by Calculated Risk on 9/28/2021 11:51:00 AM

Tuesday, September 28, 2021

Comments on House Prices

Today, in the Newsletter: House Prices Increase Sharply in July

Excerpt:

This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through July 2021).

In July, the months-of-supply was at 2.6 months, and the Case-Shiller National Index (SA) increased 1.55% month-over-month. The black arrow points to the July 2021 dot.

Case-Shiller: National House Price Index increased 19.7% year-over-year in July

by Calculated Risk on 9/28/2021 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports Record High 19.7% Annual Home Price Gain In July

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.7% annual gain in July, up from 18.7% in the previous month. The 10-City Composite annual increase came in at 19.1%, up from 18.5% in the previous month. The 20-City Composite posted a 19.9% year-over-year gain, up from 19.1% in the previous month.

Phoenix, San Diego, and Seattle reported the highest year-over-year gains among the 20 cities in July. Phoenix led the way with a 32.4% year-over-year price increase, followed by San Diego with a 27.8% increase and Seattle with a 25.5% increase. Seventeen of the 20 cities reported higher price increases in the year ending July 2021 versus the year ending June 2021.

...

Before seasonal adjustment, the U.S. National Index posted an 1.6% month-over-month increase in July, while the 10-City and 20-City Composites both posted increases of 1.3% and 1.5%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.5%, and the 10-City and 20-City Composites both posted increases of 1.4% and 1.5%, respectively. In July, all 20 cities reported increases before and after seasonal adjustments.

“July 2021 is the fourth consecutive month in which the growth rate of housing prices set a record, says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. “The National Composite Index marked its fourteenth consecutive month of accelerating prices with a 19.7% gain from year-ago levels, up from 18.7% in June and 16.9% in May. This acceleration is also reflected in the 10- and 20-City Composites (up 19.1% and 19.9%, respectively). The last several months have been extraordinary not only in the level of price gains, but in the consistency of gains across the country. In July, all 20 cities rose, and 17 gained more in the 12 months ended in July than they had gained in the 12 months ended in June. Home prices in 19 of our 20 cities now stand at all-time highs, with the sole outlier (Chicago) only 0.3% below its 2006 peak. The National Composite, as well as the 10- and 20-City indices, are likewise at their all-time highs.

“July’s 19.7% price gain for the National Composite is the highest reading in more than 30 years of S&P CoreLogic Case-Shiller data. This month, New York joined Boston, Charlotte, Cleveland, Dallas, Denver, and Seattle in recording their all-time highest 12-month gains. Price gains in all 20 cities were in the top quintile of historical performance; in 15 cities, price gains were in the top five percent of historical performance.

“We have previously suggested that the strength in the U.S. housing market is being driven in part by a reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes. July’s data are consistent with this hypothesis. This demand surge may simply represent an acceleration of purchases that would have occurred anyway over the next several years. Alternatively, there may have been a secular change in locational preferences, leading to a permanent shift in the demand curve for housing. More time and data will be required to analyze this question

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.4% in July (SA).

The Composite 20 index is up 1.5% (SA) in July.

The National index is 43% above the bubble peak (SA), and up 1.5% (SA) in July. The National index is up 93% from the post-bubble low set in February 2012 (SA).

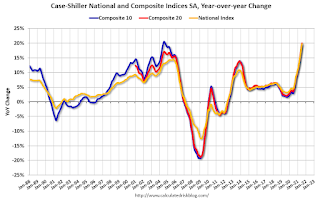

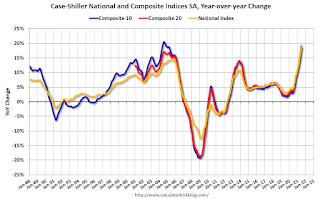

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 19.2% compared to July 2020. The Composite 20 SA is up 20.0% year-over-year.

The National index SA is up 19.7% year-over-year.

Price increases were close to expectations. I'll have more later.

Monday, September 27, 2021

Tuesday: Case-Shiller House Prices, Fed Chair Powell Testimony

by Calculated Risk on 9/27/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: Highest Mortgage Rates in Nearly 3 Months

Mortgage rates continued somewhat higher on Monday as bond markets lost ground over the weekend, adding to the heavier losses seen on Thursday and Friday last week. ... This improves the outlook for the economy and further steels the resolve of the Federal Reserve to announce another instance of "tapering" (a reduction in the pace of the Fed's rate-friendly bond buying efforts). Unlike 2013, markets are much more prepared this time around, and in fact, we can credit tapering expectations for some of the weakness in rates seen earlier this year.Tuesday:

The average lender is at an eighth to a quarter of a percent higher in conventional 30yr fixed rates compared to the beginning of last week. [30 year fixed 3.14%]

emphasis added

• At 9:00 AM ET, FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for July. The consensus is for a 20.0% year-over-year increase in the Comp 20 index for July.

• At 10:00 AM, the Richmond Fed manufacturing survey for September. This is the last of the regional surveys for September.

• Also at 10:00 AM, Testimony, Fed Chair Powell, Coronavirus and CARES Act, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

Freddie Mac: Mortgage Serious Delinquency Rate decreased in August

by Calculated Risk on 9/27/2021 04:50:00 PM

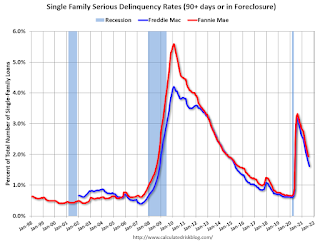

Freddie Mac reported that the Single-Family serious delinquency rate in August was 1.62%, down from 1.74% in July. Freddie's rate is down year-over-year from 3.17% in August 2020.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.12%, down from 0.15% in July, and down from the peak of 0.20% in April 2021.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 2.96%"

by Calculated Risk on 9/27/2021 04:00:00 PM

Note: This is as of September 19th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 2.96%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 4 basis points from 3.00% of servicers’ portfolio volume in the prior week to 2.96% as of September 19, 2021. According to MBA’s estimate, 1.5 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 3 basis points to 1.44%. Ginnie Mae loans in forbearance increased 3 basis points to 3.42%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 4 basis points to 6.91%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 1 basis point relative to the prior week to 3.24%, and the percentage of loans in forbearance for depository servicers decreased 4 basis points to 3.06%.

“The share of loans in forbearance continued to decrease last week, dropping below 3 percent for the first time since March 2020,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “However, there was a slight increase in the forbearance share for Ginnie Mae loans, and this increase was seen for both depository and IMB servicers. New forbearance requests and re-entries continue to run at a higher rate for Ginnie Mae loans as well as for portfolio and PLS loans, which include many delinquent FHA, VA, and USDA loans that have been bought out of Ginnie Mae pools.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same relative to the prior week at 0.05%."

September 27th COVID-19: Data reported on Monday is always low, and will be revised up as data is received

by Calculated Risk on 9/27/2021 03:58:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 55.4% | 54.7% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 183.9 | 181.7 | ≥2321 | |

| New Cases per Day3 | 95,228 | 134,500 | ≤5,0002 | |

| Hospitalized3 | 75,112 | 86,009 | ≤3,0002 | |

| Deaths per Day3 | 1,332 | 1,508 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 21 states have between 50% and 59.9% fully vaccinated: Colorado at 59.2%, California, Minnesota, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, Kentucky, Arizona, Kansas, Texas, Nevada, Alaska, Utah and Ohio at 50.1%.

Next up (total population, fully vaccinated according to CDC) are North Carolina 49.6%, Indiana at 48.3% and Montana at 48.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Mortgage Rates Increasing

by Calculated Risk on 9/27/2021 12:48:00 PM

Today, in the Newsletter: Mortgage Rates Increasing

Excerpt:

With the ten year yield close to 1.50%, and based on an historical relationship, 30-year rates should currently be around 3.4%.

Mortgage News Daily reports that the most prevalent 30 year fixed rate is now at 3.13% for top tier scenarios. So mortgage rates are a little lower than expected.

The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Housing Inventory Sept 27th Update: Inventory Down Slightly Week-over-week, Up 41% from Low in early April

by Calculated Risk on 9/27/2021 10:41:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 9/27/2021 08:34:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of September 26th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 24.5% from the same day in 2019 (75.5% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through September 25, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday. The 7-day average for the US is down 11% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $63 million last week, down only about 55% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through September 18th. The occupancy rate was down 11.6% compared to the same week in 2019. The comparison to 2019 was difficult this week due to the timing of Labor Day.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of September 10th, gasoline supplied was down 4.8% compared to the same week in 2019.

There have been five weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through September 25th for the United States and several selected cities.

This data is through September 25th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 119% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, September 24th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, September 26, 2021

Sunday Night Futures

by Calculated Risk on 9/26/2021 07:10:00 PM

Weekend:

• Schedule for Week of September 26, 2021

• The Home ATM

Monday:

• 8:30 AM ET, Durable Goods Orders for August from the Census Bureau. The consensus is for a 0.7% increase in durable goods orders.

• 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 7 and DOW futures are up 92 (fair value).

Oil prices were up over the last week with WTI futures at $74.53 per barrel and Brent at $78.55 per barrel. A year ago, WTI was at $40, and Brent was at $41 - so WTI oil prices are UP 90% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.18 per gallon. A year ago prices were at $2.18 per gallon, so gasoline prices are up $1.00 per gallon year-over-year.

The Home ATM, aka Mortgage Equity Withdrawal (MEW)

by Calculated Risk on 9/26/2021 04:06:00 PM

In the Newsletter I have The Home ATM

Excerpt:

In Q2 2021, mortgage debt increased $223 billion, the largest quarterly increase since 2006.

...

The bottom line is the recent increase in MEW is not concerning - it is far less as a percent of disposable personal income than during the bubble, and most homeowners have substantial equity.

Saturday, September 25, 2021

Newsletter Articles this Week

by Calculated Risk on 9/25/2021 02:11:00 PM

At the Calculated Risk Newsletter this week:

• Comments on August New Home Sales; Record 105 thousand homes have not been started

• Existing Homes: Some Regional Differences Appear; Final August Update for Local Housing Markets

• Existing-Home Sales Decreased to 5.88 million in August; Sales will be down year-over-year for the remainder of 2021

• Housing Starts increased to 1.615 Million Annual Rate in August; Most Multi-Family Units Under Construction Since 1974

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Schedule for Week of September 26, 2021

by Calculated Risk on 9/25/2021 08:11:00 AM

The key reports this week are the third estimate of Q2 GDP, the September ISM manufacturing index, September auto sales, Personal Income and Outlays for August and Case-Shiller house prices for July.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

Fed Chair Powell testifies on Coronavirus and CARES Act this week.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 0.7% increase in durable goods orders.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

9:00 AM: FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for July.

9:00 AM: S&P/Case-Shiller House Price Index for July.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 20.0% year-over-year increase in the Comp 20 index for July.

10:00 AM: the Richmond Fed manufacturing survey for September. This is the last of the regional surveys for September.

10:00 AM, Testimony, Fed Chair Powell, Coronavirus and CARES Act, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for August. The consensus is 1.3% increase in the index.

11:45 AM: Discussion, Fed Chair Powell, Policy Panel Discussion, At the European Central Bank Forum on Central Banking

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 335 thousand initial claims, down from 351 thousand last week.

8:30 AM: Gross Domestic Product, 2nd quarter 2021 (Third estimate). The consensus is that real GDP increased 6.7% annualized in Q2, revised up from the second estimate of 6.6%.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 65.0, down from 66.8 in August.

8:30 AM: Personal Income and Outlays for August. The consensus is for a 0.3% increase in personal income, and for a 0.6% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: ISM Manufacturing Index for September. The consensus is for a reading of 59.5, down from 59.9 in August.

10:00 AM: Construction Spending for August. The consensus is for a 0.3% increase.

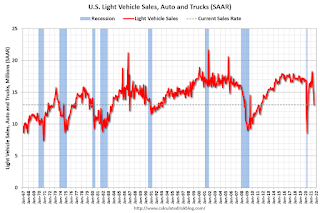

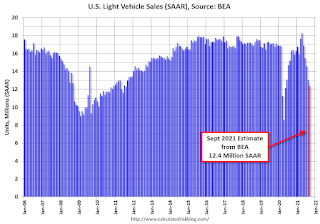

All day: Light vehicle sales for September.

All day: Light vehicle sales for September.The consensus is for sales of 13.4 million SAAR, up from 13.1 million SAAR in August (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

Friday, September 24, 2021

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Declined Slightly

by Calculated Risk on 9/24/2021 04:18:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of September 21st.

From Andy Walden at Black Knight: Little Movement in Forbearance Volumes This Week

The number of active forbearance plans fell by 18,000 (-1.4%) this week, leaving 1.58 million U.S. homeowners in COVID-19 forbearance as of September [21].

Declines of 11,000 and 10,000 among FHA/VA and GSE loans respectively were partially offset by a 3,000 rise in PLS/portfolio plans. Overall, forbearances are now down 182,000 (-10%) from the same time last month, with the strongest decline (-13%) seen among GSE plans.

The population of mortgage holders in COVID-19 related forbearance plans represents 3% of all active mortgages, including 1.7% of GSE, 5.2% of FHA/VA and 3.8% of portfolio held and privately securitized loans.

In terms of forbearance plan starts, 15,000 new plans were initiated since last Tuesday – down slightly from last week’s 16,000 starts – while 34,000 plans were restarted, compared to last week’s volume of 35,000. Meanwhile, in typical mid-month behavior, plan exits dipped slightly this week, but are expected to ramp up in coming weeks.

Click on graph for larger image.

More than 460,000 plans are still slated for review for extension/removal over the final week of September, with some 300,000 set to reach their final expirations based on current allowable forbearance term lengths. This could lead to significant movement in volumes entering early October.

emphasis added

September 24th COVID-19: 7-Day Average Cases off 27% from Recent Peak

by Calculated Risk on 9/24/2021 04:13:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 55.1% | 54.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 183.0 | 180.6 | ≥2321 | |

| New Cases per Day3 | 117,066 | 142,885 | ≤5,0002 | |

| Hospitalized3 | 80,957 | 89,248 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,559 | 1,553 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 19 states and D.C. have between 50% and 59.9% fully vaccinated: District of Columbia at 59.6%, Colorado, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, and Utah at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Ohio at 49.9%, Alaska at 49.7%, North Carolina 49.2%, Indiana at 48.1% and Montana at 48.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Q3 GDP Forecasts: Around 4.5%

by Calculated Risk on 9/24/2021 12:32:00 PM

GDP forecasts had been downgraded sharply for Q3 due to COVID, but now seem to have stabilized.

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

| 9/24/21 | 4.5% | 4.5% | 3.7% |

From BofA Merrill Lynch:

We continue to track 4.5% qoq saar for 3Q GDP. [Sept 24 estimate]From Goldman Sachs:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +4.5% (qoq ar). [Sept 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 3.7 percent on September 21, up from 3.6 percent on September 16. [Sept 21 estimate]

Comments on August New Home Sales

by Calculated Risk on 9/24/2021 11:02:00 AM

In the Newsletter I have Comments on August New Home Sales

Excerpt:

Sales, year to date in 2021, are only 2.4% ahead of sales in 20202, and new home sales in 2021 will be below sales in 2020 - since sales in 2020 finished strong.

This graph shows new home sales for 2020 and 2021 by month (Seasonally Adjusted Annual Rate).

New Home Sales Increase to 740,000 Annual Rate in August

by Calculated Risk on 9/24/2021 10:10:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 740 thousand.

The previous three months were revised up, combined.

Sales of new single‐family houses in August 2021 were at a seasonally adjusted annual rate of 740,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.5 percent above the revised July rate of 729,000, but is 24.3 percent below the August 2020 estimate of 977,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now declining year-over-year since sales soared following the first few months of the pandemic.

The second graph shows New Home Months of Supply.

The months of supply increased in August to 6.1 months from 6.0 months in July.

The months of supply increased in August to 6.1 months from 6.0 months in July. The all time record high was 12.1 months of supply in January 2009. The all time record low was 3.5 months, most recently in October 2020.

This is above the normal range (about 4 to 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of August was 378,000. This represents a supply of 6.1 months at the current sales rate."

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In August 2021 (red column), 62 thousand new homes were sold (NSA). Last year, 81 thousand homes were sold in August.

The all time high for August was 110 thousand in 2005, and the all time low for August was 23 thousand in 2010.

This was above expectations of 714 thousand SAAR and sales in the three previous months were revised up, combined. I'll have more later today.

September Vehicle Sales Forecast: "Disappearing Inventory Taking U.S. Light-Vehicle Sales to Another Low in September"

by Calculated Risk on 9/24/2021 07:57:00 AM

From WardsAuto: Disappearing Inventory Taking U.S. Light-Vehicle Sales to Another Low in September (pay content)

Low inventories and supply issues continue to impacting vehicle sales.

This graph shows actual sales from the BEA (Blue), and Wards forecast for September (Red).

The Wards forecast of 12.4 million SAAR, would be down about 5% from last month, and down 23.8% from a year ago (sales were solid in September 2020, as sales recovered from the depths of the pandemic).

Thursday, September 23, 2021

Friday: New Home Sales

by Calculated Risk on 9/23/2021 09:38:00 PM

Friday:

• At 10:00 AM ET, New Home Sales for August from the Census Bureau. The consensus is for 714 thousand SAAR, up from 708 thousand in July.

• Also at 10:00 AM, Opening Remarks, Fed Chair Jerome Powell, At Fed Listens: Perspectives on the Pandemic Recovery

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |