by Calculated Risk on 8/27/2021 01:28:00 PM

Friday, August 27, 2021

Forbearance, Delinquencies and Foreclosure

Will the end of the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, lead to a surge in foreclosures and impact house prices, as happened following the housing bubble?

I'm launching a newsletter focused solely on real estate. This newsletter will be ad free.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Q3 GDP Forecasts: Around 5.5%

by Calculated Risk on 8/27/2021 12:05:00 PM

From Goldman Sachs:

Following this morning’s data, we left our Q3 GDP tracking estimate unchanged at +5.5% (qoq ar). [August 27 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 3.8% for 2021:Q3. [August 27 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 5.1 percent on August 27, down from 5.7 percent on August 25. [August 27 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 8/27/2021 10:29:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of August 24th.

From Andy Walden at Black Knight: Familiar Midmonth Uptick in Forbearances

Continuing the same mid-month trend we also noted last week, the number of active forbearance plans edged slightly higher once again.

According to Black Knight’s McDash Flash forbearance tracker, there are now 1.76 million borrowers who remain in COVID-19 related forbearance plans as of August 24, including 1.9% of GSE, 5.8% of FHA/VA and 4.1% of portfolio held and privately securitized mortgages.

The overall number of active forbearances rose by 12,000 since last Tuesday, driven primarily by a 10,000 increase in plans among portfolio/PLS loans. FHA/VA volumes also rose – though a more modest 3,000 – with GSE plans seeing the week’s only decline (-1,000).

Click on graph for larger image.

This puts plan volumes down 132,000 from the same time last month for a 7% decline. More than 150,000 plans are slated for review for extension or removal through the final week of August, so there is still some opportunity for modest improvement yet this month.

That number ramps up to nearly 670,000 for September, though, with 415,000 of those plans set to reach their final expiration next month based on current allowable forbearance term lengths.

emphasis added

Fed Chair Powell: "It could be appropriate to start reducing the pace of asset purchases this year"

by Calculated Risk on 8/27/2021 10:18:00 AM

From Fed Chair Powell at Jackson Hole Symposium: Monetary Policy in the Time of Covid (Watch speech here). Excerpt:

That brings me to a concluding word on the path ahead for monetary policy. The Committee remains steadfast in our oft-expressed commitment to support the economy for as long as is needed to achieve a full recovery. The changes we made last year to our Statement on Longer-Run Goals and Monetary Policy Strategy are well suited to address today's challenges.

We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, measured since last December, when we first articulated this guidance. My view is that the "substantial further progress" test has been met for inflation. There has also been clear progress toward maximum employment. At the FOMC's recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year. The intervening month has brought more progress in the form of a strong employment report for July, but also the further spread of the Delta variant. We will be carefully assessing incoming data and the evolving risks. Even after our asset purchases end, our elevated holdings of longer-term securities will continue to support accommodative financial conditions.

The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test. We have said that we will continue to hold the target range for the federal funds rate at its current level until the economy reaches conditions consistent with maximum employment, and inflation has reached 2 percent and is on track to moderately exceed 2 percent for some time. We have much ground to cover to reach maximum employment, and time will tell whether we have reached 2 percent inflation on a sustainable basis.

emphasis added

Personal Income increased 1.1% in July, Spending increased 0.3%

by Calculated Risk on 8/27/2021 08:37:00 AM

The BEA released the Personal Income and Outlays, July 2021 report:

Personal income increased $225.9 billion (1.1 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $198.0 billion (1.1 percent) and personal consumption expenditures (PCE) increased $42.2 billion (0.3 percent).The July PCE price index increased 4.2 percent year-over-year and the July PCE price index, excluding food and energy, increased 3.6 percent year-over-year.

Real DPI increased 0.7 percent in July and Real PCE decreased 0.1 percent; goods decreased 1.6 percent and services increased 0.6 percent. The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.3 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through July 2021 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations, and personal spending was at expectations, and the increase in PCE was at expectations.

Thursday, August 26, 2021

Friday: Personal Income & Outlays, Fed Chair Powell Speaks

by Calculated Risk on 8/26/2021 07:15:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, July 2021. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%.

• At 10:00 AM, Speech, Fed Chair Jerome Powell, The Economic Outlook, At the Jackson Hole Economic Policy Symposium

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 70.9.

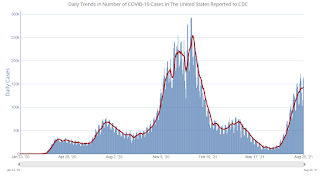

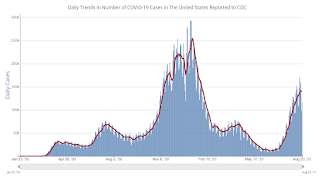

August 26th COVID-19: Over 1,200 Deaths, Almost 90,000 Hospitalized, 165,000 Cases Reported Today

by Calculated Risk on 8/26/2021 05:28:00 PM

The 7-day average deaths is the highest since March 16th.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 51.9% | 51.7% | 51.1% | ≥70.0%1 |

| Fully Vaccinated (millions) | 172.2 | 171.8 | 169.6 | ≥2321 |

| New Cases per Day3🚩 | 142,006 | 142,946 | 138,087 | ≤5,0002 |

| Hospitalized3🚩 | 87,297 | 86,406 | 77,516 | ≤3,0002 |

| Deaths per Day3🚩 | 864 | 844 | 778 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.7%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.2%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 48.8%, Ohio at 48.0%, Kentucky at 47.9%, Kansas at 47.7%, Arizona at 47.4%, Utah at 47.3%, Nevada at 47.2%, and Alaska at 46.9%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Las Vegas Visitor Authority for July: Convention Attendance N/A, Visitor Traffic Down 10% Compared to 2019

by Calculated Risk on 8/26/2021 03:26:00 PM

From the Las Vegas Visitor Authority: July 2021 Las Vegas Visitor Statistics

July marked the strongest visitation month since the pandemic began as the destination hosted 3.3M visitors, up 11.2% MoM and down ‐10.4% from July 2019.

Hotel occupancy continued to ramp up, exceeding 79% (up 3.5 pts MoM, down ‐11.7 pts vs. July 2019), as Weekend occupancy came in at 88.1% (down ‐1.3 pts MoM) while Midweek occupancy increased to 74.6% (up 3.7 pts MoM, down ‐14.1 pts vs. July 2019.)

ADR came in very strong during the month, reaching $152, surpassing last month by 19%, and RevPAR beat comparable 2019 monthly levels for the first time as it reached $120.79, up +24.4% MoM and 4.5% ahead of July 2019.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 10.4% compared to the same month in 2019.

How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2022?

by Calculated Risk on 8/26/2021 01:29:00 PM

I'm launching a newsletter focused solely on real estate. This newsletter will be ad free.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Hotels: Occupancy Rate Down 9% Compared to Same Week in 2019

by Calculated Risk on 8/26/2021 10:14:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 9.1% compared to the same week in 2019.

Reflecting seasonal demand patterns and concerns around the pandemic, U.S. hotel performance continued to decline from previous weeks, according to STR‘s latest data through August 21.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

August 15-21, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 63.7% (-9.1%)

• Average daily rate (ADR): $135.77 (+5.1%)

• Revenue per available room (RevPAR): $86.43 (-4.5%)

While none of the Top 25 Markets recorded an occupancy increase over 2019, Detroit came closest to its 2019 comparable (-0.7% to 69.3%).

...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Weekly Initial Unemployment Claims increase to 353,000

by Calculated Risk on 8/26/2021 08:41:00 AM

The DOL reported:

In the week ending August 21, the advance figure for seasonally adjusted initial claims was 353,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 348,000 to 349,000. The 4-week moving average was 366,500, a decrease of 11,500 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 250 from 377,750 to 378,000.This does not include the 117,709 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 108,081 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 366,500.

The previous week was revised up.

Regular state continued claims decreased to 2,862,000 (SA) from 2,865,000 (SA) the previous week.

Note: There are an additional 5,004,753 receiving Pandemic Unemployment Assistance (PUA) that increased from 4,900,047 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 3,793,956 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 3,846,045.

Weekly claims were slightly above the consensus forecast.

Q2 GDP Growth Revised up to 6.6% Annual Rate

by Calculated Risk on 8/26/2021 08:34:00 AM

From the BEA: Gross Domestic Product, 2nd Quarter 2021 (Second Estimate); Corporate Profits, 2nd Quarter 2021 (Preliminary Estimate)

Real gross domestic product (GDP) increased at an annual rate of 6.6 percent in the second quarter of 2021, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 6.3 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 11.8% to 11.9%. Residential investment was revised down from -9.8% to -11.5%. This was slightly below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 6.5 percent. The update reflects upward revisions to nonresidential fixed investment and exports that were partly offset by downward revisions to private inventory investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, were revised down

emphasis added

Wednesday, August 25, 2021

Thursday: GDP, Unemployment Claims

by Calculated Risk on 8/25/2021 06:20:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2021 (second estimate). The consensus is that real GDP increased 6.7% annualized in Q2, up from the advance estimate of 6.5% in Q2.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a increase slightly to 350 thousand from 348 thousand last week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

• Thursday through Saturday, Jackson Hole Economic Policy Symposium, Macroeconomic Policy in an Uneven Economy

August 25th COVID-19: 7-Day Average New Cases Highest Since January

by Calculated Risk on 8/25/2021 04:16:00 PM

The 7-day average deaths is the highest since March 17th.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 51.7% | 51.6% | 51.0% | ≥70.0%1 |

| Fully Vaccinated (millions) | 171.8 | 171.4 | 169.2 | ≥2321 |

| New Cases per Day3🚩 | 142,029 | 141,091 | 134,091 | ≤5,0002 |

| Hospitalized3🚩 | 85,611 | 85,004 | 75,544 | ≤3,0002 |

| Deaths per Day3🚩 | 809 | 765 | 659 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.6%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.1%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 48.7%, Ohio at 47.9%, Kentucky at 47.8%, Kansas at 47.5%, Arizona at 47.3%, Utah at 47.2%, Nevada at 47.0%, and Alaska at 46.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Philly Fed: State Coincident Indexes Increased in 46 States in July

by Calculated Risk on 8/25/2021 11:34:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2021. Over the past three months, the indexes increased in 48 states, decreased in one state, and remained stable in one, for a three-month diffusion index of 94. Additionally, in the past month, the indexes increased in 46 states, decreased in one state, and remained stable in three, for a one-month diffusion index of 90. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 1.9 percent over the past three months and 0.8 percent in July.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is almost all positive on a three month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In July, 48 states had increasing activity including minor increases.

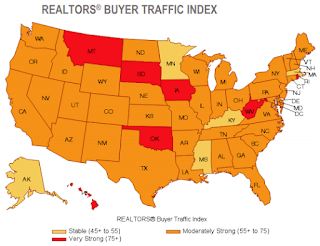

REALTORS® Confidence Index Survey July 2021: "Demand is cooling in a moderately strong market"

by Calculated Risk on 8/25/2021 10:11:00 AM

Some interesting information from the REALTORS® Confidence Index Survey July 2021

Several metrics indicate that demand is cooling in a moderately strong market. With limited supply in the market, homes typically sold within 17 days (22 days one year ago). The REALTORS® Buyer Traffic Index decreased further from 71 in June to 64 in July (moderately strong conditions) while the REALTORS® Seller Traffic Index remains below 50 which is “weak” traffic compared to the level one year ago. On average, a home sold had more than 4 offers, for which remains unchanged from last month’s survey. REALTORS® expect home prices in the next three months to increase nearly 2% from one year ago compared to 4% outlook in last month’s survey. Respondents expect sales in the next three months to decrease 1% from last year’s sales level compared to the 1% outlook in last month’s survey.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This map, from the July NAR report, shows buyer traffic is mostly "moderately strong" just about everywhere.

This is less demand than last month, and significantly less than a few months ago.

As the NAR noted: "demand is cooling in a moderately strong market".

The second map is from the April report.

The second map is from the April report.In April, buyer traffic was very strong just about everywhere.

There has also been a shift in seller traffic, with more traffic in many states (compare map from April on page 3 to the map from July also on page 3).

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 8/25/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 20, 2021.

... The Refinance Index increased 1 percent from the previous week and was 3 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 16 percent lower than the same week one year ago.

“Treasury yields fell last week, as investors continue to anxiously monitor if the rise in COVID-19 cases in several states starts to dampen economic activity. Mortgage rates slightly declined as a result, with the 30-year fixed rate decreasing for the first time in three weeks. Lower rates led to an increase in refinance applications, with government loan applications jumping 10 percent to the highest level since May 2021,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications for both conventional and government loans also increased. The purchase index was at its highest level since early July, despite still continuing to lag 2020’s pace. There was also some easing in average loan sizes, which is potentially a sign that more first-time buyers looking for lower-priced homes are being helped by the recent uptick in for-sale inventory for both newly built homes and existing homes.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.03 percent from 3.06 percent, with points decreasing to 0.29 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 16% year-over-year unadjusted.

According to the MBA, purchase activity is down 16% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 24, 2021

August Vehicle Sales Forecast: "Light-Vehicle Sales to Continue Downward Spiral"

by Calculated Risk on 8/24/2021 05:53:00 PM

From WardsAuto: JAugust U.S. Light-Vehicle Sales to Continue Downward Spiral (pay content)

Low inventories and supply issues (microchips) are impacting sales.

This graph shows actual sales from the BEA (Blue), and Wards forecast for August (Red).

The Wards forecast of 14.1 million SAAR, would be down about 4% from last month, and down 7.5% from a year ago (sales were recovering in July 2020 from the depths of the pandemic).

Alabama Real Estate in July: Sales Down 1% YoY, Inventory Down 29% YoY

by Calculated Risk on 8/24/2021 04:07:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

Here is a summary post for many markets: Existing Home Inventory in July: Local Markets

For the entire state of Alabama:

Closed sales in July 2021 were 7,601, down 1.5% from 7,714 in July 2020.

Active Listings in July 2021 were 11,146, down 29.3% from 15,772 in July 2020.

Months of Supply was 1.5 Months in July 2021, compared to 2.0 Months in July 2020.

Inventory in July was up 12.0% from last month, and up 19.0% from the record low in May 2021.

August 24th COVID-19: Cases Might be Peaking

by Calculated Risk on 8/24/2021 03:56:00 PM

The 7-day average deaths is the highest since March 20th.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 51.6% | 51.5% | 50.9% | ≥70.0%1 |

| Fully Vaccinated (millions) | 171.4 | 171.1 | 168.9 | ≥2321 |

| New Cases per Day3🚩 | 141,091 | 140,189 | 132,499 | ≤5,0002 |

| Hospitalized3🚩 | 84,456 | 83,549 | 73,593 | ≤3,0002 |

| Deaths per Day3🚩 | 775 | 756 | 652 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.5%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.0%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 48.4%, Ohio at 47.9%, Kentucky at 47.7%, Kansas at 47.4%, Arizona at 47.2%, Nevada at 46.9%, Utah at 46.9%, and Alaska at 46.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.