by Calculated Risk on 12/27/2012 08:30:00 AM

Thursday, December 27, 2012

Weekly Initial Unemployment Claims decline to 350,000, 4-Week average at low for 2012

The DOL reports:

In the week ending December 22, the advance figure for seasonally adjusted initial claims was 350,000, a decrease of 12,000 from the previous week's revised figure of 362,000. The 4-week moving average was 356,750, a decrease of 11,250 from the previous week's revised average of 368,000.The previous week was revised up slightly from 361,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 356,750.

The 4-week average is now at the low for the year. The previous low for the 4-week average was 363,000.

The recent spike in the 4-week average was due to Hurricane Sandy.

Weekly claims were lower than the 365,000 consensus forecast.

And here is a long term graph of weekly claims:

Note: There are large seasonal factors in December and January, and that can make for large swings for weekly claims. Still - it is nice finishing year at the lowest level for the 4-week average.

Wednesday, December 26, 2012

Thursday: New Home Sales, Initial Unemployment Claims

by Calculated Risk on 12/26/2012 09:02:00 PM

First, a reminder that rents can't outpace incomes for long ... from Conor Dougherty at the WSJ: Tenants Feel Pinch of Rising Rents

The rising cost of renting is putting pressure on tenants at a time when many are still grappling with slow or falling income growth. In the third quarter, renters spent 24.12% of their disposable income on financial obligations—things such as rent, debts and auto leases. That was the highest level since early 2010, according to the Federal Reserve.And on house prices from Nick Timiraos at the WSJ: Home Prices Hit a Milestone

Home prices are on track to notch their first yearly gain since 2006, the strongest performance since the housing bust and a development that could accelerate the real-estate rebound even as the broader economy stutters.Thursday economic releases:

...

"The tide has changed," said Ivy Zelman, chief executive of research firm Zelman & Associates. "People feel it's OK to go back into residential real estate—it's no longer taboo—and that change in sentiment could have a very powerful effect."

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 361 thousand last week. If correct, this would put the 4-week average near the low for the year.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for an increase in sales to 375 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 368 thousand in October.

• Also at 10:00 AM, the Conference Board's consumer confidence index for December will be released. The consensus is for an decrease to 70.0 from 73.7 last month.

Earlier on house prices:

• Case-Shiller: House Prices increased 4.3% year-over-year in October

• Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

• All Current House Price Graphs

Another question for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Lawler: An “Update” to the “Excess” Supply of Housing

by Calculated Risk on 12/26/2012 04:42:00 PM

CR: Housing economist Tom Lawler sent me the following long piece that suggests a large number of the excess vacant housing supply has been absorbed.

Housing economist Tom Lawler writes: An “Update” to the “Excess” Supply of Housing; How Much Has the Number of Vacant Homes Fallen Since April 1, 2010 (through December 1, 2012?)

It is over 2 1/2 years since the Decennial Census 2010’s “snapshot” of the US population and housing market on April 1, 2010. While private housing analysts are still awaiting the result of research by Census analysts on the reasons for the sharply different results of Census 2010 compared to other Census surveys (e.g., the ACS and the HVS), I thought it might be useful to review some numbers since the Census was taken.

On the housing production from, Census estimates suggest that from April 2010 to November 2012, housing completions plus manufactured housing units totaled about 1.817 million (an annualized pace of about 681 thousand).

There are no data on the net loss to the housing stock over this period. Prior to the release of Census 2010 results many folks thought that the net loss to the housing stock last decade was averaging around 200 – 250 thousand units a year, but the decennial Census results suggested a much smaller number. But for fun, let’s assume that the net loss in the housing stock since the decennial Census has been about 400,000, or an annualized rate of 150,000.

Such a number would imply that the housing stock at the end of November/beginning of December increased by about 1.417 million, or an annualized rate of about 531 thousand.

Now what about the number of households (or occupied housing units)? Sadly, here there are no good, reliable data to count on. For 2012, there are two sources of “estimates” on US “households,” both based on supplement surveys of the Current Population Survey. One source is the Housing Vacancy Survey, which assumes that (1) the Census’ Population Division estimates of the US housing stock are correct; and (2) the HVS’ estimates of the % of the housing stock are correct. Census 2010 results (and to a lesser extent ACS results) strongly indicated, of course, that the latter assumption is not correct: the HVS appears to overstate significantly the share of the housing stock that is vacant, with the overstatement growing over the past few decades.

With that caveat in mind, the HVS estimates are that the number of US households averaged 114.916 million in September 2012, compared to an average of 112.633 million in March-April of 2010. The official Census 2010 household estimate for April 2010 was 116.716 million. Assuming that the HVS estimates for the last 3 months of 2012 show similar YOY growth as the previous few months, and “grossing up” the totals to be consistent with Census 2010 totals, the HVS estimates might suggest household growth from April 1, 2010 to December 1, 2012 of about 2.62 million, or an annualized rate of about 983 thousand. This is a “low” estimate.

Another source of an “estimate” of US households in 2012 is the Annual Social and Economic Supplement to the Current Population Survey. This annual survey, taken over February, March, and April with an “expanded” sample size relative to the “normal” monthly CPS and HVS surveys, purportedly produces “estimates” of the number of US households in March of each year that are consistent with (1) civilian non-institutionalized population estimates, and (2) survey results. The CPS/ASEC, in essence, is “controlled” to population estimates, as opposed to the CPS/HVS, which is “controlled” to housing stock estimates.

In the latest CPS/ASEC for March, 2012, the estimate of the number of US households was 121.084 million, which is a staggering 4.368 million higher than the official Census 2010 estimate for April 1, 2010. The CPS/ASEC revised household estimate for March, 2011, based on Census 2010 population controls, was 119.927 million, up from the previous 118.682 million in the 2011 report based on Census 2000 population controls. Census did not provide updated March 2010 estimates based on Census 2010 population controls.

It should be noted, however, that the CPS/ASEC household “estimates” are not “controlled” to Census 2010 household estimates, but instead are “controlled” to population estimates, and the CPS/ASEC survey results appear to significantly overstate US households (they also aren’t consistent with decennial Census estimates of the household, as opposed to civilian non-institutionalized, population estimates). I “guesstimate” that a CPS/ASEC household estimate consistent with Census 2010 household population estimates and recently-released 2012 household population estimates by age group for March, 2012 would be about 119.6 million, and that an estimate for December 1, 2012 using updated household population estimates would be about 120.5 million, about 3.8 million higher than the Census 2010 estimate for April 1, 2010, and an annualized increase of about 1.425 million. This is a “high” to “very high” estimate.

Another alternative would be to look at updated estimates of the household population (available through December 1, 20121), and then make certain assumptions either about household size (very crude) or make certain assumptions about “headship” rates by age group. Below is a table with some data to start with.

A few things are worth noting: first, overall population growth is estimated to have grown at an annualized rate of about 0.74% since the decennial Census was taken, and the household population is estimated to have grown at an annualized rate of 0.76%. This growth rate is significantly lower than last decade’s average, partly reflecting lower immigration levels and partly reflecting lower birth rates.

The population of adults – which is more important in terms of household growth, is estimated to have grown at a more rapid annualized rate. E.g., the 25+ year household population is estimated to have grown at an annualized rate of about 1.09%.

| Annualized % Chg | ||||

| 4/1/2010 | 12/1/2012 | |||

| Resident Population | 308,747,508 | 314,918,615 | 0.74% | |

| Household Population | 300,758,251 | Average Household Size | 306,855,515 | 0.76% |

| Households | 116,716,292 | 2.577 | ||

| Household Population by Age Group | ||||

| 15-24 | 40,202,045 | 40,442,554 | 0.22% | |

| 25-34 | 40,005,898 | 41,371,961 | 1.27% | |

| 35-44 | 40,277,153 | 39,666,291 | -0.57% | |

| 45-54 | 44,288,729 | 43,274,284 | -0.87% | |

| 55-64 | 36,068,290 | 38,485,646 | 2.46% | |

| 65-74 | 21,429,316 | 24,256,989 | 4.76% | |

| 75+ | 17,380,962 | 18,231,315 | 1.81% | |

| 25+ Years | 199,450,348 | 205,286,486 | 1.09% | |

| Households by Age Group | Headship Rate* | |||

| 15-24 | 5,400,799 | 13.43% | ||

| 25-34 | 17,957,375 | 44.89% | ||

| 35-44 | 21,290,880 | 52.86% | ||

| 45-54 | 24,907,064 | 56.24% | ||

| 55-64 | 21,340,338 | 59.17% | ||

| 65-74 | 13,504,517 | 63.02% | ||

| 75+ | 12,315,319 | 70.86% | ||

| * Households divided by Household Population | ||||

[Note: the difference between the “resident” population and the “household” population is the number of people estimated to be living in “group quarters,” usually broken out between “institutionalized” (including correctional facilities for adults, juvenile facilities, and nursing/skilled nursing facilities) and “non-institutionalized” (including college/university student housing, military quarters, and other group housing).]

There are two “Q&D” ways one might “gueestimate” the number of households on December 1, 2012: one – very quick, extremely dirty – would be to assume that the average household size had remained the same. That approach, which doesn’t take into account shifts in the age distribution of the population, would lead to an estimate of 119.028 million, up 2.366 million from April 1, 2010.

A second approach would be to assume that the “headship” rates for different age groups on December 1, 2012 was about the same as on April 1, 2012. Using that “Q&D” approach, one would get an estimate of the number of households on December 1, 2012 of about 120.283 million, up 3.567 million from April 1, 2010.

So … let’s assume that a “very low” case for household growth from April 1, 2010 is around 2.4 million (annual rate of 900 thousand); a “high” case is 4.0 million (annual rate of 1.5 million), and a “base” case is around 3.2 million (annual rate of around 1.2 million). What might these numbers mean for the number of vacant homes as of December 1, 2012 compared to April 1, 2010? Here is a table showing (rounded) what the numbers might look like.

| Changes from April 1, 2010 to December 1, 2012 (millions of units) | |||

|---|---|---|---|

| Low | Base | High | |

| Household Increase | 2.4 | 3.1 | 3.8 |

| Housing Production* | 1.8 | 1.8 | 1.8 |

| Net Housing Units Lost | 0.4 | 0.4 | 0.4 |

| Housing Units | 1.4 | 1.4 | 1.4 |

| Vacant Housing Units | -1.0 | -1.7 | -2.4 |

| *Housing Completions plus Manufactured Housing Placements (with November estimate) | |||

Under a “very low end” estimate of household growth, the number of vacant units since April 1, 2010 would be down by about a million. Under a “very high end” estimate of household growth, the number of vacant housing units would be 2.4 million lower. And a “not too unrealistic” estimate of household growth would imply that the number of vacant housing units was down by about 1.7 million.

Now, does a 1.7 million decline in the number of vacant homes for sale since April 1, 2010 seem plausible? Well, if that were the case one would probably expect that the number of homes for sale, for rent, and held as REO would be down significantly. So, let’s take a look at some available numbers.

NAR estimates that the number of existing homes for sales declined from 3.09 million at the end of March 2010 to 2.03 million at the end of November 2012, a decline of about 1.06 million. Realtor.com’s listings numbers fell by a similar amount. Obviously not all homes listed for sale are vacant, but a significant % are vacant.

Census estimates that the number of completed new SF homes for sales declined from 92 thousand at the end of March 2010 to 40 thousand at the end of October 2012, a decline of 52 thousand.

The REO inventory of Fannie, Freddie, FHA, and private-label ABS, combined with an estimate of the REO inventory of FDIC-insured institutions (based on $ carrying amounts and estimates of the average carrying balance) declined from about 531 thousand from the end of March 2010 to about 367 thousand at the end of September 2012, a decline of about 164 thousand. Some, but probably less than 40%, of these REO properties were listed for sale.

There aren’t good, aggregate data on the number of homes for rent: HVS has estimates, but comparisons with decennial Census data indicate that HVS rental vacancy rates not only are overstated, but also that the overstatement has grown over time. Given that caveat, the HVS estimates show that the number of homes for rent declined from a first-half 2010 average (to come close to an April 1 estimate) of about 4.458 million to a third-quarter 2012 average of 3.809 million, a decline of about 649 thousand. The actual decline is probably larger.

Hmmmm…..gosh, a decline in the number of vacant homes of about 1.7 million since April 1, 2010 sure SEEMS plausible!

But wait: if the number of vacant homes since Census 2010 has been that large, then that would imply a sizable reduction in the “excess” supply of housing – enough so that, if true, one should have expected to see stability in, or even in many areas even increases in, home prices in 2012! Could that really be true? (CR note: see previous posts!)

Looking ahead to the next few years, the likely growth in population by age groups suggests that household formations should average about 1.3 million a year, with some upside if headship rates rebound in any meaningful fashion.

1 Actually, “estimates” are available through July 1, 2012, and data from August 1, 2012 through December 1, 2012, are short-term “projections.”

CR Note: This was from housing economist Tom Lawler.

Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

by Calculated Risk on 12/26/2012 12:23:00 PM

There is a seasonal pattern for house prices, and I've been predicting that the Case-Shiller indexes would turn negative month-to-month in October on a Not Seasonally Adjusted (NSA) basis.

That is the normal seasonal pattern. Also, as I've noted, I expect smaller month-to-month declines this winter than for the same months last year. Sure enough, Case-Shiller reported that the Composite 20 index declined 0.1% in October from September (barely negative). In October 2011, the index declined 1.3% on a month-to-month basis.

Over the winter, the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. I think the house price indexes have already bottomed, and will be up about 6% or so year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (both through October). The CoreLogic index turned negative month-to-month in the September report (CoreLogic is a 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted).

Case-Shiller reported the fifth consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in October suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase for each month this year.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.6% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 1.9% |

| Sep-12 | 2.9% |

| Oct-12 | 4.3% |

| Nov-12 | |

| Dec-12 | |

| Jan-13 | |

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through October) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through October) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to September 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to July 2000, and the CoreLogic index back to January 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to August 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to 1999 or early 2000 levels.

Case-Shiller: House Prices increased 4.3% year-over-year in October

by Calculated Risk on 12/26/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October (a 3 month average of August, September and October).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Sustained Recovery in Home Prices According to the S&P/Case-Shiller Home Price Indices

Data through October 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices, ... showed home prices rose 4.3% in the 12 months ending in October in the 20-City Composite, out-distancing analysts’ forecasts. Anticipated seasonal weakness appeared as twelve of the 20 cities and both Composites posted monthly declines in home prices in October.

The 10- and 20-City Composites recorded respective annual returns of +3.4% and +4.3% in October 2012 – larger than the +2.1% and +3.0% annual rates posted for September 2012. In nineteen of the 20 cities, annual returns in October were higher than September. Chicago and New York were the only two cities with negative annual returns in October. Phoenix home prices rose for the 13th month in a row. San Diego was second best with nine consecutive monthly gains.

...

“Annual rates of change in home prices are a better indicator of the performance of the housing market than the month-over-month changes because home prices tend to be lower in fall and winter than in spring and summer. Both the 10- and 20-City Composites and 19 of 20 cities recorded higher annual returns in October 2012 than in September. The impact of the seasons can also be seen in the seasonally adjusted data where only three cities declined month-to-month. The 10-City Composite annual rate of +3.4% in October was lower than the 20-City Composite annual figure of +4.3% because the two weaker cities – Chicago and New York – have higher weights in the 10-City Composite." [says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices.]

“Looking over this report, and considering other data on housing starts and sales, it is clear that the housing recovery is gathering strength. Higher year-over-year price gains plus strong performances in the southwest and California, regions that suffered during the housing bust, confirm that housing is now contributing to theeconomy.'

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.0% from the peak, and up 0.6% in October (SA). The Composite 10 is up 4.8% from the post bubble low set in March (SA).

The Composite 20 index is off 30.3% from the peak, and up 0.7% (SA) in October. The Composite 20 is up 5.4% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 3.4% compared to October 2011.

The Composite 20 SA is up 4.3% compared to October 2011. This was the fifth consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in October seasonally adjusted (also 12 of 20 cities increased NSA). Prices in Las Vegas are off 58.0% from the peak, and prices in Dallas only off 4.6% from the peak. Note that the red column (cumulative decline through October 2012) is above previous declines for all cities.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in October seasonally adjusted (also 12 of 20 cities increased NSA). Prices in Las Vegas are off 58.0% from the peak, and prices in Dallas only off 4.6% from the peak. Note that the red column (cumulative decline through October 2012) is above previous declines for all cities.This was slightly above the consensus forecast for a 4.1% YoY increase. I'll have more on prices later.

LPS: House Price Index increased 0.3% in October, Up 4.3% year-over-year

by Calculated Risk on 12/26/2012 08:39:00 AM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses October closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.3 Percent for the Month; Up 4.3 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on October 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 22.6% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 53.6% from the peak in Las Vegas, 45.5% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and barely off in Austin and Houston.

Looking at the year-over-year price change throughout the year - in May, the LPS HPI was up 0.4% year-over-year, in June the index was up 0.9% year-over-year, 1.8% in July, 2.6% in August, 3.6% in September, and now 4.3% in October. This is steady improvement on a year-over-year basis. Note: Case-Shiller for October will be this morning.

Tuesday, December 25, 2012

Wednesday: Case-Shiller House Prices, Richmond Fed Manufacturing Survey

by Calculated Risk on 12/25/2012 07:33:00 PM

First a great story about Jack Klugman from Joshua Green at the WaPo: Jack Klugman’s secret, lifesaving legacy

And for those seeing Les Mis this week, here are couple of incredible performances of "I Dreamed a Dream", first by Ruthie Henshall at the 10th Anniversary and another by Lea Salonga at the 25th Anniversary Concert.

Wednesday economic releases:

• At 9:00 AM, the S&P/Case-Shiller House Price Index for October will be released. Although this is the October report, it is really a 3 month average of August, September and October. The consensus is for a 4.1% year-over-year increase in the Composite 20 index (NSA) for September. The Zillow forecast is for the Composite 20 to increase 4.1% year-over-year, and for prices to increase 0.3% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for December will be released. The consensus is for a decrease to 6 for this survey from 9 in November (Above zero is expansion).

A couple of posts yesterday:

• Review of My 2012 Forecasts

• Ten Economic Questions for 2013

Two more questions this week for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Private Investment and the Business Cycle

by Calculated Risk on 12/25/2012 01:01:00 PM

A little holiday cheer ...

Discussions of the business cycle frequently focus on consumer spending (PCE: Personal consumption expenditures), but the key is to watch private domestic investment, especially residential investment. Even though private investment usually only accounts for around 15% of GDP, the swings for private investment are significantly larger than for PCE during the business cycle, so private investment has an outsized impact on GDP at transitions in the business cycle.

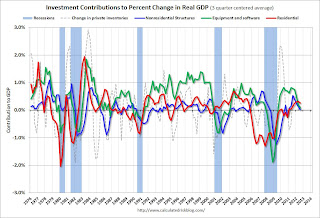

The first graph shows the real annualized change in GDP and private investment since 1960 (this is a 3 quarter centered average to smooth the graph).

GDP has fairly small annualized changes compared to the huge swings in investment, especially during and just following a recession. This is why investment is one of the keys to the business cycle.

Click on graph for larger image.

Click on graph for larger image.

Note that during the recent recession, the largest decline for GDP was in Q4 2008 (a 8.9% annualized rate of decline). On a three quarter center averaged basis (as presented on graph), the largest decline was 5.9% annualized.

However the largest decline for private investment was a 43% annualized rate! On a three quarter average basis (on graph), private investment declined at a 35% annualized rate.

The second graph shows the contribution to GDP from the four categories of private investment: residential investment, equipment and software, nonresidential structures, and "Change in private inventories". Note: this is a 3 quarter centered average of the contribution to GDP.

This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment lags the business cycle. Red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, and blue.

The dashed purple line is the "Change in private inventories". This category has significant ups and downs, but is always negative during a recession, and provides a boost to GDP just after a recession.

The dashed purple line is the "Change in private inventories". This category has significant ups and downs, but is always negative during a recession, and provides a boost to GDP just after a recession.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the recovery was sluggish so far.

Residential investment finally turned positive during 2011 and made a positive contribution to GDP in 2012.

What does this mean for the business cycle? Usually residential investment would turn down before a recession, and that isn't happening right now. Instead residential investment is starting to increase.

What does this mean for the business cycle? Usually residential investment would turn down before a recession, and that isn't happening right now. Instead residential investment is starting to increase.

The third graph shows residential investment as a percent of GDP. Residential investment as a percent of GDP is just above the record low, and it seems likely that residential investment as a percent of GDP will increase further in 2013.

The key downside risk for the US economy in 2013 is too much austerity, too quickly. However, barring a policy mistake (I expect a fiscal agreement), it seems unlikely there will be a sharp decline in private investment in 2013. This is because residential investment is already near record lows as a percent of GDP and will probably increase further in 2013, and that suggests the US will avoid a new recession in 2013.

Happy Holidays!

by Calculated Risk on 12/25/2012 09:01:00 AM

Happy Holidays and Merry Christmas to all!

A couple of posts yesterday:

• Review of My 2012 Forecasts

• Ten Economic Questions for 2013

And a repeat gift ... a common question, using excel, is how do you get from this:

Thanks to all. Happy Holidays!

Monday, December 24, 2012

Ten Economic Questions for 2013

by Calculated Risk on 12/24/2012 06:43:00 PM

Here are some questions I'm thinking about ...

1) US Policy: This is probably the biggest downside risk for the US economy in 2013. I assume some sort of fiscal agreement will be reached soon, but how much austerity will be included? What will happen with the Alternative Minimum Tax (AMT)? What about emergency unemployment benefits? What about extending the mortgage relief for debt forgiveness (important for short sales)?

And what about other policy in 2013 such as the "default ceiling" (aka debt ceiling)? In 2011, the threat of a US government default slowed the economy to almost a standstill for a month. Right now the White House is taking the Ronald Reagan approach (when the Democrats pulled a similar reckless stunt) and they are saying President Obama will only sign a clean debt ceiling bill. Good. Hopefully default is off the table, but you never know.

2) Economic growth: Heading into 2013 there are still significant downside risks from the European financial crisis and from U.S. fiscal policy. Will the U.S. economy grow in 2013? Or will there be another recession?

3) Employment: How many payroll jobs will be added in 2013? Will we finally see some pickup over the approximately 2 million private sector job creation rate of 2011 and 2012?

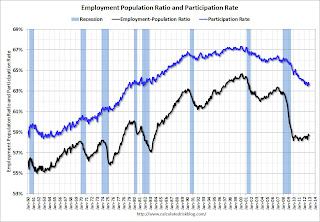

4) Unemployment Rate: The unemployment rate is still elevated at 7.7% in November. For the last two years I've been too pessimistic on the unemployment rate because I was expecting some minor bounce back in the participation rate. Instead the participation rate continued to decline. Maybe 2013 will be the year the participation rate increases a little, or at least stabilizes. Economists at the SF Fed wrote about this last week: Will the Jobless Rate Drop Take a Break?

The recent recession was unusual in its depth and its duration. Labor market conditions have remained difficult for a long time. As a result, large numbers of discouraged workers have stopped looking for jobs. A big unknown is whether these workers will stay out of the labor force permanently or enter as the economy recovers. If these workers join the labor force, increasing participation could have a major impact on the unemployment rate in the coming years.What will the unemployment rate be in December 2013?

5) Inflation: The Fed has made it clear they will tolerate a little more inflation, but currently the inflation rate is running below the Fed's 2% target. Will the inflation rate rise or fall in 2013?

6) Monetary Policy: Currently the Fed is planning to buy $85 billion in Treasury and agency mortgage-backed securities per month as part of the open-ended QE3. Will the Fed continue all year at this pace? Or will the Fed increase their purchase rate? Or will the Fed decrease their purchase rate, stop these purchases, or even sell some securities?

7) House Prices: It now appears house prices, as measured by the national repeat sales indexes, bottomed in early 2012? What will happen with house prices in 2013?

8) Housing Inventory: Over the last few years, we've seen a dramatic plunge in existing home inventory. Will inventory bottom in 2013?

9) Residential Investment: Residential investment (RI) picked up in 2012, with new home sales and housing starts increasing 20% or so. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. This still leaves RI at a historical low level. How much will RI increase in 2013?

10) Europe and the Euro: What will happen in Europe in 2013? Will a country leave the euro this coming year, will the euro-zone implode, or will 2013 be the bottom for the euro-zone economies?

I'm sure there are other key questions, but these are the ones I'm thinking about now.

Review of My 2012 Forecasts

by Calculated Risk on 12/24/2012 11:52:00 AM

Near the end of each year I try to post a few general forecasts for the coming year. The purpose is to try to provide an overview of how I think the economy will perform.

Some years there are BIG calls, like in late 2006 when I predicted a recession would start in 2007 (made it by one month!). Another “BIG” call example was in early 2009 when I started writing about a second half economic recovery.

Most of my forecasts are more mundane, as an example for 2012 GDP, I wrote:

“my guess is growth will be sluggish relative to the slack in the system, but above the 2011 growth rate. “Right now “sluggish” looks correct, and if Q4 2012 GDP is at or above 1.6% (annualized), then 2012 will actually be better than 2011 (Q4 over Q4 of previous year). But even if I had been wrong, I find it useful to write down some forecasts and then to understand why I was right or wrong. (I’d say my guess on growth was about right).

Of course my BIG call for 2012 was that house prices would finally find a bottom as measured by the national repeat sales indexes (see: The Housing Bottom is Here). In early 2012, I wrote:

“My guess is that nominal house prices, using the national repeat sales indexes and not seasonally adjusted, will bottom in March 2012.”As of right now – with prices up almost 5% seasonally adjusted since early this year – the house price bottom call looks correct.

Note: When I wrote that post, the consensus was house prices would decline throughout 2012. Since then the consensus has changed and most analysts now think prices bottomed early this year.

I did get a couple of forecasts wrong in 2012. For the unemployment rate, I wrote:

A couple of predictions.Even though I’ve been arguing that most of the decline in the participation rate over the last few years was due to changing demographics (as opposed to cyclical due to the recession), I still thought we’d see some slight increase in participation in 2012 – and that didn’t happen.

• The participation rate will rise slightly in 2012 and probably end the year in the 64.0% to 64.5% range.

• The unemployment rate will still be in the 8% to 9% range in December 2012.

Click on graph for larger image.

Click on graph for larger image.The participation rate fell to 63.6% in November, and the unemployment rate declined to 7.7%. (Participation rate is the blue line. This is the percentage of the working age population in the labor force).

Since I was wrong on the participation rate, my forecast for the unemployment rate was too pessimistic.

I was also too pessimistic on foreclosures. I wrote:

Will foreclosure activity increase in 2012?The policy changes were announced, but the lenders focused more on modifications and short sales than foreclosures, and foreclosure activity has only picked up recently in some judicial foreclosure states.

This is a difficult question. There are several significant policy changes in the works: 1) a possible Mortgage Settlement, 2) HARP refinance (the automated program starts in March), and 3) a REO to rental program. It appears the overall goal of these policy changes is to reduce the large backlog of seriously delinquent loans while, at the same time, not flood the housing market with distressed homes.

My guess is the policy changes will all be announced in the next few months, and that foreclosure activity will increase significantly.

On employment I was close. I wrote:

My guess is private employment will increase around 150 to 200 thousand per month on average in 2012; about the same rate as in 2011.That was about right. The economy has added 1.7 million private sector jobs through November (over 1.8 million including the preliminary benchmark revision).

With over 13 million unemployed workers - and 5.6 million unemployed for more than 26 weeks - adding 2 million private sector jobs will not seem like much of job recovery for many Americans. Hopefully I'm too pessimistic.

A key forecast – that appears correct – was that the drag from state and local governments would end around mid-year. I wrote:

It is looking like there will be less drag from state and local governments in 2012, and that most of the drag will be over by the end of Q2 (end of FY 2012). This doesn't mean state and local government will add to GDP in the 2nd half of 2012, just that the drag on GDP and employment will probably end. Just getting rid of the drag will help.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. So far in 2012, state and local governments have actually added a few jobs, and state and local government employment increased by 4,000 in November.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. So far in 2012, state and local governments have actually added a few jobs, and state and local government employment increased by 4,000 in November.Note: The dashed line shows an estimate including the benchmark revision.

It appears most of the state and local government layoffs are over, however the Federal government layoffs are ongoing.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

The red bars are for state and local governments. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending, and state and local governments actually added to GDP growth in Q3 2012 - for the first time since Q3 2009.

A few more forecasts - On monetary policy I wrote:

• I expect the Fed will change their communication strategy and add a likely future path of the Fed Funds rate to the quarterly economic forecasts.The Fed introduced the new communication strategy, and then changed it again near the end of 2012. They waited a little longer than I expected, and the FOMC announced QE3 in September.

• I think QE3 is likely, but more towards mid-year - and [timing] is data dependent.

And on inflation:

The bottom line is the inflation rate will probably stay low in 2012 with high unemployment and low resource utilization. I expect QE3 to be announced before mid-year, and that will probably keep the inflation rate near the Fed's target (as opposed to falling further). But I don't see inflation as a significant threat in 2012.The inflation outlook was correct. It is stunning how many analysts and policymakers have consistently been wrong on inflation for the last several years - and they still haven't changed their views or models!

And on Europe and the Euro:

So once again my guess is the euro will survive another year without losing any countries (Assuming a Greek debt deal). There will be plenty of blowups along the way, but I think the impact on the US economy will be fairly minimal.I was pessimistic on Europe, but less pessimistic than many others. And once again Europe made it through another year.

All and all the economy evolved about as I expected in 2012. I’ll try to post some forecasts for 2013 soon, but I’ll wait until we see the details of the fiscal agreement. Policy matters – and the key downside risk for the US economy in 2013 is rapid austerity.

"Fiscal Cliff": Weary eyes turn toward the Senate

by Calculated Risk on 12/24/2012 09:23:00 AM

From the NY Times: Search for Way Through Fiscal Impasse Turns to the Senate

Senators Kay Bailey Hutchison of Texas and Johnny Isakson of Georgia, both Republicans, implored Senate leaders to reach an accommodation with Mr. Obama when Congress returns on Thursday, even if that meant that taxes would go up for those with high incomes and that spending cuts would be put off.I think Isakson is correct about what will happen in January - that Congress will approve an agreement after the tax cuts expire so they can claim they are cutting taxes. Politics is weird.

“The president’s statement is right,” Mr. Isakson said Sunday on the ABC program “This Week.” “No one wants taxes to go up on the middle class."...

“The truth of the matter is, if we do fall off the cliff after the president is inaugurated, he’ll come back, propose just what he proposed yesterday in leaving Washington, and we’ll end up adopting it,” Mr. Isakson continued. “But why should we put the markets in such turmoil and the people in such misunderstanding or lack of confidence? Why not go ahead and act now?”

Sunday, December 23, 2012

Sunday Night Futures

by Calculated Risk on 12/23/2012 09:34:00 PM

Happy Holidays to all. There are no releases scheduled for Monday, and the U.S. markets will close early.

We will also get a two day break from the "fiscal cliff"!

Weekend:

• Summary for Week Ending Dec 21st

• Schedule for Week of Dec 23rd

The Asian markets are mostly green tonight, with both the Shanghai Composite and the Hang Seng up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 4 and DOW futures are down 30.

Oil prices have moved up a little recently withWTI futures at $88.46 per barrel and Brent at $108.80 per barrel. Gasoline prices are now near the low for the year.

Gasoline Prices near Low for Year, Expected to Increase

by Calculated Risk on 12/23/2012 05:39:00 PM

Another update on gasoline prices. It looks like prices will finish the year near the low, but probably increase soon.

From CNN: Gas prices slide, but the decline won't last, survey says

The average cost of a gallon of regular gasoline is $3.26, down 58 cents over the past 11 weeks, the Lundberg Survey found.Yesterday:

But that good news at the pump is unlikely to continue, says publisher Tribly Lundberg.

“Higher crude oil prices are translating into higher wholesale gasoline prices,” and retailers will need to pass them through, she says. Expect prices to jump 5 or 10 cents per gallon soon.

• Summary for Week Ending Dec 21st

• Schedule for Week of Dec 23rd

Here is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

DOT: Vehicle Miles Driven increased 0.3% in October

by Calculated Risk on 12/23/2012 01:39:00 PM

The Department of Transportation (DOT) reported Friday:

Travel on all roads and streets changed by +0.3% (0.9 billion vehicle miles) for October 2012 as compared with October 2011. Travel for the month is estimated to be 251.5 billion vehicle miles.Vehicle miles driven decreased in the Northeast (probably impacted by Hurricane Sandy) and increased in all other regions. The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by +0.6% (14.9 billion vehicle miles). The Cumulative estimate for the year is 2,464.5 billion vehicle miles of travel.

The rolling 12 month total is still moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 59 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in October compared to October 2011. In October 2012, gasoline averaged of $3.81 per gallon according to the EIA. Last year, prices in October averaged $3.51 per gallon.

Gasoline prices were up in October compared to October 2011. In October 2012, gasoline averaged of $3.81 per gallon according to the EIA. Last year, prices in October averaged $3.51 per gallon. However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it may be years before we see a new peak in miles driven.

Fiscal Agreement Update

by Calculated Risk on 12/23/2012 10:33:00 AM

A few obvious points on the "fiscal cliff": 1) It is about the deficit shrinking too quickly next year, 2) there is no "drop dead" date and an agreement in early January still seems likely (the sites and TV stations with countdown times are embarrassing themselves), and 3) entitlements are not part of the "cliff" (although it was possible some changes might be part of an agreement).

Clearly there is going to be more austerity in the US at the Federal level next year. How much is unclear.

From Ezra Klein at Wonkblog: Obama’s “small deal” could lead to bigger tax increases

The talk in Washington now is about a “small deal.” That would likely include the Senate tax bill [to extend tax cuts for anyone making less than $250,000], some policy to turn off at least the defense side of the sequester and a handful of other policies to blunt or delay various parts of the fiscal cliff.This means the payroll tax cuts would expire (something I've expected) and tax rates for those making more than $250,000 would increase (also expected). There are many other issues - the medicare "doc" fix, mortgage debt relief, emergency unemployment benefits and on and on - that still need to be addressed.

That’s not a very good deal for the short-term health of the economy.

It is hard to guess the impact on the economy until we see the details.

And an interesting article from the NY Times: How Party of Budget Restraint Shifted to ‘No New Taxes,’ Ever

On a Saturday afternoon in October 1990, Senator Pete V. Domenici turned from a conversation on the Senate floor, caught the eye of a clerk by raising his right hand and voted in favor of a huge and contentious bill to reduce federal deficits. Then he put his hand back into his pocket and returned to the conversation.This shift in the Republican party (to no taxes ever) is why I think an early January agreement is likely. In my first post on the fiscal agreement, I wrote: "Given that the top marginal tax rate will increase - and that certain politicians can't vote for any bill with a tax increase - the agreement will probably be voted on in January after the Bush tax cuts expire." That may seem weird, but it is the current state of politics.

It was the end of an era, although no one knew it then. It was the last time any Congressional Republican has voted for higher income taxes.

...

In the early 1980s, majorities of Congressional Republicans voted for a pair of deficit deals orchestrated by President Ronald Reagan, even though tax increases accounted for more than 80 percent of the projected reductions.

Saturday, December 22, 2012

Unofficial Problem Bank list declines to 841 Institutions

by Calculated Risk on 12/22/2012 06:20:00 PM

Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 21, 2012.

Changes and comments from surferdude808:

As expected, the OCC released its enforcement actions through mid-November this week. For the week, there were eight removals and four additions to the Unofficial Problem Bank List. After the changes, the list holds 841 institutions with assets of $313.3 billion. A year ago, the list held 973 institutions with assets of $397.6 billion.Earlier:

The OCC terminated actions against National Bank of Kansas City, Overland Park, KS ($640 million); First Community Bank, National Association, Sugar Land, TX ($610 million); RiverWood Bank, Bemidji, MN ($156 million); The Midland National Bank of Newton, Newton, KS ($132 million); and Texas Republic Bank, National Association, Frisco, TX ($76 million).

The following three banks solved their problems by finding a healthier merger partner: The Community Bank, A Massachusetts Cooperative Bank, Brockton, MA ($317 million); Premier Bank, Tallahassee, FL ($272 million); and Stone County National Bank, Crane, MO ($81 million).

The OCC issued new actions against Los Alamos National Bank, Los Alamos, NM ($1.6 billion); Westbury Bank, West Bend, WI ($525 million); GCF Bank, Sewell, NJ ($314 million); and Home Loan Investment Bank, F.S.B., Warwick, RI ($196 million). Keen readers will know that Los Alamos National Bank is making its second appearance on the list after being removed in April 2012 when the OCC terminated an action issued in January 2010.

Next week, we look for the FDIC to release its actions through November but to shut it down as far as closings go. Wishing all a Merry Christmas and may you find a safe & sound bank under your tree.

• Summary for Week Ending Dec 21st

• Schedule for Week of Dec 23rd

Schedule for Week of Dec 23rd

by Calculated Risk on 12/22/2012 01:11:00 PM

Earlier:

• Summary for Week Ending Dec 21st

This will be a light week for economic data with the markets closing early on Monday, and closed on Tuesday, in observance of the Christmas Day holiday.

The key economic reports this week are the Case-Shiller house price indexes on Wednesday, and New Home sales on Thursday.

Happy Holidays to All. As usual, the Calculated Risk blog will be open.

SIFMA recommends US markets close at 2:00 PM ET in advance of the Christmas Day holiday.

US markets are closed in observance of the Christmas Day holiday.

Note: The Mortgage Bankers Association (MBA) will not release the mortgage purchase applications index this week. They will release two weeks of results on Thursday, January 3, 2013.

9:00 AM: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October.

9:00 AM: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through September 2012 (the Composite 20 was started in January 2000).

The consensus is for a 4.1% year-over-year increase in the Composite 20 index (NSA) for September. The Zillow forecast is for the Composite 20 to increase 4.1% year-over-year, and for prices to increase 0.3% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. The consensus is for a decrease to 6 for this survey from 9 in November (Above zero is expansion).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 361 thousand last week. If correct, this would put the 4-week near the low for the year.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the October sales rate.

The consensus is for an increase in sales to 375 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 368 thousand in October.

10:00 AM: Conference Board's consumer confidence index for December. The consensus is for an decrease to 70.0 from 73.7 last month.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for an increase to 51.0, up from 50.4 in November.

10:00 AM ET: Pending Home Sales Index for November. The consensus is for a 18% increase in the index

Summary for Week ending Dec 21st

by Calculated Risk on 12/22/2012 08:01:00 AM

The economic data released this week was encouraging. The November Personal Income and Outlays report suggests PCE might increase over 2% in Q4 - not great, but higher than most forecasts.

The housing numbers were solid. Housing starts are on pace to increase about 25% this year, and, for existing homes, inventory is down sharply and conventional sales up.

Other positives include Q3 GDP being revised up, the highest Architecture Billings Index since 2007, a rebound in the trucking index, a decline in the 4-week average of initial weekly unemployment claims, and another increase in builder confidence.

Manufacturing was still weak, but two of the three regional surveys were slightly better than expected. A negative was consumer sentiment, and that is probably related to the "fiscal cliff" debate in Washington that is still showing no signs of progress. I expect an agreement, but not until early January (although it could happen sooner). Next week will be a light week for economic data, but there are two key housing reports - new home sales and Case-Shiller house prices.

Here is a summary of last week in graphs:

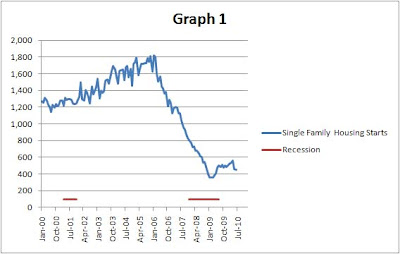

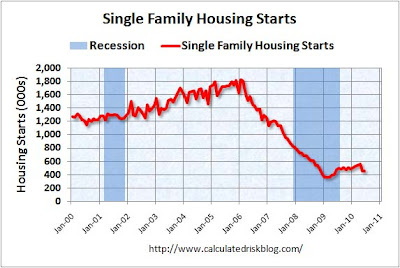

• Housing Starts at 861 thousand SAAR in November

Total housing starts were at 861 thousand (SAAR) in November, down 3.0% from the revised October rate of 888 thousand (SAAR).

Total housing starts were at 861 thousand (SAAR) in November, down 3.0% from the revised October rate of 888 thousand (SAAR).

A few key points:

• Housing starts are on pace to increase about 25% in 2012. This is a solid year-over-year increase, and residential investment is now making a positive contribution to GDP growth.

• Even after increasing 25% in 2012, the approximately 770 thousand housing starts this year will still be the 4th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2009 through 2011). Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 level.

• Residential investment and housing starts are usually the best leading indicator for economy. Nothing is foolproof, but this suggests the economy will continue to grow over the next couple of years.

This was slightly below expectations of 865 thousand starts in November.

• Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

The NAR reports: November Existing-Home Sales and Prices Maintain Uptrend

The NAR reports: November Existing-Home Sales and Prices Maintain UptrendThis graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2012 (5.04 million SAAR) were 5.9% higher than last month, and were 14.5% above the November 2011 rate.

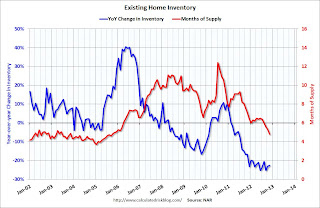

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.Months of supply declined to 4.8 months in November.

This was above expectations of sales of 4.90 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• Personal Income increased 0.6% in November, Spending increased 0.4%

The BEA released the Personal Income and Outlays report for November.

The BEA released the Personal Income and Outlays report for November.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. Personal income increased more than expected in November and PCE for October was revised up.

The "two month method" for estimating Q4 PCE suggests PCE will increase close to 2.2% in Q4 - more growth than most expect - although this estimate is probably a little high because PCE was strong in September. Still better than expected, and we are already seeing some upward revisions to Q4 GDP forecasts.

• AIA: Architecture Billings Index increases in November, "Strongest conditions since end of 2007"

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Signaling Gains for Fourth Straight Month

From AIA: Architecture Billings Index Signaling Gains for Fourth Straight MonthThis graph shows the Architecture Billings Index since 1996. The index was at 53.2 in November, up from 52.8 in October. Anything above 50 indicates expansion in demand for architects' services.

This increase is mostly being driven by demand for design of multi-family residential buildings, but every building sector is now expanding. New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

• Weekly Initial Unemployment Claims at 361,000

"In the week ending December 15, the advance figure for seasonally adjusted initial claims was 361,000, an increase of 17,000 from the previous week's revised figure of 344,000."

"In the week ending December 15, the advance figure for seasonally adjusted initial claims was 361,000, an increase of 17,000 from the previous week's revised figure of 344,000."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 367,750.

The recent spike in the 4 week average was due to Hurricane Sandy as claims increased significantly in NY, NJ and other impacted areas. Now, as expected, the 4-week average is back to the pre-storm level.

Weekly claims were slightly higher than the 359,000 consensus forecast.

• Final December Consumer Sentiment declines to 72.9

The final Reuters / University of Michigan consumer sentiment index for December declined to 72.9, down from the preliminary reading of 74.5, and was down from the November reading of 82.7.

The final Reuters / University of Michigan consumer sentiment index for December declined to 72.9, down from the preliminary reading of 74.5, and was down from the November reading of 82.7.This was below the consensus forecast of 75.0. The recent decline in sentiment is probably related to Congress and the so-called "fiscal cliff". This is similar to the sharp decline in 2011 when Congress threatened to force the US to default (not pay the bills).

I still think an agreement will be reached in early January - there is no drop dead date - but you never know.

Friday, December 21, 2012

Earlier: Chicago Fed National Activity Index improves, Kansas City Fed Mfg Survey shows contraction

by Calculated Risk on 12/21/2012 06:51:00 PM

A couple of reports from earlier this morning:

• The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Increased in November

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.10 in November from –0.64 in October. Two of the four broad categories of indicators that make up the index increased from October, but only the production and income category made a positive contribution to the index in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased from –0.59 in October to –0.20 in November—its ninth consecutive reading below zero. November’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity increased, but growth was still below trend in November.

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.• From the Kansas City Fed: Tenth District Manufacturing Activity Declined Further

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Tenth District manufacturing activity declined further in December, though by a smaller amount than in October or November. Factories’ production expectations were somewhat more optimistic than last month, but a higher share of firms plan to decrease employment in coming months. Approximately half of all contacts cited fiscal policy uncertainty as having impacted their hiring decisions. Price indexes mostly increased, particularly for future raw materials, with the increase driven heavily by food prices.This showed contraction, but the index was slightly better than expected.

The month-over-month composite index was -2 in December, up slightly from -6 in November and -4 in October ... The employment index decreased from 22 to 13 after rebounding solidly last month.

...

“We saw factory activity decline for the third straight month, which many firms blamed on the uncertainty created by the fiscal cliff talks", said [Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City]. "Contacts still plan modest output expansion in the first half of 2012, but they now expect their employment to fall, before recovering later in the year.”