by Calculated Risk on 11/25/2012 08:59:00 PM

Sunday, November 25, 2012

Sunday Night Futures

Monday economic releases:

• At 8:30 AM ET, the Chicago Fed will release their National Activity Index for October. This is a composite index of other data.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for November will be released. The consensus is for 4.7 for the general business activity index, up from 1.8 in October.

• Expected: LPS "First Look" Mortgage Delinquency Survey for October.

• Also on Monday, Euro zone finance ministers will discuss the funding situation for Greece.

The Asian markets are mostly green tonight, with the Nikkei up 0.8%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 6 and DOW futures are down 56.

Oil prices are down with WTI futures at $87.95 per barrel and Brent at $111.23 per barrel.

Here is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices. Notes: Add a California city to the graph - like Los Angeles or San Francisco - and you will see the recent sharp increase and decrease due to refinery problems. If you add New York, it will show the recent spike (much smaller than in California).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Weekend:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Four more questions this week for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Greece Update: Eurozone finance ministers meet Monday

by Calculated Risk on 11/25/2012 01:08:00 PM

The eurozone finance ministers are meeting on Monday, and trying to reach an agreement to disburse more funds to Greece.

From the Financial Times: Greece upbeat about signing debt deal

Eurozone finance ministers will make another attempt on Monday ... to settle differences over debt relief measures for Athens and give a green light to disburse up to €44bn of aid.And from Bloomberg: Euro Ministers Take Third Swing at Clearing Greek Payment

The stumbling blocks to a deal, in addition to Berlin’s reluctance to accept drastic interest rate cuts, include opposition by some eurozone members to returning profits from the European Central Bank’s purchases of Greek bonds, and a gloomy assessment of Greece’s growth prospects until 2020 by the IMF.

excerpt with permission

Finance chiefs from the 17-member single currency return to Brussels tomorrow ...I expect an agreement will be reached soon that will buy more time.

Euro-area finance ministers held a conference call yesterday to prepare for the Brussels meeting. A breakthrough hinges on coming up with 10 billion euros ($13 billion) through reductions in interest rates charged by creditors and a debt buyback financed by bailout funding. The gap emerged when the finance chiefs agreed this month to give Greece two more years to meet targets.

Update: Case-Shiller House Prices will probably decline month-to-month Seasonally starting in October

by Calculated Risk on 11/25/2012 10:32:00 AM

This is just a reminder: The Not Seasonally Adjusted (NSA) monthly Case-Shiller house price indexes will show month-to-month declines soon, probably starting with the October report to be released in late December. The CoreLogic index has already started to decline on a month-to-month basis. This is not a sign of impending doom - or another collapse in house prices - it is just the normal seasonal pattern.

Even in normal times house prices tend to be stronger in the spring and early summer, than in the fall and winter. Currently there is a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have a larger negative impact on prices in the fall and winter.

In the coming months, the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. As an example, the September CoreLogic report showed a 0.3% month-to-month decline in September from August, but prices were up 5.0% year-over-year. That was the largest year-over-year increase since 2006.

I think house prices have already bottomed, and that prices will be up close to 5% year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

Note: The Case-Shiller September report will be released this coming Tuesday. For this graph, I used Zillow's forecast for September.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years. The CoreLogic index turned negative in the September report (CoreLogic is 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA will probably turn negative month-to-month in the October report (also a three month average, but not weighted).

Saturday, November 24, 2012

Jim the Realtor: Upcoming REO listings

by Calculated Risk on 11/24/2012 07:48:00 PM

I haven't checked in with Jim the Realtor in San Diego for some time. In this video below, Jim reviews a few upcoming REO listings in North County San Diego. Jim says: "there are only 16 houses owned by banks that aren't on the market" in the North County area (152 homes closed in the area last month, so the bank owned REO will not have much of an impact).

The first house is interesting. It looks like the bank will actually make money when they sell it.

The third house is good for a laugh (starts about 4:20). The bank has made some absurd repairs, like putting in a low end vanity in the master bath to replace a built-in that went all the way across the bathroom. (around 9:20 - Jim can't help but laugh).

Earlier:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Unofficial Problem Bank list unchanged at 857 Institutions

by Calculated Risk on 11/24/2012 05:27:00 PM

CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 23, 2012. (repeat from last week, table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, a very quiet week for the Unofficial Problem Bank List as it went without change. You have to go back to January 6th of this year for the last time it went a week unchanged. The list stands at 857 institutions with assets of $329.2 billion. A year ago, the list held 980 institutions with assets of $400.5 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Next week, the FDIC will likely release its actions through October 2012 and the Official Problem Bank List as of September 30, 2012. The difference between the two lists will likely drop from 187 at last issuance to the low 170s.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Schedule for Week of Nov 25th

by Calculated Risk on 11/24/2012 01:01:00 PM

Earlier:

• Summary for Week Ending Nov 23rd

Negotiations concerning the "fiscal slope" in the US will be back in the headlines this week. And, in Europe, the discussion on funding for Greece will resume on Monday.

There are two key housing reports this week: Case-Shiller house prices on Tuesday, and New Home Sales on Wednesday.

Revised Q3 GDP will be released on Thursday, and the October Personal Income and Outlays report will be released on Friday.

For manufacturing, three regional manufacturing reports will be released (Richmond, Dallas and Kansas City Fed surveys), plus the Chicago PMI will be released Friday.

The NY Fed will release their Q3 Report on Household Debt and Credit on Tuesday, and the FDIC is expected to release the Q3 Quarterly Banking Profile this week.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for November. The consensus is for 4.7 for the general business activity index, up from 1.8 in September.

Expected: LPS "First Look" Mortgage Delinquency Survey for October.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through August 2012 (the Composite 20 was started in January 2000).

The consensus is for a 2.9% year-over-year increase in the Composite 20 index (NSA) for September. The Zillow forecast is for the Composite 20 to increase 3.0% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. The consensus is for a decrease to -8 for this survey from -7 in October (below zero is contraction).

10:00 AM: FHFA House Price Index for September 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.5% increase in house prices.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for an increase to 72.8 from 72.2 last month.

3:00 PM: New York Fed to Release Q3 Report on Household Debt and Credit

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

10:00 AM ET: New Home Sales for October from the Census Bureau.

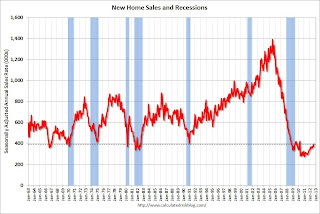

10:00 AM ET: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for a decrease in sales to 387 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 389 thousand in September.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 390 thousand from 410 thousand.

8:30 AM: Q3 GDP (second release). This is the second release from the BEA. The consensus is that real GDP increased 2.8% annualized in Q3, revised up from 2.0% in the advance release.

10:00 AM ET: Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for November. The consensus is for an a reading of -1, up from -4 in October (below zero is contraction).

8:30 AM ET: Personal Income and Outlays for October. The consensus is for a 0.3% increase in personal income in October, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for an increase to 50.3, up from 49.9 in October.

Summary for Week Ending Nov 23rd

by Calculated Risk on 11/24/2012 08:03:00 AM

Last week was a short holiday week and I hope everyone is enjoying their Thanksgiving weekend!

Overall the economic data was positive last week, especially the housing data. Housing starts were at the highest level in four years, but are still very low - and both comments are important. Housing (residential investment) is now a tail wind for the economy, and housing can increase significantly from here.

Also the existing home sales market continues to show improvement. The keys for the existing home report are inventory and the number of conventional sales. Inventory is down significantly, and conventional sales are increasing. There will be more housing data next week (New home sales and the Case-Shiller house price indexes).

Initial weekly unemployment claims were still elevated because of Hurricane Sandy, but I expect claims will decline back to the pre-storm level pretty quickly.

Early in the week I spoke with Joe Weisenthal at Business Insider, and he wrote a way too nice article: The Genius Who Invented Economics Blogging Reveals How He Got Everything Right And What's Coming Next.

As I noted, I just track economic data and make a few forecasts - and I didn't invent economic blogging (although I've been at it for eight years). Professor Krugman added a few nice comments: All Hail Calculated Risk.

Excuse my blushing - thanks to all for reading!

Here is a summary of last week in graphs:

• Housing Starts increased to 894 thousand SAAR in October

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 894 thousand (SAAR) in October, up 3.6% from the revised September rate of 863 thousand (SAAR). Note that September was revised down from 872 thousand.

Single-family starts decreased slightly to 594 thousand in October.

Total starts are up about 87% from the bottom start rate, and single family starts are up about 70% from the low.

This was above expectations of 840 thousand starts in October. This was mostly because of the volatile multi-family sector that increased sharply in October, however single family starts have increased recently too. Starts are still very low, but on pace to be up about 25% from 2011.

• Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in October 2012 (4.79 million SAAR) were 2.1% higher than last month, and were 10.9% above the October 2011 rate.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.Months of supply declined to 5.4 months in October.

This was slightly above expectations of sales of 4.74 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• Weekly Initial Unemployment Claims decline to 410,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 396,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

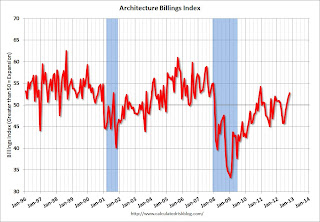

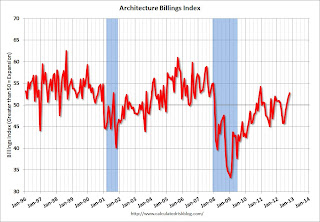

• AIA: Architecture Billings Index increases in October, Highest in Two Years

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment next year (it will be some time before investment in offices and malls increases significantly).

• Final November Consumer Sentiment at 82.7

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.This was below the consensus forecast of 84.0. Overall, consumer sentiment has been improving; the recent decline in sentiment might be related to the stock market decline (the consumer sentiment index is impacted by employment, gasoline prices, the stock market and more).

Friday, November 23, 2012

Las Vegas: Visitor Traffic on pace for Record High, Convention Attendance Lags

by Calculated Risk on 11/23/2012 08:34:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered and here is an update.

Through September visitor traffic is running just ahead of the 2007 pace (the previous peak) and it is possible Las Vegas will see 40 million visitors this year. However convention attendance is barely ahead of last year, and about 20% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale). 2012 is estimated based on traffic through September.

The gamblers are back, but not the conventions ...

ATA Trucking Index declines sharply in October, Impacted by Hurricane Sandy

by Calculated Risk on 11/23/2012 04:09:00 PM

This is a minor indicator that I follow. Clearly truck tonnage was impacted by Hurricane Sandy in October, and we will probably see a bounce back in November and December.

From ATA: ATA Truck Tonnage Index Fell 3.8% in October

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 3.8% in October after falling 0.4% in September. (The 0.4% decrease in September was revised from a 0.1% gain ATA reported on October 23, 2012.) October’s drop was the third consecutive totaling 4.7%. As a result, the SA index equaled 113.7 (2000=100) in October, the lowest level since May 2011. Compared with October 2011, the SA index was off 2.1%, the first year-over-year decrease since November 2009. Year-to-date, compared with the same period last year, tonnage was up 2.9%.Note from ATA:

...

“Clearly Hurricane Sandy negatively impacted October’s tonnage reading,” ATA Chief Economist Bob Costello said. “However, it is impossible for us to determine the exact impact.”

Costello noted that a large drop in fuel shipments into the affected area likely put downward pressure on October’s tonnage level since fuel is heavy freight, in addition to reductions in other freight.

“I’d expect some positive impact on truck tonnage as the rebuilding starts in the areas impacted by Sandy, although that boost may only be modest in November and December,” he said. “Excluding the Hurricane impacts, I still think truck tonnage is decelerating along with factory output and consumer spending on tangible-goods.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Even with the sharp decline in October, the index is at the pre-recession level. However, even before the hurricane, the index was mostly moving sideways this year due to the slowdown in manufacturing.

Q3 GDP: Here come the upward revisions

by Calculated Risk on 11/23/2012 11:55:00 AM

Next Thursday, the BEA will release the second estimate of Q3 GDP. The consensus is GDP will be revised up to 2.8% annualized growth, from the advance estimate of 2.0%. This would be a pretty sharp upward revision.

As an example, from Nomura analysts today:

"We believe real GDP growth will be revised significantly upward to an annualized pace of 3.0% versus the originally reported 2.0%, supported by greater inventory building and better net trade statistics than previously estimated."It is important to remember that the "advance" estimate is based on incomplete source data, or data subject to revisions. It appears the missing data (mostly for September) was better than expected, and that revisions have been favorable for GDP. I'll post some more Q3 estimates later.

LA area Port Traffic: Inbound Traffic up in October

by Calculated Risk on 11/23/2012 09:13:00 AM

I've been following port traffic for some time. Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for October. LA area ports handle about 40% of the nation's container port traffic. This data suggests trade with Asia will be fairly steady in October.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are up slightly compared to the 12 months ending in September.

In general, inbound and outbound traffic has been mostly moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of October, loaded outbound traffic was up slightly compared to October 2011, and loaded inbound traffic was up 5% compared to October 2011.

For the month of October, loaded outbound traffic was up slightly compared to October 2011, and loaded inbound traffic was up 5% compared to October 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports will probably decline in November.

Thursday, November 22, 2012

Irwin: "Five economic trends to be thankful for"

by Calculated Risk on 11/22/2012 07:30:00 PM

From Neil Irwin at the WaPo looked for a few positives: Five economic trends to be thankful for. Some excerpts a few comments:

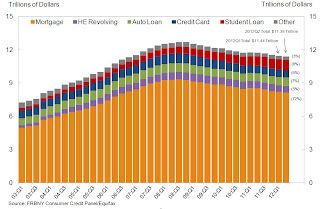

Household debt is way down. ... The good news is that in the past three years, Americans have made remarkable progress cleaning up their balance sheets and paying down those debts. After peaking at nearly 98 percent of economic output at the start of 2009, the household debt was down to 83 percent of GDP in the spring of 2012. ...CR Note: This level is still fairly high, but households have made progress. We will have more data next week when the NY Fed releases their Q3 Report on Household Debt and Credit.

Click on graph for larger image.

Click on graph for larger image.This graph is from the Q2 NY Fed Report on Household Debt and Credit and shows that aggregate consumer debt has been decreasing.

From the NY Fed: "Household indebtedness declined to $11.38 trillion [in Q2], a $53 billion decline from the first quarter of 2012. Outstanding household debt has decreased $1.3 trillion since its peak in Q3 2008."

Note: Irwin uses a different starting point, and also looks at household debt as percent of GDP (a good way to look at debt), and clearly household is debt is down significantly.

Irwin:

The cost of servicing that debt is way, way down. ... In late 2007, debt service payments added up to a whopping 14 percent of disposable personal income. Now it’s down to 10.7 percent, about the same as in the early 1990s. ..CR Note: Here is the data source: Household Debt Service and Financial Obligations Ratios.

Irwin:

Electricity and natural gas prices are falling. ... The retail price for consumers’ gas service piped into their homes is down 8.4 percent in the year ended in October. The lower wholesale price of natural gas is also pulling down electricity prices; they are off 1.2 percent over the past year. ...CR Note: I track the JOLTS data every month, and, as Irwin notes, layoffs and discharges are down.

Businesses aren’t firing people. ... While businesses aren’t adding new workers at a pace that would put the hordes of unemployed back on the job very rapidly, they also aren’t slashing jobs at a very rapid clip. Private employers laid off or discharged 1.62 million people in September, according to the Labor Department’s Job Openings and Labor Turnover data. ...

Irwin:

Housing is dramatically more affordable. ... In the spring of 2006, ... typical American home buyer would have faced a monthly mortgage payment of $1,247 a month ... home prices have fallen, so have mortgage rates ... Add it all up, and in the spring of 2012 that median American house would require a mortgage payment of only $889 a month ...CR Note: I'm not sure of all the numbers Irwin is using, but according to Case-Shiller, the Composite 20 house price index declined 31% from the peak (some areas more, some much less). Factor in low mortgage rates, and the payment would have fallen even further. There are definitely positive trends.

Happy Thanksgiving!

Zillow forecasts Case-Shiller House Price index to increase 3.0% Year-over-year for September

by Calculated Risk on 11/22/2012 11:58:00 AM

Note: The Case-Shiller report to be released next Tuesday is for September (really an average of prices in July, August and September).

Zillow Forecast: September Case-Shiller Composite-20 Expected to Show 3% Increase from One Year Ago

On Tuesday November 27th, the Case-Shiller Composite Home Price Indices for September will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 3 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be up 2.3 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from August to September will be 0.4 percent for the 20-City Composite, as well as for the 10-City Composite Home Price Index (SA). All forecasts are ... are based on a model incorporating the previous data points of the Case-Shiller series, the September Zillow Home Value Index data and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close.

CR Note: It looks like house prices will be up about 5% this year based on the Case-Shiller indexes.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Sept 2011 | 155.61 | 152.55 | 141.96 | 139.12 |

| Case-Shiller (last month) | Aug 2012 | 158.62 | 155.35 | 145.87 | 142.7 |

| Zillow Sept Forecast | YoY | 2.3% | 2.3% | 3.0% | 3.0% |

| MoM | 0.3% | 0.4% | 0.3% | 0.4% | |

| Zillow Forecasts1 | 159.1 | 156 | 146.3 | 143.3 | |

| Current Post Bubble Low | 146.5 | 149.38 | 134.08 | 136.65 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Feb-12 | |

| Above Post Bubble Low | 8.6% | 4.4% | 9.1% | 4.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Europe Summit Update

by Calculated Risk on 11/22/2012 09:24:00 AM

No announcements yet. There is much more being dicussed at the summit than just the Greek situation. Here are a few articles ...

From the WSJ: EU Leaders Prepare for Battle Royal at Summit

European Union leaders are headed to Brussels on Thursday for a big showdown over the bloc's spending budget, in a battle that pits richer against poorer member states, the East of the continent against the West, and the U.K. against almost everyone else.From the Financial Times: German Doubts Force Rethink on Greece

...

European Council President, Herman Van Rompuy, who will preside over the two-day meeting, has vowed repeatedly to keep heads of state in Brussels through the weekend to avert a collapse of the talks, arguing that a deal is needed urgently to ensure the EU and its institutions continue to function properly.

The Multiannual Financial Framework, as the 2014 to 2020 budget is known, sets out the headline figures allocated to different EU programs and activities, ranging from foreign policy to transport and infrastructure.

After almost 10 hours of intense talks on Tuesday night, eurozone finance ministers failed to agree on how fast to cut Greece’s debt pile. They called a further meeting next week to settle differences and release €44bn of long-overdue aid.From Reuters: EU's Rehn Sees Definitive Deal on Greek Aid on Monday

excerpt with permission

Greece has taken all the steps necessary to secure its next tranche of aid and euro zone finance ministers should be able to sign off definitively on the assistance on Monday, the European commissioner for economic affairs said on Wednesday.And from Reuters: Spain Kicks Off 2013 Funding With Strong Bond Sale

"I trust everyone will reconvene in Brussels on Monday with the necessary constructive spirit, and move beyond the detrimental mindset of red lines," Olli Rehn told the European Parliament.

Spain sold nearly 4 billion euros of bonds with ease at an auction on Thursday that kicked off its funding program for a daunting 2013 ...

Wednesday, November 21, 2012

Thursday: Happy Thanksgiving!

by Calculated Risk on 11/21/2012 08:22:00 PM

Happy Thanksgiving to all!

The US markets are closed on Thursday, however there might be some news from the European Union Summit Meeting. CR is always open.

Thanks again to Joe Weisenthal at Business Insider for his nice comments today, and to Paul Krugman for adding even more: All Hail Calculated Risk.

While I'm giving thanks - I'm forever thankful for having the privilege of knowing and sharing this blog with Doris "Tanta" Dungey, thanks to my friend Tom Lawler for all of our data discussions and for allowing me to excerpt from his newsletter, to surferdude808 for all his work on tracking problem banks, and to Ken Cooper for his help with the comments. I'm thankful for all the wonderful people I've met while blogging. And thanks to all the commenters too, and to all the readers!

And on topic, Jon Hilsenrath at the WSJ interviewed San Francisco Fed President John Williams today: Fed's Williams: Fed Not Near Limit on Bond Buying. A short excerpt:

WSJ: Would a reduction in the monthly flow of the Fed's purchases right now be counterproductive?What to do when Twist expires will be a key topic at the December FOMC meeting. It seems likely the $85 billion a month in purchases of mortgages and long-term Treasury securities will continue next year.

WILLIAMS: I would say that interest rates and financial conditions today in the market are based on the expectation that we will continue these policies into next year. That would include long-term Treasury purchases. A decision not to continue buying long-term Tereasurys when Twist expires I think that would be a surprise to markets and that would be counterproductive. In my view it would push long-term rates up and cause financial conditions to be a little less supportive of growth. That's my interpretation of market expectations today.

DOT: Vehicle Miles Driven decreased 1.5% in September

by Calculated Risk on 11/21/2012 04:52:00 PM

I first started tracking monthly vehicle miles to see the impact of the recession on driving. Since then we've seen the impact of demographics and changing preferences ... very interesting.

The Department of Transportation (DOT) reported today:

Travel on all roads and streets changed by -1.5% (-3.6 billion vehicle miles) for September 2012 as compared with September 2011. ◦Travel for the month is estimated to be 237.1 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by 0.6% (14.2 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 58 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in September compared to September 2011. In September 2012, gasoline averaged of $3.91 per gallon according to the EIA. Last year, prices in September averaged $3.67 per gallon, so - just looking at gasoline prices - it is no surprise that miles driven decreased year-over-year in September.

Gasoline prices were up in September compared to September 2011. In September 2012, gasoline averaged of $3.91 per gallon according to the EIA. Last year, prices in September averaged $3.67 per gallon, so - just looking at gasoline prices - it is no surprise that miles driven decreased year-over-year in September.Just looking at gasoline prices suggest miles driven will be down again in October - especially with the very high prices in California. Nationally gasoline prices averaged $3.81 in October, up sharply from $3.51 a year ago.

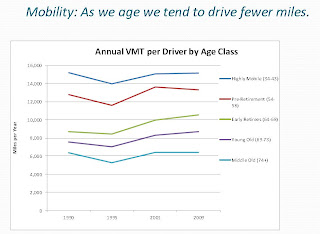

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.Also miles driven has been falling for lower age groups over the last few years, and the next survey will probably show that decline. Here is an article on younger drivers: Young People Are Driving Less—And Not Just Because They're Broke (ht KarmaPolice)

An April study by the U.S. Public Interest Research Group found that between 2001 and 2009 the average annual vehicle miles traveled by Americans ages 16 to 34 fell by close to a quarter, from 10,300 to 7,900 per capita (four times greater than the drop among all adults), and from 12,800 to 10,700 among those with jobs.With all these factors, it may be years before we see a new peak in miles driven.

...

The PIRG researchers concluded that this change couldn’t simply be pegged to the economy, but indicates a value shift.

Business Insider Interview

by Calculated Risk on 11/21/2012 02:07:00 PM

I spoke with Joe Weisenthal at Business Insider yesterday. He wrote a way too nice article and included some of our conversation: The Genius Who Invented Economics Blogging Reveals How He Got Everything Right And What's Coming Next

Genius? Hardly. I just paid attention and put 2 plus 2 together.

And I didn't get "everything right", but I did get most of the US macro trends correct over the last 8 years. I started blogging in January 2005, and most of my early posts were about housing, as an example: Housing: Speculation is the Key

And I definitely didn't invent economics blogging. Barry Ritholtz and others were ahead of me.

In the interview, I mentioned the "doomer" mentality. Many people now think of the '90s as a great decade for the economy - and it was. But there were doomsday predictions every year. As an example, in 1994 Larry Kudlow was arguing the Clinton tax increases would lead to a severe recession or even Depression. Wrong. By the end of the '90s, there were many people concerned about the stock bubble and I shared that concern, but there were doomers every year (mostly wrong).

In the Business Insider interview, I said: "I’m not a roaring bull, but looking forward, this is the best shape we’ve been in since ’97". Obviously the economy is still sluggish, and the unemployment rate is very high at 7.9%, but I was looking forward. I mentioned the downside risks from Europe and US policymakers (the fiscal slope), but I think the next few years could see a pickup in growth.

In the article I highlighted two of the reasons I expect a pickup in growth that I've mentioned before on the blog; a further increase in residential investment, and the end of the drag from state and local government cutbacks.

I also mentioned an excellent piece on autos from David Rosenberg back in early 2009. His piece made me think about auto sales - and I came to a different conclusion than Rosenberg, see: Vehicle Sales. I started expecting auto sales to bottom, and that led me to be more optimistic for the 2nd half of 2009.

I enjoyed talking with Joe - although he was way too nice - and, yes, that is a picture of me.

AIA: Architecture Billings Index increases in October, Highest in Two Years

by Calculated Risk on 11/21/2012 11:49:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Positive for Third Straight Month

Billings at architecture firms accelerated to their strongest pace of growth since December 2010. As a leading economic indicator of construction activity, the Architecture Billings Index (ABI) reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 52.8, up from the mark of 51.6 in September. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.4, compared to a mark of 57.3 the previous month.

“With three straight monthly gains – and the past two being quite strong – it’s beginning to look like demand for design services has turned the corner,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “With 2012 winding down on an upnote, and with the national elections finally behind us, there is a general sense of optimism. However, this is balanced by a tremendous amount of anxiety and uncertainty in the marketplace, which likely means that we’ll have a few more bumps before we enter a full-blown expansion.”

• Regional averages: South (52.8), Northeast (52.6), West (51.8), Midwest (50.8)

• Sector index breakdown: multi-family residential (59.6), mixed practice (52.4), institutional (51.4), commercial / industrial (48.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.

This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment next year (it will be some time before investment in offices and malls increases significantly).

Final November Consumer Sentiment at 82.7, MarkIt Flash PMI shows Improvement in Manufacturing

by Calculated Risk on 11/21/2012 09:58:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.

This was below the consensus forecast of 84.0. Overall, consumer sentiment has been improving; the recent decline in sentiment might be related to the stock market decline (the consumer sentiment index is impacted by employment, gasoline prices, the stock market and more).

From MarkIt: Manufacturing growth strengthens to five-month high in November

The Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1 signalled the strongest improvement in U.S. manufacturing business conditions for five months in November. The preliminary ‘flash’ PMI reading, which is based on around 85% of usual monthly replies, rose to 52.4 from 51.0 in October to indicate a moderate manufacturing expansion overall.

Weekly Initial Unemployment Claims decline to 410,000

by Calculated Risk on 11/21/2012 08:30:00 AM

The DOL reports:

In the week ending November 17, the advance figure for seasonally adjusted initial claims was 410,000, a decrease of 41,000 from the previous week's revised figure of 451,000. The 4-week moving average was 396,250, an increase of 9,500 from the previous week's revised average of 386,750.The previous week was revised up from 439,000.

[New York] +43,956 Increase in initial claims due to Hurricane Sandy. These separations were primarily in the construction, food service, and transportation industries.

[New Jersey] +31,094 Increase in initial claims due to Hurricane Sandy. These separation were primarily in the accommodation and food services, manufacturing, transportation and warehousing, administrative service, healthcare and social assistance,construction, retail, professional, trade, educational service, and public administration industries.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 396,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year until the recent spike due to Hurricane Sandy. Weekly claims should continue to decline over the next few weeks.