by Calculated Risk on 12/18/2012 03:10:00 PM

Tuesday, December 18, 2012

Report: Housing Inventory declines 17% year-over-year in November

From Realtor.com: November 2012 Real Estate Data

Flat list prices—a leading indicator of future house price trends—most likely signal a slowdown in the recent rate of house price appreciation. At the same time, historically low inventories suggest that significant price concessions on the part of home sellers may be coming to an end. How these potentially offsetting trends play out in the housing market will depend on a variety of factors, including potential buyers’ optimism regarding the continued strength of the overall economy.Note: Realtor.com only started tracking inventory in September 2007, but this is probably the lowest level in a decade. On a month-over-month basis, inventory declined 4.7%, and declined in 133 of 146 markets.

The total U.S. for-sale inventory of single family homes, condos, townhomes and co-ops (SFH/CTHCOPS) dropped to its lowest point since 2007, with 1.674 million units for sale in November, down 16.87 percent compared to a year ago and more than 45 percent below its peak of 3.1 million units in September 2007, when Realtor.com began monitoring these markets. The median age of the inventory was also down by 11.4 percent on a year-over-year basis. However, the median list price in November ($189,900) was the same as it was a year ago despite the significant gains observed earlier in the year.

...

The national for-sale inventory of SFH/CTHCOPS in November (1,674,412) decreased (4.69 percent) from what it was in October and was down by 16.87 percent on an annual basis.

Going forward, I expect to see smaller year-over-year declines simply because inventory is already very low.

The NAR is scheduled to report November existing home sales and inventory on Thursday, December 20th. A key number in the NAR report will be inventory, and inventory will be down sharply again year-over-year in November.

Update on Fiscal Cliff

by Calculated Risk on 12/18/2012 01:37:00 PM

I try to ignore the fiscal cliff, but I do read the Wonkblog daily for updates.

From Suzy Khimm at the Wonkblog: Five sticking points in the fiscal cliff deal

President Obama’s latest fiscal cliff offer has brought the outlines of a final deal into focus. But there are still some major sticking points and outstanding questions that have to be resolved before a final deal will be able to pass Congress.Here are the five issues Khimm identifies:

1) Will low-income seniors be protected from Social Security cuts? If so, how?And on the AMT from Mark Koba at CNBC: Will 'Fiscal Cliff' Deal Include Cap on the AMT?

...

2) Will House Republicans go along with tax hikes?

...

3) How much short-term stimulus will survive in a final deal?

...

4) What kind of enforcement mechanism will be attached to the health-care cuts?

...

5) How will the debt ceiling be resolved?

President Barack Obama's latest proposal in the "Fiscal Cliff" talks includes an offer to permanently cap the Alternative Minimum Tax ... Right now, some 29 million more Americans—in addition to the current 4 million—could be subject to the AMT in their 2012 returns if no agreement is reached on the fiscal cliff. ... That's because the AMT has never been indexed to inflation, so every year more Americans are caught up in it. Congress has traditionally created patches in years past to keep the AMT from clobbering more taxpayers, but so far no patch has been put up for a vote for tax year 2012.Finding a permanent fix to the AMT would be a small positive step.

Builder Confidence increases in December, Highest since April 2006

by Calculated Risk on 12/18/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 2 points in December to 47. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Continues Improving in December

Builder confidence in the market for newly built, single-family homes rose for an eighth consecutive month in December to a level of 47 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This marked a two-point gain from a slightly revised November reading, and the highest level the index has attained since April of 2006.

...

“While there is still much room for improvement, the consistent upward trend in builder confidence over the past year is indicative of the gradual recovery that has been taking place in housing markets nationwide and that we expect to continue in 2013,” noted NAHB Chief Economist David Crowe.

...

Two of the HMI’s three component indexes are now above the critical midpoint of 50. The component gauging current sales expectations rose two points to 51 in December, while the component gauging sales expectations in the next six months slipped one point, to 51. The component measuring traffic of prospective buyers increased one point, to 36.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November housing starts will be released tomorrow). This was at the consensus estimate of a reading of 47.

Housing: Inventory down 24% year-over-year in mid-December

by Calculated Risk on 12/18/2012 08:56:00 AM

Inventory declines every year in December and January as potential sellers take their homes off the market for the holidays. That is why it helps to look at the year-over-year change in inventory.

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 23.9% year-over-year and probably at the lowest level since the early '00s.

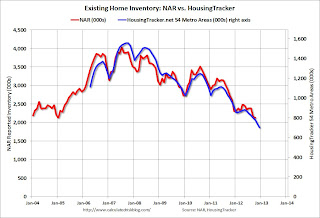

This graph shows the NAR estimate of existing home inventory through October (left axis) and the HousingTracker data for the 54 metro areas through mid-December.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. So inventory will probably decline a little further over the next month before increasing again next year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the mid-December listings, for the 54 metro areas, declined 23.9% from the same period last year.

HousingTracker reported that the mid-December listings, for the 54 metro areas, declined 23.9% from the same period last year.

My guess is inventory will bottom in January (both seasonally and for the current cycle). I think the recent increase in prices will entice a few more people to list their homes (some people will no longer have negative equity too and can finally sell). Also there may be a few more foreclosure listings in some judicial states.

Nick Timiraos at the WSJ writes: 2013: How Rising Prices Could Boost Housing Demand

Rising prices could eventually encourage more sellers to put their homes on the market, which would help boost demand even further. Glenn Kelman, chief executive of Redfin, says he is looking to increase the company’s workforce of 400 agents nationally by 50% by the end of January. “I’m going across the country meeting with managers, and the only topic we’re talking about is hiring,” he said.At the least the year-over-year declines should still start to get smaller since inventory is already very low. It seems very unlikely we will see 20%+ year-over-year declines next summer!

Monday, December 17, 2012

Tuesday: NAHB Home Builder Confidence

by Calculated Risk on 12/17/2012 10:09:00 PM

Two more articles on the possible "fiscal cliff" deal:

From the NY Times: President Delivers a New Offer on the Fiscal Crisis to Boehner

The White House plan would permanently extend Bush-era tax cuts on incomes below $400,000, essentially meaning that only the top tax bracket, 35 percent, would rise to 39.6 percent.From the WSJ: White House Revises Offer on Tax Rates in Deficit Talks

The president’s plan would cut spending by $1.22 trillion over 10 years, an official said, $800 billion of it in programmatic cuts, and $122 billion by adopting a new measure of inflation that slows the growth of government benefits, especially Social Security.

In President Barack Obama's latest budget proposal, the White House said it now would seek to raise tax rates on income above $400,000, a person familiar with the talks said. ...Tuesday economic releases:

In total, the plan would include $1.22 trillion in spending reductions, with $400 billion coming from changes to health-care programs, $200 billion from cuts to other mandatory spending programs, $100 billion in cuts coming from defense spending and another $100 billion coming from nondefense discretionary spending.

• At 10:00 AM ET, The December NAHB Housing Market Index (HMI) survey will be released. The consensus is for a reading of 47, up from 46 in November. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

Fiscal Cliff: Chained CPI

by Calculated Risk on 12/17/2012 07:32:00 PM

Ezra Klein at the WaPo WonkBlog wrote earlier today: A ‘fiscal cliff’ deal is near: Here are the details

Boehner offered to let tax rates rise for income over $1 million. The White House wanted to let tax rates rise for income over $250,000. The compromise will likely be somewhere in between. More revenue will come from limiting deductions, likely using some variant of the White House’s oft-proposed, oft-rejected idea for limiting itemized deductions to 28 percent. The total revenue raised by the two policies will likely be a bit north of $1 trillion. ...Chained CPI is a relatively new series (started in 2002), and measures inflation at a slightly lower rate than CPI or CPI-W - and over time this would add up both for Social Security payments and also for revenue (tax brackets would increase slower using chained CPI than using currently).

On the spending side, the Democrats’ headline concession will be accepting chained-CPI, which is to say, accepting a cut to Social Security benefits.

From the BLS: Frequently Asked Questions about the Chained Consumer Price Index for All Urban Consumers (C-CPI-U)

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The graph shows the year-over-year change in headline CPI, CPI-W, and chained CPI.

There isn't much difference on a year-over-year basis, but notice the blue line is mostly below the other two all the time. Those small differences add up over time as the following table shows.

This table shows the 10 year change in each measure (from Nov 2002 to Nov 2012) and the annualized change over that period. If we were using chained CPI instead of CPI-W over the last 10 years, Social Security benefits would be about 3.6% lower than they are now.

| 10 Year Increase | Annualized | |

|---|---|---|

| CPI (headline) | 27.0% | 2.42% |

| CPI-W (current) | 27.7% | 2.48% |

| CPI (chained) | 24.1% | 2.19% |

Lawler: Foreclosure Share Way Down, But Not All-Cash Share; Suggests Investor Purchases of Non-REO Properties Up Sharply

by Calculated Risk on 12/17/2012 04:26:00 PM

From economist Tom Lawler:

While most areas have experienced a significant decline in the foreclosure share (as well as the overall “distressed-sales” share of home sales this year, it’s sorta interesting to note that the all-cash share of homes purchases has not fallen, at least in areas where data on financing are available. E.g., here is a table showing the “all-cash” share of home purchases this November compared to last November in selected markets. All data are based on realtor association/MLS reports, save for the Southern California, which are Dataquick’s tabulations based on property/mortgage records. Also shown are the foreclosure and short-sales shares of home sales. Note that for Sothern California the foreclosure and short-sales shares are share of resales, while the all-cash share is the share of total sales. Note also that I don’t have the foreclosure and short sales shares for the Baltimore and DC metro areas, but only for the whole area covered by MRIS. However, the Baltimore and DC metro areas account for about 77% of total home sales through MRIS, so ...

While in most of these areas the foreclosure sales share of resales in November was down considerably from last November, as was the overall “distressed” sales shares, the all-cash-financed share of home sales was actually higher this November than last November in many areas, and in other areas it was little changed from a year ago.

Most analysts (and realtors) believe that investors make up a substantial share of all-cash purchases. Given that the all-cash share of purchases is flat to higher while the foreclosure share of purchases is down considerably, it appears as if investors have considerably increased their purchases of non-foreclosure properties over the last year.

| All Cash Share | Foreclosure Share | Short-Sales Share | ||||

|---|---|---|---|---|---|---|

| Nov-12 | Nov-11 | Nov-12 | Nov-11 | Nov-12 | Nov-11 | |

| Las Vegas | 52.7% | 48.2% | 10.7% | 46.0% | 41.2% | 26.8% |

| Phoenix | 43.2% | 45.4% | 12.9% | 29.8% | 23.2% | 29.6% |

| Sacramento | 37.1% | 27.4% | 11.5% | 34.3% | 36.1% | 29.8% |

| Orlando | 54.0% | 49.9% | 20.9% | 22.8% | 29.0% | 37.2% |

| Baltimore Metro | 23.8% | 23.8% | ||||

| DC Metro | 18.8% | 20.4% | ||||

| MRIS (Mid Atl) | 8.7% | 14.2% | 11.9% | 13.7% | ||

| Toledo | 40.9% | 38.2% | ||||

| Southern CA | 33.0% | 29.5% | 15.3% | 31.6% | 26.3% | 24.9% |

Early: Housing Forecasts for 2013

by Calculated Risk on 12/17/2012 01:42:00 PM

Towards the end of each year I collect some housing forecasts for the following year. Here was a summary of forecasts for 2012. Right now it looks like new home sales will be around 365 thousand this year, and total starts around 750 thousand or so.

Here is one without details, from Hui Shan, Sven Jari Stehn, Jan Hatzius at Goldman Sachs:

We project housing starts to continue to rise, reaching an annual rate of 1.0 million by the end of 2013 and 1.5 million by the end of 2016.The table below shows several forecasts for 2013.

From Fannie Mae: Housing Forecast: November 2012

From NAHB: Housing and Interest Rate Forecast, 11/29/2012 (excel)

I'll add some more forecasts soon:

| Some Housing Forecasts for 2013 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | CS House Prices | |

| Fannie Mae | 452 | 659 | 936 | 1.6%1 |

| NAHB | 447 | 641 | 910 | |

| Wells Fargo | 460 | 680 | 990 | 2.6% |

| Merrill Lynch | 466 | 976 | 2.6% | |

| 2012 Estimate | 365 | 525 | 750 | 6.0% |

| 1FHFA Purchase-Only Index | ||||

LA area Port Traffic: Down in November due to Strike

by Calculated Risk on 12/17/2012 11:51:00 AM

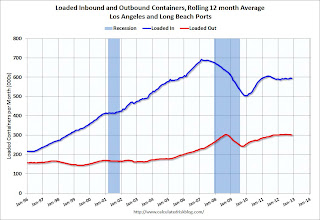

Note: Clerical workers at the ports of Long Beach and Los Angeles went on strike starting Nov 27th and ending Dec 5th. The strike impacted port traffic for November, but traffic is expected to bounce back in December. The strike happened after the holiday shipping period, so the slowdown isn't expected to impact holiday related shopping.

I've been following port traffic for some time. Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for November. LA area ports handle about 40% of the nation's container port traffic. Some of the LA traffic was routed to other ports, so this data might not be very useful this month.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are down slightly compared to the 12 months ending in October.

In general, inbound and outbound traffic has been mostly moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of November, loaded outbound traffic was down 7.5% compared to November 2011, and loaded inbound traffic was down 3% compared to November 2011.

For the month of November, loaded outbound traffic was down 7.5% compared to November 2011, and loaded inbound traffic was down 3% compared to November 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, so some decline in November was expected.

Empire State Manufacturing index indicates further contraction

by Calculated Risk on 12/17/2012 08:40:00 AM

From the NY Fed: Empire State Manufacturing Survey

The December 2012 Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to decline at a modest pace. The general business conditions index was negative for a fifth consecutive month, falling three points to -8.1. The new orders index dropped to -3.7, while the shipments index declined six points to 8.8. At 16.1, the prices paid index indicated that input prices continued to rise at a moderate pace, while the prices received index fell five points to 1.1, suggesting that selling prices were flat. Employment indexes pointed to weaker labor market conditions, with the indexes for both number of employees and the average workweek registering values below zero for a second consecutive month. Indexes for the six-month outlook were generally higher than last month, although the level of optimism remained at a level well below that seen earlier this year.The general business condition index declined from -5.22 in November to -8.1 in December - the fifth consecutive negative reading. This was another weak manufacturing index and below expectations of a reading of 0.0.

...

The index for number of employees rose five points to -9.7, while the average workweek index declined three points to -10.8.

emphasis added

Sunday, December 16, 2012

Sunday Night Futures

by Calculated Risk on 12/16/2012 08:47:00 PM

On Monday, at 8:30 AM ET, the NY Fed will release the Empire State Manufacturing Survey for December. The consensus is for a reading of 0, up from minus 5.2 in November (below zero is contraction).

Weekend:

• Summary for Week Ending Dec 14th

• Schedule for Week of Dec 16th

The Asian markets are mixed tonight, with the Nikkei up 1.5% following the election of the new government: Japan’s new government to get aggressive

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 7 and DOW futures are up 60.

Oil prices still moving sideways with WTI futures at $86.88 per barrel and Brent at $108.23 per barrel. Gasoline prices are now near the low for the year.

Here is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Two more questions this week for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

NY Times: Sunnier Forecast, D.C. Shadow

by Calculated Risk on 12/16/2012 03:38:00 PM

From Catherine Rampell at the NY Times: Economic Forecast Is Sunnier, but Washington Casts a Big Shadow

Economists see a number of sources of underlying strength in the economy, but for the growth to gain traction, they say, political leaders need to avoid the broad tax increases and spending cuts now being debated.There are some clear positives for 2013, especially from housing and less drag from state and local governments (Rampell didn't mention this, but I did on Friday). I expect the rate of growth to pickup next year, but I wouldn't get too excited.

The nascent housing rebound, the natural gas boom, record profit margins, a friendlier credit market for small businesses, along with pent-up demand for autos and other big purchases, could in combination unleash growth and hiring that the economy needs.

“Underneath all the shenanigans in Washington, there’s a lot of strengthening,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

...

Estimates for the last quarter of 2012 are hovering around an unusually weak 1 percent annualized rate.

That dismal pace is driven partly by drags from Europe’s recession and China’s slowdown; partly by companies readjusting after potentially overstocking their back-room shelves in the third quarter; and largely by worries about the so-called fiscal cliff of spending cuts and tax increases set for early 2013.

Obviously there is going to be some more austerity in the US at the Federal level next year, and we need some reasonable resolution to the "fiscal cliff". My expectation is that relief from the Alternative Minimum Tax (AMT) will be extended, the tax cuts for low to middle income families will be extended, and that most, but not all, of the defense spending cuts will be reversed (aka "sequestration"). However I think the payroll tax cut will probably not be extended, and tax rates on high income earners will increase a few percentage points to the Clinton era levels. There are also many more details that will need to be worked out - like Mortgage Debt Relief Act for short sellers, extending emergency unemployment benefits, and the Medicare "Doc Fix".

A few obvious points on the "fiscal cliff": 1) It is about the deficit shrinking too quickly next year, 2) there is no "drop dead" date (the sites with countdown times are embarrassing themselves), and 3) entitlements are not part of the "cliff" (although some changes might be part of an agreement).

Table of Short Sales and Foreclosures for Selected Cities in November

by Calculated Risk on 12/16/2012 11:19:00 AM

Economist Tom Lawler sent me the table below of short sales and foreclosures for a few selected cities in November. Keep this table in mind when the NAR releases existing home sales on Thursday.

The NAR headline number will probably be around 5 million SAAR, but there are other signs of significant change in the housing market. First, inventory has declined sharply, and there is very little inventory in many areas. Second, it appears that the share of conventional sales in certain markets has increased significantly (these are normal sales - not foreclosures or short sales). Both the decline in inventory, and the increase in conventional sales, are signs of moving towards a more normal housing market.

Look at the right two columns in the table below (Total "Distressed" Share for Nov 2012 compared to Nov 2011). In every area that reports distressed sales, the share of distressed sales is down year-over-year - and down significantly in most areas. The NAR will release some distressed sales measurements Thursday from an unscientific survey of Realtors - and I have little confidence in the survey results - but these local reports suggest distressed sales have fallen sharply in many areas.

Last month, CoreLogic sent me their data on distressed and conventional sales showing the percent of distressed sales falling. If we use the NAR estimate for sales, and CoreLogic's estimate of distressed share, conventional sales are now back up to around 3.8 million SAAR. The NAR reported total sales were up 10.9% year-over-year in October, but using this method, conventional sales were up almost 18% year-over-year.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for Nov 2012 to Nov 2011. Foreclosure sales have declined in all these areas, and some of the declines have been stunning (the Nevada sales were impacted by a new foreclosure law). There will probably be an increase in foreclosure sales in some judicial states late this year and in 2013, but overall foreclosures will probably be down next year.

Also there has been a shift from foreclosures to short sales. In most areas, short sales now far out number foreclosures, although Minneapolis is still an exception with more foreclosures than short sales. Note: This shift to short sales could reverse if the Mortgage Debt Relief Act is not extended.

Imagine that the number of total sales doesn't change over the next year - some people would argue that is "bad" news and the housing market isn't recovering. But also imagine that the share of distressed sales declines 20%, and conventional sales increase to make up the difference. That would be a positive sign - and that is what appears to be happening.

Table from Tom Lawler:

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Nov | 11-Nov | 12-Nov | 11-Nov | 12-Nov | 11-Nov | |

| Las Vegas | 41.2% | 26.8% | 10.7% | 46.0% | 51.9% | 72.8% |

| Reno | 41.0% | 36.0% | 9.0% | 35.0% | 50.0% | 71.0% |

| Phoenix | 23.2% | 29.6% | 12.9% | 29.8% | 36.1% | 59.4% |

| Sacramento | 36.1% | 29.8% | 11.5% | 34.3% | 47.6% | 64.1% |

| Minneapolis | 11.2% | 13.8% | 24.6% | 34.8% | 35.8% | 48.7% |

| Mid-Atlantic (MRIS) | 11.9% | 13.7% | 8.7% | 14.2% | 20.6% | 27.9% |

| California (DQ)* | 26.3% | 24.9% | 16.9% | 32.9% | 43.2% | 57.8% |

| Hampton Roads VA | 28.3% | 33.0% | ||||

| Northeast Florida | 42.2% | 48.0% | ||||

| Chicago | 43.0% | 43.1% | ||||

| Charlotte | 13.3% | 18.3% | ||||

| Spokane | 9.2% | 22.4% | ||||

| Memphis* | 24.3% | 31.3% | ||||

| Birmingham AL | 26.5% | 34.5% | ||||

| *share of existing home sales, based on property records | ||||||

Saturday, December 15, 2012

FNC: Residential Property Values increased 3.7% year-over-year in October

by Calculated Risk on 12/15/2012 08:55:00 PM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their October index data last night. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.4% from September to October.

From FNC: Home Prices Up 0.4% in October; Year-Over-Year Growth Acceleration Continues

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that home prices nationally were up 0.4% in October. This was the eighth consecutive month that prices moved higher, leading to a total appreciation rate of 5.1% year to date. The year-over-year growth has accelerated rapidly since first turning positive four months ago. Foreclosures as a percentage of total home sales were 17.6% in October, down from 26.7% at the beginning of the year or 23.5% a year ago.The year-over-year trends continued to show improvement in October, with the 100-MSA composite up 3.7% compared to October 2011. The FNC index turned positive on a year-over-year basis in July - that was the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

Click on graph for larger image.

Click on graph for larger image.This graph is based on the FNC index (four composites) through October 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The key is the indexes are now showing a year-over-year increase indicating prices probably bottomed early this year.

The October Case-Shiller index will be released on Wednesday, Dec 26th.

Earlier:

• Summary for Week Ending Dec 14th

• Schedule for Week of Dec 16th

Unofficial Problem Bank list declines to 845 Institutions

by Calculated Risk on 12/15/2012 06:20:00 PM

Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 14, 2012.

Changes and comments from surferdude808:

Similar to last week, the only changes this week to the Unofficial Problem Bank list were removals. In all, there were four removals, which leaves the list at 845 institutions with assets of $312.9 billion. A year ago, the list held 974 institutions with assets of $398.3 billion.Earlier:

Oasis Bank, SSB, Houston, TX ($77 million) left the list through an unassisted merger and actions were terminated against WaterStone Bank, SSB, Wauwatosa, WI ($1.7 billion Ticker: WSBF); Essex Bank, Tappahannock, VA ($1.1 billion Ticker: BTC); and Northwestern Bank, Chippewa Falls, WI ($366 million). The failure tonight -- Community Bank of the Ozarks, Sunrise Beach, MO -- was not on the Unofficial Problem Bank List as an enforcement action could not be located on the FDIC website.

Next week, several changes should occur as the OCC will release its actions through mid-November 2012.

• Summary for Week Ending Dec 14th

• Schedule for Week of Dec 16th

Schedule for Week of Dec 16th

by Calculated Risk on 12/15/2012 01:05:00 PM

Earlier:

• Summary for Week Ending Dec 14th

This will be a very busy week for economic data. There are three key housing reports to be released this week: December homebuilder confidence on Tuesday, November housing starts on Wednesday, and November existing home sales on Thursday.

For manufacturing, the December NY Fed (Empire state), Philly Fed, and the Kansas City Fed surveys will be released this week.

The third estimate of Q3 GDP will be released on Thursday, and the November Personal Income and Outlays report will be released on Friday.

8:30 AM: NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of 0, up from minus 5.2 in November (below zero is contraction).

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 47, up from 46 in November. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. Total housing starts were at 894 thousand (SAAR) in October, up 3.6% from the revised September rate of 863 thousand (SAAR). Single-family starts decreased slightly to 594 thousand in October.

The consensus is for total housing starts to decline to 865,000 (SAAR) in November, down from 894,000 in October.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 359 thousand from 343 thousand last week. If correct, this would put the 4-week just above the low for the year.

8:30 AM: Q3 GDP (third estimate). This is the third estimate from the BEA. The consensus is that real GDP increased 2.8% annualized in Q3, up slightly from the 2.7% second estimate.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 4.90 million on seasonally adjusted annual rate (SAAR) basis. Sales in October 2012 were 4.79 million SAAR.

Economist Tom Lawler estimates the NAR will report sales at 5.05 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: Philly Fed Survey for December. The consensus is for a reading of minus 2.0, up from minus 10.7 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for November. The consensus is for a 0.2% decrease in this index.

10:00 AM: FHFA House Price Index for October 2012. This was original a GSE only epeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.3% increase in house prices.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

8:30 AM ET: Personal Income and Outlays for November. The consensus is for a 0.3% increase in personal income in November, and for 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 75.0.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for October 2012

11:00 AM: Kansas City Fed regional Manufacturing Survey for December. The consensus is for a reading of -3, up from -6 in November (below zero is contraction).

Summary for Week ending Dec 14th

by Calculated Risk on 12/15/2012 08:24:00 AM

The key US economic story of the week was the FOMC announcement of thresholds for raising the Fed Funds rate based on the unemployment rate and inflation. Also the FOMC expanded QE3 by an additional $45 billion per month starting in January (some people are calling it QE4, but that isn't consistent - the FOMC expanded an earlier QE). This was a significant change in Fed communication, and the change allows the FOMC to drop the date language from the FOMC statement. If the economy improves quicker than the forecast, then investors will adjust their estimate of timing (or the opposite). The Fed also made it very clear they will tolerate a little more inflation in the near term.

The economic data showed some bounce back following Hurricane Sandy. The retail report increased 0.3% (less than forecast though), and industrial production increase 1.1% (more than forecast). And initial weekly unemployment claims continued to decline following the Sandy spike.

This bounce back shows the declines in October were storm related.

The austerity debate (aka "Fiscal cliff) still showing no signs of progress. But I don't expect agreement until early January (although it could happen sooner). Next week will be very busy with several key housing reports.

Here is a summary of last week in graphs:

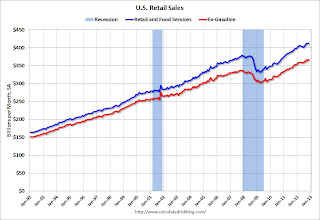

• Retail Sales increased 0.3% in November

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales increased 0.3% from October to November (seasonally adjusted), and sales were up 3.7% from November 2011. The change in sales for October was unrevised at a 0.3% decline.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.5% from the bottom, and now 8.8% above the pre-recession peak (not inflation adjusted)

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.0% on a YoY basis (3.7% for all retail sales).

This was at the consensus forecast of no change ex-autos, but below the consensus forecast for total retail sales of a 0.6% increase in November. Retail sales are still sluggish, but generally trending up.

• Trade Deficit increased in October to $42.2 Billion

The Dept of Commerce reported: "[T]otal October exports of $180.5 billion and imports of $222.8 billion resulted in a goods and services deficit of $42.2 billion, up from $40.3 billion in September, revised. October exports were $6.8 billion less than September exports of $187.3 billion. October imports were $4.9 billion less than September imports of $227.6 billion."

The Dept of Commerce reported: "[T]otal October exports of $180.5 billion and imports of $222.8 billion resulted in a goods and services deficit of $42.2 billion, up from $40.3 billion in September, revised. October exports were $6.8 billion less than September exports of $187.3 billion. October imports were $4.9 billion less than September imports of $227.6 billion."

Both exports and imports decreased in October. US trade has slowed recently.

Exports are 9% above the pre-recession peak and up 1.0% compared to October 2011; imports are 4% below the pre-recession peak, and down 0.8% compared to October 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Oil averaged $99.75 in October, up from $98.88 per barrel in September. The trade deficit with China increased to $29.5 billion in October, up from $28.1 billion in October 2011. Most of the trade deficit is still due to oil and China.

The trade deficit with the euro area was $8.9 billion in October, up from $7.1 billion in October 2011. It appears the eurozone recession is impacting trade.

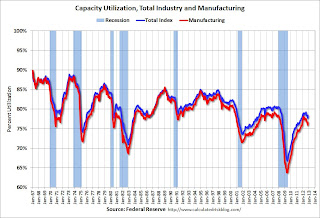

• Industrial Production increased 1.1% in November, Bounces back following Hurricane Sandy

From the Fed: "Industrial production increased 1.1 percent in November after having fallen 0.7 percent in October. The gain in November is estimated to have largely resulted from a recovery in production for industries that had been negatively affected by Hurricane Sandy, which hit the Northeast region in late October."

From the Fed: "Industrial production increased 1.1 percent in November after having fallen 0.7 percent in October. The gain in November is estimated to have largely resulted from a recovery in production for industries that had been negatively affected by Hurricane Sandy, which hit the Northeast region in late October."

This graph shows Capacity Utilization. This series is up 11.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.4% is still 1.9 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.

Industrial production increased in November to 97.5. This is 17% above the recession low, but still 3.2% below the pre-recession peak.

IP was above expectations due to the bounce back following Hurricane Sandy. Overall IP has only up 2.5% year-over-year.

• Key Measures show low inflation in November

The Cleveland Fed released the median CPI and the trimmed-mean CPI.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.8%, and the CPI less food and energy rose 1.9%. Core PCE is for October and increased 1.7% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.8%, and the CPI less food and energy rose 1.9%. Core PCE is for October and increased 1.7% year-over-year.On a monthly basis, median CPI was above the Fed's target at 2.3% annualized. However trimmed-mean CPI was at 1.6% annualized, and core CPI increased 1.4% annualized. Also core PCE for October increased 1.6% annualized. These measures suggest inflation is mostly below the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis. Also, the FOMC statement this week indicated the Fed will tolerate an inflation outlook "between one and two years ahead" of 2 1/2 percent. So, with this low level of inflation and the current high level of unemployment, the Fed will keep the "pedal to the metal".

• BLS: Job Openings "little changed" in October

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in October to 3.675 million, up from 3.547 million in September. The number of job openings (yellow) has generally been trending up, and openings are up about 8% year-over-year compared to October 2011.

Quits increased in October, and quits are up 4% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits"). The trend suggests a gradually improving labor market.

• Weekly Initial Unemployment Claims decline to 343,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 381,500.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 381,500.The recent sharp increase in the 4 week average was due to Hurricane Sandy as claims increased significantly in NY, NJ and other impacted areas. Now, as expected, the 4-week average is almost back to the pre-storm level.

Weekly claims were lower than the 370,000 consensus forecast.

Note: We use the 4-week average to smooth out noise, but following an event like Hurricane Sandy, the 4-week average lags the event. It looks like the average should decline next week to around 370,000 or so.

Friday, December 14, 2012

Some Bullish 2013 House Price Forecasts

by Calculated Risk on 12/14/2012 09:07:00 PM

From the WSJ: Home Prices Could Jump 9.7% in 2013, J.P. Morgan Says

J.P. Morgan Chase & Co. expects U.S. home prices to rise 3.4% in its base-case estimate and up to 9.7% in its most bullish scenario of economic growth. Standard & Poor’s, which rates private-issue mortgage bonds, on Friday said it expects a 5% rise in 2013.I think house prices will increase further in 2013 based on supply and demand (there is little supply, however I think it is possible that inventory will bottom in 2013), but I doubt we will see a 9.7% price increase next year on the repeat sales indexes.

The J.P. Morgan analysts boosted their base-case estimate from 1.5% ...

The WSJ's Nick Timiraos makes an amusing comment on Twitter: "All these analysts forecasting monster home price gains were forecasting moderate declines a few months ago."

At the beginning of the year, the consensus was that house prices would decline for at least another year. When I posted The Housing Bottom is Here in early February, many people were surprised. How views change!

Bank Failure #51: Community Bank of the Ozarks, Sunrise Beach, Missouri

by Calculated Risk on 12/14/2012 07:16:00 PM

From the FDIC: Bank of Sullivan, Sullivan, Missouri, Assumes All of the Deposits of Community Bank of the Ozarks, Sunrise Beach, Missouri

As of September 30, 2012, Community Bank of the Ozarks had approximately $42.8 million in total assets and $41.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.4 million. ... Community Bank of the Ozarks is the 51st FDIC-insured institution to fail in the nation this year, and the fourth in Missouri.Another one bites the dust.

Lawler: Very Early Read on Existing Home Sales in November

by Calculated Risk on 12/14/2012 04:38:00 PM

From economist Tom Lawler:

While I normally wait for more data than I have before giving an “early read” on existing home sales, I’ve seen enough data to report that I expect a “healthy” gain in existing home sales in November, as estimated by the National Association of Realtors. Despite a significant decline in foreclosure sales from a year ago, overall existing home sales last month appear to have increased significantly from a year ago – implying, over of course, a sizable YOY increase in non-foreclosure sales. Based on the admittedly limited number of reports I’ve seen, I estimate that existing home sales as measured by the NAR ran at a seasonally adjusted annual rate of 5.05 million, up 5.4% from October’s pace.

On the median home sales front, the vast bulk of local realtor/MLS report showed noticeable YOY gain in median home sales prices in November, with several showing sizable gains – in large part because of significantly lower foreclosure/distressed sales shares, but also because, well, “typical” home prices were higher. Net, I expect the NAR’s median SF home sales price will show a YOY increase of around 11%.

Finally, my “best guess” for the NAR’x measure of the inventory of existing homes for sale is that November’s number will be down about 4.5% from October, and down about 22.1% from a year ago. The NAR’s inventory measure, however, often doesn’t track regional listings numbers. Moreover, of late there have been unusually large (and unexplained, even when asked) revisions (e.g., September’s preliminary inventory number was revised downward by an astonishingly large 6.5% in the October report.)

CR Note: The NAR will report November existing home sales on Thursday, Dec 20th. The consensus is the NAR will report sales of 4.85 million.

Based on Lawler's estimates, the NAR will report inventory around 2.05 million units for November, and months-of-supply might be under 5 months. This would be the lowest level of inventory in over 10 years, and the lowest months-of-supply since 2005.