nov 18th

And on mortgage delinquencies:

• Press Release: Q3 National Delinquency Survey

• Q3 MBA National Delinquency Survey Graph and Comments

• Mortgage Delinquencies by Loan Type in Q3

• Serious Mortgage Delinquencies and In-Foreclosure by State

• Percent of Mortgage Seriously Delinquent over time, Selected States

Two more questions this week for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Table of Short Sales and Foreclosures for Selected Cities in October

by Calculated Risk on 11/18/2012 05:26:00 PM

Economist Tom Lawler sent me the table below of short sales and foreclosures for a few selected cities in October. Keep this table in mind when the NAR releases existing home sales tomorrow.

The NAR headline number will probably be close to the 4.75 million SAAR in September, but there are other signs of significant change in the housing market. First, inventory has declined sharply, and there is very little inventory in many areas. Second, it appears that the share of conventional sales in certain markets has increased significantly (these are normal sales - not foreclosures or short sales). Both the decline in inventory, and the increase in conventional sales, are signs of moving towards a more normal housing market.

Look at the right two columns in the table below (Total "Distressed" Share for Oct 2012 compared to Oct 2011). In every area that reports distressed sales, the share of distressed sales is down year-over-year - and down significantly in most areas. The NAR will release some distressed sales measurements tomorrow from an unscientific survey of Realtors - and I have little confidence in the survey results - but these local reports suggest distressed sales have fallen sharply in many areas.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for Oct 2012 to Oct 2011. Foreclosure sales have declined in all these areas, and some of the declines have been stunning (the Nevada sales were impacted by a new foreclosure law).

Also there has been a shift from foreclosures to short sales. In most areas, short sales now far out number foreclosures, although Minneapolis is an exception with more foreclosures than short sales.

Imagine that the number of total sales doesn't change over the next year - some people would argue that is "bad" news and the housing market isn't recovering. But also imagine that the share of distressed sales declines 25%, and conventional sales increase to make up the difference. That would be a positive sign! As I noted a week ago, conventional sales in Sacramento were up 55% year-over-year in October (there were 2 more selling days in Oct 2012, but that is still a stunning increase). Too bad we don't have better national numbers on the share of distressed / conventional sales, but this table suggests some improvement.

Table from Tom Lawler:

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Oct | 11-Oct | 12-Oct | 11-Oct | 12-Oct | 11-Oct | |

| Las Vegas | 44.7% | 25.4% | 11.6% | 48.1% | 56.3% | 73.5% |

| Reno | 40.0% | 32.0% | 12.0% | 38.0% | 52.0% | 70.0% |

| Phoenix | 26.2% | 29.2% | 12.9% | 35.6% | 39.1% | 64.8% |

| Sacramento | 35.7% | 26.8% | 12.0% | 37.3% | 47.7% | 64.1% |

| Minneapolis | 10.5% | 12.6% | 25.1% | 33.6% | 35.6% | 46.2% |

| Mid-Atlantic (MRIS) | 11.7% | 15.2% | 9.1% | 16.0% | 20.7% | 31.2% |

| California (DQ)* | 26.0% | 24.9% | 17.4% | 34.0% | 43.4% | 58.9% |

| Lee County, FL*** | 20.4% | 19.8% | 16.4% | 33.7% | 36.8% | 53.5% |

| Hampton Roads VA | 28.3% | 33.2% | ||||

| Northeast Florida | 44.7% | 48.4% | ||||

| Chicago | 42.5% | 43.6% | ||||

| Charlotte | 13.2% | 17.4% | ||||

| Spokane WA | 8.4% | 20.4% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Birmingham AL | 30.8% | 35.5% | ||||

| Metro Detroit | 32.5% | 38.3% | ||||

| *share of existing home sales, based on property records | ||||||

| *** SF only | ||||||

Percent of Mortgage Seriously Delinquent over time, Selected States

by Calculated Risk on 11/18/2012 01:32:00 PM

A key question is: What has happened to the mortgage delinquency rate over time by state?

For the graph below I plotted the serious delinquency rate for several states over time (states selected by serious delinquency rate in Q1 2010 - at the national peak). Although the national delinquency rate has been steadily declining, the state level data shows different patterns. There has been dramatic improvement in some non-judicial states, like Arizona and California - and some judicial foreclosure states are still seeing the seriously delinquent rate increase, like New Jersey and New York.

Previous posts on Q3 delinquencies:

• Press Release: Q3 National Delinquency Survey

• Q3 MBA National Delinquency Survey Graph and Comments

• Mortgage Delinquencies by Loan Type in Q3

• Serious Mortgage Delinquencies and In-Foreclosure by State

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

I picked the states with the highest serious delinquency rate in Q1 2010 (Serious delinquencies peaked nationally in Q1 2010).

The red column for each state is the Q1 2010 data.

The light blue column was for Q2 2007. This was just as the serious delinquency rate started to increase nationally. Even then, the serious delinquency rate was elevated in some states like Michigan, Ohio and Indiana.

The states that have seen the most improvement - Arizona, California, Michigan, Nevada - are all non-judicial states. Florida is a judicial state that has seen some decline in the seriously delinquent rate. However the serious delinquency rate in New Jersey and New York has increased since Q1 2010.

The national data is useful, but with the different foreclosure processes, we also need to look at state and local data. Some states will be back to a "normal" delinquency rate soon - other states will take years.

Serious Mortgage Delinquencies and In-Foreclosure by State

by Calculated Risk on 11/18/2012 10:15:00 AM

Last week the MBA released the results of their Q3 National Delinquency Survey. One of the key points was the difference in the number of mortgages in the foreclosure process between judicial and non-judicial foreclosure states.

The first graph below (repeat) is from the MBA and shows the percent of loans in the foreclosure process by state.

The second graph shows all stages of delinquency (and in-foreclosure) by states, sorted by the percent seriously delinquent (90+ days plus in-foreclosure).

Previous posts on Q3 delinquencies:

• Q3 MBA National Delinquency Survey Graph and Comments

• Mortgage Delinquencies by Loan Type in Q3

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (13.04% in foreclosure down from 13.70% in Q2), New Jersey (8.87% up from 7.65%), Illinois (6.83% down from 7.11%), New York (6.46% down from 6.47%) and Nevada (the only non-judicial state in the top 13 at 5.93% down from 6.09%).

California (2.63% down from 3.07%) and Arizona (2.51% down from 3.24%) are now well below the national average.

The second graph includes all delinquent loans (sorted by percent seriously delinquent).

The second graph includes all delinquent loans (sorted by percent seriously delinquent).

Florida and New Jersey have the highest percentage of serious delinquent loans, followed by Nevada, Illinois, New York, Maine and Maryland. Nevada still leads with the highest percent of loans 90+ days delinquent.

Previous high delinquency states like California and Arizona are now well down the list.