by Calculated Risk on 12/07/2012 08:30:00 AM

Friday, December 07, 2012

November Employment Report: 146,000 Jobs, 7.7% Unemployment Rate

From the BLS:

Total nonfarm payroll employment rose by 146,000 in November, and the unemployment rate edged down to 7.7 percent, the U.S. Bureau of Labor Statistics reported today.

...

Hurricane Sandy made landfall on the Northeast coast on October 29th, causing severe damage in some states. Nevertheless, our survey response rates in the affected states were within normal ranges. Our analysis suggests that Hurricane Sandy did not substantively impact the national employment and unemployment estimates for November.

...

The change in total nonfarm payroll employment for September was revised from +148,000 to +132,000, and the change for October was revised from +171,000 to +138,000.

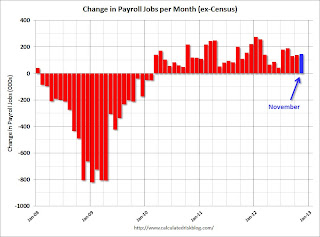

Click on graph for larger image.

Click on graph for larger image.There was uncertainty about this report because of Hurricane Sandy.

The headline number was above expectations of 80,000, but both September and October payroll growth was revised down.

The second graph shows the unemployment rate. The unemployment rate declined to 7.7%.

The unemployment rate is from the household report.

The unemployment rate is from the household report.The unemployment rate declined because of lower participation (a decline in the civilian labor force).

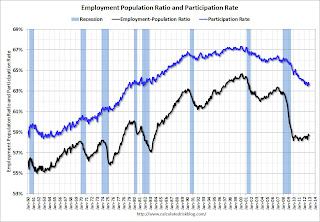

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 63.6% in November (blue line. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 63.6% in November (blue line. This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio decreased to 58.7% in November (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

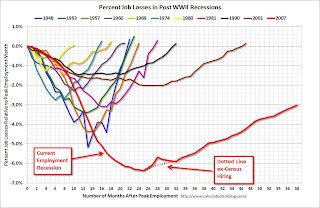

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

With all the uncertainty about the impact of Hurricane Sandy, this was a decent report, especially with the decline in the unemployment rate. However, negatives include the downward revisions to prior months, and the decline in the participation rate. I'll have much more later ...

Thursday, December 06, 2012

Friday: Employment Report, Consumer Sentiment

by Calculated Risk on 12/06/2012 08:26:00 PM

A couple of employment report preview articles, first from Patti Domm at CNBC: Short-Term Jobs Hit Expected From Sandy

The markets are ... likely to take the number in stride because the impact from the hurricane should be temporary and ultimately turn into a positive by adding jobs in construction and other areas. "If there was ever a number that people could look past, it would be this one," said Deutsche Bank chief U.S. economist Joseph LaVorgna.And from Neil Irwin at the WaPo: The jobs report Friday is going to be a giant mess

LaVorgna's forecast is at the low end. He expects just 25,000 jobs in total were created in November ...

[W]ith all [the] layers of uncertainty, it’s hard to imagine any number that would count as a total surprise. BNP Paribas, for example, expects payroll gains of only 25,000 positions, which would be the weakest in more than two years. Economist Julia Coronado notes that her week forecast is “entirely attributable to disruptions associated with Hurricane Sandy,” which could bode well for the longer-term, as the impacts of the storm on the job market seem to be reversing quickly.Irwin makes a good point; the state level data will be especially useful this month.

It will be possible to filter out the effects of the storm and glean what happened in the economy more broadly last month, but not until December 21. That is when the Labor Department releases state jobs numbers; a data set that is often overlooked, it will be parsed to filter out the effect of job losses in New Jersey, New York, and other affected places.

Friday economic releases:

• At 8:30 AM ET, the BLS will release the Employment Report for November. The consensus is for an increase of 80,000 non-farm payroll jobs in November; there were 171,000 jobs added in October. The impact from Hurricane Sandy will show up in the November report. The consensus is for the unemployment rate to increase to 8.0% in November, up from 7.9% in October.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for December) will be released. The consensus is for sentiment to increase slightly to 83.0.

• At 3:00 PM, the Consumer Credit for October will be released. The consensus is for credit to increase $10.0 billion.

Employment Situation Preview

by Calculated Risk on 12/06/2012 03:09:00 PM

On Friday, at 8:30 AM ET, the BLS will release the employment report for November. The consensus is for an increase of 80,000 non-farm payroll jobs in November, down sharply from the 171,000 jobs added in October. The decline is probably due to Hurricane Sandy. The consensus is for the unemployment rate to increase to 8.0%.

There are some interesting timing issues, from Phil Izzo at the WSJ: Jobs Report Likely to Tell Two Different Tales

In most months, the survey of households, which is used to calculate the unemployment rate, and the survey of businesses, which determines the number of jobs added or lost for the month, are both based on data from the week of the 12th of the month. But because the survey of households requires phone calls to thousands of homes, the government moved it up a week in November to avoid conflicting with Thanksgiving. The business survey stayed in its usual week. So in tomorrow’s report, the payroll survey will show how many people were working the week of Nov. 12, while the unemployment rate will be based on who was working the week of Nov. 5.Since Hurricane Sandy made landfall on October 29th, the household survey (conducted earlier) might be impacted more by the storm than the establishment survey.

Here is a summary of recent data:

• The ADP employment report showed an increase of 118,000 private sector payroll jobs in November. This was slightly below expectations. The ADP report hasn't been very useful in predicting the BLS report for any one month, although the methodology changed last month. In general this suggests employment growth in line with expectations.

• The ISM manufacturing employment index declined in November to 48.4%, down from 52.1%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased about 26,000 in November.

The ISM non-manufacturing (service) employment index decreased in November to 50.3%, down from 54.9% in October. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for services, suggests that private sector BLS reported payroll jobs for services increased about 69,000 in November.

Added together, the ISM reports suggests about 40,000 jobs added in November. Ouch.

• Initial weekly unemployment claims averaged about 400,000 in November. This was up sharply due to Hurricane Sandy.

For the BLS reference week (includes the 12th of the month), initial claims were at 416,000; the highest for a reference week this year.

• The final November Reuters / University of Michigan consumer sentiment index increased to 82.7, up slightly from the October reading of 82.6. This is frequently coincident with changes in the labor market and stock market, but also strongly related to gasoline prices and other factors. This might suggest some increase in employment, but the level still suggests a weak labor market.

• The small business index from Intuit showed 30,000 payroll jobs added, up from 5,000 in October. That is some improvement.

• And on the unemployment rate from Gallup: U.S. Unadjusted Unemployment Shoots Back Up

U.S. unemployment, as measured by Gallup without seasonal adjustment, was 7.8% for the month of November, up significantly from 7.0% for October. Gallup's seasonally adjusted unemployment rate is 8.3%, nearly a one-point increase over October's rate.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats). So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate, but this does suggest an increase in November.

• Conclusion: The employment related data was pretty weak in November, and I expect the unemployment rate to increase and hiring to be weak; I think less than 80,000 jobs were added in November.

Fed's Q3 Flow of Funds: Household Mortgage Debt down $1.15 Trillion from Peak

by Calculated Risk on 12/06/2012 12:32:00 PM

The Federal Reserve released the Q3 2012 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q3 compared to Q2 2011. Net worth peaked at $67.3 trillion in Q3 2007, and then net worth fell to $51.2 trillion in Q1 2009 (a loss of $16.1 trillion). Household net worth was at $64.8 trillion in Q3 2012 (up $13.6 trillion from the trough, but still down $2.5 trillion from the peak).

The Fed estimated that the value of household real estate increased $301 billion to $17.2 trillion in Q3 2012. The value of household real estate is still $5.5 trillion below the peak.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased in Q3.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2012, household percent equity (of household real estate) was at 44.8% - up from Q2, and the highest since Q1 2008. This was because of both an increase in house prices in Q3 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 44.8% equity - and over 10 million have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $86 billion in Q3. Mortgage debt has now declined by $1.15 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up slightly in Q3 (as house prices increased), but is still near the lows of the last 30 years. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting still more deleveraging ahead for households.

Update: Mortgage Debt Relief Act

by Calculated Risk on 12/06/2012 10:15:00 AM

The Mortgage Debt Relief Act of 2007 is set to expire at the end of 2012 and this could have a significant impact on short sales. Usually cancelled debt is considered income, but a provision of the Debt Relief Act allowed borrowers "to exclude certain cancelled debt on [a] principal residence from income. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief." (excerpt from IRS).

If this act isn't extended, short sales could decline sharply. From Paul Reid, a Redfin real estate agent, writes:

"In an area like Orange County, where I work, the REO inventory is [minuscule]. As of this morning, there are 104 ‘Active’ REOs on the MLS in the entire county. In comparison, there is a total ‘Active’ inventory of 3,504 homes and condos. The short sale ‘Active’ inventory is 335. Where the numbers really stick out is in the ‘Pending’ sales category. As of right now, there are 6,059 homes in Orange County in escrow. Of those, only 267 homes are REOs. More than half, 3,216 homes, are short sales. The remainder are standard sales. If you remove the relief act from the equation you would likely see a significant drop in the number of short sales, but because of how slow the REO process is, you wouldn’t likely see a proportionate increase in the number of REO listings."Right now there are a large number of pending short sales in many distressed areas. They all will not close before the end of the year.

There is a bipartisan push to have Congress extend the mortgage debt relief act. Here is a recent letter from several state attorneys general urging Congress to act.

As signatories to the National Mortgage Settlement, we the undersigned state attorneys general write to urge you to pass legislation extending tax relief for citizens who have mortgage debt canceled or forgiven because of financial hardship or a decline in housing values. Such legislation is currently included in Section 112 of the Family and Business Tax Cut Certainty Act of 2012 (S. 3521), which was recently passed out of the Senate Finance Committee with bipartisan support. We strongly urge Congress to extend this critical tax exclusion, which expires on December 31, 2012, so that distressed homeowners are not stuck with an unexpected tax bill or deterred from participating in this historic settlement.I expect this act to be extended, but you never know.

...

Under the federal Mortgage Debt Relief Act, in effect since 2007, mortgage debt that is forgiven after a foreclosure or short sale or through a loan modification provided to a homeowner in financial hardship may be excluded from a taxpayer’s calculation of taxable income. This exclusion only applies to mortgage debt forgiven on primary residences, not second homes. Unfortunately, this tax exclusion expires on December 31, 2012. Therefore, unless Congress acts, all of the remaining debt relief to be provided in 2013 under the National Mortgage Settlement, as well as other mortgage debt relief programs, will likely be considered taxable income. According to the Congressional Budget Office, failure to extend this tax exclusion will result in $1.3 billion in tax increases on the very families who can least afford it.

Weekly Initial Unemployment Claims decline to 370,000

by Calculated Risk on 12/06/2012 08:30:00 AM

The DOL reports:

In the week ending December 1, the advance figure for seasonally adjusted initial claims was 370,000, a decrease of 25,000 from the previous week's revised figure of 395,000. The 4-week moving average was 408,000, an increase of 2,250 from the previous week's revised average of 405,750.The previous week was revised up from 393,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 408,000.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in NY, NJ and other impacted areas over the 4-week period (some of those areas saw another decline this week). Note the spike in 2005 was related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were lower than the consensus forecast.

And here is a long term graph of weekly claims:

We use the 4-week average to smooth out noise, but following an event like Hurricane Sandy, the 4-week average lags the event. It looks like the average should decline next week to around 390,000 and should continue to decline over the next few weeks.

Wednesday, December 05, 2012

Thursday: Weekly Unemployment Claims, Flow of Funds Report

by Calculated Risk on 12/05/2012 08:57:00 PM

"Laws, like sausages, cease to inspire respect in proportion as we know how they are made."John Godfrey Saxe, 1869.

Watching politician's public statements is definitely not inspiring. But here are a couple of articles, first from CNBC: Geithner: Ready to Go Over 'Cliff' If Taxes Don't Rise

Treasury Secretary Timothy Geither told CNBC Wednesday that Republicans are "making a little bit of progress" in "fiscal cliff" talks but said the Obama administration was "absolutely" ready to go over the cliff if the GOP doesn't agree to raise tax rates on the wealthy.I'm pretty sure that tax rates will increase on high earners, and this is why I think the agreement will not be reached until early January (so policitians can say they didn't increases taxes).

And from the WSJ: White House Unyielding on Debt Limit

The White House hardened its position that Congress should raise the U.S.'s borrowing limit without preconditions, adding an unpredictable new element into the high-stakes budget talks.I argued a year and a half ago, eliminating the debt ceiling would be the correct approach.

In a Wednesday speech to top corporate chiefs, President Barack Obama said he wouldn't negotiate with Republicans on this issue as he did in 2011.

"I want to send a very clear message to people here: We are not going to play that game next year," Mr. Obama said in remarks to the Business Roundtable, a trade group. He said Washington needs to "break that habit before it starts," referring to the way Republicans would like to use the debt limit to negotiate further spending cuts.

On the debt ceilng, it seems like Obama is taking a page from Ronald Reagan:

"Congress consistently brings the Government to the edge of default before facing its responsibility. This brinkmanship threatens the holders of government bonds and those who rely on Social Security and veterans benefits. Interest rates would skyrocket, instability would occur in financial markets, and the Federal deficit would soar. The United States has a special responsibility to itself and the world to meet its obligations. It means we have a well-earned reputation for reliability and credibility – two things that set us apart from much of the world."We don't know what else we be in the compromise, but it will obviously not be eliminating "unspecified deductions" - if deductions are eliminated, then they have to be specified (by definition). I still think a compromise will be reached, but probably not until early January. Right now the public statements are pretty fair apart.

Thursday economic releases:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. This is expected to show a further decline following the spike related to Hurricane Sandy. The consensus is for claims to decrease to 380 thousand from 393 thousand.

• At 12:00 PM, Q3 Flow of Funds Accounts of the United States from the Federal Reserve. Household mortgage debt probably declined further in Q3.

Lawler: On the upward trend in Real House Prices

by Calculated Risk on 12/05/2012 01:52:00 PM

CR NOTE: This is a very long piece from economist Tom Lawler on long term house prices. I've written about this before, The upward slope of Real House Prices, and Tom digs much deeper into the data!

From Tom Lawler:

One of the most widely abused home price series used by folks is the long-term “real” home price chart constructed by Robert Shiller in his “Irrational Exuberance” book. While he and others have sometimes characterized his “time series” of “real” home prices back to 1890 as being a good representation of “constant quality” home prices, in fact that is not even remotely the case. There are especially serious issues with the “older” home price series used by Dr. Shiller, with the “most troubling” being that used for the 1890-1934 period. Indeed, the authors of the book from which the home price index used by Dr. Shiller came from actually argued that this index did NOT reflect the behavior of “constant-quality” home price (with evidence to support that argument), and suggested using a materially different home price index. More on this point later.

When Dr. Shiller decided to explore home prices, and especially what appeared to be a housing “bubble,” he was “most surprised” that there were no “good” data going back prior to 1987 – with “good” defined as the Case-Shiller HPI.. But he wanted to “show” last decade’s house price runup in a long-term historical context. So he decided to take various home price sources, and attempt to construct a “long run” home price index by “concatenating” time series based on these sources.

Not surprisingly, from 1987 to the present Shiller used the “national” S&P/Case-Shiller home price index, which is a market-value weighted (using values from the various decennial Censuses, which unfortunately are not available for 2010. This “national” index is estimated to cover just over 70% of the US housing market.

From 1975 to 1987 Shiller used the “national” FHFA (formerly OFHEO) home price index, which is a unit-weighted index (using annually-updated estimates of states’ share of the housing stock) based on repeat sales transactions AND appraisal information on refinances of homes backing mortgages owned or guaranteed by Fannie Mae or Freddie Mac. Aside from the obvious “dataset” limitations (GSE only) and use of appraisals, the “unit-weighting” can result in materially different behavior than “value-weighting” over time.

From 1953 to 1975 Shiller used the home price index from the BLS’ Consumer Price Index, which was based on a sample of new home purchases financed with FHA-insured loans. It probably is not the case, however, that new home prices financed with FHA-insured loans, which often represent a very small sample of total home purchases, reflected trends in “overall” home prices. Indeed, the BLS characterized the data base used as representing “a small and specialized segment of the housing market and presents BLS with increasingly serious estimation problems . Here is an excerpt from a BLS paper discussing the 1983 change in the treatment of shelter costs for homeowners in the CPI.

LPS: Mortgage Delinquency Rates decreased in October

by Calculated Risk on 12/05/2012 12:20:00 PM

LPS released their Mortgage Monitor report for October today. According to LPS, 7.03% of mortgages were delinquent in October, down from 7.40% in September, and down from 7.58% in October 2011.

LPS reports that 3.61% of mortgages were in the foreclosure process, down from 3.87% in September, and down from 4.30% in October 2011.

This gives a total of 10.64% delinquent or in foreclosure. It breaks down as:

• 1,957,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,543,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,800,000 loans in foreclosure process.

For a total of 5,300,000 loans delinquent or in foreclosure in October. This is down from 5,640,000 last month, and down from 6,111,000 in October 2011.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

From LPS:

The October Mortgage Monitor report released by Lender Processing Services (NYSE: LPS) showed a significant decline in foreclosure starts for the last two months – down 21.9 percent in October and almost 48 percent on a year-over-year basis – leading to a nearly 7 percent drop in overall foreclosure inventory. However, as LPS Applied Analytics Senior Vice President Herb Blecher explained, this fall-off in foreclosure starts is likely a temporary phenomenon, driven by new borrower notification requirements called for in the National Mortgage Settlement.

“LPS observed a drop-off in foreclosure starts in September that accelerated in October,” Blecher said. “This decline coincided with the implementation of new procedural changes outlined in the National Mortgage Settlement, which requires, among other things, that mortgage servicers provide written notice to borrowers 14 days prior to referring a delinquent loan to a foreclosure attorney. This has resulted in what is likely a temporary slowdown in foreclosure starts that we do not believe is indicative of a longer-term trend. However, we will continue to monitor this activity closely in the coming months.”

The second graph shows a break down of home sales by conventional, foreclosure and short sale.

The second graph shows a break down of home sales by conventional, foreclosure and short sale.As the housing market slowly recovers, we'd expect distressed sales to decline and conventional sales to increase. This appears to be starting.

There is much more in the mortgage monitor.

ISM Non-Manufacturing Index increases in November

by Calculated Risk on 12/05/2012 10:00:00 AM

The November ISM Non-manufacturing index was at 54.7%, up from 54.2% in October. The employment index decreased in November to 50.3%, down from 54.9% in October. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 35th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 54.7 percent in November, 0.5 percentage point higher than the 54.2 percent registered in October. This indicates continued growth at a slightly faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 61.2 percent, which is 5.8 percentage points higher than the 55.4 percent reported in October, reflecting growth for the 40th consecutive month. The New Orders Index increased by 3.3 percentage points to 58.1 percent. The Employment Index decreased by 4.6 percentage points to 50.3 percent, indicating growth in employment for the fourth consecutive month but at a slower rate. The Prices Index decreased 8.6 percentage points to 57 percent, indicating prices increased at a slower rate in November when compared to October. According to the NMI™, 11 non-manufacturing industries reported growth in November. Respondents' comments are mixed; however, the majority of survey respondents reflect a cautious optimism about current economic conditions."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.6% and indicates faster expansion in November than in October. The internals were mixed with the employment index down, but new orders up.

ADP: Private Employment increased 118,000 in November

by Calculated Risk on 12/05/2012 08:24:00 AM

Private sector employment increased by 118,000 jobs from October to November, according to the November ADP National Employment Report®, which is produced by Automatic Data Processing, Inc. (ADP®) ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. The October 2012 report, which reported job gains of 158,000, was revised down by 1,000 to 157,000 jobs.This was below the consensus forecast for 125,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 80,000 payroll jobs in November, on a seasonally adjusted (SA) basis.

Mark Zandi, chief economist of Moody’s Analytics, said, “Superstorm Sandy wreaked havoc on the job market in November, slicing an estimated 86,000 jobs from payrolls. The manufacturing, retailing, leisure and hospitality, and temporary help industries were hit particularly hard by the storm. Abstracting from the storm, the job market turned in a good performance during the month. This is especially impressive given the uncertainty created by the Presidential election and the fast-approaching fiscal cliff. Businesses appear to be holding firm on their hiring and firing decisions.”

ADP hasn't been very useful in predicting the BLS report, but maybe the new method will work better. This is the 2nd month for the new method.

MBA: Mortgage Applications increase, Record Low Mortgage Rates

by Calculated Risk on 12/05/2012 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 0.1 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.52 percent, matching the lowest rate in the history of the survey, from 3.53 percent, with points increasing to 0.41 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index had been mostly moving sideways over the last two years, however the purchase index has increased 9 of the last 11 weeks. The 4-week average of the purchase index is at the highest level since 2010 (when the tax credit boosted application activity).

The 4-week average is up about 25% from the low in 2011.

Tuesday, December 04, 2012

Wednesday: ISM Service, ADP Employment

by Calculated Risk on 12/04/2012 08:45:00 PM

Oh my. From Business Insider: 47% Of People Think The Deficit Would INCREASE If We Go Over The Fiscal Cliff

Were the United States to "go over the fiscal cliff," what do you expect would happen to the National Deficit?The so-called "fiscal cliff" would cut spending and raise taxes, and the deficit would decrease very quickly. The key concern is that the CBO's analysis suggests a rapid decrease in the deficit will lead to a recession in 2013. That is why a better name is "austerity slope" or something similar.

At least according to the CBO and most economists, the correct answer is that "It will decrease." Going over the Fiscal Cliff would, according a Congressional Budget Office study, result in a reduction in the National Deficit of $607 billion between fiscal years 2012 and 2013.

However that was not the most popular answer. Per the survey, 47.4% of respondents said that the deficit would INCREASE if we went over the Fiscal Cliff. Only 12.6% think it will decrease.

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for November will be released. This report is for private payrolls only (no government). The consensus is for 125,000 payroll jobs added in November. This is the second report using a new methodology, and the report last month (158,000) was fairly close to the BLS report for private employment (the BLS reported 184,000 private sector jobs added in November).

• At 10:00 AM, the ISM non-Manufacturing Index (Service) for November will be released. The consensus is for a decrease to 53.6 from 54.2 in October. Note: Above 50 indicates expansion, below 50 contraction.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1% decrease in orders.

Another question for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Manufacturing: ISM PMI vs. Markit

by Calculated Risk on 12/04/2012 05:55:00 PM

The ISM manufacturing index indicated contraction in November, with the PMI declining to 49.5% (below 50 is contraction). A couple of weeks ago, the Markit PMI increased to 52.4 from 51.0 in October - a five month high - suggesting "moderate" expansion.

Which was it? Contraction or expansion?

Chris Williamson, Markit chief economist wrote today (ht NW): Divergence in ISM and Markit survey headline indicators masks consistent picture of sluggish expansion in fourth quarter

Two barometers of US manufacturing business conditions moved in different directions in November, but if examined in more detail both tell a similar story of modest expansion of manufacturing output so far in the fourth quarter.Of course this commentary was from Markit (the ISM index has a much longer history). And, however we look at the data, manufacturing is clearly weak.

...

the PMIs are composite indicators derived from various survey questions, and although using the same indexes, the two surveys have different weights for each component. While the headline composite indexes from the two surveys did diverge, the discrepancies are smaller when you look at the subindices.

...

When the Output Indexes from the two surveys are compared against the three-month change in official production data (a widely used comparison for survey and official data), the Markit index has a correlation of 94% compared with 87% for the ISM data (this is based in both cases on the data from mid-2007 onwards, when Markit data were first available).

Tim Duy at EconomistsView has more: Apples and Oranges in the Manufacturing Data?

Lawler: Single Family REO inventories down 21.7% in Q3

by Calculated Risk on 12/04/2012 03:00:00 PM

The following graph is from economist Tom Lawler and shows the total REO for Fannie, Freddie, FHA, Private Label (PLS) and FDIC insured institutions. This isn't all the REO, as Lawler noted before, it "excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts", but it is probably over 90%.

From Tom Lawler:

On the SF REO front, the [FDIC insured] industry’s “carrying value” of 1-4 family REO properties at the end of September was $8.7663 billion, down from 8.0% on the quarter and down 26.3% from a year ago. The FDIC neither reports on nor collects data on the number of 1-4 family REO properties held by FDIC-insured institutions, which is annoying. Assuming that the average carrying value of 1-4 family properties at such institutions is 50% higher than the average for Fannie and Freddie (which seems broadly consistently with other data sources on average UPB balances), then a chart showing SF REO inventories of Fannie, Freddie, FHA, private-label securities, and FDIC-insured institution would look as follows.

Click on graph for larger image.

Click on graph for larger image.

SF REO inventories for these combined sectors in September were down 21.7% from last September.

CR Note: There are still quite a few properties with loans 90+ days delinquent or in the foreclosure process, but it appears these institutions are working down the number of foreclosed properties they are holding.

FDIC reports Fewer Problem banks, Total REO Declines in Q3

by Calculated Risk on 12/04/2012 12:45:00 PM

The FDIC released the Quarterly Banking Profile for Q3 today.

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $37.6 billion in the third quarter of 2012, a $2.3 billion (6.6 percent) improvement from the $35.2 billion in profits the industry reported in the third quarter of 2011. This is the 13th consecutive quarter that earnings have registered a year-over-year increase. Increased noninterest income and lower provisions for loan losses accounted for most of the year-over-year improvement in earnings.The FDIC reported the number of problem banks declined:

Also noteworthy was a decline in the number of banks on the FDIC's "Problem List" from 732 to 694. This marked the sixth consecutive quarter that the number of "problem" banks has fallen, and the first time in three years that there have been fewer than 700 banks on the list. Total assets of "problem" institutions declined from $282 billion to $262 billion

Click on graph for larger image.

Click on graph for larger image.The dollar value of Real Estate Owned (REOs, foreclosure houses) declined from $9.5 billion in Q2 to $8.8 billion in Q3. This is the lowest level of REOs since Q1 2008. Even in good times, the FDIC insured institutions have about $2.5 billion in residential REO.

This graph shows the dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Trulia: Asking House Prices increased in November

by Calculated Risk on 12/04/2012 10:08:00 AM

Press Release: Home Prices Rebound in Hard-Hit Atlanta, Sacramento, and the Inland Empire at the Price Recovery Accelerates in November

In November, asking home prices rose 0.8 percent month-over-month (M-o-M), seasonally adjusted–which implies an annualized growth rate of 10 percent. Year-over-year (Y-o-Y) prices increased 3.8 percent, which was also the largest yearly increase to date. Quarter-over-quarter (Q-o-Q) prices rose 2.2 percent, seasonally adjusted, another post-crisis high; in fact, prices rose 0.8 percent Q-o-Q without adjusting for seasonality (not shown in table), even though prices typically decline after the summer. Excluding foreclosures, asking prices rose 4.3 percent Y-o-Y and 1.6 percent Q-o-Q, seasonally adjusted.These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a SA basis.

...

For the first time since the housing crisis began, Atlanta and two inland California metros—Riverside-San Bernardino and Sacramento—all experienced significantly large Q-o-Q asking home price gains. Unlike other hard-hit metros such as Phoenix, Las Vegas, and Miami, prices in these metros have been slower to bounce back, declining in February and making smaller gains in August and May.

...

Nationally, rents rose 5.6 percent Y-o-Y, outpacing the national price gain of 3.8 percent. However, asking prices in 14 of the 25 largest rental markets actually rose faster than rents as the price recovery picks up.

...

“The key factors behind today’s price gains are job growth, falling vacancies, and–above all–rebounding from the huge price declines of the housing bust,” said Jed Kolko, Trulia’s Chief Economist. “The latest metros to join the price rebound are Atlanta, Sacramento, and Riverside-San Bernardino. Now, all of the metros that suffered most during the bust have had year-over-year price gains.”

More from Jed Kolko, Trulia Chief Economist: Asking Price Gains Accelerate in November, but Local Differences Widen

CoreLogic: House Prices up 6.3% Year-over-year in October, Largest increase since 2006

by Calculated Risk on 12/04/2012 09:01:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Marks Eighth Consecutive Month of Year-Over-Year Gains

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 6.3 percent in October 2012 compared to October 2011. This change represents the biggest increase since June 2006 and the eighth consecutive increase in home prices nationally on a year-over-year basis. On a month-over-month basis, including distressed sales, home prices decreased by 0.2 percent in October 2012 compared to September 2012*. Decreases in month-over-month home prices are expected as the housing market enters the offseason.

...

Excluding distressed sales, home prices nationwide also increased on a year-over-year basis by 5.8 percent in October 2012 compared to October 2011. On a month-over-month basis excluding distressed sales, home prices increased 0.5 percent in October 2012 compared to September 2012, the eighth consecutive month-over-month increase. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that November 2012 home prices, including distressed sales, are expected to rise by 7.1 percent on a year-over-year basis from November 2011 and fall by 0.3 percent on a month-over-month basis from October 2012 as sales exhibit a seasonal slowdown going into the winter.

...

“The housing recovery that started earlier in 2012 continues to gain momentum," said Mark Fleming, chief economist for CoreLogic. “The recovery is geographically broad-based with almost all markets experiencing some appreciation. Sand and energy states continue to experience the most robust appreciation and some judicial foreclosure states are even recording increasing prices.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.2% in October, and is up 6.3% over the last year.

The index is off 27% from the peak - and is up 9.6% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eight consecutive months suggesting house prices bottomed earlier this year on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eight consecutive months suggesting house prices bottomed earlier this year on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in October, and will probably stay negative on a month-to-month basis until the March 2013 report is released. The key for the next several months will be to watch the year-over-year change.

Monday, December 03, 2012

Housing: Inventory down 22% year-over-year in early December

by Calculated Risk on 12/03/2012 09:07:00 PM

Tuesday economic releases:

• At 10:00 AM ET, Trulia Price & Rent Monitors for November. This is the index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 22% year-over-year and probably at the lowest level since the early '00s.

This graph shows the NAR estimate of existing home inventory through October (left axis) and the HousingTracker data for the 54 metro areas through early December.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. So inventory will probably decline a little further over the next month or so, before increasing again next year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early December listings, for the 54 metro areas, declined 21.7% from the same period last year.

HousingTracker reported that the early December listings, for the 54 metro areas, declined 21.7% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already very low. It seems very unlikely we will see 20%+ year-over-year declines next summer, but it does appear that inventory will be very low in 2013.

U.S. Light Vehicle Sales at 15.5 million annual rate in November, Highest Since 2007

by Calculated Risk on 12/03/2012 03:45:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 15.54 million SAAR in November. That is up 15% from November 2011, and up 9% from the sales rate last month. This is the highest level of sales since December 2007.

This was above the consensus forecast of 15.0 million SAAR (seasonally adjusted annual rate), however some of the increase was a bounce back from Hurricane Sandy that negatively impacted sales at the end of October.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 15.54 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

Sales have averaged a 14.4 million annual sales rate this year through November, up from 12.7 million rate for the same period of 2011. Last year sales were depressed for several months (May through August) due to supply chain issues related to the tsunami in Japan.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

Most (or all) of the month-to-month decline in October was related to Hurricane Sandy, and some of the sharp increase this month was a bounce back.