by Calculated Risk on 12/21/2012 02:52:00 PM

Friday, December 21, 2012

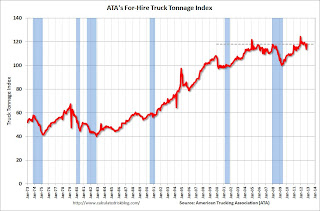

ATA Trucking Index rebounds in November

This is a minor indicator that I follow. Truck tonnage was negatively impacted by Hurricane Sandy in October, and bounced back in November.

From ATA: ATA Truck Tonnage Index Rebounds 3.7% in November

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index jumped 3.7% in November erasing October’s 3.7% drop. (The 3.7% decrease in October was revised from a 3.8% contraction ATA reported on November 20, 2012.) November’s gain was the first since July of this year. As a result, the SA index equaled 118.0 (2000=100) in November versus 113.8 in October. Compared with November 2011, the SA index was up 1%, after contracting 2.1% on a year-over-year basis in October. Year-to-date, compared with the same period last year, tonnage was up 2.8%.Note from ATA:

...

“Sandy impacted both October’s and November’s tonnage readings,” ATA Chief Economist Bob Costello said. “But it was still good to see tonnage snap back in November.” Costello said he expects a boost to flatbed tonnage from the rebuilding in the areas impacted by Sandy, but most of that won’t happen until the spring when the money starts flowing and the weather is conducive to building.

“Outside of Sandy, if the fiscal cliff isn’t fixed in time, expect a slowdown in tonnage early next year as paychecks shrink for all households,” Costello said. “Since trucks account for the vast majority of deliveries in the retail supply, any reduction in consumer spending will hurt.” Costello added that even if we don’t go off the fiscal cliff, he expects slower tonnage growth in 2013 than 2012 as better housing starts and auto sales will be offset by slower factory output and consumer spending.

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Overall the index has been mostly moving sideways this year due to the slowdown in manufacturing.

State Unemployment Rates decreased in 45 States in November

by Calculated Risk on 12/21/2012 11:55:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in November. Forty-five states and the District of Columbia recorded unemployment rate decreases and five states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 10.8 percent in November, followed by Rhode Island at 10.4 percent. North Dakota again registered the lowest jobless rate, 3.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Ohio have seen the most improvement - New Jersey and Connecticut are the laggards.

The states are ranked by the highest current unemployment rate. Only two states still have double digit unemployment rates: Nevada and Rhode Island. In early 2010, 18 states and D.C. had double digit unemployment rates.

Last month I wrote: "I expect the unemployment rate in California to fall below 10% very soon" and sure enough the unemployment rate in California fell to 9.8% in November, the lowest level since January 2009.

Even though Nevada still has the highest unemployment rate, the rate has declined in recent months, falling from 12.1% in August to 10.8% in November.

LPS: Mortgage delinquencies increased in November, "In Foreclosure" Declines

by Calculated Risk on 12/21/2012 10:55:00 AM

LPS released their First Look report for November today. LPS reported that the percent of loans delinquent increased in November compared to October, and declined about 9% year-over-year. Also the percent of loans in the foreclosure process declined further in November and are the lowest level since 2009.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.12% from 7.03% in October. Note: the normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 3.51% from 3.61% in October.

The number of delinquent properties, but not in foreclosure, is down about 10% year-over-year (434,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 18% or 388,000 year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high, but the number of loans in the foreclosure process is now declining.

LPS will release the complete mortgage monitor for November in early January.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Nov 2012 | Oct 2012 | Nov 2011 | |

| Delinquent | 7.12% | 7.03% | 7.83% |

| In Foreclosure | 3.51% | 3.61% | 4.20% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,999,000 | 1,957,000 | 2,250,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,584,000 | 1,543,000 | 1,767,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,767,000 | 1,800,000 | 2,155,000 |

| Total Properties | 5,350,000 | 5,300,000 | 6,172,000 |

Final December Consumer Sentiment declines to 72.9

by Calculated Risk on 12/21/2012 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for December declined to 72.9, down from the preliminary reading of 74.5, and was down from the November reading of 82.7.

This was below the consensus forecast of 75.0. The recent decline in sentiment is probably related to Congress and the so-called "fiscal cliff". This is similar to the sharp decline in 2011 when Congress threatened to force the US to default (not pay the bills).

I still think an agreement will be reached in early January - there is no drop dead date - but you never know.

Personal Income increased 0.6% in November, Spending increased 0.4%

by Calculated Risk on 12/21/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $85.8 billion, or 0.6 percent ... in November, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $41.3 billion, or 0.4 percent..The following graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.6 percent in November, in contrast to a decrease of 0.2 percent in October. ... The price index for PCE decreased 0.2 percent in November, in contrast to an increase of 0.1 percent in October. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared with an increase of 0.1 percent.

...

Personal saving -- DPI less personal outlays -- was $436.7 billion in November, compared with $404.6 billion in October. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 3.6 percent in November, compared with 3.4 percent in October.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. Personal income increased more than expected in November and PCE for October was revised up.

The "two month method" for estimating Q4 PCE suggests PCE will increase close to 2.2% in Q4 - more growth than most expect - although this estimate is probably a little high because PCE was strong in September. Still better than expected ...

Thursday, December 20, 2012

Friday: November Personal Income and Outlays, Durable Goods, Consumer Sentiment

by Calculated Risk on 12/20/2012 07:45:00 PM

On household formation from Cardiff Garcia at FT Alphaville: Another look at US household formation, and why it matters

James Sweeney of Credit Suisse has written one of the more optimistic (and convincing) notes we’ve come across about the near-term trajectory for US housing.And from the Credit Suisse research note:

Its optimism is based mainly on its analysis of expected household formation growth, which Sweeney finds has been underestimated by most observers. The note includes a good discussion of the ways in which healthy household formation growth can have powerful multiplicative effects throughout the rest of the economy. ...

But the two really interesting points in the Sweeney note are that 1) household formation growth can grow meaningfully even under relatively pessimistic assumptions for the US economy, and 2) even modest assumptions of household formation growth can have an have an unexpectedly big impact on the rest of the economy.

So how many households will form? A reasonable estimate, in our view, is somewhere between the strong and base case views, meaning 6-8 million over the next five years. Demographics alone should create 5.7 million, with the rest driven by a labor market recovery that falls short of our strong scenario.I'll revisit household formation soon, but I think we will see even higher household formation than the Credit Suisse estimate. But even with 1.1 million households per year (plus 2nd home buying and demolitions), means housing starts will have to increase to 1.4 to 1.5 million in a few years (once the excess is absorbed). That is almost double from the 770 or so thousand this year.

We need not assume such high numbers to demonstrate the powerful forces formation can unleash. Even the base case scenario of 5.7 million will drive a substantial pick-up in residential investment. The extremely low levels of housing starts and permits over the past few years means a large number of new housing units will likely need to be built.

And here is Business Insider's list of the most important charts for 2012. They include two of my charts - the first showing the beginning of the recovery for housing, and the second that the drag from state and local governments is near the end.

Friday economic releases:

• At 8:30 AM ET, Durable Goods Orders for November from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

• Also at 8:30 AM, Personal Income and Outlays for November. The consensus is for a 0.3% increase in personal income in November, and for 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%. This will give us a preliminary estimate for Q4 PCE.

• Also at 8:30 AM, the Chicago Fed National Activity Index for November. This is a composite index of other data.

• At 9:55 AM, the final Reuter's/University of Michigan's Consumer sentiment index for December. The consensus is for a reading of 75.0.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for October 2012.

• At 11:00 AM, Kansas City Fed regional Manufacturing Survey for December. The consensus is for a reading of -3, up from -6 in November (below zero is contraction).

Existing Home Sales: The Increase in Conventional Sales

by Calculated Risk on 12/20/2012 03:34:00 PM

There are two keys to the existing home sales report: 1) inventory, and 2) the number of conventional sales. I've written extensively about the decline in inventory, but here is more data on conventional sales. First, on distressed sales from the NAR (the inverse of conventional):

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 22 percent of November sales (12 percent were foreclosures and 10 percent were short sales), down from 24 percent in October and 29 percent in November 2011.Unfortunately the NAR uses an unscientific survey to estimate distressed sales. However CoreLogic estimates the percent of distressed sales each month - and they were kind enough to send me their series. The first graph below shows CoreLogic's estimate of the distressed share starting in October 2007.

Note that the percent distressed increases every winter. This is because distressed sales happen all year, and conventional sales follow the normal seasonal pattern of stronger in the spring and summer, and weaker in the winter.

Click on graph for larger image.

Click on graph for larger image.The seasonal impact of distressed sales is why the Case-Shiller seasonal adjustment increased in recent years.

Also note that the percent of distressed sales over the last 6 months is at the lowest level since mid-2008, but still very high. This is the lowest percent of distressed sales for November since 2007.

The second graph shows the NAR existing home series using the CoreLogic share of distressed sales.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.Using this method (NAR's estimate for sales, CoreLogic estimate of share), conventional sales have recovered significantly. The NAR reported total sales were up 14.5% year-over-year in November, but using this method, conventional sales were up almost 20.9% year-over-year.

Earlier:

• Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

• Existing Home Sales: Another Solid Report

• Existing Home Sales graphs

Misc: Philly Fed Mfg Shows Expansion, Q3 GDP Revised Up, FHFA House Prices increase

by Calculated Risk on 12/20/2012 01:30:00 PM

Here are a few more releases from this morning:

• From the Philly Fed: December Manufacturing Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of ‑10.7 in November to 8.1 this month. This is the highest reading since April and is slightly above the reading before the post-storm decline in November.

Labor market conditions at the reporting firms improved marginally this month. The current employment index, at 3.6, registered its first positive reading in six months ...

The survey’s future indicators suggest improved optimism among the reporting manufacturers. The future general activity index increased from 20.0 to 30.9, its highest reading in three months. emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through December. The ISM and total Fed surveys are through November.

The average of the Empire State and Philly Fed surveys increased in December, but is just back to 0. This is the highest combined level since May, but still suggests another weak reading for the ISM manufacturing index.

• Earlier this morning the BEA reported Q3 GDP increased at a 3.1% annualized rate, higher than the 2.7% estimated earlier. The upward revision was due to increases in the estimate of personal consumption expenditures (PCE), trade, and state and local governments. Although the revision for state and local governments was small, it moved to a positive contribution for the first time since Q3 2009.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).The red bars are for state and local governments. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

I don't expect state and local governments will contribute much to GDP growth in 2013, but just stopping the drag will help.

• From the FHFA: FHFA House Price Index Up 0.5 Percent in October

U.S. house prices rose 0.5 percent on a seasonally adjusted basis from September to October, according to the Federal Housing Finance Agency’s monthly House Price Index (HPI). The previously reported 0.2 percent increase in September was revised downward to a 0.0 percent change. For the 12 months ending in October, U.S. prices rose 5.6 percent. The U.S. index is 15.7 percent below its April 2007 peak and is roughly the same as the July 2004 index level.

Existing Home Sales: Another Solid Report

by Calculated Risk on 12/20/2012 11:29:00 AM

This was another solid report. Based on historical turnover rates, I think "normal" sales would be close to 5.0 million, so existing home sales at 5.04 million are pretty close to normal.

However a "normal" market would have very few distressed sales, so there is still a long ways to go. One key to returning to "normal" are more conventional sales and fewer distressed sales. Not all areas report the percentage of distressed sales, but the areas that do have shown a sharp decline in distressed sales, and a sharp increase in conventional sales.

The NAR reported total sales were up 14.5% from November 2011, but conventional sales are probably up more than 20% from November 2011 (and distressed sales down).

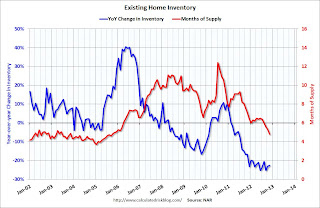

And what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

The NAR reported inventory decreased to 2.03 million units in November, down from 2.11 million in October. This is down 22.5% from November 2011, and down 30% from the inventory level in November 2005 (mid-2005 was when inventory started increasing sharply). This is the lowest level for the month of November since 2000. Inventory will be even lower in December and January - the normal seasonal pattern - and then start increasing in February.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

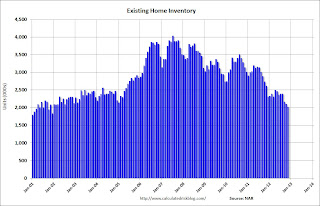

Click on graph for larger image.

Click on graph for larger image.

This graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red for 2012) inventory is at the lowest level for the month of November since 2000, and inventory is sharply below the level in November 2005 (not counting contingent sales). The months-of-supply has fallen to 4.8 months. Since months-of-supply uses Not Seasonally Adjusted (NSA) inventory, and Seasonally Adjusted (SA) sales, I expect months-of-supply to fall further over the next couple of months before increasing in February.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in November (red column) are above last year. Sales are well below the bubble years of 2005 and 2006.

Sales NSA in November (red column) are above last year. Sales are well below the bubble years of 2005 and 2006.

Earlier:

• Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

• Existing Home Sales graphs

Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

by Calculated Risk on 12/20/2012 10:00:00 AM

The NAR reports: November Existing-Home Sales and Prices Maintain Uptrend

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 5.9 percent to a seasonally adjusted annual rate of 5.04 million in November from a downwardly revised 4.76 million in October, and are 14.5 percent higher than the 4.40 million-unit pace in November 2011. Sales are at the highest level since November 2009 when the annual pace spiked at 5.44 million.

...

Total housing inventory at the end of November fell 3.8 percent to 2.03 million existing homes available for sale, which represents a 4.8-month supply 4 at the current sales pace; it was 5.3 months in October, and is the lowest housing supply since September of 2005 when it was 4.6 months.

Listed inventory is 22.5 percent below a year ago when there was a 7.1-month supply. Raw unsold inventory is now at the lowest level since December 2001 when there were 1.89 million homes on the market.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2012 (5.04 million SAAR) were 5.9% higher than last month, and were 14.5% above the November 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 2.03 million in November down from 2.11 million in October. This is the lowest level of inventory since December 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.

According to the NAR, inventory declined to 2.03 million in November down from 2.11 million in October. This is the lowest level of inventory since December 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.Months of supply declined to 4.8 months in November.

This was above expectations of sales of 4.90 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

Weekly Initial Unemployment Claims at 361,000

by Calculated Risk on 12/20/2012 08:30:00 AM

The DOL reports:

In the week ending December 15, the advance figure for seasonally adjusted initial claims was 361,000, an increase of 17,000 from the previous week's revised figure of 344,000. The 4-week moving average was 367,750, a decrease of 13,750 from the previous week's unrevised average of 381,500.The previous week was revised up from 343,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 367,750.

The recent spike in the 4 week average was due to Hurricane Sandy as claims increased significantly in NY, NJ and other impacted areas. Now, as expected, the 4-week average is back to the pre-storm level.

Weekly claims were slightly higher than the 359,000 consensus forecast.

And here is a long term graph of weekly claims:

Note: We use the 4-week average to smooth out noise, but following an event like Hurricane Sandy, the 4-week average lags the event. It looks like the average should decline again next week, perhaps to a new low for the year. The low for the year is 363,000.

Wednesday, December 19, 2012

Thursday: Existing Home Sales, Q3 GDP, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 12/19/2012 09:23:00 PM

First, Stan Collender reviews his budget predictions for 2012 and offers five predictions for 2013: Beyond The Fiscal Cliff: My Budget Crystal Ball For 2013. One of his 2012 predictions is still open:

The one prediction whose fate is still unknown is that I told readers not to be shocked if the only thing that happens in a lame-duck session is a deal that both extends the tax cuts and delays the sequester spending cuts until June 30, 2013, or beyond. We should know in a few weeks whether that happens.My guess is some sort of deal will be worked out in early January, but Collender might be correct and everything could get extended for six months.

Wednesday economic releases:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 359 thousand from 343 thousand last week. If correct, this would put the 4-week just above the low for the year.

• Also at 8:30 AM, the third estimate of Q3 GDP from the BEA. The consensus is that real GDP increased 2.8% annualized in Q3, up slightly from the 2.7% second estimate.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 4.90 million on seasonally adjusted annual rate (SAAR) basis. Sales in October 2012 were 4.79 million SAAR. Economist Tom Lawler estimates the NAR will report sales at 5.10 million SAAR.

• Also at 10:00 AM, the Philly Fed Manufacturing Survey for December. The consensus is for a reading of minus 2.0, up from minus 10.7 last month (above zero indicates expansion).

• Also at 10:00 AM, the Conference Board Leading Indicators for November. The consensus is for a 0.2% decrease in this index.

• Also at 10:00 AM, FHFA House Price Index for October 2012. This was originally a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.3% increase in house prices.

Another question for the December economic prediction contest (Note: You can use Facebook, Twitter, or OpenID to log in).

2013 Housing Forecasts

by Calculated Risk on 12/19/2012 06:57:00 PM

Towards the end of each year I collect some housing forecasts for the following year.

Here was a summary of forecasts for 2012. Right now it looks like new home sales will be around 370 thousand this year, and total starts around 770 thousand or so. Tom Lawler, John Burns and David Crowe (NAHB) were all very close on New Home sales for 2012. Lawler was the closest on housing starts.

The table below shows several forecasts for 2013. (several analysts were kind enough to share their forecasts - thanks!)

From Fannie Mae: Housing Forecast: November 2012

From NAHB: Housing and Interest Rate Forecast, 11/29/2012 (excel)

I haven't worked up a forecast yet for 2013. I've heard there are some lot issues for some of the builders (not improved until 2014), and that might limit supply. In general I expect prices to increase around the rate of inflation, and to see another solid increase in 2013 for new home sales and housing starts.

| Housing Forecasts for 2013 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| NAHB | 447 | 641 | 910 | 1.6% |

| Fannie Mae | 452 | 659 | 936 | 1.6%2 |

| Merrill Lynch | 466 | 976 | 2.6% | |

| Barclays | 424 | 988 | 4.8%3 | |

| Wells Fargo | 460 | 680 | 990 | 2.6% |

| Moody's Analytics | 500 | 820 | 1190 | 1.4% |

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3Corelogic | ||||

| 2011 Actual | 306 | 431 | 609 | -4.0% |

| 2012 Estimate | 370 | 535 | 770 | 6.0% |

Lawler: Updated Outlook on November Existing Home Sales: Expect 5.1 Million (SAAR)

by Calculated Risk on 12/19/2012 04:48:00 PM

From economist Tom Lawler:

"Based on realtor/MLS reports released through today, I have increased my estimate of November existing home sales (as measured by the National Association of Realtors) to a seasonally adjusted annual rate of 5.10 million, up 6.5% from October’s pace, and up 15.9% from last November’s pace."

CR Note: The NAR will report November existing home sales tomorrow, Thursday, Dec 20th. The consensus is the NAR will report sales of 4.85 million.

Based on Lawler's estimates, the NAR will report inventory around 2.05 million units for November, and months-of-supply might be under 5 months. This would be the lowest level of inventory in over 10 years, and the lowest months-of-supply since 2005.

Tom Lawler also sent me some distressed sales data for a few more cities in November.

One of the key changes this year has been the dramatic decline in distressed sales. As the table shows, distressed sales are down everywhere (Chicago is close), foreclosure sales are down everywhere, and short sales are mixed (there is a clear shift from foreclosures to short sales).

The decline in the percent distressed means conventional sales are up even more than total sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Nov | 11-Nov | 12-Nov | 11-Nov | 12-Nov | 11-Nov | |

| Las Vegas | 41.2% | 26.8% | 10.7% | 46.0% | 51.9% | 72.8% |

| Reno | 41.0% | 36.0% | 9.0% | 35.0% | 50.0% | 71.0% |

| Phoenix | 23.2% | 29.6% | 12.9% | 29.8% | 36.1% | 59.4% |

| Sacramento | 36.1% | 29.8% | 11.5% | 34.3% | 47.6% | 64.1% |

| Minneapolis | 11.2% | 13.8% | 24.6% | 34.8% | 35.8% | 48.7% |

| Mid-Atlantic (MRIS) | 11.9% | 13.7% | 8.7% | 14.2% | 20.6% | 27.9% |

| Orlando | 29.0% | 37.2% | 20.9% | 22.8% | 49.9% | 60.0% |

| California (DQ)* | 26.3% | 24.9% | 16.9% | 32.9% | 43.2% | 57.8% |

| So. California (DQ)* | 26.6% | 25.4% | 15.3% | 31.6% | 41.9% | 57.0% |

| Hampton Roads VA | 28.3% | 33.0% | ||||

| Northeast Florida | 42.2% | 48.0% | ||||

| Chicago | 43.0% | 43.1% | ||||

| Charlotte | 13.3% | 18.3% | ||||

| Atlanta | 30.0% | 46.0% | ||||

| Houston | 15.0% | 20.2% | ||||

| Spokane | 9.2% | 22.4% | ||||

| Memphis* | 24.3% | 31.3% | ||||

| Birmingham AL | 26.5% | 34.5% | ||||

| Metro Detroit | 33.6% | 38.7% | ||||

| *share of existing home sales, based on property records | ||||||

Comments on Housing Starts

by Calculated Risk on 12/19/2012 02:41:00 PM

A few key points:

• Housing starts are on pace to increase about 25% in 2012. This is a solid year-over-year increase, and residential investment is now making a positive contribution to GDP growth.

• Even after increasing 25% in 2012, the approximately 770 thousand housing starts this year will still be the 4th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2009 through 2011). Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 level.

• Residential investment and housing starts are usually the best leading indicator for economy. Nothing is foolproof, but this suggests the economy will continue to grow over the next couple of years.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year, but still well below the 1997 through 2007 level of multi-family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts are moving up, but the increase in completions has just started. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Zillow forecasts Case-Shiller House Price index to increase 4.1% Year-over-year for October

by Calculated Risk on 12/19/2012 12:15:00 PM

Zillow Forecast: October Case-Shiller Composite-20 Expected to Show 4.1% Increase from One Year Ago

On Wednesday December 26th, the Case-Shiller Composite Home Price Indices for October will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 4.1 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be up 3.1 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from September to October will be 0.3 percent for the 20-City Composite and 0.1 percent for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below and are based on a model incorporating the previous data points of the Case-Shiller series, the October Zillow Home Value Index data and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close. Right now it looks like Case-Shiller will be up close to 6% for 2013 (through the December / Q4 reports to be released next year).

As we had previously discussed, monthly appreciation has slowed and will eventually turn negative in the last months of 2012. This slowdown is in large part due to Case-Shiller’s mix of distressed and non-distressed properties in the same index, as they include foreclosure re-sales. As the market slows down a bit and fewer homes are listed, foreclosure re-sales will make up a larger part of the transactional mix and will therefore skew the Case-Shiller Indices to be more negative. Despite this slowdown, home values are still higher this year than they were at this same time last year.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Oct 2011 | 153.54 | 151.55 | 140.05 | 138.21 |

| Case-Shiller (last month) | Sept 2012 | 158.93 | 155.63 | 146.22 | 143.15 |

| Zillow Oct Forecast | YoY | 3.1% | 3.1% | 4.1% | 4.1% |

| MoM | -0.4% | 0.1% | -0.3% | 0.3% | |

| Zillow Forecasts1 | 158.3 | 156.0 | 145.8 | 143.7 | |

| Current Post Bubble Low | 146.46 | 149.39 | 134.07 | 136.66 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 8.1% | 4.4% | 8.7% | 5.2% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

AIA: Architecture Billings Index increases in November, "Strongest conditions since end of 2007"

by Calculated Risk on 12/19/2012 10:25:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Signaling Gains for Fourth Straight Month

Billings at architecture firms across the country continue to increase. As a leading economic indicator of construction activity, the Architecture Billings Index (ABI) reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the November ABI score was 53.2, up from the mark of 52.8 in October. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.6, up slightly from the 59.4 mark of the previous month.

“These are the strongest business conditions we have seen since the end of 2007 before the construction market collapse,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The real question now is if the federal budget situation gets cleared up which will likely lead to the green lighting of numerous projects currently on hold. If we do end up going off the ‘fiscal cliff’ then we can expect a significant setback for the entire design and construction industry.”

• Regional averages: Northeast (56.3), Midwest (54.4), South (51.1), West (49.6)

• Sector index breakdown: multi-family residential (55.9), mixed practice (53.9), commercial / industrial (52.0), institutional (50.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.2 in November, up from 52.8 in October. Anything above 50 indicates expansion in demand for architects' services.

This increase is mostly being driven by demand for design of multi-family residential buildings, but every building sector is now expanding. New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment next year.

Housing Starts at 861 thousand SAAR in November

by Calculated Risk on 12/19/2012 08:44:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 861,000. This is 3.0 percent below the revised October estimate of 888,000, but is 21.6 percent (±12.5%) above the November 2011 rate of 708,000.

Single-family housing starts in November were at a rate of 565,000; this is 4.1 percent below the revised October figure of 589,000. The November rate for units in buildings with five units or more was 285,000.

Building Permits:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 899,000. This is 3.6 percent above the revised October rate of 868,000 and is 26.8 percent above the November 2011 estimate of 709,000.

Single-family authorizations in November were at a rate of 565,000; this is 0.2 percent below the revised October figure of 566,000. Authorizations of units in buildings with five units or more were at a rate of 307,000 in November.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased slightly from October.

Single-family starts (blue) decreased to 565,000 thousand in November.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total housing starts were at 861 thousand (SAAR) in November, down 3.0% from the revised October rate of 888 thousand (SAAR).

Total starts are up about 80% from the bottom start rate, and single family starts are up about 60% from the low.

This was slightly below expectations of 865 thousand starts in November. Starts in November were up 21.6% from November 2011, and right now starts are on pace to be up about 25% from 2011. I'll have more soon ...

MBA: Mortgage Applications decline sharply

by Calculated Risk on 12/19/2012 07:01:00 AM

From the MBA: Refinance Applications Fall to Lowest Level in Over a Month in Latest MBA Weekly Survey

The Refinance Index decreased 14 percent from the previous week to the lowest level since week ending November 2, 2012. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. ...

“Despite the Federal Reserve’s announcement last week that it would purchase an additional $45 billion in Treasury securities per month as part of its continuing quantitative easing effort, rates increased in the second half of the week,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “As a result, refinance applications dropped sharply to the lowest level in over a month.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.50 percent from 3.47 percent, with points increasing to 0.44 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

Although the purchase index declined 5% this week, the 4-week average is up about 25% from the post-bubble low.

Tuesday, December 18, 2012

Wednesday: Housing Starts

by Calculated Risk on 12/18/2012 08:16:00 PM

The following table shows annual starts (total and single family) since 2005, an estimate for 2012, and a 2013 "consensus" based on several forecasts. I expect another solid growth year for housing starts in 2013 (with the usual Congressional caveats).

Note: from 1959 through 2000, housing starts average 1.5 million per year. The forecasts for 2013 would still be the sixth lowest year since 1959, with only 2008 through 2012 lower.

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 20121 | 770.0 | 26% | 530.0 | 23% |

| 20132 | 960.0 | 25% | 660.0 | 25% |

| 12012 estimated. 2early 2013 consensus based on several forecasts | ||||

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for November will be released. The consensus is for total housing starts to decline to 865,000 Seasonally Adjusted Annual Rate (SAAR) in November, down from 894,000 in October. Note: In November 2011, housing starts were above 700,000 (SAAR) for the first time in several years - it was considered a blow out month. Now expectations are for starts to be up more than 20% from that level.

• During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

Another question for the December economic prediction contest (Note: You can use Facebook, Twitter, or OpenID to log in).