by Calculated Risk on 10/05/2021 03:13:00 PM

Tuesday, October 05, 2021

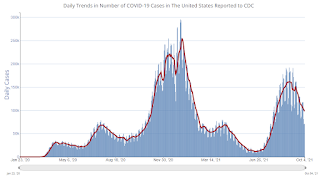

October 5th COVID-19: 7-Day Average Cases Falls Below 100K, Lowest since August 3rd

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.0% | 55.8% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 186.1 | 185.3 | ≥2321 | |

| New Cases per Day3 | 97,909 | 111,851 | ≤5,0002 | |

| Hospitalized3 | 66,131 | 76,734 | ≤3,0002 | |

| Deaths per Day3 | 1,444 | 1,492 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 22 states have between 50% and 59.9% fully vaccinated: Colorado at 59.8%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah, Ohio and North Carolina at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Montana at 48.8%, Indiana at 48.7%, Missouri at 48.3% and Oklahoma at 48.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

On Private Lenders Raising the "Conforming Loan Limit"

by Calculated Risk on 10/05/2021 12:33:00 PM

Today, in the Newsletter: On Private Lenders Raising the "Conforming Loan Limit"

Excerpt:

Some private mortgage industry participants have already increased their “conforming loan limits” in anticipation of the FHFA raising the CLL. This is NOT an official increase.

...

Note that they are only raising the “limit” from $548,250 (low cost areas) to $625,000. That is a 14% increase, and the FHFA will probably increase the limit closer to 18% (like to around $645,000 or so).

ISM® Services Index Increased to 61.9% in September

by Calculated Risk on 10/05/2021 10:05:00 AM

(Posted with permission). The September ISM® Services index was at 61.9%, up from 61.7% last month. The employment index decreased to 53.0%, from 53.7%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: Services PMI® at 61.9%, September 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in September for the 16th month in a row, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.This was above the consensus forecast, however the employment index decreased slightly to 53.0%, from 53.7% the previous month.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “The Services PMI® registered 61.9 percent, 0.2 percentage point higher than the reading of 61.7 percent in August. The September reading indicates the 16th straight month of growth for the services sector, which has expanded for all but two of the last 140 months.

“The Supplier Deliveries Index registered 68.8 percent, down 0.8 percentage point from August’s reading of 69.6 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Prices Index registered 77.5 percent, up 2.1 percentage points from the August figure of 75.4 percent.”

Nieves continues, “According to the Services PMI®, 17 services industries reported growth. The composite index indicated growth for the 16th consecutive month after a two-month contraction in April and May 2020. The slight uptick in the rate of expansion in the month of September continued the current period of strong growth for the services sector. However, ongoing challenges with labor resources, logistics, and materials are affecting the continuity of supply.”

emphasis added

Trade Deficit Increased to $73.3 Billion in August

by Calculated Risk on 10/05/2021 08:40:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $73.3 billion in August, up $2.9 billion from $70.3 billion in July, revised.

August exports were $213.7 billion, $1.0 billion more than July exports. August imports were $287.0 billion, $4.0 billion more than July imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports increased in August.

Exports are up 23% compared to August 2020; imports are up 21% compared to August 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

CoreLogic: House Prices up 18.1% YoY in August, All-Time High YoY Increase

by Calculated Risk on 10/05/2021 08:00:00 AM

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Record-High Repeat: U.S. Annual Home Price Growth Reaches a New All-Time High in August, CoreLogic Reports

CoreLogic® ... released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2021.

Home prices rose to a fever pitch this summer, with annual price gains reaching another all-time high in August at 18.1%. Ongoing affordability challenges within the supply-constricted market have also been exacerbated by an influx in homebuying activity from investors. As the home purchase market continues to boom and buoy the post-pandemic economy, these market factors are unevenly affecting access for some buyers. This is reflected in a recent CoreLogic consumer survey, where 59% of consumers looking to purchase a home reported combined household earnings of at least six figures, compared to the 10% of consumers looking to purchase earning less than $50,000.

“Home prices continue to escalate at a torrid pace as a broad spectrum of buyers drive demand for a limited supply of homes,” said Frank Martell, president and CEO of CoreLogic. “We expect to see the trend of strong price gains continue indefinitely with large amounts of capital chasing too few assets.”

...

Nationally, home prices increased 18.1% in August 2021, compared to August 2020. This is the largest 12-month growth in the U.S. index since the series began (January 1976 – January 1977). On a month-over-month basis, home prices increased by 1.3% compared to July 2021.

...

“Single-family detached homes continue to be in high demand,” said Dr. Frank Nothaft, chief economist at CoreLogic. “These properties offer more living space and distance from neighboring homes than that of attached properties. On average, detached homes have 28% more inside space compared to single-family attached properties and about twice as much space as apartments in multifamily structures.”

emphasis added

Monday, October 04, 2021

Tuesday: Trade Deficit, ISM Services

by Calculated Risk on 10/04/2021 08:00:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Fairly Flat Despite Mixed Signals From Bond Market

Mortgage rates are unchanged to a hair lower compared to last Friday, depending on the lender. While that's welcome news given some of the big jumps in rates seen in the past 2 weeks, the underlying bond market suggests we're still in the middle of a waiting game. [30 year fixed 3.09%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for August

• At 8:30 AM, Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $70.5 billion in August, from $70.1 billion in July.

• At 10:00 AM, the ISM Services Index for September.

October 4th COVID-19: 56% of Total Population Fully Vaccinated

by Calculated Risk on 10/04/2021 06:15:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.0% | 55.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 185.8 | 183.9 | ≥2321 | |

| New Cases per Day3 | 86,801 | 112,311 | ≤5,0002 | |

| Hospitalized3 | 64,217 | 77,983 | ≤3,0002 | |

| Deaths per Day3 | 1,327 | 1,502 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 22 states have between 50% and 59.9% fully vaccinated: Colorado at 59.7%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah, Ohio and North Carolina at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Montana at 48.8%, Indiana at 48.7% and Missouri at 48.3% .

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 2.89%"

by Calculated Risk on 10/04/2021 04:00:00 PM

Note: This is as of September 26th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 2.89%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 2.96% of servicers’ portfolio volume in the prior week to 2.89% as of September 26, 2021. According to MBA’s estimate, 1.4 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 6 basis points to 1.38%. Ginnie Mae loans in forbearance decreased 7 basis points to 3.35%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 14 basis points to 6.77%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 5 basis points relative to the prior week to 3.19%, and the percentage of loans in forbearance for depository servicers decreased 13 basis points to 2.93%.

“The share of loans in forbearance declined at a faster rate last week, dropping by 7 basis points, as exits increased and new requests and re-entries declined,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “While 1.4 million homeowners remained in forbearance as of September 26th , this number is expected to drop sharply over the next few weeks as many are reaching the 18-month expiration point of their forbearance terms. Most borrowers exiting forbearance through a workout are opting for a deferral plan, which allows them to resume their original payment, while moving the forborne amount to the end of the loan.”

Added Fratantoni, “Although call volume dropped in the last week of September, we expect that servicers will be very busy through October.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.05% to 0.04%."

Housing Inventory Oct 4th Update: Inventory Down 1% Week-over-week, Up 40% from Low in early April

by Calculated Risk on 10/04/2021 02:40:00 PM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Real Personal Income: Transfer Payments

by Calculated Risk on 10/04/2021 01:05:00 PM

The BEA released the Personal Income and Outlays, August 2021 report on Friday. The report showed that government transfer payments were still almost $770 billion (on SAAR basis) above the February 2020 level (pre-pandemic) Note: Seasonal adjustment doesn't make sense with one time payments, but that is how the data is presented.

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Jan-20 | $511 | $26 |

| Feb-20 | $506 | $26 |

| Mar-20 | $516 | $67 |

| Apr-20 | $3,393 | $435 |

| May-20 | $1,373 | $1,287 |

| Jun-20 | $743 | $1,396 |

| Jul-20 | $750 | $1,366 |

| Aug-20 | $697 | $612 |

| Sep-20 | $950 | $325 |

| Oct-20 | $714 | $296 |

| Nov-20 | $580 | $285 |

| Dec-20 | $604 | $319 |

| Jan-21 | $2,317 | $574 |

| Feb-21 | $735 | $558 |

| Mar-21 | $4,706 | $566 |

| Apr-21 | $1,345 | $516 |

| May-21 | $806 | $492 |

| Jun-21 | $744 | $433 |

| Jul-21 | $920 | $380 |

| Aug-21 | $939 | $365 |

Black Knight Mortgage Monitor for August: "the longer borrowers remain in forbearance, the higher the post-forbearance non-performance rate"

by Calculated Risk on 10/04/2021 10:38:00 AM

This gives a total of 4.27% delinquent or in foreclosure.

Press Release: Strong Equity Stakes Alone May Not Be Enough to Stave Off Foreclosure Starts, But Will Reduce Inflow of Distressed Properties Into Housing Market

Today, the Data & Analytics division of Black Knight, Inc. (NYSE:BKI) released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. Given Black Knight’s recent analysis of the strong equity positions of borrowers in forbearance, even when adding 18 months of deferred payments to their debt loads, this month’s report explores the relationship between such equity positions and downstream foreclosure start rates and – ultimately – distressed liquidations. According to Black Knight Data & Analytics President Ben Graboske, the data suggests that the healthy stores of equity in the hands of homeowners currently in forbearance may not be sufficient on its own to ward off foreclosure activity.

“An analysis of our McDash loan-level mortgage performance dataset back to 2007 shows that holding equity in one’s home might not be a blanket backstop to foreclosure activity,” said Graboske. “Borrowers with limited equity were much more likely to be referred to foreclosure during the early stages of the Great Recession than those with strong equity positions. But foreclosure start rates on homeowners who were 120 or more days past due have been relatively similar regardless of equity stakes from 2010 on, with borrowers in the strongest positions only slightly less likely to be referred to foreclosure. So, while we may see some variation in foreclosure activity based on the equity levels of borrowers who are unable to return to making payments post-forbearance, those with strong equity won’t necessarily be immune to foreclosure referral.

“The same data also shows that borrowers with strong equity stakes are more than 40% less likely to face the involuntary liquidation of their homes than borrowers with weaker equity positions, limiting both potential losses on such mortgages and distressed inflow into the housing market. Still, even among borrowers with 40% equity stakes who are referred to foreclosure, some 30% in recent years have lost their home to foreclosure sale, short sale, deed in lieu, etc. What the data doesn’t tell us is why so many people who could avoid involuntary liquidation by selling through traditional channels simply do not end up doing so. Whether that’s due to lack of understanding of their equity positions or the foreclosure process in general is unclear. But given the large number of high equity homeowners currently struggling to make their payments, this represents a significant challenge for the industry: how to educate struggling homeowners on the post-forbearance, foreclosure and – if needed – home sale processes, to limit unneeded stress on homeowners and the market alike.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph on delinquencies from Black Knight:

• At 4% in August, the national mortgage delinquency rate is now at its lowest level since the onset of the pandemic early last year

• A 108K loan decline in serious delinquencies in August was partially offset by 14K and 11K rises in 30-day and 60-day delinquencies, respectively

• Despite the overall improvement, serious delinquencies remain more than 3X (+930K) pre-pandemic levels, while early-stage delinquencies (30/60 days) remain approximately 40% below pre-pandemic levels

• At the current rate of improvement, the overall national delinquency rate would be on pace to return to pre-pandemic levels by early 2022

And on the current status of loans that have exited forbearance:

And on the current status of loans that have exited forbearance: • Nearly 3.7M borrowers exited forbearance plans in 2020, with the largest volumes in July and October as early entrants reached the three- and six- month points in their plansThere is much more in the mortgage monitor.

• Exit volumes tapered off in early 2021, but picked up with 338K exits in August, and are expected to rise in coming months as early plan entrants reach their final expirations

• Post-forbearance performance among those who've exited has varied, with borrowers who remained in plans longer – and exited later – having more trouble getting back to making payments

• A large share of recent exits remains in active loss mitigation, working through post-forbearance options, so it will be a few weeks before August/September exit performance trends become more discernible

• That said, a clear pattern has emerged: the longer borrowers remain in forbearance, the higher the post-forbearance non-performance rate, with the current high-water mark the 9% non-performance rate seen among July plan exits

• Non-performance rates among those borrowers facing final plan expirations in coming months will dictate the ultimate downstream impacts on both foreclosure activity as well as the broader housing market

Seven High Frequency Indicators for the Economy

by Calculated Risk on 10/04/2021 08:34:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 3rd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 23.1% from the same day in 2019 (76.9% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 2, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - but might be picking up a little again. The 7-day average for the US is down 7% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $50 million last week, down about 63% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through September 25th. The occupancy rate was down 11.0% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of September 24th, gasoline supplied was up 2.7% compared to the same week in 2019.

There have been six weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 2nd for the United States and several selected cities.

This data is through October 2nd for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 116% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, October 1st.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, October 03, 2021

Sunday Night Futures

by Calculated Risk on 10/03/2021 07:06:00 PM

Weekend:

• Schedule for Week of October 3, 2021

• Measuring Rents

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 15 and DOW futures are up 100 (fair value).

Oil prices were up over the last week with WTI futures at $76.00 per barrel and Brent at $79.42 per barrel. A year ago, WTI was at $37, and Brent was at $38 - so WTI oil prices are UP 100%+ year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.19 per gallon. A year ago prices were at $2.18 per gallon, so gasoline prices are up $1.01 per gallon year-over-year.

Measuring Rents

by Calculated Risk on 10/03/2021 05:30:00 PM

Today, in the Newsletter: Measuring Rents

Excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through Aug 2021, except ApartmentList is through Sept 2021.

The Zillow measure is up 7.4% YoY as of August, and the ApartmentList measure is up 15.1% as of September.

Saturday, October 02, 2021

Newsletter Articles this Week

by Calculated Risk on 10/02/2021 02:11:00 PM

At the Calculated Risk Newsletter this week:

• The Home ATM, aka Mortgage Equity Withdrawal (MEW)

• Mortgage Rates Increasing, Mortgage Rates and the Ten Year Yield

• House Prices Increase Sharply in July, Case-Shiller National Index up Record 19.7% Year-over-year in July

• Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in July, And a look at "Affordability"

• As Forbearance Ends

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Schedule for Week of October 3, 2021

by Calculated Risk on 10/02/2021 08:11:00 AM

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM Services index and the August trade deficit.

No major economic releases scheduled.

8:00 AM ET: Corelogic House Price index for August

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $70.5 billion in August, from $70.1 billion in July.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $70.5 billion in August, from $70.1 billion in July.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

10:00 AM: the ISM Services Index for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 430,000 jobs added, up from 374,000 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 345 thousand initial claims, down from 362 thousand last week.

8:30 AM: Employment Report for September. The consensus is for 460 thousand jobs added, and for the unemployment rate to decrease to 5.1%.

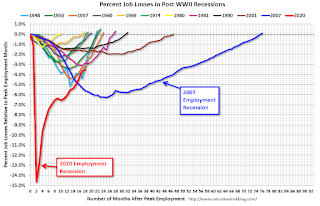

8:30 AM: Employment Report for September. The consensus is for 460 thousand jobs added, and for the unemployment rate to decrease to 5.1%.There were 235 thousand jobs added in August, and the unemployment rate was at 5.2%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

Friday, October 01, 2021

September Vehicles Sales Decreased to 12.2 Million SAAR

by Calculated Risk on 10/01/2021 06:30:00 PM

Wards Auto released their estimate of light vehicle sales for September this evening. Wards Auto estimates sales of 12.18 million SAAR in September 2021 (Seasonally Adjusted Annual Rate), down 6.7% from the August sales rate, and down 25.2% from September 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for September (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

October 1st COVID-19: Progress

by Calculated Risk on 10/01/2021 04:12:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 55.7% | 55.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 184.9 | 183.0 | ≥2321 | |

| New Cases per Day3 | 104,649 | 118,371 | ≤5,0002 | |

| Hospitalized3 | 71,944 | 81,647 | ≤3,0002 | |

| Deaths per Day3 | 1,489 | 1,523 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 21 states have between 50% and 59.9% fully vaccinated: Colorado at 59.4%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah and Ohio at 50.3%.

Next up (total population, fully vaccinated according to CDC) are North Carolina 49.9%, Montana at 48.5%, Indiana at 48.4% and Missouri at 48.0% .

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

As Forbearance Ends

by Calculated Risk on 10/01/2021 02:16:00 PM

Today, in the Newsletter: As Forbearance Ends

Excerpt:

An analysis from CoreLogic today suggests “Nearly three-in-four loans in forbearance are expected to reach the 18-month maximum limit at the end of September.”

...

In Forbearance Will Not Lead to a Huge Wave of Foreclosures, I presented some data from Black Knight and argued “that most homeowners in forbearance have sufficient equity in their homes, and there will not be a huge wave of foreclosures like following the housing bubble.” But there will be some increase in foreclosure activity. I’ll track the data over the next few months, but this isn’t a huge concern.

Q3 GDP Forecasts: More Downgrades

by Calculated Risk on 10/01/2021 12:42:00 PM

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

| 9/24/21 | 4.5% | 4.5% | 3.7% |

| 10/1/21 | 4.1% | 4.25% | 2.3% |

From BofA Merrill Lynch:

Following this week's data, 3Q GDP tracking dropped to 4.1% qoq saar from 4.5% previously. The August deterioration in the goods trade deficit was the main driver. [Oct 1 estimate]From Goldman Sachs:

emphasis added

Following this morning’s data, we left our Q3 GDP tracking estimate unchanged at +4¼% (qoq ar). [Oct 1 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 2.3 percent on October 1, down from 3.2 percent on September 27. After recent releases from the US Bureau of Economic Analysis, the US Census Bureau, and the Institute for Supply Management, the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth decreased from 2.2 percent and 15.9 percent, respectively, to 1.4 percent and 12.9 percent, respectively, while the nowcast of the contribution of the change in real net exports to third-quarter real GDP growth increased from -1.36 percentage points to -1.27 percentage points. [Oct 1 estimate]

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |