by Calculated Risk on 12/03/2012 01:59:00 PM

Monday, December 03, 2012

CoreLogic: 58,000 Completed Foreclosures in October

From CoreLogic: CoreLogic® Reports 58,000 Completed Foreclosures in October

CoreLogic ... today released its National Foreclosure Report for October that provides data on completed U.S. foreclosures and the overall foreclosure inventory. According to CoreLogic, there were 58,000 completed foreclosures in the U.S. in October 2012, down from 70,000 in October 2011 representing a year-over-year decrease of 17 percent. On a month-over-month basis, completed foreclosures fell from 77,000* in September 2012 to the current 58,000, representing a decrease of 25 percent. As a basis of comparison, prior to the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month between 2000 and 2006. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 3.9 million completed foreclosures across the country.Note: The foreclosure inventory reported by CoreLogic is lower than the number reported by LPS of 3.61% of mortgages or 1.8 million in foreclosure.

Approximately 1.3 million homes, or 3.2 percent of all homes with a mortgage, were in the national foreclosure inventory as of October 2012 compared to 1.5 million, or 3.6 percent, in October 2011. Month-over-month, the national foreclosure inventory was down 1.3 percent from September 2012 to October 2012. The foreclosure inventory is the share of all mortgaged homes in any stage of the foreclosure process.

...

“As a result of completed foreclosures and alternative disposition methods, the foreclosure inventory has declined by 9 percent year-to-date. This is good news for housing markets as we look forward to 2013,” said Mark Fleming, chief economist for CoreLogic.

Many observers expected a "surge" in foreclosures this year, but that hasn't happened. However there are still a large number of properties in the foreclosure inventory in some states:

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were: Florida (11.1 percent), New Jersey (7.7 percent), New York (5.3 percent), Illinois (5.0 percent) and Nevada (4.8 percent).

Construction Spending increased in October

by Calculated Risk on 12/03/2012 11:27:00 AM

Three key construction spending themes:

• Residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). Looking forward, private residential construction spending will be the largest category again very soon - but spending is still very low (at 1998 levels not adjusted for inflation).

• Private non-residential construction spending picked up last year mostly due to energy spending (power and electric), but spending on office buildings, hotels and malls is still very low.

• Public construction spending declined for several years, but the decline appears to be mostly over. Note: Public construction spending is mostly state and local spending, and the drag from state and local cutbacks appears to be ending.

The Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2012 was estimated at a seasonally adjusted annual rate of $872.1 billion, 1.4 percent above the revised September estimate of $860.4 billion. The October figure is 9.6 percent above the October 2011 estimate of $795.7 billion.Both private and public construction spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $592.1 billion, 1.6 percent above the revised September estimate of $582.7 billion. ... In October, the estimated seasonally adjusted annual rate of public construction spending was $280.1 billion, 0.8 percent above the revised September estimate of $277.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 57% below the peak in early 2006, and up 32% from the post-bubble low. Non-residential spending is 28% below the peak in January 2008, and up about 31% from the recent low.

Public construction spending is now 14% below the peak in March 2009 and just above the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 21%. Non-residential spending is also up 11% year-over-year mostly due to energy spending (power and electric). Public spending is down 1% year-over-year.

ISM Manufacturing index declines in November to 49.5, Lowest since July 2009

by Calculated Risk on 12/03/2012 10:00:00 AM

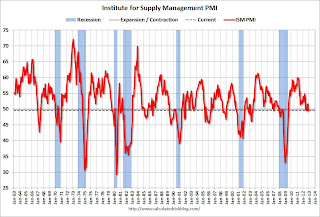

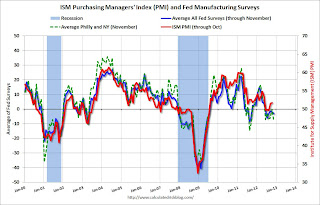

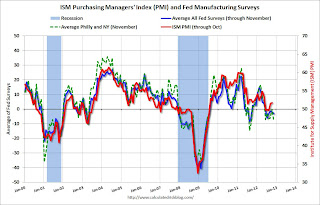

The ISM manufacturing index indicated contraction in November. PMI was at 49.5% in November, down from 51.7% in October. The employment index was at 48.4%, down from 52.1%, and the new orders index was at 50.3%, down from 54.2%.

From the Institute for Supply Management: November 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector contracted in November following two months of modest expansion, while the overall economy grew for the 42nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 49.5 percent, a decrease of 2.2 percentage points from October's reading of 51.7 percent, indicating contraction in manufacturing for the fourth time in the last six months. This month's PMI™ reading reflects the lowest level since July 2009 when the PMI™ registered 49.2 percent. The New Orders Index registered 50.3 percent, a decrease of 3.9 percentage points from October, indicating growth in new orders for the third consecutive month. The Production Index registered 53.7 percent, an increase of 1.3 percentage points, indicating growth in production for the second consecutive month. The Employment Index registered 48.4 percent, a decrease of 3.7 percentage points, which is the index's lowest reading since September 2009 when the Employment Index registered 47.8 percent. The Prices Index registered 52.5 percent, reflecting a decrease of 2.5 percentage points. Comments from the panel this month generally indicate that the second half of the year continues to show a slowdown in demand; respondents also express concern over how and when the fiscal cliff issue will be resolved."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 51.7% and suggests manufacturing contracted in November.

Unofficial Problem Bank list declines to 856 Institutions

by Calculated Risk on 12/03/2012 08:44:00 AM

CR Note: Usually I post this on Saturday - sorry for the delay. The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 30, 2012.

Changes and comments from surferdude808:

This week, the FDIC released its enforcement actions through October but did not release industry results for the third quarter. Changes to the Unofficial Problem Bank List include six removals and five additions that leave the list at 856 institutions with assets of $326.4 billion. A year ago, the list held 980 institutions with assets of $400.5 billion. For the month of November, the list declined by eight institutions after 13 action terminations, three failures, two unassisted mergers, and 10 additions.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

The six removals were for action terminations against Johnson Bank, Racine, WI ($3.8 billion); NexBank, SSB, Dallas, TX ($607 million); Ohana Pacific Bank, Honolulu, HI ($94 million Ticker: OHPB): Lead Bank, Garden City, MO ($84 million); Prosper Bank, Prosper, TX ($64 million); and Millennium Bank, Des Plaines, IL ($44 million).

Additions this week were Inland Bank and Trust, Oak Brook, IL ($1.3 billion); Cornerstone Bank, Moorestown, NJ ($351 million Ticker: CFIC); Devon Bank, Chicago, IL ($250 million); First Citizens Bank of Georgia, Dawsonville, GA ($95 million); and Community State Bank, Norwalk, WI ($27 million).

Look for the FDIC to release industry third quarter results this Tuesday.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Weekend:

• Summary for Week Ending Nov 30th

• Schedule for Week of Dec 2nd

Sunday, December 02, 2012

Monday: ISM Manufacturing, Auto Sales, Construction Spending

by Calculated Risk on 12/02/2012 08:43:00 PM

This will be another week of sausage making - uh, "fiscal cliff", or more accurately "austerity slope" - negotiations. The key question for the economy is: When and how much austerity will the US fiscal authorities enact?

My guess is an agreement will be reached in early January, and Federal austerity will subtract 1% to 1.5% from GDP in 2013. Note: There is no drop dead date – despite the silly countdown timers on some sites.

Monday economic releases:

• At 10:00 AM ET, the ISM Manufacturing Index for November will be released. The consensus is for be PMI to be unchanged at 51.7. (above 50 is expansion).

• Also at 10:00 AM, the Construction Spending for October. The consensus is for a 0.4% increase in construction spending.

• All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 15.0 million SAAR in November (Seasonally Adjusted Annual Rate) from 14.2 million in October (October sales were impacted by Hurricane Sandy).

The Asian markets are mostly green tonight, with the Nikkei up 0.4% and the Shanghai Composite is up 0.8%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 2 and DOW futures are up 20.

Oil prices are down slightly with WTI futures at $88.82 per barrel and Brent at $111.18 per barrel.

Weekend:

• Summary for Week Ending Nov 30th

• Schedule for Week of Dec 2nd

Four more questions this week for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Report: Germany to eventually consider Greek Losses

by Calculated Risk on 12/02/2012 03:12:00 PM

From the Financial Times: Merkel prepared to consider Greek losses

"If Greece one day handles its revenues again without taking on new debt, then we must take a look at the situation and assess it,” the [Chancellor Angela Merkel] told Germany’s Bild am Sonntag newspaper ... even Wolfgang Schäuble, Germany’s finance minister, last week hinted [a haircut on official debt] could come eventually.Eventually some of the official debt will have to be forgiven. This will not happen until after the German election next September, and probably not until 2014 at the earliest.

excerpt with permission

Note: Long term readers probably remember the "Lord of the Dark Matter" who provided excellent insights on the derivative market. We discussed Europe about a week ago, and his view was a "short of full blown restructuring, there is no solution". Maybe - just maybe - the Germans are starting to realize that there will have to an official restructuring for Greece - and that would be a positive step.

Impact of Sandy on Employment, November Contest Winners

by Calculated Risk on 12/02/2012 09:19:00 AM

A key question for the November employment report, to be released Friday, is the impact of Hurricane Sandy. Sandy hit New York city on October 29th.

Hurricane Katrina hit New Orleans on August 29, 2005, so it might be helpful to look back at the impact on employment in the months following Katrina for some clues. Here is the BLS report for September 2005 with a note on Katrina (I expect a note in the November report related to Sandy). Katrina was a much larger storm, and large areas were devastated, but Sandy struck an area with a much larger population - so the impact on employment might be similar.

The following table shows the average number of jobs added for the four months prior to the storm (both storms hit at the end of a month - after the BLS reference period). Following Katrina, employment gains dropped sharply for the next two months. Note: September 2005 (the first month following Katrina) was originally reported at -35,000, but was eventually revised up to +66,000.

| Total Nonfarm Jobs, 1 Month Net Change (000) | ||

|---|---|---|

| Katrina | Sandy | |

| Average (4 previous months) | 245 | 173 |

| Month After Storm | 66 | |

| 2nd Month After | 80 | |

| Average 3rd and 4th Month | 247 | |

The consensus is for an increase of 80,000 non-farm payroll jobs in November 2012.

Here are the winners for the November economic question contest:

1st: Terry Oldham

2nd: Pat MacAuley

3rd tie: Alexander Petrov, Daniel Brawdy

Congratulations all!

Yesterday:

• Summary for Week Ending Nov 30th

• Schedule for Week of Dec 2nd

Saturday, December 01, 2012

House Prices: Case-Shiller to turn negative month-to-month seasonally in October

by Calculated Risk on 12/01/2012 07:29:00 PM

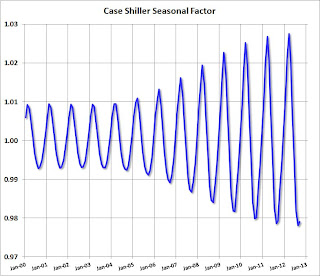

I expect the Case-Shiller Composite 20 Not Seasonally Adjusted (NSA) index to decline month-to-month in October. This will not be a sign of impending doom - or another collapse in house prices - it is just the normal seasonal pattern. I expect smaller month-to-month declines this winter than for the same months last year.

Even in normal times house prices tend to be stronger in the spring and early summer, than in the fall and winter. Currently there is a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have a larger negative impact on prices in the fall and winter.

In the coming months, the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. I think the house price indexes have already bottomed, and will be up about 5% year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (both through September). The CoreLogic index turned negative month-to-month in the September report (CoreLogic is a 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA will probably turn negative month-to-month in the October report (also a three month average, but not weighted).

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

Note: I was one of several people to question this change in the seasonal factor - and this led to S&P Case-Shiller reporting the NSA numbers.

It appears the seasonal factor has stopped increasing, and I expect that over the next several years - as the percent of distressed sales decline - the seasonal factors will slowly move back towards the previous levels.

Summary for Week Ending Nov 30th

by Calculated Risk on 12/01/2012 11:59:00 AM

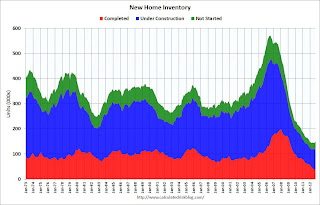

Overall the economic data was weaker than expected last week, even the housing data. New home sales were at a seasonally adjusted annual rate (SAAR) of 368 thousand in October, below expectations of 387,000. However sales are still up close to 20% from 2011.

Hurricane Sandy continues to negatively impact the economic numbers. Personal income and outlays for October were especially weak, and weekly initial unemployment claims remained elevated.

And, once again, the regional manufacturing surveys indicated contraction (except Richmond).

Overall this was a disappointing week, but it is difficult to separate out the underlying trend from the impact of Hurricane Sandy.

Of course most of the headlines last week were about the so-called "fiscal cliff". Some news agencies are running embarrassing countdown timers, even though there is no drop dead date. I still think a deal in early January is likely, although I'd like to see an agreement reached sooner.

Here is a summary of last week in graphs:

• New Home Sales at 368,000 SAAR in October

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 368 thousand. This was down from a revised 369 thousand SAAR in August (revised down from 389 thousand).

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 368 thousand. This was down from a revised 369 thousand SAAR in August (revised down from 389 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was just above the record low in October. The combined total of completed and under construction is also just above the record low since "under construction" is starting to increase.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In October 2012 (red column), 29 thousand new homes were sold (NSA). Last year only 25 thousand homes were sold in October. This was the third weakest October since this data has been tracked (above 2011 and 2010). The high for October was 105 thousand in 2005.

In October 2012 (red column), 29 thousand new homes were sold (NSA). Last year only 25 thousand homes were sold in October. This was the third weakest October since this data has been tracked (above 2011 and 2010). The high for October was 105 thousand in 2005.New home sales have averaged 361 thousand SAAR over the first 10 months of 2012, up sharply from the 307 thousand sales in 2011. Also sales are finally at the lows for previous recessions too.

This was below expectations of 387,000.

• Case-Shiller: Comp 20 House Prices increased 3.0% year-over-year in September

From S&P: Home Prices Rise for the Sixth Straight Month According to the S&P/Case-Shiller Home Price Indices

From S&P: Home Prices Rise for the Sixth Straight Month According to the S&P/Case-Shiller Home Price IndicesNote: These graphs use the Seasonally Adjusted (SA) data.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.4% from the peak, and up 0.3% in September (SA). The Composite 10 is up 4.2% from the post bubble low set in January 2012 (SA).

The Composite 20 index is off 30.7% from the peak, and up 0.4% (SA) in September. The Composite 20 is up 4.7% from the post-bubble low set in January 2012 (SA).

The Composite 20 index is off 30.7% from the peak, and up 0.4% (SA) in September. The Composite 20 is up 4.7% from the post-bubble low set in January 2012 (SA).The second graph shows the Year over year change in both indices.

The Composite 10 SA is up 2.1% compared to September 2011.

The Composite 20 SA is up 3.0% compared to September 2011. This was the fourth consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.Prices increased (SA) in 19 of the 20 Case-Shiller cities in September seasonally adjusted (15 of 20 cities increased NSA). Prices in Las Vegas are off 59.1% from the peak, and prices in Dallas only off 4.8% from the peak. Note that the red column (cumulative decline through September 2012) is above previous declines for all cities.

• Real House Prices, Price-to-Rent Ratio

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

This graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through September) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through September) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to June 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to July 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to 1999 or early 2000 levels.

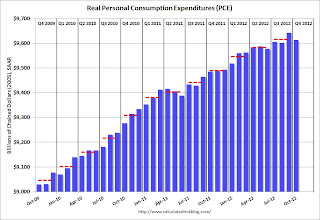

• Personal Income unchanged in October, Spending decreased 0.2%

The BEA released the Personal Income and Outlays report for October:

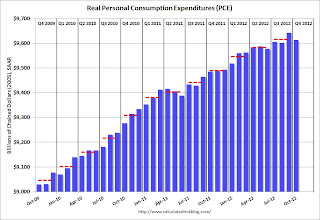

The BEA released the Personal Income and Outlays report for October: Personal income increased $0.4 billion, or less than 0.1 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $20.2 billion, or 0.2 percent.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. According to the BEA, Hurricane Sandy impacted PCE in October, but the BEA could not quantify the total impact - however PCE in October was weak.

A key point is the PCE price index has only increased 1.7% over the last year, and core PCE is up only 1.6%.

• Weekly Initial Unemployment Claims decline to 393,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 405,250.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 405,250.This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas (update: claims increased in NY, NJ and other impacted areas over the 4-week period - some of those areas saw a decline this week). Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

• Regional Manufacturing Surveys mostly weak in November

Most of the regional manufacturing surveys were weak in November (Richmond was the exception). From the Kansas City Fed: Tenth District Manufacturing Activity Eased Further

The month-over-month composite index was -6 in November, down from -4 in October and 2 in September.From the Dallas Fed: Texas Manufacturing Activity: Growth Stalls and Company Outlook Worsens

The general business activity index fell to -2.8, returning to negative territory. The company outlook index moved down to -4.8, registering its first negative reading since April.From the Richmond Fed: Manufacturing Activity Advanced in November; Optimism Increased

In November, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — gained sixteen points to 9 from October's reading of −7.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:The New York and Philly Fed surveys are averaged together (dashed green, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM index for November will be released Monday, Dec 3rd, and these surveys suggest another weak reading.

Schedule for Week of Dec 2nd

by Calculated Risk on 12/01/2012 08:20:00 AM

Note: I'll post a summary for last week later today.

The key report next week is the November employment report to be released on Friday. Other key reports include November auto sales on Monday, the November ISM manufacturing index, and the November ISM service index.

The November employment report will probably be negatively impacted by Hurricane Sandy, but November auto sales probably saw a boost from the storm.

The Q3 Flow of Funds report will be released on Thursday.

The FDIC is expected to release the Q3 Quarterly Banking Profile this week.

10:00 AM ET: ISM Manufacturing Index for November.

10:00 AM ET: ISM Manufacturing Index for November. Here is a long term graph of the ISM manufacturing index. The ISM manufacturing index indicated expansion in October. The PMI was at 51.7%, up from 51.5% in September. The employment index was at 52.1%, down from 54.7%, and the new orders index was at 54.2%, up from 52.3%. The consensus is for be PMI to be unchanged at 51.7. (above 50 is expansion).

10:00 AM: Construction Spending for October. The consensus is for a 0.4% increase in construction spending.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 15.0 million SAAR in November (Seasonally Adjusted Annual Rate) from 14.2 million in October (October sales were impacted by Hurricane Sandy).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the October sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the October sales rate. TrueCar is forecasting:

The November 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 15.2 million new car sales, up from 13.5 million in November 2011 and up from 14.3 million in October 2012

10:00 AM: Trulia Price Rent Monitors for November. This is the index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 125,000 payroll jobs added in November. This is the second report using the new methodology, and the report last month (158,000) was fairly close to the BLS report for private employment (the BLS reported 184,000 private sector jobs added in November).

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1% decrease in orders.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for a decrease to 53.6 from 54.2 in October. Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 380 thousand from 393 thousand.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for November. The consensus is for an increase of 80,000 non-farm payroll jobs in November; there were 171,000 jobs added in October. The October reference period was before Hurricane Sandy, and the impact from Sandy will show up in the November report.

8:30 AM: Employment Report for November. The consensus is for an increase of 80,000 non-farm payroll jobs in November; there were 171,000 jobs added in October. The October reference period was before Hurricane Sandy, and the impact from Sandy will show up in the November report.The consensus is for the unemployment rate to increase to 8.0% in November, up from 7.9% in October.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through September.

The economy has added 5.4 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.9 million total jobs added including all the public sector layoffs).

The economy has added 5.4 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.9 million total jobs added including all the public sector layoffs).There are still 3.45 million fewer private sector jobs now than when the recession started in 2007 (including benchmark revision).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for sentiment to increase slightly to 83.0.

3:00 PM: Consumer Credit for October. The consensus is for credit to increase $10.0 billion.

Friday, November 30, 2012

Goldman Sachs: "Moving Over the Hump"

by Calculated Risk on 11/30/2012 08:25:00 PM

To end the week on a slightly upbeat note, here is a multi-year forecast from Goldman Sachs economists Jan Hatzius and Sven Jari Stehn: The US Economy in 2013-2016: Moving Over the Hump. A couple of excerpts, first on next year:

We expect US economic growth to remain below 2% in the first half of 2013. The step-up in the pace of fiscal retrenchment is likely to outweigh the healing in the private sector and the bounce-back from the disruptions associated with Hurricane Sandy. The risk to our forecast is tilted to the downside; a full fiscal cliff outcome would likely result in renewed recession. ... But ... growth is likely to improve starting in the second half of 2013.And over the next few years:

emphasis added

The key theme of our 2013-2016 economic forecasts is the “great race” between recovery in the private sector and an offsetting contraction in the government sector. ... Beyond 2013, however, we see a pickup to an above-trend growth pace as the fiscal drag abates to ½%-1% of GDP. ... the private sector is likely to deliver an impulse of around 1½ percentage points to real GDP growth in 2014-2015. Even with a continued drag from fiscal policy, this should result in solidly above-trend growth of 3% or a bit more. This would still not be a very rapid recovery by the standards of past cycles, but it would be clearly better than the 2%-2½% seen in the recovery so far.Goldman sees housing starts at a 900 thousand annual rate in the first half of 2013, and around 1 million in the 2nd half of next year They are forecasting new home sales at around a 400 thousand annual rate in the 1st half, and picking up to close to around 500 thousand (annual rate) in Q4. Not mentioned in the note (I was on the conference call earlier), the Goldman forecast for the S&P500 is 1575 by the end of 2013.

Happy Friday to all!

Fannie Mae, Freddie Mac Mortgage Serious Delinquency rates declined in October

by Calculated Risk on 11/30/2012 05:01:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in October to 3.35% from 3.41% September. The serious delinquency rate is down from 4.00% in October last year, and this is the lowest level since March 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 3.31%, from 3.37% in September. Freddie's rate is down from 3.54% in October 2011, and this is the lowest level since August 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

In 2009, Fannie's serious delinquency rate increased faster than Freddie's rate. Since then, Fannie's rate has been falling faster - and now the rates are at about the same level.

Although this indicates ongoing progress, the "normal" serious delinquency rate is under 1% - and it looks like it will take several years until the rates back to normal.

Restaurant Performance Index indicates contraction in October

by Calculated Risk on 11/30/2012 12:08:00 PM

From the National Restaurant Association: Restaurant Performance Index Fell to its Lowest Level in 14 Months as Operator Optimism Plunged

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.5 in October, down 0.9 percent from September. In addition, October represented the first time in 14 months that the RPI fell below 100, which signifies contraction in the index of key industry indicators.

“Although restaurant operators overall continued to report positive same-store sales in October, their short-term outlook for sales growth and the economy is decidedly more pessimistic,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Nearly two out of five restaurant operators expect business conditions to worsen in the next six months, which is double the proportion that expect conditions to improve.”

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 99.3 in October – down 0.6 percent from a level of 99.9 in September. While same-store sales remained positive in October, declines in the labor and customer traffic indicators outweighed the performance, which resulted in a Current Situation Index reading below 100 for the third time in the last four months.

Click on graph for larger image.

Click on graph for larger image.The index declined to 99.5 in October, down from 100.4 in September (below 100 indicates contraction).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

The impact of Sandy on PCE, Chicago PMI at 50.4

by Calculated Risk on 11/30/2012 10:00:00 AM

I've receive several questions about the impact of Hurricane Sandy on PCE. Sandy hit New York city on October 29th.

We have an example of a hurricane hitting at the end of a month. Katrina hit on August 29, 2005, so we can look back at the real PCE numbers then.

July, 2005: $8,886.8 (Billions of chained (2005) dollars; seasonally adjusted at annual rates)

Aug, 2005: $8,854.9 (Katrina hit on Aug 29th, decline of $32 billion)

Sept, 2005: $8,817.0 (decline of $37 billion)

Then PCE increased in October and November to $8,833.8 and $8,878.4, respectively.

This time for real PCE:

Sept, 2012: $9,641.9

Oct, 2012: $9,612.4 (Sandy hit on Oct 29th, decline of $29 billion)

So Sandy will probably impact November PCE, and any impact on PCE from the storm will be mostly over in December.

From Joe Joe Weisenthal at Business Insider: CHICAGO PMI RISES TO 50.4 — But Huge Drop In New Orders

ChicagoPMI rose back ... 50.4 was a hair shy of estimates.Above 50 is expansion and this follows two months of contraction. Last month the Chicago PMI was at 49.9.

The new orders index fell to 45.3 from 50.6.

On the other hand, employment rose to 55.2 from 50.3.

Personal Income unchanged in October, Spending decreased 0.2%

by Calculated Risk on 11/30/2012 08:47:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $0.4 billion, or less than 0.1 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $20.2 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

The October estimates of personal income and outlays reflect the effects of Hurricane Sandy, which made landfall in the United States on October 29. The storm affected 24 states, with particularly severe damage in New York and New Jersey. BEA cannot quantify the total impact of the storm on personal income and outlays because most of the source data used to estimate these components reflect the effects of the storm and cannot be separately identified. However, BEA did make adjustments where source data were not yet available or did not reflect the effects of Sandy. The largest of these adjustments was for work interruptions, which reduced wages and salaries by about $18 billion (at an annual rate).

Real PCE -- PCE adjusted to remove price changes -- decreased 0.3 percent in October, in contrast to an increase of 0.4 percent in September. ... The price index for PCE increased 0.1 percent in October, compared with an increase of 0.3 percent in September. The PCE price index, excluding food and energy, increased 0.1 percent in October, the same increase as in September.

...

Personal saving -- DPI less personal outlays -- was $410.1 billion in October, compared with $391.3 billion in September. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 3.4 percent in October, compared with 3.3 percent in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. According to the BEA, Hurricane Sandy impacted PCE in October, but the BEA could not quantify the total impact - however PCE in October was weak.

A key point is the PCE price index has only increased 1.7% over the last year, and core PCE is up only 1.6%.

Thursday, November 29, 2012

Friday: October Personal Income and Outlays, Chicago PMI

by Calculated Risk on 11/29/2012 09:04:00 PM

A couple of articles on the fiscal slope negotiations:

Suzy Khimm at the WaPo has the initial White House proposal: The White House’s fiscal cliff proposal

Jonathan Weisman at the NY Times writes: G.O.P. Balks at White House Plan on Fiscal Crisis

Treasury Secretary Timothy F. Geithner presented the House speaker, John A. Boehner, a detailed proposal on Thursday to avert the year-end fiscal crisis with $1.6 trillion in tax increases over 10 years, $50 billion in immediate stimulus spending, home mortgage refinancing and a permanent end to Congressional control over statutory borrowing limits.For the economy this proposal would resolve the "fiscal cliff" uncertainty, significant reduce the fiscal drag, and also reduce the deficit. Of course there are other agendas too - this proposal is a starting point - but hopefully eliminating the debt ceiling nonsense is part of the final agreement.

My guess is an agreement will be reached, perhaps in early January after the tax cuts expire, so politicians can claim to be cutting taxes.

Friday:

• At 8:30 AM, the Personal Income and Outlays report for October will be released. The consensus is for a 0.3% increase in personal income in October, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for November. The consensus is for an increase to 50.3, up from 49.9 in October.

The last question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Freddie Mac: Mortgage Rates Near Record Lows

by Calculated Risk on 11/29/2012 05:05:00 PM

From Freddie Mac today: Mortgage Rates Virtually Unchanged

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates virtually unchanged and remaining near their record lows ...

30-year fixed-rate mortgage (FRM) averaged 3.32 percent with an average 0.8 point for the week ending November 29, 2012, up from last week when it averaged 3.31 percent. Last year at this time, the 30-year FRM averaged 4.00 percent.

15-year FRM this week averaged 2.64 percent with an average 0.6 point, up from last week when it averaged 2.63 percent. A year ago at this time, the 15-year FRM averaged 3.30 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a significant refinance boom, and refinance activity has picked up.

There has also been an increase in refinance activity due to HARP.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.The y-intercept is around 2.6%, so if the 10 year Treasury yield falls to zero, 30 year mortgage rates would still be around 2.6% (using this fit).

Currently the 10 year Treasury yield is 1.62% and 30 year mortgage rates are at 3.32%.

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).Note: Mortgage rates were at or below 5% back in the 1950s.

A few comments on GDP Revision and Unemployment Claims

by Calculated Risk on 11/29/2012 02:21:00 PM

• GDP Revision: Although Q3 real GDP growth was revised up from 2.0% annualized to 2.7%, the underlying details were disappointing. There were three main sources for the revision: 1) Personal consumption expenditures (PCE) increased at a 1.4% annualized rate, revised down from 2.0%. This means PCE contributed 0.99 percentage points to real growth in Q3 (revised down from a 1.42 percentage point contribution in the advance release), and 2) the change in private inventories added 0.77 percentage point contribution to growth (revised up from -0.12), and 3) exports were revised up to a 0.16 percentage point contribution (revised up from -0.23).

This suggests weaker final demand in the US than originally estimated.

Also Justin Wolfers at Bloomberg discusses the weak Gross Domestic Income (GDI) data: The Bad News in Today's Happy Growth Report. Sluggish growth continues.

• Unemployment Claims: A reader sent me some "analysis" on the initial weekly unemployment claims report released this morning that was incorrect. The writer wrote that the 1) the 4-week moving average was at the highest level this year, 2) that there were 30,603 fewer layoffs in New York "last week", so 3) the recent increase in the 4-week average can't be blamed on Hurricane Sandy.

The first point is correct. The 4-week average is at the highest level since October 2011, but the conclusion about not blaming Sandy is incorrect.

First, the initial claims data is very noisy, so most analysts use the 4-week average to smooth out the noise. When an event happens - like Hurricanes Katrina in 2005 or Sandy this year - the 4-week average lags the event. Here is the unemployment claims data for the last 10 weeks:

| Week Ending | Initial Claims (SA) | 4-Week Average |

|---|---|---|

| 9/22/2012 | 363,000 | 375,000 |

| 9/29/2012 | 369,000 | 375,500 |

| 10/6/2012 | 342,000 | 364,750 |

| 10/13/2012 | 392,000 | 366,500 |

| 10/20/2012 | 372,000 | 368,750 |

| 10/27/2012 | 363,000 | 367,250 |

| 11/3/2012 | 361,000 | 372,000 |

| 11/10/2012 | 451,000 | 386,750 |

| 11/17/2012 | 416,000 | 397,750 |

| 11/24/2012 | 393,000 | 405,250 |

It is no surprise that the 4-week average increased this week. The 363,000 claims for the week ending Oct 27th were dropped out of the average and replaced with the 393,000 initial claims this week - so the 4-week average increased even though initial unemployment claims are declining.

The 4-week average will probably increase again next week as the 361,000 claims for the week ending Nov 3rd will be replaced with the claims for this week. Note: There are some large seasonal adjustment this time of year - especially the week after Thanksgiving - so it is hard to predict the level of claims. But the math is simple.

The good news is in two weeks the 451,000 claims for the week of Nov 10th will be dropped out of the 4-week average.

Key point: the 4-week average is intended to smooth out noise, but it lags events.

The writer's conclusion about 30,603 fewer layoffs in New York "last week" so the increase in the 4-week average can't be blamed on hurricane Sandy are incorrect. As part of the weekly release, the DOL notes the UNADJUSTED state data for the PREVIOUS week. The headline number was for the week ending Nov 24th, but the unadjusted state data was for Nov 17th.

The state data for New York showed a large decline, but the week before the New York data showed an even large increase. Since this data is unadjusted, we can't tell if claims are still elevated in New York, but since the increase for the week ending Nov 10th was much larger than the decrease for the week ending Nov 17th, my guess would be that claims are still above normal.

The bottom line is the recent increase in unemployment claims is most likely due to Hurricane Sandy, and there is nothing in the data that would suggest otherwise. And using simple arithmetic, we'd expect the 4-week average to lag the event. The state data supports this view, and I expect the 4-week average to increase again next week, and then start declining the following week (although there can be large seasonal effects this time of year, so we could be off a week or two).

Kansas City Fed: Regional Manufacturing Activity "Eased Further" in November

by Calculated Risk on 11/29/2012 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Eased Further

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity eased further in November, while producers’ expectations were unchanged from last month at modestly positive levels.Most of the regional manufacturing surveys were weak in November (Richmond was the exception).

“We saw a decline in regional factory activity for the second straight month, and firms have put hiring plans on hold for the next six months” said Wilkerson. “However, overall production and capital spending are expected to rise moderately in coming months.”

...

Several contacts noted uncertainties about the upcoming fiscal cliff, and a few producers cited delayed deliveries and reduced orders from the East Coast as a result of the Hurricane Sandy. Price indexes moderated slightly.

The month-over-month composite index was -6 in November, down from -4 in October and 2 in September. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. This marked the first time the composite index has been negative for two straight months since mid-2009. Manufacturing slowed at durable goods-producing plants, while nondurable factories reported a slight uptick in activity, particularly for food and plastics products. Other month-over-month indexes were mixed in November. The production index was unchanged at -6, while the new orders and order backlog indexes declined for the third straight month to their lowest levels in three years. In contrast, the employment index increased from -6 to 0, and the shipments and new orders for exports indexes were less negative.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM index for November will be released Monday, Dec 3rd, and these surveys suggest another weak reading.

NAR: Pending Home Sales Index increases in October

by Calculated Risk on 11/29/2012 10:16:00 AM

From the NAR: Pending Home Sales Rise in October to Highest Level in Over Five Years

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 5.2 percent to 104.8 in October from an upwardly revised 99.6 in September and is 13.2 percent above October 2011 when it was 92.6. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December. However, because of the increase in short sales that take longer to close, some of these contract signings are probably for next year.

...

Outside of a few spikes during the tax credit period, pending home sales are at the highest level since March 2007 when the index also reached 104.8. On a year-over-year basis, pending home sales have risen for 18 consecutive months.