by Calculated Risk on 12/14/2012 03:07:00 PM

Friday, December 14, 2012

Economic Outlook: Where are we?

Once again we are nearing a political event horizon that could significantly impact the economy - and we can't see beyond the horizon. My baseline assumption is an agreement will be reached, probably during the first few weeks of January, and the agreement will mean Federal fiscal drag next year at about the level of the CBO's alternative fiscal scenario. This would suggest modest GDP and employment growth next year, although probably better than in 2012.

Note: There is no clear drop dead date for the "fiscal cliff". Nothing horrible happens on January 1st, but the longer it takes to reach an agreement next year, the larger the negative impact on the economy.

With that assumption, there are two key drivers for additional growth next year. The first is residential investment (construction employment lags investment with a lag, so construction employment should pick up in 2013), and the second is the end of the state and local drag. I've discussed both of these before - see: Two Reasons to expect Economic Growth to Increase - but I think this is worth repeating.

Over the last 3+ years, state and local governments have lost over 700 thousand payroll jobs (including the preliminary estimate of the benchmark revision) and it appears these layoffs are coming to an end. I don't expect state and local government to add much to economic and employment growth next year, but just stopping the drag will help.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

However the drag from state and local governments is ongoing, although the drag in Q3 was small. State and local governments have been a drag on GDP for twelve consecutive quarters. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

Yesterday, the Rockefeller Institute put out an update on state government revenues: State Tax Revenues Showed Continued Yet Slow Growth in the Third Quarter of 2012

The Rockefeller Institute's compilation of preliminary data from 47 states shows that collections from major tax sources increased by 2.1 in nominal terms in the third quarter of 2012 compared to the same quarter of 2011. Tax collections have now risen for 11 straight quarters, beginning with the first quarter of 2010. This growth followed five quarters of declines brought on by the Great Recession.Revenues are not increasing sharply, but they are increasing enough to probably stop most of the layoffs.

...

Among 47 early reporting states, 38 states reported gains while nine states reported declines in total tax revenue collections during the third quarter of 2012.

....

Overall, state tax revenues are showing continued improvement, though the pace of growth has been much slower in the recent quarters compared to historic averages. While state tax revenues have now grown for 11 consecutive quarters, they are still far below where they would have been in the absence of the Great Recession. Nationwide, state tax revenues in fiscal 2012 were less than 1 percent higher than fiscal 2008 in nominal terms. After adjusting for inflation, state tax revenues declined 5 percent in fiscal 2012 compared to fiscal 2008.

And from the NY Times: As State Budgets Rebound, Federal Cuts Could Pose Danger

A fiscal survey of states released Friday by the National Governors Association and the National Association of State Budget Officers found that states expect to collect $692.8 billion in general fund revenues this fiscal year, which is more than they collected in 2008, the last fiscal year before the recession.So there are some reasons for a little optimism, but it is difficult to make projections without knowing the budget agreement.

That is good news, but perhaps not as good as it initially appears. Adjusted for inflation, this year’s revenues are still expected to be 7.9 percent below the 2008 levels.

...

“What we’re really seeing here is there is not enough money to make up for any federal cuts,” said Scott D. Pattison, the executive director of the state budget officers’ association. “What I’ve heard from the state budget people is that they’ve told departments and agencies in state government: Do not expect us to have the money available, even if we wanted to, to make up for federal cuts.”

Key Measures show low inflation in November

by Calculated Risk on 12/14/2012 12:23:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in November. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for November here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.3% (-3.7% annualized rate) in November. The CPI less food and energy increased 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.8%, and the CPI less food and energy rose 1.9%. Core PCE is for October and increased 1.7% year-over-year.

On a monthly basis, median CPI was above the Fed's target at 2.3% annualized. However trimmed-mean CPI was at 1.6% annualized, and core CPI increased 1.4% annualized. Also core PCE for October increased 1.6% annualized. These measures suggest inflation is mostly below the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis. Also, the FOMC statement this week indicated the Fed will tolerate an inflation outlook "between one and two years ahead" of 2 1/2 percent.

So, with this low level of inflation and the current high level of unemployment, the Fed will keep the "pedal to the metal".

Industrial Production increased 1.1% in November, Bounces back following Hurricane Sandy

by Calculated Risk on 12/14/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.1 percent in November after having fallen 0.7 percent in October. The gain in November is estimated to have largely resulted from a recovery in production for industries that had been negatively affected by Hurricane Sandy, which hit the Northeast region in late October. In November, manufacturing output increased 1.1 percent after having decreased 1.0 percent in October; in addition to the storm-related rebound, a sizable rise in the production of motor vehicles and parts boosted factory output in November. The output of utilities advanced 1.0 percent, and production at mines rose 0.8 percent. At 97.5 percent of its 2007 average, total industrial production in November was 2.5 percent above its year-earlier level. Capacity utilization for total industry increased 0.7 percentage point to 78.4 percent, a rate 1.9 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

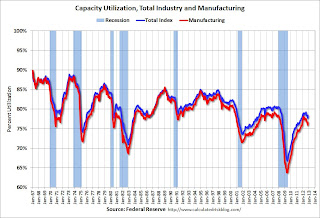

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.4% is still 1.9 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 97.5. This is 17% above the recession low, but still 3.2% below the pre-recession peak.

IP was above expectations due to the bounce back following Hurricane Sandy. Overall IP has only up 2.5% year-over-year.

BLS: CPI declines 0.3% in November, Core CPI increases 0.1%

by Calculated Risk on 12/14/2012 08:40:00 AM

From the BLS: Consumer Price Index - November 2012

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.3 percent in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment. The gasoline index fell 7.4 percent in November; this decrease more than offset increases in other indexes, resulting in the decline in the seasonally adjusted all items index.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was below the consensus forecast of a 0.2% decrease for CPI, and below the consensus for a 0.2% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in November after a 0.2 percent increase in October. ... The index for all items less food and energy rose 1.9 percent over the last 12 months, slightly lower than the October figure of 2.0 percent. The food index has risen 1.8 percent over the last 12 months, and the energy index has risen 0.3 percent.

The decrease in CPI was mostly due to the recent decline in gasoline prices. On a year-over-year basis, CPI is up 1.8 percent, and core CPI is up 1.9 percent. Both below the Fed's target.

Thursday, December 13, 2012

Friday: CPI, Industrial Production

by Calculated Risk on 12/13/2012 08:27:00 PM

A couple of articles for light evening reading:

From Derek Thompson at the Atlantic: The Best Idea for the Debt Ceiling? Abolish It Forever. It really should be called the "default ceiling". I've been arguing for years - since Reagan demanded a clean bill from Congress in the '80s - that the default ceiling is just for political grandstanding.

From Suzy Khimm at the Wonkblog: New language, same findings: Tax hikes on the rich won’t cripple the economy. Here is the updated Congressional Research Service report. The data speaks.

Note: I still expect some sort of compromise to be reached on the "fiscal cliff", probably in early January.

Thursday economic releases:

• At 8:30 AM ET, the Consumer Price Index for November will be released. The consensus is for CPI to decrease 0.2% in November and for core CPI to increase 0.2%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.3% increase in Industrial Production in November, and for Capacity Utilization to increase to 78.0%.

Another question for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

CoStar: Commercial Real Estate prices decrease slightly in October, Up 6% Year-over-year

by Calculated Risk on 12/13/2012 05:30:00 PM

From CoStar: Commercial Property Prices Show Little Movement in October Amid Economic Uncertainty

The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the equal-weighted U.S. Composite Index and the value-weighted U.S. Composite Index—saw very little change in the month of October 2012, dipping -0.1% and -0.8%, respectively, although both improved over quarter and year-ago levels. Recent pricing fluctuations likely signify a more cautious attitude among investors stemming from uncertainty over U.S. fiscal policy heading into 2013.

...

The number of distressed property trades in October fell to 14.8%, the lowest level witnessed since the first quarter of 2009. This reduction in distressed deal volume should result in higher, more consistent pricing, and lead to enhanced market liquidity, giving lenders more confidence to finance deals.

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 35.0% from the bottom (showing the demand for higher end properties) and up 6.1% year-over-year. However the Equal-Weighted index is only up 10.0% from the bottom, and up 5.9% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Sacramento November House Sales: Conventional Sales up 46% year-over-year

by Calculated Risk on 12/13/2012 02:44:00 PM

Note: I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement in the Sacramento market.

In November 2012, 47.6% of all resales (single family homes and condos) were distressed sales. This was down slightly from 47.7% last month, and down from 64.1% in November 2011. The is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs fell to 11.5%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 36.1%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were more than three times as many short sales as REO sales in November (the highest recorded). The gap between short sales and REO sales is increasing.

Total sales were up slightly from November 2011, and conventional sales were up 46% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 56.7% from last November, although listings were up 2% in November compared to October.

Cash buyers accounted for 37.1% of all sales (frequently investors), and median prices were up sharply year-over-year (the mix has changed).

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.

Will Housing Inventory Bottom in 2013?

by Calculated Risk on 12/13/2012 11:55:00 AM

Economist Jed Kolko at Trulia writes: Housing in 2013: What’s In, What’s Out. Kolko discusses five predictions for 2013, the first is on inventory:

1. OUT: Will Home Prices Bottom? IN: Will Inventories Bottom? The big question this year was whether home prices had finally hit bottom. We now know the answer is a resounding “Yes”: every major index shows asking and sales prices rising in 2012. The key question in 2013, though, is whether prices will rise enough so that for-sale inventory–which has fallen 43% nationally since the summer of 2010–will hit bottom and start expanding again. The sharp decline in inventory was a necessary correction to the oversupply of homes after the bubble, but now inventory is below normal levels and holding back sales, particularly in California and the rest of the West. Rising prices should lead to more inventory, for two reasons: (1) rising prices encourage new construction, and (2) rising prices encourage some homeowners to sell. The big question for 2013 is whether today’s price gains will continue strongly enough to encourage builders to build and homeowners to sell. Why it matters: more inventory will lead to more sales and give buyers more homes to choose from.This is a very important question for 2013. This graph shows nationwide inventory for existing homes through October.

Click on graph for larger image.

Click on graph for larger image.According to the NAR, inventory declined to 2.14 million in October down from 2.17 million in September. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

If we see the usually seasonal decline in December and January, then NAR reported inventory will probably fall to the 1.80 to 1.85 million range. That would be the lowest level since January 2001.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. When we compare inventory to earlier periods, we need to remember there were essentially no "short sale contingent" listings prior to 2006.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 21.9% year-over-year in October from October 2011. This was the 20th consecutive month with a YoY decrease in inventory. It appears that inventory will be down sharply YoY in November too.

Months of supply declined to 5.4 months in October and is now in the normal range. I expect months-of-supply will be under 5 in December and January for the first time since early 2005.

Whenever I talk with real estate agents, I ask why they think inventory is so low. A common answer is that people don't want to sell at the bottom. In a market with falling prices, sellers rush to list their homes, and inventory increases. But if sellers think prices have bottomed, then they believe they can be patient, and inventory declines. Another reason is that many homeowners are "underwater" on their mortgage and can't sell.

If prices increase enough (probably around 5% in 2012) then some of the potential sellers will come off the fence, and some of these underwater homeowners will be able to sell. It might be enough for inventory to bottom in 2013.

Another issue is if the Mortgage Debt Relief Act of 2007 is allowed to expire at the end of 2012. If the act isn't extended, many of the contingent short sales will be pulled off the market. Although this doesn't impact active inventory directly, it might have an indirect impact.

Right now my guess is active inventory will bottom in 2013.

Retail Sales increased 0.3% in November

by Calculated Risk on 12/13/2012 09:00:00 AM

On a monthly basis, retail sales increased 0.3% from October to November (seasonally adjusted), and sales were up 3.7% from November 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $412.4 billion, an increase of 0.3 percent from the previous month and 3.7 percent above November 2011. ... The September to October 2012 percent change was unrevised from -0.3 percent.

Click on graph for larger image.

Click on graph for larger image.The change in sales for October was unrevised at a 0.3% decline.

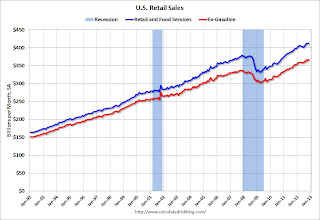

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.5% from the bottom, and now 8.8% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in November - so only autos bounced back.

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in November - so only autos bounced back.Excluding gasoline, retail sales are up 21.3% from the bottom, and now 8.9% above the pre-recession peak (not inflation adjusted).

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.0% on a YoY basis (3.7% for all retail sales).

This was at the consensus forecast of no change ex-autos, but below the consensus forecast for total retail sales of a 0.6% increase in November. Retail sales are still sluggish, but generally trending up.

This was at the consensus forecast of no change ex-autos, but below the consensus forecast for total retail sales of a 0.6% increase in November. Retail sales are still sluggish, but generally trending up.

Weekly Initial Unemployment Claims decline to 343,000

by Calculated Risk on 12/13/2012 08:37:00 AM

The DOL reports:

In the week ending December 8, the advance figure for seasonally adjusted initial claims was 343,000, a decrease of 29,000 from the previous week's revised figure of 372,000. The 4-week moving average was 381,500, a decrease of 27,000 from the previous week's revised average of 408,500.The previous week was revised up from 370,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 381,500.

The recent sharp increase in the 4 week average was due to Hurricane Sandy as claims increased significantly in NY, NJ and other impacted areas. Now, as expected, the 4-week average is almost back to the pre-storm level.

Weekly claims were lower than the 370,000 consensus forecast.

And here is a long term graph of weekly claims:

Note: We use the 4-week average to smooth out noise, but following an event like Hurricane Sandy, the 4-week average lags the event. It looks like the average should decline next week to around 370,000 or so.

Wednesday, December 12, 2012

Thursday: Retail Sales, Unemployment Claims, PPI

by Calculated Risk on 12/12/2012 09:31:00 PM

The big story today was the Federal Open Market Committee (FOMC) of the Federal Reserve announcing thresholds for the unemployment rate and inflation that will guide Fed Funds rate policy in the future. I think this significantly improves Fed communication. Also the FOMC - as expected - announced that they will expand QE3 by $45 billion per month starting in January after the expiration of Operation Twist.

Going forward, the Fed will adjust the amount of monthly QE3 purchases based on their evolving economic outlook.

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 370 thousand. The 4-week of claims should start to decline back towards the pre-Hurricane Sandy level.

• Also at 8:30 AM, Retail sales for November will be released. October retail sales (especially auto sales) were impacted by Hurricane Sandy, and auto sales bounced back in November. The consensus is for retail sales to increase 0.6% in November, and to be unchanged ex-autos.

• Also at 8:30 AM, the Producer Price Index for November will be released. The consensus is for a 0.5% decrease in producer prices (0.2% increase in core).

Another question for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

DataQuick: SoCal Home Sales highest for November in Six Years

by Calculated Risk on 12/12/2012 06:53:00 PM

From DataQuick: More Year-Over-Year Gains for Southland Home Sales and Prices

Southern California’s housing market continued its gradual recovery last month, logging the highest November sales in six years amid strong demand from investors and move-up buyers. ... total of 19,285 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 8.5 percent from 21,075 sales in October, and up 14.2 percent from 16,884 sales in November 2011, according to San Diego-based DataQuick.The median price is being impacted by the mix, with fewer low end distressed sales pushing up the median. This is why I focus on the repeat sales indexes.

A decline in sales from October to November is normal for the season. Last month’s sales were the highest for the month of November since 23,005 homes sold in November 2006, though they were 11.3 percent below the November average of 21,730 since 1988, when DataQuick’s statistics begin.

...

Lower-cost areas again posted the weakest sales compared with last year. The number of homes that sold below $200,000 fell 18.7 percent year-over-year, while sales below $300,000 dipped 7.8 percent. Sales in the more affordable markets have been hampered by the slowdown in foreclosure activity, which results in fewer foreclosed properties listed for sale. Also, lower-cost markets typically have a relatively high percentage of homeowners who owe more than their homes are worth, meaning they can’t sell and move.

Last month foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 15.3 percent of the Southland resale market. That was down from 16.3 percent the month before and 31.6 percent a year earlier. Last month’s level was the lowest since foreclosure resales were 13.6 percent of the resale market in September 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 26.6 percent of Southland resales last month. That was down slightly from an estimated 27.6 percent the month before and up from 25.4 percent a year earlier.

Sales are declining in the high foreclosures areas because the number of foreclosed properties is declining, but sales are now picking up in other areas, and these are mostly conventional sales - a positive sign for the housing market.

The NAR is scheduled to report November existing home sales and inventory next week on Thursday, December 20th.

Lawler: Delinquency/Foreclosure Rates by State for Five Servicers

by Calculated Risk on 12/12/2012 04:08:00 PM

From economist Tom Lawler: “Free” Data on Delinquency/Foreclosure Rates for First and Second Liens by State for Five “Mortgage Settlement” Servicers

On “The Office of Mortgage Settlement Oversight,” there is a report that can be downloaded that shows the first- and second-lien servicing portfolios for Ally, Bank of America, Citi, Chase, and Wells by delinquency status as of September 30th, 2012 – both nationally and by state.

Below are some summary stats (stated as a % of number of loan) for each servicer.

The data highlight how truly badly Bank of America’s servicing portfolio is performing, with the “DLQ 180+” and “in Foreclosure” %’s suggesting unusual “slowness” in resolving seriously-delinquent loans (Chase’s “in foreclosure” % suggests problems at that institution as well).

The reports (which, again, have data by state) are available here. (click on “servicer performance data”). Here is the spreadsheet.

| 1st Lien Portfolio | Bank of America | Chase | Ally | Citi | Wells |

|---|---|---|---|---|---|

| Current (0-29) | 84.44% | 87.29% | 88.85% | 89.43% | 91.91% |

| DLQ 30-59 | 3.07% | 3.62% | 3.48% | 3.14% | 2.50% |

| DLQ 60-179 | 2.08% | 2.07% | 2.47% | 2.11% | 1.74% |

| DLQ 180+ | 3.27% | 0.51% | 0.49% | 1.13% | 0.70% |

| Bankruptcy | 2.33% | 1.46% | 1.65% | 1.69% | 0.80% |

| Foreclosure | 4.81% | 5.06% | 3.06% | 2.50% | 2.35% |

| Total Active Portfolio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| 2nd Lien Portfolio | Bank of America | Chase | Ally | Citi | Wells |

| Current (0-29) | 92.81% | 95.19% | 93.33% | 93.18% | 95.12% |

| DLQ 30-59 | 1.48% | 1.31% | 1.87% | 1.64% | 0.80% |

| DLQ 60-179 | 1.65% | 1.27% | 2.07% | 1.96% | 1.01% |

| DLQ 180+ | 1.71% | 0.30% | 0.46% | 0.61% | 0.42% |

| Bankruptcy | 2.15% | 1.49% | 2.15% | 2.30% | 1.98% |

| Foreclosure | 0.20% | 0.45% | 0.13% | 0.31% | 0.66% |

| Total Active Portfolio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

FOMC Projections and Bernanke Press Conference

by Calculated Risk on 12/12/2012 02:00:00 PM

Here are the updated projections from the FOMC meeting.

Fed Chairman Ben Bernanke's press conference starts at 2:15 PM ET. Here is the video stream.

Live stream by Ustream

The FOMC is no longer presenting a "date-based guidance" for policy, and instead changed to announcing thresholds for raising the Fed Funds rate based on the unemployment rate and inflation. How this will work will be a key topic of the press conference today. Currently the thresholds are holding rates low "at least" until the unemployment rate is below 6 1/2%, and the inflation outlook "between one and two years ahead" is no more than 2 1/2%, as long as inflation expectations remain "well anchored" - this means inflation could increase to 3% or 4% without an increase in rates, as long as expectations remain anchored and the outlook one to two years ahead is at or below 2 1/2%. This is a significant change in policy guidance.

Another key question is: Which will come first, a rate hike or stopping or slowing QE3 (the FOMC will expand QE3 to $85 billion per month in January)?

The four tables below show the FOMC December meeting projections, and the September projections to show the change.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 | 2015 |

| Dec 2012 Projections | 1.7 to 1.8 | 2.3 to 3.0 | 3.0 to 3.5 | 3.0 to 3.7 |

| Sept 2012 Projections | 1.7 to 2.0 | 2.5 to 3.0 | 3.0 to 3.8 | 3.0 to 3.8 |

GDP projections have been revised down slightly for 2013.

The unemployment rate was at 7.7 in November, and the projection for 2012 has been revised down. The projection for 2014 was revised down too.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 | 2015 |

| Dec 2012 Projections | 7.8 to 7.9 | 7.4 to 7.7 | 6.8 to 7.3 | 6.0 to 6.6 |

| Sept 2012 Projections | 8.0 to 8.2 | 7.6 to 7.9 | 6.7 to 7.3 | 6.0 to 6.6 |

The forecasts for overall and core inflation show the FOMC is still not concerned about inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 | 2015 |

| Dec 2012 Projections | 1.6 to 1.7 | 1.3 to 2.0 | 1.5 to 2.0 | 1.7 to 2.0 |

| Sept 2012 Projections | 1.7 to 1.8 | 1.6 to 2.0 | 1.6 to 2.0 | 1.8 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 | 2015 |

| Dec 2012 Projections | 1.6 to 1.7 | 1.6 to 1.9 | 1.6 to 2.0 | 1.8 to 2.0 |

| Sept 2012 Projections | 1.7 to 1.9 | 1.7 to 2.0 | 1.8 to 2.0 | 1.9 to 2.0 |

FOMC Statement: Expand QE3, Sets Thresholds of 6.5% Unemployment Rate, 2 1/2 Inflation

by Calculated Risk on 12/12/2012 12:30:00 PM

The thresholds are huge!

FOMC Statement:

Information received since the Federal Open Market Committee met in October suggests that economic activity and employment have continued to expand at a moderate pace in recent months, apart from weather-related disruptions. Although the unemployment rate has declined somewhat since the summer, it remains elevated. Household spending has continued to advance, and the housing sector has shown further signs of improvement, but growth in business fixed investment has slowed. Inflation has been running somewhat below the Committee’s longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable.The projections will be released at 2:00 PM, and the press conference will be at 2:15 PM.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee remains concerned that, without sufficient policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely will run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will purchase longer-term Treasury securities after its program to extend the average maturity of its holdings of Treasury securities is completed at the end of the year, initially at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and, in January, will resume rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. The Committee views these thresholds as consistent with its earlier date-based guidance. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed the asset purchase program and the characterization of the conditions under which an exceptionally low range for the federal funds rate will be appropriate.

Irwin: Five Things to Watch for on Fed Day

by Calculated Risk on 12/12/2012 10:02:00 AM

Note: The FOMC statement will be released around 12:30 PM ET today.

Neil Irwin at the WaPo lists Five things to look for out of the Fed today.

Here is the list:

1. More bond buying starting in January (after the expiration of Operation Twist). Most estimates are for an expansion of QE3 from $40 billion per month to around $85 billion per month.

2. "But what kinds of bonds?" Treasuries or Fannie / Freddie Mortgage Backed Securities (MBS) or some combination of both.

3. "What’s the threshold?". This probably will not happen at this meeting (setting thresholds for raising the Fed Funds rate based on the unemployment rate, inflation, and possibly other economic indicators). As Irwin notes, if they do announce thresholds it "would be a surprise and would be the big headline out of the meeting."

4. "What kind of year is 2013 going to be?" The projections will be released at 2:00 PM ET. Of course the projections depend on the "fiscal cliff" negotiations.

5. "What’s our potential?" This is the Fed's longer term projections for GDP growth, the unemployment rate, and inflation, and these will be included in the projections.

MBA: Mortgage Applications increase, Record Low Mortgage Rates

by Calculated Risk on 12/12/2012 07:01:00 AM

From the MBA: Mortgage Rates Drop to New Lows in Latest MBA Weekly Survey

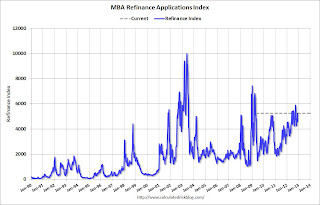

The Refinance Index increased 8 percent from the previous week and is at its highest level since the week ending October 12, 2012. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. ...

“Continued uncertainty due to the lack of resolution regarding the fiscal cliff led interest rates lower last week, with mortgage rates reaching a new low in our survey,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Refinance activity increased, with the refinance index hitting its highest level in two months, and the refinance share reaching its highest level since January 2009. Applications for purchase increased for a fifth consecutive week, and are running almost ten percent above their level at this time last year.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.47 percent, the lowest rate in the history of the survey, from 3.52 percent, with points decreasing to 0.36 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is at the highest level in two months, and has been at a fairly high level all year.

The second graph shows the MBA mortgage purchase index.

As Fratantoni noted, purchase activity is up about 10% from a year ago. The purchase index has increased 10 of the last 12 weeks, and the 4-week average of the purchase index is at the highest level since 2010 (when the tax credit boosted application activity).

As Fratantoni noted, purchase activity is up about 10% from a year ago. The purchase index has increased 10 of the last 12 weeks, and the 4-week average of the purchase index is at the highest level since 2010 (when the tax credit boosted application activity).The 4-week average is up about 25% from the post-bubble low.

Tuesday, December 11, 2012

Wednesday: FOMC Meeting

by Calculated Risk on 12/11/2012 08:52:00 PM

The FOMC will probably announce additional bond buying tomorrow that will start in January after the conclusion of Operation Twist. I don't expect the Fed to announce tomorrow a change to thresholds (using the unemployment rate and inflation) for the timing of the first Fed Funds rate hike.

On Sunday I posted a preview, and the September economic projections for review. The unemployment rate is lower than previously expected, but the other indicators are close.

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Recently the Purchase Index has been showing more purchase activity.

• At 8:30 AM, Import and Export Prices for November. The consensus is a 0.4% decrease in import prices.

• At 12:30 PM, the FOMC statement will be released. With Operation Twist ending in a few weeks, the FOMC will probably announce additional policy accommodation that will start in January.

• At 2:00 PM, The Federal Open Market Committee (FOMC) participants' quarterly economic projections.

• At 2:15 PM, Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

Merrill Lynch on Housing and Construction Employment

by Calculated Risk on 12/11/2012 07:17:00 PM

We are still waiting for a strong increase in construction employment, but we know it is coming (I expect construction employment will be revised up in the annual revision).

Michelle Meyer at Merrill Lynch wrote about this today (and more on housing): The housing market in 2013

We believe 2012 will go down in history as a year of transition for the housing market. Housing starts are on track to be up 25% and home prices are set to rise 5% over 2012. We believe the recovery will continue into 2013 for several reasons. Most importantly, household formation has started to turn higher, reflecting the shortfall of household creation over the prior five years. In addition, listed inventory is low, owing to extraordinarily slow construction and only a gradual reduction of the distressed pipeline. And specifically for prices, there has been a shift toward short sales as a means of disposing distressed properties. Moreover, investor demand is strong, particularly for distressed inventory.I've wrote about the positive impact of prices early this year, see The economic impact of stabilizing house prices?

We forecast housing starts to increase another 25% to an average of 975,000 and home prices to increase 3% in 2013.

...

The housing market is turning into an engine of growth once again. Housing construction will likely add 0.3pp to GDP growth in 2012 and 0.4pp to 2013 growth. ... The gain in homebuilding will support related sectors such as furniture, building material sales and financial companies. Moreover, construction jobs will finally come back, allowing some of the 2 million people who lost construction jobs to find employment in the field again.

There will also be a jolt to the economy from the gain in home prices. An increase in home values lifts household net worth and boosts consumer confidence. If consumers perceive the gain in wealth to be permanent, they will increase their current consumption. But the rise in home prices can do something even more vital for the economy – it can spur credit creation, which then fuels housing demand and reinforces the gain in home prices. We are seeing the very early stages of a positive feedback loop between the housing market, credit market and real economy, which can be quite powerful in time.

We are probably already seeing the impact of stabilizing prices on housing inventory. If potential sellers think prices will fall further, then they will rush to sell and list their homes right away. But if potential sellers think prices are stabilizing, and may even increase, they are more willing to wait for a better market or to sell when it is most convenient. I think we are seeing that right now.And on construction employment: Back to work we go

More importantly, I think stabilizing prices will give hope to some “underwater” homeowners and we will probably see mortgage default rates fall quicker. And over time, buyers will gain confidence that prices have stopped falling, and I expect demand to increase – and also for more private lenders to reenter the mortgage market and help support that demand.

And this demand will also boost homebuilding and new home sales – since homebuilders will have a better idea of the pricing needed to compete in a market (falling prices makes it hard to plan).

There are several ways that the recovery in the housing market multiplies through the economy. One of the key channels is to create jobs in the construction industry and related fields. However, despite the 25% gain in housing starts this year, the construction sector has not added workers. Looking back at prior cycles, it appears that it is normal for construction jobs to lag output by about a year. We think we are on the verge of construction hiring.I also expect a pickup in construction employment in 2013.

...

As demand for housing continues to improve, construction companies will likely become more comfortable expanding their workforce. In addition, construction workers do not just focus on new construction; they can also find employment for renovations. Renovation spending has been on the rise and will likely receive a boost from Hurricane Sandy rebuilding. We think the future looks brighter for construction workers.

Lawler: Update to Distressed Sales Table, Reno Correction

by Calculated Risk on 12/11/2012 03:59:00 PM

Economist Tom Lawler sent me an update today of short sales and foreclosures for a few selected cities in November.

Note: Reno was corrected (the table yesterday used October numbers instead of November). There will be more cities added soon.

For all of these cities, the percentage of foreclosures is down from a year ago. The percentage of short sales is up in Las Vegas and Reno, but down in Phoenix and in the mid-Atlantic area.

Look at the overall percent of distressed sales (combined foreclosures and short sales). There is a large year-over-year decline in distressed sales in all of these cities.

The two key numbers for real estate markets are 1) inventory, and 2) the percent of conventional sales (non-distressed sales). Inventory is falling, and the percent of conventional sales is increasing - and those are positive signs.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Nov | 11-Nov | 12-Nov | 11-Nov | 12-Nov | 11-Nov | |

| Las Vegas | 41.2% | 26.8% | 10.7% | 46.0% | 51.9% | 72.8% |

| Reno | 41.0% | 36.0% | 9.0% | 35.0% | 50.0% | 71.0% |

| Phoenix | 23.2% | 29.6% | 12.9% | 29.8% | 36.1% | 59.4% |

| Mid-Atlantic (MRIS) | 11.9% | 13.7% | 8.7% | 14.2% | 20.6% | 27.9% |

| Memphis* | 24.3% | 31.3% | ||||

| Metro Detroit | 33.6% | 38.7% | ||||

| *share of existing home sales, based on property records | ||||||