by Calculated Risk on 11/29/2012 08:30:00 AM

Thursday, November 29, 2012

Weekly Initial Unemployment Claims decline to 393,000

Note: From MarketWatch: U.S. Q3 GDP revised up to 2.7% from 2.0% (I'll have more later on the GDP revision).

The DOL reports:

In the week ending November 24, the advance figure for seasonally adjusted initial claims was 393,000, a decrease of 23,000 from the previous week's revised figure of 416,000. The 4-week moving average was 405,250, an increase of 7,500 from the previous week's revised average of 397,750.The previous week was revised up from 410,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 405,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas (update: claims increased in NY, NJ and other impacted areas over the 4-week period - some of those areas saw a decline this week). Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year until the recent spike due to Hurricane Sandy. Weekly claims should continue to decline over the next few weeks.

Wednesday, November 28, 2012

Thursday: Q3 GDP, Unemployment claims, Pending Home Sales

by Calculated Risk on 11/28/2012 08:55:00 PM

First, Jon Hilsenrath at the WSJ discusses some of the issues that will be discussed at the next FOMC meeting in December: Fed Likely to Keep Buying Bonds

Central bank officials face critical decisions at their next policy meeting Dec. 11-12. ... Since September the Fed has been buying $40 billion a month of mortgage-backed securities and looks set to continue that program. ...My guess is the Fed will expand "QE3" to around $85 billion per month when Operation Twist concludes. On communication, I'm not sure they are ready to change to thresholds for unemployment and inflation, so that will probably wait until March (but it could happen in December).

The more urgent issue is what to do with a $45 billion-a-month program known as Operation Twist, in which the central bank is buying long-term Treasury securities and funding the purchases with sales of short-term Treasurys.

...

Another issue for officials to consider at the December meeting is whether to alter their communications strategy. For several months, they have been debating whether to state explicitly what unemployment rates or inflation rates would get them to raise short-term interest rates from their very low levels. ... If the Fed is going to adopt such a move, it would make sense to do it either at the December meeting or in March, when Mr. Bernanke will hold news conferences and be able to explain the central bank's thinking on the complicated subject.

emphasis added

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 390 thousand from 410 thousand.

• Also at 8:30 AM, the second estimate for Q3 GDP will be released. The consensus is that real GDP increased 2.8% annualized in Q3, revised up from 2.0% in the advance release.

• At 10:00 AM, the NAR will release Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for November. This is the last of the regional surveys for November, and the consensus is for a reading of -1, up from -4 in October (below zero is contraction).

Earlier on New Home Sales:

• New Home Sales at 368,000 SAAR in October

• New Home Sales and Distressing Gap

• New Home Sales graphs

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

FHFA: HARP Refinance Boom Continued in September

by Calculated Risk on 11/28/2012 04:38:00 PM

Note: HARP is the program that allows borrowers with loans owned or guaranteed by Fannie Mae or Freddie Mac - and with high loan-to-value (LTV) ratios - to refinance at low rates. Fannie or Freddie are already responsible for the loan, and allowing the borrower to refinance lowers the default risk.

From the FHFA:

The Federal Housing Finance Agency (FHFA) today released its September Refinance Report, which shows that Fannie Mae and Freddie Mac loans refinanced through the Home Affordable Refinance Program (HARP) accounted for nearly one-quarter of all refinances in the third quarter of 2012. More than 90,000 homeowners refinanced their mortgage in September through HARP with more than 709,000 loans refinanced since the beginning of this year. The continued high volume of HARP refinances is attributed to record-low mortgage rates and program enhancements announced last year.Note: the automated system wasn't released until the end of March - and there were some issues with that system - so HARP refinances didn't really pickup until sometime in Q2. Now they are on pace for around 1 million refinances this year.

...

In September, half of the loans refinanced through HARP had loan-to-value (LTV) ratios greater than 105 percent and one-fourth had LTVs greater than 125 percent.

In September, 19 percent of HARP refinances for underwater borrowers were for shorter-term 15- and 20-year mortgages, which help build equity faster than traditional 30-year mortgages.

HARP refinances in September represented 45 percent of total refinances in states hard hit by the housing downturn–Nevada, Arizona, Florida and Georgia–compared with 21 percent of total refinances nationwide.

These "underwater" borrowers are current (most took out loans 5 to 7 years ago), and they will probably stay current with the lower interest rate.

This table shows the number of HARP refinances by LTV through September of this year compared to all of 2011. Clearly there has been a sharp increase in activity. Note: Here is the September report.

| HARP Activity | |||

|---|---|---|---|

| 2012, Through September | All of 2011 | Since Inception | |

| Total HARP | 709,006 | 400,024 | 1,730,857 |

| LTV >80% to 105% | 407,330 | 340,033 | 1,338,565 |

| LTV >105% to 125% | 159,980 | 59,991 | 250,596 |

| LTV >125% | 141,696 | 0 | 141,696 |

Fed's Beige Book: "Economic activity expanded at a measured pace"

by Calculated Risk on 11/28/2012 02:00:00 PM

Economic activity expanded at a measured pace in recent weeks, according to reports from contacts in the twelve Federal Reserve Districts. Cleveland, Richmond, Atlanta, Chicago, Kansas City, Dallas, and San Francisco grew at a modest pace, while St. Louis and Minneapolis indicated a somewhat stronger increase in activity. In contrast, Boston reported a slower rate of growth. Weaker conditions in New York were attributed to widespread disruptions at the end of October and into November caused by Hurricane Sandy. Philadelphia reported general weakness that was exacerbated by the hurricane. ...And on real estate:

Among key sectors, consumer spending grew at a moderate pace in most Districts, while manufacturing weakened, on balance. Seven of the twelve Districts reported either slowing or outright contraction in manufacturing, and two others gave mixed reports. ...

Overall, markets for single-family homes continued to improve across most Districts with the exception of Boston and Philadelphia. Residential real estate markets in the New York District were mixed but generally firm prior to the storm. Selling prices were steady or rising. Boston, New York, Richmond, Atlanta, Kansas City, and Dallas noted declining or tight inventories.Hmmm ... from "moderate" growth a few months ago, to "modest" growth in the last report, and now "measured". I'm not sure about the difference, but it does suggest sluggish growth. Real estate continues to be the bright spot.

Construction and commercial real estate activity generally improved across Districts since the last report. Gains, albeit modest in most cases, were reported by Philadelphia, Richmond, Chicago, and Minneapolis. The gains among Cleveland's contacts were tempered by reports in recent weeks of a slowdown in inquiries and a decline in public-sector projects. Kansas City described activity as holding firm and noted that real estate markets remained stronger than a year ago.

New Home Sales and Distressing Gap

by Calculated Risk on 11/28/2012 11:49:00 AM

New home sales in October were below expectations at a 368 thousand seasonally adjusted annual rate (SAAR). And sales for September were revised down from 389 thousand SAAR to 369 thousand.

This has led to some worrying about the housing recovery, as an example from Reuters: New Home Sales Drop 0.3%, Cast Shadow on Recovery

The data leaves the pace of new home sales just below the pace reported in May, suggesting little upward momentum the market for new homes.Yes, new home sales have been moving sideways for the last 6 months. However sales are still up significantly from 2011, and I expect sales to continue to increase over the next few years.

New home sales have averaged 361,000 on an annual rate basis through October. That means sales are on pace to increase 18% from last year. Most sectors would be pretty upbeat about an 18% increase in sales.

But even with the significant increase this year, 2012 will be the 3rd lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, but below the 375,000 sales in 2009. I expect sales to double from here within the next several years as distressed sales continue to decline.

Click on graph for larger image.

Click on graph for larger image.I started posting this graph four years ago when the "distressing gap" first appeared.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through October. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 368,000 SAAR in October

• New Home Sales graphs

New Home Sales at 368,000 SAAR in October

by Calculated Risk on 11/28/2012 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 368 thousand. This was down from a revised 369 thousand SAAR in August (revised down from 389 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in October 2012 were at a seasonally adjusted annual rate of 368,000 ... This is 0.3 percent below the revised September rate of 369,000, but is 17.2 percent above the October 2011 estimate of 314,000.

Click on graph for larger image in graph gallery.

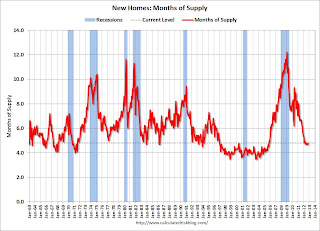

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply increased in October to 4.8 months. September was revised up to 4.7 months (from 4.5 months).

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of October was 147,000. This represents a supply of 4.8 months at the current sales rate.On inventory, according to the Census Bureau:

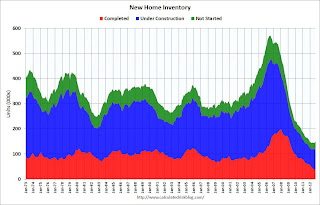

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was just above the record low in October. The combined total of completed and under construction is also just above the record low since "under construction" is starting to increase.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In October 2012 (red column), 29 thousand new homes were sold (NSA). Last year only 25 thousand homes were sold in October. This was the third weakest October since this data has been tracked (above 2011 and 2010). The high for October was 105 thousand in 2005.

New home sales have averaged 361 thousand SAAR over the first 10 months of 2012, up sharply from the 307 thousand sales in 2011. Also sales are finally at the lows for previous recessions too.

New home sales have averaged 361 thousand SAAR over the first 10 months of 2012, up sharply from the 307 thousand sales in 2011. Also sales are finally at the lows for previous recessions too.This was below expectations of 387,000. I'll have more soon ...

MBA: Purchase Mortgage Applications increase, Refinance Applications decrease

by Calculated Risk on 11/28/2012 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

This week’s results include an adjustment for the Thanksgiving holiday. ...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.53 percent from 3.54 percent, with points remaining constant at 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years, however the purchase index has increased 8 of the last 10 weeks and is now near the high for the year.

Tuesday, November 27, 2012

Wednesday: New Home Sales, Beige Book

by Calculated Risk on 11/27/2012 09:01:00 PM

Earlier, a little good manufacturing news from the Richmond Fed: Manufacturing Activity Advanced in November; Optimism Increased

Manufacturing activity in the central Atlantic region advanced moderately in November following a slight pullback in October, according to the Richmond Fed's latest survey. ...And on consumer confidence from the Financial Times: US growth hopes lifted by housing data

In November, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — gained sixteen points to 9 from October's reading of −7. Among the index's components, shipments rose twenty points to 11, new orders moved up seventeen points to finish at 11, and the jobs index increased eight points to 3.

The figures suggest that consumers and companies are holding their nerve despite anxiety about the fiscal cliff ... The Conference Board, an industry group, said its index of consumer attitudes towards the economy rose to 73.7 in November, its highest since February 2008.Wednesday:

excerpt with permission

• At 7:00 AM, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for October from the Census Bureau will be released. The consensus is for a decrease in sales to 387 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 389 thousand in September.).

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

Earlier on House Prices:

• Case-Shiller: Comp 20 House Prices increased 3.0% year-over-year in September

• Case-Shiller House Price Comments and Graphs

• Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Update: The Recession Probability Chart

by Calculated Risk on 11/27/2012 05:36:00 PM

A few weeks ago, I mentioned a recession probability chart from the St Louis Fed that was making the rounds. (see below). This graph shouldn't be interpreted as indicating a new recession. Jeff Miller at a Dash of Insight discussed why: Debunking the 100% Recession Chart.

Now the author, University of Oregon Professor Jeremy Piger, posted some FAQs and data for the chart online. Professor Piger writes:

2. How should I interpret these probabilities as a recession signal?

Historically, three consecutive months of smoothed probabilities above 80% has been a reliable signal of the start of a new recession, while three consecutive months of smoothed probabilities below 20% has been a reliable signal of the start of a new expansion. For an analysis of the performance of the model for identifying new turning points in real time, see:

Chauvet, M. and J. Piger, “A Comparison of the Real-Time Performance of Business Cycle Dating Methods,” Journal of Business and Economic Statistics, 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is the chart from FRED at the St Louis Fed.

Obviously we haven't seen three consecutive months above 80%. Also I expect the recent data point to be revised down.

This is kind of a Woody Allen and Marshall McLuhan moment! Those arguing this chart indicated a 100% probability of a new recession knew nothing of Piger's work.

Earlier on House Prices:

• Case-Shiller: Comp 20 House Prices increased 3.0% year-over-year in September

• Case-Shiller House Price Comments and Graphs

• Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

Fed: Consumer Deleveraging Continued in Q3, Student Debt increases

by Calculated Risk on 11/27/2012 03:00:00 PM

From the NY Fed: Decrease in Overall Debt Balance Continues Despite Rise in Non-Real Estate Debt

In its latest Quarterly Report on Household Debt and Credit, the Federal Reserve Bank of New York announced that in the third quarter, non-real estate household debt jumped 2.3% to $2.7 trillion. The increase was due to a boost in student loans ($42 billion), auto loans ($18 billion) and credit card balances ($2 billion).Here is the Q3 report: Quarterly Report on Household Debt and Credit

During the third quarter of 2012, total consumer indebtedness shrunk $74 billion to $11.31 trillion, a 0.7% decrease from the previous quarter. The reduction in overall debt is attributed to a decrease in mortgage debt ($120 billion) and home equity lines of credit ($16 billion), despite mortgage originations increasing for a fourth consecutive quarter.

“The increase in mortgage originations, auto loans and credit card balances suggests that consumers are slowly gaining confidence in their financial position,” said Donghoon Lee, senior economist at the New York Fed. “As consumers feel more comfortable, they may start to make purchases that were previously delayed.”

emphasis added

Mortgages, the largest component of household debt, continue to drive the decline in overall indebtedness. Mortgage balances shown on consumer credit reports continued to drop, and now stand at $8.03 trillion, a 1.5% decrease from the level in 2012Q2. Home equity lines of credit (HELOC) balances dropped by $16 billion (2.7%). Non-mortgage household debt balances instead jumped by 2.3% in the third quarter to $2.7 trillion, boosted by increases of $18 billion in auto loans, $42 billion in student loans, and $2 billion in credit card balances.Here are two graphs:

...

About 242,000 individuals had a new foreclosure notation added to their credit reports between June 30 and September 30, a slowdown of 5.5%, continuing the downward trend as foreclosure starts slowly move toward their pre-crisis levels.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased in Q3. This was mostly due to a decline in mortgage debt.

However student debt is still increasing. From the NY Fed:

Outstanding student loan balances increased to $956 billion as of September 30, 2012, an increase of $42 billion from the previous quarter. However, of the $42 billion, $23 billion is new debt while the remaining $19 billion is attributed to previously defaulted student loans that have been newly updated on credit reports this quarter.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Overall, delinquency rates improved slightly in 2012Q3. As of September 30, 8.9% of outstanding debt was in some stage of delinquency, compared with 9.0% in 2012Q2. About $1.01 trillion of debt is delinquent, with $740 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 11/27/2012 12:11:00 PM

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

For the Case-Shiller National index, real prices declined slightly in Q3, and are up 1.7% year-over-year. The nominal Case-Shiller National index is up 3.6% year-over-year.

Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through September) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to August 2003 levels, and the CoreLogic index (NSA) is back to December 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to June 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to July 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to 1999 or early 2000 levels.

I think nominal house prices have bottomed, but I expect real prices to mostly move sideways for the next year or two.

Case-Shiller House Price Comments and Graphs

by Calculated Risk on 11/27/2012 09:59:00 AM

Case-Shiller reported the fourth consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in September suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase for each month this year.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.5% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 1.9% |

| Sep-12 | 3.0% |

| Oct-12 | |

| Nov-12 | |

| Dec-12 | |

| Jan-13 | |

On a not seasonally adjusted basis (NSA), Case-Shiller house prices will probably start to decline month-to-month in October. But I think prices will remain above the post-bubble lows set earlier this year.

Note: S&P reports the NSA, the following graphs use the Seasonally Adjusted (SA) data.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.4% from the peak, and up 0.3% in September (SA). The Composite 10 is up 4.2% from the post bubble low set in January 2012 (SA).

The Composite 20 index is off 30.7% from the peak, and up 0.4% (SA) in September. The Composite 20 is up 4.7% from the post-bubble low set in January 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 2.1% compared to September 2011.

The Composite 20 SA is up 3.0% compared to September 2011. This was the fourth consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in September seasonally adjusted (15 of 20 cities increased NSA). Prices in Las Vegas are off 59.1% from the peak, and prices in Dallas only off 4.8% from the peak. Note that the red column (cumulative decline through September 2012) is above previous declines for all cities.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in September seasonally adjusted (15 of 20 cities increased NSA). Prices in Las Vegas are off 59.1% from the peak, and prices in Dallas only off 4.8% from the peak. Note that the red column (cumulative decline through September 2012) is above previous declines for all cities.I'll have more on house prices later.

Case-Shiller: Comp 20 House Prices increased 3.0% year-over-year in September

by Calculated Risk on 11/27/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September (a 3 month average of July, August and September).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities), and the quarterly National Index.

From S&P: Home Prices Rise for the Sixth Straight Month According to the S&P/Case-Shiller Home Price Indices

Data through September 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices ... showed that home prices continued to rise in the third quarter of 2012. The national composite was up 3.6% in the third quarter of 2012 versus the third quarter of 2011, and was up 2.2% versus the second quarter of 2012. In September 2012, the 10- and 20-City Composites showed annual returns of +2.1% and +3.0%. Average home prices in the 10- and 20-City Composites were each up by 0.3% in September versus August 2012. Seventeen of the 20 MSAs and both Composites posted better annual returns in September versus August 2012; Detroit and Washington D.C. recorded a slight deceleration in their annual rates, and New York saw no change.This was about at the consensus forecast and the recent change to a year-over-year increase is a significant story. I'll have graphs and more on prices later (S&P's website is having a problem).

“Home prices rose in the third quarter, marking the sixth consecutive month of increasing prices,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “In September’s report all three headline composites and 17 of the 20 cities gained over their levels of a year ago. Month-over-month, 13 cities and both Composites posted positive monthly gains.

“The National Composite increased by 3.6% from the same quarter in 2011 and by 2.2% from the second quarter of 2012. The 10- and 20-City Composites have posted positive annual returns for four consecutive months with a +2.1% and +3.0% annual change in September, respectively. Month-over-month, both Composites have recorded increases for six consecutive months, with the most recent monthly gain being +0.3% for each Composite.

“We are entering the seasonally weak part of the year. The headline figures, which are not seasonally adjusted, showed five cities with lower prices in September versus only one in August; in the seasonally adjusted data the pattern was reversed: one city fell in September versus two in August. Despite the seasons, housing continues to improve.

Monday, November 26, 2012

Tuesday: Case-Shiller House Prices, Durable Goods Orders

by Calculated Risk on 11/26/2012 09:01:00 PM

First, on Greece, here is the Eurogroup statement on Greece. Excerpt:

The Eurogroup was informed that Greece is considering certain debt reduction measures in the near future, which may involve public debt tender purchases of the various categories of sovereign obligations. If this is the route chosen, any tender or exchange prices are expected to be no higher than those at the close on Friday, 23 November 2012.This buy-back lacks details such as the source of money for the buy-backs and how much debt will be bought. The IMF will wait to disburse funds until the results of the buy-backs are known (that was my understanding from the press conference).

From the WSJ: Greece's Creditors Reach Deal on New Aid

From the NY Times: European Finance Ministers Agree on Greek Bailout Terms

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

• At 9:00 AM, the S&P/Case-Shiller House Price Index for September will be released. Although this is the September report, it is really a 3 month average of July, August and September. The consensus is for a 2.9% year-over-year increase in the Composite 20 index (NSA) for September. This release also includes the Q3 Case-Shiller National index.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for November will be released. The consensus is for a decrease to -8 for this survey from -7 in October (below zero is contraction).

• Also at 10:00 AM, the FHFA House Price Index for September 2012 will be released. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.5% increase in house prices.

• Also at 10:00 AM, Conference Board's consumer confidence index for November. The consensus is for an increase to 72.8 from 72.2 last month.

• At 3:00 PM: the New York Fed will release the Q3 Report on Household Debt and Credit.

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Greek Debt Deal Reached

by Calculated Risk on 11/26/2012 07:38:00 PM

Press conference here.

From Reuters: Euro zone, IMF reach deal on long-term Greek debt

Euro zone finance ministers and the International Monetary Fund clinched agreement on a new debt target for Greece on Monday in a breakthrough towards releasing an urgently needed tranche of loans to the near-bankrupt economy, officials said.From AlphaVille: A mere three weeks later, a Greek debt deal (?)

After nearly 10 hours of talks at their third meeting on the issue in as many weeks, Greece's international lenders agreed to reduce Greek debt by 40 billion euros, cutting it to 124 percent of gross domestic product by 2020, via a package of steps.

UPDATE: Press release here: Eurogroup statement on Greece.

LPS: House Price Index increased 0.1% in September, Up 3.6% year-over-year

by Calculated Risk on 11/26/2012 07:10:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses September closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.1 Percent for the Month; Up 3.6 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on September 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 22.8% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 54.4% from the peak in Las Vegas, 46% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and barely off in Austin and Houston.

Looking at the year-over-year price change, in May, the LPS HPI was up 0.4% year-over-year, in June the index was up 0.9% year-over-year, 1.8% in July, 2.6% in August, and now 3.6% in September. This is steady improvement on a year-over-year basis. Note: Case-Shiller for September will be released tomorrow morning.

LPS: Mortgage delinquencies decreased in October, Percent in foreclosure process lowest since August 2009

by Calculated Risk on 11/26/2012 04:15:00 PM

LPS released their First Look report for October today. LPS reported that the percent of loans delinquent decreased in October compared to September, and declined about 7% year-over-year. Also the percent of loans in the foreclosure process declined sharply in October and are the lowest level since August 2009.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 7.03% from 7.40% in September (delinquencies increased seasonally in September). Note: the normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 3.61% from 3.87% in September.

The number of delinquent properties, but not in foreclosure, is down about 10% year-over-year (400,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 19% or 412,000 year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high, but the number of loans in the foreclosure process is starting to decline fairly quickly.

LPS will release the complete mortgage monitor for October in early December.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Oct 2012 | Sept 2012 | Oct 2011 | |

| Delinquent | 7.03% | 7.40% | 7.58% |

| In Foreclosure | 3.61% | 3.87% | 4.30% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,957,000 | 2,170,000 | 2,219,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,543,000 | 1,530,000 | 1,681,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,800,000 | 1,940,000 | 2,212,000 |

| Total Properties | 5,300,000 | 5,640,000 | 6,111,000 |

Timiraos: "The FHA’s Biggest Loser"

by Calculated Risk on 11/26/2012 12:58:00 PM

A frequent topic on this blog back in 2005, 2006, 2007 and even in 2008 were FHA loans and DAPs (seller financed Down-payment Assistance Programs). With DAPs, the seller "donated" the down payment to a non-profit (for a fee of course), and the non-profit gave the down payment to the buyer. This allowed people to get around the FHA's down payment requirement, and to buy for no money down. For nerdy details, see Tanta's DAP for UberNerds

DAPs were finally banned in 2008 after wrecking havoc on the FHA's finances.

From Nick Timiraos at the WSJ: FHA’s Biggest Loser: No-Money-Down Mortgages

One of the biggest reasons the Federal Housing Administration is facing severe financial woes is a problem agency officials identified and sought to correct years ago.The FHA made many bad loans in fiscal years 2008 and 2009 (from October 2007 through October 2009) when private capital left the mortgage market, and the FHA saw a huge surge in market share. With falling house prices, and low down payment loans, many of these borrowers defaulted.

...

A big chunk of the losses leading to a $16.3 billion shortfall have come from programs that allowed home sellers to fund down payments via nonprofit groups that provided them to buyers as a “gift.” After trying for years, the FHA finally prevailed on Congress to shut down the programs in late 2008, but not before the agency backed billions in risky no-money-down loans as home prices were dropping fast.

...

Seller-funded down-payment assistance loans accounted for just 4% of outstanding loans at the end of September, but they represented 13% of all seriously delinquent mortgages, according to a recently released audit.

The audit said that had the FHA not allowed the programs to go forward, then the mortgage program’s $13.5 billion net worth deficit would have turned to a positive $1.77 billion.

However DAPs also played a significant role in negatively impacting the FHA - and that was obvious in early 2005!

Dallas Fed: Regional Manufacturing Activity "Growth Stalls" in November

by Calculated Risk on 11/26/2012 10:30:00 AM

From the Dallas Fed: Growth Stalls and Company Outlook Worsens

Texas factory activity was little changed in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, came in at 1.7, indicating output barely increased from October.This was below expectations of a reading of 4.7 for the general business activity index. Later this week two more regional manufacturing surveys will be released (Richmond and Kansas City).

Other survey measures suggested flat manufacturing activity in November. The new orders index came in at 0.4, suggesting that demand was unchanged from October.

...

Perceptions of broader business conditions worsened in November. The general business activity index fell to -2.8, returning to negative territory. The company outlook index moved down to -4.8, registering its first negative reading since April.

Labor market indicators were mixed. The employment index edged up to 6.7 in November, with more than 20 percent of firms reporting hiring compared with 15 percent reporting layoffs. The hours worked index dipped from -5.9 to -7.1.

Chicago Fed: Economic Activity Slower in October

by Calculated Risk on 11/26/2012 08:30:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Slower in October

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.56 in October from 0.00 in September. All four broad categories of indicators that make up the index decreased from September, and only two made positive contributions to the index in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased from –0.36 in September to –0.56 in October—its eighth consecutive reading below zero. October’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity slowed, and growth was still below trend in October.

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.