by Calculated Risk on 9/08/2021 11:12:00 AM

Wednesday, September 08, 2021

Black Knight Mortgage Monitor for July; Tappable Equity Rises to All-Time High of $9.1 Trillion

Black Knight released their Mortgage Monitor report for July today. According to Black Knight, 4.14% of mortgage were delinquent in July, down from 4.37% of mortgages in June, and down from 6.91% in July 2020. Black Knight also reported that 0.26% of mortgages were in the foreclosure process, down from 0.36% a year ago.

This gives a total of 4.40% delinquent or in foreclosure.

Press Release: Black Knight: Tappable Equity Rises $1 Trillion in Q2 2021 Alone to Hit All-Time High of $9.1 Trillion; Quarter Also Sees Largest Volume of Cash-Out Refis in 15 Years

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. With full Q2 data in and analyzed, this month’s report looks at incredible growth in the nation’s levels of tappable equity – the amount available for homeowners with mortgages to borrow against while still retaining at least 20% equity in their homes. According to Black Knight Data & Analytics President Ben Graboske, continued heat in the housing market drove tappable equity levels to never-before-seen heights in the second quarter of 2021.

“Tappable equity grew an astonishing 37% year-over-year in Q2 2021, driven by increasing gains in home values over the quarter,” said Graboske. “According to our Black Knight HPI, as of the end of June, home values had risen nearly 20% from the year before and 7.4% in Q2 alone. As a result, already at a record high of $8.1 trillion at the end of Q1, U.S. homeowners with mortgages gained another $1 trillion in tappable equity in the second quarter alone. This is by far the strongest growth we’ve ever seen and equates to some $173,000 in equity available to the average mortgage holder, a $20,000 increase in just three months.

“A rising tide lifts all boats as they say, including homeowners in forbearance – whose ability to return to making payments when forbearance ends will likely be a key driver in the nation’s overall COVID-19 economic recovery. Some 98% of homeowners in forbearance now have at least 10% equity in their homes. Even when we add in 18 months of forborne payments – including principal, interest, taxes and insurance – the share with less than 10% equity only climbs to 7%, about 135,000 homeowners. This is a drastically different dynamic than during the worst of the Great Recession, when more than 40% of all mortgage holders had less than 10% equity and 28% were fully underwater. Such strong equity positions should help limit the volume of distressed inflow into the real estate market as well as provide strong incentive for homeowners to return to making mortgage payments – even if needing to be reduced through modification.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph on delinquencies from Black Knight:

• The national delinquency rate saw a 5% reduction in July, and at 4.14% is within a single percentage point of its pre-pandemic level

• While overall delinquency volumes continue to edge closer to pre-pandemic levels, some 1.45 million borrowers remained 90 or more days past due – but not yet in foreclosure – at the end of July

And on tappable equity from Black Knight:

And on tappable equity from Black Knight: • Despite rising equity withdrawals, the housing market continues to drive skyrocketing borrower equity positionsThere is much more in the mortgage monitor.

• Tappable equity – the amount available for homeowners with mortgages to borrow against while still retaining at least 20% equity in their homes – was already at a record high of $8.1T at the end of Q1

• According to our Black Knight HPI, as of the end of June, home values had risen nearly 20% from the year before and 7.4% in Q2 alone

• As a result, U.S. homeowners with mortgages gained another $1T in tappable equity in Q2 alone to make an astonishing 37% year-over-year gain

...

• The 1.1M cash-outs originated in Q2 were the largest quarterly volume in nearly 15 years, with more than $63B in equity withdrawn in the quarter – the most since mid-2007

BLS: Job Openings Increase to Series High 10.9 Million in July

by Calculated Risk on 9/08/2021 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to a series high of 10.9 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.7 million and 5.8 million, respectively. Within separations, the quits rate was unchanged at 2.7 percent while the layoffs and discharges rate was little changed at 1.0 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in July to 10.934 million from 10.185 million in June. This is a new record high for this series.

The number of job openings (yellow) were up 63% year-over-year.

Quits were up 25% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Forbearance Will Not Lead to a Huge Wave of Foreclosures

by Calculated Risk on 9/08/2021 08:17:00 AM

At the Calculated Risk Newsletter: Forbearance Will Not Lead to a Huge Wave of Foreclosures

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/08/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 3, 2021.

... The Refinance Index decreased 3 percent from the previous week and was 4 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 18 percent lower than the same week one year ago.

“Mortgage application volume fell last week to its lowest level since mid-July, as mortgage rates have stayed just above 3% for several weeks. Refinance volume has been moderating, while purchase volume continues to be lower than expected given the lack of homes on the market,” said Mike Fratantoni, MBA's Senior Vice President and Chief Economist. “Economic data has sent mixed signals, with slower job growth but a further drop in the unemployment rate in August. We expect that further improvements will lead to a tapering of Fed MBS purchases by the end of the year, which should put some upward pressure on mortgage rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) remained unchanged at 3.03 percent, with points decreasing to 0.33 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

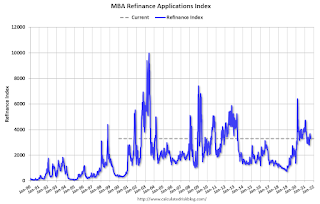

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 18% year-over-year unadjusted.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 07, 2021

Wednesday: Job Openings, Beige Book

by Calculated Risk on 9/07/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Begin The Week Slightly Higher

Mortgage rates moved slightly higher to begin the holiday-shortened week. ... The damage is minimal in the bigger picture. On average, lenders are quoting the same rates seen last week, but with slightly higher closing costs today. Most of the weakness in the underlying bond market is centered on US Treasuries as opposed to the mortgage-backed securities (MBS) that serve as the foundation for mortgage rates. The Treasury-specific weakness is likely due to the presence of several big Treasury auctions this week in addition to heavy corporate bond issuance (which tends to hurt Treasuries more than MBS). [30 year fixed 2.97%]Tuesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for July from the BLS.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Northwest Real Estate in August: Sales up 7% YoY, Inventory down 23% YoY

by Calculated Risk on 9/07/2021 05:49:00 PM

The Northwest Multiple Listing Service reported Northwest MLS brokers say August housing activity follows patterns of seasonal slowing

August typically brings a dip in housing activity and this year was no different, according to representatives from Northwest Multiple Listing Service when commenting on newly-released statistics. Figures comparing July to August show month-to-month drops in new listings, total inventory, pending sales, close sales, and median prices.The press release is for the Northwest MLS area. There were 10,571 closed sales in August 2021, up 7.4% from 9,847 sales in August 2020. Active inventory for the Northwest was down 22.6%.

"August showed a more traditional seasonal pattern with decreased activity as families took end-of-summer vacations and made back-to-school preparations," remarked Frank Wilson, Kitsap regional manager and branch managing broker at John L. Scott Real Estate.

...

NWMLS statistics show the volume of new listings added during August, including single family homes and condominiums, declined from both July (down 11.5%) and twelve months ago (down 4.2%). Total inventory for the 26 counties in the report also fell, shrinking about 6.6% from July and nearly 22.6% from a year ago. At month end, there were 7,425 active listings, down from the year-ago total of 9,591.

emphasis added

In Seattle, sales were up 10.1% year-over-year, and inventory was down 43.9% year-over-year. This puts the months-of-supply in Seattle at just 0.40 months.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 3.23%"

by Calculated Risk on 9/07/2021 04:00:00 PM

Note: This is as of August 29th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 3.23%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 3.25% of servicers’ portfolio volume in the prior week to 3.23% as of August 29, 2021. According to MBA’s estimate, 1.6 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 3 basis points to 1.63%. Ginnie Mae loans in forbearance decreased 29 basis points to 3.63%, while the forbearance share for portfolio loans and private-label securities (PLS) increased 34 basis points to 7.52%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 1 basis point to 3.49%, and the percentage of loans in forbearance for depository servicers decreased 2 basis points to 3.33%.

“The share of loans in forbearance decreased by two basis points last week, with both new requests and exits remaining at a slow pace as we reached the end of August,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “There was another large shift in the location of many FHA and VA loans, which have been bought out of Ginnie Mae pools and moved onto servicer balance sheets. As a result, there was a sharp drop in the share of Ginnie Mae loans in forbearance, and an offsetting increase in the share of portfolio loans in forbearance. These buyouts enable servicers to stop advancing principal and interest payments, and work with borrowers to begin paying again before they are resecuritized into Ginnie Mae pools.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.05% to 0.04%."

September 7th COVID-19: Data reported after Holidays is always low and will be revised up

by Calculated Risk on 9/07/2021 03:19:00 PM

| COVID Metrics (POST-HOLIDAY DATA IS LOW) | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 53.0% | 52.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 176.0 | 174.1 | ≥2321 | |

| New Cases per Day3 | 127,100 | 155,534 | ≤5,0002 | |

| Hospitalized3 | 87,220 | 91,958 | ≤3,0002 | |

| Deaths per Day3 | 962 | 1,129 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 13 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 58.5%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.8%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.6%, Kentucky at 49.1%, Arizona at 49.0%, Kansas at 48.8%, Ohio at 48.8%, Nevada at 48.3%, Utah at 48.1%, Texas at 48.1% and Alaska at 47.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 9/07/2021 10:51:00 AM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through September 7th.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.There were supply constraints over the last year, for example, sawmills cut production and inventory at the beginning of the pandemic, and the West Coast fires in 2020 damaged privately-owned timberland (and maybe again in 2021).

Seven High Frequency Indicators for the Economy

by Calculated Risk on 9/07/2021 09:59:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of September 6th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 17.8% from the same day in 2019 (82.2% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through September 5, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was generally picking up, but has moved down recently - and now picked up again for the Holiday weekend. The 7-day average for the US is up 1% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $82 million last week, down about 44% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is above the horrible 2009 levels, but, according to STR, occupancy is declining due to both seasonal factors and "concerns around the pandemic". With solid leisure travel, the Summer months had decent occupancy - but it is uncertain what will happen in the Fall with business travel - especially with the sharp increase in COVID pandemic cases and hospitalizations.

This data is through August 28th. The occupancy rate is down 8.4% compared to the same week in 2019. Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of August 27th, gasoline supplied was up 1.1% compared to the same week in 2019.

This was the fifth week so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through September 5th for the United States and several selected cities.

This data is through September 5th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 116% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, September 3rd.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

CoreLogic: House Prices up 18.0% YoY in July, All-Time High YoY Increase

by Calculated Risk on 9/07/2021 08:00:00 AM

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: U.S. Home Price Index Annual Growth Reaches All-Time High in July, CoreLogic Reports

CoreLogic® ... released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for July 2021.

With mortgage rates remaining near record lows, the ongoing challenges of persistent demand and constricted supply continue to put upward pressure on home prices. A recent CoreLogic survey of consumers looking to buy homes shows that, on average, 65.8% of respondents across all age cohorts strongly prefer standalone properties compared to other property types. Given the widespread demand, and considering the number of standalone homes built during the past decade, the single-family market is estimated to be undersupplied by 4.35 million units by 2022.

“Home price appreciation continues to escalate as millennials entering their prime home buying years, renters looking to escape skyrocketing rents and deep pocketed investors drive demand,” said Frank Martell, president and CEO of CoreLogic. “On the supply side, it is also the result of chronic under building, especially of affordable stock. This lack of supply is unlikely to be resolved over the next 5 to 10 years without more aggressive incentives for builders to add new units.”

...

Nationally, home prices increased 18% in July 2021, compared to July 2020. This is the largest 12-month growth in the U.S. index since the series began (January 1976 – January 1977). On a month-over-month basis, home prices increased by 1.8% compared to June 2021.

...

“July’s annual home price growth was the most that we have ever seen in the 45-year history of the CoreLogic Home Price Index,” said Dr. Frank Nothaft, chief economist at CoreLogic. “This price gain has far exceeded income growth and eroded affordability. In the coming months this will temper demand and lead to a slowing in price growth.”

emphasis added

Monday, September 06, 2021

Monday Night Futures

by Calculated Risk on 9/06/2021 08:55:00 PM

Weekend:

• Schedule for Week of September 5, 2021

Monday:

• At 8:00 AM ET, Corelogic House Price index for July

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 7 and DOW futures are up 49 (fair value).

Oil prices were up over the last week with WTI futures at $68.89 per barrel and Brent at $72.22 per barrel. A year ago, WTI was at $40, and Brent was at $41 - so WTI oil prices are UP about 70% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.17 per gallon. A year ago prices were at $2.20 per gallon, so gasoline prices are up $0.97 per gallon year-over-year.

Housing: A Look at "Affordability" Indexes

by Calculated Risk on 9/06/2021 01:07:00 PM

At the Calculated Risk Newsletter: Housing: A Look at "Affordability" Indexes

Note: I've started a newsletter focused solely on real estate. This newsletter is ad free.

• Expect House Prices to be up 20% YoY in July Report

• House Prices Increase Sharply in June

• Housing: Inventory is the Key Metric in 2021

• Forbearance, Delinquencies and Foreclosure: Will the end of the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, lead to a surge in foreclosures and impact house prices, as happened following the housing bubble?

• How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2022?

• New Home Sales Increase to 708,000 Annual Rate in July

• Existing-Home Sales Increased to 5.99 million in July

• Housing Starts decreased to 1.534 Million Annual Rate in July

• Housing and Demographics: The Next Big Shift

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Housing Inventory Sept 6th Update: Inventory Up 1.4% Week-over-week, Up 43% from Low in early April

by Calculated Risk on 9/06/2021 08:51:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, September 05, 2021

Denver Real Estate in August: Sales Down 15% YoY, Active Inventory Down 35% YoY

by Calculated Risk on 9/05/2021 11:10:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

Keeping in trend with traditional seasonality, the transition from July to August felt like a shift as vacations slowed down in preparation for the school year and fall. Buyers are more willing to be patient in order to find the right house for the “right” price. The report saw this reflected in the days in MLS, which increased from nine to 11 in August 2021. Likewise, the close-price-to-list-price ratio dipped ever so slightly month-over-month. In a dramatic data point, the month-end active inventory dropped 11.69 percent. Historically speaking, the change in inventory is relatively consistent from July to August.Active inventory in Denver is up 87% from the record low in March 2021.

However, with both inventory and new listings decreasing, the short-lived “loose grip” on inventory has tightened once again. Months of inventory decreased from the previous month to 0.637. The report also indicated that if no one were to put a property on the market for 19 days, there would be nothing to sell in the entire Denver Metro area.

emphasis added

Saturday, September 04, 2021

The Employment Situation is Worse than the Unemployment Rate Indicates

by Calculated Risk on 9/04/2021 05:35:00 PM

The headline unemployment rate of 5.2% significantly understates the current situation.

Then I calculated the unemployment rate by including the number of people that have left the labor force since early 2020, and the expected growth in the labor force.

| Unemployment Rate | Unemployed (000s) | Left Labor Force (000s) | Expected Labor Force Growth (000s) | Adjusted Unemployment Rate | |

|---|---|---|---|---|---|

| Feb-20 | 3.5% | 5,717 | 0 | 0 | 3.5% |

| Mar-20 | 4.4% | 7,185 | -1,727 | 100 | 5.5% |

| Apr-20 | 14.8% | 23,109 | -7,970 | 200 | 19.0% |

| May-20 | 13.3% | 20,975 | -6,248 | 300 | 16.7% |

| Jun-20 | 11.1% | 17,697 | -4,651 | 400 | 13.8% |

| Jul-20 | 10.2% | 16,308 | -4,363 | 500 | 12.8% |

| Aug-20 | 8.4% | 13,542 | -3,630 | 600 | 10.8% |

| Sep-20 | 7.8% | 12,535 | -4,370 | 700 | 10.7% |

| Oct-20 | 6.9% | 11,049 | -3,730 | 800 | 9.4% |

| Nov-20 | 6.7% | 10,728 | -3,912 | 900 | 9.4% |

| Dec-20 | 6.7% | 10,736 | -3,881 | 1,000 | 9.4% |

| Jan-21 | 6.3% | 10,130 | -4,287 | 1,100 | 9.4% |

| Feb-21 | 6.2% | 9,972 | -4,237 | 1,200 | 9.3% |

| Mar-21 | 6.0% | 9,710 | -3,890 | 1,300 | 9.0% |

| Apr-21 | 6.1% | 9,812 | -3,460 | 1,400 | 8.8% |

| May-21 | 5.8% | 9,316 | -3,513 | 1,500 | 8.6% |

| Jun-21 | 5.9% | 9,484 | -3,362 | 1,600 | 8.7% |

| Jul-21 | 5.4% | 8,702 | -3,101 | 1,700 | 8.1% |

| Aug-21 | 5.2% | 8,384 | -2,911 | 1,800 | 7.9% |

As the economy recovers, many of the people that left the labor force will probably return, and there will likely be more entrants into the labor force (although recent demographic data has been dismal).

Schedule for Week of September 5, 2021

by Calculated Risk on 9/04/2021 08:11:00 AM

This will be a light week for economic data.

All US markets will be closed in observance of the Labor Day holiday.

8:00 AM ET: Corelogic House Price index for July

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 10.073 million from 9.483 million in May. This was a new record high for this series.

The number of job openings (yellow) were up 65% year-over-year, and Quits were up 46% year-over-year.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. There were 340 thousand initial claims last week.

8:30 AM: The Producer Price Index for August from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.6% increase in core PPI.

Friday, September 03, 2021

CalculatedRisk Newsletter

by Calculated Risk on 9/03/2021 04:39:00 PM

I've started a newsletter focused solely on real estate. This newsletter is ad free.

• Expect House Prices to be up 20% YoY in July Report

• House Prices Increase Sharply in June

• Housing: Inventory is the Key Metric in 2021

• Forbearance, Delinquencies and Foreclosure: Will the end of the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, lead to a surge in foreclosures and impact house prices, as happened following the housing bubble?

• How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2022?

• New Home Sales Increase to 708,000 Annual Rate in July

• Existing-Home Sales Increased to 5.99 million in July

• Housing Starts decreased to 1.534 Million Annual Rate in July

• Housing and Demographics: The Next Big Shift

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

September 3rd COVID-19: Vaccination Rate has Increased, Over 1,500 Deaths Reported Today

by Calculated Risk on 9/03/2021 04:00:00 PM

NOTE: There will be no weekend updates on COVID.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 52.9% | 52.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 175.5 | 172.6 | ≥2321 | |

| New Cases per Day3🚩 | 152,546 | 148,564 | ≤5,0002 | |

| Hospitalized3🚩 | 91,674 | 88,858 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,094 | 1,038 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 13 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 58.4%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.7%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.5%, Kentucky at 49.0%, Arizona at 48.9%, Ohio at 48.6%, Kansas at 48.6%, Nevada at 48.2%, Utah at 47.9%, Texas at 47.9% and Alaska at 47.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

AAR: August Rail Carloads and Intermodal Down Compared to 2019

by Calculated Risk on 9/03/2021 02:11:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Intermodal is navigating many of the same challenges that have plagued global supply chains for months, such as shutdowns at ports and manufacturing centers in Asia; port congestion; labor and capacity shortages at docks, warehouses, and drayage firms; container and chassis shortages; natural and man-made disasters (e.g., wildfires, hurricanes, and ships getting stuck in canals). Pressures are intensifying as retailers, many of whom already have much lower inventories than they’d like, are trying to stock up for the upcoming holiday season. At this point, no one knows if things will get worse before they get better, and if they do get worse, how much worse they will get.

emphasis added

Click on graph for larger image.

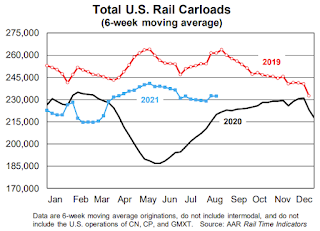

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2019, 2020 and 2021:

Total originated carloads on U.S. railroads in August 2021 were 934,762, up 4.1% (36,815 carloads) over August 2020 and down 11.4% (120,262 carloads) from August 2019. The 4.1% year-over-year gain in August 2021 was the smallest year-over-year gain since March 2021. Total carloads averaged 233,691 per week in August 2021. Except for August 2020, that’s the lowest weekly average for total carloads for an August in our records that begin in 1988.

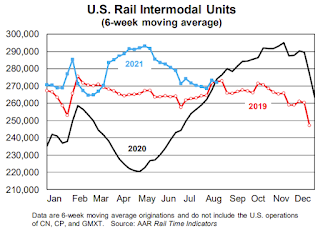

The second graph shows the six week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):

The second graph shows the six week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):U.S. intermodal originations, which are not included in carloads, were 3.3% lower in August 2021 than August 2020 and 0.4% lower than August 2019. That’s their first year-over-year decline in 13 months. Intermodal originations averaged 271,336 containers and trailers per week in August 2021, the third lowest of the eight months so far in 2021. In the 21 years from 2000 to 2020, August was a top-three intermodal month 16 times. That’s obviously won’t happen this year.