by Calculated Risk on 8/31/2021 04:21:00 PM

Tuesday, August 31, 2021

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in July

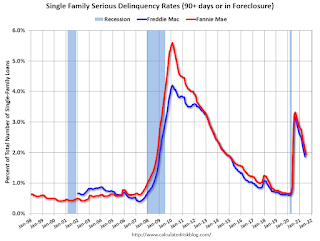

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 1.94% in July, from 2.08% in June. The serious delinquency rate is down from 3.24% in July 2020.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble, and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 4.82% are seriously delinquent (down from 5.04% in June). For loans made in 2005 through 2008 (2% of portfolio), 8.26% are seriously delinquent (down from 8.75%), For recent loans, originated in 2009 through 2021 (97% of portfolio), 1.57% are seriously delinquent (down from 1.69%). So Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

August 31st COVID-19: Cases May be Peaking at Average 150,000 per Day

by Calculated Risk on 8/31/2021 03:26:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 52.4% | 51.6% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 174.1 | 171.4 | ≥2321 | |

| New Cases per Day3 | 149,263 | 145,423 | ≤5,0002 | |

| Hospitalized3🚩 | 90,279 | 85,350 | ≤3,0002 | |

| Deaths per Day3🚩 | 985 | 883 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 14 states and D.C. have between 50% and 59.9% fully vaccinated: New Hampshire at 59.7%, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.5%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.1%, Kentucky at 48.5%, Ohio at 48.4%, Kansas at 48.3%, Arizona at 47.9%, Nevada at 47.8%, Utah at 47.5%, Texas at 47.4% and Alaska at 47.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

House Prices Increase Sharply in June

by Calculated Risk on 8/31/2021 01:26:00 PM

New newsletter article: House Prices Increase Sharply in June

I've started a newsletter focused solely on real estate. This newsletter will be ad free.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Reis: Office and Mall Vacancy Rates Increased in Q2

by Calculated Risk on 8/31/2021 10:59:00 AM

Click on graph for larger image.

Click on graph for larger image.The first graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis also reported that office effective rents declined in Q2; the fifth consecutive quarter with declining rents.

The second graph shows the regional and strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual).

The second graph shows the regional and strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual).For Neighborhood and Community malls (strip malls), the vacancy rate was 10.5% in Q2, down from 10.6% in Q1, and up from 10.2% in Q2 2020.

For Regional malls, the vacancy rate was 11.5% in Q2, up from 11.4% in Q1, and up from 9.8% in Q2 2020.

All vacancy data courtesy of Reis

Case-Shiller: National House Price Index increased 18.6% year-over-year in June

by Calculated Risk on 8/31/2021 09:13:00 AM

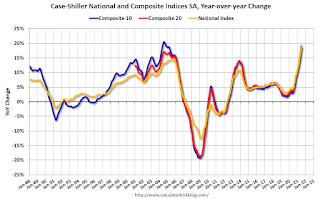

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Shows Annual Home Price Gain Topped 18.6% In June

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 18.6% annual gain in June, up from 16.8% in the previous month. The 10-City Composite annual increase came in at 18.5%, up from 16.6% in the previous month. The 20-City Composite posted a 19.1% year-over-year gain, up from 17.1% in the previous month.

Phoenix, San Diego, and Seattle reported the highest year-over-year gains among the 20 cities in June. Phoenix led the way with a 29.3% year-over-year price increase, followed by San Diego with a 27.1% increase and Seattle with a 25.0% increase. All 20 cities reported higher price increases in the year ending June 2021 versus the year ending May 2021.

...

Before seasonal adjustment, the U.S. National Index posted a 2.2% month-over-month increase in June, while the 10-City and 20-City Composites both posted increases of 1.8% and 2.0%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.8%, and the 10-City and 20-City Composites both posted increases of 1.6% and 1.8%, respectively. In June, all 20 cities reported increases before and after seasonal adjustments.

“June 2021 is the third consecutive month in which the growth rate of housing prices set a record, says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. “The National Composite Index marked its thirteenth consecutive month of accelerating prices with an 18.6% gain from year-ago levels, up from 16.8% in May and 14.8% in April. This acceleration is also reflected in the 10- and 20-City Composites (up 18.5% and 19.1%, respectively). The last several months have been extraordinary not only in the level of price gains, but in the consistency of gains across the country. In June, all 20 cities rose, and all 20 gained more in the 12 months ended in June than they had gained in the 12 months ended in May. Home prices in 19 of our 20 cities (all but Chicago) now stand at all-time highs, as do the National Composite and both the 10- and 20-City indices.

June’s 18.6% price gain for the National Composite is the highest reading in more than 30 years of S&P CoreLogic Case-Shiller data. This month, Boston joined Charlotte, Cleveland, Dallas, Denver, and Seattle in recording their all-time highest 12-month gains. Price gains in all 20 cities were in the top quartile of historical performance; in 19 cities, price gains were in top decile.

We have previously suggested that the strength in the U.S. housing market is being driven in part by reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes. June’s data are consistent with this hypothesis. This demand surge may simply represent an acceleration of purchases that would have occurred anyway over the next several years. Alternatively, there may have been a secular change in locational preferences, leading to a permanent shift in the demand curve for housing. More time and data will be required to analyze this question.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.6% in June (SA).

The Composite 20 index is up 1.8% (SA) in June.

The National index is 40% above the bubble peak (SA), and up 1.8% (SA) in June. The National index is up 90% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 18.5% compared to June 2020. The Composite 20 SA is up 19.1% year-over-year.

The National index SA is up 18.6% year-over-year.

Price increases were at expectations. I'll have more later.

Monday, August 30, 2021

Tuesday: Case-Shiller House Prices

by Calculated Risk on 8/30/2021 08:30:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Fall Back to 3 week Lows

Mortgage rates drifted lower again today, with the average lender getting back down to the lowest levels since the first week of August. In a general sense, today's friendly rate momentum represented follow-through momentum after Fed Chair Powell soothed the market on Friday morning.Tuesday:

...

Specifically, the labor market needs to show that it can weather the various storm cycles of the pandemic. To that end, there are several upcoming reports that can offer some clarity with this Friday's jobs report being the most important. In other words, even if the Fed doesn't have anything new to say this week, an exceptionally strong jobs report could easily push rates back up. [30 year fixed 2.91%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for June. The consensus is for a 18.6% year-over-year increase in the Comp 20 index for June.

• Also at 9:00 AM, FHFA House Price Index for June. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:45 AM, Chicago Purchasing Managers Index for August.

MBA Survey: "Share of Mortgage Loans in Forbearance Remains Unchanged at 3.25%"

by Calculated Risk on 8/30/2021 04:00:00 PM

Note: This is as of August 22nd.

From the MBA: Share of Mortgage Loans in Forbearance Remains Unchanged at 3.25%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance remained unchanged relative to the prior week at 3.25% as of August 22, 2021. According to MBA’s estimate, 1.6 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance remained the same relative to the prior week at 1.66%. Ginnie Mae loans in forbearance also remained the same at 3.92%, while the forbearance share for portfolio loans and private-label securities (PLS) increased 3 basis points to 7.18%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers increased 2 basis points to 3.50%, and the percentage of loans in forbearance for depository servicers was unchanged at 3.35%.

“The share of loans in forbearance changed little once again this week, as both new requests and exits remained at a slow pace,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “We expect a sharp increase in forbearance exits over the next month as many borrowers reach the 18- month mark and see their forbearance plans end. For those borrowers who have exited in August, the majority either enter deferral plans or obtain modifications.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained unchanged relative to the prior week at 0.05%."

August 30th COVID-19: Data reported on Monday is always low, and will be revised up as data is received

by Calculated Risk on 8/30/2021 03:53:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 52.4% | 51.5% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 173.8 | 171.1 | ≥2321 | |

| New Cases per Day3 | 129,418 | 144,614 | ≤5,0002 | |

| Hospitalized3🚩 | 84,639 | 83,992 | ≤3,0002 | |

| Deaths per Day3🚩 | 895 | 875 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 15 states and D.C. have between 50% and 59.9% fully vaccinated: New Mexico at 59.9%, New Hampshire, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.5%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.1%, Ohio at 48.4%, Kentucky at 48.4%, Kansas at 48.2%, Arizona at 47.8%, Nevada at 47.7%, Utah at 47.5%, Texas at 47.3% and Alaska at 47.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Housing: Inventory is the Key Metric in 2021

by Calculated Risk on 8/30/2021 01:42:00 PM

New newsletter article: Housing: Inventory is the Key Metric in 2021

I've started a newsletter focused solely on real estate. This newsletter will be ad free.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Reis: Apartment Vacancy Rate unchanged in Q2 at 5.3%

by Calculated Risk on 8/30/2021 12:44:00 PM

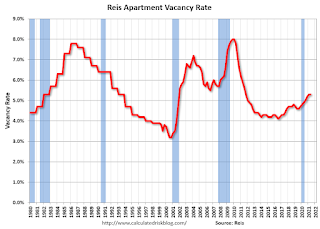

Reis reported that the apartment vacancy rate was at 5.3% in Q2 2021, unchanged from 5.3% in Q1, and up from 4.9% in Q2 2020. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate has increased somewhat from the low in 2016.

Housing Inventory August 30th Update: Inventory Unchanged Week-over-week, Up 41% from Low in early April

by Calculated Risk on 8/30/2021 11:09:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

NAR: Pending Home Sales Decreased 1.8% in July

by Calculated Risk on 8/30/2021 10:04:00 AM

From the NAR: Pending Home Sales Wane 1.8% In July

Pending home sales dipped modestly in July, noting two consecutive months of declines, according to the National Association of Realtors®. Only the West region registered a month-over-month gain in contract activity, while the other three major U.S. regions reported drops. All four regions saw transactions decrease year-over-year.This was below expectations of a 0.4% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, declined 1.8% to 110.7 in July. Year-over-year, signings fell 8.5%. An index of 100 is equal to the level of contract activity in 2001.

...

Month-over-month, the Northeast PHSI fell 6.6% to 92.0 in July, a 16.9% decrease from a year ago. In the Midwest, the index dropped 3.3% to 104.6 last month, down 8.5% from July 2020.

Pending home sales transactions in the South declined 0.9% to an index of 130.9 in July, down 6.7% from July 2020. The index in the West rose 1.9% in July to 99.8, but still down 5.7% from a year prior.

emphasis added

Seven High Frequency Indicators for the Economy

by Calculated Risk on 8/30/2021 08:21:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

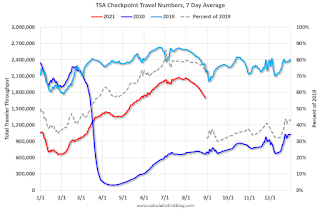

The TSA is providing daily travel numbers.

This data is as of August 29th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 23.7% from the same day in 2019 (76.3% of 2019). (Dashed line)

There was a slow increase from the bottom starting in May 2020 - and then TSA data picked up in 2021 - but the dashed line has moved down a little recently.

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through August 28, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was generally picking up, but has moved down recently. The 7-day average for the US is down 9% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $88 million last week, down about 43% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is above the horrible 2009 levels, but, according to STR, occupancy is declining due to both seasonal factors and "concerns around the pandemic". With solid leisure travel, the Summer months had decent occupancy - but it is uncertain what will happen in the Fall with business travel - especially with the sharp increase in COVID pandemic cases and hospitalizations.

This data is through August 21st. The occupancy rate is down 9.1% compared to the same week in 2019. Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of August 20th, gasoline supplied was down 3.3% compared to the same week in 2019.

There have been four weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through August 28th for the United States and several selected cities.

This data is through August 28th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 109% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, August 27th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, August 29, 2021

Monday: Pending Home Sales, Dallas Fed Mfg

by Calculated Risk on 8/29/2021 06:46:00 PM

Weekend:

• Schedule for Week of August 29, 2021

Monday:

• At 10:00 AM ET, Pending Home Sales Index for July. The consensus is for a 0.4% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for August. This is the last of the regional Fed manufacturing surveys for August.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 43 and DOW futures are up 260 (fair value).

Oil prices were up over the last week with WTI futures at $69.33 per barrel and Brent at $73.42 per barrel. A year ago, WTI was at $43, and Brent was at $45 - so WTI oil prices are UP about 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.13 per gallon. A year ago prices were at $2.22 per gallon, so gasoline prices are up $0.91 per gallon year-over-year.

August 29th COVID-19: Posting on Weekdays Only Going Forward

by Calculated Risk on 8/29/2021 03:48:00 PM

The 7-day average deaths is the highest since March 14th.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 52.3% | 52.0% | 51.5% | ≥70.0%1 |

| Fully Vaccinated (millions) | 173.5 | 172.6 | 170.8 | ≥2321 |

| New Cases per Day3🚩 | 147,030 | 144,761 | 142,514 | ≤5,0002 |

| Hospitalized3🚩 | 88,009 | 87,585 | 79,393 | ≤3,0002 |

| Deaths per Day3🚩 | 949 | 902 | 815 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 16 states and D.C. have between 50% and 59.9% fully vaccinated: New York State and New Mexico at 59.9%, New Hampshire, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.4%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.1%, Ohio at 48.3%, Kentucky at 48.3%, Kansas at 48.1%, Arizona at 47.7%, Nevada at 47.6%, Utah at 47.5%, Texas at 47.2% and Alaska at 47.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Energy expenditures as a percentage of PCE

by Calculated Risk on 8/29/2021 10:17:00 AM

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the recently released July PCE report.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through July 2021.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In general, energy expenditures as a percent of PCE have been trending down for years.

At the beginning of the pandemic, energy expenditures as a percentage of PCE, fell to a record low of 3.3% in May 2020.

Saturday, August 28, 2021

Real Personal Income: Transfer Payments

by Calculated Risk on 8/28/2021 06:46:00 PM

The BEA released the Personal Income and Outlays, July 2021 report yesterday. The report showed that government transfer payments were still almost $1.0 trillion (on SAAR basis) above the February 2020 level (pre-pandemic) Note: Seasonal adjustment doesn't make sense with one time payments, but that is how the data is presented.

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Jan-20 | $511 | $26 |

| Feb-20 | $506 | $26 |

| Mar-20 | $516 | $67 |

| Apr-20 | $3,393 | $435 |

| May-20 | $1,373 | $1,287 |

| Jun-20 | $743 | $1,396 |

| Jul-20 | $750 | $1,366 |

| Aug-20 | $697 | $612 |

| Sep-20 | $950 | $325 |

| Oct-20 | $714 | $296 |

| Nov-20 | $580 | $285 |

| Dec-20 | $604 | $319 |

| Jan-21 | $2,317 | $574 |

| Feb-21 | $735 | $558 |

| Mar-21 | $4,706 | $566 |

| Apr-21 | $1,344 | $516 |

| May-21 | $802 | $492 |

| Jun-21 | $736 | $433 |

| Jul-21 | $907 | $381 |

Schedule for Week of August 29, 2021

by Calculated Risk on 8/28/2021 08:11:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the August ISM manufacturing and services indexes, August auto sales, Case-Shiller house prices for June, and the July trade deficit.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 0.4% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August. This is the last of the regional Fed manufacturing surveys for August.

9:00 AM: S&P/Case-Shiller House Price Index for June.

9:00 AM: S&P/Case-Shiller House Price Index for June.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 18.6% year-over-year increase in the Comp 20 index for June.

9:00 AM: FHFA House Price Index for June. This was originally a GSE only repeat sales, however there is also an expanded index.

9:45 AM: Chicago Purchasing Managers Index for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 638,000 payroll jobs added in August, up from 330,000 added in July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 58.5, down from 59.5 in July.

10:00 AM: Construction Spending for July. The consensus is for a 0.3% increase in construction spending.

Late: Light vehicle sales for August. The consensus is for light vehicle sales to be 15.0 million SAAR in August, up from 14.75 million in July (Seasonally Adjusted Annual Rate).

Late: Light vehicle sales for August. The consensus is for light vehicle sales to be 15.0 million SAAR in August, up from 14.75 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease slightly to 350 thousand from 353 thousand last week.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $70.9 billion in July, from $75.7 billion in June.

8:30 AM: Employment Report for August. The consensus is for 728 thousand jobs added, and for the unemployment rate to decrease to 5.2%.

8:30 AM: Employment Report for August. The consensus is for 728 thousand jobs added, and for the unemployment rate to decrease to 5.2%.There were 943 thousand jobs added in July, and the unemployment rate was at 5.4%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

10:00 AM: ISM Services Index for August.

Friday, August 27, 2021

CalculatedRisk Newsletter

by Calculated Risk on 8/27/2021 06:08:00 PM

I'm launching a newsletter focused solely on real estate. This newsletter will be ad free.

• Forbearance, Delinquencies and Foreclosure: Will the end of the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, lead to a surge in foreclosures and impact house prices, as happened following the housing bubble?

• How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2022?

• New Home Sales Increase to 708,000 Annual Rate in July

• Existing-Home Sales Increased to 5.99 million in July

• Housing Starts decreased to 1.534 Million Annual Rate in July

• Housing and Demographics: The Next Big Shift

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

August 27th COVID-19: Cases Might be Peaking

by Calculated Risk on 8/27/2021 03:52:00 PM

The 7-day average deaths is the highest since March 16th.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 52.0% | 51.9% | 51.2% | ≥70.0%1 |

| Fully Vaccinated (millions) | 172.6 | 172.2 | 170.0 | ≥2321 |

| New Cases per Day3🚩 | 144,138 | 143,835 | 140,242 | ≤5,0002 |

| Hospitalized3🚩 | 88,009 | 87,585 | 79,393 | ≤3,0002 |

| Deaths per Day3🚩 | 906 | 860 | 803 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.8%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.3%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 48.8%, Ohio at 48.1%, Kentucky at 48.0%, Kansas at 47.8%, Arizona at 47.5%, Utah at 47.3%, Nevada at 47.3%, and Alaska at 47.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.